Navigating the complexities of higher education financing can feel overwhelming, but understanding direct student loans is crucial for prospective and current students. This guide unravels the intricacies of federal direct student loans, offering a clear path to understanding eligibility, application processes, repayment options, and the broader implications of this significant financial commitment. We’ll explore the different loan types, their associated interest rates, and strategies for responsible repayment to ensure a smoother journey towards academic success.

From subsidized and unsubsidized loans to the PLUS program, we’ll demystify the terminology and provide practical advice for making informed decisions. We’ll also examine the government’s role in shaping these programs and analyze the long-term effects of student loan debt on individuals and the economy. This comprehensive overview aims to empower you with the knowledge needed to confidently manage your student loan journey.

Definition and Characteristics of Direct Student Loans

Direct student loans are federal student loans disbursed directly by the U.S. Department of Education. Unlike private loans, they offer several advantages, including government-backed repayment options and protections against predatory lending practices. Understanding their characteristics is crucial for prospective students and their families in navigating the complexities of financing higher education.

Direct student loans are distinguished from other loan types primarily by their source (the federal government) and the associated benefits and protections. They typically have lower interest rates than private loans and offer various repayment plans tailored to individual circumstances. Furthermore, the government offers programs to assist borrowers facing financial hardship, such as income-driven repayment plans and loan forgiveness programs, which are not always available with private student loans.

Types of Direct Student Loans

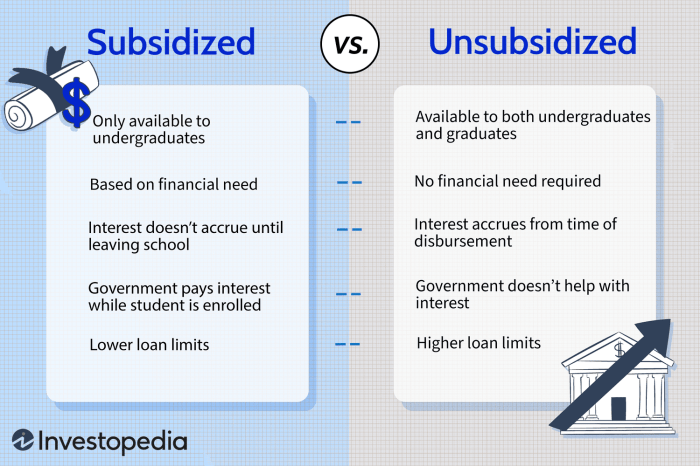

There are several types of direct student loans, each designed to cater to specific needs and financial situations. These loans differ in eligibility criteria, interest rates, and repayment terms. Understanding these differences is vital for selecting the most appropriate loan type.

Interest Rates and Repayment Terms

Interest rates for direct student loans vary depending on the loan type, the borrower’s credit history (in the case of PLUS loans), and the loan disbursement date. Subsidized loans may have lower rates than unsubsidized loans. Repayment terms also differ, offering flexible options such as standard repayment plans (typically 10 years), extended repayment plans, and income-driven repayment plans. The specific interest rate and repayment terms for each loan are established annually by the federal government and are available on the Federal Student Aid website. For example, a subsidized loan might have a fixed interest rate of 4.99% for the 2023-2024 academic year, while an unsubsidized loan for the same period could have a rate of 6.54%. These rates are subject to change. Repayment terms can range from 10 to 25 years depending on the chosen plan.

Eligibility Criteria for Direct Student Loans

| Loan Type | Eligibility Requirements | Credit Check Required? | Interest Accrues While in School? |

|---|---|---|---|

| Subsidized Direct Loan | U.S. citizen or eligible non-citizen; enrolled at least half-time in an eligible degree program; demonstrates financial need | No | No |

| Unsubsidized Direct Loan | U.S. citizen or eligible non-citizen; enrolled at least half-time in an eligible degree program | No | Yes |

| Direct PLUS Loan (for Parents) | U.S. citizen or eligible non-citizen; parent of a dependent student; meet credit requirements (no adverse credit history); complete a Master Promissory Note (MPN) | Yes | Yes |

| Direct PLUS Loan (for Graduate Students) | U.S. citizen or eligible non-citizen; enrolled at least half-time in an eligible graduate or professional degree program; meet credit requirements (no adverse credit history); complete a Master Promissory Note (MPN) | Yes | Yes |

