Navigating the world of student loans can feel overwhelming, especially when faced with the choices between subsidized and unsubsidized loans. Understanding the nuances of each loan type is crucial for responsible financial planning during and after your education. This guide clarifies the key differences, helping you make informed decisions about your financial future.

These loans, while both designed to assist students with educational costs, differ significantly in interest accrual, eligibility requirements, repayment options, and overall impact on your financial aid package. This exploration will cover these distinctions, providing a comprehensive comparison to empower you in your borrowing decisions.

Interest Rates and Accrual

Understanding the differences in interest rates and accrual between subsidized and unsubsidized federal student loans is crucial for effective financial planning during and after your education. These differences can significantly impact the total amount you ultimately repay.

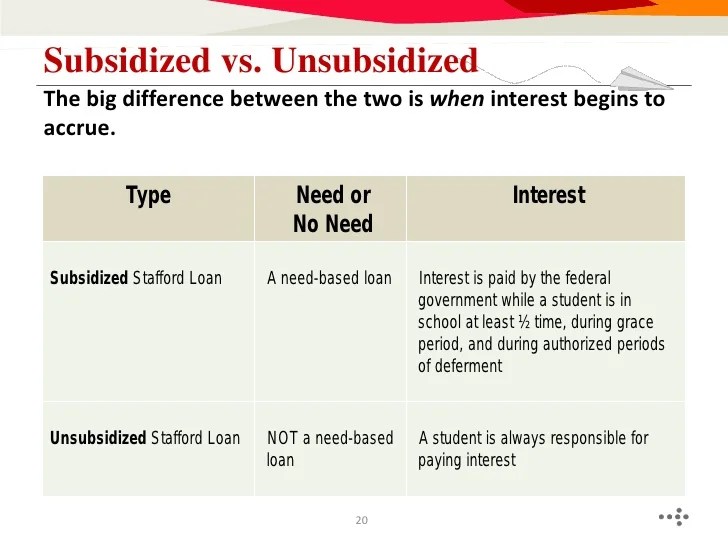

Subsidized and unsubsidized loans differ primarily in how interest is handled. The government pays the interest on subsidized loans while you’re in school at least half-time, during grace periods, and during certain deferment periods. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This means your loan balance grows even before you begin repayment.

Interest Rate Comparison

The interest rates for both subsidized and unsubsidized federal student loans are set annually by the government and are generally similar, though not always identical. The rates are fixed for the life of the loan, meaning they won’t change after the loan is disbursed. Checking the current interest rates on the Federal Student Aid website is recommended before borrowing. The small difference in interest rate between the two loan types is typically negligible compared to the impact of interest capitalization.

Interest Accrual During Deferment and Forbearance

During periods of deferment or forbearance, interest accrual behaves differently for subsidized and unsubsidized loans. For subsidized loans, the government covers the interest during certain deferment periods, preventing the loan balance from growing. However, for unsubsidized loans, interest continues to accrue throughout deferment and forbearance periods, adding to the principal balance. This leads to a larger total loan amount upon repayment.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This happens at the end of a deferment or forbearance period or when the loan enters repayment. For unsubsidized loans, interest capitalization is unavoidable, increasing the total amount owed. While subsidized loans don’t typically have interest capitalized during deferment, this can still occur in other situations. The effect of capitalization is that you pay interest on interest, significantly increasing the total cost of the loan over time. The longer the deferment or forbearance period, the greater the impact of capitalization.

Total Loan Cost Comparison

The following table illustrates the potential difference in total loan cost between a $10,000 subsidized and unsubsidized loan over a 10-year repayment period, assuming a 5% fixed interest rate. Note that this is a simplified example and does not include any potential fees. Actual repayment amounts may vary depending on the repayment plan chosen.

| Year | Subsidized Loan Balance | Unsubsidized Loan Balance | Interest Difference |

