Navigating the world of student loans can feel overwhelming, but understanding your options is key to a successful academic journey. This guide delves into Discover student loans, exploring their various types, application processes, and management strategies. We’ll compare them to other lenders and financing options, equipping you with the knowledge to make informed decisions about your education funding.

From eligibility requirements and interest rates to repayment plans and potential challenges, we’ll cover all the essential aspects of Discover student loans. We aim to provide a clear, concise, and practical resource to help you confidently manage your student loan experience.

Understanding Discover Student Loans

Discover Student Loans offer various financing options to help students pay for higher education. Understanding the different loan types, eligibility criteria, and repayment plans is crucial for making informed borrowing decisions. This section will provide a clear overview of these key aspects.

Discover Student Loan Types

Discover offers several student loan products catering to different needs and situations. These generally include federal student loans (through the government’s loan programs) and private student loans (directly from Discover). The specific loan options and their availability may vary depending on factors such as your creditworthiness, educational institution, and enrollment status. Federal loans typically have more favorable terms and borrower protections compared to private loans.

Discover Student Loan Eligibility Requirements

Eligibility for Discover student loans varies depending on the type of loan. Federal student loans usually require U.S. citizenship or eligible non-citizen status, enrollment in an eligible educational institution, and demonstration of financial need (for some loan types). Private student loans from Discover often have stricter eligibility criteria. These typically involve a credit check, a co-signer might be required (especially for students with limited or no credit history), and a minimum credit score. Income verification may also be necessary. Specific requirements will be detailed on Discover’s website and loan application.

Discover Student Loan Interest Rates Compared to Competitors

Discover’s student loan interest rates are competitive within the market, but they fluctuate based on several factors including your creditworthiness, the loan type, and prevailing market interest rates. Direct comparison with competitors requires checking current rates from various lenders at the time of application. Generally, federal student loans often have lower interest rates than private student loans. It’s crucial to compare multiple offers to secure the best possible rate. For example, a hypothetical comparison might show Discover offering a 6.5% interest rate on a private student loan, while a competitor offers 7%. However, these rates are subject to change and should be verified independently.

Discover Student Loan Repayment Plans

Discover offers various repayment plans to accommodate different financial situations. These may include standard repayment plans (fixed monthly payments over a set period), graduated repayment plans (payments increase over time), and income-driven repayment plans (payments are tied to your income). Specific repayment options and their terms should be reviewed in your loan documents. For instance, a standard repayment plan might have a 10-year term, while an income-driven plan could extend the repayment period based on your income level. Choosing a suitable repayment plan is essential for managing your debt effectively and avoiding delinquency.

Applying for a Discover Student Loan

Securing funding for your education is a crucial step, and understanding the Discover student loan application process can make the journey smoother. This section details the steps involved, necessary documentation, factors influencing approval, and actions to take beforehand.

The application process for a Discover student loan is designed to be straightforward and user-friendly. It primarily involves completing an online application form, providing supporting documentation, and undergoing a credit check (if applicable).

The Application Process

The application process typically involves these sequential steps:

- Create an Account: Begin by creating an account on the Discover Student Loans website. You’ll need to provide basic personal information.

- Complete the Application Form: The online application will request details about your education, financial background, and co-signer information (if applicable). Be sure to accurately and completely fill out all sections.

- Submit Supporting Documentation: You’ll need to upload necessary documents, such as your FAFSA (Free Application for Federal Student Aid) data, acceptance letter from your school, and tax returns (if required).

- Review and Submit: Carefully review your application for accuracy before submitting it. Once submitted, Discover will process your application.

- Approval Notification: Discover will notify you of their decision via email or mail. This notification will Artikel the loan terms, including the interest rate and repayment schedule, if approved.

Required Documentation

The specific documents required may vary depending on individual circumstances, but generally include:

- FAFSA Data: Your Student Aid Report (SAR) from the FAFSA will provide information about your financial need and eligibility for federal aid.

