Navigating the world of student loans can feel overwhelming, especially when faced with the seemingly similar yet distinctly different options of subsidized and unsubsidized federal loans. Understanding the nuances between these loan types is crucial for responsible borrowing and minimizing long-term financial burdens. This exploration will illuminate the key distinctions, empowering you to make informed decisions about your educational funding.

This guide will delve into the core differences between subsidized and unsubsidized federal student loans, examining interest rates, eligibility requirements, repayment options, credit impact, and the role of government subsidies. Through clear explanations and practical examples, we aim to provide a comprehensive understanding of each loan type, enabling you to choose the best financing path for your educational journey.

Interest Rates and Accrual

Understanding the differences in interest rates and accrual between subsidized and unsubsidized federal student loans is crucial for effective financial planning during and after your education. The key difference lies in who pays the interest and when. This impacts the total amount you ultimately repay.

Subsidized and unsubsidized loans differ primarily in how interest is handled while you’re in school or during periods of deferment. Subsidized loans are generally more advantageous because the government pays the interest while you’re enrolled at least half-time or during certain grace periods. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status.

Interest Rate Differences

While both subsidized and unsubsidized federal student loans have interest rates set by the government, they are typically the same for a given loan period. The difference doesn’t lie in the initial rate itself, but in how that rate impacts the principal balance over time due to the accrual of interest. The government sets these rates annually, so they are subject to change.

Interest Accrual During Deferment

The most significant difference between subsidized and unsubsidized loans is how interest accrues during deferment periods—times when you’re not required to make payments. With subsidized loans, the government pays the accrued interest during these deferment periods, preventing the principal balance from growing. In contrast, with unsubsidized loans, interest continues to accrue and is added to the principal balance during deferment. This means your loan balance increases even though you’re not making payments, leading to a larger overall debt.

Long-Term Cost Implications

The long-term cost implications of interest accrual can be substantial. Because interest on unsubsidized loans accrues during deferment, borrowers end up paying significantly more in interest over the life of the loan. This can lead to a much larger total repayment amount compared to a subsidized loan with the same initial principal. For example, a $10,000 unsubsidized loan with a 5% interest rate accumulating interest for four years of deferment could result in a significantly higher principal amount than a subsidized loan of the same value. The longer the deferment period, the greater the difference in total cost.

Interest Rate and Accrual Comparison (10-Year Period)

The following table illustrates a hypothetical example of the differences in interest paid over a 10-year repayment period. Note that actual interest rates vary annually and the total interest paid will depend on the repayment plan chosen and the initial loan amount.

| Loan Type | Interest Rate (Example) | Accrual During Deferment | Total Interest Paid (Estimate) |

|---|---|---|---|

| Subsidized | 5% | Interest paid by government | $X |

| Unsubsidized | 5% | Interest capitalized | $Y (>$X) |

Note: $X and $Y represent hypothetical amounts. The actual figures would depend on the specific loan amount, interest rate, and repayment plan. $Y will always be greater than $X due to interest capitalization in unsubsidized loans.

Eligibility Requirements

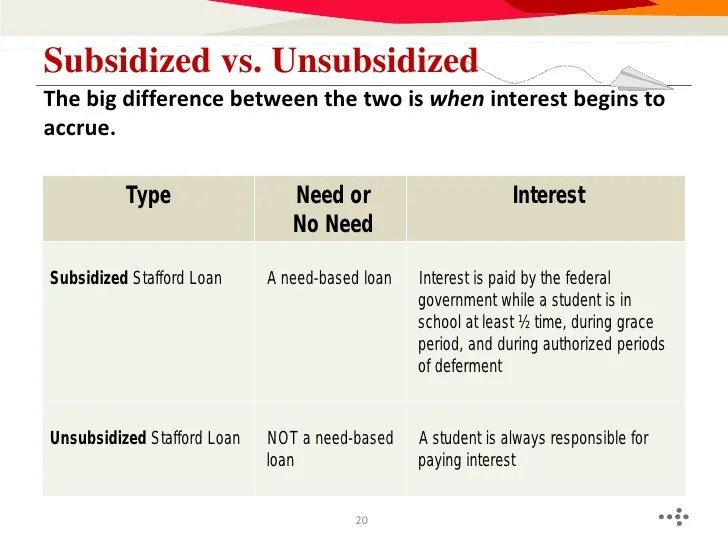

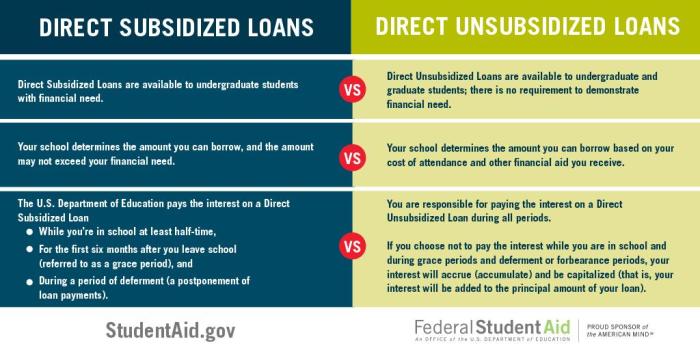

Understanding the eligibility requirements for subsidized and unsubsidized federal student loans is crucial for prospective borrowers. These requirements determine who qualifies for each type of loan and significantly impact the overall borrowing process. The primary differentiator lies in the role of financial need.

