The fluctuating landscape of student loan interest rates significantly impacts borrowers. Understanding recent changes, their causes, and the resulting financial implications is crucial for current and prospective students. This exploration delves into the current rates, recent adjustments, and the broader economic consequences, offering insights into managing student loan debt effectively in this dynamic environment.

We’ll examine the factors driving these changes, from inflation and economic conditions to government policies and the role of the Federal Reserve. Furthermore, we’ll explore strategies for managing debt, including refinancing options and proactive financial planning techniques.

Current Interest Rates

Understanding current student loan interest rates is crucial for borrowers to effectively manage their debt. These rates, which fluctuate based on several factors, significantly impact the overall cost of repayment. This section details the current rates for various federal student loan programs and the elements that influence them.

It’s important to note that interest rates are subject to change. The information below reflects the rates as of October 26, 2023, and should be verified with official government sources before making any financial decisions. Always consult the official Federal Student Aid website for the most up-to-date information.

Federal Student Loan Interest Rates

The interest rates for federal student loans vary depending on the loan type, the loan disbursement date, and the borrower’s creditworthiness (for PLUS loans). The following table provides a general overview. Keep in mind that these are fixed rates, meaning they remain the same for the life of the loan.

| Loan Type | 2023-2024 Rate (Undergraduate) | 2023-2024 Rate (Graduate/Professional) | Notes |

|---|---|---|---|

| Direct Subsidized Loan | 4.99% | 6.49% | Interest does not accrue while the borrower is in school at least half-time, during grace periods, and during deferment periods. |

| Direct Unsubsidized Loan | 4.99% | 6.49% | Interest accrues from the time the loan is disbursed. |

| Direct PLUS Loan (Graduate/Professional) | 7.54% | 7.54% | Interest accrues from the time the loan is disbursed. Credit check required. |

| Direct PLUS Loan (Parent) | 7.54% | N/A | Interest accrues from the time the loan is disbursed. Credit check required. |

Disclaimer: These rates are subject to change and are approximate. Always consult the official Federal Student Aid website for the most current rates.

Factors Influencing Interest Rates

Several factors contribute to the determination of federal student loan interest rates. These factors are complex and involve economic conditions and government policy.

The most significant factor is the prevailing market interest rates. When overall interest rates in the economy are high, student loan rates tend to be higher as well. Conversely, lower market rates generally lead to lower student loan rates. Government policy, specifically the budget and the annual appropriations process, also plays a role in setting these rates. Changes in government policy can lead to adjustments in the interest rates charged on federal student loans. For example, changes to the budget might result in alterations to the interest rate subsidies the government provides.

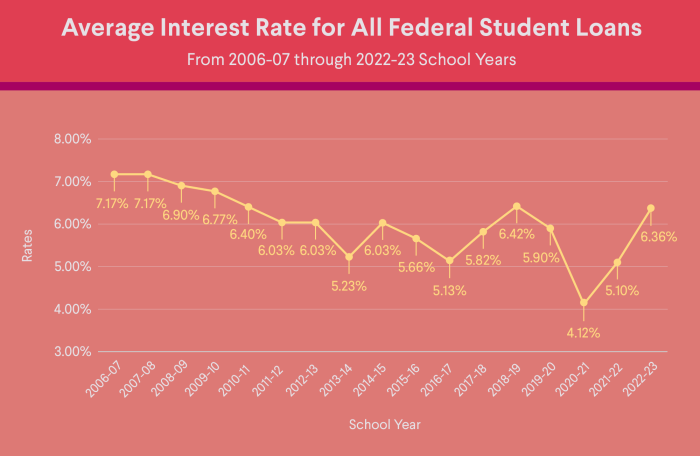

Historical Rate Comparisons

Comparing current rates to historical rates provides context. Over the past few decades, interest rates on federal student loans have fluctuated considerably. During periods of economic expansion, rates might be lower, while during recessions or periods of high inflation, rates might increase. For instance, rates were significantly lower in the early 2000s than they are currently, reflecting a period of relatively low overall interest rates. However, in the past few years, rates have risen, mirroring the broader economic trend of increasing interest rates.

