Navigating the complexities of student loan debt can feel overwhelming, especially when understanding interest rates is crucial to long-term financial health. This guide demystifies direct student loan interest rates, exploring the various factors that influence them, and providing practical strategies for managing costs and minimizing their impact on your future.

From understanding the differences between subsidized and unsubsidized loans to exploring the implications of various repayment plans, we’ll cover key aspects of interest rate calculations, historical trends, and the potential consequences of high versus low interest rates. We’ll also compare federal direct loans to private options, helping you make informed decisions about your educational financing.

Understanding Direct Student Loan Interest Rates

Direct student loans are a crucial part of financing higher education in the United States. Understanding the interest rates associated with these loans is essential for responsible borrowing and long-term financial planning. This section will detail the various types of federal direct student loans, how their interest rates are determined, and provide a historical perspective on rate changes.

Types of Federal Direct Student Loans and Their Interest Rates

The federal government offers several types of direct student loans, each with its own interest rate. These rates are typically fixed for the life of the loan, meaning they don’t change after the loan is disbursed. The primary loan types are subsidized and unsubsidized loans, further categorized by undergraduate, graduate, and professional studies. Subsidized loans differ from unsubsidized loans in that the government pays the interest while the borrower is in school (under certain conditions), during grace periods, and during periods of deferment. Unsubsidized loans accrue interest from the time the loan is disbursed, regardless of the borrower’s enrollment status.

Interest Rate Determination for Direct Student Loans

Interest rates for federal direct student loans are set annually by the government. The rates are not arbitrary; they are influenced by several factors, including prevailing market interest rates and the overall economic climate. The specific rate for each loan type is typically announced before the start of each academic year. For example, the interest rate for a subsidized undergraduate loan in 2024 might be different than the rate for a graduate unsubsidized loan in the same year, reflecting the different risk profiles and market conditions.

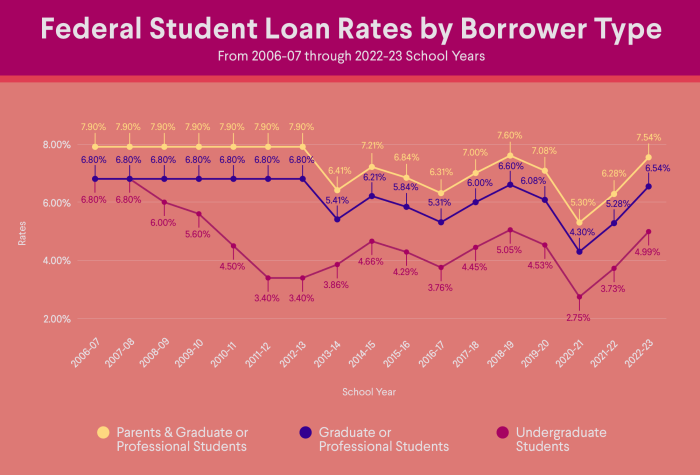

Historical Overview of Direct Student Loan Interest Rate Changes

Direct student loan interest rates have fluctuated throughout the years. Since their inception, rates have generally risen and fallen in line with overall interest rate trends. For instance, during periods of low inflation and economic stability, rates have often been lower. Conversely, periods of economic uncertainty or high inflation have typically resulted in higher rates. Tracking these historical changes provides valuable context for understanding the current rate environment and predicting future trends, although predicting future rates with certainty is impossible. For example, comparing the rates from 2010 to 2020 would reveal significant changes reflecting the economic conditions of each period.

Comparison of Subsidized and Unsubsidized Loan Interest Rates

The following table compares the interest rates for subsidized and unsubsidized loans across different loan programs. Note that these rates are illustrative and subject to change. Always consult the official government website for the most current information.

| Loan Program | Subsidized Loan Rate (Example) | Unsubsidized Loan Rate (Example) | Loan Period |

|---|---|---|---|

| Undergraduate | 4.5% | 5.5% | 2024-2025 |

| Graduate/Professional | 6.0% | 7.0% | 2024-2025 |

| Parent PLUS | N/A | 8.0% | 2024-2025 |

Factors Influencing Interest Rates

Several key factors interact to determine the interest rate a student borrower receives on their federal direct loan. These factors are not equally weighted, and the precise impact can vary depending on the specific loan program and the overall economic climate. Understanding these factors can help borrowers anticipate their interest rate and make informed decisions about their borrowing.

Credit History

A borrower’s credit history significantly impacts their interest rate, although it’s less of a factor for federal student loans than for private loans. While federal student loans don’t typically require a credit check for undergraduate loans, a strong credit history can potentially lead to lower interest rates on some federal loan programs or better terms on private student loans, which may be necessary to supplement federal borrowing. Conversely, a poor credit history can result in higher interest rates or even loan denial for private student loans. Factors considered in a credit history include payment history, debt levels, and length of credit history. A consistent record of on-time payments demonstrates financial responsibility, making borrowers more attractive to lenders and potentially resulting in more favorable interest rates.

