Navigating the world of student loans can feel overwhelming, especially when considering private options like Discover student loans. This guide aims to demystify the process, providing a clear and concise overview of Discover’s offerings, from application to repayment. We’ll explore various loan types, interest rates, repayment plans, and crucial considerations to help you make informed decisions about your financial future.

Understanding the nuances of student loan financing is paramount for securing a successful educational journey and a stable financial footing afterward. This comprehensive guide delves into the specifics of Discover student loans, equipping you with the knowledge to navigate the complexities of borrowing responsibly and effectively managing your debt.

Understanding Discover Student Loans

Discover offers a range of student loan products designed to help students finance their education. Understanding the nuances of these loans, including their types, eligibility criteria, and repayment options, is crucial for prospective borrowers to make informed decisions. This section provides a clear overview of these key aspects.

Discover Student Loan Types

Discover primarily offers two main types of student loans: federal student loans and private student loans. Federal student loans are backed by the government, offering benefits like flexible repayment plans and potential loan forgiveness programs. Private student loans, on the other hand, are offered by private lenders like Discover and are subject to varying terms and conditions. The specific loan type available to a student depends on their financial need and eligibility.

Eligibility Requirements for Discover Student Loans

Eligibility criteria for Discover student loans vary depending on the type of loan. Federal student loans typically require students to demonstrate financial need through the FAFSA (Free Application for Federal Student Aid) process. Specific requirements can include enrollment at an eligible institution, maintaining satisfactory academic progress, and being a U.S. citizen or eligible non-citizen. Private student loans from Discover generally require a creditworthy co-signer, particularly for undergraduate students, and may have additional requirements such as a minimum credit score or a demonstrable ability to repay the loan. Graduate students may have different eligibility requirements than undergraduates.

Comparison of Discover Student Loan Interest Rates

Discover student loan interest rates are competitive but vary depending on several factors, including the type of loan (federal vs. private), creditworthiness of the borrower (or co-signer), and the loan term. Generally, federal student loans offer lower interest rates compared to private student loans. Direct comparison with other lenders requires checking current interest rate offerings from each lender, as rates are subject to change. For example, a hypothetical scenario could show Discover offering a 6% interest rate on a private loan while another lender offers 7%. However, this is only an example and does not reflect current rates. Always consult the lender’s website for the most up-to-date information.

Discover Student Loan Repayment Plans

Discover offers various repayment plans to accommodate different financial situations. These typically include standard repayment plans (fixed monthly payments over a set period), graduated repayment plans (payments start low and increase over time), and extended repayment plans (longer repayment periods with lower monthly payments). Specific repayment plan options and their terms are Artikeld in the loan agreement. For instance, a borrower might choose a 10-year standard repayment plan or a 20-year extended repayment plan, depending on their comfort level and financial capabilities. Borrowers should carefully consider their financial situation and choose a plan that aligns with their long-term goals.

Applying for a Discover Student Loan

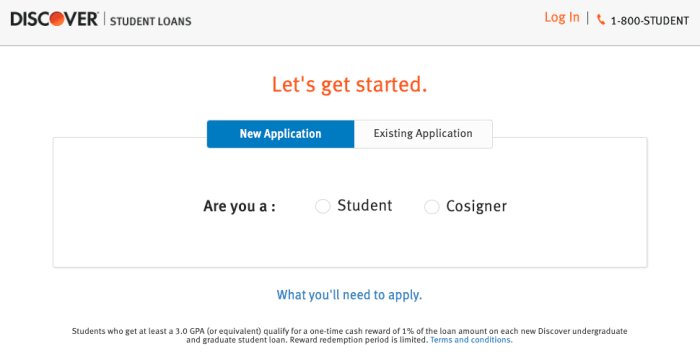

Securing a Discover student loan involves a straightforward application process designed for ease of use. The entire process, from initial application to loan disbursement, is typically managed online, offering convenience and transparency throughout. Understanding the steps involved will help you navigate the process efficiently and ensure a smooth application.

