Navigating the world of student loans can feel overwhelming, especially when faced with the complexities of federal direct loans. Understanding the various loan types, eligibility requirements, repayment options, and potential forgiveness programs is crucial for responsible financial planning. This guide provides a clear and concise overview of direct student loans, empowering you to make informed decisions about your education and future finances.

From subsidized and unsubsidized loans to the PLUS loan program, we’ll explore the differences between these options, comparing them to private student loans. We’ll also walk you through the application process, including completing the FAFSA form, and discuss various repayment strategies to help you manage your debt effectively. Finally, we’ll examine loan forgiveness programs and their impact on long-term financial goals.

Understanding Direct Student Loans

Direct student loans are federal loans offered by the U.S. Department of Education to help students finance their education. They are a crucial component of many students’ financial aid packages, offering a relatively straightforward and accessible path to funding higher education. Understanding their features and comparing them to other loan options is vital for making informed financial decisions.

Key Features of Direct Student Loans

Direct student loans offer several key advantages. They typically have fixed interest rates, meaning your monthly payments won’t fluctuate unpredictably. Furthermore, the government sets these rates, which are generally lower than those offered by private lenders. Deferment and forbearance options are often available, allowing you to temporarily postpone payments under certain circumstances, such as unemployment or enrollment in school. Finally, various repayment plans cater to different financial situations and income levels.

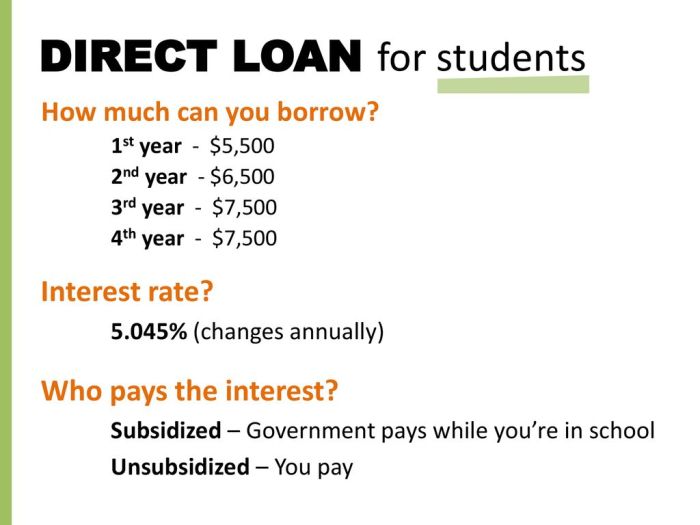

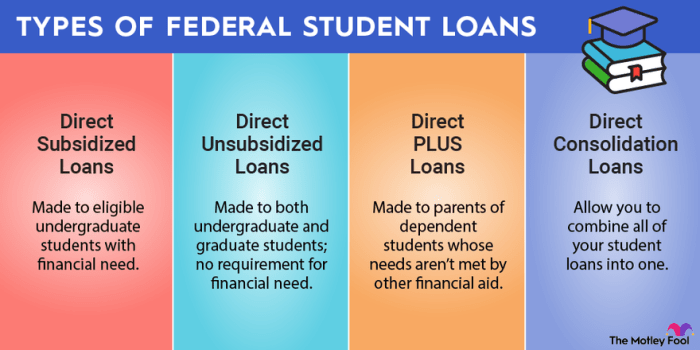

Types of Direct Student Loans

There are several types of direct student loans, each with its own eligibility criteria and terms.

| Loan Type | Interest Accrual | Eligibility | Repayment |

|---|---|---|---|

| Subsidized Direct Loan | Interest is not charged while the borrower is in school at least half-time, during a grace period, and during periods of deferment. | Based on financial need as determined by the Free Application for Federal Student Aid (FAFSA). | Begins six months after graduation or leaving school. |

| Unsubsidized Direct Loan | Interest accrues from the time the loan is disbursed, regardless of the borrower’s enrollment status. | Available to undergraduate and graduate students, regardless of financial need. | Begins six months after graduation or leaving school. |

| Direct PLUS Loan | Interest accrues from the time the loan is disbursed. | Available to graduate and professional students and parents of dependent undergraduate students. Credit check required. | Begins 60 days after the final disbursement. |

