The weight of student loan debt is a significant concern for many, and the specter of default looms large for those struggling to manage repayments. This comprehensive guide delves into the complexities of student loan default, exploring its causes, consequences, and potential avenues for prevention. We will examine both the individual and societal impacts, providing a clear understanding of this critical issue and offering practical strategies for navigating the challenges involved.

From the initial loan disbursement to the potential ramifications of default, we will trace the entire lifecycle of student loan debt. We’ll dissect the factors contributing to default, including socioeconomic disparities, unexpected life events, and the crucial role of financial literacy. Furthermore, we will explore the available resources and support systems designed to assist borrowers in avoiding default and managing their debt effectively.

Understanding Student Loan Default

Student loan default is a serious financial situation with significant consequences. It occurs when a borrower fails to make their scheduled loan payments for a specific period, typically 90 days or more, leading to the loan being considered delinquent and eventually in default. Understanding the process, consequences, and potential causes is crucial for borrowers to avoid this detrimental outcome.

Definition of Student Loan Default

Student loan default is formally defined as the failure to make required payments on a student loan for a specified period, resulting in the loan being reported to credit bureaus as delinquent and potentially leading to further legal and financial repercussions. This typically occurs after a period of non-payment, usually 90 days or longer, depending on the loan type and lender. The lender then considers the loan to be in default, triggering a range of actions to recover the outstanding debt.

The Process Leading to Default

The path to student loan default usually begins with missed payments. Initially, borrowers may receive late payment notices and reminders. As missed payments continue, the loan becomes delinquent. Lenders may attempt to contact the borrower to arrange repayment plans or explore options like forbearance or deferment. If these efforts fail, the loan eventually progresses to default status. This process can vary slightly depending on whether the loan is federal or private.

Consequences of Defaulting on a Student Loan

Defaulting on a student loan carries severe consequences that can significantly impact a borrower’s financial life for years to come. These consequences include damage to credit scores, wage garnishment, tax refund offset, difficulty obtaining future loans or credit, and potential legal action. The severity of these consequences can vary depending on the loan type and the amount of debt.

Situations Leading to Student Loan Default

Several situations can contribute to student loan default. Unexpected job loss, significant medical expenses, divorce, or a combination of these factors can create financial hardship making loan repayments difficult or impossible. Underestimating repayment costs, poor financial planning, or lack of understanding of repayment options can also lead to default. For example, a borrower who loses their job and is unable to find new employment may struggle to make payments, ultimately leading to default. Similarly, a borrower facing unexpected medical bills might find themselves unable to prioritize loan payments.

Comparison of Consequences: Federal vs. Private Student Loans

| Consequence | Federal Student Loans | Private Student Loans |

|---|---|---|

| Credit Score Impact | Negative impact reported to credit bureaus; can significantly lower credit score. | Negative impact reported to credit bureaus; can significantly lower credit score. |

| Wage Garnishment | Possible; government can garnish wages to recover the debt. | Possible; lender can pursue legal action, including wage garnishment. |

| Tax Refund Offset | Possible; government can seize a portion or all of the borrower’s tax refund. | Less common; lender may need to pursue legal action to obtain this. |

| Legal Action | Government can pursue legal action, including lawsuits. | Lender can pursue legal action, including lawsuits. |

Factors Contributing to Student Loan Default

Student loan default is a complex issue stemming from a confluence of factors, often interacting in intricate ways. Understanding these contributing elements is crucial for developing effective prevention and intervention strategies. While individual responsibility plays a role, systemic and circumstantial factors significantly influence the likelihood of default.

Socioeconomic Factors Contributing to Student Loan Default

Lower socioeconomic backgrounds often present significant barriers to successful loan repayment. Individuals from families with limited financial resources may have less access to financial education and support networks, making responsible financial planning more challenging. Furthermore, they may face higher rates of unemployment and underemployment, leading to reduced earning potential and difficulty in meeting loan obligations. Limited access to higher-paying jobs, compounded by potential geographical limitations (e.g., needing to relocate for better opportunities but lacking resources), further exacerbates the problem. For example, a student from a low-income family may struggle to afford living expenses while attending college, forcing them to take on additional part-time work which could hinder their academic performance and ultimately affect their career prospects.