The application process for a Discover student loan is primarily online. Applicants begin by completing a pre-qualification form, which provides an estimate of their potential loan amount and interest rate without impacting their credit score. This allows applicants to explore their options and understand potential loan terms before proceeding with a full application. Following pre-qualification, applicants complete a formal application, providing detailed financial and academic information. This information is then reviewed by Discover, and if approved, the loan is disbursed directly to the educational institution.

The Step-by-Step Application Process

The Discover student loan application process can be broken down into several key steps. First, gather all necessary documentation (detailed in the next section). Then, complete the online pre-qualification form, providing basic information such as your education level, intended school, and estimated expenses. After reviewing your pre-qualification results, proceed to the full online application, providing more detailed financial information and academic records. Finally, you will need to accept the loan terms and await disbursement. The entire process is designed to be intuitive and user-friendly.

Required Documents for a Discover Student Loan Application

It’s crucial to have the necessary documents readily available before beginning the application. This will streamline the process and prevent delays. Missing documentation can significantly prolong the application timeline.

- Social Security Number (SSN): This is essential for verifying your identity and credit history.

- Driver’s License or State-Issued ID: Used for identity verification purposes.

- Proof of Enrollment: An acceptance letter or enrollment confirmation from your chosen school.

- Federal Student Aid (FAFSA) Data: This provides information on your financial need and eligibility for federal student aid.

- Parent Information (if applicable): For dependent students, information regarding parents’ income and assets will be required.

Information Needed for Accurate and Efficient Application Completion

To ensure a smooth and efficient application, you should gather all relevant financial and academic information beforehand. Accuracy is paramount to avoid delays or potential rejections.

- Personal Information: Full name, address, contact information, date of birth.

- Financial Information: Income, assets, debts, and credit history (if applicable).

- Educational Information: School name, program of study, anticipated graduation date.

- Loan Amount Request: An accurate estimate of the funds needed to cover educational expenses.

The Verification Process and Borrower Expectations

After submitting your application, Discover will begin the verification process. This involves checking the information provided against various databases to ensure accuracy and eligibility. Expect to provide additional documentation if requested. This might include tax returns, pay stubs, or bank statements. The verification process typically takes several business days. Discover will notify you of the status of your application and any necessary actions. During this time, it’s important to remain responsive to any requests for further information from Discover.

Managing Your Discover Student Loan

Successfully managing your Discover student loan requires careful planning and proactive strategies. Understanding your repayment options, budgeting effectively, and staying organized are crucial for avoiding late payments and minimizing long-term financial burdens. This section will provide practical guidance and resources to help you navigate this important process.

Sample Student Budget Incorporating Loan Repayments

A well-structured budget is essential for managing student loan payments. This example demonstrates how a student might allocate their monthly income, factoring in their loan repayment:

| Income | Amount |

|---|---|

| Part-time Job | $1000 |

| Summer Internship (seasonal) | $1500 |

| Expenses | Amount |

| Rent/Housing | $600 |

| Groceries | $200 |

| Utilities | $100 |

| Transportation | $150 |

| Student Loan Payment | $250 |

| Books/Supplies | $50 |

| Savings | $150 |

This budget demonstrates a realistic allocation of funds, prioritizing essential expenses and incorporating a dedicated amount for loan repayment. The inclusion of savings highlights the importance of financial security alongside loan management. Remember that this is a sample budget and should be adjusted based on your individual income and expenses.

Effective Budgeting and Loan Repayment Strategies

Effective budgeting and loan repayment involve several key strategies. Creating a detailed budget, tracking expenses meticulously, and exploring different repayment plans are crucial.

Consider these strategies:

- Track your spending: Use budgeting apps or spreadsheets to monitor your income and expenses. This provides a clear picture of your financial situation, enabling informed decision-making.

- Prioritize loan payments: Treat your loan payments like any other essential expense, ensuring timely payments to avoid late fees and damage to your credit score.

- Explore repayment options: Discover offers various repayment plans. Research these options to find one that best suits your financial situation. This might include income-driven repayment plans, which adjust your monthly payments based on your income.

