Navigating the complexities of student loan repayment can feel overwhelming, especially when faced with unexpected financial hurdles. One potential solution often explored is student loan deferment. This guide delves into the intricacies of deferment, providing a clear understanding of its meaning, various types, application processes, and potential long-term implications. We’ll explore the key differences between deferment and forbearance, examine the eligibility criteria for different deferment types, and analyze the impact on interest accrual and overall loan cost. Ultimately, understanding deferment empowers borrowers to make informed decisions about managing their student loan debt.

This comprehensive guide aims to demystify the process of student loan deferment, offering practical advice and insights to help borrowers navigate this crucial aspect of student loan repayment. We will cover the application process in detail, explore alternative repayment options, and highlight potential pitfalls to avoid. By the end, you’ll possess a solid understanding of how deferment works and whether it’s the right choice for your financial situation.

Definition of Student Loan Deferment

Student loan deferment offers a temporary pause on your student loan repayment obligations. This means you don’t have to make any payments during the deferment period, and importantly, interest may or may not accrue depending on the type of loan and the reason for deferment. Understanding the nuances of deferment is crucial for responsible loan management.

A student loan deferment is a period where your federal student loan payments are temporarily suspended. This is distinct from forbearance, which we’ll discuss shortly. It provides borrowers with needed financial breathing room during times of hardship or specific life circumstances. This temporary reprieve allows borrowers to focus on other pressing financial matters without the immediate pressure of loan repayments.

Deferment versus Forbearance

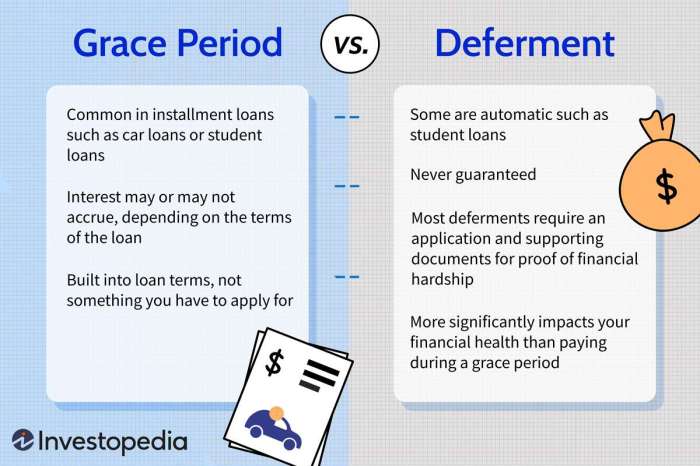

Deferment and forbearance are often confused, but they are distinct processes. Both temporarily suspend your loan payments, but they differ significantly in their eligibility criteria, the impact on interest accrual, and the overall process. A key difference lies in the reasons for granting the suspension and the required documentation. Deferments are typically granted based on specific qualifying circumstances, while forbearance is often granted based on temporary financial hardship that doesn’t necessarily fit the criteria for deferment.

Examples of Qualifying Situations for Deferment

Several circumstances qualify borrowers for student loan deferment. These generally involve situations that significantly impact a borrower’s ability to make timely payments due to unforeseen circumstances or life transitions. The specific criteria and documentation required can vary based on the lender and the type of loan.

For instance, unemployment often qualifies for deferment. If you lose your job through no fault of your own and are actively seeking employment, you may be eligible. Another common example is graduate or professional school enrollment. Continuing your education in a qualifying program can provide a deferment, allowing you to focus on your studies without the added financial burden of loan repayments during that period. Furthermore, borrowers experiencing economic hardship due to a natural disaster may also be eligible for a deferment, provided they meet specific criteria. Finally, certain types of military service can also qualify for deferment. This recognizes the significant commitment and potential financial strain faced by those serving their country.

Types of Student Loan Deferments

Federal student loan deferments offer temporary pauses on your repayment obligations, providing relief during periods of financial hardship or other qualifying circumstances. Understanding the different types of deferments and their eligibility criteria is crucial for borrowers seeking this assistance. The specific type of deferment available will depend on your individual circumstances and the type of federal student loans you hold.

Several types of deferments exist for federal student loans, each with its own set of eligibility requirements and duration limits. These deferments provide a valuable safety net for borrowers facing temporary financial challenges, allowing them to postpone payments without incurring penalties, although interest may still accrue on unsubsidized loans during the deferment period. Careful consideration of the implications of each deferment type is essential before applying.