Recent Rate Changes

Student loan interest rates are not static; they fluctuate based on various economic and political factors. Understanding these changes is crucial for borrowers to effectively manage their loan repayments. This section will Artikel recent adjustments to student loan interest rates, exploring the underlying causes and illustrating the trends over the past five years.

Recent changes in student loan interest rates have been influenced primarily by shifts in the overall economic climate, particularly inflation and Federal Reserve policy. Government policies, such as changes to the federal budget and the political landscape surrounding student loan forgiveness programs, also play a significant role. These interconnected factors create a complex interplay that directly impacts the cost of borrowing for students.

Timeline of Interest Rate Adjustments

The following timeline illustrates key adjustments to federal student loan interest rates over the past five years. Note that these rates can vary depending on the loan type (e.g., subsidized vs. unsubsidized, graduate vs. undergraduate) and the year the loan was disbursed. This data is simplified for illustrative purposes. Precise figures should be verified through official government sources.

| Date | Rate Change | Magnitude | Reason |

|---|---|---|---|

| July 1, 2019 | Increase | 0.25% | Inflationary pressures and anticipation of future rate hikes by the Federal Reserve. |

| July 1, 2020 | Decrease | 0.75% | Economic downturn caused by the COVID-19 pandemic; Federal Reserve emergency rate cuts. |

| July 1, 2021 | Increase | 0.50% | Economic recovery and rising inflation; Federal Reserve policy shift. |

| July 1, 2022 | Increase | 1.00% | High inflation and aggressive Federal Reserve interest rate increases to combat inflation. |

| July 1, 2023 | Increase | 0.25% | Persistent inflation, although at a slower pace than the previous year; continued Federal Reserve rate adjustments. |

Graphical Representation of Rate Changes

The following description depicts a line graph illustrating the trend of student loan interest rates over the past five years. The horizontal axis (x-axis) represents time, specifically the date of each rate change (July 1st of each year from 2019 to 2023). The vertical axis (y-axis) represents the interest rate, expressed as a percentage.

The graph begins in July 2019 with a relatively low interest rate. A slight increase is observed in July 2019. A significant drop occurs in July 2020, reflecting the economic impact of the COVID-19 pandemic. Subsequently, the rate steadily climbs from July 2021 to July 2022, mirroring the rising inflation and the Federal Reserve’s response. A slight increase is observed in July 2023, indicating continued, albeit moderated, inflationary pressures. The overall trend shows an initial decrease followed by a substantial increase, illustrating the dynamic nature of student loan interest rates in response to macroeconomic conditions. The graph visually represents the data presented in the table above, providing a clear illustration of the rate fluctuations over time.

Impact on Borrowers

The recent increase in student loan interest rates has significant financial implications for both current and prospective borrowers. Higher interest rates translate directly into increased borrowing costs, meaning borrowers will pay more over the life of their loan. This added expense can strain personal finances and delay other financial goals, such as saving for a down payment on a house or investing for retirement.

The impact of these rate hikes varies depending on several factors, including the loan amount, repayment plan, and the length of the repayment period. Borrowers with larger loan balances will naturally face a more substantial increase in their overall debt burden compared to those with smaller loans. Similarly, those on longer repayment plans will pay significantly more in interest over time, even if their monthly payments seem manageable.

Increased Monthly Payments and Total Repayment Costs

Increased interest rates directly translate to higher monthly payments for borrowers. For example, a borrower with a $50,000 loan at a 5% interest rate might have a significantly lower monthly payment than the same loan at a 7% interest rate, even with the same repayment period. This increase in monthly payments can create financial hardship, particularly for those with limited disposable income. The total cost of repayment, including principal and interest, also rises substantially with higher interest rates, extending the time it takes to become debt-free. This longer repayment period further amplifies the total interest paid.

Impact on Repayment Plan Options

Higher interest rates can affect the feasibility and attractiveness of different repayment plans. For instance, income-driven repayment (IDR) plans, which tie monthly payments to income, may still offer lower monthly payments. However, the longer repayment periods associated with IDR plans under higher interest rates will result in a significantly larger total amount paid over the life of the loan. Borrowers might find themselves needing to re-evaluate their repayment strategy to minimize long-term costs, potentially considering refinancing options if rates eventually fall.