Loan Repayment Period

The length of the repayment period directly affects the total interest paid over the life of the loan. Longer repayment periods generally result in lower monthly payments, but significantly increase the total interest accrued. For example, a 10-year repayment plan will have higher monthly payments than a 20-year plan for the same loan amount, but the total interest paid will be substantially less with the shorter repayment period. Borrowers should carefully weigh the advantages of lower monthly payments against the increased long-term cost of a longer repayment period.

Undergraduate vs. Graduate Student Loan Interest Rates

Interest rates for graduate student loans are typically higher than those for undergraduate student loans. This difference reflects the generally higher loan amounts borrowed by graduate students and the perceived higher risk associated with these larger loans. The government may view graduate students as having higher earning potential post-graduation, but also a higher risk of default due to the potentially longer time to repayment and the greater debt burden. Therefore, the interest rate reflects this risk assessment. Specific interest rates are set annually by the government and may fluctuate based on economic conditions.

Managing Interest Rates and Costs

Understanding and managing your student loan interest is crucial to minimizing your overall debt burden. Effective strategies can significantly reduce the total amount you repay, saving you considerable money over the life of your loans. This section Artikels practical approaches to control interest costs and resources available to help you navigate this process.

Strategies for Minimizing Interest Impact

Minimizing the impact of interest on your student loans requires a proactive approach. Several strategies can help borrowers reduce their overall repayment costs. These include making extra payments, refinancing to a lower interest rate (if eligible), and choosing a repayment plan that aligns with your financial situation. Careful planning and consistent effort are key to achieving significant savings.

Sample Repayment Plan Demonstrating Different Strategies

Let’s consider a hypothetical scenario: A borrower has a $30,000 federal student loan with a 5% interest rate and a 10-year standard repayment plan.

Scenario 1: Standard Repayment. The borrower makes the minimum monthly payment, resulting in a total repayment amount significantly higher due to accumulated interest. (Detailed calculations would be included here showing the total interest paid over 10 years).

Scenario 2: Accelerated Repayment. The borrower makes an extra $100 payment each month. This reduces the loan’s lifespan and significantly lowers the total interest paid. (Detailed calculations showing the reduced interest and loan term would be included here).

Scenario 3: Refinancing (if eligible). If interest rates fall, the borrower could refinance to a lower rate (e.g., 3%). This would substantially decrease the total interest paid over the loan term. (Detailed calculations comparing the interest paid under the original and refinanced rates would be included here). It’s crucial to note that refinancing federal loans can result in the loss of certain benefits.

Resources for Lowering Interest Rates

Several resources can assist borrowers in exploring options to reduce their interest rates. These include:

- Federal Student Aid Website: This website offers comprehensive information on repayment plans, income-driven repayment options, and other programs that can help manage student loan debt.

- National Foundation for Credit Counseling (NFCC): The NFCC provides free and low-cost credit counseling services, including assistance with student loan repayment strategies.

- Your Loan Servicer: Your loan servicer can provide information on your specific loan terms, repayment options, and potential hardship programs.

- Private Refinancing Companies: Several private companies offer student loan refinancing options. It’s crucial to carefully compare interest rates, fees, and terms before refinancing.

Examples of Interest Capitalization

Interest capitalization occurs when accrued interest is added to the principal loan balance. This increases the total amount owed and, consequently, the total interest paid over the life of the loan.

Example: Suppose a borrower has a $10,000 loan with a 6% interest rate. If interest capitalizes annually, and the borrower makes no payments during the first year, the interest accrued ($600) would be added to the principal. The new principal balance becomes $10,600, and subsequent interest calculations are based on this higher amount. This compounding effect can significantly increase the overall cost of the loan over time. Failure to make payments during periods of deferment or forbearance often leads to interest capitalization, resulting in a substantially larger debt burden.

Interest Rate Implications for Borrowers

Understanding the nuances of student loan interest rates is crucial for long-term financial well-being. The interest rate directly impacts the total cost of your education and can significantly influence your financial stability for years to come. Choosing repayment plans and managing your debt effectively requires a clear grasp of how interest rates affect your overall repayment burden.

The difference between high and low interest rates on student loans can amount to thousands of dollars over the life of the loan. A low interest rate translates to lower monthly payments and a smaller total repayment amount. Conversely, a high interest rate leads to significantly higher monthly payments and a substantially larger total amount repaid. This difference becomes increasingly pronounced over longer repayment periods. For example, a $30,000 loan at 5% interest over 10 years will cost considerably less than the same loan at 10% interest over the same period. The compounding effect of interest means that the higher rate accumulates significantly more debt over time.

Impact of Interest Rates on Total Repayment

The total amount repaid on a student loan is directly influenced by the interest rate. A higher interest rate increases the total cost of borrowing. This increase is not simply a matter of paying a slightly higher monthly payment; the interest accrues on the outstanding principal balance, meaning that you’re paying interest on interest. To illustrate, consider two loans of $20,000: one with a 4% interest rate and another with an 8% interest rate, both amortized over 10 years. The higher interest rate loan will result in a significantly larger total repayment amount, potentially thousands of dollars more than the lower rate loan. This difference can dramatically impact a borrower’s post-graduation financial planning and ability to save for future goals like a down payment on a house or retirement.