Economic Hardship Deferment

This deferment is available to borrowers experiencing temporary economic hardship. Eligibility requires demonstrating a significant financial setback, such as unemployment, reduced income, or medical expenses exceeding a certain percentage of your income. Documentation supporting the hardship claim is typically required. The duration of an economic hardship deferment can be granted for a period of up to three years, with possible extensions depending on the ongoing circumstances and supporting documentation. It’s important to note that the lender’s review and approval of the documentation is essential for the deferment to be granted.

Unemployment Deferment

This deferment is specifically designed for borrowers who have become unemployed. To qualify, you must be actively seeking employment and be able to provide proof of unemployment, such as a termination letter or unemployment benefits documentation. The deferment period is typically granted for up to three years, and extensions may be possible depending on the continued unemployment status and provided documentation. It is crucial to maintain consistent documentation of your job search efforts to maintain eligibility.

Graduate Fellowship Deferment

This deferment is for borrowers enrolled at least half-time in a graduate fellowship program. Eligibility requires official documentation from the institution confirming your enrollment and the fellowship’s nature. The duration of the deferment generally aligns with the duration of your graduate fellowship program, but it is essential to maintain your enrollment status to continue the deferment.

In-School Deferment

This deferment applies to borrowers who are enrolled at least half-time in a degree or certificate program. Eligibility is straightforward, requiring only proof of enrollment from your educational institution. The deferment typically lasts for the duration of your enrollment, plus an additional grace period (usually six months after graduation or leaving school).

Medical Deferment

This deferment is for borrowers facing significant medical challenges that prevent them from working and repaying their loans. Eligibility requires documentation from a physician or other licensed medical professional verifying the medical condition and its impact on your ability to repay your loans. The length of the deferment is determined on a case-by-case basis, depending on the severity and duration of the medical condition, and requires periodic updates and documentation from your physician.

| Type | Eligibility | Duration | Implications |

|---|---|---|---|

| Economic Hardship | Demonstrated significant financial hardship (e.g., unemployment, reduced income, medical expenses) with supporting documentation. | Up to 3 years, with possible extensions. | Interest may accrue on unsubsidized loans. Repayment resumes after the deferment period. |

| Unemployment | Active job search and proof of unemployment (e.g., termination letter, unemployment benefits documentation). | Up to 3 years, with possible extensions. | Interest may accrue on unsubsidized loans. Repayment resumes after the deferment period. |

| Graduate Fellowship | Enrollment at least half-time in a graduate fellowship program, with official documentation from the institution. | Duration of the fellowship program. | Interest may accrue on unsubsidized loans. Repayment typically begins after the fellowship ends. |

| In-School | Enrollment at least half-time in a degree or certificate program, with proof of enrollment from the institution. | Duration of enrollment plus grace period. | Interest may accrue on unsubsidized loans. Repayment begins after the grace period. |

| Medical | Significant medical condition preventing repayment, with documentation from a medical professional. | Varies based on the medical condition, requiring periodic updates. | Interest may accrue on unsubsidized loans. Repayment resumes after the deferment period ends. |

Applying for Student Loan Deferment

Applying for a student loan deferment involves navigating a process specific to your loan type and the reason for your request. The steps generally involve gathering necessary documentation, completing an application form, and submitting everything to your loan servicer. Failure to provide complete and accurate information may delay or deny your deferment request.

The application process is not universally standardized across all lenders and loan programs. It is crucial to consult your loan servicer’s website or contact them directly for precise instructions. The following Artikels a general process, but specific requirements might vary.

Economic Hardship Deferment Application

Economic hardship deferments require demonstrating a significant financial setback impacting your ability to repay your student loans. This usually involves a loss of employment, reduced income, or medical expenses.

- Gather Documentation: This typically includes proof of income (pay stubs, tax returns), documentation of unemployment (unemployment benefit statements), and evidence of unexpected expenses (medical bills, eviction notices). For example, a pay stub showing a significant decrease in income compared to previous months, or a letter from your employer confirming job loss, would be acceptable. Similarly, copies of medical bills and a doctor’s statement could substantiate unexpected medical expenses.

- Complete the Application: Your loan servicer will provide the specific application form. Carefully fill out all sections, providing accurate and complete information. Inaccurate information can lead to the rejection of your application.

- Submit the Application and Documentation: Submit the completed application form and supporting documentation. You can usually do this online through your loan servicer’s website, by mail, or by fax. Keep copies of everything for your records.

In-School Deferment Application

In-school deferments are granted to students enrolled at least half-time in a degree or certificate program.

- Gather Documentation: You’ll need proof of enrollment, typically a copy of your enrollment certificate or a statement from your school’s registrar confirming your enrollment status and the number of credit hours you are taking. A copy of your school’s academic calendar showing the duration of your enrollment may also be necessary.

