Navigating the complexities of student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. This guide delves into the Department of Education’s student loan consolidation programs, offering a clear and concise overview of the process, benefits, and potential drawbacks. We’ll explore eligibility criteria, interest rates, repayment plans, and the long-term impact on your credit and financial future, empowering you to make informed decisions about your debt management.

From understanding the different types of consolidation programs available to navigating the application process, we aim to provide a comprehensive resource for borrowers seeking to simplify their student loan repayment journey. We’ll also address common concerns and misconceptions surrounding consolidation, ensuring you have the knowledge to confidently approach this significant financial undertaking.

Understanding Student Loan Consolidation

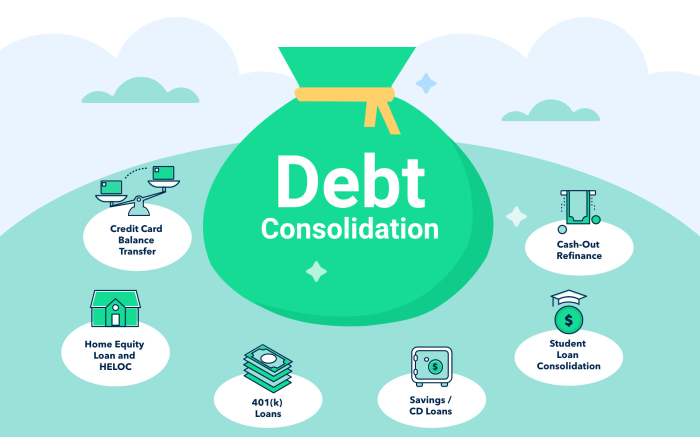

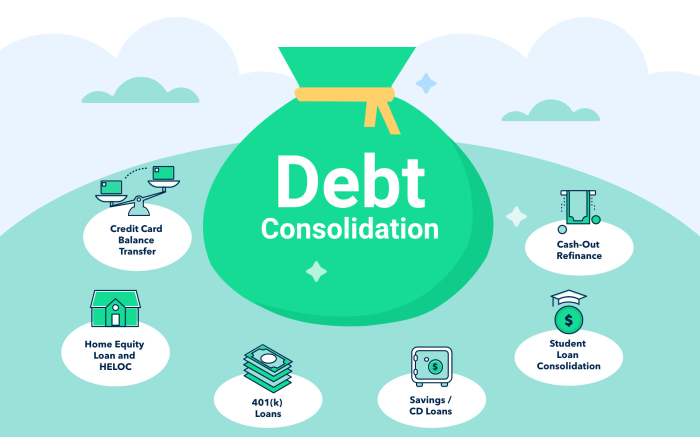

Student loan consolidation, offered through the Department of Education, is a process that combines multiple federal student loans into a single, new loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. However, it’s crucial to understand both the advantages and disadvantages before making a decision.

The Process of Federal Student Loan Consolidation

The Department of Education’s Direct Consolidation Loan program is the primary method for consolidating federal student loans. The process involves applying online through the StudentAid.gov website. You’ll need to provide information about your existing loans, including lender names and loan numbers. Once your application is approved, your existing loans are paid off, and you receive a single new loan with a new interest rate and repayment plan. The entire process typically takes several weeks.

Benefits and Drawbacks of Federal Student Loan Consolidation

Consolidating federal student loans offers several potential benefits, including simplifying repayment with a single monthly payment, potentially lowering your monthly payment amount (depending on the repayment plan chosen), and potentially extending the repayment period. However, it’s important to note potential drawbacks. Consolidation can result in a higher total interest paid over the life of the loan, especially if you choose a longer repayment term. Furthermore, consolidating loans might lose certain benefits associated with your original loans, such as income-driven repayment plans or loan forgiveness programs.

Comparison of Department of Education Consolidation Programs

The Department of Education primarily offers one consolidation program: the Direct Consolidation Loan. While there aren’t multiple distinct programs to compare, it’s important to understand that the terms of your consolidated loan will depend on factors such as your credit history (though this is not a direct eligibility requirement for federal consolidation), the interest rates at the time of consolidation, and the repayment plan you select.

Step-by-Step Guide to Applying for Student Loan Consolidation

1. Gather your information: Collect details about all your federal student loans, including loan numbers, lenders, and outstanding balances.

