The crushing weight of student loan debt is a pervasive issue impacting millions, hindering financial stability and economic growth. This pervasive burden stems from a confluence of factors: escalating tuition costs, stagnant wages, and a complex loan system. Understanding the current landscape of student loan debt, available government programs, and effective management strategies is crucial for navigating this challenging financial reality.

This exploration delves into the multifaceted nature of student loan debt, examining its impact on individuals and the broader economy. We will analyze government initiatives, explore individual strategies for debt reduction, and consider long-term solutions for preventing future crises. The goal is to empower individuals with the knowledge and tools to effectively manage their student loan debt and contribute to a more sustainable higher education system.

The Current State of Student Loan Debt

The weight of student loan debt in the United States is a significant economic and social concern, impacting millions of individuals and the national economy as a whole. Understanding the current state of this debt is crucial for developing effective solutions and mitigating its far-reaching consequences.

The Magnitude of Student Loan Debt

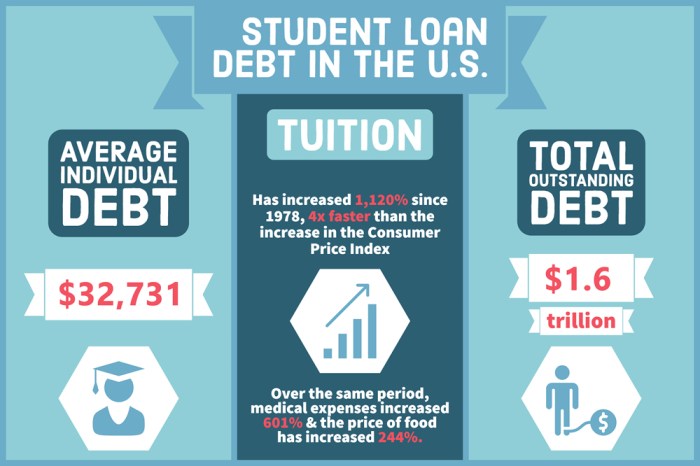

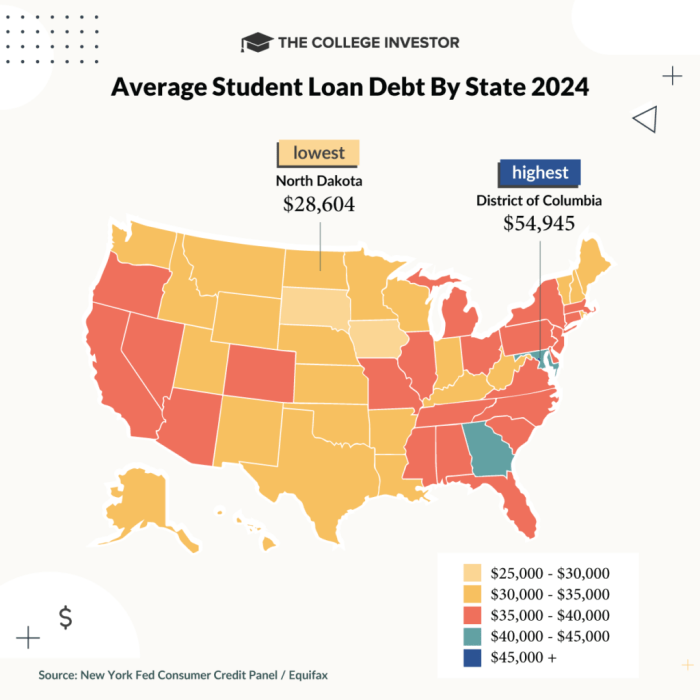

Student loan debt in the United States has reached staggering levels. As of [Insert most recent data available, citing source, e.g., Q3 2023, the Federal Reserve], total student loan debt surpasses [Insert total debt figure, e.g., $1.7 trillion]. This represents a substantial increase from previous years and places a considerable burden on borrowers. The average debt per borrower is approximately [Insert average debt figure, e.g., $37,000], though this figure varies significantly depending on factors such as degree pursued, institution attended, and individual borrowing habits. The distribution of this debt is not uniform across demographics; borrowers from minority groups and those from lower socioeconomic backgrounds often carry a disproportionately higher debt burden.