- Acceptance Letter from School: Proof of enrollment at an eligible institution is crucial.

- Tax Returns (Possibly): Depending on your financial situation and the loan amount, Discover may request tax returns to verify income.

- Social Security Number (SSN): This is essential for identification and credit check purposes.

- Co-signer Information (If Applicable): If a co-signer is required, their financial information will also be needed.

Factors Influencing Loan Approval

Several factors influence the approval of a Discover student loan application. These include:

- Credit History (If Applicable): If you are applying for an unsubsidized loan and are above a certain age, a credit check will be conducted. A strong credit history increases the likelihood of approval.

- Income and Debt: Your income and existing debt levels are assessed to determine your ability to repay the loan.

- Enrollment Status: You must be enrolled or accepted at an eligible educational institution.

- Co-signer Credit (If Applicable): If you have a co-signer, their credit history will also be considered.

- Academic History (Possibly): In some cases, Discover might review your academic record to gauge your commitment to completing your education.

Pre-Application Checklist

Before beginning the application process, it’s beneficial to gather the necessary information and documents to streamline the process:

- Gather Financial Documents: Collect tax returns, pay stubs, and bank statements.

- Obtain Your FAFSA Data: Complete the FAFSA and obtain your SAR.

- Secure Your Acceptance Letter: Ensure you have an official acceptance letter from your chosen school.

- Identify a Potential Co-signer (If Needed): If you anticipate needing a co-signer, discuss this with them beforehand.

- Review Your Credit Report (If Applicable): Check your credit report for any inaccuracies and address them before applying.

Managing Your Discover Student Loan

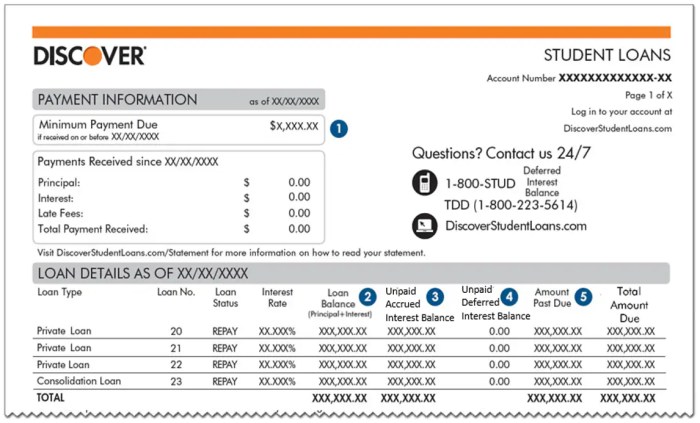

Successfully navigating student loan repayment requires proactive planning and responsible financial habits. Understanding your repayment options, budgeting effectively, and knowing the consequences of default are crucial for long-term financial well-being. This section will provide practical strategies to help you manage your Discover student loan effectively.

Responsible Loan Repayment Strategies

Effective repayment begins with understanding your loan terms, including your interest rate, repayment plan, and the total amount owed. Explore different repayment options offered by Discover, such as standard repayment, graduated repayment, or income-driven repayment plans. Consider the long-term implications of each plan and choose the one that best aligns with your current financial situation and future income projections. Creating a detailed budget that prioritizes loan repayment is essential. Automating your monthly payments can help prevent missed payments and associated late fees. Finally, consistently monitoring your loan balance and making extra payments whenever possible can significantly reduce the overall interest paid and shorten the repayment period.

Sample Student Loan Budget

A well-structured budget is crucial for successful loan repayment. The following example demonstrates how to incorporate student loan payments:

| Income | Amount |

|---|---|

| Monthly Salary | $3000 |

| Other Income | $200 |

| Total Income | $3200 |

| Expenses | Amount |

| Rent/Mortgage | $1000 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $300 |

| Student Loan Payment | $500 |

| Other Expenses | $300 |

| Total Expenses | $2700 |

| Savings/Emergency Fund | $500 |

This budget shows a $500 allocation for student loan payments, leaving $500 for savings. Adjust amounts based on individual circumstances. Remember to factor in unexpected expenses.

