Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is the first step towards financial freedom. This guide explores various repayment plans, budgeting techniques, and government programs designed to help you manage and ultimately eliminate your student loan debt. We’ll cover everything from choosing the right repayment plan to understanding loan forgiveness programs, empowering you to make informed decisions about your financial future.

From income-driven repayment plans that adjust your monthly payments based on your income to standard and extended repayment options, the choices can seem daunting. However, by carefully considering your financial situation and long-term goals, you can develop a sustainable repayment strategy that minimizes stress and maximizes your financial well-being. This guide provides the tools and information you need to confidently tackle your student loans.

Understanding Direct Student Loan Repayment Plans

Choosing the right repayment plan for your federal student loans is crucial for managing your debt effectively and avoiding financial strain. Understanding the various options available and their implications is key to making an informed decision. This section will Artikel the different repayment plans, highlighting their features and eligibility requirements to help you navigate this important process.

Direct Student Loan Repayment Plan Types

Several repayment plans are available for federal direct student loans, each designed to cater to different financial situations and repayment preferences. The choice depends heavily on your income, loan amount, and personal financial goals. Understanding these plans is vital for responsible debt management.

Income-Driven Repayment Plans and Eligibility

Income-driven repayment (IDR) plans link your monthly payment amount to your income and family size. This ensures your payments are manageable, even during periods of lower earnings. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility typically requires a federal student loan and submission of income documentation. Specific requirements may vary depending on the plan and your loan type. For instance, REPAYE is generally more forgiving for borrowers with higher loan balances, while IBR may be preferable for those with lower incomes. These plans often lead to loan forgiveness after a set period of qualifying payments, usually 20 or 25 years, but the forgiven amount is considered taxable income.

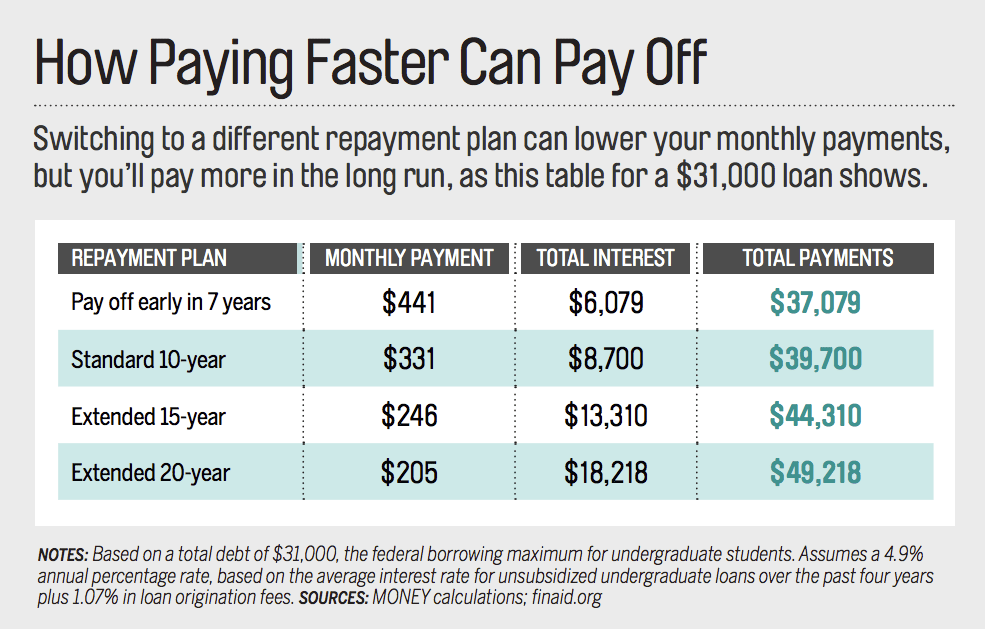

Standard Repayment Plan vs. Extended Repayment Plan

The standard repayment plan involves fixed monthly payments over a 10-year period. This plan offers the quickest path to loan repayment but may result in higher monthly payments. In contrast, the extended repayment plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but accumulating more interest over the loan’s life. For example, a $30,000 loan with a 5% interest rate would have a monthly payment of approximately $317 under the standard plan and approximately $170 under the extended plan. The trade-off is between shorter repayment time and lower monthly payments.