Differing Impacts Based on Loan Amount and Repayment Terms

The impact of rate increases is not uniform across all borrowers. A borrower with a $20,000 loan will experience a smaller absolute increase in their monthly payment and total repayment cost compared to a borrower with a $100,000 loan. Furthermore, the length of the repayment term significantly influences the total interest paid. A 10-year repayment plan will result in a much lower total interest paid than a 20-year plan, even with the same interest rate. Therefore, borrowers with shorter repayment terms will be less affected by rate increases in terms of total interest paid, although their monthly payments will still be higher. A hypothetical scenario illustrates this: a $50,000 loan at 5% interest over 10 years will have a lower total interest paid than the same loan at 7% interest over 20 years, although the monthly payment for the 10-year loan will be significantly higher.

Government Policies and Regulations

Student loan interest rates are significantly influenced by government policies and regulations. These policies dictate not only the rates themselves but also the eligibility criteria for various loan programs and the overall availability of federal student aid. Understanding these mechanisms is crucial for borrowers to navigate the complexities of student loan debt.

The federal government plays a dominant role in shaping the student loan landscape. Several key agencies and policies directly impact interest rates. The most significant player is the Department of Education, which manages the federal student loan programs. However, other agencies, including the Federal Reserve, indirectly influence rates through broader macroeconomic policies.

The Role of the Department of Education

The Department of Education sets the interest rates for federal student loans. These rates are typically tied to market-based indices, such as the 10-year Treasury note, plus a fixed margin. For example, the interest rate for a subsidized Direct Subsidized Loan might be set at the 10-year Treasury note rate plus 2.5%. This means that fluctuations in the 10-year Treasury note directly affect the interest rate borrowers pay. The Department also determines eligibility criteria for different loan programs, impacting the types of loans available and the associated interest rates. Changes to eligibility criteria, such as increasing or decreasing income thresholds for loan qualification, can have a significant impact on the overall demand for student loans and, indirectly, on interest rates.

The Influence of the Federal Reserve

While the Department of Education directly sets the interest rates, the Federal Reserve’s monetary policy plays a significant indirect role. The Federal Reserve’s actions, such as adjusting the federal funds rate, influence overall interest rates in the economy. When the Federal Reserve raises interest rates to combat inflation, for instance, it typically leads to higher borrowing costs across the board, including student loans. Conversely, when the Federal Reserve lowers interest rates to stimulate economic growth, it can result in lower student loan interest rates. This relationship is not always direct or immediate, but it’s a crucial factor in the long-term trends of student loan interest rates.

Potential Future Policy Changes and Their Impact

Predicting future policy changes is inherently speculative, but several scenarios could significantly alter student loan interest rates. For example, increased government spending on higher education could lead to lower interest rates on federal loans, making college more accessible. Conversely, budget constraints might necessitate higher interest rates or reduced loan availability. Changes in the political landscape, with shifts in priorities and approaches to higher education financing, could also significantly impact interest rates. A significant shift towards income-driven repayment plans, for example, could potentially reduce the need for government subsidies and, consequently, lead to adjustments in interest rates. Analyzing historical trends in government spending on higher education, along with projected budgetary constraints, provides valuable insight into potential future shifts in student loan interest rates.

Refinancing Options

Refinancing your student loans can be a strategic move to lower your monthly payments and potentially save money over the life of your loan. However, it’s crucial to carefully weigh the pros and cons before making a decision. Several options exist, each with its own set of terms and conditions. Understanding these differences is key to choosing the best path for your individual financial situation.

Refinancing involves replacing your existing student loan(s) with a new loan from a private lender, typically at a lower interest rate. This can significantly reduce your monthly payments and the total amount you pay over the life of the loan. However, refinancing often comes with trade-offs, such as losing access to federal student loan benefits like income-driven repayment plans or loan forgiveness programs.

Types of Refinancing Programs

Several types of refinancing programs are available, each catering to different borrower needs and financial profiles. These programs generally differ in their eligibility requirements, interest rates, repayment terms, and fees. Borrowers should carefully compare these factors across various lenders to find the most suitable option.

