Navigating the complexities of student loan debt can feel overwhelming, but understanding the student loan interest deduction can significantly alleviate the financial burden. This guide provides a comprehensive overview of eligibility requirements, calculation methods, necessary documentation, and potential tax savings associated with this valuable deduction. We’ll explore various scenarios, common pitfalls, and alternative strategies for managing student loan debt, empowering you to make informed decisions about your finances.

This deduction offers a crucial opportunity for taxpayers to reduce their tax liability by claiming a portion of the interest they paid on qualified student loans. However, understanding the specific rules and regulations is essential to ensure a successful claim. This guide aims to demystify the process, providing clear explanations and practical examples to help you navigate the complexities of claiming this deduction.

Eligibility Requirements for Student Loan Interest Deduction

The student loan interest deduction allows taxpayers to deduct the amount they paid in student loan interest during the tax year. This can significantly reduce your taxable income and, consequently, your tax liability. However, eligibility isn’t universal and depends on several factors, including your adjusted gross income (AGI) and the type of loan.

Adjusted Gross Income (AGI) Limits

The amount of student loan interest you can deduct is limited based on your modified adjusted gross income (MAGI). This is your AGI with certain deductions added back. For the 2023 tax year, the deduction is phased out for single filers with a MAGI above $85,000 and for married couples filing jointly with a MAGI above $170,000. The phase-out means the deduction is gradually reduced as your income increases within these ranges, eventually reaching zero. It’s crucial to consult the IRS guidelines for the specific phase-out rules applicable to your tax year, as these limits can change.

Qualifying Student Loans

The deduction applies only to interest paid on qualified education loans. These are loans taken out to pay for higher education expenses for yourself, your spouse, or your dependent. This includes tuition, fees, room, and board. Loans taken out for other purposes, such as personal expenses or business ventures, do not qualify. Loans from federal, state, or private lenders are generally eligible, provided they meet the criteria.

Determining Eligibility Based on Filing Status

Eligibility for the student loan interest deduction is determined based on your filing status and your modified adjusted gross income (MAGI).

- Single Filers: Single filers can claim the deduction if their MAGI is below $85,000 (for the 2023 tax year). Above this threshold, the deduction is gradually phased out.

- Married Filing Jointly: Married couples filing jointly can claim the deduction if their combined MAGI is below $170,000 (for the 2023 tax year). Above this, the deduction is phased out.

- Married Filing Separately: Individuals filing separately generally cannot claim the student loan interest deduction.

- Head of Household: The MAGI limits for head of household filers are between the single and married filing jointly limits and should be checked with the current IRS guidelines.

Remember to consult the official IRS instructions for the specific tax year you are filing. The income thresholds and phase-out rules can vary from year to year.

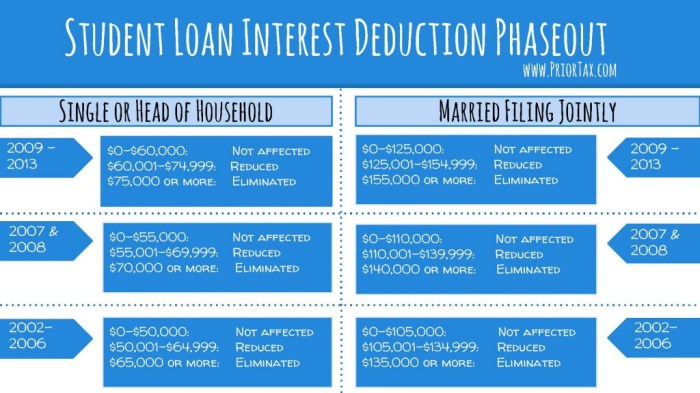

Eligibility Requirements Comparison Across Tax Years

It’s important to note that the AGI limits for the student loan interest deduction are subject to change annually. Therefore, it’s vital to consult the official IRS publications for the specific year you are filing. The following table provides a general comparison, but it is not exhaustive and may not reflect the most up-to-date information. Always refer to the IRS website for the most current details.

| Tax Year | Single Filers (MAGI Limit) | Married Filing Jointly (MAGI Limit) | Other Filing Statuses |

|---|---|---|---|

| 2023 | $85,000 | $170,000 | Refer to IRS Publication 970 |

| 2022 | $85,000 | $170,000 | Refer to IRS Publication 970 |

| 2021 | $70,000 | $140,000 | Refer to IRS Publication 970 |

| 2020 | $70,000 | $140,000 | Refer to IRS Publication 970 |

Calculating the Deduction

The student loan interest deduction allows you to deduct the actual amount of interest you paid on qualified student loans during the tax year. However, there are limitations, and the deduction’s value depends on your modified adjusted gross income (MAGI) and the amount of interest paid. Understanding the calculation process is crucial for accurately claiming this deduction.