Consequences of Missed or Late Payments

Failing to make timely student loan payments has severe financial consequences, primarily driven by the accumulation of interest. Missed payments typically result in late fees, which add to the overall debt. More importantly, interest continues to accrue on the unpaid balance, increasing the principal amount owed. This can lead to a snowball effect, where the debt grows exponentially, making it increasingly difficult to manage. Furthermore, late or missed payments can negatively impact your credit score, making it harder to secure loans or favorable interest rates in the future for mortgages, car loans, or credit cards. In some cases, prolonged delinquency can lead to loan default, resulting in wage garnishment, tax refund offset, or even legal action.

Financial Hardships Associated with High Interest Rates

The following are potential financial hardships faced by borrowers with high interest rates on their student loans:

- Difficulty in affording monthly payments, potentially leading to financial stress and lifestyle adjustments.

- Reduced ability to save for future goals such as a down payment on a home, retirement, or starting a family.

- Increased reliance on high-interest credit cards or other forms of debt to cover essential expenses.

- Limited opportunities for career advancement due to financial constraints and stress.

- Potential for loan default and the associated negative consequences, including damage to credit score and legal action.

Comparing Direct Loans to Other Loan Types

Choosing between federal direct student loans and private student loans requires careful consideration of interest rates and repayment terms. Both offer funding for higher education, but their structures differ significantly, impacting the overall cost of borrowing. Understanding these differences is crucial for making informed financial decisions.

Federal direct student loans, offered by the government, generally have fixed interest rates that are set annually. These rates are typically lower than those offered by private lenders. Private student loans, on the other hand, are offered by banks and credit unions and their interest rates are variable, often tied to market indices, making them potentially more volatile. The interest rate you receive on a private loan depends on your creditworthiness, credit history, and the lender’s current lending standards.

Interest Rate Comparisons and Repayment Terms

Federal direct student loans offer several advantages regarding interest rates and repayment. Their fixed rates provide predictability, allowing borrowers to accurately budget for monthly payments. Furthermore, the government offers various income-driven repayment plans that can significantly reduce monthly payments, especially during periods of lower income. These plans can extend the repayment period, leading to higher overall interest paid, but they provide crucial flexibility. In contrast, private loans often come with higher interest rates, especially for borrowers with less-than-perfect credit. Repayment terms can also be less flexible, potentially leading to financial hardship if unforeseen circumstances arise.

Advantages and Disadvantages of Each Loan Type

A summary of the key advantages and disadvantages of each loan type is presented below:

| Feature | Federal Direct Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, fixed rates | Generally higher, often variable rates |

| Repayment Plans | Flexible repayment options, including income-driven plans | Less flexible repayment options |

| Credit Check | Typically no credit check required for subsidized loans, unsubsidized loans may require a credit check for higher loan amounts | Credit check required, impacting interest rates |

| Borrower Protections | Strong borrower protections, including deferment and forbearance options | Fewer borrower protections |

| Loan Forgiveness Programs | Eligibility for certain loan forgiveness programs | Generally not eligible for government loan forgiveness programs |

Scenarios Favoring Each Loan Type

Choosing between federal direct loans and private loans depends heavily on individual circumstances. For instance, a student with excellent credit and a co-signer might secure a favorable interest rate on a private loan, potentially making it a more cost-effective option. However, if the student lacks a strong credit history or a suitable co-signer, federal direct loans would provide a more accessible and predictable path to funding their education. Borrowers with limited financial resources might find the income-driven repayment plans offered with federal loans significantly beneficial. Conversely, those with high earning potential and strong credit might prefer the potentially lower interest rates (though variable) available through private loans, assuming they can manage the higher repayment amounts. The availability of loan forgiveness programs associated with federal loans should also be considered a significant factor.

Conclusion

Successfully managing student loan debt requires a proactive approach to understanding and mitigating the effects of interest rates. By utilizing the strategies and resources discussed, borrowers can gain control over their financial future and minimize the long-term burden of their educational loans. Remember, informed decision-making is key to navigating the complexities of student loan repayment and achieving financial well-being.

Helpful Answers

What happens if I don’t make my student loan payments?

Failure to make timely payments can result in delinquency, negatively impacting your credit score and potentially leading to wage garnishment or tax refund offset.

Can I refinance my federal student loans to a lower interest rate?

While refinancing options exist, it’s important to carefully weigh the pros and cons. Refinancing federal loans often means losing federal protections and benefits.

How often do direct student loan interest rates change?

Interest rates for federal student loans are typically set annually and can vary depending on the loan type and market conditions.

What is interest capitalization?

Interest capitalization is the process of adding unpaid interest to the principal loan balance, increasing the total amount owed.