The Impact of Rising Tuition Costs and Stagnant Wages

The escalating cost of higher education, coupled with stagnant wage growth, has fueled the rapid accumulation of student loan debt. Tuition fees at both public and private institutions have increased significantly over the past several decades, outpacing inflation and the growth of average wages. This disparity leaves many students with no choice but to borrow heavily to finance their education. The resulting debt can significantly delay major life milestones such as homeownership, starting a family, and saving for retirement. For example, a student graduating with $50,000 in debt might face monthly payments that consume a considerable portion of their income, leaving less for other essential expenses.

Types of Student Loans and Their Terms

Borrowers can access various types of student loans, each with its own interest rates and repayment terms. Federal student loans, offered by the government, generally offer lower interest rates and more flexible repayment options compared to private student loans. Federal loans include subsidized and unsubsidized loans for undergraduates and graduate students, as well as PLUS loans for parents and graduate students. Private student loans, on the other hand, are offered by banks and other financial institutions. These loans typically carry higher interest rates and less favorable repayment terms. Interest rates for both federal and private loans fluctuate based on market conditions and the borrower’s creditworthiness. Repayment plans vary, with options ranging from standard 10-year plans to income-driven repayment plans that adjust monthly payments based on the borrower’s income and family size.

Comparison of Federal and Private Student Loan Repayment Options

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, fixed or variable depending on the loan type. | Generally higher, fixed or variable, depending on creditworthiness. |

| Repayment Plans | Standard, graduated, extended, and income-driven repayment plans available. | Typically standard repayment plans, with limited options for income-based repayment. |

| Deferment/Forbearance | Options available under specific circumstances (e.g., unemployment, economic hardship). | Limited or no options for deferment or forbearance, often resulting in accruing interest. |

| Loan Forgiveness Programs | Potential eligibility for loan forgiveness programs (e.g., Public Service Loan Forgiveness). | No government-sponsored loan forgiveness programs. |

Government Policies and Programs Aimed at Reducing Student Loan Debt

The United States government employs a multifaceted approach to addressing the burden of student loan debt, encompassing various programs and policies designed to make repayment more manageable and, in some cases, offer forgiveness. These initiatives, however, have varying degrees of effectiveness and face ongoing debate regarding their long-term impact and cost-effectiveness.

Existing Federal and State Programs for Student Loan Debt Relief

The federal government offers several key programs. Income-driven repayment (IDR) plans adjust monthly payments based on income and family size, potentially extending repayment terms. These include plans like the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. Additionally, federal programs provide loan consolidation options, allowing borrowers to combine multiple loans into a single loan with a potentially lower interest rate. At the state level, initiatives vary widely, with some states offering grants or tax breaks to borrowers, or establishing their own loan forgiveness programs targeted at specific professions or geographic areas. For instance, some states offer loan forgiveness for teachers or healthcare professionals who work in underserved communities. The specifics and availability of these programs differ significantly across states.

Effectiveness of Current Income-Driven Repayment Plans

Income-driven repayment plans offer a crucial lifeline to borrowers facing financial hardship, allowing them to manage monthly payments based on their income. However, their effectiveness is a subject of ongoing discussion. While they prevent immediate default for many, they can significantly extend the repayment period, leading to higher overall interest paid. Furthermore, the complexity of these plans and the variations between them can create confusion for borrowers, potentially leading to unintentional enrollment in less beneficial options. Studies have shown mixed results on the long-term impact of IDR plans, with some suggesting they offer substantial relief while others highlight the potential for increased overall debt burden due to prolonged repayment.