Choosing the Most Suitable Repayment Plan: A Step-by-Step Guide

Selecting the optimal repayment plan requires careful consideration of your individual circumstances. Follow these steps to make an informed decision:

- Assess your current financial situation: Evaluate your income, expenses, and overall financial stability. This will help determine your capacity for monthly payments.

- Calculate your monthly payments under different plans: Use the loan servicer’s online tools or calculators to estimate your payments for each plan type. This will give you a clear picture of the financial implications of each option.

- Consider your long-term financial goals: Think about your career aspirations, potential income growth, and other financial obligations. A longer repayment plan might be beneficial if you anticipate significant income increases in the future.

- Review the terms and conditions of each plan: Understand the eligibility criteria, payment schedules, and potential consequences of defaulting on your loans. This information is readily available on the Federal Student Aid website.

- Compare the total interest paid: While lower monthly payments are attractive, remember that longer repayment periods lead to higher overall interest costs. Carefully compare the total cost of each plan.

- Choose the plan that best aligns with your financial capabilities and long-term goals: Once you’ve carefully weighed the pros and cons of each plan, select the one that offers the best balance between manageable payments and minimizing overall interest costs.

Managing Direct Student Loan Repayments

Successfully managing your direct student loan repayments requires a proactive approach to budgeting, planning, and understanding the potential consequences of missed payments. This section will Artikel strategies for effective repayment, including budgeting techniques, the impact of late payments, and options for simplifying your repayment process.

Budgeting and Prioritizing Student Loan Payments

Creating a realistic budget is crucial for managing student loan repayments. This involves carefully tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards your loans. Prioritizing loan payments means considering the interest rates and repayment terms of each loan. It’s often beneficial to focus on high-interest loans first to minimize the total amount paid over the life of the loans. A well-structured budget helps ensure that loan payments are made on time, avoiding late fees and negative impacts on your credit score. Consider using budgeting apps or spreadsheets to track your finances and visualize your progress.

Sample Monthly Budget Incorporating Student Loan Repayments

A sample monthly budget could look like this:

| Income | Amount |

|---|---|

| Net Monthly Salary | $3,000 |

| Expenses | Amount |

| Rent/Mortgage | $1,000 |

| Utilities (Electricity, Water, Gas) | $200 |

| Groceries | $300 |

| Transportation | $200 |

| Student Loan Payment | $500 |

| Other Expenses (Entertainment, Savings, etc.) | $800 |

| Total Expenses | $3,000 |

This is a simplified example; your budget will vary depending on your individual circumstances. The key is to allocate a sufficient amount to your student loan payments while maintaining a comfortable living standard. Remember to adjust your budget as needed, considering unexpected expenses and changes in income.

Consequences of Missing or Late Student Loan Payments

Missing or making late student loan payments can have significant negative consequences. These include:

- Late fees: Lenders typically charge late fees for missed payments, adding to your overall debt.

- Damaged credit score: Late payments are reported to credit bureaus, negatively impacting your credit score and making it harder to obtain loans or credit cards in the future.

- Increased interest charges: Missed payments can lead to increased interest charges, making it more difficult to pay off your loans.

- Default: Repeatedly missing payments can result in loan default, which has severe financial consequences, including wage garnishment, tax refund offset, and damage to your credit history.

It’s crucial to contact your loan servicer immediately if you anticipate difficulties making a payment to explore options for avoiding delinquency.

