Navigating the complexities of private student loans can be daunting, especially when faced with the prospect of default. This guide delves into the current landscape of private student loan defaults in the United States, exploring the contributing factors, potential consequences, and available solutions. We’ll examine historical trends, compare default rates across lenders and demographics, and offer practical strategies for both borrowers and lenders to mitigate the risk of default.

Understanding the nuances of private student loan defaults is crucial for both borrowers seeking to avoid financial hardship and lenders aiming to minimize losses. This exploration will provide a clear picture of the challenges involved, outlining the steps individuals can take to manage their debt responsibly and the support systems available to those facing difficulties.

Understanding Default Rates

Private student loan defaults represent a significant financial challenge for both borrowers and lenders. Understanding the intricacies of default rates, including their current levels, historical trends, and variations across different demographics and lenders, is crucial for informed decision-making and policy development. This section provides an overview of these key aspects.

Current Private Student Loan Default Rates

Precise, publicly available data on the current overall private student loan default rate in the United States is difficult to obtain. Unlike federal student loans, which are tracked by the Department of Education, private student loans lack a centralized reporting system. Data is often held by individual lenders and is not always consistently reported or made public. Estimates from various sources suggest that the default rate is considerably lower than that of federal student loans, but a precise figure is elusive. This lack of transparency highlights the need for greater regulatory oversight in the private student loan market.

Historical Trends in Private Student Loan Defaults

Tracking historical trends in private student loan defaults presents similar challenges to determining current rates. Consistent, comprehensive data across all lenders is lacking. However, available data suggests that default rates have fluctuated over time, often mirroring broader economic conditions. Periods of economic recession or high unemployment typically see an increase in defaults, while periods of economic growth tend to show lower rates. More research and data transparency are needed to develop a robust historical analysis of these trends.

Default Rates Across Different Lenders

Variations in default rates exist across different private student loan lenders. Factors contributing to these differences include lender lending practices, underwriting standards, and the types of borrowers they serve. Lenders with more stringent underwriting criteria and a focus on lower-risk borrowers tend to experience lower default rates. Conversely, lenders with less stringent criteria may face higher default rates. Unfortunately, a direct comparison of default rates across all private lenders is not readily available due to the lack of public data.

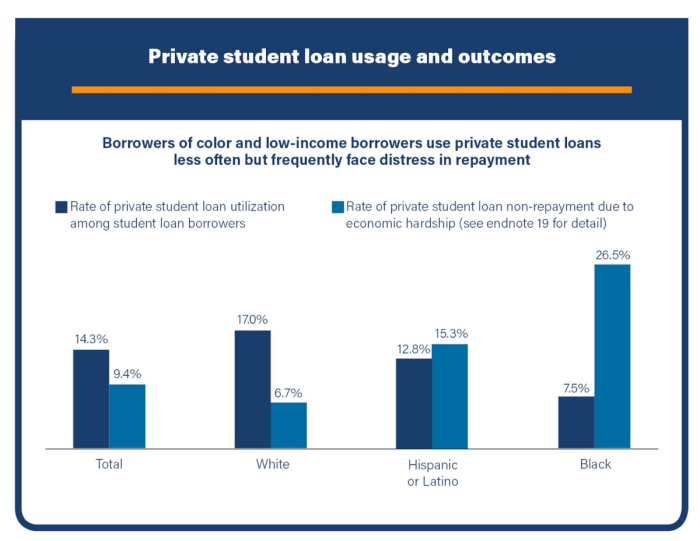

Default Rates by Borrower Demographics

Default rates on private student loans are influenced by several borrower demographic factors. Generally, borrowers with lower incomes, limited credit history, or those pursuing less lucrative fields of study tend to exhibit higher default rates. Younger borrowers may also face higher default rates due to limited work experience and established financial stability. Similarly, borrowers with lower levels of education may have less access to higher-paying jobs, increasing their risk of default. Detailed breakdowns by specific age ranges, income levels, and educational attainment are often unavailable due to the previously mentioned lack of centralized data collection.

Default Rates by Loan Type and Year

The following table presents hypothetical data illustrating potential default rates by loan type and year. The actual data is not publicly available in a consistent format across all lenders. This table serves as an example to illustrate the kind of information that would be beneficial to have for a more complete understanding.

| Year | Loan Type | Default Rate | Number of Defaults |

|---|---|---|---|

| 2020 | Undergraduate | 3% | 1500 |

| 2020 | Graduate | 4% | 800 |

| 2021 | Undergraduate | 2.5% | 1250 |

| 2021 | Graduate | 3.5% | 700 |

| 2022 | Undergraduate | 3.2% | 1600 |

| 2022 | Graduate | 4.2% | 840 |

Factors Contributing to Private Student Loan Default

Private student loan default is a complex issue stemming from a confluence of economic conditions, borrower behaviors, and unforeseen circumstances. Understanding these contributing factors is crucial for developing effective strategies to mitigate default rates and improve borrower outcomes. This section will explore the key elements that lead to borrowers falling behind on their private student loan repayments.