Pros and Cons of Student Loan Forgiveness Programs

Student loan forgiveness programs, while offering immediate debt relief to eligible borrowers, present a complex array of advantages and disadvantages. On the positive side, such programs can stimulate the economy by freeing up borrowers’ disposable income, allowing them to spend more on goods and services. They can also alleviate financial stress and improve borrowers’ overall well-being. However, the significant cost to taxpayers is a major drawback. Furthermore, the criteria for eligibility often lead to debates about fairness and equity, with questions arising about who benefits most and whether the programs effectively target those most in need. There are also concerns that forgiveness programs could incentivize future borrowing, potentially exacerbating the problem in the long run. The Public Service Loan Forgiveness (PSLF) program, for example, has faced criticism for its complex eligibility requirements and low success rate.

A Hypothetical Policy Proposal for Significant Student Loan Debt Reduction

This proposal focuses on a comprehensive approach combining targeted loan forgiveness with long-term systemic reforms. It would prioritize loan forgiveness for borrowers with the highest debt burdens relative to their income, potentially utilizing a sliding scale based on income and debt-to-income ratio. Simultaneously, it would implement significant reforms to the higher education system, including increased transparency in college costs, greater emphasis on affordable educational options, and stricter regulation of for-profit colleges. This two-pronged approach addresses both the immediate crisis of existing debt and the underlying structural issues driving the problem. The predicted impact would be a substantial reduction in overall student loan debt, improved financial stability for borrowers, and a more sustainable and equitable higher education system. The cost would be significant, but could be offset through a combination of increased tax revenue from a stronger economy and targeted cuts in other areas of the federal budget. A similar approach, albeit on a smaller scale, could be seen in the Biden administration’s plan to forgive some student loan debt. While this was met with legal challenges, it illustrates a potential path towards large-scale debt reduction.

The Economic Impact of Student Loan Debt

The crippling weight of student loan debt extends far beyond the individual borrower, significantly impacting both personal financial well-being and the broader macroeconomic landscape. The sheer volume of outstanding loans casts a long shadow over various aspects of the economy, influencing consumer behavior, investment patterns, and overall economic growth. Understanding these multifaceted impacts is crucial for developing effective solutions to address this growing concern.

Impact on Individual Borrowers’ Financial Well-being

High student loan debt severely restricts individual financial freedom. Borrowers often face significant challenges in achieving key financial milestones. For example, the burden of monthly payments can delay or prevent homeownership, a cornerstone of the American Dream. Many find themselves diverting funds earmarked for retirement savings or other crucial investments towards loan repayments, jeopardizing their long-term financial security. This financial strain can also lead to increased stress and reduced overall quality of life. A study by the Federal Reserve found that borrowers with higher student loan debt reported lower levels of financial well-being, including lower savings rates and increased reliance on credit cards. The impact is particularly pronounced for those pursuing lower-paying careers, where loan repayments consume a disproportionately large share of their income.

Macroeconomic Implications of High Student Loan Debt

The accumulation of massive student loan debt has significant macroeconomic consequences. Reduced consumer spending is a major concern. With a substantial portion of their income allocated to loan repayments, borrowers have less disposable income to spend on goods and services, thus dampening overall economic demand. This reduced consumer spending can lead to slower economic growth and potentially hinder job creation. Furthermore, high levels of student loan debt can negatively impact investment. Individuals burdened with debt may postpone or forgo investments in education, business ventures, or other opportunities that could contribute to economic expansion. The uncertainty surrounding future loan repayments can also deter entrepreneurship and risk-taking, hindering innovation and long-term economic growth. The overall effect can be a drag on the economy, potentially slowing down the rate of economic recovery after recessions.