Consolidating Multiple Student Loans

Consolidating multiple student loans into a single loan can simplify the repayment process by combining multiple monthly payments into one. This can make budgeting easier and potentially lower your monthly payment, although it might extend the repayment period and increase the total interest paid over the life of the loan. It’s essential to carefully weigh the pros and cons before consolidating your loans. The terms of the consolidated loan will depend on your creditworthiness and the types of loans being consolidated. Federal loan consolidation programs offer benefits such as fixed interest rates and streamlined repayment options.

Government Programs and Resources for Direct Loan Repayment

Navigating the complexities of student loan repayment can be daunting, but several government programs offer assistance and potential pathways to loan forgiveness. Understanding these options is crucial for borrowers seeking to manage their debt effectively and potentially reduce their overall repayment burden. This section details key government programs and resources designed to help borrowers repay their federal student loans.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. Several IDR plans exist, including Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE). Eligibility requirements vary slightly by plan, but generally involve having a federal student loan and demonstrating your income and family size. The application process typically involves completing a form online through the StudentAid.gov website and providing necessary documentation. Choosing the right IDR plan depends on your individual financial circumstances; comparing the potential long-term costs and benefits of each plan is essential before making a decision. Note that while IDR plans lower monthly payments, they may extend the repayment period, potentially increasing the total interest paid over the life of the loan.

Loan Forgiveness Programs

Several loan forgiveness programs offer the possibility of having a portion or all of your student loan debt forgiven. These programs often target specific professions, such as teaching, public service, or working in underserved communities. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of your federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying employer. Eligibility for PSLF requires employment by a government organization or a non-profit organization, consistent payments, and adherence to the program’s specific guidelines. Other programs, such as the Teacher Loan Forgiveness program, offer forgiveness for teachers who meet specific requirements regarding teaching in low-income schools. The application process for loan forgiveness programs varies depending on the specific program but typically involves submitting documentation verifying employment and loan payments.

Applying for Income-Driven Repayment Plans and Loan Forgiveness

The application process for both IDR plans and loan forgiveness programs primarily occurs through the StudentAid.gov website. Borrowers will need to create an account, provide necessary documentation (such as tax returns and employment verification), and complete the relevant applications. It’s crucial to meticulously review the eligibility requirements and application instructions for each program to ensure a successful application. Failure to meet all requirements can lead to application denial or delays in processing. Furthermore, actively monitoring your account and maintaining consistent communication with your loan servicer is essential throughout the application and repayment process.

Comparison of Government Assistance Programs

| Program | Description | Eligibility | Application Process |

|---|---|---|---|

| Income-Driven Repayment (IDR) Plans (REPAYE, IBR, ICR, PAYE) | Adjusts monthly payments based on income and family size. | Federal student loans; income and family size verification. | Online application through StudentAid.gov. |

| Public Service Loan Forgiveness (PSLF) | Forgives remaining balance after 120 qualifying payments while working full-time for a qualifying employer. | Federal student loans; full-time employment with qualifying employer; consistent payments under an IDR plan. | Online application through StudentAid.gov; employment verification. |

| Teacher Loan Forgiveness | Forgives a portion of loans for teachers who meet specific requirements. | Federal student loans; teaching in a low-income school; meeting specific teaching requirements. | Online application through StudentAid.gov; employment and teaching verification. |

The Impact of Direct Student Loan Repayment on Personal Finances

Managing student loan debt significantly impacts your overall financial well-being, extending far beyond the monthly payment itself. The repayment strategy you choose, the resulting debt burden, and the length of repayment all have profound and long-lasting consequences on your financial future. Understanding these implications is crucial for making informed decisions and achieving your long-term financial goals.

Student loan repayment significantly affects various aspects of personal finance. The chosen repayment plan directly influences the total interest paid, the length of the repayment period, and the overall financial burden. Furthermore, outstanding student loan debt interacts with credit scores, borrowing capacity, and the ability to pursue other financial goals like saving, investing, and homeownership.

