Navigating the complexities of student loan repayment can be daunting, especially when faced with financial hardship. Understanding the distinctions between forbearance and deferment is crucial for borrowers seeking temporary relief. Both options offer a pause on loan payments, but they differ significantly in their impact on interest accrual, eligibility requirements, and long-term financial consequences. This guide will clarify these key differences, empowering you to make informed decisions about your student loan repayment strategy.

This exploration will delve into the specific definitions of forbearance and deferment, outlining eligibility criteria and the processes involved in applying for each. We will analyze how interest accrues under each program, the potential impact on your credit score, and the long-term financial implications of each choice. Ultimately, this guide aims to provide a comprehensive understanding, allowing you to choose the best option for your individual circumstances.

Definitions of Forbearance and Deferment

Student loan forbearance and deferment are both options that temporarily postpone your student loan payments, offering relief during financial hardship. However, they differ significantly in their terms and conditions, impacting your loan’s overall cost and repayment schedule. Understanding these differences is crucial for making informed decisions about managing your student loan debt.

Forbearance and deferment are both temporary pauses in your student loan payments, but they function differently and have distinct implications. Both can provide short-term relief, but the long-term effects vary depending on the chosen option. Crucially, the interest accrual differs significantly between the two, leading to different levels of debt upon repayment resumption.

Forbearance Definition and Characteristics

Forbearance is a temporary suspension of your student loan payments, granted by your loan servicer. It’s typically used when you experience unexpected financial difficulties that prevent you from making your scheduled payments. The key characteristic of forbearance is that interest usually continues to accrue on your loan balance during the forbearance period, leading to a larger overall debt. The length of a forbearance period can vary, and multiple forbearance periods may be granted, depending on your circumstances and your loan servicer’s policies. While forbearance offers immediate payment relief, borrowers should be aware that it increases the total cost of their loan.

Deferment Definition and Characteristics

Deferment, unlike forbearance, is a postponement of your student loan payments authorized by law, often due to specific circumstances like returning to school or experiencing unemployment. A significant difference is that for certain types of federal student loans, interest may not accrue during a deferment period. This means that the total loan amount remains unchanged. However, interest will still accrue on subsidized federal loans during deferment, while unsubsidized loans will accrue interest. The eligibility criteria for deferment are stricter than for forbearance and are dependent on specific life events and loan types.

Comparison of Forbearance and Deferment Impacts on Loan Payments

The primary difference between forbearance and deferment lies in the treatment of interest. In forbearance, interest typically continues to accrue, increasing the total amount you owe. This means that when your forbearance period ends, you will have a larger balance to repay, potentially resulting in higher monthly payments. Conversely, with deferment, depending on the loan type and circumstances, interest may not accrue, or may accrue at a reduced rate, keeping the principal loan amount unchanged. This can significantly reduce the overall cost of your loan compared to forbearance. Therefore, while both provide temporary payment relief, deferment generally offers a more financially advantageous option, provided you qualify.

Eligibility Criteria for Forbearance and Deferment

Understanding the eligibility requirements for forbearance and deferment is crucial for borrowers navigating financial hardship. Both offer temporary pauses in student loan payments, but their eligibility criteria differ significantly, impacting which option is best suited to a borrower’s circumstances. This section details the specific requirements for each program.

Forbearance Eligibility Criteria

Forbearance is generally granted when a borrower experiences temporary financial difficulty, preventing them from making their scheduled loan payments. Lenders typically review several factors to determine eligibility. While specific requirements vary between lenders and loan types, common eligibility criteria include demonstrating a financial hardship, such as unemployment, medical emergencies, or natural disasters. The process usually involves completing an application and providing documentation supporting the claim of hardship. Some forbearance plans may require borrowers to make interest-only payments during the forbearance period, while others may allow for a complete suspension of payments, but interest will usually continue to accrue.

Deferment Eligibility Criteria

Deferment, unlike forbearance, is typically granted based on specific qualifying life events or circumstances rather than general financial hardship. Eligibility is often determined by the type of loan and the borrower’s situation. Common qualifying circumstances include returning to school at least half-time, experiencing unemployment, or undergoing military service. For deferment, borrowers typically need to provide documentation proving their eligibility, such as enrollment verification from an educational institution or proof of unemployment. A key difference is that, for certain federal loans, interest may not accrue during a deferment period, unlike forbearance where interest usually continues to accumulate.

