The soaring cost of higher education in the United States has left many graduates burdened with substantial student loan debt. Understanding the default rate on these loans is crucial, not only for individuals facing financial hardship but also for policymakers and the economy as a whole. This exploration delves into the complexities of student loan defaults, examining their causes, consequences, and potential solutions.

From the historical trends in default rates to the multifaceted factors influencing them – socioeconomic disparities, evolving repayment plans, and the role of financial literacy – we will analyze the impact on both individuals and the broader financial landscape. We’ll also consider potential future scenarios and the policy interventions needed to mitigate this growing issue.

Defining the Default Rate

The default rate of student loans refers to the percentage of borrowers who fail to make their scheduled loan payments for a specified period, typically 90 days or more. This is a crucial indicator of the health of the student loan market and the financial well-being of borrowers. A high default rate signals potential problems within the system, impacting both lenders and the overall economy.

Student loan default rates provide a valuable snapshot of the financial challenges faced by borrowers after completing their education. Understanding these rates helps policymakers, lenders, and borrowers themselves to assess the effectiveness of existing programs and identify areas needing improvement.

Historical Overview of US Student Loan Default Rates

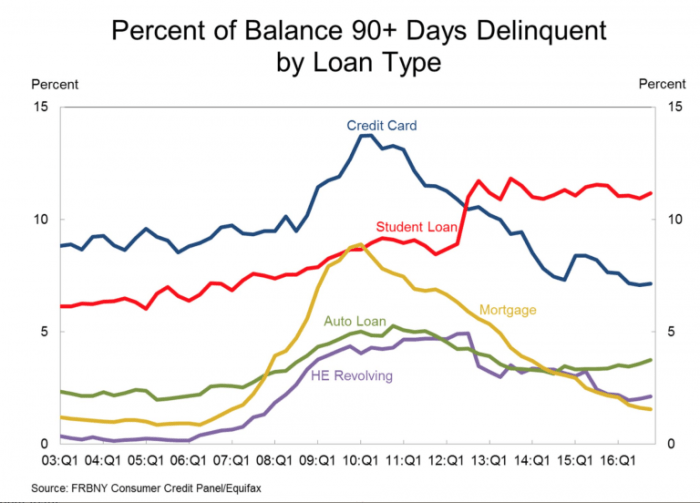

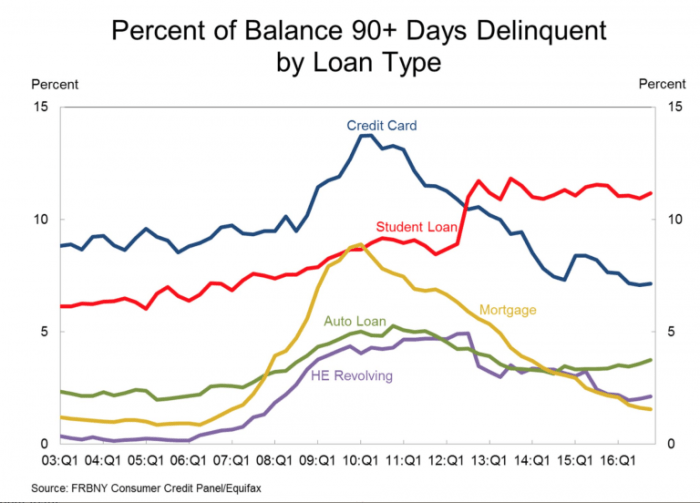

Student loan default rates in the US have fluctuated significantly over time. While precise figures vary depending on the data source and methodology used, a general trend shows relatively low rates in the early years of federal student loan programs, followed by a period of substantial increase, peaking around the late 2000s and early 2010s. Since then, rates have generally declined, though they remain a concern. This fluctuation reflects changes in the economy, student borrowing behavior, and government policies. For example, the Great Recession significantly impacted default rates, as did shifts in loan program eligibility criteria and repayment plans. Analyzing this historical data is critical for informed policy decisions and predicting future trends.

Variation in Default Rates Across Loan Programs

Default rates differ considerably between subsidized and unsubsidized federal student loans. Subsidized loans, where the government pays the interest while the student is in school, typically have lower default rates. This is likely because borrowers face less accumulated debt at the time of repayment. Unsubsidized loans, on the other hand, accrue interest during the borrower’s education, leading to a larger initial loan balance and potentially higher default rates. Furthermore, different loan programs (e.g., Perkins Loans, Stafford Loans, PLUS Loans) may exhibit varying default rates due to differences in eligibility criteria, interest rates, and repayment options. Analyzing these differences is crucial for understanding the effectiveness of various loan programs.