- Automate payments: Setting up automatic payments ensures timely repayments and eliminates the risk of forgetting due dates.

Avoiding Late Payments and Penalties

Late payments can negatively impact your credit score and lead to penalties. To avoid this, implement the following:

Proactive measures include:

- Set reminders: Use calendar alerts or reminders on your phone to ensure you don’t miss payment deadlines.

- Enroll in auto-pay: Automatic payments ensure on-time payments, regardless of your schedule.

- Budget meticulously: A well-structured budget ensures you have sufficient funds allocated for your loan payment each month.

- Communicate with Discover: If you anticipate difficulty making a payment, contact Discover immediately. They may offer options to avoid late payment penalties.

Resources for Students Struggling with Loan Repayment

Students facing difficulties with loan repayment can access several resources:

Several avenues for support are available:

- Discover’s customer service: Contact Discover directly to discuss your situation and explore potential solutions, such as deferment or forbearance.

- Financial aid office: Your college or university’s financial aid office can provide guidance and support in managing your student loans.

- National Student Loan Data System (NSLDS): NSLDS provides a centralized database of your federal student loans, offering a comprehensive overview of your loan details.

- Non-profit credit counseling agencies: These agencies offer free or low-cost financial counseling and can help you create a budget and develop a repayment plan.

Discover Student Loan Repayment Options

Choosing the right repayment plan for your Discover student loan is crucial for managing your debt effectively and avoiding financial hardship. Several options are available, each with its own set of advantages and disadvantages. Understanding these differences will help you make an informed decision that aligns with your financial situation and goals.

Discover offers a variety of repayment plans to accommodate different borrowers’ needs and financial situations. The optimal choice depends heavily on factors such as your income, employment status, and overall financial goals. Careful consideration of these factors is essential before selecting a plan.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most Discover student loans. Under this plan, you’ll make fixed monthly payments over a period of 10 years. This plan offers predictability and allows for consistent budgeting, making it a suitable choice for borrowers with stable income and a desire for a shorter repayment period. However, the fixed monthly payments may be higher compared to other plans, especially if you borrowed a substantial amount.

Extended Repayment Plan

This plan extends the repayment period beyond the standard 10 years, potentially lowering your monthly payments. This can be beneficial for borrowers with lower incomes or those facing financial challenges. However, extending the repayment period will result in paying significantly more in interest over the life of the loan. For example, a $30,000 loan at 7% interest could cost you thousands more in interest over a 20-year extended plan compared to a 10-year standard plan.

Income-Driven Repayment Plan

Discover may offer income-driven repayment plans, though the specifics might vary. These plans typically base your monthly payment on your income and family size. If your income is low, your monthly payment may be significantly reduced, or even zero in some cases. However, the remaining balance may be forgiven after a specific period (often 20 or 25 years), but this forgiven amount is usually considered taxable income. The lower monthly payments come at the cost of a potentially longer repayment period and the tax implications of loan forgiveness.

Deferment and Forbearance

Discover offers temporary options to postpone or reduce your monthly payments during times of financial hardship. Deferment postpones payments entirely, while forbearance reduces them. These options are not designed for long-term use and should be considered only as temporary relief. Interest may still accrue during deferment or forbearance, increasing the total loan cost. It is crucial to contact Discover promptly if you anticipate needing to use these options.

Consequences of Defaulting on a Discover Student Loan

Defaulting on a Discover student loan has serious financial repercussions. This includes damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your paycheck is seized to repay the debt, is also a possibility. Furthermore, the debt may be referred to collections agencies, leading to additional fees and legal action. The long-term consequences of default can significantly impact your financial well-being. Preventing default requires proactive management of your student loans and communication with Discover if you face financial difficulties.

Discover Student Loan Customer Service

Navigating the world of student loans can sometimes feel overwhelming, and having reliable customer service is crucial. Discover Student Loans offers several avenues for borrowers to access support, addressing questions, concerns, and resolving any issues that may arise. Understanding these options and how to effectively utilize them can significantly improve your loan management experience.

