Navigating the world of student loans can be daunting, but understanding your options is key to a successful financial future. This guide delves into the specifics of Discover student loans, offering a clear overview of their products, eligibility requirements, benefits, and drawbacks. We’ll explore various repayment plans, customer service experiences, and even potential loan forgiveness programs, equipping you with the knowledge to make informed decisions about your student loan journey.

From comparing Discover’s offerings to those of other lenders to providing practical advice on budgeting and debt management, this resource aims to empower you with the information necessary to confidently manage your student loan debt. We’ll cover everything from application processes to strategies for minimizing your overall loan cost, ensuring you’re well-prepared for the financial aspects of your education.

Discover Student Loan Products

Discover offers a range of student loan products designed to help students finance their education. These loans are generally characterized by competitive interest rates and flexible repayment options, although specific details are subject to change and depend on individual creditworthiness and the prevailing market conditions. It’s crucial to review the most up-to-date information directly on Discover’s website before making any decisions.

Discover Student Loan Types and Features

Discover primarily offers two main types of student loans: private student loans and Parent PLUS loans. Private student loans are available to students pursuing undergraduate or graduate degrees, while Parent PLUS loans are specifically designed for parents borrowing to help finance their children’s education. Both loan types have varying interest rates and repayment plans, tailored to individual circumstances. The interest rate you qualify for will depend on your credit history, the loan amount, and the prevailing market conditions at the time of application.

Interest Rates and Repayment Options

Interest rates for Discover student loans are variable, meaning they can fluctuate over the life of the loan. The specific rate offered will be determined during the application process based on your creditworthiness. Repayment options generally include standard repayment plans (fixed monthly payments over a set period), graduated repayment plans (payments increase over time), and extended repayment plans (longer repayment periods resulting in lower monthly payments but potentially higher overall interest paid). Discover may also offer other repayment options, such as income-driven repayment, which links your monthly payments to your income. It’s essential to carefully consider each option and its long-term financial implications.

Comparison with Other Lenders

Compared to other major lenders, Discover student loans often compete favorably in terms of interest rates and repayment flexibility. However, direct comparisons are difficult because interest rates and loan terms are constantly changing and vary significantly based on individual applicant qualifications. Some lenders might offer slightly lower rates for borrowers with excellent credit, while others may provide more diverse repayment options. It’s advisable to compare offers from several lenders before deciding on a loan. Factors beyond interest rates, such as customer service, online tools, and the lender’s reputation, should also be considered.

Key Features Comparison Table

The following table compares three hypothetical Discover student loan options, illustrating the potential variation in interest rates, fees, and repayment terms. Remember, these are examples only and actual rates and terms will vary based on individual circumstances and market conditions. Always check the most current information on Discover’s website.

| Loan Type | Interest Rate (Example) | Origination Fee (Example) | Repayment Term (Example) |

|---|---|---|---|

| Undergraduate Private Loan | 6.5% Variable | 1% of loan amount | 10 years |

| Graduate Private Loan | 7.0% Variable | 1.5% of loan amount | 15 years |

| Parent PLUS Loan | 7.5% Variable | 1% of loan amount | 10 years |

Benefits and Drawbacks of Discover Student Loans

Choosing the right student loan can significantly impact your financial future. Discover offers a range of student loan products, but it’s crucial to weigh the advantages and disadvantages before committing. This section will explore the benefits and drawbacks of Discover student loans, comparing them to federal student loan options to help you make an informed decision.

Advantages of Discover Student Loans

Discover student loans offer several attractive features. Many borrowers appreciate the competitive interest rates Discover often provides, potentially leading to lower overall borrowing costs compared to other private lenders. Additionally, some Discover loan options include flexible repayment plans, allowing borrowers to tailor their payments to their budget. Discover’s customer service is also frequently praised for its responsiveness and helpfulness, a significant advantage when navigating the complexities of student loan repayment. Furthermore, Discover may offer certain benefits or rewards programs that can add value to the loan experience.