Factors Contributing to Demographic Variations in Default Rates

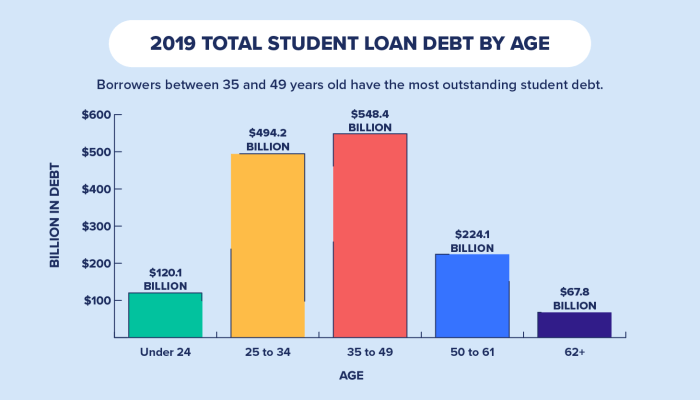

Default rates often vary significantly across different demographic groups. Several factors contribute to this disparity. For example, borrowers from lower socioeconomic backgrounds may face greater financial challenges, increasing their risk of default. Similarly, students who attended less selective colleges or pursued less lucrative majors may have more difficulty securing employment that allows them to comfortably repay their loans. Differences in access to financial literacy resources and family support networks also play a significant role. Understanding these demographic variations is essential for designing targeted interventions to improve repayment outcomes and promote financial equity.

Impact of Default Rates on Individuals

Defaulting on student loans carries significant and far-reaching consequences for borrowers, impacting their financial well-being both immediately and in the long term. Understanding these repercussions is crucial for responsible loan management and avoiding the severe penalties associated with default.

Immediate Consequences of Student Loan Default

The immediate consequences of student loan default can be financially devastating. Borrowers may face wage garnishment, where a portion of their paycheck is automatically seized to repay the debt. This significantly reduces disposable income, making it difficult to meet basic living expenses. Furthermore, the government may levy tax refunds to satisfy the debt, leaving borrowers with little to no return from their tax filing. In some cases, default may lead to the seizure of assets, such as bank accounts or property, to cover the outstanding loan amount. These immediate actions can quickly create a financial crisis for the borrower.

Long-Term Financial Repercussions of Student Loan Default

The long-term effects of student loan default extend far beyond immediate financial hardship. The negative impact on credit scores can severely restrict future borrowing opportunities. Securing a mortgage, auto loan, or even a credit card becomes significantly more challenging, if not impossible, due to the damaged credit history. This can limit opportunities for homeownership, vehicle purchase, and other essential financial needs. Moreover, default may affect employment prospects, as some employers conduct credit checks as part of their hiring process. The financial instability caused by default can have a ripple effect, impacting various aspects of a borrower’s life for years to come.

Impact on Credit Scores and Future Borrowing Opportunities

A student loan default significantly damages a borrower’s credit score. This negative mark remains on their credit report for seven years, making it extremely difficult to obtain loans or credit cards at favorable interest rates. Lenders view defaulters as high-risk borrowers, leading to higher interest rates or outright rejection of loan applications. This can create a vicious cycle of debt, making it challenging to improve one’s financial situation. For instance, someone hoping to buy a home may find their dream delayed or even unattainable due to the inability to secure a mortgage with a tarnished credit history resulting from loan default.

Consequences of Student Loan Default: Severity and Timeframe

| Consequence | Severity | Timeframe | Example |

|---|---|---|---|

| Wage Garnishment | High | Ongoing | 25% of monthly income seized until debt is repaid. |

| Tax Refund Offset | Medium | Annual | Entire tax refund applied towards loan repayment. |

| Negative Impact on Credit Score | High | 7 years | Significant drop in credit score, impacting future borrowing opportunities. |

| Difficulty Securing Loans | High | Ongoing | Rejection of loan applications for mortgages, auto loans, and credit cards. |

| Potential Asset Seizure | Very High | Immediate or delayed | Bank accounts or property seized to repay the debt. |

| Impact on Employment Prospects | Medium to High | Variable | Difficulty finding employment due to credit check results. |

Impact of Default Rates on the Economy

High student loan default rates exert a significant drag on the overall economic health of a nation, impacting various sectors and creating a ripple effect throughout the financial system. The consequences extend beyond individual borrowers, affecting taxpayers, government budgets, higher education institutions, and the stability of lending institutions.