Repayment Options and Strategies for Direct Student Loans

Choosing the right repayment plan for your federal student loans is crucial for managing your debt effectively and avoiding financial hardship. Understanding the various options and their implications will help you make an informed decision that aligns with your financial circumstances and long-term goals. This section details the available repayment plans and provides strategies to navigate the process.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loan borrowers. It involves fixed monthly payments over a 10-year period. This plan offers predictability and allows for quicker loan payoff, minimizing the total interest paid compared to longer-term plans. However, monthly payments can be significantly higher than those under income-driven plans.

- Advantage: Faster loan payoff, lower total interest paid.

- Disadvantage: Higher monthly payments.

Graduated Repayment Plan

Under the Graduated Repayment Plan, your monthly payments start low and gradually increase every two years for a period of 10 years. This can be beneficial initially for borrowers with limited income, but payments become substantially higher in later years.

- Advantage: Lower initial payments.

- Disadvantage: Payments significantly increase over time; higher total interest paid than Standard Plan.

Income-Driven Repayment Plans

Income-driven repayment plans tie your monthly payments to your income and family size. These plans typically extend the repayment period to 20 or 25 years. There are several types of income-driven plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). The specific plan details and eligibility criteria vary.

- Advantage: Lower monthly payments, potentially leading to loan forgiveness after 20 or 25 years (depending on the plan and income).

- Disadvantage: Longer repayment period, resulting in higher total interest paid over the life of the loan.

Example Repayment Scenarios

- Scenario 1 (Standard Plan): A borrower with a $30,000 loan at 5% interest would have a monthly payment of approximately $317 under a standard 10-year plan, paying approximately $9,600 in interest.

- Scenario 2 (Graduated Plan): The same borrower might start with a lower monthly payment under a graduated plan, but their payment would increase significantly over time, potentially exceeding $500 in later years. Total interest paid would likely be higher than the standard plan.

- Scenario 3 (Income-Driven Plan): A borrower with a lower income might have a monthly payment of $150 under an income-driven plan, but their repayment period would extend to 20 or 25 years, leading to significantly higher total interest paid.

Step-by-Step Guide to Choosing a Repayment Plan

- Assess your current financial situation: Consider your income, expenses, and overall debt load.

- Determine your repayment goals: Do you prioritize paying off your loans quickly, or minimizing your monthly payments?

- Compare repayment plan options: Use the federal student aid website’s repayment calculators to estimate your monthly payments and total interest paid under each plan.

- Consider your long-term financial outlook: Think about potential changes in your income and expenses in the coming years.

- Choose the plan that best aligns with your financial situation and goals: Remember, there’s no one-size-fits-all solution. What works for one borrower might not be ideal for another.

Managing and Avoiding Default on Direct Student Loans

Defaulting on your student loans can have severe and long-lasting consequences, significantly impacting your financial future. Understanding the risks and proactively implementing strategies to avoid default is crucial for maintaining good credit and achieving long-term financial stability. This section Artikels the potential repercussions of default and provides practical steps to manage your student loan debt effectively.

Consequences of Defaulting on Direct Student Loans

Defaulting on a federal student loan triggers a cascade of negative consequences. Your credit score will plummet, making it difficult to obtain loans, rent an apartment, or even secure certain jobs. The government may garnish your wages, seize your tax refunds, and even suspend your professional licenses. Furthermore, you may face lawsuits and collections actions, leading to additional fees and stress. The impact extends beyond financial repercussions; default can severely damage your creditworthiness for years, hindering future financial opportunities. For example, a borrower who defaults may find it impossible to qualify for a mortgage or an auto loan, even years after the debt is resolved. The long-term financial instability caused by default can significantly impact one’s quality of life.