Long-Term Financial Implications of Different Repayment Strategies

Different repayment plans offer varying degrees of short-term relief versus long-term financial impact. A standard repayment plan, for example, offers a lower monthly payment but results in higher total interest paid over the life of the loan. Conversely, an income-driven repayment plan might offer a lower monthly payment initially, but could potentially extend the repayment period significantly, leading to higher overall interest costs. Careful consideration of the trade-offs between monthly payment amounts and total interest paid is essential. For instance, a shorter repayment period, while demanding a higher monthly payment, ultimately reduces the overall interest burden and frees up finances sooner.

The Effect of Student Loan Debt on Credit Scores and Borrowing Capacity

Student loan debt directly impacts credit scores. Missed or late payments can severely damage credit scores, making it more difficult to obtain loans, credit cards, or even rent an apartment in the future. High levels of student loan debt can also reduce borrowing capacity, limiting access to other forms of credit, such as mortgages or auto loans, or resulting in higher interest rates on those loans. Maintaining a positive payment history on student loans is crucial for building and maintaining a strong credit profile. Conversely, consistently making on-time payments demonstrates financial responsibility, positively impacting credit scores and improving borrowing opportunities.

Student Loan Repayment and Other Financial Goals

Student loan debt can significantly restrict the ability to pursue other important financial goals. Large monthly payments can leave little room for saving, investing, or building an emergency fund. The burden of student loan debt can also delay major life milestones, such as buying a home or starting a family. Careful budgeting and prioritizing debt repayment while simultaneously saving and investing is crucial for balancing these competing financial goals. For example, prioritizing high-interest debt repayment before investing can lead to greater long-term financial gains by minimizing interest accrual.

Examples of Successful Student Loan Debt Management

Successfully managing student loan debt often involves a combination of proactive planning and diligent execution. Many individuals have successfully navigated this challenge by employing various strategies.

- Strategic Budgeting and Prioritization: One individual meticulously tracked their income and expenses, creating a budget that prioritized student loan payments while still allowing for savings and essential living expenses. This allowed them to consistently make on-time payments and pay down their debt faster.

- Income-Driven Repayment Plans: Another individual benefited significantly from enrolling in an income-driven repayment plan, which lowered their monthly payments based on their income and family size, providing much-needed financial flexibility.

- Debt Consolidation: A third individual successfully consolidated their multiple student loans into a single loan with a lower interest rate, simplifying repayment and potentially reducing the overall cost of borrowing.

- Part-Time Employment: To accelerate repayment, one individual took on a part-time job in addition to their full-time employment, dedicating the extra income specifically to their student loan payments.

Understanding Loan Forgiveness Programs

Navigating the complexities of student loan repayment can be daunting, but understanding available loan forgiveness programs can significantly alleviate financial burdens. These programs offer the possibility of having a portion or all of your student loan debt forgiven under specific circumstances. It’s crucial to carefully examine the eligibility requirements and application processes to determine if you qualify.

Public Service Loan Forgiveness (PSLF) Requirements

Public Service Loan Forgiveness (PSLF) is a program designed to forgive the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Key requirements include employment by a qualifying employer, consistent payments under an eligible repayment plan, and having Direct Loans. Failure to meet even one of these criteria can jeopardize forgiveness. For example, a teacher working for a private school, even if it’s a charitable organization, may not qualify for PSLF. Similarly, inconsistent payments, even due to administrative errors, could delay or prevent forgiveness.

Teacher Loan Forgiveness Eligibility Criteria

The Teacher Loan Forgiveness program offers forgiveness of up to $17,500 in Direct Subsidized and Unsubsidized Loans, or Federal Stafford Loans. Eligibility necessitates teaching full-time for five complete and consecutive academic years in a low-income school or educational service agency. “Low-income” is defined by the federal government, and schools are designated as such based on specific criteria. The program is designed to incentivize individuals to pursue teaching careers in areas of critical need. For instance, a teacher working in a high-poverty urban school district could potentially qualify, whereas a teacher in a wealthy suburban school likely would not.