Direct Student Loans vs. Private Student Loans

Direct student loans and private student loans differ significantly. Direct loans offer fixed interest rates, government-set terms, and various repayment options designed to protect borrowers. Private loans, on the other hand, are offered by banks and other financial institutions, often with variable interest rates, less flexible repayment plans, and potentially higher overall costs. Eligibility for direct loans is based on financial need (for subsidized loans) or enrollment status, while private loan eligibility is largely determined by creditworthiness. Defaulting on a direct loan may impact your credit score and future access to federal aid, while defaulting on a private loan can have severe financial consequences.

Interest Rates, Repayment Plans, and Eligibility for Direct Loans

| Loan Type | Interest Rate (Example – rates vary by year) | Repayment Plans | Eligibility Requirements |

|---|---|---|---|

| Subsidized Direct Loan | 4.99% (Undergraduate) | Standard, Graduated, Extended, Income-Driven | Financial need demonstrated through FAFSA |

| Unsubsidized Direct Loan | 4.99% (Undergraduate) | Standard, Graduated, Extended, Income-Driven | Undergraduate or graduate enrollment |

| Direct PLUS Loan | 7.54% (Graduate/Professional) | Standard, Extended | Graduate/professional student status or parent of dependent undergraduate student; credit check required |

Eligibility and Application Process

Securing federal direct student loans involves meeting specific eligibility requirements and navigating the application process. Understanding these aspects is crucial for prospective students aiming to finance their education. This section details the criteria for eligibility, the steps involved in applying, and the verification procedures.

Eligibility Criteria for Federal Direct Student Loans

Eligibility for federal direct student loans hinges on several factors. Applicants must be U.S. citizens or eligible non-citizens, be enrolled or accepted for enrollment at least half-time in a degree or certificate program at a participating institution, maintain satisfactory academic progress, and possess a valid Social Security number. Furthermore, they must demonstrate financial need, which is assessed through the Free Application for Federal Student Aid (FAFSA). Specific requirements may vary depending on the type of loan (subsidized or unsubsidized) and the student’s educational level. For instance, graduate students may face different eligibility requirements compared to undergraduates.

Applying for Direct Student Loans

The application process for direct student loans begins with completing the FAFSA. This form collects information about the student’s financial situation and educational plans, which is then used to determine eligibility for federal student aid, including direct loans. After the FAFSA is processed, the student’s school will provide a financial aid award letter outlining the types and amounts of aid offered, including loans. The student then must accept the loan offer, completing a master promissory note (MPN) which is a legally binding agreement to repay the loan. Once the MPN is signed and the loan is disbursed, the funds are usually credited to the student’s account.

Direct Student Loan Verification Process

The verification process is a crucial step in ensuring the accuracy of the information provided on the FAFSA. Not all applicants are selected for verification, but those chosen will need to provide additional documentation to support the information they submitted. This may include tax returns, W-2 forms, and other financial records. The purpose of verification is to confirm the accuracy of the student’s financial information and ensure that the aid awarded is appropriate. Failure to provide the necessary documentation may delay or prevent the disbursement of loan funds.

Completing the FAFSA Form: A Step-by-Step Guide

Completing the FAFSA requires careful attention to detail. Before starting, gather all necessary tax information, including tax returns, W-2 forms, and other relevant financial documents. The process begins by creating an FSA ID, a username and password that will be used to access and manage the FAFSA. Next, complete the FAFSA form itself, providing accurate information about your financial situation, family details, and educational plans. This includes information about income, assets, household size, and the schools you plan to attend. After completing the form, review it thoroughly for accuracy before submitting. You’ll receive a Student Aid Report (SAR) confirming your submission and providing an overview of your results. Finally, monitor your FAFSA status to ensure the information has been processed and that any required documentation has been submitted.

