Navigating the complex world of student loan debt after graduation can feel overwhelming. Understanding the relationship between your post-graduation income and your student loan debt is crucial for long-term financial well-being. This guide explores the impact of your debt-to-income ratio on major financial decisions, outlining strategies for effective management and highlighting available government programs and debt relief options.

From budgeting techniques to exploring income-driven repayment plans, we’ll equip you with the knowledge and tools to make informed decisions about your student loan debt and build a secure financial future. We will delve into the long-term implications of various repayment strategies and provide practical advice for navigating this significant financial challenge.

Understanding Student Loan Debt and Income

Navigating the complexities of student loan debt requires a clear understanding of its relationship with post-graduation income. Successfully managing this debt hinges on a careful assessment of your earning potential and the resulting debt-to-income ratio. This section will explore these crucial factors and provide practical examples to illustrate the connection.

The Relationship Between Student Loan Debt and Post-Graduation Income

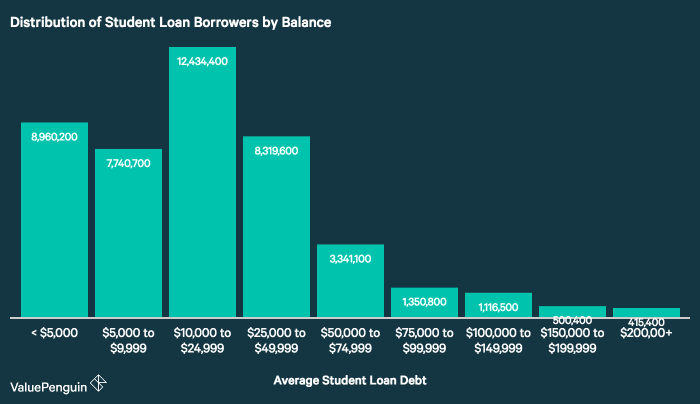

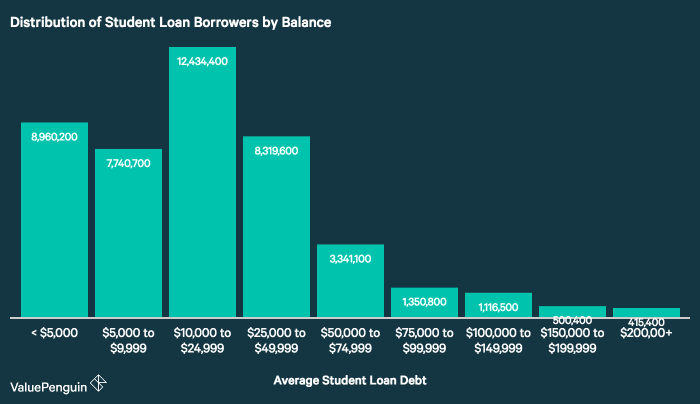

The amount of student loan debt a borrower accumulates is often directly correlated with their anticipated post-graduation income. Individuals pursuing higher-paying professions, such as medicine or engineering, may take on significantly larger loan amounts to finance their education, expecting higher earning potential to offset the debt. Conversely, those pursuing careers with lower average salaries might borrow less, aiming for a more manageable debt-to-income ratio from the outset. This relationship, however, is not always straightforward, as individual career paths and salary negotiations can significantly impact the equation. Unexpected job market fluctuations or career changes can also alter the anticipated income-to-debt balance.

Factors Influencing Student Loan Debt-to-Income Ratio

Several factors influence the debt-to-income ratio for student loan borrowers. These include the total amount borrowed, the interest rate on the loans, the repayment plan chosen, and the borrower’s post-graduation income. Other significant factors are the length of the education (undergraduate vs. graduate), the type of institution attended (public vs. private), and the chosen field of study. Unexpected life events, such as job loss or illness, can also significantly impact a borrower’s ability to manage their debt. Careful planning and realistic budgeting are essential to mitigate these potential challenges.

Examples of Manageable Student Loan Debt Amounts

A manageable student loan debt amount is relative and depends heavily on the individual’s income. For example, a graduate with a starting salary of $60,000 per year might comfortably manage a student loan debt of $50,000, resulting in a debt-to-income ratio of approximately 0.83 (50,000/60,000). However, the same $50,000 debt could be significantly more challenging for a graduate earning $35,000 annually, yielding a debt-to-income ratio of 1.43 (50,000/35,000), which is considered high-risk. These examples highlight the importance of aligning borrowing with realistic income expectations. A lower debt-to-income ratio is generally preferable, aiming for a ratio below 0.40, depending on other financial obligations.