Strategies for Avoiding Loan Default

Effective budgeting and financial planning are essential to avoid student loan default. Creating a realistic budget that accounts for all income and expenses is the first step. This budget should prioritize loan repayments alongside essential living expenses like housing, food, and transportation. Exploring different repayment plans offered by the federal government, such as income-driven repayment (IDR) plans, can significantly reduce monthly payments and make repayment more manageable. These plans adjust your monthly payments based on your income and family size. Moreover, seeking professional financial guidance from a credit counselor can provide personalized strategies and support in navigating debt management. Regular communication with your loan servicer is also vital, allowing for early identification and resolution of any potential payment difficulties.

Resources and Support for Borrowers Facing Financial Difficulties

Numerous resources are available to assist borrowers experiencing financial hardship. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, helping individuals create personalized debt management plans. Your loan servicer can also provide information on repayment options, deferment, and forbearance programs, which temporarily postpone or reduce payments. Additionally, government websites such as StudentAid.gov provide comprehensive information on federal student loan programs and available resources. These resources can help borrowers navigate challenging financial situations and avoid default. Remember, seeking help early is crucial in preventing a default.

Warning Signs Indicating Potential Default

Recognizing warning signs early is crucial in preventing default. Proactive monitoring of your financial situation is key.

- Missed or late loan payments: Consistent late payments are a major indicator of impending default.

- Difficulty making minimum payments: Struggling to meet even the minimum monthly payment is a significant red flag.

- Decreased income or job loss: A sudden reduction in income or unemployment significantly increases the risk of default.

- Unforeseen expenses: Unexpected medical bills or other large expenses can strain finances and lead to missed payments.

- Ignoring communication from your loan servicer: Disregarding notices and calls from your loan servicer indicates a lack of engagement with your debt.

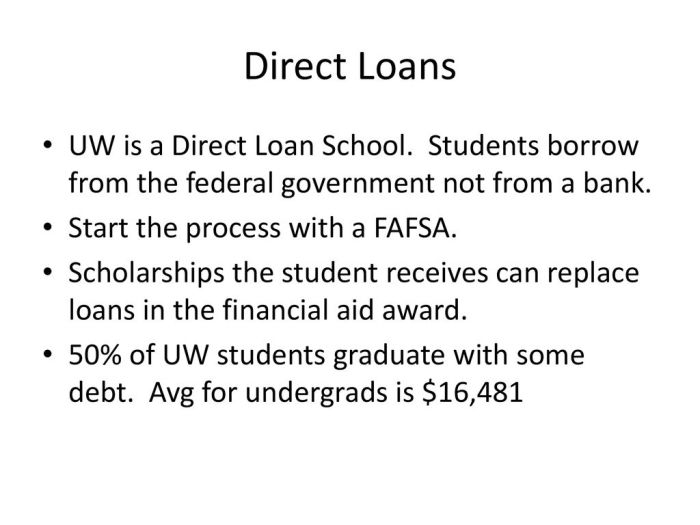

The Role of the Federal Government in Direct Student Loans

The federal government plays a pivotal role in the Direct Student Loan program, acting as both the lender and the administrator. This involvement ensures accessibility, affordability, and accountability within the system, significantly impacting higher education access for millions of Americans. The government’s actions shape not only the availability of loans but also their associated costs and repayment terms.

The government’s administration and regulation of the Direct Loan program encompass various functions. This includes establishing eligibility criteria for borrowers, setting interest rates and loan terms, overseeing loan servicing and disbursement, and enforcing regulations to protect both borrowers and taxpayers. The Department of Education, specifically, manages the program through its various offices and agencies. These offices handle applications, process loan payments, address borrower inquiries, and manage the overall program’s financial aspects. Effective administration ensures the program’s smooth operation and minimizes the risk of fraud or mismanagement.

Government Subsidies in Direct Student Loan Programs

Government subsidies are a crucial component of the Direct Student Loan program, significantly impacting its affordability. These subsidies reduce the cost of borrowing for students by lowering interest rates or covering a portion of the interest that accrues while students are in school or during grace periods. The impact is substantial, making higher education attainable for students who might otherwise be unable to afford it. For example, subsidized loans help keep monthly payments manageable after graduation, lessening the financial burden on borrowers as they enter the workforce. Without these subsidies, the overall cost of higher education would increase considerably, potentially limiting access for low- and middle-income families. The reduction in interest rates directly translates to lower overall loan balances for borrowers, increasing their financial well-being post-graduation.

