Navigating the world of student loans can be daunting, especially when faced with the choices between subsidized and unsubsidized options. Understanding the nuances of these loan types is crucial for responsible financial planning during and after your education. This guide will illuminate the key distinctions, helping you make informed decisions about your financial future.

From interest rates and eligibility requirements to repayment plans and long-term credit implications, we will explore the practical differences between subsidized and unsubsidized federal student loans. We’ll delve into how these differences impact your overall borrowing costs and your credit score, equipping you with the knowledge to manage your student loan debt effectively.

Interest Rates

Understanding the interest rates applied to subsidized and unsubsidized federal student loans is crucial for effective financial planning during and after your education. The key difference lies in how and when interest accrues, impacting the total amount you ultimately repay.

Interest rates for both subsidized and unsubsidized federal student loans are set annually by the government and are influenced by several factors, primarily the prevailing market interest rates and economic conditions. These rates are fixed for the life of the loan, meaning they don’t change once your loan is disbursed. However, the rate will vary depending on when the loan was disbursed, as each year’s cohort of borrowers may have a different rate. Other factors, such as the type of loan (undergraduate, graduate, etc.), can also play a minor role.

Interest Accrual

Interest accrual differs significantly between subsidized and unsubsidized loans. For subsidized loans, the government pays the interest while you’re in school at least half-time, during a grace period, and during periods of deferment. For unsubsidized loans, interest begins to accrue from the moment the loan is disbursed, regardless of your enrollment status or repayment period. This means that the principal amount of the loan will be higher when repayment begins.

Interest Rate Comparison: 10-Year Repayment

The following table illustrates a hypothetical comparison of interest calculations over a 10-year repayment period for a $10,000 loan, assuming a fixed interest rate of 5% for unsubsidized loans and 0% interest accrued during in-school periods for subsidized loans (This is a simplification; actual rates vary annually). Note that this example simplifies the calculations by assuming a fixed annual interest rate and consistent monthly payments. In reality, interest capitalization may occur, affecting the total interest paid.

| Loan Type | Annual Interest Rate (Example) | Interest Accrued During School (Example) | Total Interest Paid (Approximate) |

|---|---|---|---|

| Unsubsidized | 5% | Accrues from disbursement | $2,500 (This is an approximation and will vary based on the repayment plan.) |

| Subsidized | 5% | 0% while enrolled at least half-time | Less than $2,500 (The exact amount depends on the length of in-school periods.) |

Eligibility Requirements

Understanding the eligibility requirements for subsidized and unsubsidized federal student loans is crucial for prospective borrowers. These requirements vary based on several factors, primarily financial need, dependency status, and enrollment status. Meeting these criteria is essential to securing federal student aid.

Eligibility for both subsidized and unsubsidized federal student loans hinges on several key factors. The most significant difference lies in the assessment of financial need, a factor directly impacting eligibility for subsidized loans but not for unsubsidized loans. Dependency status, determined by the student’s age and financial independence from their parents, also plays a role. Finally, maintaining satisfactory academic progress, as defined by the student’s institution, is a requirement for continued loan eligibility for both types of loans.

Financial Need for Subsidized Loans

The determination of financial need for subsidized loans is a complex process, but fundamentally involves comparing a student’s expected family contribution (EFC) with the student’s cost of attendance (COA). The EFC represents the amount a family is expected to contribute towards the student’s education based on their income, assets, and family size. The COA includes tuition, fees, room and board, and other education-related expenses. The difference between the COA and the EFC represents the student’s financial need. The Free Application for Federal Student Aid (FAFSA) is the primary tool used to calculate both the EFC and determine eligibility for subsidized loans. A lower EFC, indicating a greater financial need, increases the likelihood of qualifying for subsidized loans. For example, a student with a low EFC and a high COA would likely have a significant financial need, making them eligible for a larger amount in subsidized loans compared to a student with a high EFC and a similar COA.

Dependency Status

Dependency status significantly influences eligibility for both subsidized and unsubsidized federal student loans. Students are generally considered dependent if they are under the age of 24 and financially dependent on their parents or guardians. Independent students, on the other hand, generally have greater access to loan funds, regardless of their financial need, as they are not subject to the same parental income considerations used in determining their EFC. Examples of students considered independent include those who are married, have children, are veterans, or are orphans. Independent students may qualify for higher loan amounts than dependent students, as their financial need is assessed solely based on their own income and assets, rather than their family’s overall financial situation.