Situations Where One Might Be Eligible for One but Not the Other

A borrower might be eligible for forbearance but not deferment if they are experiencing a temporary financial hardship that doesn’t fall under the defined categories for deferment, such as a sudden job loss or unexpected medical expenses. Conversely, a borrower may be eligible for deferment but not forbearance if they meet the specific criteria for deferment, such as returning to school, but do not demonstrate financial hardship sufficient for forbearance approval. For example, a borrower who is enrolled in school half-time might qualify for a deferment, but if their income is sufficient to make loan payments, they might not qualify for forbearance. The availability of each option also depends on the type of loan. Federal student loans often offer more deferment options than private loans, which may primarily offer forbearance.

Impact on Interest Accrual

Understanding how interest accrues during forbearance and deferment is crucial for managing your student loan debt effectively. The key difference lies in whether or not interest is added to your principal balance during the period of non-payment. This impacts the total amount you ultimately owe and the length of time it takes to repay your loans.

Interest accrual differs significantly between forbearance and deferment. During a forbearance period, interest typically continues to accrue on your loan. This means that interest charges are added to your principal balance over time, even though you are not making payments. This can lead to a larger overall debt than if you were making payments, and it’s important to understand that the accrued interest will eventually need to be repaid.

Interest Accrual During Forbearance

In a forbearance plan, you are temporarily relieved from making your scheduled loan payments. However, the clock keeps ticking on interest. This accumulated interest is typically added to your principal loan balance at the end of the forbearance period, a process known as capitalization. For example, imagine you have a $10,000 loan with a 5% interest rate and enter a six-month forbearance. Over those six months, interest will accrue, increasing your total debt. If $250 in interest accrues, your principal balance will become $10,250 once the forbearance ends. You will then be responsible for paying this higher amount. The longer the forbearance period, the greater the impact of interest capitalization.

Interest Accrual During Deferment

Deferment offers a different scenario. While you are also temporarily not required to make payments, the way interest is handled depends on the type of deferment. For some deferments, interest may not accrue at all, while for others, subsidized loans might have the government pay the interest while unsubsidized loans still accrue interest. Subsidized loans typically have interest paid by the government during the deferment period, meaning your principal balance remains unchanged. Unsubsidized loans, however, will still accrue interest, similar to forbearance. This interest will be added to the principal balance upon the end of the deferment period, leading to a larger loan balance that must be repaid.

Long-Term Cost Differences Due to Interest Capitalization

The long-term cost difference between forbearance and deferment, particularly concerning unsubsidized loans, can be substantial. Capitalization of interest significantly increases the total amount owed. For instance, a loan with $1000 of accrued interest capitalized will lead to higher monthly payments and a longer repayment period. Repeated use of forbearance or deferment with accruing interest can dramatically increase the overall cost of your education. Consider a scenario where a student uses multiple forbearance periods over several years. The compounding effect of capitalized interest can easily add thousands of dollars to the final loan balance, extending the repayment timeline and increasing the total interest paid. This ultimately makes it more expensive to repay the student loan.

Length of Forbearance and Deferment

Understanding the duration limits for both forbearance and deferment is crucial for effective student loan management. These limits vary depending on the lender and the specific program, but general guidelines exist to help borrowers plan accordingly. Exceeding these limits often requires reapplication or a change in repayment plan.

The length of time a borrower can utilize forbearance or deferment significantly impacts their overall loan repayment strategy. Prolonged periods of non-payment, even with interest capitalization, can lead to a substantial increase in the total amount owed. Therefore, understanding these timeframes is essential for responsible financial planning.

Forbearance Duration Limits

Forbearance periods are typically granted in increments, often ranging from a few months to a year. The maximum total forbearance period varies considerably depending on the lender and the reason for the forbearance. Some lenders might allow for multiple forbearance periods, while others might impose stricter limits. It’s vital to check with your loan servicer for specific details on your loan’s forbearance options and limitations. Repeated requests for forbearance may be viewed negatively by lenders and could affect future loan applications. The borrower should actively seek solutions to resolve the underlying financial difficulties that necessitate forbearance.

Deferment Duration Limits

Deferment periods, unlike forbearance, are often linked to specific qualifying circumstances, such as enrollment in school or experiencing economic hardship. The maximum duration for deferment is usually capped, often totaling several years across multiple deferment periods, but this varies significantly depending on the loan type and the reason for deferment. It’s important to note that certain types of deferment may have stricter limits than others. Again, contacting your loan servicer is crucial to understand the precise limits applicable to your specific loans. Borrowers should carefully consider the implications of deferment, as it can postpone but not eliminate interest accrual.