The Role of Unexpected Life Events in Student Loan Default

Unexpected life events can dramatically impact an individual’s ability to manage their student loan debt. Job loss, a major illness, or a family emergency can severely disrupt income and create unexpected expenses, making loan payments a low priority. For instance, a sudden job loss might leave a borrower struggling to meet basic needs, let alone their monthly loan payments. Similarly, a serious illness can lead to substantial medical bills and lost wages, pushing borrowers into a difficult financial situation that can quickly lead to default. The lack of adequate savings or emergency funds further compounds the issue, leaving borrowers vulnerable to these unforeseen circumstances.

The Impact of Inadequate Financial Literacy on Default Rates

A lack of financial literacy significantly contributes to student loan default. Many borrowers lack a clear understanding of loan terms, repayment options, and the long-term consequences of default. This includes a lack of understanding regarding interest capitalization, the impact of deferment and forbearance on long-term loan costs, and the available resources for managing debt. Without proper financial education, borrowers may make poor financial decisions, leading to increased debt and ultimately, default. For example, an individual who doesn’t understand the compounding effect of interest might prioritize other expenses over their loan payments, resulting in a snowballing debt that becomes increasingly difficult to manage.

Comparison of Default Rates Among Different Student Loan Repayment Plans

Different student loan repayment plans can influence default rates. While income-driven repayment plans (IDR) are designed to make repayment more manageable, they can sometimes lead to higher overall loan costs due to longer repayment periods and potential interest capitalization. Standard repayment plans, while requiring higher monthly payments, can lead to faster loan payoff and lower total interest costs if borrowers can consistently meet their obligations. The choice of repayment plan significantly affects the likelihood of default; borrowers who select a plan unsuitable for their financial circumstances are more likely to default. A borrower with fluctuating income might find an IDR plan more sustainable, while a borrower with a stable, higher income might benefit from a standard repayment plan. Analyzing default rates across these different plans reveals valuable insights into the effectiveness of each approach and the needs of various borrower populations.

A Flowchart Illustrating the Path from Loan Disbursement to Potential Default

Imagine a flowchart beginning with “Loan Disbursement.” This branches into two paths: “Successful Repayment” and “Financial Difficulty.” The “Successful Repayment” path leads to “Loan Paid in Full.” The “Financial Difficulty” path branches further into “Unexpected Life Events” (job loss, illness, etc.) and “Poor Financial Management” (lack of budgeting, inadequate financial literacy). Both these branches lead to “Missed Payments.” From “Missed Payments,” there are two more branches: “Loan Rehabilitation/Consolidation” and “Default.” “Loan Rehabilitation/Consolidation” can lead back to “Successful Repayment,” while “Default” leads to “Negative Credit Impact” and “Wage Garnishment/Tax Refund Offset.” This visual representation clearly demonstrates the various factors and choices that contribute to the outcome.

Preventing Student Loan Default

Successfully navigating student loan repayment requires proactive planning and a clear understanding of available resources. Defaulting on your loans can have severe consequences, impacting your credit score, employment prospects, and financial well-being. This section Artikels strategies to prevent default and provides information on available support systems.

Effective Student Loan Repayment Planning

Creating a comprehensive repayment plan is crucial for avoiding default. This involves accurately assessing your post-graduation income, calculating your monthly loan payments across all loans, and budgeting accordingly. Consider creating a detailed budget that Artikels all income and expenses, allowing you to see precisely how much you can allocate towards loan repayment. Prioritize paying off high-interest loans first to minimize long-term costs. Explore various repayment options, such as graduated repayment plans or extended repayment plans, to find one that aligns with your financial situation. Regularly review and adjust your budget as needed, especially in response to changes in income or expenses. Using budgeting apps or spreadsheets can significantly aid in this process.

Resources and Tools for Borrowers Facing Financial Hardship

Numerous resources exist to assist borrowers facing financial difficulties. The federal government offers several programs, including income-driven repayment (IDR) plans, deferment, and forbearance. These programs can temporarily reduce or suspend payments during periods of financial hardship. Additionally, many non-profit organizations provide free financial counseling and guidance on managing student loan debt. These counselors can help borrowers understand their options, navigate the application process for government programs, and create personalized repayment strategies. Contacting your loan servicer directly is also crucial; they can provide information on available options and assist with the application process.

Applying for Income-Driven Repayment Plans

Income-driven repayment (IDR) plans link your monthly payment amount to your income and family size. The application process typically involves completing a form provided by your loan servicer, supplying documentation to verify your income and family size (such as tax returns or pay stubs), and submitting the completed application. Different IDR plans exist, each with its own eligibility requirements and payment calculation formula. These plans generally offer lower monthly payments than standard repayment plans, but they may result in a longer repayment period and potentially higher total interest paid over the life of the loan. Careful consideration of the long-term implications is necessary before selecting an IDR plan.

