Navigating the complexities of student loan debt and its impact on your financial future can feel overwhelming. Understanding your debt-to-income ratio (DTI) is crucial for securing loans, mortgages, and achieving long-term financial stability. This guide provides a clear and concise overview of how student loans affect your DTI, offering practical strategies for managing debt and improving your financial health.

We’ll explore the calculation of DTI, including various debt types, and illustrate how different levels of student loan debt impact your score. We’ll then delve into the long-term consequences of a high DTI, examining its effects on securing future loans and overall financial well-being. Finally, we’ll present effective strategies for managing student loan debt, including repayment plans and refinancing options, to improve your DTI and achieve your financial goals.

Defining Debt-to-Income Ratio (DTI) and its Relevance to Student Loans

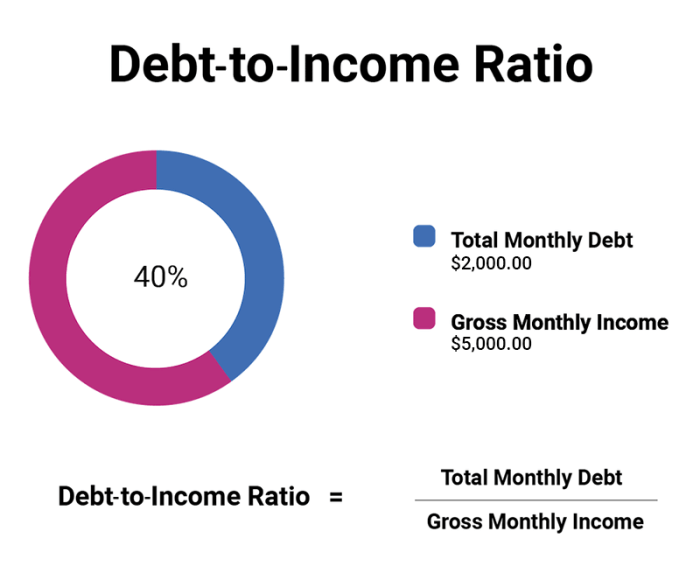

Understanding your debt-to-income ratio (DTI) is crucial, especially when managing student loan debt. This ratio provides a snapshot of your financial health, showing lenders how well you manage your existing debt compared to your income. A lower DTI generally signifies a lower risk to lenders, potentially leading to better loan terms and approval chances.

The debt-to-income ratio is calculated by dividing your total monthly debt payments by your gross monthly income. This calculation includes various types of debt, and student loan payments are a significant component for many individuals.

Debt Included in DTI Calculations

The DTI calculation encompasses a range of recurring debt obligations. These typically include: minimum monthly payments on credit cards, auto loans, personal loans, mortgages, and of course, student loans. It’s important to note that only the minimum monthly payments are usually considered, not the total outstanding balance. Alimony and child support payments may also be included, depending on the lender’s criteria. Other debts, like medical bills, are generally not factored into the DTI calculation unless they are part of a structured repayment plan.

Impact of Student Loan Debt on DTI

Student loan debt significantly influences your DTI. High monthly student loan payments can substantially increase your DTI, potentially making it challenging to qualify for other loans or even impacting your chances of securing favorable interest rates. For instance, a person with a $1,000 monthly student loan payment and a $5,000 gross monthly income would have a DTI of 20% (1000/5000 * 100). This is considered a relatively healthy DTI. However, if that same person also had a $500 car payment and a $300 credit card minimum payment, their DTI would jump to 36% (1800/5000 * 100), which might be considered high by some lenders. This illustrates how even moderate student loan debt can impact your overall DTI when combined with other debts.

DTI Scenarios with Varying Student Loan Debt

The following table illustrates various DTI scenarios with different levels of student loan debt. Remember that these are examples, and acceptable DTI ratios can vary among lenders and loan types.

| Gross Monthly Income | Monthly Student Loan Payment | Other Monthly Debt Payments | DTI (%) |

|---|---|---|---|

| $4,000 | $500 | $300 | 20% |

| $4,000 | $1,000 | $300 | 32.5% |

| $3,000 | $750 | $200 | 31.7% |

| $5,000 | $250 | $500 | 15% |

Impact of Student Loan Debt on DTI and Financial Health

Student loan debt significantly impacts an individual’s debt-to-income ratio (DTI) and overall financial health. The weight of these loans can extend far beyond the repayment period, influencing major life decisions like homeownership and investment opportunities. Understanding this impact is crucial for effective financial planning and long-term well-being.

Student loan payments, often substantial, directly increase your monthly debt obligations. This, in turn, elevates your DTI, a key factor lenders consider when assessing creditworthiness. A high DTI can restrict access to credit, limit borrowing power, and potentially lead to higher interest rates on future loans. The consequences of carrying a high DTI for an extended period can be far-reaching, affecting everything from purchasing a home to securing a car loan.