Enrollment Status

Maintaining satisfactory academic progress (SAP) is a critical requirement for continued eligibility for both subsidized and unsubsidized loans. Each institution defines SAP based on its own standards, but typically involves maintaining a minimum grade point average (GPA) and completing a minimum number of credit hours per academic term. Failure to meet SAP requirements can result in the suspension or termination of loan eligibility. For example, a student who falls below the required GPA or fails to complete the necessary credit hours may lose their eligibility to receive further federal student loan funds. It is crucial for students to understand their institution’s SAP policies to ensure continued loan eligibility.

Loan Repayment

Both subsidized and unsubsidized federal student loans offer various repayment plans, but the specifics and implications can differ. Understanding these differences is crucial for effective financial planning after graduation. The choice of repayment plan significantly impacts the total amount paid over the loan’s lifespan, affecting your long-term financial health.

Repayment options for subsidized and unsubsidized federal student loans are largely the same. The key difference lies in the accumulation of interest during periods like deferment or forbearance; unsubsidized loans accrue interest regardless of your repayment status, while subsidized loans do not accrue interest during in-school periods or grace periods. This impacts the overall loan balance and ultimately the total interest paid.

Repayment Plan Options and Interest Implications

Several repayment plans are available, each with different monthly payment amounts and total repayment periods. The Standard Repayment Plan involves fixed monthly payments over a 10-year period. Other options include Graduated Repayment Plans (payments increase over time), Extended Repayment Plans (longer repayment periods, leading to lower monthly payments but higher total interest), and Income-Driven Repayment Plans (payments are based on your income and family size). Choosing a plan with a longer repayment period will generally result in lower monthly payments but significantly increase the total interest paid over the life of the loan. Conversely, a shorter repayment period leads to higher monthly payments but reduces the total interest paid. For example, choosing an Extended Repayment Plan instead of a Standard Repayment Plan might make your monthly payments more manageable, but you’ll likely pay thousands more in interest over the life of the loan. Conversely, selecting a Standard Repayment Plan might lead to higher monthly payments, but ultimately save you money on interest in the long run. The best plan depends on your individual financial situation and priorities.

Applying for Deferment or Forbearance

Understanding the process for applying for deferment or forbearance is vital for managing your student loan debt, especially during periods of financial hardship. Both subsidized and unsubsidized loans allow for deferment or forbearance, but the eligibility criteria and application procedures are similar for both.

Applying for deferment or forbearance generally involves these steps:

- Contact your loan servicer: Locate the contact information for your loan servicer (the company responsible for managing your loans). This information is usually available on the National Student Loan Data System (NSLDS) website or your loan documents.

- Gather necessary documentation: Depending on the reason for requesting deferment or forbearance, you might need supporting documentation. This could include proof of unemployment, enrollment in school, or medical documentation.

- Complete the application: Your loan servicer will provide the necessary application forms. Complete these forms accurately and thoroughly, providing all required information and supporting documentation.

- Submit the application: Submit the completed application and supporting documents to your loan servicer through their preferred method (mail, fax, or online portal).

- Monitor your application status: After submitting your application, follow up with your loan servicer to monitor its status and ensure it’s being processed.

Subsidized Loan Benefits

Subsidized federal student loans offer a significant advantage over unsubsidized loans: the government pays the interest that accrues while you’re in school (or during grace periods and certain deferment periods). This seemingly small detail translates to substantial savings over the life of the loan. Understanding these benefits can significantly impact your post-graduation financial planning.

The government’s subsidy directly reduces the total amount you’ll eventually pay back. Because the interest isn’t accruing during eligible periods, the principal loan amount remains smaller. This leads to lower monthly payments and less interest paid over the repayment period. For example, a borrower with a $10,000 subsidized loan might save hundreds, even thousands of dollars compared to a borrower with an equivalent unsubsidized loan, depending on the interest rate and repayment plan.

Government Interest Payment Cessation

The government’s payment of interest on subsidized loans isn’t indefinite. This crucial aspect of subsidized loans warrants careful consideration. The government’s interest subsidy ceases when the borrower is no longer meeting the eligibility requirements. This typically occurs when the borrower graduates, leaves school, drops below half-time enrollment, or the grace period expires. Once the subsidy ends, interest begins to accrue on the loan’s principal balance, increasing the overall cost of the loan. Borrowers should be aware of these deadlines and actively monitor their loan status to understand when the interest subsidy ends and interest capitalization begins. Failure to understand these timelines can lead to a surprisingly larger loan balance than initially expected.

Unsubsidized Loan Implications

Unsubsidized federal student loans differ significantly from subsidized loans in how interest accrues. Understanding these implications is crucial for responsible financial planning during and after your education. Failing to grasp the nuances of unsubsidized loans can lead to a substantially larger debt burden upon graduation.