History and Evolution of the Federal Direct Student Loan Program

The federal government’s involvement in student loan programs has evolved significantly over time. Initially, the government primarily guaranteed loans made by private lenders. However, concerns about lender participation and the increasing cost of higher education led to the creation of the Federal Direct Loan (FDL) program. This shift, beginning in the 1990s, aimed to streamline the process, increase efficiency, and provide greater control over the program’s administration and funding. The FDL program gradually replaced the previous guaranteed student loan program, becoming the primary source of federal student aid. Over the years, modifications have been made to address issues such as loan default rates and access for underserved populations. These changes reflect a continuous effort to improve the program’s effectiveness and responsiveness to the needs of students and the broader economy.

Government Policies and Their Influence on Interest Rates and Loan Terms

Government policies directly influence interest rates and loan terms associated with Direct Student Loans. These policies are often tied to broader economic conditions and national priorities related to higher education. For instance, Congress sets the interest rates for subsidized and unsubsidized loans annually, often based on market rates and the overall federal budget. Furthermore, government regulations determine loan repayment periods, deferment options, and income-driven repayment plans. These regulations aim to balance the need to provide affordable access to higher education with the responsible management of taxpayer funds. For example, changes in the availability of income-driven repayment plans can significantly impact a borrower’s monthly payment amount and overall repayment timeline, reflecting government efforts to address affordability concerns and reduce default rates. These policies are regularly reviewed and adjusted to ensure the program remains relevant and sustainable.

Impact of Direct Student Loans on Higher Education

Direct student loans have profoundly reshaped the landscape of higher education in the United States, significantly impacting college affordability, enrollment rates, and the long-term financial well-being of students and the economy as a whole. The availability of federal loans has made college accessible to many who otherwise wouldn’t have been able to afford it, but this accessibility comes with substantial financial burdens and long-term consequences that require careful consideration.

The influence of direct student loans on college affordability and enrollment rates is complex and multifaceted. Increased access to loans has undoubtedly fueled enrollment growth, particularly among students from lower-income backgrounds. However, the rising cost of tuition, often exceeding the amount of available financial aid, has created a situation where students are increasingly reliant on loans to cover their educational expenses, leading to higher levels of debt upon graduation. This dynamic suggests that while loans have broadened access, they haven’t necessarily addressed the underlying issue of escalating tuition costs.

College Affordability and Enrollment Rates

The expansion of direct student loan programs has demonstrably increased college enrollment rates. This is particularly evident in the rising participation of students from lower socioeconomic backgrounds who previously lacked access to sufficient funds for higher education. However, this increase has coincided with a parallel rise in tuition costs, creating a scenario where students are borrowing larger sums to cover increasingly expensive educations. The net effect is a significant increase in student loan debt, raising concerns about the long-term financial health of graduates. For instance, studies show a strong correlation between increased loan availability and enrollment growth, but also a simultaneous increase in the average student loan debt burden. This highlights the need for policies that address both access and affordability in a comprehensive manner.

Post-Graduation Financial Situations

High levels of student loan debt significantly impact graduates’ post-graduation financial situations. Many graduates face challenges in establishing financial stability, delaying major life decisions like homeownership, starting a family, or investing in retirement. The weight of loan repayments can limit career choices, forcing graduates to prioritize higher-paying jobs over those that might be more fulfilling or aligned with their passions. Furthermore, the burden of debt can contribute to increased stress and anxiety, impacting overall mental and physical well-being. The impact varies based on factors such as the amount of debt, the chosen field of study, and the prevailing economic conditions. For example, graduates with substantial debt in fields with lower earning potential often struggle to manage their repayments effectively.

