Navigating the complexities of higher education often involves understanding the intricacies of student financing. Direct student loans, a cornerstone of federal financial aid, represent a significant pathway for many aspiring students to pursue their academic goals. This exploration delves into the definition of direct student loans, examining their various forms, eligibility criteria, repayment options, and broader economic impact. We’ll unravel the nuances between subsidized and unsubsidized loans, clarifying the application process and highlighting the crucial role these loans play in shaping both individual financial futures and the national economy.

This guide aims to provide a clear and concise overview of direct student loans, empowering prospective borrowers with the knowledge necessary to make informed decisions about their educational funding. We will cover everything from the initial application to long-term repayment strategies, addressing common questions and misconceptions along the way. By the end, you’ll have a comprehensive understanding of this vital aspect of higher education financing.

Definition of Direct Student Loans

Direct student loans are federal student loans disbursed directly by the U.S. Department of Education to students pursuing higher education. They are a crucial component of financial aid packages, helping students cover tuition, fees, room and board, and other education-related expenses. Unlike private loans, direct loans offer various repayment plans and protections for borrowers.

Direct Loan Characteristics

Direct student loans are characterized by their federal backing, providing several benefits not always found with private loans. These benefits include fixed interest rates, various repayment options, and potential for deferment or forbearance during periods of financial hardship. The loan terms, including interest rates and repayment periods, are established by the federal government and are generally more favorable than those offered by private lenders. The amount a student can borrow is determined by factors such as their year in school, dependency status, and the cost of attendance at their chosen institution.

Subsidized vs. Unsubsidized Direct Loans

The primary distinction between subsidized and unsubsidized direct loans lies in interest accrual. With subsidized loans, the government pays the interest while the student is enrolled at least half-time and during grace periods. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, even while the student is in school. This means borrowers of unsubsidized loans will owe more upon graduation unless they choose to make interest payments while studying. Eligibility for subsidized loans is typically based on financial need, as determined by the Free Application for Federal Student Aid (FAFSA).

Direct Loans Compared to Other Student Financial Aid

Direct loans represent one form of student financial aid. Others include grants, scholarships, and work-study programs. Grants and scholarships are generally forms of free money that do not need to be repaid. Work-study provides part-time employment opportunities to help offset education costs. Direct loans, in contrast, are borrowed money that must be repaid with interest. The choice between these options depends on a student’s financial need and overall financial aid package. Many students utilize a combination of these funding sources to finance their education.

Direct Loan Comparison Table

| Loan Type | Interest Accrual | Eligibility Requirements | Repayment Options |

|---|---|---|---|

| Subsidized Direct Loan | Accrues interest only after graduation or leaving school | Demonstrated financial need (based on FAFSA) | Standard, Graduated, Extended, Income-Driven Repayment |

| Unsubsidized Direct Loan | Accrues interest from disbursement | No financial need requirement | Standard, Graduated, Extended, Income-Driven Repayment |

| Parent PLUS Loan | Accrues interest from disbursement | Parent must meet credit requirements | Standard, Graduated, Extended |

| Graduate PLUS Loan | Accrues interest from disbursement | Graduate student must meet credit requirements | Standard, Graduated, Extended, Income-Driven Repayment (for some loans) |

Loan Eligibility and Application Process

Securing a Direct Student Loan involves understanding the eligibility requirements and navigating the application process. This section Artikels the criteria you must meet to be eligible for federal student aid and details the steps involved in applying for and receiving your loan funds.

Eligibility for Direct Student Loans hinges on several key factors. Applicants must be U.S. citizens or eligible non-citizens, enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution, maintain satisfactory academic progress, and possess a valid Social Security number. Furthermore, applicants must demonstrate financial need (for subsidized loans) or meet other creditworthiness requirements (for unsubsidized loans). Specific requirements can vary depending on the type of loan and the applicant’s circumstances.

Eligibility Criteria for Direct Student Loans

Eligibility for federal student aid is determined by several factors, including citizenship status, enrollment status, academic standing, and financial need. The Free Application for Federal Student Aid (FAFSA) is the primary tool used to determine eligibility. Factors such as income, assets, family size, and number of dependents are considered in the calculation of Expected Family Contribution (EFC), which plays a crucial role in determining eligibility for need-based aid. Students are expected to maintain satisfactory academic progress to continue receiving aid; this usually involves meeting minimum grade point average (GPA) and credit hour completion requirements set by their institution.