2. Visit StudentAid.gov: Access the website and locate the Direct Consolidation Loan application.

3. Complete the application: Provide accurate information and electronically sign the application.

4. Review and submit: Carefully review your application for accuracy before submitting it.

5. Await processing: The Department of Education will process your application, and you will receive notification of approval or denial.

6. Understand your new loan terms: Once approved, carefully review the terms of your consolidated loan, including the interest rate and repayment options.

Key Features of Consolidation Programs

| Program Name | Eligibility Requirements | Interest Rates | Repayment Options |

|---|---|---|---|

| Direct Consolidation Loan | Must have eligible federal student loans | Weighted average of your existing loans’ interest rates, rounded up to the nearest one-eighth of a percent. | Standard, Graduated, Extended, Income-Driven Repayment Plans (IDR) |

Eligibility Criteria for Consolidation

Student loan consolidation offers a streamlined approach to managing multiple federal student loans, but eligibility hinges on several key factors. Understanding these requirements is crucial before applying, ensuring a smooth and successful consolidation process. This section Artikels the specific criteria you must meet to be eligible.

Types of Loans Eligible for Consolidation

The Department of Education’s Direct Consolidation Loan program allows you to combine various federal student loans into a single loan. However, not all loans are eligible. Specifically, you can consolidate Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for graduate or professional students and parents), and Federal Stafford Loans (subsidized and unsubsidized). Consolidation is generally not available for private student loans or certain other federal loan programs.

Credit History’s Impact on Consolidation Eligibility

Your credit history does not directly impact your eligibility for federal student loan consolidation. Unlike private loan refinancing, which often considers credit scores, the federal consolidation program primarily focuses on the types and status of your existing federal student loans. Having a poor credit history might impact other financial decisions, but it won’t prevent you from consolidating your federal student loans.

Examples of Ineligibility for Consolidation

While most borrowers with federal student loans are eligible for consolidation, certain situations can lead to ineligibility. For example, borrowers who are currently in default on their federal student loans will typically need to resolve the default before they can consolidate. Additionally, loans already in the process of consolidation or those held by another entity (such as a private lender) cannot be included in a new consolidation loan. Finally, loans that are already in default may require additional steps before consolidation is possible, such as rehabilitation.

Eligibility Criteria Summary

The following points summarize the key eligibility requirements for federal student loan consolidation:

- You must have multiple federal student loans.

- Your loans must be eligible for consolidation (Direct Subsidized, Unsubsidized, PLUS Loans, and Federal Stafford Loans).

- You must not be in default on any of your federal student loans.

- Your loans must not already be in the process of consolidation.

Interest Rates and Repayment Plans

Consolidating your student loans can simplify your repayment process, but understanding how interest rates and repayment plans work is crucial to making informed decisions. This section will clarify how interest rates are determined for consolidated loans, compare rates across different programs, and explain the various repayment options available, demonstrating their impact on your overall loan cost.

Interest Rate Calculation for Consolidated Loans

The interest rate on a consolidated federal student loan is a weighted average of the interest rates on your existing loans. This weighted average takes into account the principal balance of each loan. For example, if you have a $10,000 loan at 5% interest and a $20,000 loan at 7% interest, the weighted average interest rate would be calculated as follows: [(10000 * 0.05) + (20000 * 0.07)] / (10000 + 20000) = 0.06 or 6%. This new rate will generally be fixed, meaning it won’t change over the life of the loan, unless you choose an income-driven repayment plan where adjustments might occur. It’s important to note that this weighted average might round up or down slightly depending on the specific lender’s calculation methods.

Comparison of Interest Rates Across Consolidation Programs

While the interest rate calculation method is generally consistent across federal student loan consolidation programs, the specific interest rate you receive will depend on the type of loans being consolidated and the current market interest rates. There isn’t a significant difference in interest rates between different federal consolidation programs. The primary benefit of consolidation lies in simplifying the repayment process rather than obtaining a lower interest rate. Private loan consolidation options, however, may offer different interest rates depending on the lender and your creditworthiness. These rates can often be higher or lower than the federal weighted average, depending on individual circumstances.

Repayment Plan Options After Consolidation

Several repayment plans are available after consolidating federal student loans. These plans differ in monthly payment amounts and loan repayment periods, impacting the total interest paid. The options generally include:

- Standard Repayment Plan: Fixed monthly payments over 10 years.