Consequences of Loan Default

Failing to make timely student loan payments can lead to serious consequences. These include damage to your credit score, impacting future borrowing opportunities (such as mortgages or car loans), wage garnishment, and potential legal action. Furthermore, default can result in the loan being sent to collections, incurring additional fees and negatively impacting your credit report for years. In severe cases, it can even lead to the loss of professional licenses or eligibility for certain government benefits. For example, a default could make it difficult to secure a rental apartment or obtain a favorable interest rate on a future loan.

Resources for Borrowers Facing Financial Hardship

Discover offers several resources to borrowers facing financial difficulties. These may include forbearance (temporary suspension of payments), deferment (postponement of payments), or income-driven repayment plans that adjust payments based on income. It is crucial to contact Discover directly to discuss your options and explore available hardship programs. Additionally, you can seek guidance from independent non-profit credit counseling agencies that provide free or low-cost financial advice and assistance with debt management. These agencies can help you create a budget, negotiate with your lenders, and explore options for consolidating or refinancing your loans. Early intervention is key; contacting your lender and exploring available resources before defaulting on your loans is highly recommended.

Discover Student Loan Features and Benefits

Discover student loans offer a range of features and benefits designed to make borrowing and repayment more manageable. Understanding these features and comparing them to other lenders is crucial for making an informed decision about your student financing. This section will explore Discover’s key offerings and highlight their advantages.

Choosing the right student loan lender involves careful consideration of several factors. Interest rates, fees, repayment options, and available online tools all play a significant role in the overall cost and convenience of your loan. Comparing Discover’s offerings to those of other major lenders provides a clear picture of its competitive position in the market.

Discover Student Loan Features Compared to Other Lenders

The following table compares key features of Discover student loans with those of several other prominent lenders. Note that interest rates and fees can vary based on creditworthiness, loan amount, and other factors. The data presented represents a snapshot in time and should be verified with the respective lenders for the most up-to-date information.

| Feature | Discover | Sallie Mae | Navient | Wells Fargo |

|---|---|---|---|---|

| Interest Rate (Variable Example) | 7.00% – 10.00% | 7.50% – 11.00% | 8.00% – 12.00% | 7.25% – 10.50% |

| Origination Fee | 0% – 1% | 0% – 1.5% | 0% – 2% | 0% – 1% |

| Repayment Options | Standard, Graduated, Extended | Standard, Graduated, Income-Driven | Standard, Graduated, Income-Driven | Standard, Graduated |

| Online Tools | Loan management portal, payment calculator, autopay | Loan management portal, payment calculator, autopay | Loan management portal, payment calculator | Loan management portal, payment calculator, autopay |

Disclaimer: Interest rates and fees are subject to change. This table provides example ranges and does not constitute financial advice. Always check with the lender for the most current information.

Benefits of Discover’s Online Loan Management Tools

Discover provides a robust online platform designed to simplify loan management. This user-friendly interface offers several key benefits for borrowers.

These tools empower borrowers to actively manage their loans, fostering financial responsibility and potentially reducing the risk of late payments or other financial complications. The convenience and transparency provided by these tools are significant advantages.

Using Discover’s Online Payment Calculator

Discover’s online payment calculator allows borrowers to estimate their monthly payments based on various loan parameters. To use the calculator, you typically need to input the loan amount, interest rate, and loan term (length of the repayment period). The calculator then computes the estimated monthly payment amount. For example, a $20,000 loan at 7% interest over 10 years would result in an approximate monthly payment of $239.00. This is a valuable tool for planning and budgeting. Remember that this is an estimate; the actual payment may vary slightly.

The formula for calculating monthly payments is complex, but the online calculator handles the calculations for you. It is advisable to use the online tool for accurate estimations.