The Direct Student Loan Application Process

Applying for Direct Student Loans begins with completing the Free Application for Federal Student Aid (FAFSA). This application collects information about the student and their family’s financial situation. Once the FAFSA is processed, the student’s school will receive a Student Aid Report (SAR), which Artikels the student’s eligibility for federal student aid. The school will then use this information to determine the student’s financial aid package, which may include Direct Subsidized and/or Unsubsidized Loans. The student must then accept the loan offer through their school’s financial aid portal, and the funds are typically disbursed directly to the school to cover tuition and fees. Additional loan funds can be disbursed to the student for living expenses.

Required Documentation for the Direct Student Loan Application

The primary document required for applying for Direct Student Loans is the completed Free Application for Federal Student Aid (FAFSA). Supporting documentation may be requested to verify the information provided on the FAFSA, such as tax returns, W-2 forms, and bank statements. The specific documents required will vary depending on individual circumstances. It’s important to provide accurate and complete information to expedite the application process.

Completing the Free Application for Federal Student Aid (FAFSA)

Completing the FAFSA is a crucial step in the financial aid process. A step-by-step guide follows:

- Gather necessary information: Collect tax returns, W-2 forms, bank statements, and other relevant financial documents for both the student and their parents (if applicable).

- Create an FSA ID: Both the student and a parent (if applicable) will need an FSA ID, which is a username and password used to access the FAFSA website and electronically sign the application.

- Complete the FAFSA online: Access the FAFSA website (studentaid.gov) and complete the application accurately and completely. This includes providing personal information, educational information, and financial information.

- Review and submit: Carefully review the completed application for accuracy before submitting. Once submitted, you cannot make changes without contacting the federal student aid office.

- Track your application: Monitor the status of your application through the FAFSA website or your school’s financial aid portal.

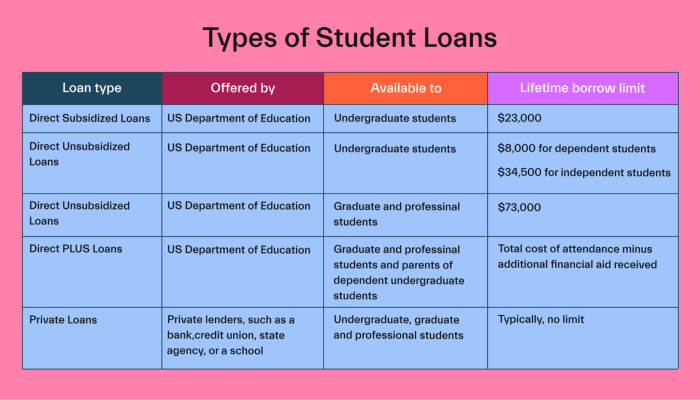

Types of Direct Student Loans

The federal government offers several types of direct student loans, each with its own eligibility requirements, interest rates, and repayment terms. Understanding these differences is crucial for students to make informed borrowing decisions and manage their student loan debt effectively. Choosing the right loan type can significantly impact the overall cost of your education.

The primary types of federal direct student loans are categorized based on the borrower’s financial need and educational status. These categories help determine eligibility and loan limits.

Direct Subsidized Loans

Direct Subsidized Loans are need-based loans. This means your eligibility is determined by your demonstrated financial need as calculated by the Free Application for Federal Student Aid (FAFSA). The government pays the interest on these loans while you are in school at least half-time, during grace periods, and during periods of deferment.

- Key Feature: Need-based eligibility.

- Advantage: Government pays interest during certain periods.

- Disadvantage: Lower loan limits compared to unsubsidized loans; eligibility depends on financial need.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are not need-based. Any student can borrow these loans regardless of their financial need. Interest accrues (adds up) on these loans from the time the loan is disbursed, even while the borrower is in school. The borrower is responsible for paying this accumulated interest.

- Key Feature: Available to all students, regardless of financial need.

- Advantage: Higher loan limits compared to subsidized loans.

- Disadvantage: Interest accrues from disbursement; borrower is responsible for all interest.

Direct PLUS Loans

Direct PLUS Loans are available to graduate and professional students, and to parents of undergraduate students. These loans are credit-based; the borrower must pass a credit check to be eligible. Interest accrues on these loans from the time the loan is disbursed.

- Key Feature: Credit check required; available to graduate/professional students and parents.

- Advantage: Can help cover costs not covered by other loans.

- Disadvantage: Higher interest rates than subsidized and unsubsidized loans; credit check can be a barrier.

Interest Rates and Repayment Terms

Interest rates for Direct Subsidized, Unsubsidized, and PLUS loans vary depending on the loan disbursement date. The Department of Education sets these rates annually. Repayment typically begins six months after the borrower graduates, leaves school, or drops below half-time enrollment (grace period). Several repayment plans are available, including standard, graduated, extended, and income-driven repayment plans, each offering different monthly payments and overall repayment durations. For example, a standard repayment plan might have a 10-year term, while an extended repayment plan could stretch to 25 years. The specific interest rate and repayment terms will be detailed in the loan promissory note.