- Complete the Application: This may involve completing a form provided by your loan servicer or simply updating your information in your online account. Ensure all details regarding your school and program are accurate.

- Submit the Application and Documentation: Submit the completed application and your enrollment documentation through your loan servicer’s preferred method (online, mail, or fax).

Military Deferment Application

Military deferments are available to service members on active duty.

- Gather Documentation: You will need official documentation verifying your active duty status in the military. This could be a copy of your military orders or a statement from your commanding officer.

- Complete the Application: Your loan servicer may have a specific application for military deferments, or you may need to provide your military documentation along with a request for deferment.

- Submit the Application and Documentation: Submit the completed application and your military documentation via your loan servicer’s preferred method.

Impact of Deferment on Student Loan Payments

Deferment significantly alters the repayment schedule and overall cost of your student loans. Understanding these changes is crucial for responsible financial planning. While providing temporary relief from payments, deferment impacts both your monthly obligations and the total amount you ultimately repay.

Deferment’s Effect on Monthly Payments and Interest Accrual

During a deferment period, you are not required to make any monthly payments on your student loans. This provides immediate financial relief, allowing you to focus on other priorities. However, this temporary reprieve comes with a cost: interest continues to accrue on most federal student loans. The interest accrued during deferment is added to your principal loan balance, increasing the total amount you owe.

Interest Capitalization During Deferment

Interest capitalization occurs when accumulated interest during a deferment period is added to your principal loan balance. This effectively increases the amount of your loan, meaning you will pay interest on the accumulated interest in the future. The larger your principal balance becomes due to capitalized interest, the higher your future monthly payments will be, and the more you’ll pay in interest overall. For example, if you have a $10,000 loan with a 5% interest rate and defer for one year, you might accrue $500 in interest. After capitalization, your principal would be $10,500, and future interest calculations will be based on this increased amount.

Hypothetical Scenario Illustrating Deferment’s Impact

Let’s consider a hypothetical scenario: Sarah has a $20,000 federal student loan with a 6% annual interest rate. She decides to defer her loan payments for two years while pursuing a postgraduate degree. During the two-year deferment, interest accrues at a rate of $1,200 per year ($20,000 x 0.06). After two years, $2,400 in interest has accumulated. If this interest is capitalized, Sarah’s new loan balance becomes $22,400. Without deferment, her original loan would have required smaller monthly payments over a longer period, resulting in a lower overall interest payment. The deferment, while offering short-term relief, ultimately increases the total cost of her loan due to interest capitalization. This example highlights the importance of carefully considering the long-term implications before opting for a deferment.

Alternatives to Deferment

Deferment, while offering temporary relief from student loan payments, isn’t always the best solution. It delays, but doesn’t reduce, your overall loan balance, and can even accrue interest in some cases. Understanding alternative options is crucial for effective long-term student loan management. These alternatives offer more sustainable approaches to repayment, often leading to lower overall costs and faster debt elimination.

Exploring alternatives to deferment involves carefully considering your financial situation and long-term goals. Factors such as your income, expenses, and the type of student loans you hold will influence the most appropriate strategy. By comparing the pros and cons of different options against deferment, you can make an informed decision that best aligns with your individual circumstances.

Income-Driven Repayment Plans Compared to Deferment

Income-driven repayment (IDR) plans calculate your monthly payment based on your income and family size. Unlike deferment, which simply postpones payments, IDR plans adjust your payments to make them more manageable. This means lower monthly payments compared to the standard repayment plan, but it typically extends the repayment period. Deferment, on the other hand, provides a temporary pause on payments, often resulting in a larger balance due later due to accrued interest. The choice between IDR and deferment depends on your current financial hardship and long-term financial planning. If you anticipate long-term financial challenges, an IDR plan might be preferable to deferment, as it offers a more sustainable repayment strategy. Conversely, if you foresee a short-term financial setback, deferment might be a more suitable option.

Pros and Cons of Income-Driven Repayment Plans

IDR plans offer several advantages. Lower monthly payments can ease financial strain, making it easier to manage other expenses. The extended repayment period reduces the immediate financial burden. However, the extended repayment period also means you’ll pay more interest overall. Additionally, IDR plans often require regular income recertification to ensure your payments remain aligned with your income.

Pros and Cons of Deferment

Deferment’s main advantage is its simplicity. It provides a temporary pause on payments, offering immediate relief. However, interest usually continues to accrue during deferment, increasing the total loan amount. This can lead to a significantly larger balance owed once the deferment period ends. Furthermore, deferment doesn’t address the underlying financial challenges that led to the need for payment postponement. It only temporarily masks the problem.