Disadvantages and Limitations of Discover Student Loans

While Discover offers several advantages, potential drawbacks should be considered. Unlike federal student loans, Discover student loans typically do not offer income-driven repayment plans or loan forgiveness programs. This means that borrowers may face challenges if they experience financial hardship after graduation. Moreover, interest rates on private student loans, including those from Discover, can be variable, meaning your monthly payment could fluctuate. Finally, the application process for private loans might be more stringent compared to federal loans, potentially requiring a higher credit score or a co-signer.

Comparison with Federal Student Loans

Federal student loans generally offer greater borrower protections than private loans like those from Discover. Federal loans often include income-driven repayment plans, deferment options, and loan forgiveness programs for certain professions. These protections are crucial for borrowers who may face financial uncertainty after graduation. However, federal loans may have slightly higher interest rates in some cases than competitive private loan options, depending on the borrower’s creditworthiness and market conditions. A direct comparison of interest rates and repayment options from both federal and Discover loan programs is essential before making a final decision. Consider the long-term implications of each loan type, factoring in potential changes to your financial situation.

Pros and Cons of Discover Student Loans

| Pros | Cons |

|---|---|

| Potentially lower interest rates compared to some other private lenders | No income-driven repayment plans or loan forgiveness programs |

| Flexible repayment options | Variable interest rates possible |

| Often praised customer service | More stringent application process than federal loans |

| Potential for rewards programs | Lack of the same borrower protections as federal loans |

Repayment Options and Financial Planning

Managing your Discover student loan effectively requires understanding your repayment options and developing a solid financial plan. Careful planning can minimize stress and ensure timely repayment, ultimately improving your financial health. This section Artikels available repayment plans and strategies for effective debt management.

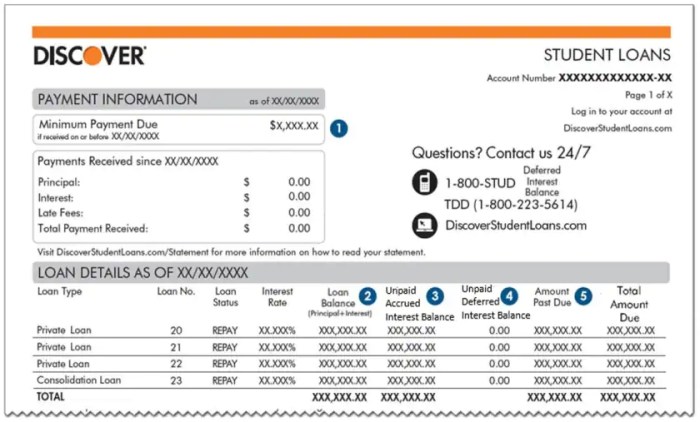

Discover Student Loan Repayment Plans

Discover offers several repayment plans to accommodate varying financial situations. The specific options available may depend on your loan type and terms. Generally, these include standard repayment plans, graduated repayment plans, and possibly income-driven repayment plans (IDR). Standard plans involve fixed monthly payments over a set period, typically 10-15 years. Graduated plans begin with lower monthly payments that gradually increase over time. IDR plans tie monthly payments to your income, offering potentially lower payments but potentially extending the repayment period. It’s crucial to carefully review your loan documents and contact Discover directly to determine which plans are available for your specific loan.

Creating a Realistic Repayment Budget

A realistic repayment budget is fundamental to successful student loan repayment. This involves assessing your monthly income, expenses, and the amount of your student loan payments. Creating a detailed budget allows you to identify areas where you can potentially reduce expenses or increase income to accommodate your loan payments without compromising your essential needs. Consider using budgeting apps or spreadsheets to track your income and expenses, providing a clear picture of your financial situation. Unexpected expenses should also be factored into the budget, creating a contingency fund to prevent loan payment defaults.