The macroeconomic effects of high student loan default rates are multifaceted and far-reaching. These defaults represent a significant loss of capital for lenders, impacting their profitability and potentially their stability. This loss of capital can lead to tighter lending standards, making it more difficult for future borrowers to access credit, including for essential purposes beyond education. Furthermore, the reduced availability of credit can stifle economic growth and hinder investment.

Burden on Taxpayers and Government Resources

High student loan default rates place a substantial burden on taxpayers and government resources. When borrowers default, the government often steps in to cover the losses, either through direct subsidies to lenders or by purchasing defaulted loans. This diverts public funds away from other essential social programs and infrastructure projects. For example, the US government’s investment in loan forgiveness programs represents a significant budgetary expenditure, and the cost of administering and collecting on defaulted loans adds to the overall financial strain. The opportunity cost of these funds, that is, what could have been achieved with this money if it was allocated to other priorities, is substantial.

Impact on the Higher Education System and its Funding

High default rates can negatively impact the higher education system and its funding. Institutions may face reduced enrollment if prospective students are hesitant to take on debt due to concerns about repayment. This decline in enrollment can lead to budget cuts and reduced educational quality, potentially creating a vicious cycle of lower quality education leading to reduced employment prospects and ultimately, higher default rates. Furthermore, the negative publicity surrounding high default rates can damage the reputation of colleges and universities, further impacting their ability to attract students and secure funding.

Impact on the Financial Stability of Lending Institutions

A high volume of student loan defaults poses a significant risk to the financial stability of lending institutions, particularly those heavily invested in the student loan market. Significant losses from defaults can weaken a lender’s capital position, potentially leading to increased risk aversion and tighter lending practices. In extreme cases, high default rates could even threaten the solvency of lending institutions, requiring government intervention or bailouts, further burdening taxpayers. This instability can also trigger broader financial market concerns, impacting investor confidence and overall economic stability.

Factors Contributing to Defaults

Student loan defaults are a complex issue stemming from an interplay of individual circumstances and broader systemic factors. Understanding these contributing elements is crucial for developing effective strategies to mitigate the problem and support borrowers. This section will explore the key socioeconomic factors influencing student loan defaults, categorizing them for clarity and illustrating their interrelationships.

Socioeconomic Factors and Student Loan Defaults

Several socioeconomic factors significantly contribute to student loan defaults. These factors are not mutually exclusive; rather, they often interact and exacerbate each other’s impact. For example, low income can limit employment opportunities, which in turn increases the likelihood of default. Conversely, limited educational attainment can restrict access to higher-paying jobs, leading to financial strain and potential default.

Individual Factors Contributing to Default

Individual factors are personal characteristics and choices that increase the risk of default. These include:

| Factor | Description | Example | Impact |

|---|---|---|---|

| Low Income | Insufficient earnings to cover living expenses and loan repayments. | A borrower graduating with a degree in a low-demand field earning a minimum wage. | Directly impacts ability to make timely payments. |

| Unexpected Life Events | Unforeseen circumstances such as job loss, illness, or family emergencies. | A borrower losing their job due to an economic downturn. | Creates financial hardship, making loan repayment difficult. |

| Poor Financial Literacy | Lack of understanding of loan terms, repayment options, and budgeting strategies. | A borrower unaware of income-driven repayment plans. | Leads to poor financial management and increased risk of default. |

| High Debt Burden | Accumulation of significant debt beyond student loans, such as credit card debt or medical bills. | A borrower with substantial credit card debt in addition to student loans. | Overwhelms the borrower’s financial capacity, increasing the probability of default. |

Systemic Factors Contributing to Default

Systemic factors are broader societal and economic conditions that influence default rates. These are often beyond the control of individual borrowers.

| Factor | Description | Example | Impact |

|---|---|---|---|

| Limited Employment Opportunities | Scarcity of jobs in a borrower’s field or region, resulting in low wages. | A graduate with a degree in a saturated field facing high unemployment rates. | Reduces income, hindering repayment capacity. |

| High Cost of Living | Rising costs for housing, healthcare, and other necessities. | A borrower living in a high-cost city with a modest income. | Leaves less disposable income for loan repayments. |

| Predatory Lending Practices | Deceptive or unfair lending practices that trap borrowers in difficult-to-manage debt. | Borrowers enrolled in loans with high interest rates and hidden fees. | Increases the overall debt burden and makes repayment challenging. |

| Inadequate Financial Aid and Counseling | Insufficient support and guidance for borrowers in managing their debt. | Lack of access to resources that explain different repayment options. | Leaves borrowers ill-equipped to navigate the complexities of loan repayment. |