- Single Loan Refinancing: This involves consolidating multiple federal and/or private student loans into one new private loan. This simplifies repayment by consolidating multiple monthly payments into a single payment. However, it might lead to a higher interest rate than the lowest rate of your original loans if your credit score isn’t excellent.

- Multiple Loan Refinancing: Some lenders allow refinancing of a subset of loans, while leaving others untouched. This offers flexibility for borrowers who want to refinance only their highest-interest loans, preserving favorable terms on other loans.

- Parent PLUS Loan Refinancing: Parents who borrowed PLUS loans to fund their children’s education can also refinance these loans. This option allows parents to lower their monthly payments and potentially reduce their overall debt burden.

Comparison of Refinancing Terms and Conditions

The terms and conditions of refinancing programs vary significantly among lenders. Key factors to consider include the interest rate, loan term, fees, and eligibility requirements. Lower interest rates translate to lower monthly payments and overall savings, but shorter loan terms result in higher monthly payments. Fees can include origination fees, prepayment penalties, and late payment fees. Eligibility often depends on credit score, income, and debt-to-income ratio. Some lenders may require a co-signer if the borrower’s credit history is weak.

| Factor | Lender A | Lender B |

|---|---|---|

| Interest Rate | 6.5% | 7.0% |

| Loan Term | 10 years | 15 years |

| Origination Fee | 1% | 0% |

| Prepayment Penalty | None | 3 months’ interest |

(Note: This is a simplified example; actual terms and conditions will vary significantly based on the lender, borrower profile, and market conditions.)

Pros and Cons of Refinancing

Before deciding to refinance, it’s essential to carefully consider the potential benefits and drawbacks. The decision should be based on your individual financial circumstances and long-term goals.

- Pros: Lower monthly payments, lower overall interest paid, simplified repayment, potential for a shorter repayment period.

- Cons: Loss of federal student loan benefits (e.g., income-driven repayment plans, loan forgiveness programs), higher interest rates compared to some federal loan options, potential for higher fees, risk of impacting credit score if repayment is missed.

Strategies for Managing Student Loan Debt

Managing student loan debt effectively, especially with rising interest rates, requires a proactive and strategic approach. Failing to address the debt can lead to significant financial strain and long-term consequences. A well-defined plan, incorporating budgeting, financial planning, and a thorough understanding of loan terms, is crucial for navigating this challenge successfully.

Budgeting and Financial Planning

Effective budgeting is paramount to managing student loan debt. By carefully tracking income and expenses, borrowers can identify areas where spending can be reduced to allocate more funds towards loan repayments. This process involves creating a realistic budget that prioritizes essential expenses like housing, food, and transportation, while minimizing discretionary spending. Financial planning goes beyond budgeting; it encompasses setting financial goals, such as paying off the loans early or saving for future expenses. For example, a borrower could allocate a portion of their income each month towards an emergency fund, reducing the risk of falling behind on loan payments due to unforeseen circumstances. This proactive approach safeguards against unexpected expenses and ensures consistent loan repayments. A detailed financial plan, perhaps created with the assistance of a financial advisor, can provide a clear roadmap for debt reduction.

Understanding Loan Terms and Repayment Options

Understanding the terms of your student loans is crucial for effective debt management. This includes knowing the interest rate, loan balance, repayment schedule, and any associated fees. Different repayment options exist, each with its own advantages and disadvantages. For example, the standard repayment plan involves fixed monthly payments over a 10-year period, while an income-driven repayment plan adjusts payments based on income and family size. Borrowers should carefully consider their financial situation and long-term goals when selecting a repayment plan. Failing to understand the nuances of these plans could lead to unnecessary interest accrual or difficulties meeting repayment obligations. Researching and comparing different repayment plans allows borrowers to make informed decisions that align with their individual circumstances.

Prioritizing High-Interest Loans

When dealing with multiple student loans, it’s advantageous to prioritize those with the highest interest rates. By focusing repayment efforts on these loans first, borrowers can minimize the overall interest paid over the life of the loans. This strategy, often called the avalanche method, can significantly reduce the total debt burden and save money in the long run. For example, if a borrower has one loan with a 7% interest rate and another with a 4% interest rate, making extra payments on the 7% loan first will yield greater savings compared to focusing on the lower-interest loan. This strategic approach can accelerate the debt repayment process and ultimately save a considerable amount of money.