Maximum Durations and Renewal Possibilities

| Feature | Forbearance | Deferment |

|---|---|---|

| Typical Maximum Duration (per period) | 3-12 months (varies widely by lender) | 6-12 months (varies by program and reason for deferment) |

| Total Maximum Duration | Often capped, but the limit varies greatly by lender and program (could be several years total with multiple periods) | Often capped, with the limit varying by loan type and reason (could be several years total with multiple periods) |

| Renewal Possibilities | Usually possible, but subject to lender approval and often requires reapplication | Usually possible, subject to continued eligibility criteria and reapplication |

Application Process and Requirements

Applying for either a forbearance or deferment on your student loans involves navigating the specific processes established by your loan servicer. While the overall steps are similar, the required documentation and eligibility criteria differ significantly. Understanding these differences is crucial for a smooth application process.

Forbearance Application Process

The application process for a forbearance typically begins online through your loan servicer’s website. You will need to log in to your account and locate the forbearance application. This usually involves selecting the forbearance option, providing the reason for requesting forbearance (e.g., temporary financial hardship), and completing any necessary forms. Some servicers may require you to upload supporting documentation at this stage, while others may request it later. Following submission, you’ll receive confirmation and an indication of the processing time, which can vary depending on the servicer and the complexity of your situation.

Deferment Application Process

Applying for a deferment often mirrors the forbearance application process in its initial stages. You will usually begin online through your loan servicer’s portal, navigating to the deferment application section. However, unlike forbearance, deferment applications generally require more substantial documentation to prove your eligibility. This is because deferments are granted based on specific qualifying circumstances, such as enrollment in school or experiencing unemployment. After submitting the completed application and supporting documents, you’ll receive confirmation and a timeline for processing.

Documentation Requirements Comparison

The documentation needed for forbearance and deferment applications differs significantly. Forbearance often requires minimal documentation, possibly just a brief explanation of your financial hardship. However, deferment requires more comprehensive proof of eligibility.

| Document Type | Forbearance | Deferment |

|---|---|---|

| Proof of Income | Often not required, but may be requested for certain types of forbearance. | May be required depending on the type of deferment (e.g., unemployment deferment). |

| Enrollment Verification | Not required. | Required for in-school deferments, typically a copy of your enrollment certificate or acceptance letter. |

| Unemployment Documentation | Not required. | Required for unemployment deferments; this might include a layoff notice or unemployment benefit statement. |

| Medical Documentation | May be required for certain hardship situations. | May be required for deferments based on medical reasons. This typically involves documentation from a healthcare provider. |

It is crucial to remember that specific documentation requirements can vary based on your loan servicer and the type of forbearance or deferment you are seeking. Always check your servicer’s website for the most up-to-date and accurate information.

Impact on Credit Score

Choosing between forbearance and deferment for your student loans can significantly impact your credit score. Both options temporarily pause your loan payments, but they affect your credit report differently, leading to varying consequences for your creditworthiness. Understanding these differences is crucial for making informed financial decisions.

Forbearance and deferment both have the potential to negatively affect your credit score, although the impact can vary depending on several factors, including the length of the forbearance or deferment period and your overall credit history. It’s important to remember that the goal is to get back on track with your loan repayments as soon as possible to minimize the long-term effects on your credit.

Forbearance’s Impact on Credit Score

While not automatically reported as a negative mark, forbearance can still hurt your credit score. The missed payments during the forbearance period are usually reported to the credit bureaus. This can lead to a lower credit score due to a decrease in your payment history, which is a significant factor in credit scoring models. The length of the forbearance period directly correlates with the potential damage; longer periods of forbearance generally result in a more substantial negative impact. For example, a six-month forbearance will likely have a less severe effect than a two-year forbearance. Additionally, if you already have a low credit score, the impact of forbearance will be more pronounced.

Deferment’s Impact on Credit Score

Deferment typically has a less severe impact on your credit score than forbearance. While missed payments are still reported to the credit bureaus, the impact is often mitigated by the fact that deferment is generally granted for specific reasons, such as unemployment or enrollment in school. Lenders often view deferments more favorably than forbearances because they represent a temporary pause in payments due to extenuating circumstances rather than a failure to pay. However, it’s important to note that even with a deferment, a prolonged period without payments can still negatively affect your credit score. A short deferment period may have a negligible effect on a strong credit history, but a lengthy one could still result in a credit score decrease.