Economic Factors Influencing Default

Economic downturns significantly impact a borrower’s ability to repay student loans. High unemployment rates directly reduce disposable income, making loan payments a significant burden. Periods of economic stagnation often lead to wage stagnation or even decreases, further exacerbating the problem. Inflation, increasing the cost of living, also plays a crucial role, reducing the amount of money available for loan repayment after essential expenses are met. For example, the Great Recession of 2008 saw a sharp increase in student loan defaults as unemployment soared and wages remained stagnant for many borrowers.

Borrower Behavior and Loan Defaults

Borrower behavior plays a significant role in default rates. Overborrowing, taking on more debt than realistically manageable, is a major contributing factor. Lack of financial literacy, including a poor understanding of loan terms, repayment options, and budgeting strategies, also increases the likelihood of default. Furthermore, poor financial planning and a lack of proactive management of student loan debt can quickly lead to missed payments and eventual default. For instance, a borrower who fails to explore income-driven repayment plans or consolidate their loans may struggle to manage their debt effectively.

Impact of Unexpected Life Events

Unexpected life events can significantly disrupt a borrower’s ability to repay their loans. Job loss, illness, or disability can dramatically reduce or eliminate income, making loan payments impossible. Major unexpected expenses, such as significant medical bills or home repairs, can also deplete savings and divert funds away from loan repayment. For example, a borrower who experiences a serious illness requiring extensive medical treatment might be forced to default on their loans due to mounting medical expenses and lost wages.

Predatory Lending Practices

Predatory lending practices contribute significantly to student loan defaults. These practices often involve high-interest rates, hidden fees, and aggressive sales tactics that target vulnerable borrowers. Loans with adjustable interest rates, which can fluctuate significantly, can also make repayment unpredictable and challenging. For instance, loans with balloon payments, requiring a large lump sum payment at the end of the term, can lead to default if the borrower is unable to afford the final payment. The lack of transparency in loan terms and conditions further exacerbates the problem.

Progression from Loan Origination to Default: A Flowchart

A simplified flowchart illustrates the progression:

[Imagine a flowchart here. The flowchart would begin with “Loan Origination,” branching to “Successful Repayment” and “Difficulty in Repayment.” The “Difficulty in Repayment” branch would further branch into “Economic Hardship,” “Poor Financial Management,” “Unexpected Life Events,” and “Predatory Lending Practices.” Each of these would then lead to “Default.”] The flowchart visually depicts how various factors can contribute to a borrower’s inability to repay their loan and ultimately lead to default.

The Repercussions of Default

Defaulting on a private student loan carries significant and lasting consequences that extend far beyond the immediate financial impact. Understanding these repercussions is crucial for borrowers to make informed decisions and proactively manage their debt. The ramifications can be severe, affecting creditworthiness, financial opportunities, and even legal standing.

Immediate Consequences of Default

Immediately following a default on a private student loan, borrowers face several challenges. The lender may report the default to credit bureaus, resulting in a sharp drop in credit scores. This can severely limit access to future credit, making it difficult to obtain mortgages, auto loans, or even credit cards. Furthermore, lenders may pursue collection activities, such as repeated phone calls, letters, and potentially even legal action. Late payment fees and accrued interest will continue to accumulate, significantly increasing the total debt owed. In some cases, lenders may initiate wage garnishment or bank levy, directly seizing a portion of a borrower’s income or assets to repay the debt.

Long-Term Effects on Credit Scores and Future Borrowing

The long-term effects of a private student loan default are particularly damaging. A default remains on a credit report for seven years, significantly impacting creditworthiness. This can make it extremely difficult to secure loans with favorable interest rates or even qualify for rental housing or certain employment opportunities. The negative impact on credit scores can make it challenging to rebuild financial stability and can hinder major life goals such as purchasing a home or investing in a business. The higher interest rates associated with future borrowing, if possible, can further exacerbate financial difficulties.

Legal Ramifications of Default, Including Wage Garnishment and Lawsuits

Defaulting on a private student loan can lead to significant legal repercussions. Lenders have the right to pursue legal action to recover the debt. This may involve lawsuits, wage garnishment, and even the seizure of assets. Wage garnishment allows lenders to legally deduct a portion of a borrower’s earnings directly from their paycheck. The percentage garnished can vary depending on state and federal laws, but it can significantly reduce a borrower’s disposable income. Lawsuits can result in judgments against the borrower, leading to further financial penalties and the potential for liens being placed on assets.