Repayment Options and Strategies

Understanding your repayment options is crucial for effectively managing your student loan debt. Choosing the right plan depends on your financial situation and long-term goals. Failing to plan can lead to unnecessary stress and potential financial hardship. This section Artikels various repayment plans and strategies to help you navigate this process successfully.

Available Repayment Plans

The federal government offers several repayment plans for Direct Student Loans, each with its own terms and conditions. Selecting the best option requires careful consideration of your individual circumstances.

- Standard Repayment Plan: This is the most common plan, requiring fixed monthly payments over a 10-year period. It offers the shortest repayment period, resulting in less interest paid overall but higher monthly payments.

- Graduated Repayment Plan: Payments start low and gradually increase every two years over a 10-year period. This plan offers lower initial payments, but ultimately results in higher total interest paid compared to the standard plan.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years, lowering monthly payments significantly. However, it leads to substantially higher interest payments over the life of the loan.

- Income-Driven Repayment Plans (IDR): These plans (such as PAYE, REPAYE, IBR, and ICR) base your monthly payments on your income and family size. Payments are typically lower than other plans, but the repayment period can extend beyond 20 years. Any remaining balance after 20 or 25 years (depending on the plan) may be forgiven, but this forgiven amount is considered taxable income.

Sample Repayment Schedule for a $20,000 Loan

The following table provides a simplified example. Actual payments may vary based on interest rates and specific loan terms. These figures are illustrative and do not constitute financial advice. Consult the official federal student aid website for the most up-to-date information.

| Repayment Plan | Monthly Payment (approx.) | Total Paid (approx.) | Repayment Period |

|---|---|---|---|

| Standard | $210 | $25,200 | 10 years |

| Graduated (Year 1) | $150 | $25,200 | 10 years |

| Extended (25 years) | $85 | $25,500 | 25 years |

| Income-Driven (Example – varies greatly) | $100 – $200 (depending on income) | Varies greatly | 20-25 years |

Strategies for Managing Student Loan Debt

Effective management involves proactive planning and consistent effort.

- Budgeting: Create a detailed budget that includes your loan payments. This helps track your spending and ensures you can afford your monthly payments.

- Prioritize Payments: Prioritize high-interest loans to minimize the overall interest paid. Consider making extra payments to reduce the principal balance faster.

- Explore Refinancing: Refinancing might lower your interest rate if rates are favorable. However, be aware that refinancing federal loans can result in the loss of federal protections.

- Consolidation: Combining multiple loans into a single loan can simplify repayment and potentially reduce administrative burden.

Consequences of Defaulting on Direct Student Loans

Defaulting on your student loans has serious consequences.

- Wage garnishment: A portion of your wages can be seized to repay the debt.

- Tax refund offset: Your tax refund can be used to repay the loan.

- Negative credit impact: Defaulting severely damages your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment.

- Difficulty obtaining federal benefits: Your eligibility for certain federal benefits and programs may be affected.

- Legal action: The government may pursue legal action to recover the debt.

Loan Forgiveness and Cancellation Programs

Student loan forgiveness and cancellation programs offer the possibility of reducing or eliminating your student loan debt under specific circumstances. These programs are designed to address various situations, from public service to economic hardship, and understanding their requirements is crucial for borrowers seeking relief. Eligibility criteria vary significantly depending on the program, and the application process can be complex, requiring careful attention to detail and documentation.

Loan forgiveness and cancellation programs are not a guaranteed path to debt relief. Each program has specific eligibility requirements, and meeting these requirements doesn’t automatically guarantee forgiveness. The process often involves extensive paperwork, and approval may take considerable time. It’s vital to thoroughly research the specific program you’re interested in and understand the potential implications before applying.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations at the federal, state, local, or tribal level, and not-for-profit organizations. A qualifying repayment plan is generally an income-driven repayment plan. The process involves regularly certifying your employment with your loan servicer and ensuring your payments are consistently made on time. Failure to meet these stringent requirements can result in ineligibility for forgiveness.