Discover Student Loan Alternatives

Choosing the right path to finance your higher education is crucial. While Discover student loans offer a viable option, exploring alternatives is essential to find the best fit for your individual financial situation and needs. Understanding the various funding avenues available can help you make informed decisions and potentially secure more favorable terms.

Federal Student Loan Programs

Federal student loan programs provide government-backed financial aid for higher education. These loans generally offer lower interest rates and more flexible repayment options compared to private loans. They are also often accompanied by various borrower protections and benefits.

Examples of federal student loan programs include:

- Direct Subsidized Loans: These loans are need-based and the government pays the interest while you’re in school at least half-time, during grace periods, and during deferment periods.

- Direct Unsubsidized Loans: These loans are available to undergraduate and graduate students regardless of financial need. Interest accrues from the time the loan is disbursed, even while you’re in school.

- Direct PLUS Loans: These loans are available to graduate students and parents of undergraduate students. Credit checks are required, and borrowers are responsible for all interest charges.

The benefits of federal student loans include fixed interest rates, various repayment plans (including income-driven repayment), and potential loan forgiveness programs based on specific professions or circumstances. However, it’s important to note that federal loan applications can be time-consuming and involve a thorough review process.

Private Student Loans versus Federal Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. They often have higher interest rates than federal loans and may lack the same borrower protections. Federal student loans, on the other hand, are backed by the government and offer several benefits, including income-driven repayment plans and loan forgiveness programs.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower | Generally higher |

| Repayment Options | More flexible, including income-driven repayment | Less flexible |

| Borrower Protections | Stronger borrower protections | Fewer borrower protections |

| Credit Check | Usually not required for subsidized loans | Typically required |

The choice between federal and private loans often depends on factors such as credit history, financial need, and the amount of funding required. A strong credit history can improve eligibility for private loans with better terms, but federal loans offer greater protection for borrowers with less-than-perfect credit.

Alternative Financing Options

Beyond federal and private student loans, other financing options exist to help fund higher education. These alternatives can provide supplemental funding or serve as a primary source of financing depending on individual circumstances.

Some examples include:

- Scholarships and Grants: These are forms of financial aid that do not need to be repaid. They are often based on merit, need, or specific criteria.

- Work-Study Programs: These programs allow students to work part-time while attending school, providing income to help cover educational expenses.

- Savings and Investments: Utilizing personal savings and investments can significantly reduce the reliance on loans.

- Family Contributions: Financial support from family members can reduce the need for external borrowing.

These alternatives can reduce the overall amount of debt incurred, making repayment more manageable. However, securing scholarships and grants is competitive, and family contributions may not always be feasible. Careful planning and diligent application are crucial to maximize the benefits of these options.

Potential Challenges and Solutions

Repaying student loans can be a significant undertaking, presenting various challenges for borrowers. Understanding these potential hurdles and proactively implementing solutions is crucial for successful loan management and avoiding financial distress. This section will Artikel common challenges and offer practical strategies for addressing them.

Managing High Interest Rates

High interest rates can significantly increase the total cost of a student loan and lengthen the repayment period. Strategies for mitigating the impact of high interest rates include exploring loan refinancing options with lower interest rates from other lenders. This involves shopping around and comparing rates from different institutions. Another effective approach is to make extra principal payments whenever possible. Even small additional payments can substantially reduce the total interest paid over the life of the loan. For example, paying an extra $100 per month on a $30,000 loan could save thousands of dollars in interest and shorten the repayment timeline considerably.

Avoiding Loan Default

Loan default, which occurs when a borrower fails to make payments for an extended period, has severe consequences, including damage to credit score, wage garnishment, and potential legal action. To avoid default, borrowers should prioritize creating a realistic repayment budget that integrates loan payments alongside other essential expenses. This may involve adjusting spending habits, exploring income-driven repayment plans (IDRs), which tie monthly payments to income, or seeking assistance from student loan counselors. Open communication with the lender is also critical; contacting them early to discuss potential difficulties can often lead to workable solutions, such as forbearance or deferment, temporary pauses in payments under specific circumstances.