Comparison of Consequences: Private vs. Federal Student Loans

While both private and federal student loans have serious consequences for default, there are key differences. Federal student loans have additional protections, such as income-driven repayment plans and loan rehabilitation programs, that can help borrowers avoid default. Defaulting on a federal loan can affect access to future federal student aid, but the legal ramifications may be less severe than with private loans in some instances. Private student loans generally offer fewer options for borrowers facing financial hardship, and the collection practices by private lenders can be more aggressive.

Steps to Avoid Default

Avoiding default requires proactive management of student loan debt. It is crucial to understand the terms of your loans, including repayment amounts and deadlines. Here are some crucial steps to take:

- Create a Realistic Budget: Track income and expenses to identify areas where savings can be made to allocate funds for loan repayments.

- Explore Repayment Options: Contact your lender to discuss options such as income-driven repayment plans, deferment, or forbearance, if available.

- Communicate with Your Lender: Reach out to your lender as soon as you anticipate difficulties making payments. Open communication can help you negotiate a solution before default occurs.

- Seek Professional Help: Consult with a credit counselor or financial advisor to develop a debt management plan and explore options for consolidating or refinancing your loans.

- Consider Loan Consolidation: Combining multiple loans into a single loan with a potentially lower interest rate can simplify repayment and reduce the overall cost.

Available Solutions and Support

Facing difficulty in repaying private student loans can be overwhelming, but numerous resources and strategies can help borrowers navigate this challenging situation. Understanding the available options and seeking appropriate support can significantly improve the chances of successful repayment and avoid the severe consequences of default. This section explores various avenues for assistance and Artikels steps to regain financial stability.

Several strategies exist to manage private student loan debt effectively. These include exploring different repayment plans, seeking professional financial guidance, and proactively engaging with your lender. Remember that proactive engagement is key to finding a solution that works for your individual circumstances.

Repayment Options for Struggling Borrowers

Many lenders offer various repayment plans designed to accommodate borrowers facing financial hardship. These options often involve adjusting the monthly payment amount, extending the loan term, or temporarily suspending payments (deferment or forbearance). It’s crucial to contact your lender directly to discuss your situation and explore the available options. Some common options include income-driven repayment plans (though these are less common with private loans than federal loans), extended repayment plans, and temporary forbearance periods. The specific terms and conditions will vary depending on your lender and loan agreement. Carefully review the terms of any modified repayment plan to understand the long-term implications, including potential increases in total interest paid.

Loan Rehabilitation and Consolidation Programs

Loan rehabilitation is a process primarily associated with federal student loans, which involves making consistent on-time payments for a specified period to reinstate your good standing. Private lenders may offer similar programs, though they’re less standardized. Consolidation, however, might be a viable option for private loans. Consolidating multiple private student loans into a single loan can simplify repayment by combining payments into one monthly payment. This may also result in a lower interest rate, though this is not always guaranteed. It’s important to compare offers from different lenders to ensure you’re getting the best possible terms.

Nonprofit Organizations Offering Financial Counseling and Debt Management Services

Numerous nonprofit organizations provide free or low-cost financial counseling and debt management services. These organizations can offer personalized guidance, helping you create a budget, explore debt management strategies, and negotiate with your lenders. The National Foundation for Credit Counseling (NFCC) is one example of a reputable organization that offers such services. These services can provide valuable support in navigating the complexities of student loan repayment and developing a long-term financial plan. They can also help you understand your rights and options as a borrower.

Negotiating with Lenders for More Favorable Repayment Terms

Direct communication with your lender is crucial. Clearly explain your financial difficulties and propose a modified repayment plan. Documenting your financial situation with supporting evidence can strengthen your negotiation position. Be prepared to compromise and explore different options. While lenders are not obligated to agree to every request, a proactive and well-reasoned approach increases the chances of reaching a mutually acceptable solution. Remember to get any agreed-upon changes in writing.

Creating a Personal Budget to Manage Loan Repayments Effectively

A well-structured budget is essential for effective loan repayment. Track your income and expenses meticulously to identify areas where you can reduce spending and allocate more funds towards loan payments. Use budgeting apps or spreadsheets to monitor your progress. Prioritize essential expenses and consider reducing non-essential spending. A realistic budget ensures you can meet your loan obligations without jeopardizing other financial needs. For example, creating a budget might involve tracking income from employment, side hustles, or other sources, and then categorizing expenses such as housing, transportation, food, and loan payments. This allows you to see where your money is going and identify areas for potential savings.