Long-Term Economic Consequences

Widespread student loan debt has far-reaching economic consequences. The large amount of outstanding student loan debt can hinder economic growth by reducing consumer spending and investment. Graduates burdened by debt may delay major purchases, impacting various sectors of the economy. Furthermore, high levels of student loan debt can contribute to income inequality, as those with larger debt burdens struggle to accumulate wealth at the same rate as their peers. The long-term implications extend to national economic productivity, potentially affecting future economic growth and prosperity. For example, studies have indicated a correlation between high student debt and slower economic growth in certain regions.

Impact Across Demographics

The impact of direct student loans varies across different demographics. While loans have increased access to higher education for many, disparities persist. Minority students and students from low-income backgrounds often borrow more and face greater challenges in repayment, exacerbating existing inequalities. Women, on average, tend to borrow more than men for similar degrees, potentially reflecting differences in career paths and earning potential. These disparities highlight the need for targeted interventions and policies to ensure equitable access to higher education and minimize the disproportionate impact of student loan debt on certain groups. For example, initiatives focused on increasing financial literacy and providing tailored support for underserved communities are crucial in mitigating these disparities.

Visual Representation of Key Information

Visual aids are crucial for understanding the complexities of direct student loans. Infographics and charts can effectively communicate key information, simplifying the process and improving comprehension for borrowers. The following sections detail two such visual representations.

Direct Student Loan Lifecycle Infographic

This infographic would depict the journey of a direct student loan, from initial application to final repayment. It would be a horizontal timeline, divided into distinct phases. The first phase, “Application & Approval,” would show the steps involved in applying for a loan, including completing the FAFSA, receiving an award letter, and accepting the loan offer. The next phase, “Disbursement,” would illustrate how funds are released to the student’s institution. This would be followed by “Enrollment & Studies,” visually represented by a student in a classroom or studying. The “Repayment” phase would illustrate the various repayment plans available (standard, graduated, extended, etc.), showing the monthly payments and the loan’s amortization schedule. A final section, “Loan Completion,” would indicate the point at which the loan is fully repaid. Each phase would include short, concise descriptions and relevant icons (e.g., a dollar sign for disbursement, a graduation cap for enrollment). A key element would be a clear visual representation of interest accrual during the in-school and grace periods, showing how the loan balance grows. Finally, a potential section could address loan forgiveness or cancellation programs, depending on the loan type.

Comparison of Direct Student Loan Repayment Plan Costs

This visual would use a line graph to compare the total cost of different repayment plans over time. The x-axis would represent the repayment period (in years), and the y-axis would represent the total amount repaid (principal plus interest). Multiple lines would represent different repayment plans (e.g., Standard, Graduated, Extended). Each line would clearly show the total cost incurred under each plan. For example, the Standard plan line might show a steeper initial decline in the loan balance, while the Extended plan would show a gentler slope over a longer period, but with a higher total cost due to accumulated interest. A data table accompanying the graph would provide specific numerical values for each plan, such as the monthly payment amount, total interest paid, and total amount repaid. This would allow for a precise comparison and facilitate informed decision-making. The graph’s legend would clearly label each line with the corresponding repayment plan name. An example could compare a $20,000 loan under different plans, showcasing the varying total costs over 10, 15, and 20-year repayment periods. This would clearly demonstrate the trade-offs between monthly payment amounts and total interest paid.

Last Recap

Securing a higher education often involves leveraging direct student loans, a powerful tool that can unlock academic opportunities. However, responsible management is key. By understanding the various loan types, eligibility criteria, repayment plans, and potential consequences of default, borrowers can navigate the system effectively. This guide provides a framework for making informed decisions, empowering students to pursue their educational goals while mitigating long-term financial risks. Remember to explore all available resources and seek professional advice when needed to ensure a successful and financially responsible path through higher education.

Commonly Asked Questions

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and eventually, loan default with serious consequences like wage garnishment.

Can I refinance my direct student loans?

Yes, but refinancing federal loans with a private lender means losing federal protections like income-driven repayment plans.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

How do I apply for a Direct PLUS loan?

The application process involves completing a PLUS loan application through the Federal Student Aid website and meeting specific credit requirements.