- Graduated Repayment Plan: Payments start low and gradually increase over a 10-year period.

- Extended Repayment Plan: Payments are spread over a longer period (up to 25 years), resulting in lower monthly payments but higher total interest paid.

- Income-Driven Repayment Plans (IDR): Monthly payments are based on your income and family size. These plans typically last 20-25 years and may offer loan forgiveness after a certain period.

Choosing the right repayment plan significantly impacts the total cost. Longer repayment periods lower monthly payments but increase the total interest paid over the life of the loan. Conversely, shorter repayment periods increase monthly payments but decrease the total interest paid. Income-driven plans can provide affordability but often lead to higher overall costs and potential loan forgiveness after a considerable time.

Impact of Different Repayment Plans on Total Loan Cost

Let’s consider a hypothetical scenario: a $50,000 consolidated loan with a 6% interest rate.

| Repayment Plan | Monthly Payment (approx.) | Loan Repayment Period | Total Interest Paid (approx.) |

|---|---|---|---|

| Standard (10 years) | $550 | 10 years | $16,000 |

| Extended (25 years) | $280 | 25 years | $36,000 |

| Income-Driven (20 years, assuming consistent income) | Variable (depends on income) | 20 years | Variable (potentially higher than extended) |

*Note: These are approximate figures and actual amounts will vary based on the specific interest rate and repayment plan chosen.* The example clearly illustrates that while the extended repayment plan offers significantly lower monthly payments, it leads to substantially higher total interest paid compared to the standard repayment plan. Income-driven plans offer flexibility but the total cost can be unpredictable depending on income fluctuations throughout the repayment period. This highlights the importance of carefully considering your financial situation and long-term goals when selecting a repayment plan.

Impact on Credit Score and Financial Aid

Consolidating your student loans can have a multifaceted impact on your financial standing, affecting both your credit score and your eligibility for future financial aid. Understanding these potential consequences is crucial before making a decision. While consolidation can simplify repayment, it’s essential to weigh the potential benefits against the possible drawbacks.

Consolidation’s effect on your credit score is complex and not always immediately positive. The process itself involves opening a new loan account, which can temporarily lower your credit score due to the age of your credit history being slightly reduced. However, responsible repayment of the consolidated loan can ultimately improve your credit score over time, especially if you’ve had issues managing multiple loans previously. Consistent on-time payments on your consolidated loan demonstrate improved creditworthiness to lenders.

Credit Score Impact

The impact of student loan consolidation on your credit score is generally short-term and depends largely on your pre-consolidation credit habits. A sudden drop in credit score is possible initially, but with consistent on-time payments, the score usually recovers and even improves. This is because a single, consolidated loan simplifies your credit profile, making it easier for lenders to assess your creditworthiness. For example, a borrower with multiple delinquent loans might see their score initially dip but then significantly rise after consolidating and consistently making payments. Conversely, a borrower with a consistently excellent credit history might see only a minor, temporary decrease.

Impact on Future Financial Aid

Consolidating federal student loans may affect your eligibility for future federal student aid programs. This is because consolidation changes the status of your loans. For instance, some programs, like Parent PLUS loans, require borrowers to demonstrate financial need, and the consolidation process might alter the calculation of that need. Additionally, consolidating loans can affect eligibility for income-driven repayment plans, which are based on your income and family size. Therefore, carefully consider the long-term implications for future educational pursuits before consolidating.

Long-Term Financial Implications

The long-term financial implications of student loan consolidation depend heavily on the interest rate of the consolidated loan compared to the interest rates of the individual loans. If the consolidated loan offers a lower interest rate, it could result in significant savings over the life of the loan. However, if the consolidated loan has a higher interest rate, it could lead to paying more in interest over time. Furthermore, extending the repayment period, a common feature of consolidation, might result in paying more in total interest even with a lower interest rate. Consider a scenario where a borrower consolidates loans with varying interest rates (e.g., 4%, 6%, 8%) into a single loan with a 5% interest rate. While seemingly beneficial, extending the repayment period could negate this advantage, leading to higher overall interest payments.

Potential Risks Associated with Consolidation

Consolidation is not without risks. A key risk is the potential for a higher overall interest rate if the weighted average of your existing loans is lower than the rate offered on the consolidated loan. Another risk is losing access to certain repayment plans or benefits associated with specific loan types. For instance, some income-driven repayment plans might not be available after consolidation. Finally, extending the repayment period, while seemingly helpful, can lead to paying significantly more interest over the loan’s life.