Long-Term Effects of High DTI Due to Student Loans

A persistently high DTI stemming from student loan debt can have several long-term consequences. It can hinder the ability to save for retirement, limit investment opportunities, and even impact credit scores. For example, individuals struggling with high DTI may find it difficult to save enough for a down payment on a house, delaying homeownership and potentially missing out on the benefits of building equity. Similarly, a high DTI might prevent them from securing favorable interest rates on other loans, leading to increased overall borrowing costs. The cumulative effect of these financial limitations can significantly impede long-term financial growth and security.

Strategies for Managing Student Loan Debt to Improve DTI

Several strategies can effectively manage student loan debt and improve DTI. These strategies often involve a combination of repayment plans, budgeting techniques, and financial planning. For instance, exploring income-driven repayment plans can reduce monthly payments, making them more manageable and lowering the DTI. Simultaneously, creating a detailed budget to identify areas for savings and allocating extra funds toward loan repayment can accelerate debt reduction. Furthermore, refinancing student loans at a lower interest rate can significantly reduce monthly payments and shorten the repayment period, positively impacting the DTI.

Implications of a High DTI on Securing Loans or Mortgages

A high DTI significantly impacts the ability to secure loans or mortgages. Lenders view a high DTI as an indicator of increased financial risk. A borrower with a high DTI may be perceived as having less capacity to handle additional debt, leading to loan denials or less favorable terms, such as higher interest rates. For example, an individual with a high DTI might struggle to obtain a mortgage, delaying or preventing homeownership. Even if a loan is approved, a high DTI can lead to higher interest rates, resulting in significantly increased overall borrowing costs. Understanding the lender’s perspective and taking steps to lower DTI is crucial for improving loan approval chances and securing favorable loan terms.

Steps to Lower DTI Focusing on Student Loan Repayment

The following flowchart illustrates the steps involved in lowering DTI with a focus on student loan repayment.

[Start] -->

|

V

Assess Current DTI & Student Loan Debt -->

|

V

Explore Repayment Options (Income-Driven, Refinancing) -->

|

V

Create a Detailed Budget -->

|

V

Identify Areas for Savings & Increased Loan Payments -->

|

V

Prioritize High-Interest Debt -->

|

V

Make Extra Loan Payments When Possible -->

|

V

Monitor DTI Regularly -->

|

V

[End]

This flowchart Artikels a systematic approach to lowering DTI by focusing on managing and reducing student loan debt. Each step contributes to a more manageable financial situation and improved creditworthiness.

Student Loan Repayment Strategies and Their Effect on DTI

Understanding your student loan repayment options is crucial for managing your debt-to-income ratio (DTI) and overall financial health. Different repayment plans significantly impact your monthly payments and, consequently, your DTI. Choosing the right plan can help you navigate your debt effectively and improve your financial standing.

Choosing the right repayment plan significantly impacts your monthly budget and long-term financial health. The most suitable option depends on your individual financial circumstances, income level, and long-term goals. Let’s explore some common repayment strategies and their influence on your DTI.

Standard Repayment Plans

Standard repayment plans typically involve fixed monthly payments over a 10-year period. This approach offers predictability and the advantage of paying off your loans relatively quickly. However, the fixed monthly payments can be substantial, potentially leading to a higher DTI, especially for borrowers with high loan balances or lower incomes. For example, a borrower with $50,000 in student loans might face a monthly payment exceeding $500, significantly impacting their DTI.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) adjust your monthly payments based on your income and family size. These plans typically extend the repayment period to 20 or 25 years, resulting in lower monthly payments compared to standard plans. This can significantly reduce your DTI in the short term, making it easier to manage your other financial obligations. However, the longer repayment period means you’ll pay more in interest over the life of the loan. Examples of IDRs include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). A borrower with a lower income might find an IDR more manageable, leading to a lower DTI, even though the total interest paid will be higher.

Impact of Repayment Plans on Monthly Payments and Overall DTI

The impact of different repayment plans on monthly payments and DTI is directly proportional to the loan amount, interest rate, and repayment period. Standard plans generally result in higher monthly payments and potentially higher DTI initially, while IDRs offer lower monthly payments and lower DTI, but at the cost of increased total interest paid. The choice between these plans requires careful consideration of short-term versus long-term financial implications. A comparison table could illustrate this clearly, showing different scenarios with varying loan amounts and income levels. For instance, one column could represent the monthly payment under a standard plan, another the monthly payment under an IDR, and a third, the resulting DTI for each.

Tips for Improving DTI Through Repayment Strategies

Improving your DTI through effective student loan repayment strategies requires proactive planning and discipline. Here are some key steps:

- Budgeting and Prioritization: Create a detailed budget to track your income and expenses, identifying areas where you can reduce spending to allocate more towards loan repayment.