Strategies for Managing Student Loan Debt Effectively

Effective student loan debt management involves proactive strategies beyond simply making monthly payments. These include exploring options for loan refinancing to potentially secure a lower interest rate, resulting in lower overall repayment costs. Another effective strategy is making extra payments whenever possible, accelerating the repayment process and reducing the total interest paid. Regularly reviewing your loan statements and maintaining open communication with your lender is crucial to ensure accuracy and address any issues promptly. Finally, prioritizing high-interest loans for faster repayment can significantly reduce long-term costs.

Sample Repayment Plan

The following table illustrates different repayment scenarios, highlighting the impact of loan amount, interest rate, and repayment term on monthly payments and total repayment costs. These are illustrative examples and your actual repayment amounts may vary.

| Loan Amount | Interest Rate | Monthly Payment (10-year term) | Total Repayment (10-year term) |

|---|---|---|---|

| $20,000 | 5% | $212.47 | $25,496.40 |

| $30,000 | 7% | $344.35 | $41,322.00 |

| $40,000 | 6% | $428.60 | $51,432.00 |

Customer Service and Support

Discover Student Loans offers various customer service channels designed to assist borrowers throughout their loan journey. Understanding these options and the experiences of other borrowers can help you navigate any challenges effectively. Access to prompt and helpful support is crucial for managing student loan debt successfully.

Discover’s customer service aims to provide comprehensive assistance to borrowers. Their representatives are trained to handle a wide range of inquiries, from basic account information to complex repayment options and troubleshooting technical issues. However, the quality of service can vary based on individual experiences and the specific representative contacted.

Customer Service Channels

Discover provides multiple avenues for borrowers to contact customer support. These options allow for flexibility, catering to different communication preferences and levels of urgency. Choosing the right channel can significantly impact the speed and efficiency of resolving issues.

- Phone Support: Discover offers a dedicated phone number for student loan inquiries. This allows for immediate assistance and the ability to speak directly with a representative. Call wait times can vary depending on the time of day and demand.

- Online Messaging: Through their online portal, borrowers can send secure messages to customer service representatives. This provides a convenient way to ask questions or report issues outside of phone call hours. Response times may vary.

- Email Support: Discover typically provides an email address for contacting customer service. This is useful for non-urgent inquiries or to provide documentation. Response times might be longer than phone or messaging.

- Online Help Center/FAQ: A comprehensive online help center or frequently asked questions (FAQ) section addresses common student loan questions. This self-service option can resolve many issues quickly without needing to contact support directly.

User Experiences and Reviews

Online reviews offer insights into real-world experiences with Discover’s customer service. While many users report positive interactions, praising the helpfulness and responsiveness of representatives, some negative experiences also exist. For example, some users have mentioned longer-than-expected wait times on the phone, while others have experienced difficulties navigating the online portal or receiving timely responses to emails. These varied experiences highlight the importance of being persistent and utilizing multiple channels if necessary to resolve any issues.

Issue Resolution Processes

When contacting Discover customer service, it’s helpful to have your account information readily available. Clearly explaining the issue, providing relevant documentation (if necessary), and noting the desired outcome will facilitate a more efficient resolution process. If the initial interaction doesn’t resolve the problem, escalating the issue to a supervisor or utilizing a different communication channel may be necessary. Maintaining a record of all communications, including dates, times, and summaries of conversations, can be beneficial if further action is required.

Discover Student Loan Forgiveness Programs

Discover, unlike some federal loan providers, does not offer its own dedicated loan forgiveness programs. Their student loans are private loans, and therefore, eligibility for federal loan forgiveness programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness does not apply. However, borrowers may explore other options to manage their debt.

Discover does not offer any loan forgiveness programs directly tied to their student loans. This is a key difference between private and federal student loans. Federal student loans often have forgiveness programs linked to specific professions or circumstances.