Loan Repayment and Default

Successfully navigating the repayment phase of your student loans is crucial to avoiding financial hardship. Understanding the available repayment plans and the serious consequences of default is essential for responsible loan management. This section details the various repayment options and the repercussions of failing to meet your repayment obligations.

Repayment Plan Options

Several repayment plans are designed to accommodate varying financial situations. The best plan for you depends on your income, loan amount, and personal financial goals. Choosing the right plan can significantly impact your monthly payments and overall repayment period.

- Standard Repayment Plan: This is the most common plan, requiring fixed monthly payments over a 10-year period. Payments are typically higher than other plans but result in the fastest repayment.

- Graduated Repayment Plan: Payments start low and gradually increase over time, making them more manageable initially. However, the total repayment period is still 10 years.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR) Plans: These plans link your monthly payment to your income and family size. Several IDR plans exist (e.g., ICR, PAYE, REPAYE,IBR), each with its own calculation method. Payments are typically lower than other plans, but the repayment period may extend beyond 20 or 25 years. Remaining balances may be forgiven after a specific period (usually 20 or 25 years, depending on the plan), but this forgiveness is considered taxable income.

Repayment Scenarios

Let’s consider examples illustrating the differences between repayment plans. Assume a $30,000 loan with a 5% interest rate.

| Repayment Plan | Monthly Payment (Estimate) | Total Repayment (Estimate) | Repayment Period |

|---|---|---|---|

| Standard | $317 | $38,040 | 10 years |

| Graduated | Starts at ~$200, increases over time | $38,040 (approximately) | 10 years |

| Extended | ~$158 | >$38,040 | 25 years |

| IDR (Example – PAYE) | Varies based on income | Varies, potential forgiveness | 20-25 years |

*Note: These are estimates. Actual payments will vary based on interest rates, loan type, and individual circumstances.*

Consequences of Default

Defaulting on your student loans has severe consequences. These include:

- Damage to Credit Score: A significant negative impact on your credit history, making it difficult to obtain loans, credit cards, or even rent an apartment.

- Wage Garnishment: The government can garnish your wages to recover the debt.

- Tax Refund Offset: Your tax refund can be seized to pay off the debt.

- Difficulty Obtaining Federal Benefits: Access to federal benefits like passports and professional licenses may be restricted.

- Collection Agency Involvement: The debt may be sold to a collection agency, resulting in further fees and aggressive collection tactics.

Monthly Payment Calculation

Precise monthly payment calculations require specialized loan amortization calculators readily available online. These calculators consider the loan amount, interest rate, and repayment plan to provide accurate monthly payment estimates. For example, a standard repayment plan calculator would take the loan principal, interest rate, and 10-year repayment period as inputs to determine the fixed monthly payment. Different calculators are available for different repayment plans, offering individualized results based on chosen parameters. For IDR plans, income verification and family size are additional inputs that influence the calculation. Using these calculators ensures accurate estimations.

Governmental Agencies and Regulations

The federal government plays a significant role in managing and regulating the Direct Student Loan program, ensuring its accessibility and responsible administration. Several agencies work together to oversee various aspects of the program, from loan disbursement to debt collection. Understanding the roles of these agencies and the relevant regulations is crucial for both borrowers and lenders.

The Department of Education is the primary agency responsible for the Direct Student Loan program. It sets the policies, manages the funds, and oversees the overall administration of the program. Other agencies, such as the Federal Student Aid (FSA), a part of the Department of Education, handle the day-to-day operations, including processing applications, disbursing funds, and managing loan repayment. The role of these agencies extends to ensuring compliance with federal regulations and laws related to student lending.

The Department of Education’s Role in Student Loan Programs

The Department of Education’s primary function within the Direct Student Loan program is to establish and maintain the program’s framework. This includes setting eligibility criteria for borrowers, determining interest rates and repayment plans, and enforcing regulations to protect both borrowers and taxpayers. The Department also conducts oversight of loan servicers, ensuring they adhere to established standards and treat borrowers fairly. Furthermore, the Department is responsible for managing the overall budget allocated to the program and for reporting to Congress on its performance and effectiveness. This comprehensive oversight aims to ensure the program’s long-term sustainability and its ability to effectively serve students pursuing higher education.

Key Federal Regulations and Laws Governing Direct Student Loans

Several federal laws and regulations govern the Direct Student Loan program, designed to protect borrowers and maintain the integrity of the program. The Higher Education Act of 1965, as amended, serves as the foundational legislation for federal student aid programs, including Direct Loans. This act Artikels the general framework for student financial assistance and establishes the eligibility requirements and responsibilities of both borrowers and lenders. Regulations promulgated under this act specify details concerning loan disbursement, repayment plans, default procedures, and borrower protections. These regulations are regularly updated to reflect changes in the economic climate and to address evolving needs within the higher education landscape. The Department of Education’s website provides access to these regulations and updates.