The calculation itself is relatively straightforward. You start by determining the total amount of student loan interest you paid during the tax year. This information is typically found on Form 1098-E, Student Loan Interest Statement, which your lender should provide. You then compare this amount to your adjusted gross income (AGI) to determine your maximum deduction. The maximum deduction is $2,500, but this amount can be reduced based on your MAGI.

Maximum Deduction Based on MAGI

The amount you can deduct is phased out if your modified adjusted gross income (MAGI) exceeds certain thresholds. These thresholds change annually, so it’s essential to consult the current IRS guidelines. For example, in a hypothetical scenario, let’s say the single filer phase-out range is between $70,000 and $85,000. If a taxpayer’s MAGI is $75,000, their deduction will be reduced proportionally. The exact reduction calculation is determined by the IRS and will vary depending on the tax year. It’s advisable to use tax software or consult a tax professional for precise calculations in such cases.

Hypothetical Example

Let’s imagine Sarah paid $1,800 in student loan interest during the tax year. Her MAGI is below the phase-out threshold. In this case, Sarah can deduct the full $1,800. She will report this deduction on Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), even though she’s not claiming an education credit. The deduction will reduce her taxable income, leading to a lower tax liability.

Interaction with Other Tax Deductions

The student loan interest deduction is an above-the-line deduction, meaning it’s subtracted from your gross income before calculating your adjusted gross income (AGI). This is beneficial because it reduces your AGI, which can impact your eligibility for other tax benefits that are based on AGI, such as certain tax credits. For example, a lower AGI could potentially increase the amount of certain credits you are eligible to claim. However, it doesn’t directly interact with other itemized deductions (like those on Schedule A).

Scenarios Illustrating Deduction Variation

The student loan interest deduction amount is directly affected by the interest paid and the taxpayer’s MAGI.

| Scenario | Interest Paid | MAGI | Deduction | Reasoning |

|---|---|---|---|---|

| Scenario 1 | $2,200 | $60,000 (Below Phase-out) | $2,200 | Full deduction allowed because MAGI is below the threshold. |

| Scenario 2 | $3,000 | $60,000 (Below Phase-out) | $2,500 | Maximum deduction is $2,500, regardless of interest paid above this amount. |

| Scenario 3 | $1,500 | $90,000 (Above Phase-out) | $0 | No deduction allowed because MAGI is significantly above the phase-out threshold. |

| Scenario 4 | $2,000 | $75,000 (Within Phase-out Range) | Partial Deduction (amount varies based on IRS phase-out rules) | Deduction is reduced proportionally based on the taxpayer’s MAGI within the phase-out range. |

Student Loan Interest Deduction Calculation Flowchart

The following flowchart visually represents the process of calculating the student loan interest deduction.

(Note: A textual representation is provided below as image creation is outside the scope of this response. Imagine a flowchart with boxes and arrows. The boxes would contain the steps described below. Arrows would indicate the flow from one step to the next.)

- Determine total student loan interest paid (from Form 1098-E).

- Determine your Modified Adjusted Gross Income (MAGI).

- Check IRS guidelines for the applicable MAGI phase-out ranges for your filing status and tax year.

- If MAGI is below the phase-out range, the deduction is the lesser of the interest paid or $2,500.

- If MAGI is within the phase-out range, calculate the reduced deduction based on IRS rules (this usually involves a proportional reduction).

- If MAGI is above the phase-out range, the deduction is $0.

- Report the deduction on Form 8863.

Documentation and Record Keeping

Proper documentation is crucial for successfully claiming the student loan interest deduction. Failing to maintain accurate records can lead to delays in processing your return or even rejection of your claim. Careful record-keeping ensures a smooth and efficient tax filing process.

Accurate record keeping simplifies the process of claiming the student loan interest deduction. This involves collecting and organizing all necessary documentation, ensuring it’s readily accessible when filing your tax return. Maintaining well-organized records also helps prevent errors and simplifies potential audits.

Necessary Documentation

To claim the student loan interest deduction, you’ll need Form 1098-E, Student Loan Interest Statement. This form is issued by your lender and reports the total amount of interest you paid during the tax year. If you made payments to multiple lenders, you will receive a separate Form 1098-E from each. You should also retain copies of your student loan payment records, even if they are not explicitly required by the IRS, as they can be invaluable in case of discrepancies or audits. These records might include bank statements showing loan payments, payment confirmations from your lender, or canceled checks.

