Navigating the world of student loans can feel overwhelming, especially when confronted with the complexities of interest rates. Understanding these rates is crucial for making informed decisions about financing your education and avoiding potential financial pitfalls down the line. This guide delves into the intricacies of Discover student loan interest rates, providing you with the knowledge you need to secure the best possible terms for your educational journey.

From comparing fixed versus variable rates and exploring the factors that influence them, to understanding repayment options and managing your debt effectively, we’ll equip you with the tools to make confident choices. We’ll also examine various loan programs, including federal and private options, highlighting their advantages and disadvantages to help you choose the path that best suits your circumstances. This comprehensive guide aims to demystify the process, empowering you to take control of your student loan financing.

Understanding Student Loan Interest Rates

Choosing a student loan involves carefully considering the interest rate, as it significantly impacts the total cost of your education. Understanding the different types of rates and the factors that influence them is crucial for making informed financial decisions.

Fixed vs. Variable Interest Rates

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s repayment period, providing predictability and stability in your monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR. This means your monthly payments could increase or decrease over time, depending on market conditions. The advantage of a variable rate is that it might initially be lower than a fixed rate, but the disadvantage is the inherent uncertainty.

Factors Influencing Student Loan Interest Rates

Several factors determine the interest rate you’ll receive on your student loan. These include your credit history (or the credit history of your co-signer, if applicable), the type of loan (federal or private), the loan’s repayment term, and the prevailing economic conditions. A strong credit history generally leads to lower interest rates, while a poor credit history can result in higher rates or even loan denial. Federal loans often have lower interest rates than private loans due to government subsidies. Longer repayment terms typically result in higher interest rates, and periods of higher inflation often lead to higher interest rates across the board.

Interest Rate Calculation Examples

Student loan interest is typically calculated using simple interest. The formula is:

Interest = Principal x Rate x Time

Where ‘Principal’ is the loan amount, ‘Rate’ is the annual interest rate (expressed as a decimal), and ‘Time’ is the time period (usually in years). For example, a $10,000 loan with a 5% annual interest rate over 10 years would accrue $5,000 in simple interest ($10,000 x 0.05 x 10). However, most student loans use a more complex method of calculating interest, typically compounding daily or monthly, meaning that interest is added to the principal balance, and future interest is calculated on this larger amount. This results in a higher total interest paid over the life of the loan than simple interest would suggest.

Interest Rate Comparison Table

Understanding the differences in interest rates offered by various lenders is crucial for securing the best possible loan terms. The following table provides a comparison (note: these are examples and actual rates may vary based on individual circumstances):

| Lender Name | Interest Rate Type | Rate Percentage (Example) | Repayment Term (Example) |

|---|---|---|---|

| Lender A (Federal) | Fixed | 4.5% | 10 years |

| Lender B (Private) | Variable | 6.0% – 8.0% (Current Range) | 15 years |

| Lender C (Private) | Fixed | 7.2% | 12 years |

Discovering Available Student Loan Options

Navigating the world of student loans can feel overwhelming, but understanding the different options available is crucial for making informed financial decisions. This section Artikels the various student loan programs offered by the government and private lenders, highlighting their key differences to help you choose the best fit for your circumstances.

Federal and private student loans represent two distinct pathways to funding your education. Each carries its own set of advantages and disadvantages, impacting your repayment strategy and overall financial well-being.

Federal Student Loan Programs

Federal student loans are offered by the U.S. Department of Education and generally offer more borrower protections than private loans. These programs are designed to make higher education more accessible and affordable. Key programs include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for parents and graduate students, and Direct Consolidation Loans. Eligibility criteria vary depending on the specific loan type, but generally involve demonstrating financial need (for subsidized loans), being enrolled at least half-time in an eligible program, and maintaining satisfactory academic progress.

Private Student Loan Programs

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, these loans are not backed by the government. This means they may come with higher interest rates and less flexible repayment options. However, private loans can be an option for students who have exhausted their federal loan eligibility or need additional funding beyond their federal loan limits. Eligibility for private student loans typically depends on creditworthiness (often requiring a co-signer for students with limited or no credit history), income, and enrollment status.

Comparison of Federal and Private Student Loans

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower | Generally higher |

| Repayment Options | More flexible options, including income-driven repayment plans | Fewer flexible repayment options |

| Borrower Protections | Stronger borrower protections, such as deferment and forbearance options | Fewer borrower protections |

| Eligibility | Based on financial need and enrollment status | Based on creditworthiness and income |

| Fees | Generally lower fees | Potentially higher fees |

Eligibility Criteria for Student Loan Programs

Eligibility requirements vary considerably across different loan programs. For federal loans, factors such as enrollment status (at least half-time in an eligible program), citizenship or residency status, and satisfactory academic progress are typically assessed. Private lenders will usually examine credit history (often requiring a co-signer if the student’s credit history is insufficient), income, and debt-to-income ratio. Some lenders may also consider the student’s intended field of study and the reputation of the educational institution.

Applying for Student Loans: A Flowchart

A flowchart visually representing the student loan application process would depict a series of sequential steps. The process begins with determining eligibility for federal loans, followed by completing the FAFSA (Free Application for Federal Student Aid). If additional funding is needed, the student would then explore private loan options, comparing interest rates and terms from various lenders. The next step would involve submitting applications to chosen lenders and receiving loan offers. Finally, the student would accept the loan offer, complete any required documentation, and receive the loan disbursement. The flowchart would visually represent these steps with boxes and arrows, indicating the flow of the process.

Managing Student Loan Debt

Successfully navigating student loan repayment requires a proactive approach. Understanding various strategies for minimizing interest payments, exploring refinancing options, and implementing effective budgeting techniques are crucial for responsible debt management. This section will Artikel practical steps to achieve financial freedom after graduation.