Contacting Discover Student Loan Customer Service

Discover provides multiple ways to connect with their customer service team. These options cater to different preferences and levels of urgency. Choosing the most appropriate method depends on the nature of your inquiry and your preferred communication style.

Methods of Contact and Response Times

| Contact Method | Response Time | Accessibility | Pros | Cons |

|---|---|---|---|---|

| Phone | Generally immediate, may vary depending on call volume | Available during specified business hours | Quick resolution for urgent matters, direct interaction with a representative | Potential for long hold times, limited availability outside business hours |

| Typically within 1-2 business days, may be longer depending on complexity | Accessible 24/7 | Provides a written record of the communication, allows for more detailed explanations | Slower response than phone, may require follow-up | |

| Online Chat | Usually immediate or within a few minutes during business hours | Available during specified business hours | Convenient and quick for simple questions, immediate interaction | May not be suitable for complex issues, availability limited to business hours |

Customer Service Experiences

Anecdotal evidence suggests a mixed bag of experiences with Discover’s customer service. Some borrowers report positive interactions, praising the helpfulness and efficiency of representatives in resolving their issues. For example, one borrower recounted a quick resolution to a billing discrepancy through a phone call, with the representative promptly correcting the error and providing clear explanations. Conversely, other experiences have been less positive, citing long wait times on the phone or delayed responses to emails. One example includes a borrower waiting over a week for a response to an email regarding a loan modification request. These varying experiences highlight the importance of persistence and utilizing multiple contact methods if necessary.

Tips for Efficient Issue Resolution

To ensure a smoother experience when contacting Discover student loan customer service, several strategies can be employed. First, gather all relevant information before contacting them, including your account number, loan details, and a clear description of the issue. Second, choose the appropriate contact method based on the urgency and complexity of your issue. Third, be persistent and follow up if you don’t receive a timely response. Finally, keep detailed records of all communication, including dates, times, and the names of representatives you spoke with. This documentation can be invaluable if further action is needed.

Alternatives to Discover Student Loans

Choosing the right student loan is a crucial decision impacting your financial future. While Discover offers a range of student loan options, exploring alternatives is essential to find the best fit for your individual circumstances and financial profile. Understanding the differences between federal and private loans, and comparing offerings from various lenders, will empower you to make an informed choice.

Exploring alternatives to Discover student loans involves comparing their features against federal student loan programs and other private lenders. This comparison considers factors such as interest rates, repayment options, and eligibility requirements. The ultimate choice depends on your creditworthiness, financial need, and long-term financial goals.

Federal Student Loans versus Discover Student Loans

Federal student loans, offered through the U.S. Department of Education, often present significant advantages over private loans like those from Discover. Federal loans typically have more flexible repayment options, including income-driven repayment plans that adjust payments based on your income and family size. They also offer borrower protections, such as loan forgiveness programs under certain circumstances (e.g., public service loan forgiveness). However, federal loans may have higher interest rates than private loans for borrowers with excellent credit. Discover student loans, being private loans, are subject to credit checks and may require a co-signer if the applicant’s credit history is insufficient. Eligibility for federal loans is based on financial need and enrollment in an eligible educational program, while eligibility for private loans is primarily based on creditworthiness.

Other Private Student Loan Lenders and Their Offerings

Several other private lenders offer student loans, each with its own set of terms and conditions. Examples include Sallie Mae, Citizens Bank, and PNC Bank. These lenders often compete on interest rates and repayment options, potentially offering lower rates to borrowers with strong credit scores. It’s crucial to compare interest rates, fees, and repayment terms across multiple lenders before making a decision. Some lenders might specialize in specific types of loans, such as loans for graduate students or professional programs. Understanding the nuances of each lender’s offerings is key to finding the best fit.