Teacher Loan Forgiveness Program

This program provides up to $17,500 in loan forgiveness to eligible teachers who have completed five years of full-time teaching in a low-income school or educational service agency. To qualify, teachers must have received a Direct Subsidized or Unsubsidized Loan, a Stafford Loan, or a Federal Perkins Loan. The application process requires documentation of employment and teaching experience, which must meet specific criteria Artikeld by the Department of Education. The program aims to incentivize individuals to pursue careers in education within underserved communities.

Examples of Professions Eligible for Loan Forgiveness Programs

Many professions are eligible for loan forgiveness programs, particularly those involving public service. For example, teachers in low-income schools, nurses working in underserved areas, and social workers in government agencies may qualify for loan forgiveness under various programs. The specific requirements vary depending on the program and the employer. Eligibility is not based solely on the job title but also on the specific work environment and the type of loans held.

Summary of Loan Forgiveness Programs and Eligibility Criteria

The following list summarizes some key loan forgiveness programs and their eligibility criteria. It is crucial to consult the official Department of Education website for the most up-to-date and complete information, as program details and eligibility requirements can change.

- Public Service Loan Forgiveness (PSLF): 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit employer.

- Teacher Loan Forgiveness Program: Five years of full-time teaching in a low-income school or educational service agency, with qualifying loans.

- Income-Driven Repayment (IDR) Plans: These plans don’t directly forgive loans, but they can lead to loan forgiveness after a certain number of years through programs like PSLF. Eligibility is based on income and family size.

- Federal Perkins Loan Cancellation: Forgiveness based on working in certain public service positions or experiencing economic hardship. Specific requirements vary.

Impact of Direct Student Loans on Financial Planning

Student loan debt significantly impacts long-term financial goals. Understanding this impact is crucial for effective financial planning, allowing recent graduates and borrowers to navigate their financial future with greater confidence and achieve their aspirations despite the debt burden. Failing to account for student loan payments can lead to significant setbacks in achieving major financial milestones.

Direct student loans can influence your ability to save for a down payment on a home, invest for retirement, and generally manage your finances. The monthly payment obligation reduces the disposable income available for other crucial financial needs. The longer it takes to repay loans, the more interest accrues, potentially increasing the total cost significantly. This, in turn, could delay or even prevent the achievement of other important financial goals.

Long-Term Financial Goal Impacts

Student loan repayments directly compete with other major financial goals. For example, the significant monthly payment obligations associated with student loan debt can delay homeownership. A larger portion of your income is dedicated to loan repayment, leaving less for savings. Similarly, the reduced disposable income can hinder retirement savings, potentially leading to a smaller nest egg in later life. Imagine a recent graduate aiming for a 20% down payment on a $300,000 home. Significant student loan payments might necessitate delaying this goal by several years, even with diligent saving. Likewise, consistent contributions to a retirement account are compromised when a large portion of income is already allocated to student loan repayment.

Budgeting and Financial Management While Repaying Student Loans

Creating a realistic budget is paramount for managing student loan debt effectively. This budget should incorporate all income sources and expenses, including the mandatory student loan payment. A well-structured budget ensures you allocate sufficient funds for loan repayment without compromising other essential expenses like housing, food, and transportation. Tracking expenses meticulously allows for identification of areas where spending can be reduced to free up additional funds for loan repayment or savings. For instance, reducing discretionary spending on entertainment or dining out can free up several hundred dollars each month, accelerating loan repayment and contributing to other financial goals.

Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy plays a crucial role in navigating student loan debt successfully. Understanding concepts like interest rates, loan amortization, and repayment plans is vital. A strong grasp of these concepts empowers borrowers to make informed decisions about their loan repayment strategy, minimizing the total cost of borrowing. For instance, understanding the implications of different repayment plans (standard, graduated, income-driven) allows borrowers to choose the plan that best aligns with their financial circumstances. Furthermore, financial literacy enables effective budgeting, debt management, and long-term financial planning, leading to a more secure financial future.