Resources for Students Struggling with Loan Repayment

Numerous resources are available to assist students facing difficulties with loan repayment. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, including guidance on debt management strategies. Many universities and colleges also provide financial aid offices that can offer advice and support to their alumni. The Federal Student Aid website (studentaid.gov) provides comprehensive information on repayment plans, options for borrowers experiencing hardship, and contact information for relevant agencies. Additionally, non-profit organizations like the United Way and local community action agencies often offer financial literacy programs and assistance with debt management.

Illustrative Examples of Loan Scenarios

Understanding how different choices impact student loan repayment is crucial. The following scenarios illustrate both successful navigation and the challenges that can arise. These examples are hypothetical but reflect common experiences.

Successful Student Loan Repayment

Sarah, a recent graduate with a degree in nursing, borrowed $30,000 in federal student loans. She diligently researched repayment options and chose an income-driven repayment plan, which adjusted her monthly payments based on her income. She also prioritized budgeting and minimized unnecessary expenses, ensuring she consistently made her payments on time. Within seven years, Sarah successfully repaid her loans without incurring any penalties or additional interest charges. Her proactive approach and financial discipline led to a positive outcome.

Struggling with Student Loan Repayment

In contrast, Mark, who graduated with a significant amount of private student loan debt, struggled with repayment. He initially faced unemployment after graduation, making it difficult to meet his monthly payments. Missed payments led to accruing late fees and penalties, significantly increasing his overall debt. His credit score suffered, hindering his ability to secure better financial opportunities. Mark’s situation highlights the importance of financial planning and contingency plans for unexpected life events. He eventually needed to consolidate his loans and seek professional financial guidance to manage his debt effectively.

Hypothetical Student’s Loan Repayment Journey

Consider Alex, a student who borrowed $45,000 in federal and private student loans to finance their education. Upon graduation, Alex secured a job with a starting salary of $50,000. Initially, Alex opted for a standard repayment plan, making consistent monthly payments. However, after two years, facing unexpected medical expenses, Alex struggled to maintain payments. They explored options like deferment, which temporarily suspended payments but accrued additional interest. After careful consideration, Alex decided to refinance their loans with a lower interest rate, extending the repayment period slightly to reduce their monthly payments. This decision provided short-term relief, allowing them to manage their expenses while keeping their credit score from being severely impacted. While this extended the repayment timeline, it avoided the more significant consequences of default. Alex also actively sought financial literacy resources, learning effective budgeting strategies and ways to manage their finances more efficiently. This proactive approach improved their financial well-being and ensured a more manageable repayment path.

Concluding Remarks

Securing funding for higher education is a significant step, and choosing the right student loan can significantly impact your financial future. This guide has provided a detailed overview of Discover student loans, covering everything from application to repayment. By understanding the nuances of these loans and exploring alternative options, you can make a well-informed decision that aligns with your financial goals and academic aspirations. Remember to carefully consider all aspects before committing to any loan, and don’t hesitate to seek professional financial advice if needed.

Frequently Asked Questions

What is the minimum credit score required for a Discover student loan?

Discover doesn’t publicly list a minimum credit score. Approval depends on several factors, including credit history, income, and co-signer availability.

Can I refinance my Discover student loan with another lender?

Yes, once your loans are in repayment, you can explore refinancing options with other lenders. This might lower your interest rate, but it’s crucial to compare offers carefully.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and may lead to late fees and ultimately, loan default. Contact Discover immediately if you anticipate difficulty making a payment.

Does Discover offer loan forgiveness programs?

Discover doesn’t offer loan forgiveness programs in the same way as federal loan programs. However, they may offer hardship deferment or forbearance options in certain circumstances.