Benefits of Loan Consolidation and Refinancing

Loan consolidation combines multiple federal student loans into a single loan, often simplifying the repayment process by reducing the number of payments and potentially lowering your monthly payment amount. Refinancing, on the other hand, involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. While refinancing can lead to significant savings over the life of the loan, it’s crucial to understand the terms and conditions carefully, as it might involve losing access to federal student loan benefits like income-driven repayment plans. Consider your individual financial situation and long-term goals before deciding whether consolidation or refinancing is the right option for you.

Proactive Measures to Avoid Student Loan Default

Prioritize responsible borrowing from the outset. Understand the total cost of your education and only borrow what you absolutely need.

- Create a realistic budget and stick to it.

- Explore scholarships, grants, and other forms of financial aid to minimize the amount you need to borrow.

- Choose a repayment plan that aligns with your financial capabilities.

- Stay in contact with your loan servicer and promptly address any financial challenges.

- Consider seeking professional financial counseling if needed.

- Monitor your credit report regularly to ensure accuracy and detect any potential issues.

The Impact of Default on Individuals and Society

Student loan default carries significant and far-reaching consequences, impacting not only the individual borrower but also the broader economy and society. The ramifications extend beyond the immediate financial burden, creating a ripple effect that affects creditworthiness, future opportunities, and the overall financial stability of the nation.

Long-Term Financial Implications for Individuals

Defaulting on student loans initiates a cascade of negative financial consequences. Immediate repercussions include wage garnishment, tax refund offset, and difficulty securing future loans or credit cards. Over time, this can severely limit financial advancement, hindering major life goals like homeownership, investing, and retirement planning. The constant stress and anxiety associated with debt collection further exacerbate the financial strain. For example, an individual facing wage garnishment might struggle to meet basic living expenses, leading to a vicious cycle of financial hardship.

Impact on Credit Scores and Future Borrowing

A student loan default significantly damages an individual’s credit score, impacting their ability to secure loans and credit in the future. A low credit score can lead to higher interest rates on mortgages, auto loans, and other forms of credit, making it more expensive to borrow money. This can severely limit access to essential financial tools, hindering long-term financial stability and opportunities. For instance, an individual with a damaged credit score might be unable to qualify for a mortgage, delaying or preventing homeownership.

Societal Costs of Widespread Student Loan Default

Widespread student loan default imposes substantial costs on society. The government incurs losses through defaulted loans, requiring increased taxpayer funding to compensate for these losses. Moreover, the economic productivity of individuals burdened by defaulted loans is reduced, impacting overall economic growth. The social costs also include increased inequality, as default disproportionately affects lower-income individuals, exacerbating existing socioeconomic disparities. The societal burden is substantial, encompassing both direct financial losses and indirect consequences on economic productivity and social equity.

Differential Impact Across Demographic Groups

The impact of student loan default varies across demographic groups. Minority groups and individuals from lower socioeconomic backgrounds are disproportionately affected due to factors such as limited access to financial literacy resources, higher rates of unemployment, and lower earning potential. These factors make it more challenging for these groups to manage their student loan debt and avoid default. For example, research consistently demonstrates higher default rates among Black and Hispanic borrowers compared to white borrowers.

Ripple Effect of Student Loan Default on the Economy

Imagine a ripple spreading outward from a central point. The center represents an individual defaulting on their student loan. The first ripple outwards depicts the immediate impact: lost income due to wage garnishment, reduced spending power, and inability to invest. The second ripple represents the impact on businesses: reduced consumer spending affecting sales and potentially job losses. The third ripple shows the impact on the government: increased costs of debt collection, loss of tax revenue, and potentially increased social welfare programs needed to support individuals struggling with debt. The final ripple demonstrates the overall impact on the economy: reduced economic growth, increased inequality, and potentially slower recovery from economic downturns. This visual demonstrates how a single default can have cascading effects, impacting individuals, businesses, and the economy as a whole.

Government and Institutional Responses to Default

Student loan default is a significant concern with wide-ranging consequences. Addressing this issue requires a multifaceted approach involving both government intervention and proactive measures from educational institutions. The government plays a crucial role in mitigating defaults through various programs and policies, while institutions strive to equip their graduates with the financial literacy and resources necessary to manage their debt effectively.