Comparison to Other Forms of Consumer Debt

While student loan debt shares similarities with other forms of consumer debt, such as credit card debt or auto loans, several key differences distinguish its economic consequences. Unlike other forms of debt, student loans often carry longer repayment periods and are less easily discharged through bankruptcy. This prolonged repayment schedule amplifies the long-term financial strain on borrowers and limits their ability to recover financially. Furthermore, the high interest rates associated with some student loans can exacerbate the debt burden, making repayment even more challenging. The impact on future earnings potential is another key difference. While credit card debt might affect immediate spending habits, student loan debt can impact future earning potential by delaying career advancement or limiting career choices due to the need to prioritize debt repayment.

Student Loan Debt’s Impact on Consumer Spending and Investment

The impact of student loan debt on consumer spending and investment is demonstrably negative. Numerous studies have shown a direct correlation between higher student loan debt and lower levels of consumer spending. For example, a 2018 study by the Brookings Institution found that student loan debt significantly reduces consumer spending on durable goods, such as cars and appliances. Similarly, the same study indicated that the debt significantly lowers the likelihood of investing in assets like stocks or real estate. This reduced consumer spending and investment has a ripple effect throughout the economy, impacting businesses, employment, and overall economic growth. Young adults, the primary demographic affected by student loan debt, represent a significant portion of the consumer market, and their reduced spending power has a considerable impact on overall economic activity. Delayed home purchases and reduced retirement savings are direct consequences, highlighting the significant and pervasive nature of this economic challenge.

Strategies for Individuals to Manage and Reduce Student Loan Debt

Managing student loan debt effectively requires a proactive and strategic approach. Understanding your loan terms, exploring available options, and developing a realistic repayment plan are crucial steps towards financial freedom. This section Artikels several strategies individuals can employ to navigate their student loan debt and minimize its long-term impact.

Budgeting and Expense Tracking

Creating a detailed budget is fundamental to managing student loan debt. By meticulously tracking income and expenses, individuals can identify areas where spending can be reduced, freeing up funds for loan repayment. This involves categorizing expenses (housing, transportation, food, entertainment, etc.), comparing them to income, and identifying areas for potential savings. For example, reducing dining out expenses or opting for less expensive transportation can significantly impact monthly loan payments. A well-structured budget provides a clear picture of your financial situation, allowing for informed decisions about debt repayment.

Student Loan Refinancing

Refinancing involves replacing your existing student loans with a new loan at a lower interest rate. This can significantly reduce the total amount paid over the life of the loan. However, it’s crucial to carefully compare offers from multiple lenders to secure the most favorable terms. Factors to consider include the interest rate, fees, and loan term. For example, refinancing from a high-interest private loan to a lower-interest federal loan can lead to substantial savings. Eligibility criteria for refinancing vary depending on the lender and the borrower’s creditworthiness.

Student Loan Consolidation

Consolidation combines multiple student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment by reducing the number of payments and potentially lowering the monthly payment amount. However, the overall interest paid might increase if the new interest rate is higher than the weighted average of the original loans. Therefore, careful consideration of the new interest rate and total cost is essential. For example, consolidating several private loans with varying interest rates into a single federal loan could streamline repayment, but it’s crucial to compare the total interest cost before proceeding.

Creating a Personalized Student Loan Repayment Plan

Developing a personalized repayment plan involves several key steps. First, list all your student loans, including lender, loan amount, interest rate, and minimum monthly payment. Second, calculate your total monthly debt payments, including other loans and credit card debts. Third, create a budget that allocates sufficient funds for loan repayments while covering essential living expenses. Fourth, choose a repayment plan (standard, extended, income-driven) based on your financial circumstances and long-term goals. Finally, regularly review and adjust your plan as needed to reflect changes in income or expenses. For instance, if you receive a salary increase, you can allocate a larger portion of your income towards loan repayment to accelerate the payoff process.

The Importance of Financial Literacy

Financial literacy plays a vital role in preventing and managing student loan debt. Understanding fundamental concepts such as budgeting, saving, investing, and credit management empowers individuals to make informed financial decisions. This knowledge helps in avoiding high-interest loans, creating a realistic repayment plan, and avoiding financial pitfalls that can exacerbate debt. Resources like online courses, workshops, and financial advisors can enhance financial literacy skills. For example, understanding compound interest allows individuals to appreciate the long-term impact of interest on loan repayment, encouraging proactive debt management.