Advantages and Disadvantages of Private versus Federal Loans

Choosing between private and federal student loans involves weighing several factors. Federal loans generally offer greater borrower protections and more flexible repayment options, including income-driven repayment plans that can lower monthly payments. However, they may have higher interest rates for borrowers with excellent credit. Private loans, like those from Discover, may offer lower interest rates to borrowers with strong credit, but they lack the same borrower protections and flexible repayment options as federal loans. The decision depends on your individual creditworthiness, financial situation, and risk tolerance.

Key Differences Between Discover and Other Prominent Lenders

The following points highlight key differences between Discover and other prominent student loan lenders. Remember that these are general comparisons and specific terms can vary depending on the individual loan product and the borrower’s profile.

- Interest Rates: Discover’s interest rates are competitive but may vary based on creditworthiness. Other lenders, such as Sallie Mae, might offer lower rates to borrowers with excellent credit, while others may have higher rates for borrowers with less-established credit.

- Repayment Options: Discover offers standard repayment plans, but the range of options might be less extensive compared to some other lenders or federal loan programs which may include income-driven repayment plans.

- Fees: Discover charges certain fees (origination fees, late payment fees, etc.). It’s crucial to compare the fee structures of Discover with other lenders to identify potential cost savings.

- Customer Service: The quality of customer service can vary across lenders. Researching reviews and comparing customer service ratings can help you make an informed decision.

- Eligibility Requirements: Eligibility criteria for Discover and other private lenders typically depend heavily on credit history and score. Federal loans have different eligibility requirements based on financial need and enrollment status.

The Impact of Discover Student Loans on Students’ Financial Future

Taking out student loans, whether through Discover or another lender, can significantly influence a student’s financial trajectory for years to come. Understanding the long-term implications is crucial for making informed borrowing decisions and developing effective strategies for managing debt. While student loans can provide access to higher education and potentially higher earning potential, they also carry considerable financial responsibility that requires careful planning and responsible management.

Student loan debt, if not managed effectively, can cast a long shadow over a graduate’s financial future. The repayment process can extend for many years, impacting savings goals, major purchases like a home or car, and even the ability to start a family. The interest accrued over time can substantially increase the total amount owed, further complicating financial planning.

Long-Term Financial Implications of Student Loan Debt

The long-term financial impact of student loans is multifaceted. Repayment obligations often begin shortly after graduation, competing with other essential expenses such as rent, groceries, and transportation. This can lead to financial strain, especially if the chosen career path doesn’t immediately provide a high income. The weight of monthly payments can delay major life milestones, such as buying a home or investing in retirement, potentially impacting long-term wealth accumulation. For example, a graduate with $50,000 in student loan debt at a 7% interest rate could spend many years making substantial monthly payments, delaying significant savings or investment opportunities.

Impact of Student Loan Debt on Credit Scores

Student loan debt can affect credit scores in both positive and negative ways. On the positive side, consistently making on-time payments demonstrates responsible credit behavior, which boosts credit scores. However, missed or late payments can significantly damage credit scores, impacting future borrowing opportunities, such as mortgages, auto loans, and even credit card applications. A low credit score can also lead to higher interest rates on future loans, increasing the overall cost of borrowing. For instance, a consistently poor payment history can lead to a significantly lower credit score, resulting in higher interest rates on a future mortgage, adding thousands of dollars to the overall cost of the home.

Strategies for Minimizing Long-Term Debt and Maximizing Financial Well-being

Effective strategies for managing student loan debt and improving long-term financial well-being include creating a realistic budget, exploring different repayment plans (such as income-driven repayment), and prioritizing timely payments. Careful financial planning, including budgeting and saving, is crucial. Graduates should also consider exploring opportunities for professional development to increase their earning potential, thus enabling faster loan repayment. For example, budgeting tools and financial planning resources can help graduates track their expenses and create a realistic repayment plan. Additionally, actively seeking higher-paying jobs or professional development opportunities can significantly accelerate the loan repayment process.