Sample Budget for a Recent Graduate

This sample budget illustrates how a recent graduate might allocate income while repaying student loans. Note that this is a simplified example and individual budgets will vary depending on income, expenses, and loan amounts.

| Income | Monthly Amount | Expenses | Monthly Amount |

|---|---|---|---|

| Salary | $3,500 | Student Loan Payment | $500 |

| Part-time Job | $500 | Rent | $1,000 |

| Total Income | $4,000 | Utilities | $200 |

| Groceries | $300 | ||

| Transportation | $200 | ||

| Savings (Emergency Fund & Retirement) | $300 | ||

| Other Expenses (Entertainment, etc.) | $500 | ||

| Total Expenses | $2,500 | ||

| Net Income (After Expenses) | $1,500 |

Understanding Interest Rates and Fees

Understanding the interest rates and fees associated with your Direct Student Loans is crucial for effective financial planning and managing your debt. These costs significantly impact the total amount you’ll repay, so it’s essential to be well-informed.

Interest rates on federal Direct Student Loans are determined by the U.S. Department of Education and are set annually. The rate depends on the loan type (subsidized, unsubsidized, graduate PLUS, parent PLUS) and the loan disbursement date. These rates are typically fixed for the life of the loan, meaning they don’t change, unlike variable interest rates that fluctuate. The government publishes these rates publicly, and they are usually lower than those offered by private lenders.

Direct Loan Fees

Direct loans may involve origination fees, which are deducted from the loan amount before you receive the funds. These fees help cover the administrative costs of processing the loan. The amount of the origination fee is usually a small percentage of the loan. For example, a 1.057% origination fee on a $10,000 loan would be $105.70. This fee is not added to the principal, rather it’s subtracted upfront. Therefore, the borrower receives $9,894.30, and the interest accrues on this reduced amount. It’s important to note that origination fees vary depending on the loan type and the year the loan is disbursed.

Interest Capitalization

Interest capitalization occurs when accumulated interest on a loan is added to the principal balance, increasing the total amount owed. This happens when your loan enters repayment, but you are not making payments that cover all the accrued interest. The capitalized interest then begins to accrue interest itself. This process can significantly increase the total cost of the loan over time.

Illustrative Example of Interest Capitalization

Imagine two scenarios: Loan A has no interest capitalization, and Loan B does. Both loans start at $10,000 with a 5% annual interest rate. Let’s assume a simplified scenario for illustration.

Visual Representation:

Imagine a graph with two lines representing Loan A and Loan B. The x-axis represents time (in years), and the y-axis represents the loan balance. Both lines start at $10,000 at year 0.

Loan A (no capitalization): The line for Loan A would show a relatively slow, steady increase. Each year, the balance increases by 5% of the previous year’s balance. After five years, the total would be approximately $12,763 (this is a simplified calculation and does not factor in monthly compounding).

Loan B (with capitalization): The line for Loan B would show a steeper increase. Let’s say after three years, $1,500 in interest has accrued and is capitalized. The new principal becomes $11,500. The subsequent interest calculations would then be based on this higher principal amount, leading to a more significant increase in the total loan balance over the same five-year period. After five years, the total would be significantly higher than Loan A, potentially exceeding $14,000 (this is a simplified illustrative example and may not reflect the precise amounts due to the complexity of compounding interest calculations). The difference between the two lines visually demonstrates the impact of interest capitalization. The steeper incline of Loan B’s line clearly shows how capitalization accelerates loan growth.

Outcome Summary

Securing a higher education often requires leveraging student loans, and understanding the intricacies of direct student loans is paramount. This guide has provided a framework for navigating the complexities of federal student loan programs, from application and eligibility to repayment options and forgiveness programs. By utilizing the information presented here, you can approach your student loan journey with confidence, making informed decisions that contribute to your long-term financial well-being. Remember, proactive planning and financial literacy are key to successfully managing student loan debt.

FAQ Compilation

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, which has serious financial consequences.

Can I refinance my direct student loans?

While you can’t refinance federal direct loans with another federal loan, you might be able to refinance with a private lender. However, this may result in losing federal benefits.

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the total amount you owe.

How long does it take to repay student loans?

The repayment period depends on your loan type and chosen repayment plan, ranging from 10 to 25 years or more.