Calculating the Total Cost of a Student Loan

Calculating the total cost of a student loan requires understanding the loan’s principal amount, interest rate, and repayment period. The total cost is the sum of the principal and the total interest accrued over the loan’s lifespan. There are online calculators readily available to assist with this calculation. The formula for simple interest is:

Total Interest = Principal x Interest Rate x Time (in years)

. However, most student loans use compound interest, where interest is calculated on both the principal and accumulated interest. For example, a $10,000 loan with a 5% annual interest rate over 10 years will result in significantly more than $5,000 in interest due to compounding. Using a loan amortization calculator provides a precise calculation of the total cost, including the breakdown of principal and interest payments over the repayment period.

Long-Term Solutions and Prevention Strategies

Addressing the escalating student loan debt crisis requires a multifaceted approach encompassing long-term solutions and preventative measures. Simply reacting to the problem is insufficient; proactive strategies are crucial to ensure future generations have access to affordable higher education without crippling debt. This necessitates a collaborative effort involving government, educational institutions, and individuals themselves.

Tuition Reform and Increased Funding

Tuition costs have risen significantly faster than inflation for decades, making higher education increasingly inaccessible. Long-term solutions necessitate substantial tuition reform. This could involve increased government funding for public universities, potentially through a combination of federal and state appropriations. Models like free community college programs, already implemented in some states, could be expanded nationally. Furthermore, greater transparency in college pricing and financial aid packages would empower students to make informed decisions. Successful implementation would require significant political will and careful planning to avoid unintended consequences, such as reduced quality of education or unequal access across institutions. For example, increased funding could be tied to performance metrics, ensuring accountability and responsible resource allocation.

The Role of Higher Education Institutions in Affordability

Colleges and universities have a critical role in mitigating the affordability crisis. They can achieve this through a variety of strategies. Increased investment in online and hybrid learning models can significantly reduce operational costs, potentially leading to lower tuition fees. Institutions should also prioritize efficiency in administrative processes, reducing overhead and reallocating funds towards instruction and student support. Moreover, universities can expand their scholarship and grant programs, ensuring that financial aid reaches students most in need. This requires a shift in institutional priorities, focusing on accessibility and affordability alongside academic excellence. A successful example is seen in some institutions that have frozen or reduced tuition increases while simultaneously improving student support services.

The Impact of Technology and Online Learning

Technology and online learning offer significant potential to reduce the cost of higher education. Online courses and programs often have lower overhead costs than traditional in-person instruction, potentially leading to lower tuition fees for students. Moreover, online learning can increase accessibility, allowing students in remote areas or with scheduling constraints to pursue higher education. The wider adoption of open educational resources (OER), such as free and openly licensed textbooks and learning materials, can significantly reduce the cost of educational materials for students. However, careful consideration must be given to ensuring quality and equitable access to technology and support services for all students, regardless of their socioeconomic background. The successful integration of technology requires significant investment in infrastructure and faculty training.

Preventative Measures for Individuals

Proactive measures can significantly reduce reliance on student loans. Careful planning before college is paramount.

- Explore affordable alternatives: Consider community colleges for the first two years of study, followed by transferring to a four-year university. This can significantly reduce overall tuition costs.

- Maximize financial aid: Complete the FAFSA (Free Application for Federal Student Aid) diligently and explore all available scholarships and grants. This can reduce the need for loans.

- Choose a cost-effective major: Select a major that aligns with career goals and considers potential earning potential. Some majors may lead to higher earning potential, justifying higher tuition costs, while others may not.

- Work part-time during college: Earning money while studying can reduce the amount of borrowing required. This can also provide valuable work experience.

- Live frugally: Minimize living expenses during college by living at home, sharing accommodation, or choosing affordable housing options.