Comparison of Forbearance and Deferment Effects on Creditworthiness

Generally, deferment is considered less damaging to your credit score than forbearance. The reason lies in how lenders and credit bureaus perceive the circumstances leading to the payment pause. Deferments often indicate a temporary hardship, while forbearance may suggest a more persistent struggle with loan repayment. However, both can negatively affect your credit score if the period is extended, so minimizing the duration of either is crucial for protecting your creditworthiness. The impact on individual credit scores can also vary based on other factors such as existing credit history and the specific credit scoring model used. It is advisable to contact your loan servicer to understand the potential implications of forbearance or deferment on your specific situation.

Types of Forbearance and Deferment

Understanding the different types of forbearance and deferment options available is crucial for borrowers to choose the best strategy for managing their student loan repayments during periods of financial hardship. The specific options available will vary depending on the type of loan (federal or private) and the lender.

Types of Forbearance

Several types of forbearance exist, each offering varying levels of flexibility and potential impact on your loan. The terms and conditions will be defined by your loan servicer.

- General Forbearance: This is a common type where you temporarily suspend or reduce your monthly payments. The length of the forbearance period can vary, and interest typically continues to accrue during this time, leading to a larger total loan amount upon repayment resumption.

- Partial Forbearance: This option allows you to make reduced payments rather than suspending payments entirely. The amount of the reduced payment is negotiated with the loan servicer and will depend on your financial circumstances. Interest still accrues on the unpaid balance.

- Specific Forbearance: This type is often tied to specific circumstances, such as unemployment or illness, requiring documentation to support the claim. The requirements and duration will vary based on the loan servicer’s policies and the supporting documentation provided.

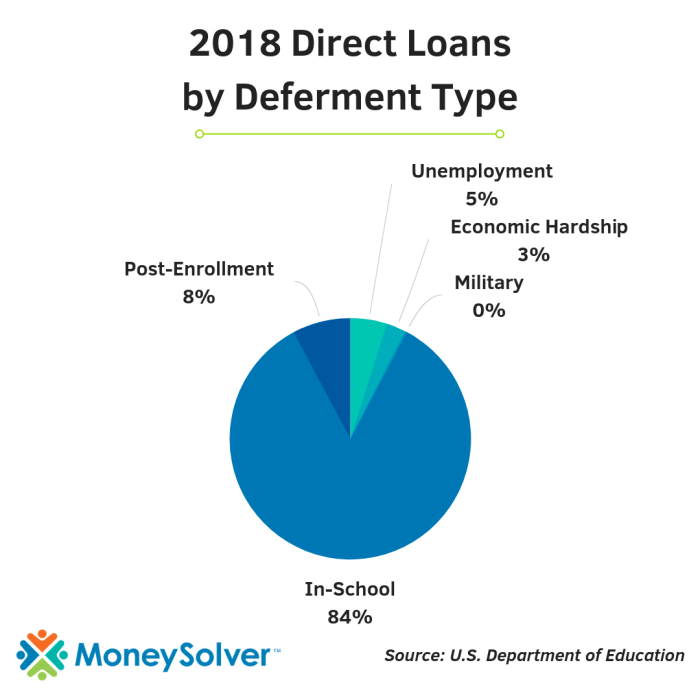

Types of Deferment

Deferment offers a more structured approach to temporary payment suspension, often with specific eligibility criteria. Unlike forbearance, some deferment options may suspend interest accrual under certain conditions.

- Economic Hardship Deferment: This type of deferment is usually available for federal student loans and requires documentation proving financial difficulty, such as unemployment or a significant reduction in income. The exact requirements and the duration of deferment are specified by the federal government.

- In-School Deferment: This deferment is typically available to students who are enrolled at least half-time in a degree or certificate program at an eligible institution. Interest may or may not accrue depending on the loan type. It is common for subsidized federal loans to have interest payments covered by the government during this deferment period.

- Graduate Fellowship Deferment: This deferment applies to graduate students who receive a fellowship or assistantship that doesn’t cover their living expenses. The deferment allows for a temporary pause in payments while pursuing advanced education.

- Military Deferment: Active duty military service members may qualify for a deferment. The terms and conditions of this deferment are often determined by the specific branch of service and the duration of the deployment or active service.

- Parent Plus Loan Deferment: Parents who borrowed through the Parent PLUS loan program may qualify for deferment under certain circumstances, similar to those for economic hardship deferment.