Subsidized Federal Student Loan Eligibility

To be eligible for a subsidized federal student loan, applicants must demonstrate financial need. This means their family’s income and assets fall below certain thresholds established by the federal government. The Free Application for Federal Student Aid (FAFSA) is used to determine this need. Eligibility also depends on maintaining satisfactory academic progress (SAP) at an eligible institution. This usually involves maintaining a minimum GPA and completing a certain number of credits per academic year. Finally, applicants must be enrolled at least half-time in a degree or certificate program at an eligible institution.

Unsubsidized Federal Student Loan Eligibility

Unsubsidized federal student loans do not require a demonstration of financial need. This makes them accessible to a broader range of students. Similar to subsidized loans, applicants must be enrolled at least half-time in a degree or certificate program at an eligible institution and maintain satisfactory academic progress (SAP). They must also be U.S. citizens or eligible non-citizens. The key difference is the absence of the financial need requirement.

Impact of Financial Need on Eligibility

Financial need plays a pivotal role in determining eligibility for subsidized loans. Only students who demonstrate financial need, as determined by the FAFSA, are eligible for subsidized loans. The government subsidizes the interest on these loans while the student is enrolled at least half-time or during a grace period. Conversely, unsubsidized loans do not consider financial need. Interest begins accruing immediately for unsubsidized loans, regardless of the student’s enrollment status. Therefore, students with greater financial need are more likely to benefit from subsidized loans due to the interest subsidy.

Eligibility Determination Process Flowchart

The following describes a flowchart illustrating the eligibility determination process. Imagine a branching diagram.

Start: Applicant completes the FAFSA.

Branch 1: Does the applicant meet the criteria for financial need (based on FAFSA data)?

Yes: Proceed to Branch 2 (Subsidized Loan Eligibility Check).

No: Proceed to Branch 3 (Unsubsidized Loan Eligibility Check).

Branch 2: Does the applicant meet the requirements for subsidized loans (enrollment status, SAP)?

Yes: Eligible for subsidized loan.

No: Ineligible for subsidized loan. Proceed to Branch 3.

Branch 3: Does the applicant meet the requirements for unsubsidized loans (enrollment status, SAP, citizenship)?

Yes: Eligible for unsubsidized loan.

No: Ineligible for unsubsidized loan.

End: Eligibility determination complete.

Loan Repayment

Both subsidized and unsubsidized federal student loans share some common repayment options, but there are also key differences to consider. Understanding these differences is crucial for effective financial planning after graduation. The repayment process hinges on factors such as loan type, loan amount, and your individual financial circumstances.

Repayment Plan Options

Several repayment plans are available for both subsidized and unsubsidized federal student loans. The best option depends on your individual financial situation and long-term goals. Choosing a plan that aligns with your income and budget is essential to avoid delinquency and maintain a good credit history.

- Standard Repayment Plan: This is the most common plan, requiring fixed monthly payments over a 10-year period. It’s a straightforward option, but the monthly payments can be relatively high. Eligibility is automatic for all federal student loans.

- Graduated Repayment Plan: Payments start low and gradually increase over a 10-year period. This can be helpful initially, but payments become significantly higher in later years. Eligibility is automatic for all federal student loans.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), leading to lower monthly payments but higher total interest paid. Eligibility is available for loans with a combined principal balance exceeding $30,000.

- Income-Driven Repayment (IDR) Plans: These plans base monthly payments on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility is available for all federal student loans, including subsidized and unsubsidized loans.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer significantly lower monthly payments than standard plans, making them attractive to borrowers with lower incomes. The specific calculation of monthly payments varies depending on the chosen IDR plan, but all plans typically involve a recalculation of payments annually or every few years based on your current income and family size. Both subsidized and unsubsidized loans are eligible for all IDR plans. After a set number of years (usually 20-25), any remaining loan balance may be forgiven under certain circumstances; however, the forgiven amount is considered taxable income.

Loan Forgiveness Programs

Loan forgiveness programs offer the potential for the cancellation of remaining loan balances after a specific period of qualifying payments, often through public service employment. Both subsidized and unsubsidized federal student loans are eligible for these programs, but the requirements and application processes are identical. The most common program is the Public Service Loan Forgiveness (PSLF) program, which requires 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. Other forgiveness programs exist, targeting specific professions or circumstances. The application process generally involves completing an application form and providing documentation of employment and loan payments.