- Graduate in a timely manner: Completing a degree within the expected timeframe minimizes overall tuition costs and interest accrued on loans.

Illustrative Examples of the Impact of Student Loan Debt

Understanding the real-world effects of student loan debt requires examining specific scenarios. These examples highlight both the potential negative consequences of high debt burdens and the positive outcomes achievable through effective repayment strategies. The following case studies and visual representation aim to provide a clearer picture of the challenges and opportunities involved.

Long-Term Financial Consequences of High Student Loan Debt

Consider Sarah, a recent college graduate with a bachelor’s degree in art history and $70,000 in student loan debt. She secured a position as a museum assistant, earning an annual salary of $35,000. While her income is sufficient for basic living expenses in her city, a significant portion is dedicated to student loan repayments. Opting for a standard 10-year repayment plan, her monthly payments are substantial, leaving limited funds for savings, investments, or addressing unexpected expenses. This financial strain impacts her ability to save for a down payment on a house, hinders potential career advancement requiring further education (which would increase her debt), and restricts her ability to build a comfortable financial future. Her limited disposable income also affects her ability to pursue personal goals, such as travel or further education. Sarah’s situation illustrates how high student loan debt can severely constrain financial flexibility and long-term prospects, potentially leading to delayed milestones like homeownership and retirement planning.

Successful Student Loan Repayment Strategy: A Case Study

In contrast, consider David, who also graduated with significant student loan debt – $60,000. However, David pursued a career in software engineering, securing a higher-paying job with an annual salary of $80,000. He proactively researched and chose an income-driven repayment plan, which adjusted his monthly payments based on his income and family size. He also aggressively paid down his high-interest loans first, minimizing the total interest accrued. By diligently budgeting, minimizing unnecessary expenses, and prioritizing his debt repayment, David successfully paid off his student loans within seven years. His proactive approach allowed him to achieve financial stability earlier than expected, enabling him to save for a down payment on a house, invest in his retirement, and enjoy a greater degree of financial freedom. David’s case highlights the positive impact of careful financial planning, strategic debt management, and the choice of a suitable repayment plan.

Visual Representation of Student Loan Debt Accumulation and Repayment

Imagine a graph charting the accumulation and repayment of student loan debt. The x-axis represents time (in years), starting from the beginning of college and extending beyond graduation. The y-axis represents the total loan balance. The graph would begin with a relatively low balance, gradually increasing during the college years as loans are taken out. Upon graduation, the graph shows a peak, representing the maximum loan balance. The graph then shows a downward slope, representing the repayment process. The steepness of this slope varies depending on the repayment plan and the borrower’s income. A steeper slope indicates faster repayment. Different colored lines could represent different repayment strategies (e.g., standard repayment, income-driven repayment). The graph would visually illustrate the length of time it takes to repay the debt and the impact of various repayment strategies on the overall repayment period. Finally, the graph would end with the loan balance reaching zero, signifying complete repayment.

Closing Notes

Addressing the student loan debt crisis requires a multi-pronged approach. While individual strategies for managing debt are essential, systemic changes are equally vital. From reforming tuition costs and increasing financial aid to implementing more effective government programs and promoting financial literacy, a collaborative effort is needed. By understanding the complexities of the issue and actively engaging in solutions, we can pave the way towards a brighter financial future for borrowers and a more equitable higher education system.

Detailed FAQs

What is the difference between federal and private student loans?

Federal loans are offered by the government and generally offer more borrower protections and flexible repayment options. Private loans are from banks and credit unions, often with higher interest rates and less lenient terms.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan, potentially simplifying repayment. However, it may not always lower your interest rate.

What is income-driven repayment?

Income-driven repayment plans adjust your monthly payment based on your income and family size. They may lead to loan forgiveness after a certain number of years.

What happens if I default on my student loans?

Defaulting on student loans has serious consequences, including wage garnishment, tax refund offset, and damage to your credit score.