Comparison of Repayment Plans and Their Impact on Debt-to-Income Ratio

The choice of repayment plan significantly affects the debt-to-income ratio. Different plans offer varying monthly payments and loan terms, influencing the overall repayment period and the proportion of income allocated to debt service.

| Repayment Plan | Monthly Payment (Example) | Loan Term (Example) | Impact on Debt-to-Income Ratio |

|---|---|---|---|

| Standard Repayment Plan | $500 | 10 years | May be high initially, decreases over time |

| Graduated Repayment Plan | Starts low, increases over time | 10 years | Lower initially, potentially higher later |

| Extended Repayment Plan | Lower monthly payments | 25 years | Lower monthly impact, but higher total interest paid |

| Income-Driven Repayment Plan (IBR, PAYE, REPAYE) | Based on income and family size | 20-25 years | Lower monthly payments, potentially leading to loan forgiveness |

Impact of Debt-to-Income Ratio on Financial Decisions

A high student loan debt-to-income ratio significantly impacts major financial decisions, potentially limiting opportunities and creating long-term financial challenges. Understanding this impact is crucial for effective financial planning and achieving long-term financial goals.

Your debt-to-income ratio (DTI), calculated by dividing your monthly debt payments by your gross monthly income, is a key factor lenders consider when assessing your creditworthiness. A high DTI indicates a larger portion of your income is already committed to debt repayment, leaving less available for new loans or other financial obligations.

Effect on Major Financial Decisions

A high student loan DTI can make it difficult to secure a mortgage. Lenders prefer borrowers with lower DTIs, as it demonstrates a greater capacity to manage additional debt. For example, someone with a DTI of 45% might find it challenging to qualify for a mortgage, especially if they’re seeking a large loan amount. Similarly, securing financing for a car purchase might also be difficult or require a higher interest rate, increasing the overall cost. This is because a high DTI signals a higher risk of default to lenders.

Challenges in Securing Loans or Credit

Individuals with high student loan DTIs often face challenges in securing loans or credit. Lenders view a high DTI as a significant risk, making it more difficult to qualify for favorable loan terms, such as lower interest rates. This can lead to higher overall borrowing costs and longer repayment periods, further impacting financial health. Credit card applications might also be denied or offered with higher interest rates and lower credit limits. The impact extends beyond traditional loans; even securing rental agreements might become more challenging, as landlords often check credit scores and DTI ratios.

Strategies for Managing High Student Loan Debt and Improving DTI

Several strategies can help manage high student loan debt and improve your DTI. Refinancing your loans at a lower interest rate can significantly reduce monthly payments, freeing up cash flow. Income-driven repayment plans can adjust monthly payments based on your income, making them more manageable. Consolidating multiple loans into a single loan can simplify repayment and potentially lower your interest rate. Additionally, increasing your income through a higher-paying job or a side hustle can improve your DTI. Careful budgeting and reducing unnecessary expenses can also free up funds for debt repayment.

Sample Budget for Reducing Student Loan Debt

A well-structured budget is essential for managing high student loan debt. The following is a sample budget, demonstrating how income can be effectively allocated:

| Category | Percentage of Income | Example (Income = $4,000) |

|---|---|---|

| Housing | 30% | $1200 |

| Student Loan Payments | 25% | $1000 |

| Food | 15% | $600 |

| Transportation | 10% | $400 |

| Utilities | 5% | $200 |

| Savings & Debt Reduction (beyond student loans) | 10% | $400 |

| Other Expenses | 5% | $200 |

This sample budget prioritizes student loan repayment while allocating funds for essential expenses and savings. Adjusting these percentages based on individual circumstances is crucial. For instance, someone with a lower income might need to allocate a smaller percentage to savings initially, focusing primarily on essential expenses and debt repayment.

Government Programs and Debt Relief Options

Navigating the complexities of student loan debt often requires understanding the various government programs designed to provide relief and manageable repayment options. These programs offer a range of solutions, from income-driven repayment plans to loan forgiveness programs, aiming to help borrowers overcome financial challenges and achieve long-term financial stability. Understanding the eligibility criteria and application processes is crucial for effectively utilizing these resources.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more affordable by basing your monthly payment on your income and family size. Several plans exist, each with its own specific formulas and eligibility requirements. Choosing the right plan depends on your individual financial circumstances and long-term goals. The key difference between plans lies in the calculation of your monthly payment and the length of the repayment period. Some plans may lead to loan forgiveness after a certain number of years, while others may not.

Eligibility Criteria and Application Process for Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, offering the possibility of complete or partial loan cancellation under specific circumstances. These programs typically target borrowers working in public service or those who have experienced significant financial hardship. Eligibility requirements vary widely depending on the specific program, often involving factors such as the type of loan, the borrower’s occupation, and the length of employment in a qualifying role. The application process generally involves submitting documentation to verify eligibility and providing detailed information about your employment history and loan details. Meeting all eligibility requirements is critical for a successful application. For example, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying employer.