Government’s Role in Addressing Student Loan Default

The federal government in the United States, for example, is deeply involved in managing student loan defaults. This involvement stems from its substantial role in the student loan program itself. The Department of Education oversees loan servicing, debt collection, and the implementation of various rehabilitation and forgiveness programs. These programs aim to provide borrowers with options to avoid default or to navigate their way out of default status. The government also influences default rates through policies that affect interest rates, loan repayment plans, and eligibility criteria for federal student aid.

Rehabilitation and Forgiveness Programs

Several programs exist to help borrowers struggling with their student loan payments. Rehabilitation involves making a series of on-time payments, typically nine, to reinstate the loan in good standing. Income-driven repayment plans adjust monthly payments based on income and family size, making them more manageable for borrowers with lower incomes. Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, offer the possibility of having remaining loan balances discharged after meeting specific requirements, such as working in public service or teaching in low-income schools. These programs represent crucial government initiatives to reduce the burden of student loan debt and prevent defaults.

Measures Taken by Educational Institutions

Colleges and universities are increasingly recognizing their role in preventing student loan defaults. Many institutions offer financial literacy workshops and counseling services to students before and after graduation. These services often cover topics such as budgeting, debt management, and understanding various repayment options. Some institutions also partner with financial aid organizations to provide personalized guidance to students, helping them create realistic repayment plans. Furthermore, some institutions actively track their graduates’ employment outcomes to identify potential at-risk populations and provide targeted support.

Examples of Successful Interventions

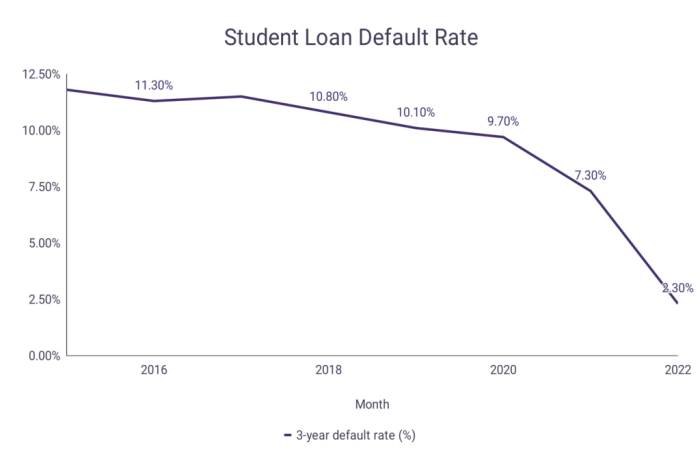

Several interventions have demonstrated success in reducing student loan default rates. For instance, targeted financial literacy programs that incorporate personalized counseling have shown positive results in improving repayment behaviors. Early intervention strategies, which identify struggling borrowers early on and connect them with resources, have also proven effective in preventing defaults. The expansion of income-driven repayment plans has broadened access to more affordable repayment options, contributing to a decline in default rates for certain segments of the population.

Impact of Government Policies on Student Loan Default

Government policies significantly impact the likelihood of student loan default. For example, policies that increase interest rates can make repayment more challenging, potentially leading to higher default rates. Conversely, policies that expand access to income-driven repayment plans or increase loan forgiveness opportunities can reduce the likelihood of default. Changes in eligibility criteria for federal student aid also influence the amount of debt students accrue, impacting their ability to repay. Careful consideration of these factors is essential in developing effective strategies to manage student loan defaults.

Last Recap

Understanding the intricacies of student loan default is paramount for both borrowers and society. By acknowledging the multifaceted nature of this issue – encompassing individual financial circumstances, systemic challenges, and the broader economic impact – we can collectively work towards developing more effective strategies for prevention and remediation. Proactive planning, access to appropriate resources, and a nuanced understanding of the available support systems are key to mitigating the risks and navigating the complexities of student loan debt.

Key Questions Answered

What happens if I miss a student loan payment?

Missing a payment initiates a grace period, after which further missed payments can lead to delinquency and eventually default. The specific timelines and consequences vary depending on whether your loan is federal or private.

Can I get my student loans forgiven?

Several programs exist offering loan forgiveness, particularly for federal loans, based on factors such as occupation (e.g., public service) or income. Eligibility requirements vary significantly.

How does student loan default affect my credit score?

Defaulting severely damages your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. The negative impact can persist for years.

What are income-driven repayment plans?

Income-driven repayment plans adjust your monthly payments based on your income and family size, potentially lowering your payments and making them more manageable. These plans are generally available for federal loans.