Examples of Responsible Borrowing Practices and Improved Financial Outcomes

Responsible borrowing practices include only borrowing what is absolutely necessary, researching various loan options carefully, and understanding the terms and conditions before signing any loan agreements. A graduate who diligently researches different loan options, chooses a loan with a favorable interest rate, and sticks to a strict repayment plan will likely experience better financial outcomes compared to someone who borrows excessively without a plan. For example, comparing interest rates and loan terms from multiple lenders before selecting a loan can save thousands of dollars in interest payments over the life of the loan. Similarly, creating a detailed budget and sticking to it will ensure that loan payments are prioritized, minimizing the risk of late payments and damage to credit scores.

Illustrative Examples of Discover Student Loan Scenarios

Understanding the potential outcomes of different approaches to managing Discover student loans can be incredibly helpful. Let’s examine a few scenarios to illustrate both successful and struggling repayment experiences, and the impact of various factors.

Successful Student Loan Management

Sarah, a recent graduate with a $30,000 Discover student loan at a 6% interest rate, diligently followed a repayment plan. She immediately began making monthly payments above the minimum amount, choosing to make bi-weekly payments instead. She also actively tracked her loan balance and interest accrual online through the Discover student loan portal. By prioritizing her loan repayment and living within her means, Sarah paid off her loan three years ahead of schedule, saving thousands of dollars in interest. This proactive approach minimized the long-term financial burden of her student loan debt.

Struggling Student Loan Repayment

Conversely, Mark, who also graduated with a similar loan amount, struggled with repayment. He only made minimum monthly payments, often late. He faced unexpected expenses, such as car repairs and medical bills, that impacted his ability to make consistent payments. As a result, interest continued to accrue, significantly increasing his total debt. Mark’s inconsistent payments led to higher overall costs and a significantly extended repayment period, creating considerable financial stress. He eventually needed to explore loan deferment options, adding to the complexity of his situation.

Impact of Different Interest Rates on Total Repayment Cost

The interest rate significantly impacts the total cost of a student loan. Consider two scenarios: Loan A has a principal of $25,000 at a 5% interest rate, while Loan B has the same principal but a 7% interest rate. Both loans have a 10-year repayment term. Over the 10 years, Loan A would likely accumulate significantly less interest than Loan B, resulting in a lower total repayment amount. While the exact figures would depend on the specific repayment plan, the higher interest rate on Loan B would lead to a substantially larger total repayment cost. This highlights the importance of securing the lowest possible interest rate when borrowing.

Impact of Various Repayment Options on Repayment Period

Choosing the right repayment plan can dramatically alter the loan repayment timeline. Let’s assume a $20,000 loan. A standard 10-year repayment plan will result in higher monthly payments but a shorter repayment period compared to a longer-term plan, such as a 15-year plan. The longer plan will have lower monthly payments, but the total interest paid will be substantially higher due to the extended repayment period. An accelerated repayment plan, where the borrower makes extra payments or larger payments, will shorten the repayment period considerably, saving on overall interest costs. The choice depends on individual financial circumstances and priorities.

Last Point

Securing a higher education often involves leveraging student loans, and choosing the right lender is a significant decision. This exploration of Discover student loans has provided a framework for understanding the application process, managing repayments, and exploring alternative options. Remember, responsible borrowing practices are key to long-term financial health. By carefully weighing the advantages and disadvantages of various loan types and repayment plans, you can confidently navigate your student loan journey and build a secure financial future.

Quick FAQs

What credit score is needed for a Discover student loan?

Discover doesn’t publicly state a minimum credit score requirement, but a good credit history generally improves approval chances and secures better interest rates. A co-signer with good credit can help if your credit is limited.

Can I refinance my Discover student loan?

Yes, once your loans are in repayment, you may be eligible to refinance your Discover student loans with Discover or another lender. This could potentially lower your interest rate, but be sure to compare offers carefully.

What happens if I miss a Discover student loan payment?

Missing payments can result in late fees, negatively impact your credit score, and potentially lead to loan default. Contact Discover immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

Does Discover offer loan forgiveness programs?

Discover does not offer loan forgiveness programs in the same way as federal student loan programs. However, they may offer hardship assistance programs depending on your circumstances. Contact customer service to discuss your options.