The primary implication of an unsubsidized loan is the accrual of interest from the moment the loan is disbursed, regardless of your enrollment status. This means interest charges begin accumulating immediately, even while you’re still in school. This contrasts sharply with subsidized loans, where the government pays the interest during certain periods of enrollment. The longer the loan term, and the higher the interest rate, the more significant this difference becomes.

Interest Accrual During School

Interest capitalization is a key factor impacting the total cost of unsubsidized loans. Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, leading to a snowball effect that can significantly increase the total amount you owe. For example, if you don’t make payments while in school, the interest accrued during that time will be added to your loan’s principal balance at the end of your grace period (typically six months after graduation or leaving school). This increased principal then accrues interest at a faster rate.

Impact of Interest Capitalization

The effect of interest capitalization can be substantial, especially with higher interest rates or longer repayment periods. To illustrate, consider the following examples.

| Scenario | Initial Loan Amount | Annual Interest Rate | Interest Accrued During School (4 years) | Capitalized Amount | Total Loan Amount After Capitalization |

|---|---|---|---|---|---|

| Scenario A: Low Interest | $10,000 | 4% | $1,697 | $1,697 | $11,697 |

| Scenario B: Moderate Interest | $10,000 | 7% | $3,222 | $3,222 | $13,222 |

| Scenario C: High Interest | $20,000 | 9% | $8,077 | $8,077 | $28,077 |

| Scenario D: High Interest, Longer Study | $20,000 | 9% | $12,115 | $12,115 | $32,115 |

These examples demonstrate how interest capitalization can dramatically inflate the final loan balance. The longer you delay repayment, the more significant the effect of compounding interest. While these are simplified examples, they highlight the importance of understanding and managing unsubsidized loan interest. Making interest payments while in school, if financially feasible, can significantly reduce the overall cost of the loan.

Impact on Credit

Student loans, whether subsidized or unsubsidized, significantly impact your credit history. Understanding how each type affects your credit score, both during and after repayment, is crucial for responsible financial planning. The key difference lies in how the interest accrues and the subsequent effect on your credit report.

The primary factor lenders consider when assessing creditworthiness is your payment history. Consistent on-time payments on any loan, including student loans, demonstrate financial responsibility and positively impact your credit score. Conversely, late or missed payments can severely damage your credit, regardless of whether the loan is subsidized or unsubsidized. Lenders also look at your credit utilization ratio (the amount of credit you’re using compared to your total available credit), your length of credit history, and the mix of credit accounts you have. A diverse mix of credit accounts, including student loans managed responsibly, can be viewed favorably. However, having too much debt relative to your income can negatively impact your credit score. While the type of student loan (subsidized or unsubsidized) doesn’t directly influence these factors, the interest accrual differences can indirectly affect your debt levels and payment history.

Subsidized Loan Impact on Credit

Subsidized loans, while offering the benefit of no interest accrual during periods of deferment, still affect credit. Responsible repayment behavior, even after graduation, remains paramount. Consistent on-time payments build a positive credit history, demonstrating creditworthiness to future lenders. Conversely, any delinquency will negatively impact your credit score, similar to unsubsidized loans. The absence of interest accrual during deferment may slightly reduce the total debt burden, potentially leading to lower credit utilization if managed properly. However, this alone won’t dramatically alter credit scores unless coupled with responsible repayment.

Unsubsidized Loan Impact on Credit

Unsubsidized loans, with interest accruing from disbursement, can potentially lead to a higher total debt amount by the time repayment begins. This higher debt might increase your credit utilization ratio, especially if you have limited other credit accounts. However, responsible management and timely payments are equally crucial for maintaining a good credit score. Consistent on-time payments demonstrate responsible financial behavior, offsetting the potential negative impact of a larger loan balance. Conversely, late payments will negatively affect your credit score, regardless of the loan type. Failing to manage the accruing interest could lead to a higher debt burden and potentially impact your ability to secure future loans or other credit.

Best Practices for Managing Student Loan Debt

Understanding the importance of responsible repayment is key to maintaining a healthy credit score. The following practices can significantly contribute to positive credit history:

- Create a Budget and Repayment Plan: Develop a realistic budget that incorporates your student loan payments. Consider income-driven repayment plans if necessary.

- Prioritize On-Time Payments: Make every payment on time, every time. Even a single late payment can negatively impact your credit score.

- Monitor Your Credit Report: Regularly check your credit report for errors and to track your progress. This allows for prompt identification and resolution of any issues.

- Explore Repayment Options: Research and understand different repayment plans, such as income-driven repayment or extended repayment, to find one that best suits your financial situation.

- Communicate with Your Lender: If you anticipate difficulties making payments, contact your lender immediately. They may offer options like forbearance or deferment to help you avoid default.