Income-Driven Repayment Plans

While not forgiveness, income-driven repayment (IDR) plans offered through federal student loan programs can significantly reduce monthly payments based on your income and family size. If you consolidated your Discover student loans into a federal loan, you might be eligible for these plans. This could lead to loan balances being reduced to zero after 20-25 years of payments, depending on the specific plan. IDR plans don’t forgive the debt; any remaining balance after the repayment period is typically discharged. To determine eligibility, you would need to contact the federal student aid agency.

Bankruptcy

In rare cases, student loan debt may be discharged through bankruptcy. This is an extremely difficult path to pursue, and only granted under very specific and limited circumstances, typically proving undue hardship. This process requires a legal professional, and the success rate is low. The discharge of student loan debt through bankruptcy should be considered a last resort, with careful consideration of its significant implications on your credit score and financial future. A bankruptcy filing would require a legal professional’s assistance and a court ruling.

Deferment and Forbearance

Discover may offer temporary deferment or forbearance options on your student loans under specific circumstances, such as unemployment or financial hardship. These options temporarily suspend or reduce your payments, but they do not forgive the debt. Interest may still accrue during these periods, increasing the total amount owed. The application process usually involves providing documentation of the qualifying circumstance to Discover. For example, proof of unemployment or a doctor’s note regarding a temporary disability might be required.

Illustrative Examples of Loan Scenarios

Understanding the potential costs and repayment options associated with Discover student loans is crucial for effective financial planning. The following scenarios illustrate how different loan amounts, interest rates, and repayment plans can significantly impact the total cost of your education. Remember that these are examples and your individual experience may vary. Always consult the Discover Student Loans website for the most up-to-date information.

Scenario 1: Standard Repayment Plan

This scenario depicts a student borrowing $30,000 for tuition and living expenses at a 6% fixed annual interest rate. They choose the standard 10-year repayment plan. The monthly payment would be approximately $330.24, resulting in a total repayment of approximately $39,629. This includes the principal loan amount plus the accumulated interest over the 10-year repayment period. This example assumes no prepayment and consistent monthly payments.

Scenario 2: Extended Repayment Plan

This scenario uses the same $30,000 loan amount at a 6% fixed annual interest rate, but the student opts for a longer, 15-year repayment plan. While the monthly payment decreases to approximately $247.62, resulting in lower monthly burden, the total repayment cost increases significantly to approximately $44,570. This demonstrates the trade-off between lower monthly payments and a higher overall cost due to prolonged interest accrual.

Comparative Table of Loan Scenarios

| Scenario | Loan Amount | Interest Rate | Repayment Plan (Years) | Approximate Monthly Payment | Approximate Total Repayment |

|---|---|---|---|---|---|

| Scenario 1: Standard | $30,000 | 6% | 10 | $330.24 | $39,629 |

| Scenario 2: Extended | $30,000 | 6% | 15 | $247.62 | $44,570 |

Conclusion

Securing funding for higher education is a significant step, and choosing the right student loan provider is crucial. This guide has provided a detailed look at Discover student loans, highlighting their strengths and weaknesses. By carefully considering the information presented – from interest rates and repayment options to customer service and potential forgiveness programs – you can make an informed decision that aligns with your financial goals and sets you up for long-term success. Remember to always compare options and seek personalized financial advice when needed.

FAQ Summary

What credit score is needed for a Discover student loan?

Discover doesn’t publicly state a minimum credit score requirement, but a good credit history generally improves your chances of approval and securing favorable interest rates.

Can I refinance my existing student loans with Discover?

Discover primarily offers new student loans, not refinancing options for existing loans from other lenders.

What happens if I miss a student loan payment?

Missing payments will negatively impact your credit score and may lead to late fees and potential default. Contact Discover immediately if you anticipate difficulties making a payment.

Does Discover offer any grace periods after graduation?

Grace periods are typically determined by the loan type and may vary; check your loan agreement for specifics.