Impact on Credit

Both subsidized and unsubsidized federal student loans impact your credit score, though in different ways and to varying degrees. Understanding these impacts is crucial for responsible borrowing and maintaining a healthy credit profile. The key difference lies in how the loans are reported to credit bureaus and the consequences of default.

Credit Reporting and Scoring

Federal student loans are reported to the major credit bureaus (Equifax, Experian, and TransUnion) once you’ve borrowed. This reporting begins after your loan enters repayment, and your payment history – whether on time or late – significantly influences your credit score. Consistent on-time payments contribute positively, while late or missed payments negatively impact your creditworthiness. Both subsidized and unsubsidized loans are treated similarly in this regard by credit reporting agencies; the type of loan itself doesn’t directly affect your score, but rather your payment behavior. A high credit score generally translates to better interest rates on future loans (mortgages, car loans, etc.), lower insurance premiums, and even better rental application approvals.

Consequences of Default

Defaulting on either a subsidized or unsubsidized loan has severe consequences for your credit. Default means you haven’t made payments for a specified period (typically 270 days). When you default, the lender reports this to the credit bureaus, significantly damaging your credit score. This negative mark can remain on your credit report for seven years, making it challenging to obtain credit, rent an apartment, or even get a job in certain fields. Furthermore, the government may take actions such as wage garnishment, tax refund offset, and even legal action to recover the defaulted loan amount. The impact of default is identical regardless of whether the loan was subsidized or unsubsidized; the severity lies in the act of default itself.

Responsible Borrowing and Debt Management

Maintaining a good credit score while managing student loan debt requires proactive strategies. This includes careful budgeting to ensure timely payments, exploring repayment plans that fit your financial situation (such as income-driven repayment plans), and actively monitoring your credit report for any errors. Consider creating a realistic budget that prioritizes loan payments, and if you anticipate difficulties, contact your loan servicer early to discuss options before defaulting. Regularly checking your credit report allows you to detect and address any inaccuracies promptly. By employing these strategies, you can minimize the negative impact of student loans on your credit and maintain a positive credit history.

Visual Representation of Credit Score Impact

Imagine a graph with “Credit Score” on the vertical axis and “Time” on the horizontal axis. A line representing a borrower with consistently on-time payments for both subsidized and unsubsidized loans would show a steady, upward trend, indicating a gradually improving credit score. Conversely, a line representing a borrower who defaults on either loan type would show a sharp, downward plunge in their credit score, followed by a slow, gradual recovery over seven years. The initial drop and the recovery rate would be largely similar for both loan types, highlighting that the type of loan is less significant than the borrower’s payment behavior. The key difference lies in the actions taken to address potential difficulties, proactive communication with lenders being crucial for mitigating negative impacts.

Government Subsidies

The key difference between subsidized and unsubsidized federal student loans lies in the government’s role in covering interest costs. Subsidized loans receive government subsidies, while unsubsidized loans do not. This subsidy significantly impacts the borrower’s overall loan repayment and total cost.

The source of government subsidies for subsidized federal student loans is the U.S. Department of Education. These subsidies are funded through taxpayer dollars and are designed to assist students from lower-income backgrounds and those demonstrating financial need in accessing higher education. The government’s contribution directly reduces the borrower’s total debt by covering the interest that accrues on the loan while the borrower is enrolled at least half-time in school, during grace periods, and during certain deferment periods.

Impact of Government Subsidies on Loan Cost

The government subsidy directly reduces the borrower’s overall loan cost. Without the subsidy, the borrower would be responsible for paying the accumulated interest from the moment the loan is disbursed. This accumulated interest is then added to the principal loan amount, resulting in a larger loan balance and higher total repayment costs. The subsidy effectively defers the accumulation of interest during specific periods, reducing the total amount the borrower must eventually repay.

Reasons for Offering Subsidized Loans

The government offers subsidized loans to promote access to higher education for students with limited financial resources. The aim is to remove financial barriers that might prevent eligible individuals from pursuing post-secondary education. By subsidizing interest, the government makes education more affordable and attainable, thereby contributing to a more skilled and educated workforce. This is a form of investment in human capital, leading to potential economic growth and societal benefits.

Hypothetical Example of Subsidized vs. Unsubsidized Loans

Let’s consider a hypothetical scenario. Suppose a student takes out a $10,000 subsidized loan and a $10,000 unsubsidized loan, both with a 5% annual interest rate. If the student is enrolled at least half-time for four years, the government will cover the interest accrued on the subsidized loan during that period. However, interest will accrue on the unsubsidized loan throughout the four years. Assuming a simple interest calculation for demonstration purposes, after four years, the unsubsidized loan will likely have accumulated significant interest, increasing the total amount owed. In contrast, the subsidized loan will only have the original $10,000 principal balance due after the four years, resulting in a significantly lower overall cost for the borrower. The exact figures would depend on the compounding frequency of the interest, but the principle remains the same: the subsidized loan saves the borrower money.