Exploring Debt Consolidation and Refinancing

Debt consolidation involves combining multiple loans into a single loan, often with a lower interest rate. Refinancing allows borrowers to secure a new loan with better terms, potentially leading to lower monthly payments and faster repayment. Both options can simplify repayment and potentially save money, but it’s crucial to carefully research and compare offers before making a decision. It’s important to note that refinancing might not always be beneficial, especially if interest rates have increased significantly since the original loans were obtained. Borrowers should assess their individual financial situations and weigh the potential benefits against the risks before pursuing either debt consolidation or refinancing.

Impact on the Economy

Changes in student loan interest rates have significant ripple effects throughout the economy, influencing consumer behavior, investment patterns, and overall economic growth. These effects are complex and interconnected, impacting both the short-term and long-term economic outlook.

The relationship between student loan interest rates and the economy is multifaceted. Higher interest rates increase the monthly payments for borrowers, reducing their disposable income. This decrease in disposable income directly impacts consumer spending, potentially leading to slower economic growth. Conversely, lower interest rates can stimulate consumer spending as borrowers have more money available for other purchases. This increased spending can boost economic activity and contribute to overall growth. However, the magnitude of these effects depends on several factors, including the size of the student loan debt burden, the overall health of the economy, and the responsiveness of consumers to changes in interest rates.

Consumer Spending and Savings

Increased student loan payments due to higher interest rates can force borrowers to curtail spending on non-essential goods and services. This reduced consumer demand can negatively impact businesses, potentially leading to job losses and slower economic growth. For example, a significant increase in interest rates could cause a decline in restaurant visits, retail purchases, and travel, impacting those sectors of the economy. Conversely, lower interest rates free up more disposable income, potentially boosting consumer spending in these areas. Savings behavior is also affected; higher rates might incentivize some borrowers to save more aggressively to pay down debt, while lower rates might encourage spending rather than saving.

Economic Growth and Investment

Changes in student loan interest rates influence aggregate demand. Higher rates can lead to decreased consumer spending and investment, slowing economic growth. This is particularly true if a significant portion of the population is burdened by student loan debt. For instance, a scenario where a large number of young professionals are heavily indebted may postpone major purchases like homes or vehicles, impacting related industries. Conversely, lower rates could stimulate investment and spending, contributing to higher economic growth. The effect on overall economic growth is not only a direct consequence of changes in consumer spending but also indirectly influences investment decisions by businesses and individuals.

Long-Term Economic Effects

The long-term effects of fluctuating student loan interest rates can be substantial. Persistently high interest rates could lead to a generation burdened by debt, potentially delaying major life milestones like homeownership and family formation. This delayed entry into the housing market, for example, could have long-term implications for the construction industry and the overall housing market. Furthermore, high levels of student loan debt could negatively impact productivity and entrepreneurship, as individuals might be less likely to take risks or start businesses due to financial constraints. Conversely, consistently low interest rates, while potentially stimulating short-term growth, might contribute to inflation in the long run if not managed effectively. A prolonged period of low interest rates could lead to unsustainable levels of borrowing, eventually impacting economic stability.

Final Conclusion

Navigating the complexities of student loan interest rates requires a thorough understanding of current rates, recent trends, and available resources. By staying informed about government policies, exploring refinancing options, and implementing effective debt management strategies, borrowers can mitigate the financial burden and achieve long-term financial stability. The information provided here serves as a starting point for making informed decisions about your student loan debt.

Popular Questions

What happens if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

Are private student loans affected by changes in federal interest rates?

Not directly. Private student loan interest rates are set by the lender and are typically influenced by market conditions and your creditworthiness, not federal policies.

How often do student loan interest rates change?

Federal student loan interest rates are typically set annually for new loans, while existing loans retain their original interest rate. Private loan rates can change more frequently.

Can I deduct student loan interest from my taxes?

Possibly. The Student Loan Interest Deduction allows taxpayers to deduct the amount they paid in student loan interest during the tax year, subject to certain limitations and income thresholds. Check the IRS website for current eligibility requirements.