|---|---|---|---|

| 1 | $9,500 | $10,500 | $100 |

| 2 | $8,975 | $10,975 | $200 |

| 3 | $8,426 | $11,426 | $300 |

| 4 | $7,854 | $11,854 | $400 |

| 5 | $7,258 | $12,258 | $500 |

| 6 | $6,640 | $12,640 | $600 |

| 7 | $5,999 | $12,999 | $700 |

| 8 | $5,337 | $13,337 | $800 |

| 9 | $4,653 | $13,653 | $900 |

| 10 | $3,948 | $13,948 | $1000 |

Eligibility Requirements

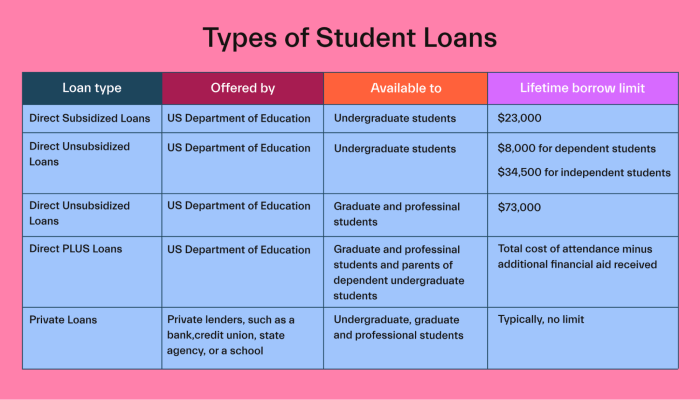

Understanding the eligibility requirements for subsidized and unsubsidized federal student loans is crucial for prospective borrowers. These requirements, while sharing some similarities, have key differences that determine which type of loan, or combination thereof, a student may receive. The primary distinction lies in the demonstration of financial need.

Eligibility for both subsidized and unsubsidized federal student loans hinges on several factors, including enrollment status, credit history, and the student’s demonstrated financial need (for subsidized loans). Income levels play a significant role, particularly in determining eligibility for subsidized loans. While unsubsidized loans are generally available to a broader range of students, meeting the requirements for subsidized loans often requires a more thorough financial aid application process.

Subsidized Loan Eligibility

Subsidized federal student loans are designed to assist students with financial need. The government subsidizes the interest on these loans while the student is enrolled at least half-time, during grace periods, and during periods of deferment. To qualify, students must demonstrate financial need through the Free Application for Federal Student Aid (FAFSA). This process assesses family income, assets, and other financial factors to determine eligibility. For example, a student from a low-income family with limited assets is more likely to qualify for a subsidized loan compared to a student from a high-income family. Conversely, a student with a high income and significant assets might be deemed ineligible for subsidized loans, even if they meet other eligibility criteria.

Unsubsidized Loan Eligibility

Unsubsidized federal student loans do not require a demonstration of financial need. This means students from all income levels can generally qualify, provided they meet the other eligibility criteria. Interest begins to accrue on unsubsidized loans from the time the loan is disbursed, regardless of the student’s enrollment status. For example, a student from a wealthy family or a student who already has significant savings might not qualify for subsidized loans but would likely qualify for unsubsidized loans. This is because the need-based assessment for subsidized loans wouldn’t favor them, while the unsubsidized loan application doesn’t consider financial need.

Eligibility Criteria Comparison

The following bullet points summarize the key eligibility differences between subsidized and unsubsidized federal student loans:

- Subsidized Loans: Requires demonstration of financial need via the FAFSA; interest is subsidized during certain periods; generally lower loan amounts available.

- Unsubsidized Loans: Does not require demonstration of financial need; interest accrues from disbursement; generally higher loan amounts available, depending on the student’s cost of attendance.

Repayment Options

Choosing a repayment plan for your student loans is a crucial step after graduation. Both subsidized and unsubsidized federal student loans offer a variety of repayment options, each with its own advantages and disadvantages. Understanding these differences is vital for managing your debt effectively and minimizing long-term costs. The choice depends heavily on your individual financial situation and post-graduation employment prospects.

Available Repayment Plans

Subsidized and unsubsidized federal student loans share many of the same repayment plan options. However, the eligibility criteria and specific terms might vary slightly depending on the loan type. The most common plans include Standard, Extended, and Graduated repayment plans, as well as several income-driven repayment (IDR) plans.

Income-Driven Repayment Plans

Income-driven repayment plans are designed to make monthly payments more manageable by basing them on your income and family size. Both subsidized and unsubsidized loans are eligible for these plans. However, the specific calculations and available plans may differ slightly. For example, the Pay As You Earn (PAYE) plan, the Revised Pay As You Earn (REPAYE) plan, and the Income-Based Repayment (IBR) plan all have slightly different formulas for determining your monthly payment. These differences can result in varying payment amounts and loan forgiveness timelines. The key is to carefully compare the different plans to determine which one best suits your financial situation.