Comparison of Loan Forgiveness Programs

Several loan forgiveness programs exist, each with unique eligibility criteria and forgiveness amounts. While PSLF focuses on public service, Teacher Loan Forgiveness targets educators in low-income settings. Other programs, such as the Income-Driven Repayment (IDR) plans, don’t forgive loans outright but can significantly reduce monthly payments, leading to lower overall debt over time. A key difference lies in the employment requirements: PSLF necessitates public service employment, while Teacher Loan Forgiveness requires teaching in specific schools. The forgiveness amounts also vary significantly, reflecting the distinct goals of each program.

Step-by-Step Guide to Applying for Loan Forgiveness

Applying for loan forgiveness requires careful planning and documentation. First, confirm your eligibility for the specific program. Next, gather all necessary documentation, including employment verification and loan information. Then, complete the application form meticulously and submit it through the appropriate channels. After submission, regularly monitor the status of your application and address any requests for additional information promptly. Finally, understand that the process can take time, and patience is crucial. For instance, for PSLF, consistent tracking of payment counts and employment verification is essential. Regularly checking your loan servicer’s website and maintaining contact with them is advisable throughout the process.

Visual Representation of Repayment Scenarios

Understanding the financial implications of different student loan repayment plans is crucial for effective budgeting and long-term financial planning. Visual aids can significantly enhance this understanding by providing a clear and concise comparison of various repayment options. The following descriptions illustrate how such visuals could effectively present this complex information.

Comparison of Total Interest Paid Across Repayment Plans

This bar chart would compare the total interest paid over the life of a hypothetical $30,000 loan under different repayment plans: Standard, Extended, Graduated, and Income-Driven Repayment (IDR). The horizontal axis would list the repayment plan names, while the vertical axis would represent the total interest paid in dollars. Each bar would represent the total interest accrued for a specific plan. For instance, the Standard Repayment plan bar might show a total interest of $10,000, while the Extended Repayment plan bar might show a lower amount, say $8,000, due to a longer repayment period, but with a trade-off of potentially higher total interest. The IDR plan might show a lower total interest paid than the Standard plan, but possibly a longer repayment period, reflecting its variable payment structure based on income. The visual would clearly show the trade-offs between repayment speed and total interest costs.

Comparison of Monthly Payments Across Repayment Plans

A line graph would effectively illustrate the differences in monthly payments under various repayment plans. The horizontal axis would represent the time in months (or years), and the vertical axis would represent the monthly payment amount in dollars. Multiple lines would represent different repayment plans. For example, the Standard Repayment plan line would show a consistently high monthly payment throughout the repayment period. The Graduated Repayment plan line would begin with a lower monthly payment that gradually increases over time. The Extended Repayment plan line would display a consistently lower monthly payment compared to the Standard plan, but extending over a longer period. The IDR plan line would show fluctuating monthly payments reflecting the income-based adjustments. This visual would clearly demonstrate the variability in monthly expenses associated with each plan.

Last Word

Successfully managing your direct student loan repayment requires a proactive and informed approach. By understanding the various repayment plans available, utilizing effective budgeting strategies, and exploring government assistance programs, you can create a path towards debt elimination. Remember that seeking professional financial advice can provide personalized guidance tailored to your specific circumstances. Take control of your financial future, and embark on a journey towards a debt-free life.

User Queries

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, which has serious financial consequences.

Can I refinance my student loans?

Yes, refinancing can consolidate multiple loans into one with a potentially lower interest rate, but be aware of potential loss of federal benefits.

How do I contact my loan servicer?

Contact information for your loan servicer can be found on your loan documents or the National Student Loan Data System (NSLDS) website.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends payments, but interest usually continues to accrue. Deferment postpones payments, and under certain circumstances, interest may not accrue.