Best Practices for Organizing and Storing Records

Organizing your student loan interest payment records effectively is essential. A simple, yet effective method is to create a dedicated file for all your student loan documents. This file should contain your Form 1098-E, payment confirmations, and bank statements. Consider using a digital filing system, such as a cloud storage service or a well-organized folder on your computer, to easily access and manage your documents. Alternatively, a physical filing system with clearly labeled folders can also work well. Regardless of your chosen method, ensure your system allows for easy retrieval of documents when needed. Remember to keep these records for at least three years after filing your tax return, as this is the IRS’s recommended period for record retention.

Acceptable Documentation Formats

Acceptable documentation formats include electronic copies (PDFs, scanned images), physical copies (paper statements, canceled checks), and online banking records showing loan payments. Ensure any scanned documents are clear and legible. For online banking records, printouts showing the relevant transactions are generally acceptable. The key is that the documentation clearly shows the date, amount, and recipient of the student loan interest payment.

Essential Documents Checklist

- Form 1098-E (Student Loan Interest Statement) from each lender.

- Copies of bank statements or other payment records showing student loan interest payments.

- Payment confirmations or receipts from your lender(s).

- Your tax return from the previous year (for comparison and reference).

Tax Form Completion and Filing

Claiming the student loan interest deduction involves accurately completing the relevant sections of your federal income tax return, Form 1040. This process is straightforward but requires careful attention to detail to ensure you receive the correct deduction amount. Understanding the steps involved will help you navigate this aspect of your tax filing efficiently.

Successfully claiming the student loan interest deduction requires accurate reporting on Form 1040. The specific form and line number may change slightly from year to year, so it’s crucial to consult the current year’s instructions. Generally, you’ll report the deduction on Schedule 1 (Additional Income and Adjustments to Income), specifically on line 21. This schedule is used to report various adjustments to income, including the student loan interest deduction.

Reporting the Student Loan Interest Deduction on Form 1040

To claim the student loan interest deduction, you’ll need to gather your Form 1098-E, Student Loan Interest Statement, which your lender provides if you paid at least $600 in student loan interest during the tax year. This form provides the total amount of interest you paid. You’ll then transfer this amount to Schedule 1 (Additional Income and Adjustments to Income), line 21. The amount reported on line 21 will then be carried over to your Form 1040 to reduce your adjusted gross income (AGI). Remember to keep a copy of your Form 1098-E for your records.

Comparison of Paper and Electronic Filing Methods

Both paper and electronic filing methods allow you to claim the student loan interest deduction. However, electronic filing offers several advantages. Electronic filing is generally faster, reducing processing time and the risk of errors. The IRS also offers tools and software that can help guide you through the process, reducing the likelihood of mistakes. While paper filing is still an option, electronic filing is often more efficient and convenient.

Steps for Claiming the Student Loan Interest Deduction

The following steps Artikel the process for claiming the student loan interest deduction:

- Gather your Form 1098-E, Student Loan Interest Statement.

- Complete Schedule 1 (Additional Income and Adjustments to Income), entering the amount from Form 1098-E on line 21.

- Transfer the amount from Schedule 1, line 21, to the appropriate line on Form 1040 to calculate your adjusted gross income (AGI).

- File your tax return, either electronically or by mail, ensuring all necessary forms and documentation are included.

Impact of the Deduction on Tax Liability

The student loan interest deduction can significantly reduce your annual tax liability, providing welcome relief for those burdened with student loan debt. The amount you save depends on several factors, primarily your adjusted gross income (AGI) and the amount of interest you paid during the tax year. This deduction is particularly beneficial for those in lower to middle income brackets, where a smaller tax liability means a larger percentage reduction in overall tax owed.

The deduction works by directly reducing your taxable income. This means the amount you deduct is subtracted from your AGI before your tax liability is calculated. The lower your taxable income, the lower your tax liability, resulting in a greater potential tax savings from the deduction. For example, someone in a higher tax bracket will see a larger dollar amount reduction in their taxes than someone in a lower tax bracket, even if they both deduct the same amount of student loan interest. However, the percentage reduction in tax liability might be higher for the individual in the lower tax bracket.

Tax Savings Examples Based on Income Levels

Let’s illustrate the potential tax savings with a couple of examples. Assume a taxpayer paid $1,500 in student loan interest during the year.

Example 1: A taxpayer with an AGI of $40,000 might be in a 12% tax bracket. Deducting $1,500 reduces their taxable income, resulting in a tax savings of approximately $180 (12% of $1,500).

Example 2: A taxpayer with an AGI of $80,000 might be in a 22% tax bracket. The same $1,500 deduction would reduce their tax liability by approximately $330 (22% of $1,500). While the dollar amount saved is higher, the percentage of tax savings is lower than for the taxpayer in the lower bracket.