Practical Examples

Understanding the nuances between subsidized and unsubsidized federal student loans becomes clearer when examining real-world scenarios. The following examples illustrate how different loan types can impact a borrower’s overall debt burden. These examples use simplified interest calculations for clarity; actual interest accrual may vary slightly depending on the lender and repayment plan.

Let’s consider three students, each facing different financial situations, and analyze their loan choices and outcomes.

Scenario Comparisons: Subsidized vs. Unsubsidized Loans

The following scenarios demonstrate the differences in total cost between subsidized and unsubsidized loans under varying circumstances. Note that these are simplified examples and do not include all potential fees or variations in repayment plans.

| Scenario | Loan Type | Total Interest Paid | Total Repayment Amount |

|---|---|---|---|

| Student A: Low Income, High Need | Subsidized | $1,500 | $11,500 |

| Student A: Low Income, High Need | Unsubsidized | $3,000 | $13,000 |

| Student B: Middle Income, Moderate Need | Subsidized | $2,500 | $12,500 |

| Student B: Middle Income, Moderate Need | Unsubsidized | $4,000 | $14,000 |

| Student C: High Income, Low Need | Subsidized (Partial Eligibility) | $3,000 | $13,000 |

| Student C: High Income, Low Need | Unsubsidized | $5,000 | $15,000 |

Detailed Scenario Explanations

Here’s a breakdown of each scenario to illustrate the practical implications of choosing between subsidized and unsubsidized loans.

Scenario A: Student A – Low Income, High Need. Student A needs $10,000 for college and qualifies for both subsidized and unsubsidized loans. With a subsidized loan, the government pays the interest while the student is in school and during grace periods. Assuming a 5% interest rate and a 10-year repayment plan, the total interest paid would be approximately $1,500, resulting in a total repayment of $11,500. If Student A chose an unsubsidized loan, interest would accrue from the moment the loan is disbursed. In this scenario, the total interest paid would be approximately $3,000, resulting in a total repayment of $13,000. The subsidized loan saves Student A $1,500.

Scenario B: Student B – Middle Income, Moderate Need. Student B also needs $10,000 but may only qualify for a smaller subsidized loan, perhaps $5,000. The remaining $5,000 would be an unsubsidized loan. Assuming the same interest rate and repayment plan, the total interest on the subsidized portion might be $1,250, while the unsubsidized portion accrues $2,750 in interest. The combined interest is $4,000. This demonstrates that even with partial subsidized loan eligibility, there can be significant interest savings. Choosing all unsubsidized would increase the total repayment to $14,000.

Scenario C: Student C – High Income, Low Need. Student C may only qualify for a small subsidized loan, perhaps $2,000, and needs to take out $8,000 in unsubsidized loans. This scenario highlights the potential for a substantial difference in cost. The interest on the subsidized loan is minimal, but the unsubsidized loan accumulates significant interest. In this case, the total interest paid could be around $5,000, resulting in a significantly higher total repayment amount compared to a scenario with more subsidized loan eligibility.

Advice for Choosing Between Loan Types

The best choice between subsidized and unsubsidized loans depends heavily on the individual’s financial circumstances and ability to repay the loan. Students with limited financial resources should prioritize subsidized loans to minimize overall borrowing costs. Students who can afford to pay some interest while in school might consider a mix of subsidized and unsubsidized loans to maximize their borrowing limit. Careful budgeting and understanding the long-term implications of loan debt are crucial before making a decision.

Last Recap

Ultimately, the choice between subsidized and unsubsidized student loans hinges on individual financial circumstances and eligibility. While subsidized loans offer the advantage of no interest accrual during deferment, unsubsidized loans provide broader accessibility. By carefully considering the factors Artikeld in this guide—interest rates, repayment options, and long-term cost implications—students can make informed borrowing decisions that align with their financial goals and minimize future debt.

User Queries

What happens if I don’t repay my student loans?

Defaulting on your student loans can severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. It can also lead to wage garnishment and tax refund offset.

Can I refinance my subsidized and unsubsidized loans together?

Yes, you can often refinance both subsidized and unsubsidized federal student loans into a single private loan. However, be aware that refinancing federal loans into private loans may mean losing access to federal repayment programs and benefits.

Are there any penalties for paying off my student loans early?

Generally, there are no penalties for paying off your student loans early. In fact, it can save you money on interest in the long run.

How do I apply for student loan forgiveness programs?

Eligibility for loan forgiveness programs varies depending on the program and your specific circumstances. You’ll need to research the different programs available and meet the required criteria, often involving working in specific public service roles for a set period.