Preventing Future Defaults

Preventing private student loan defaults requires a multifaceted approach encompassing borrower education, responsible borrowing practices, and proactive lender involvement. By fostering financial literacy and implementing sound borrowing strategies, individuals can significantly reduce their risk of default, while responsible lending practices can contribute to a more sustainable lending environment for all parties involved.

Financial Literacy Education Before Borrowing

Proactive financial literacy education is crucial in equipping prospective borrowers with the knowledge and skills necessary to navigate the complexities of student loan debt. This education should cover topics such as understanding interest rates, loan repayment options, budgeting techniques, and the long-term financial implications of borrowing. For example, a comprehensive financial literacy program might include interactive workshops, online resources, and personalized financial counseling sessions, all designed to empower students to make informed borrowing decisions. Early intervention through high school and college financial literacy programs can help prevent future defaults by laying a strong foundation for responsible financial management.

Strategies for Responsible Borrowing and Loan Selection

Responsible borrowing involves careful consideration of several key factors before taking out a student loan. This includes understanding the total cost of borrowing, including interest and fees, and comparing loan offers from different lenders to secure the most favorable terms. Borrowers should also prioritize only borrowing the amount necessary to cover educational expenses and avoid taking on excessive debt. For instance, comparing a loan with a 5% interest rate to one with a 10% interest rate will clearly illustrate the long-term financial implications of choosing a loan with a higher interest rate. Prioritizing needs over wants and exploring alternative funding options, such as scholarships and grants, can significantly reduce the overall loan burden.

Careful Budgeting and Financial Planning

Creating and maintaining a realistic budget is essential for effective student loan management. A well-structured budget should account for all income and expenses, including loan repayments, living expenses, and personal savings. Financial planning, encompassing both short-term and long-term goals, is equally vital. This process allows borrowers to anticipate potential financial challenges and develop strategies to mitigate risk. For example, a detailed budget outlining monthly income and expenses, including a dedicated line item for student loan payments, can help borrowers track their spending and ensure timely repayments. Regularly reviewing and adjusting the budget as needed ensures its ongoing relevance and effectiveness.

Managing Student Loan Debt Effectively Throughout Repayment

Effective management of student loan debt throughout the repayment period involves employing several key strategies. These include exploring various repayment options, such as income-driven repayment plans, and actively monitoring loan balances and interest accrual. Communicating with lenders promptly regarding any financial difficulties is also crucial. For instance, proactively contacting a lender to discuss potential hardship and explore options like deferment or forbearance can help prevent default. Furthermore, borrowers should consider prioritizing high-interest loans for early repayment to minimize overall interest costs. Consistent and timely payments are key to building a strong credit history and avoiding penalties.

Best Practices for Lenders to Prevent Defaults

Lenders play a critical role in preventing defaults by implementing responsible lending practices. This includes conducting thorough credit checks and assessing borrowers’ repayment capacity before approving loans. Providing clear and concise loan documentation, including detailed information about interest rates, fees, and repayment terms, is also essential. Lenders should also offer financial literacy resources and support to borrowers, such as budgeting tools and financial counseling services. Proactive communication with borrowers, particularly during periods of financial difficulty, can help identify potential issues early and facilitate timely interventions. Furthermore, implementing flexible repayment options and exploring alternative solutions, like loan modification, can help borrowers avoid default.

Final Thoughts

Defaulting on private student loans carries significant and long-lasting consequences, impacting credit scores, financial stability, and future borrowing opportunities. However, proactive measures, financial literacy, and available support systems can significantly reduce the risk. By understanding the factors contributing to default, borrowers can make informed decisions, manage their debt effectively, and navigate potential challenges with greater confidence. Responsible lending practices by institutions are equally crucial in creating a sustainable and equitable system.

Expert Answers

What happens if I miss a payment on my private student loan?

Missing payments can lead to late fees, negatively impact your credit score, and eventually result in default. Contact your lender immediately if you anticipate difficulties making payments.

Can I consolidate my private student loans?

While federal student loans offer consolidation options, private loan consolidation is less common. Explore options like refinancing with a different lender to potentially secure a lower interest rate or more manageable repayment plan.

Are there any government programs to help with private student loan debt?

Government programs primarily focus on federal student loans. However, some non-profit organizations offer financial counseling and debt management services that can assist with private student loan repayment.

What is the statute of limitations on private student loan debt?

The statute of limitations varies by state and lender. It’s crucial to consult with a legal professional for specific information regarding your situation.