Consequences of Non-Compliance

Failing to adhere to the terms of your student loan forbearance or deferment can lead to serious financial repercussions. Understanding these potential consequences is crucial to ensuring responsible management of your student loan debt. Non-compliance can range from minor inconveniences to significant damage to your credit and financial future.

Consequences of Forbearance Non-Compliance

Failure to meet the requirements of a forbearance agreement can result in several negative outcomes. These consequences primarily revolve around the reactivation of your loan and the accumulation of unpaid interest. The most immediate consequence is that your loan will likely be considered delinquent. This delinquency will be reported to credit bureaus, negatively impacting your credit score. Furthermore, the accumulated unpaid interest during the forbearance period will be capitalized, meaning it will be added to your principal loan balance, increasing the total amount you owe. This capitalization of interest can significantly increase the overall cost of your loan over time. In some cases, depending on the lender and the severity of the non-compliance, collection agencies may be involved, leading to further fees and legal action. For example, a borrower who fails to submit the required documentation to maintain their forbearance could find themselves facing immediate repayment demands and a severely damaged credit rating.

Consequences of Deferment Non-Compliance

While deferment generally offers a more favorable arrangement than forbearance because interest may not accrue (depending on the type of deferment), non-compliance can still have significant consequences. The most common issue is failing to provide the necessary documentation to maintain eligibility for the deferment. This could result in the immediate termination of the deferment, and the loan would be returned to its original repayment status. This means you would be responsible for immediately resuming payments, potentially causing financial hardship if you were relying on the deferment period to manage your budget. Similar to forbearance, the delinquency will be reported to credit bureaus, negatively impacting your credit score and future borrowing opportunities. For instance, a borrower who loses their job and qualifies for an unemployment deferment but fails to notify their lender of their re-employment could face penalties and late payment fees.

Comparison of Penalties for Non-Compliance

While both forbearance and deferment non-compliance can result in negative credit reporting and potential collection actions, the severity of the consequences might differ slightly. Forbearance generally leads to the immediate accrual of interest, potentially resulting in a larger debt burden upon repayment. Deferment, while potentially interest-free (depending on the type of deferment), carries the risk of immediate repayment demands if eligibility requirements are not met. Both scenarios, however, share the common thread of negatively impacting credit scores, making it crucial to adhere to the terms of either agreement. The key difference lies in the immediate impact on interest accrual; forbearance usually results in immediate interest capitalization, while deferment might not (depending on the deferment type), but both can lead to significant financial setbacks if the terms are not followed.

Choosing Between Forbearance and Deferment

Choosing between student loan forbearance and deferment requires careful consideration of your individual financial situation and long-term goals. Both options temporarily postpone your loan payments, but they differ significantly in how they affect your interest and overall loan cost. Understanding these differences is crucial to making the best choice for your circumstances.

A Step-by-Step Guide to Choosing Between Forbearance and Deferment

The decision of whether to pursue forbearance or deferment should be a deliberate one, based on a clear understanding of your current financial situation and future prospects. This step-by-step guide will help you navigate this decision.

- Assess your financial situation: Honestly evaluate your income, expenses, and overall financial stability. Are you facing a temporary hardship, or is your financial situation more long-term? This will heavily influence which option is more suitable.

- Consider the length of your financial hardship: Forbearance is generally better suited for shorter-term difficulties, while deferment is often a better choice for longer-term challenges. This is because deferment often requires documentation of a qualifying hardship.

- Evaluate your ability to pay accrued interest: Remember that forbearance typically accrues interest, which is added to your principal balance. Can you afford to pay the interest that will accumulate during the forbearance period? If not, deferment might be a better option, even if it means a longer repayment period later.

- Review your loan terms and eligibility requirements: Each loan servicer has specific criteria for forbearance and deferment. Check your loan documents to understand your eligibility for each option and the associated terms and conditions.

- Compare the potential long-term costs: Calculate the total cost of each option, including accrued interest. Consider the impact on your credit score and the potential increase in your overall loan repayment amount.

- Contact your loan servicer: Discuss your options with your loan servicer. They can provide personalized guidance based on your specific loan type and financial circumstances.

Decision Tree for Choosing Between Forbearance and Deferment

The following decision tree visually represents the factors to consider when choosing between forbearance and deferment.

This simplified tree demonstrates the core decision-making process. A more complex tree could incorporate factors like loan type, credit score impact, and specific eligibility criteria.