Comparison with Other Student Tax Benefits

The student loan interest deduction is one of several tax benefits available to students and recent graduates. Other options include the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), which offer tax credits for qualified education expenses. The key difference is that the student loan interest deduction reduces taxable income, while tax credits directly reduce the amount of tax owed. The most advantageous option depends on individual circumstances and which credits or deductions maximize the tax benefits. It is possible to claim both the student loan interest deduction and other education-related tax credits, provided you meet all eligibility requirements for each.

Potential Tax Savings Across Income Brackets

| Adjusted Gross Income (AGI) | Approximate Tax Bracket | Student Loan Interest Deduction ($1500) | Approximate Tax Savings |

|---|---|---|---|

| $40,000 | 12% | $1500 | $180 |

| $60,000 | 22% | $1500 | $330 |

| $80,000 | 24% | $1500 | $360 |

| $100,000 | 24% | $1500 | $360 |

*Note: Tax brackets and rates are subject to change and these are simplified examples for illustrative purposes only. Consult current IRS guidelines for accurate tax rates and eligibility criteria. The actual tax savings may vary depending on individual circumstances and other factors affecting taxable income.

Changes and Updates to the Student Loan Interest Deduction

The student loan interest deduction, while offering valuable tax relief, is subject to change. Understanding these changes and their potential impact is crucial for taxpayers utilizing this deduction. This section will Artikel recent updates, explore possible future implications, and provide resources for staying informed.

Recent Changes to the Student Loan Interest Deduction

The student loan interest deduction rules haven’t undergone sweeping revisions in recent years. However, subtle changes related to income limitations and the overall tax code can indirectly affect the deduction’s accessibility and value. For example, changes to standard deduction amounts or tax brackets can alter the overall tax liability and thus the impact of the deduction. It’s important to consult the most recent IRS publications and guidelines for the most up-to-date information, as minor adjustments can occur annually.

Potential Future Implications for the Deduction

Predicting the future of any tax deduction is inherently speculative. However, several factors could influence the student loan interest deduction’s long-term viability. Government budgetary constraints, shifts in higher education policy, and evolving societal views on student loan debt all play a role. For instance, increased government efforts to address student loan debt through forgiveness programs might lead to a reevaluation of the need for this deduction. Conversely, a significant increase in student loan debt levels could strengthen the case for its continuation or expansion.

Resources for Staying Informed About Changes

Staying informed about changes to the student loan interest deduction requires proactive engagement with official sources. The IRS website (IRS.gov) is the primary resource, providing current publications, forms, and instructions. Tax professionals, financial advisors, and reputable tax news websites can also offer valuable insights and updates. Subscribing to IRS email alerts or following their social media accounts can ensure timely notification of any significant changes.

Timeline of Significant Changes to the Student Loan Interest Deduction

Tracking precise changes requires detailed historical analysis of tax legislation. However, a general timeline could highlight major shifts affecting the deduction’s eligibility, calculation, or overall availability. For example, the American Taxpayer Relief Act of 2012 introduced several changes to the deduction’s limits and phased it out for higher-income taxpayers. This illustrates that significant changes haven’t been frequent but are possible through legislative action. A more comprehensive timeline would require reviewing historical tax legislation and IRS publications.

Common Mistakes and Pitfalls

Claiming the student loan interest deduction, while beneficial, is prone to errors. Understanding these common mistakes and their consequences is crucial for ensuring a smooth and accurate tax filing. Failure to do so can result in delays, penalties, and even amended returns.

Many taxpayers unintentionally make errors when claiming the student loan interest deduction, often due to misunderstandings of the eligibility criteria or the proper calculation methods. These errors can range from simple oversights to more significant misinterpretations of the IRS guidelines. The consequences of these errors can include delays in receiving refunds, additional tax owed, penalties, and the need to file amended tax returns.

Incorrect Reporting of Paid Interest

Accurately reporting the amount of student loan interest paid is paramount. A common mistake is misreporting the total interest paid during the tax year. This could involve overlooking interest payments made through automatic deductions, failing to include interest paid on multiple loans, or incorrectly calculating the total interest from various loan statements. For example, a taxpayer might only include interest payments reflected in one statement, forgetting about a second loan with a different servicer. This inaccuracy could lead to either an under- or over-stated deduction, resulting in an incorrect tax liability. Carefully reviewing all loan statements and keeping detailed records is vital to prevent this error.