Loan Consolidation Options and Their Impact on the Debt-to-Income Ratio

Loan consolidation combines multiple federal student loans into a single loan, often simplifying repayment by reducing the number of monthly payments and potentially lowering the interest rate. This can positively impact your debt-to-income ratio (DTI) by potentially lowering your monthly debt payments, thus improving your DTI. However, it’s crucial to understand that consolidation may not always lead to a lower interest rate, and the overall repayment period might be extended, potentially resulting in paying more interest over the life of the loan. Therefore, careful consideration of the long-term financial implications is essential before pursuing loan consolidation.

- Federal Direct Consolidation Loan: This program allows you to combine multiple federal student loans into one new loan with a single monthly payment.

- Impact on DTI: Consolidation can improve your DTI by lowering your monthly payment, but it may extend the repayment period and increase total interest paid.

- Considerations: Carefully compare interest rates before consolidating, as a higher interest rate could negate the benefits.

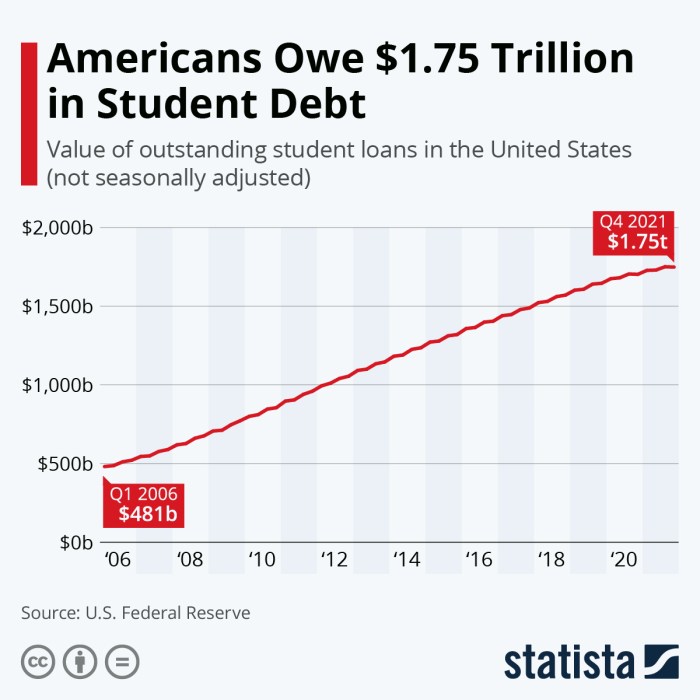

Long-Term Financial Implications of Student Loan Debt

Student loan debt, while a necessary investment for many, casts a long shadow over long-term financial well-being. Understanding its potential impact on key financial aspects is crucial for effective planning and mitigating future challenges. The weight of this debt can significantly affect retirement planning, credit scores, and overall borrowing capacity, shaping financial decisions for years to come.

Retirement Planning and Savings

High student loan debt often necessitates a significant portion of income being allocated towards repayment, leaving less for retirement savings. This can lead to a delayed retirement, reduced retirement income, or even the inability to retire comfortably. For example, someone with $100,000 in student loan debt and a monthly payment of $1,000 may find it difficult to consistently contribute to a retirement account, especially if they also have other financial obligations like housing and transportation. This reduced contribution could significantly impact the size of their retirement nest egg. Early and consistent saving, even small amounts, alongside aggressive student loan repayment strategies, are crucial to mitigate this effect.

Impact on Credit Scores and Future Borrowing Capacity

Student loan debt, particularly if managed poorly (missed payments, high debt-to-income ratio), can negatively affect credit scores. A lower credit score translates to higher interest rates on future loans – for mortgages, auto loans, or even personal loans. This means that the cost of borrowing increases significantly, further impacting long-term financial goals. For instance, a lower credit score might result in a higher interest rate on a mortgage, adding thousands of dollars to the overall cost of a home. Conversely, diligent repayment demonstrates financial responsibility, positively impacting credit scores and increasing borrowing capacity.

Financial Planning Strategies for Individuals with Significant Student Loan Debt

Effective financial planning for individuals with significant student loan debt involves a multi-pronged approach. Prioritizing high-interest debt repayment through strategies like the avalanche method (paying off the highest interest debt first) or the snowball method (paying off the smallest debt first for motivational purposes) is crucial. Budgeting meticulously to allocate funds towards both loan repayment and savings is equally important. Exploring income-driven repayment plans offered by the government can provide temporary relief, allowing for adjustments based on income fluctuations. Furthermore, consulting a financial advisor can provide personalized guidance and tailored strategies for navigating this financial landscape.