Situations Where Alternatives are Better Than Deferment

An IDR plan is generally a better choice than deferment when facing long-term financial hardship or consistently low income. If your income is consistently below a certain threshold, an IDR plan might significantly reduce your monthly payments compared to deferment, where you might accumulate a considerable amount of interest. Furthermore, IDR plans often lead to loan forgiveness after a certain number of qualifying payments, potentially eliminating a portion or all of your student loan debt. Deferment, on the other hand, offers no such long-term benefit. It simply delays the inevitable. For example, a recent graduate struggling to find a well-paying job would likely benefit more from an IDR plan than deferment, as the IDR plan would provide manageable payments during the job search, while deferment would only postpone the inevitable increase in debt.

Potential Pitfalls of Deferment

While student loan deferment offers temporary relief, it’s crucial to understand its potential long-term drawbacks. Deferring payments might seem appealing in the short term, but it can lead to significant financial burdens down the line if not carefully considered. Understanding these pitfalls is key to making informed decisions about your student loan repayment strategy.

Deferring student loan payments essentially postpones, not eliminates, your debt. Interest continues to accrue during most deferment periods, increasing the total amount you ultimately owe. This can significantly impact the overall cost of your education and extend the repayment timeline. Furthermore, deferment can negatively affect your credit score, making it harder to secure loans or favorable interest rates in the future for other financial needs, such as a mortgage or car loan.

Increased Total Loan Amount

The most significant pitfall of deferment is the accumulation of interest. Imagine a scenario where a borrower has a $30,000 loan with a 6% interest rate. If they defer payments for two years, even with a subsidized loan (where the government pays the interest), the interest still compounds, leading to a larger principal balance at the end of the deferment period. If it’s an unsubsidized loan, the borrower would be responsible for the accumulated interest, resulting in a considerably higher total debt. For example, with an unsubsidized loan, the borrower would owe significantly more than $30,000 after two years, adding thousands to their original debt. This added cost represents a direct financial impact resulting from the deferment.

Negative Impact on Credit Score

While deferment itself doesn’t always negatively impact your credit score, missed payments during or after the deferment period can significantly lower it. This is because lenders view missed payments as a sign of poor financial responsibility. A lower credit score can make it challenging to secure future loans, like a mortgage or auto loan, or lead to higher interest rates on those loans. This can have long-term financial consequences, affecting major life purchases. The resulting higher interest rates on future loans due to a damaged credit score can far outweigh the short-term benefits of the deferment.

Prolonged Repayment Period

Extended deferment periods can significantly lengthen the time it takes to repay your student loans. This means you’ll be paying off your debt for a longer period, and ultimately paying more in interest over the lifetime of the loan. For instance, a 10-year repayment plan could easily stretch to 15 or even 20 years with multiple deferment periods, substantially increasing the total interest paid. This extended repayment period can also delay other significant financial goals, such as saving for a down payment on a house or retirement.

Financial Impact of Extended Deferment

Let’s illustrate the potential financial impact. Consider a $40,000 unsubsidized loan with a 7% interest rate. If this loan is deferred for five years, and no payments are made, the accumulated interest would add thousands of dollars to the principal. At the end of the five-year deferment, the borrower might owe well over $50,000, even without any additional fees or penalties. This represents a substantial increase in the overall cost of the loan, directly attributable to the extended deferment period. This significant increase highlights the importance of carefully weighing the short-term benefits against the long-term financial implications.

Wrap-Up

Student loan deferment, while offering temporary relief from monthly payments, is a decision that requires careful consideration. Understanding the nuances of different deferment types, their eligibility requirements, and the potential impact on long-term loan costs is paramount. While deferment can provide a necessary bridge during challenging financial periods, it’s crucial to explore alternative repayment strategies and weigh the long-term consequences. Ultimately, informed decision-making empowers borrowers to effectively manage their student loan debt and achieve long-term financial stability.

Clarifying Questions

What happens to interest during a student loan deferment?

Interest typically continues to accrue on most federal student loans during a deferment period, though the rate may vary depending on the loan type. This accumulated interest is often capitalized at the end of the deferment period, increasing the principal loan amount.

Can I defer my private student loans?

The availability of deferment for private student loans depends entirely on the lender. Contact your lender directly to inquire about their deferment policies and eligibility requirements.

How long can a student loan deferment last?

The duration of a deferment varies depending on the type of deferment and the specific circumstances. Some deferments may last for a few months, while others can extend for several years.

What documents are typically needed to apply for a student loan deferment?

Required documentation often includes proof of unemployment, enrollment in school (if applicable), or evidence of other qualifying circumstances. Specific requirements vary depending on the type of deferment and the lender.