Interrelationship of Contributing Factors

| Individual Factors | Systemic Factors | Combined Impact | Example |

|---|---|---|---|

| Low Income, Poor Financial Literacy | Limited Employment Opportunities, High Cost of Living | Increased likelihood of default due to limited income and inability to manage debt effectively in a challenging economic environment. | A recent graduate with a low-paying job in a high-cost area, lacking financial knowledge to manage their student loan debt effectively. |

| High Debt Burden, Unexpected Life Events | Predatory Lending Practices | Significant financial strain exacerbated by unfair loan terms, making repayment nearly impossible. | A borrower facing job loss and medical expenses while burdened by high-interest student loans and hidden fees. |

Mitigation Strategies

Addressing the high rate of student loan defaults requires a multi-pronged approach involving government intervention, borrower education, and proactive measures by lending institutions. Effective strategies focus on preventing defaults before they occur, as well as providing support and pathways to repayment for those already struggling. This involves a combination of financial aid adjustments, improved borrower education, and streamlined repayment options.

Government Programs to Reduce Student Loan Default Rates

Several government programs aim to reduce student loan default rates. These initiatives generally focus on providing more affordable repayment options and offering support to borrowers facing financial hardship. For example, the Income-Driven Repayment (IDR) plans, discussed in more detail below, are a cornerstone of these efforts. Other programs may include grants for financial literacy training or initiatives that help borrowers consolidate their loans into more manageable packages. The specifics of these programs vary over time and by country, so it’s crucial to consult current government resources for the most up-to-date information.

Effectiveness of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans tie monthly loan payments to a borrower’s income and family size. This means that borrowers with lower incomes pay less each month, potentially preventing default by making payments more manageable. The effectiveness of IDR plans is a subject of ongoing debate. While they demonstrably reduce short-term default rates for some borrowers, long-term impacts are less clear. Some studies suggest that IDR plans can lead to increased overall loan balances due to extended repayment periods and accruing interest. However, the prevention of immediate default and the potential for eventual loan forgiveness under certain plans offer significant benefits to many borrowers. The long-term effects depend heavily on factors such as individual income trajectories and the specific IDR plan chosen.

Role of Financial Literacy Programs in Borrower Education

Financial literacy programs play a crucial role in preventing student loan defaults by equipping borrowers with the knowledge and skills to manage their debt effectively. These programs often cover budgeting, credit management, understanding loan terms, and exploring repayment options. Effective financial literacy initiatives are proactive, reaching students before they even take out loans, and providing ongoing support throughout the repayment process. By fostering responsible borrowing behavior and promoting informed decision-making, these programs can significantly reduce the likelihood of default. Evidence suggests a positive correlation between participation in financial literacy programs and improved repayment outcomes, although the magnitude of the effect can vary depending on program design and implementation.

Strategies Employed by Lending Institutions to Minimize Defaults

Lending institutions also play a critical role in minimizing defaults. Strategies include robust pre-approval processes to assess borrower risk, offering a variety of repayment options tailored to individual circumstances, and providing proactive counseling and support to borrowers who are experiencing financial difficulties. Some institutions implement sophisticated risk-assessment models to identify borrowers at high risk of default, allowing for early intervention. Furthermore, many institutions have dedicated departments that work with borrowers facing financial hardship, offering tailored repayment plans and exploring options to avoid default. These proactive strategies, combined with responsible lending practices, contribute to a lower overall default rate.

Future Trends and Predictions

Predicting future student loan default rates requires careful consideration of current trends, projected economic shifts, and potential policy interventions. While precise forecasting is inherently challenging, analyzing existing data and likely future scenarios allows for a reasonable estimation of potential outcomes and the factors that will shape them.