Loan Forgiveness and Deferment Programs

Federal student loan programs offer various avenues for loan forgiveness or deferment. These programs are available for both subsidized and unsubsidized loans, but eligibility criteria and the specific terms can differ. For instance, some forgiveness programs, such as Public Service Loan Forgiveness (PSLF), might require specific types of employment, while others, like Teacher Loan Forgiveness, target specific professions. Deferment, which temporarily suspends payments, may also have different eligibility requirements depending on the circumstances (e.g., economic hardship, unemployment). Applying for these programs typically involves completing a specific application form and providing supporting documentation to verify eligibility.

Comparison of Repayment Plan Options

| Plan Name | Subsidized Loan Applicability | Unsubsidized Loan Applicability | Key Features |

|---|---|---|---|

| Standard Repayment | Yes | Yes | Fixed monthly payments over 10 years; typically the highest monthly payment but shortest repayment period. |

| Extended Repayment | Yes | Yes | Fixed monthly payments over up to 25 years; lower monthly payments than standard repayment, but higher total interest paid. |

| Graduated Repayment | Yes | Yes | Payments start low and gradually increase over time; lower initial payments, but higher payments later in the repayment term. |

| Income-Driven Repayment (IBR, PAYE, REPAYE, ICR) | Yes | Yes | Monthly payments are calculated based on your income and family size; potential for loan forgiveness after 20-25 years of payments, depending on the plan. |

Impact on Financial Aid Packages

The type of student loan you choose—subsidized or unsubsidized—significantly impacts your overall financial aid package and your long-term debt burden. Understanding these differences is crucial for making informed decisions about financing your education. The key distinction lies in how interest accrues and whether the government covers that interest during certain periods. This directly affects the total amount you’ll borrow and ultimately repay.

Subsidized and unsubsidized loans affect your financial aid package primarily through their inclusion in the overall cost calculation and the potential for reducing or increasing your need-based aid. The amount of need-based aid you receive is often determined by subtracting your expected family contribution (EFC) from your cost of attendance. Loans, regardless of type, can reduce your demonstrated financial need, potentially impacting grants and scholarships you might otherwise receive. However, subsidized loans, with their interest-free grace periods, can be less impactful on the overall aid package compared to unsubsidized loans, which accrue interest from the moment they are disbursed.

Subsidized Loan Impact on Financial Aid

Subsidized loans are generally preferred because the government pays the interest that accrues while you are in school at least half-time, during grace periods, and during periods of deferment. This means your loan balance doesn’t grow during these times. Including a subsidized loan in your financial aid package may slightly reduce your demonstrated need, potentially leading to a smaller amount of need-based aid. However, the impact is usually less significant than with unsubsidized loans. This is because the interest-free period prevents the loan from immediately increasing your overall debt burden.

Unsubsidized Loan Impact on Financial Aid

Unsubsidized loans accrue interest from the moment they are disbursed, regardless of your enrollment status. This interest is capitalized, meaning it’s added to your principal balance. This capitalization increases the total amount you will repay. Therefore, including a larger unsubsidized loan in your financial aid package can significantly reduce your need-based aid eligibility compared to relying more heavily on subsidized loans. This is because the increased debt makes it appear you have a greater ability to pay for your education.

Examples of Financial Aid Package Changes

Let’s consider two hypothetical students, both attending a university with a $25,000 annual cost of attendance. Both have an EFC of $10,000.

Student A receives $10,000 in need-based grants and takes out $5,000 in subsidized loans. Their remaining need is covered by a $10,000 unsubsidized loan. Their total debt is $15,000.

Student B receives $5,000 in need-based grants and takes out $15,000 in unsubsidized loans. Their total debt is $15,000.

While both students have the same total debt, Student A’s financial aid package is more favorable because they received more need-based aid and a smaller portion of their financing comes from loans that accrue interest immediately.

Impact of Different Loan Combinations on Total Debt

The following table demonstrates the potential impact of different loan combinations on total debt after four years, assuming a 5% annual interest rate and simple interest calculation for illustrative purposes (actual interest calculations are more complex).

| Loan Type | Loan Amount | Total Interest Accrued (4 years) | Total Repayment Amount |

|---|---|---|---|

| 100% Subsidized | $20,000 | $0 | $20,000 |

| 100% Unsubsidized | $20,000 | $4,000 | $24,000 |

| 50% Subsidized, 50% Unsubsidized | $20,000 | $2,000 | $22,000 |

| 75% Subsidized, 25% Unsubsidized | $20,000 | $1,000 | $21,000 |

Note: This is a simplified example. Actual interest accrual depends on the loan’s interest rate, repayment plan, and capitalization of interest. This table should not be interpreted as financial advice; always consult a financial aid professional for personalized guidance.