Failure to Meet Eligibility Requirements

Another frequent error involves failing to meet all eligibility requirements. Taxpayers may incorrectly believe they qualify for the deduction without verifying their modified adjusted gross income (MAGI) falls within the limits. Similarly, they might overlook the requirement that the student loan must be for the taxpayer’s education or that of their spouse or dependent. For instance, a taxpayer might claim the deduction for a loan used to pay for their child’s graduate degree, when the child is considered an independent filer. This results in a disallowed deduction and a potential penalty. Thoroughly reviewing the IRS guidelines and confirming eligibility before claiming the deduction is essential.

Incorrect Filing Status

The student loan interest deduction is subject to the taxpayer’s filing status, meaning that a married taxpayer filing jointly has different limits than a single filer. Incorrectly stating the filing status on the tax return can lead to an incorrect calculation of the deduction and may result in the deduction being disallowed, especially if it leads to exceeding the MAGI limit for the given filing status. A taxpayer who files as married filing separately might not be eligible for the deduction at all, depending on their income. Double-checking the filing status and the corresponding MAGI limits is crucial to avoid this pitfall.

Improper Record Keeping

Maintaining accurate records of student loan interest payments is vital for successfully claiming the deduction. Without proper documentation, the IRS may disallow the deduction. This includes keeping all loan statements, payment confirmations, and any other supporting documentation that shows the amount of interest paid. For example, simply remembering the approximate amount of interest paid will not suffice. A taxpayer lacking this documentation may find their claim denied, requiring a potentially lengthy and complicated process to rectify the situation.

Alternative Strategies for Managing Student Loan Debt

Navigating student loan debt requires a multifaceted approach that extends beyond simply claiming the interest deduction. Effective management involves understanding various repayment options, exploring debt consolidation strategies, and proactively budgeting to minimize financial strain. This section Artikels several alternative strategies to help borrowers effectively manage their student loan debt.

Beyond tax deductions, several powerful tools can help manage student loan debt. These strategies offer different approaches to repayment, each with its own set of benefits and drawbacks, depending on individual financial circumstances and loan characteristics.

Repayment Plan Options

Choosing the right repayment plan is crucial for long-term financial health. Different plans offer varying monthly payments, interest accrual rates, and loan forgiveness possibilities. Understanding these nuances is key to making an informed decision.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over 10 years. While straightforward, it might result in higher monthly payments compared to other options.

- Graduated Repayment Plan: Payments start low and gradually increase over time, making them more manageable initially but potentially leading to higher payments later in the repayment period.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but significantly higher total interest paid over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans, including ICR, PAYE, REPAYE, andIBR, base monthly payments on your income and family size. Payments are typically lower, and remaining balances may be forgiven after 20-25 years, depending on the plan and your income. However, forgiven amounts may be considered taxable income.

Debt Consolidation

Consolidating multiple student loans into a single loan can simplify repayment. This often results in a single monthly payment and potentially a lower interest rate, although this isn’t always guaranteed. However, it’s crucial to carefully compare the interest rates offered by consolidation programs versus your current loans to ensure it’s financially beneficial.

Debt Management Strategies

Effective budgeting and financial planning are critical for successful debt management. Careful tracking of income and expenses helps identify areas for savings, which can then be allocated towards loan repayments.

- Budgeting and Financial Planning: Creating a detailed budget helps visualize income and expenses, allowing for strategic allocation of funds towards debt repayment.

- Seeking Financial Counseling: A financial counselor can provide personalized guidance on debt management strategies, budgeting, and exploring options like debt management plans or bankruptcy (as a last resort).

- Negotiating with Lenders: In some cases, borrowers can negotiate with their lenders for lower interest rates or modified repayment plans. This requires careful preparation and a clear understanding of your financial situation.

Final Summary

Successfully claiming the student loan interest deduction can provide substantial tax relief, easing the financial strain of student loan debt. By understanding the eligibility criteria, accurately calculating the deduction, and maintaining meticulous records, taxpayers can maximize their tax savings. Remember to stay informed about any changes in regulations and consider exploring alternative debt management strategies to create a comprehensive financial plan. Taking advantage of this deduction is a crucial step towards responsible financial management and achieving long-term financial well-being.

FAQ Summary

Can I deduct interest paid on PLUS loans?

Yes, provided the loans are used to pay for qualified education expenses.

What if I paid interest but didn’t receive a Form 1098-E?

You can still claim the deduction; you’ll need to gather documentation from your lender showing the interest paid.

Is there a limit to how much interest I can deduct?

Yes, the deduction is limited to the actual amount of interest paid, and there are AGI limits.

What happens if I make a mistake on my return?

You can file an amended return (Form 1040-X) to correct any errors.

Can I claim this deduction if I’m a non-resident alien?

Generally, no. Specific residency requirements apply.