- Explore Repayment Options: Carefully compare standard and income-driven repayment plans to determine which best aligns with your financial situation and goals.

- Make Extra Payments: Whenever possible, make extra payments towards your principal balance to reduce the total interest paid and accelerate loan payoff.

- Consolidate Loans: Consolidating multiple loans into a single loan can simplify repayment and potentially secure a lower interest rate, reducing your monthly payment and improving your DTI.

- Seek Professional Advice: Consult a financial advisor for personalized guidance on managing your student loan debt and improving your DTI.

Refinancing Student Loans to Lower DTI

Refinancing student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and improve your DTI. For example, a borrower with high-interest federal loans might refinance to a lower-interest private loan, leading to a lower monthly payment and a better DTI. However, refinancing federal loans into private loans may mean losing access to income-driven repayment plans and other federal benefits. Careful consideration is necessary to weigh the potential benefits against any potential drawbacks.

DTI and its Influence on Credit Score and Future Borrowing

Your debt-to-income ratio (DTI) is a crucial factor lenders consider when assessing your creditworthiness. It directly impacts your credit score and significantly influences your ability to secure loans in the future, affecting both approval chances and the interest rates offered. Understanding this relationship is key to responsible financial management.

Your DTI, representing the percentage of your monthly gross income dedicated to debt repayment, is a strong indicator of your financial stability. Lenders use it to gauge your capacity to manage additional debt. A high DTI suggests a greater financial burden, increasing the perceived risk of loan default. Conversely, a lower DTI indicates better financial health and a lower risk profile, making you a more attractive borrower. This translates to better chances of loan approval and potentially more favorable interest rates.

The Relationship Between DTI, Credit Score, and Loan Approval

A high DTI generally correlates with a lower credit score. Lenders view a high DTI as a sign of potential financial strain, leading them to assign a higher risk to your loan application. This results in a lower credit score, which further limits your access to credit and often leads to higher interest rates on any loans you might secure. For instance, someone with a DTI of 45% might find it difficult to secure a mortgage, even if they have a good credit history, while someone with a DTI of 25% is likely to be considered a much lower risk. Conversely, a low DTI improves your credit score, opening doors to more favorable loan terms and potentially lower interest rates.

Examples of High DTI’s Impact on Credit Access and Interest Rates

Consider two individuals applying for a car loan. Individual A has a DTI of 30% and a good credit score of 750. Individual B has a DTI of 60% and a credit score of 620. Even though both need a car loan, Individual A is significantly more likely to be approved for a loan with a lower interest rate due to their lower DTI and higher credit score. Individual B’s high DTI signals a higher risk to the lender, making them less likely to be approved and, if approved, they will likely face a significantly higher interest rate to compensate for the increased risk. This higher interest rate increases the overall cost of the loan and can make it more difficult to repay.

Improving Credit Score While Managing Student Loan Debt

Managing student loan debt while simultaneously improving your credit score requires a strategic approach.

Several steps can be taken to achieve this:

First, prioritize timely student loan payments. Consistent on-time payments are crucial for building a positive credit history. Late or missed payments significantly damage your credit score. Second, consider exploring student loan repayment options like income-driven repayment plans, which can adjust your monthly payments based on your income. This can reduce your DTI, making it easier to manage your finances. Third, reduce other debts. Paying down credit card balances and other non-student loan debts can significantly lower your DTI and positively impact your credit score. Fourth, monitor your credit report regularly. Checking your credit report for errors and ensuring accuracy is essential. Addressing any inaccuracies promptly can positively affect your credit score. Finally, avoid opening new credit accounts unless absolutely necessary. Each new account inquiry slightly lowers your credit score.

Correlation Between DTI and Credit Score

Imagine a scatter plot graph. The horizontal axis represents the DTI, ranging from 0% to 100%. The vertical axis represents the credit score, ranging from 300 to 850. The data points would generally show a negative correlation. As DTI increases (moving right along the horizontal axis), the credit score tends to decrease (moving down the vertical axis). While not a perfect linear relationship, the overall trend would demonstrate that higher DTIs are associated with lower credit scores. The data points would be clustered more densely in the lower-right quadrant (high DTI, low credit score) and upper-left quadrant (low DTI, high credit score), with fewer data points scattered in the other quadrants. A line of best fit drawn through the data points would have a negative slope, visually representing the inverse relationship between DTI and credit score.

Resources and Support for Managing Student Loan Debt and DTI

Navigating the complexities of student loan debt and its impact on your debt-to-income ratio (DTI) can feel overwhelming. Fortunately, numerous resources and support systems exist to help individuals effectively manage their debt and improve their financial health. Understanding these resources and actively utilizing them is crucial for long-term financial well-being.