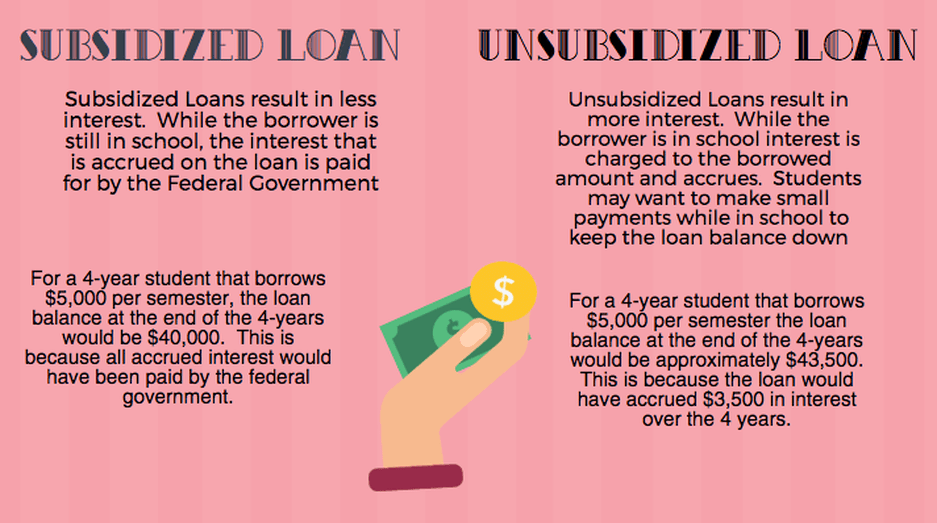

Visual Representation of Differences

A clear visual representation can effectively illustrate the cumulative cost difference between subsidized and unsubsidized federal student loans over time. This comparison helps students understand the long-term financial implications of each loan type. The following description details a bar chart that compares the total repayment costs for both loan types over a ten-year period, assuming a consistent interest rate and repayment plan.

The bar chart would have two main bars, one representing the total cost of a subsidized loan and the other representing the total cost of an unsubsidized loan, both after a 10-year repayment period. The horizontal axis (x-axis) would label each bar as “Subsidized Loan” and “Unsubsidized Loan”. The vertical axis (y-axis) would represent the total repayment cost in US dollars. The height of each bar would directly correspond to the total amount repaid. For illustrative purposes, let’s assume a $10,000 loan amount for both types.

Subsidized vs. Unsubsidized Loan Repayment Cost Comparison

To create this visualization, we need to factor in the interest accrual for both loan types. Subsidized loans do not accrue interest while the borrower is enrolled at least half-time, during grace periods, or during deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed. This difference significantly impacts the total cost. Let’s assume a 5% annual interest rate for both loans for simplicity.

For the subsidized loan, the interest would only accrue during the repayment period (assuming a 6-month grace period after graduation). The calculation would involve compounding interest over the repayment period. For the unsubsidized loan, interest would accrue from disbursement throughout the entire period of study and the grace period before repayment begins. This would result in a significantly larger total repayment amount compared to the subsidized loan. The bar representing the unsubsidized loan would be noticeably taller than the bar representing the subsidized loan, highlighting the cost difference.

For example, if the subsidized loan had a total repayment cost of $12,000 after 10 years (principal plus accrued interest), the unsubsidized loan might have a total repayment cost of $13,500 or more due to the interest accumulating during the entire period. The exact figures would depend on the specific interest rate, repayment plan, and loan amount, but the visual representation would consistently demonstrate the higher cost of the unsubsidized loan.

Data labels would be added to each bar indicating the precise total repayment amount. A clear title, such as “Comparison of Total Repayment Costs: Subsidized vs. Unsubsidized Loans (10-Year Period)”, would be included above the chart. A legend would not be necessary as the bars are clearly labeled.

Conclusive Thoughts

Ultimately, the choice between subsidized and unsubsidized student loans hinges on individual circumstances and financial needs. By carefully considering factors like eligibility, interest accrual, and repayment options, students can select the loan type best suited to their situation. Remember, proactive financial planning and responsible debt management are key to navigating the complexities of student loan repayment and maintaining a healthy credit profile.

FAQ Guide

What happens to my subsidized loan interest during school?

The government pays your interest on subsidized loans while you’re enrolled at least half-time.

Can I consolidate subsidized and unsubsidized loans?

Yes, you can consolidate both loan types into a single Direct Consolidation Loan.

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the amount you owe.

How does my credit score affect loan approval?

A good credit score can improve your chances of loan approval and may lead to better interest rates.

What are my repayment options if I can’t afford payments?

Deferment and forbearance can temporarily postpone payments, but interest may still accrue.