Illustrative Representation of Long-Term Impact of Debt Repayment Strategies on Net Worth

Imagine two graphs illustrating net worth over time (e.g., 30 years). Graph A represents an individual aggressively repaying their student loans early, resulting in a steeper upward trajectory of net worth after the loans are paid off. This graph shows rapid growth in net worth as the individual is no longer burdened by significant loan payments, allowing for increased investment and savings. Graph B shows an individual with a slower repayment strategy, resulting in a more gradual increase in net worth, with the impact of student loan payments significantly impacting their net worth accumulation during the early years. The difference between the two graphs highlights the long-term advantage of prioritizing debt repayment and strategic financial planning. The gap between the two net worths widens significantly over time, emphasizing the compounding effect of early debt reduction and consistent saving.

Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a proactive and organized approach. A well-defined plan, coupled with strong financial literacy and, when needed, professional guidance, can significantly ease the burden and accelerate repayment. This section Artikels practical strategies to help you navigate your student loan journey.

Creating a Personalized Student Loan Repayment Plan

Developing a personalized repayment plan is crucial for successful debt management. This involves understanding your loan types, interest rates, and repayment options. Begin by gathering all your loan information, including balances, interest rates, and minimum payments. Next, prioritize loans based on interest rates; focus on paying down high-interest loans first to minimize long-term costs. Consider using a debt repayment calculator available online to model different repayment scenarios and determine the most efficient strategy. Finally, create a realistic budget that incorporates your loan payments, ensuring you can comfortably afford them without compromising essential living expenses. Regularly review and adjust your plan as your financial situation changes.

Budgeting and Financial Literacy for Improved Debt Management

Effective budgeting is paramount to successful student loan repayment. Start by tracking your income and expenses to identify areas where you can cut back. This may involve reducing discretionary spending, such as dining out or entertainment, to free up funds for loan payments. Improving financial literacy is also key. Understanding concepts like interest compounding, budgeting techniques, and debt management strategies empowers you to make informed financial decisions. Utilizing free online resources, workshops, or educational materials can significantly improve your financial knowledge and management skills. For example, understanding the power of compounding interest can motivate you to aggressively pay down high-interest debt.

Benefits of Seeking Professional Financial Advice

Seeking professional financial advice can provide valuable support and guidance in navigating complex student loan repayment strategies. A financial advisor can offer personalized recommendations tailored to your unique financial situation, helping you develop a comprehensive plan that addresses your specific needs and goals. They can also provide insights into various repayment options, including income-driven repayment plans or refinancing opportunities, and help you navigate the complexities of student loan forgiveness programs. The cost of professional advice can be offset by the long-term benefits of improved debt management and increased financial well-being.

Resources and Tools for Student Loan Management

Understanding the available resources is crucial for effective debt management. Many tools and resources are available to assist borrowers in navigating their student loans.

- National Student Loan Data System (NSLDS): Provides a centralized location to view your federal student loan information.

- StudentAid.gov: The official U.S. Department of Education website for student financial aid, offering information on repayment plans, loan forgiveness programs, and other resources.

- Federal Student Aid Repayment Estimator: A tool to estimate your monthly payments under different repayment plans.

- Financial Counseling Services: Many non-profit organizations and credit unions offer free or low-cost financial counseling services.

- Debt Management Apps and Software: Numerous mobile apps and software programs can help you track your debt, create budgets, and manage your payments.

Wrap-Up

Successfully managing student loan debt requires proactive planning, informed decision-making, and a clear understanding of your financial situation. By utilizing the strategies and resources discussed, you can effectively navigate the challenges of high debt-to-income ratios, improve your financial health, and achieve your long-term financial goals. Remember that seeking professional financial advice can be invaluable in tailoring a personalized repayment plan to your specific circumstances.

Clarifying Questions

What is considered a “good” debt-to-income ratio for student loans?

Generally, a debt-to-income ratio (DTI) below 36% is considered good. However, lenders may have different thresholds, and lower is always better.

Can I refinance my student loans to lower my monthly payments?

Yes, refinancing can potentially lower your monthly payments, but it might increase your overall interest paid or affect your eligibility for government programs. Carefully compare offers before refinancing.

What happens if I can’t make my student loan payments?

Defaulting on your loans can severely damage your credit score and lead to wage garnishment or tax refund offset. Explore options like deferment, forbearance, or income-driven repayment plans before defaulting.

How do I find a reputable financial advisor to help with student loan debt?

Seek referrals from trusted sources, check for certifications (like CFP), and verify their experience with student loan debt management. Always clarify fees and services upfront.