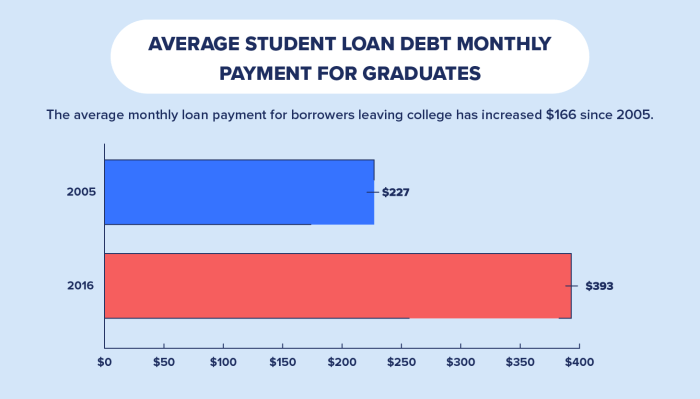

Forecasting future student loan default rates necessitates considering several intertwined factors. The rising cost of higher education, coupled with stagnant wage growth, continues to put pressure on borrowers. Economic downturns exacerbate this, leading to increased unemployment and reduced ability to repay loans. Conversely, periods of robust economic growth can positively influence repayment rates. Policy changes, technological advancements, and shifts in student borrowing behavior also play significant roles.

Projected Default Rates

Several factors suggest a potential increase in student loan default rates in the near future. Continued inflation and the possibility of a recession could significantly impact borrowers’ ability to manage their debt. The rising cost of tuition, which outpaces inflation in many cases, will likely contribute to higher loan balances and increased difficulty in repayment. For example, a hypothetical scenario of a moderate recession coupled with a 5% annual tuition increase could result in a 10-15% rise in default rates within three years, mirroring trends observed during previous economic downturns like the 2008 financial crisis. However, effective policy interventions and technological advancements could mitigate this projected increase.

Potential Policy Changes and Their Impact

Significant policy changes could dramatically alter default rates. For instance, widespread implementation of income-driven repayment (IDR) plans, coupled with loan forgiveness programs for specific professions or income levels, could lead to a substantial decrease in defaults. Conversely, stricter eligibility criteria for student loans or reduced government subsidies could potentially increase default rates. The expansion of loan forgiveness programs, similar to the limited initiatives already in place, would likely significantly reduce defaults among specific demographics, potentially offsetting increases in other areas. However, the long-term financial implications of such programs require careful evaluation.

Technological Advancements in Default Prevention

Technological advancements offer significant potential for improving default prevention. Sophisticated algorithms and machine learning can be used to predict borrowers at high risk of default based on their financial profiles and repayment history. This allows for proactive interventions, such as tailored financial counseling or offering alternative repayment plans before borrowers fall behind. Furthermore, improved online platforms and mobile applications can streamline communication between lenders and borrowers, facilitating timely payment and debt management. For example, the use of AI-powered chatbots could provide immediate assistance to borrowers facing financial hardship, potentially preventing defaults through early intervention.

Hypothetical Scenario: A Future with Significantly Lower Default Rates

Imagine a future where student loan default rates have dropped significantly – perhaps to below 5%. This scenario is plausible if several factors converge. Firstly, a sustained period of robust economic growth coupled with targeted policy interventions plays a crucial role. Secondly, widespread adoption of income-driven repayment plans and loan forgiveness programs targeted at low-income borrowers and those in high-demand fields ensures manageable debt loads. Thirdly, the widespread implementation of technological solutions, such as AI-powered financial counseling and personalized repayment strategies, leads to early identification and intervention for at-risk borrowers. Finally, a significant shift in higher education funding models, perhaps through increased government subsidies or tuition freezes, could also contribute to this positive outcome. This combination of economic stability, targeted policy adjustments, and technological innovation creates a scenario where student debt becomes far more manageable, leading to substantially lower default rates.

Conclusive Thoughts

The student loan default rate presents a significant challenge with far-reaching consequences. While the immediate impact on borrowers is severe, the ripple effects extend to the economy, impacting taxpayers, higher education institutions, and the stability of lending institutions. Addressing this requires a multi-pronged approach encompassing improved financial literacy, more flexible repayment options, and proactive government policies. By understanding the intricate interplay of individual circumstances and systemic factors, we can work towards a future where higher education doesn’t lead to insurmountable debt and widespread default.

FAQ Insights

What happens if I default on my student loans?

Defaulting on student loans can result in wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain loans or credit in the future. It can also lead to legal action.

Are there any programs to help avoid default?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size. Consolidation options may also be available to simplify repayment.

How does the default rate affect taxpayers?

When borrowers default, the government often absorbs the losses, ultimately placing a burden on taxpayers through increased government spending and potentially higher taxes.

Can I rehabilitate my defaulted student loans?

Yes, loan rehabilitation involves making a series of on-time payments, which can help restore your eligibility for federal student aid programs and improve your credit standing.