Short-Term and Long-Term Effects on Credit Scores

The following points summarize the potential short-term and long-term effects:

Understanding the impact on your credit score is crucial for making informed decisions. The initial impact can be negative due to the age of accounts, but responsible repayment leads to improvement over time.

- Short-Term Effects: Temporary decrease in credit score due to a new account opening and potential changes in credit utilization ratio. This is usually minor and temporary for borrowers with good credit history.

- Long-Term Effects: Potential increase in credit score due to simplified credit profile and consistent on-time payments. Improved creditworthiness may lead to better interest rates on future loans.

Additional Resources and Support

Navigating the student loan consolidation process can sometimes feel overwhelming. Fortunately, numerous resources and support services are available to assist borrowers throughout every step, from understanding eligibility to managing repayment. This section details the key resources and support systems designed to help you successfully consolidate your student loans and manage your debt effectively.

Contact Information and Relevant Resources

Finding the right contact information and accessing reliable resources is crucial for a smooth consolidation experience. The Department of Education provides comprehensive information and support channels for borrowers. Additionally, several non-profit organizations offer valuable guidance and assistance.

| Resource Name | Description | Contact Information | Website (Descriptive Text) |

|---|---|---|---|

| Federal Student Aid (FSA) | The primary source for information on federal student aid programs, including loan consolidation. | Visit their website for contact information. | Federal Student Aid Website (Provides comprehensive information on federal student aid programs) |

| StudentAid.gov | A website providing access to your federal student loan information, allowing you to manage your loans online. | Access through the website. | StudentAid.gov (Online portal for managing federal student loans) |

| National Foundation for Credit Counseling (NFCC) | A non-profit organization offering credit counseling and debt management services. | Their website provides contact information and a search tool to find local NFCC members. | NFCC Website (Provides access to certified credit counselors) |

| Consumer Financial Protection Bureau (CFPB) | A government agency that protects consumers’ financial rights. They provide resources on debt management and avoiding predatory lending practices. | Visit their website for contact information. | CFPB Website (Offers resources on financial rights and debt management) |

Support Services for Borrowers

For borrowers facing challenges with student loan repayment, several support services are available. These services can provide guidance, assistance with repayment plans, and resources to manage financial difficulties.

Debt Management Counseling and Financial Literacy Programs

Effective debt management requires understanding your finances and developing a sustainable repayment strategy. Debt management counseling services provide personalized guidance, helping borrowers create and stick to a budget, negotiate with creditors, and explore debt relief options. Financial literacy programs equip individuals with the knowledge and skills to manage their finances effectively, preventing future debt accumulation. These programs often cover budgeting, saving, investing, and credit management.

Appealing a Loan Consolidation Decision

In the event of a denied loan consolidation application or a dispute regarding the terms of the consolidation, borrowers have the right to appeal the decision. The appeal process typically involves submitting a formal request with supporting documentation outlining the reasons for the appeal. The Department of Education will review the appeal and provide a decision within a specified timeframe. Detailed instructions on the appeal process are usually available on the FSA website.

Summary

Consolidating your federal student loans through the Department of Education can be a powerful tool for simplifying your repayment process and potentially lowering your monthly payments. However, careful consideration of the potential long-term implications, including interest rate changes and the impact on your credit score, is crucial. By understanding the nuances of each program and weighing the benefits against the drawbacks, you can make an informed decision that aligns with your individual financial goals and sets you on a path toward responsible debt management and financial well-being.

General Inquiries

What happens to my loan grace period after consolidation?

Your grace period generally ends when consolidation is complete. A new grace period does not begin.

Can I consolidate private student loans with federal loans?

No, the Department of Education’s consolidation programs only apply to federal student loans.

Will consolidating my loans affect my credit score?

Consolidation itself typically doesn’t significantly harm your credit score, but consistently making on-time payments after consolidation will positively impact your credit.

What if I’m currently in default on my student loans?

You may still be eligible for consolidation, but you’ll need to address the default status first. Contact the Department of Education for guidance.

How long does the consolidation process take?

The processing time varies, but it generally takes several weeks. You’ll receive updates throughout the process.