Summary of Key Regulations and Their Implications for Borrowers

| Regulation/Law | Description | Implications for Borrowers |

|---|---|---|

| Higher Education Act of 1965 | Establishes the framework for federal student aid programs. | Defines eligibility criteria, repayment terms, and borrower rights. |

| Truth in Lending Act (TILA) | Requires lenders to disclose loan terms clearly and accurately. | Ensures borrowers understand the total cost of their loans before borrowing. |

| Fair Credit Reporting Act (FCRA) | Governs how credit information is collected, used, and disclosed. | Protects borrowers’ credit information and ensures accuracy in credit reports. |

| The Consolidated Appropriations Act, 2023 (and other annual appropriations acts) | Sets the annual budget for federal student aid programs, including interest rates and funding levels. | Impacts the amount of available funding, interest rates on loans, and the availability of certain repayment plans. |

Impact of Direct Student Loans on Students and the Economy

Direct student loans, while enabling access to higher education, have profound and multifaceted impacts on both individual students and the broader economy. The long-term financial implications for borrowers, the accessibility of higher education, and the overall economic effects are significant and deserve careful consideration.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can significantly impact a borrower’s financial well-being for many years after graduation. High levels of debt can delay major life milestones such as homeownership, starting a family, and retirement planning. The burden of monthly payments can restrict spending on other necessities, potentially impacting overall quality of life. For example, a recent study showed that individuals with high student loan debt were more likely to delay marriage and homeownership compared to their peers without such debt. Furthermore, the interest accrued on these loans can substantially increase the total amount owed, compounding the financial strain. Defaulting on student loans has severe consequences, including damage to credit scores, wage garnishment, and difficulty securing future loans.

Impact of Direct Student Loans on Higher Education Accessibility

Direct student loans have undeniably increased access to higher education for many individuals who might otherwise not have been able to afford it. By providing financial assistance, these loans allow students from diverse socioeconomic backgrounds to pursue post-secondary education. However, the rising cost of tuition and the increasing reliance on loans have also created concerns about affordability. The accessibility benefit is somewhat counterbalanced by the potential for students to take on unsustainable levels of debt, leading to long-term financial hardship. The expansion of loan programs hasn’t necessarily kept pace with the escalating cost of college, leading to a situation where students need to borrow more to cover even basic expenses.

Economic Effects of Student Loan Debt on Individuals and the National Economy

The accumulation of student loan debt has broad economic consequences. At the individual level, it can hinder economic mobility, limiting opportunities for entrepreneurship, homeownership, and investment. At the national level, high levels of student loan debt can slow economic growth by reducing consumer spending and investment. The burden of repayment can decrease overall disposable income, affecting the demand for goods and services. Furthermore, the potential for widespread defaults poses a systemic risk to the financial system. For example, a significant increase in loan defaults could negatively impact the financial institutions holding these loans, potentially leading to broader economic instability.

Visual Representation of the Growth of Student Loan Debt Over Time

The visual representation would be a line graph. The horizontal axis would represent time, perhaps in five-year increments from, say, 1990 to the present. The vertical axis would represent the total amount of outstanding student loan debt in trillions of dollars. The line itself would show a steadily upward trend, starting relatively low in 1990 and dramatically increasing over time, with clear upward inflection points coinciding with periods of increased tuition costs and expanded loan programs. The graph could include annotations to highlight key events or periods of particularly rapid growth, like the 2008 financial crisis or periods of significant tuition increases. The overall visual impression would be one of consistent and significant growth, emphasizing the magnitude of the issue.

Last Point

In conclusion, understanding direct student loans is crucial for anyone considering higher education. From the initial application process and the differences between loan types to the various repayment plans and potential consequences of default, a thorough understanding of these loans is paramount for responsible financial planning. By carefully considering eligibility requirements, comparing loan options, and developing a sound repayment strategy, students can leverage the benefits of direct student loans to achieve their educational aspirations while mitigating potential long-term financial burdens. Remember, informed decision-making is key to navigating the complexities of student loan debt and ensuring a successful financial future.

Q&A

What is the difference between a grace period and deferment?

A grace period is a temporary period after graduation or leaving school before loan repayment begins. Deferment is a postponement of loan payments due to specific circumstances like unemployment or further education.

Can I consolidate my direct student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new interest rate and repayment plan. This can simplify repayment but may not always lower your overall cost.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage to your credit score, and ultimately, loan default, which has severe financial consequences.

Are there income-driven repayment plans available?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers with lower incomes.