Government Programs Offering Student Loan Assistance

The federal government offers several programs designed to assist borrowers in managing their student loan debt. These programs provide various options, from income-driven repayment plans that adjust monthly payments based on income and family size, to loan forgiveness programs for specific professions, such as teaching or public service. The specific eligibility criteria and benefits vary depending on the program. For instance, the Income-Driven Repayment (IDR) plans offer lower monthly payments, potentially leading to loan forgiveness after a set period of qualifying payments. Public Service Loan Forgiveness (PSLF) program, on the other hand, forgives the remaining balance of federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. Thorough research into these programs is essential to determine which option best suits individual circumstances.

Non-Profit Organizations Providing Student Loan Assistance

Numerous non-profit organizations dedicate their efforts to assisting individuals struggling with student loan debt. These organizations often offer free or low-cost financial counseling, workshops, and educational resources. They can provide personalized guidance on debt management strategies, including budgeting, repayment planning, and exploring available government assistance programs. Some organizations may also advocate for policy changes to improve student loan accessibility and affordability. The services provided vary across organizations, so researching and finding an organization aligned with individual needs is crucial. Examples of such organizations include the National Foundation for Credit Counseling (NFCC) and the Student Borrower Protection Center (SBPC).

The Importance of Financial Literacy and Budgeting in Managing Student Loan Debt

Effective management of student loan debt and DTI relies heavily on strong financial literacy and disciplined budgeting. Understanding personal finances, including income, expenses, and debt obligations, is fundamental to creating a realistic repayment plan. Budgeting allows individuals to track their spending, identify areas for savings, and allocate funds towards student loan payments. Financial literacy empowers individuals to make informed decisions regarding their finances, preventing further debt accumulation and improving their overall financial health. This includes understanding credit scores, interest rates, and the long-term implications of various repayment options. Creating a realistic budget that prioritizes debt repayment and tracks progress is crucial for successful debt management.

Online Tools and Resources for Calculating DTI and Managing Student Loans

Several online tools and resources are available to assist individuals in calculating their DTI and managing their student loans. These tools provide convenient ways to track debt, analyze financial health, and explore various repayment strategies.

- Debt-to-Income Ratio Calculators: Many websites offer free DTI calculators that simplify the process of calculating this crucial financial metric. Users simply input their income and debt information to obtain their DTI ratio. This helps assess their financial standing and eligibility for loans or credit.

- Student Loan Repayment Calculators: These calculators help estimate monthly payments based on loan amounts, interest rates, and repayment plans. They allow individuals to explore different repayment scenarios and determine the most manageable option.

- Budgeting Apps and Software: Numerous budgeting apps and software programs are available to help individuals track their income and expenses, set financial goals, and manage their debt effectively. These tools often provide features like automated expense tracking, budgeting visualizations, and debt repayment planning tools.

- Government Websites: Federal student aid websites offer comprehensive information on student loan programs, repayment options, and available assistance. These resources provide official information and guidance directly from the source.

A Guide for Individuals Seeking Help with Student Loan Debt and DTI Management

For individuals struggling with student loan debt and DTI management, a systematic approach is crucial. First, gather all relevant financial documents, including loan statements, income statements, and expense records. Next, calculate your DTI ratio to understand your current financial position. Then, explore available government programs and non-profit organizations offering assistance. Consider consulting with a financial advisor or credit counselor for personalized guidance. Finally, create a realistic budget that prioritizes student loan repayment while maintaining essential living expenses. Regularly review and adjust your budget and repayment plan as needed to ensure you stay on track. Remember, seeking help is a sign of strength, not weakness. Many resources are available to guide you through this process.

Ending Remarks

Successfully managing student loan debt and understanding your debt-to-income ratio are essential steps toward building a secure financial future. By employing the strategies Artikeld in this guide—from choosing the right repayment plan to actively monitoring your credit score—you can gain control of your finances and pave the way for long-term financial success. Remember that seeking professional financial advice can provide personalized guidance tailored to your unique circumstances.

User Queries

What is considered a good DTI ratio?

Generally, a DTI ratio below 36% is considered good, while a ratio below 43% is often acceptable to lenders. However, lower is always better.

Can I consolidate my student loans to lower my DTI?

Consolidating your student loans into a single loan might lower your monthly payment, potentially improving your DTI. However, it’s important to carefully compare interest rates and terms before refinancing.

How does my DTI affect my chances of getting a mortgage?

Lenders use DTI to assess your ability to repay a mortgage. A lower DTI increases your chances of approval and may help you secure a better interest rate.

What if my DTI is too high?

If your DTI is high, focus on reducing your debt, increasing your income, or both. Consider exploring options like income-driven repayment plans for your student loans.