Government Regulations and Loan Forgiveness Programs

Both subsidized and unsubsidized federal student loans are subject to a range of government regulations designed to protect borrowers and ensure the responsible disbursement of funds. These regulations cover areas such as interest rates, repayment plans, and eligibility for loan forgiveness programs. Understanding these regulations is crucial for borrowers to make informed decisions about their student loan debt. Furthermore, several government programs offer loan forgiveness, providing pathways to debt relief for borrowers who meet specific criteria.

Government regulations governing subsidized and unsubsidized loans primarily stem from the Higher Education Act of 1965 and subsequent amendments. These laws establish the framework for federal student aid programs, including the parameters for loan disbursement, interest accrual, repayment terms, and default prevention measures. The Department of Education plays a central role in enforcing these regulations and overseeing the administration of student loan programs. Compliance with these regulations is vital for both lenders and borrowers, ensuring transparency and fairness in the student loan system.

Subsidized and Unsubsidized Loan Regulations

The government’s regulatory oversight differs slightly between subsidized and unsubsidized loans. Key distinctions arise in areas such as interest accrual during periods of deferment or forbearance and eligibility requirements. While both loan types are subject to overall federal regulations, the specifics of their administration vary.

- Subsidized Loans: The government pays the interest on subsidized loans while the borrower is in school at least half-time, during grace periods, and during certain deferment periods. Regulations dictate the precise calculation of interest subsidies and the conditions under which they apply. These regulations aim to minimize the overall cost of borrowing for eligible students.

- Unsubsidized Loans: Interest begins accruing on unsubsidized loans from the date of disbursement, regardless of the borrower’s enrollment status. Regulations specify the calculation of interest and the methods for repayment. Borrowers are responsible for all accrued interest, which can lead to a higher total loan amount compared to subsidized loans.

Loan Forgiveness Programs

Several federal loan forgiveness programs exist, offering partial or complete debt cancellation for borrowers who meet specific requirements. These programs are designed to incentivize public service and address economic hardships. Eligibility for these programs often depends on factors such as the type of loan, the borrower’s occupation, and the length of employment in a qualifying position. The application process for loan forgiveness programs can be complex and requires careful documentation.

Eligibility Requirements and Terms for Loan Forgiveness

Eligibility criteria vary across different loan forgiveness programs. Generally, borrowers must meet specific employment requirements (e.g., working in public service for a set number of years), have a qualifying loan type, and maintain satisfactory loan repayment history. The amount of loan forgiveness received often depends on the length of qualifying employment and the type of public service performed. For example, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an income-driven repayment plan while employed full-time by a qualifying government or non-profit organization.

Examples of Qualifying Professions and Circumstances

Many professions qualify for loan forgiveness programs, primarily those serving the public good. Examples include teachers, nurses, social workers, and members of the military. Furthermore, some programs offer forgiveness based on economic hardship or disability. Specific requirements for each program dictate which professions and circumstances are eligible for loan forgiveness. For instance, the Teacher Loan Forgiveness program forgives up to $17,500 in federal student loans for teachers who have taught full-time for five consecutive academic years in a low-income school.

Wrap-Up

Choosing between subsidized and unsubsidized student loans significantly impacts your long-term financial well-being. By carefully considering interest rates, eligibility criteria, repayment plans, and the overall effect on your financial aid package, you can make an informed decision that aligns with your financial goals. Remember to thoroughly research all available options and seek professional financial advice if needed to ensure a responsible approach to student loan debt management.

FAQ Explained

What happens if I don’t repay my student loans?

Failure to repay your student loans can result in serious consequences, including damage to your credit score, wage garnishment, and potential legal action.

Can I consolidate my subsidized and unsubsidized loans?

Yes, you can consolidate your federal student loans into a single loan with a new interest rate and repayment plan. This simplifies repayment but may not always lower your overall cost.

Are there any penalties for early repayment of student loans?

Generally, there are no penalties for early repayment of federal student loans. However, check your loan terms to be certain.

How do I apply for loan forgiveness programs?

Loan forgiveness programs have specific eligibility requirements. You’ll need to apply through the appropriate government agency and provide necessary documentation.