Examples of Situations Where One Option is Clearly Preferable

Situation 1: Temporary Job Loss

A borrower experiences a temporary job loss due to a company restructuring. They anticipate finding a new job within three months. In this case, forbearance might be preferable. The short duration of the hardship aligns with the typical timeframe for forbearance, and the borrower can potentially manage the accrued interest until their employment situation stabilizes.

Situation 2: Long-Term Disability

A borrower suffers a long-term disability that prevents them from working for an extended period. They anticipate needing assistance for at least a year. In this scenario, deferment is likely the better choice. The extended duration of the hardship aligns with deferment’s purpose, and the potential for interest capitalization is less concerning than the immediate need for payment relief.

Situation 3: Unexpected Medical Expenses

A borrower faces substantial unexpected medical expenses due to a serious illness. While the duration might be relatively short, the financial strain is significant. If the borrower anticipates difficulty covering the accrued interest, deferment might be a better option than forbearance. This prioritizes preventing the debt from growing significantly.

Long-Term Financial Implications

Choosing between forbearance and deferment for your student loans significantly impacts your long-term financial health. While both offer temporary relief from payments, they differ drastically in how they affect your overall loan cost and future financial stability. Understanding these differences is crucial for making informed decisions that minimize long-term debt burdens.

The primary distinction lies in interest accrual. This seemingly small detail compounds over time, leading to substantial differences in the total amount repaid. Failing to understand this can result in a significantly larger debt burden than initially anticipated.

Long-Term Financial Effects of Forbearance

Forbearance, while providing temporary relief from payments, typically allows interest to accrue on your loan balance. This means that the principal amount you owe doesn’t decrease during the forbearance period, and the accumulated interest is added to your principal, increasing the total amount you eventually need to repay. The longer the forbearance period, the greater the increase in your total loan cost. For example, a $30,000 loan with a 6% interest rate could easily accumulate thousands of dollars in additional interest over a three-year forbearance period, ultimately extending the repayment period and significantly increasing the total cost of the loan. This can make it difficult to manage your finances and may lead to financial stress long after the forbearance period ends. The increased debt can also impact your credit score, making it harder to secure loans or other forms of credit in the future.

Long-Term Financial Effects of Deferment

Deferment, unlike forbearance, may or may not allow interest to accrue, depending on the type of loan and your specific circumstances. Some deferment plans allow for interest to be capitalized (added to the principal), while others allow for subsidized loans where the government pays the interest. Even with subsidized loans, however, the deferment period extends the total repayment time, potentially impacting other financial goals such as saving for a down payment on a house or investing for retirement. For example, a five-year deferment on a $20,000 unsubsidized loan with a 5% interest rate could add several thousand dollars to the total repayment amount. The extended repayment period also delays the point at which you become debt-free, impacting your ability to pursue other financial opportunities.

Potential Differences in Total Repayment Amounts

The difference in total repayment amounts between choosing forbearance and deferment can be substantial. Consider two scenarios: a borrower with a $50,000 loan at 7% interest who opts for a three-year forbearance versus a borrower with an identical loan who qualifies for a three-year subsidized deferment. The forbearance borrower will likely end up paying significantly more over the life of the loan due to capitalized interest. The subsidized deferment borrower, while still facing an extended repayment period, will avoid the added cost of capitalized interest. The exact difference depends on the interest rate, loan amount, and length of the forbearance or deferment period, but it’s crucial to understand that even small differences in interest rates and loan terms can lead to a substantial difference in the total cost over the life of the loan. This illustrates the importance of carefully considering the long-term implications before selecting either forbearance or deferment.

Final Wrap-Up

Choosing between student loan forbearance and deferment requires careful consideration of your individual financial situation and long-term goals. While both offer temporary relief from payments, understanding the nuances of interest accrual, credit score impact, and eligibility requirements is paramount. By weighing the potential short-term benefits against the long-term financial implications, you can make an informed decision that best protects your financial well-being. Remember to consult your loan servicer for personalized guidance and explore all available options before making a choice.

Expert Answers

What happens if I don’t apply for forbearance or deferment and can’t make my payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in loan default. Contact your loan servicer immediately to discuss options.

Can I switch from forbearance to deferment or vice versa?

This depends on your loan servicer and your eligibility for each program. Contact your servicer to discuss the possibility of switching programs.

How long can I stay in forbearance or deferment?

The maximum duration varies depending on the program and your lender. There are usually limits, and extensions may be possible but not guaranteed.

Will forbearance or deferment affect my ability to get future loans?

While it might not automatically disqualify you, a history of forbearance or deferment could impact your creditworthiness and make it harder to qualify for future loans.