Minimizing interest payments is key to reducing the overall cost of your loans. This can significantly impact the total amount you repay. Several strategies can help achieve this goal.

Strategies for Minimizing Student Loan Interest Payments

Making extra payments, even small amounts, can significantly reduce the principal balance and, consequently, the total interest accrued over the life of the loan. Consider making bi-weekly payments instead of monthly; this equates to an extra monthly payment each year. Another effective strategy is to prioritize high-interest loans. Focus your extra payments on the loans with the highest interest rates to save the most money in the long run. Finally, explore the possibility of income-driven repayment plans which may lower your monthly payments, though it will likely extend the repayment period. These plans adjust your monthly payment based on your income and family size.

Refinancing Student Loans to Lower Interest Rates

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. However, carefully consider the terms and conditions of the new loan before refinancing. Factors to consider include the interest rate, fees, and loan term. For example, a borrower with excellent credit might qualify for a significantly lower interest rate through refinancing, potentially saving thousands of dollars over the repayment period. Conversely, a borrower with poor credit might not qualify for a lower rate or might face higher fees.

Budgeting Techniques for Effective Student Loan Repayment

Creating a realistic budget is crucial for successful student loan repayment. Track your income and expenses meticulously. Categorize your expenses to identify areas where you can cut back. Allocate a specific amount each month towards your student loan payments. Use budgeting apps or spreadsheets to monitor your progress. For example, a borrower with a $1,000 monthly income and $500 in essential expenses might allocate $200 towards student loan payments, leaving $300 for discretionary spending. This approach ensures consistent loan payments while maintaining a manageable lifestyle.

Exploring Loan Forgiveness Programs

Several loan forgiveness programs exist, offering partial or complete loan cancellation under specific circumstances. These programs often target individuals working in public service or specific professions. Research eligibility requirements carefully. Explore the Public Service Loan Forgiveness (PSLF) program, which forgives the remaining balance of your federal student loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Similarly, the Teacher Loan Forgiveness program can forgive up to $17,500 of your federal student loans if you meet certain requirements, such as teaching full-time for five consecutive academic years in a low-income school. It’s crucial to understand the specific criteria for each program and meticulously document your progress to ensure eligibility for forgiveness.

The Impact of Interest Rates on Repayment

Understanding how interest rates affect your student loan repayment is crucial for long-term financial planning. The interest rate directly impacts the total amount you’ll pay back, significantly influencing your overall debt burden. Higher interest rates translate to higher overall costs, while lower rates lead to lower total repayment amounts.

The interest rate determines how much interest accrues on your loan’s principal balance over time. This interest is calculated daily and added to your principal, meaning you’re paying interest on interest—a phenomenon known as compound interest. The longer you take to repay your loan, the more significant the impact of compound interest becomes.

Repayment Plan Comparisons and Interest Accumulation

Choosing a repayment plan significantly impacts how much interest you accumulate. Standard repayment plans typically involve fixed monthly payments over a 10-year period. Extended repayment plans stretch payments over a longer timeframe (often up to 25 years), reducing monthly payments but increasing the total interest paid. Income-driven repayment plans base monthly payments on your income and family size, offering lower payments but potentially extending the repayment period significantly.

| Repayment Plan | Typical Repayment Period | Monthly Payment | Total Interest Paid (Example: $30,000 Loan) |

|---|---|---|---|

| Standard | 10 years | Higher | Lower |

| Extended | 25 years | Lower | Higher |

| Income-Driven | Varies (up to 20-25 years) | Lower (based on income) | Potentially Highest |

*Note: The example figures are illustrative and will vary significantly based on the loan amount, interest rate, and specific repayment plan terms.*

Consequences of Loan Default

Failing to make timely student loan payments results in loan default. This has serious financial repercussions. Default triggers penalties such as late fees, collection costs, and potential damage to your credit score. Your wages may be garnished, and you may face difficulty obtaining future loans or credit. Furthermore, the defaulted loan may be referred to collections agencies, leading to further fees and potential legal action. The negative impact on your credit score can make it difficult to rent an apartment, buy a car, or even secure a job in certain industries.

Long-Term Financial Implications of High vs. Low Interest Rates

High interest rates on student loans significantly increase the total cost of borrowing. This can delay major life goals such as buying a home, starting a family, or investing for retirement. Borrowers may need to make significant lifestyle adjustments to manage high monthly payments, potentially limiting career opportunities or personal choices. In contrast, low interest rates reduce the overall repayment burden, freeing up financial resources for other priorities and accelerating financial progress. For example, a $30,000 loan with a 7% interest rate will cost considerably more over the life of the loan than the same loan with a 3% interest rate. This difference in interest rates can translate to thousands of dollars in extra costs over the repayment period. The long-term financial implications of choosing a loan with a lower interest rate versus a higher one can be substantial, affecting one’s ability to achieve long-term financial goals.

Resources for Finding Information

Navigating the world of student loans can be daunting, but access to reliable information is key to making informed decisions. Understanding where to find accurate and unbiased information is crucial for avoiding pitfalls and securing the best possible loan terms. This section provides resources and guidance to help you navigate this process effectively.

Knowing where to look for information about student loans is paramount. Misinformation can lead to poor financial choices, resulting in higher interest rates and greater long-term debt. Therefore, prioritizing reputable sources is essential for a successful student loan journey.

Reputable Sources of Student Loan Information

Several government agencies and non-profit organizations offer reliable and unbiased information regarding student loans. These sources provide comprehensive details on loan types, interest rates, repayment plans, and consumer protections. Relying on these trusted sources ensures you’re making decisions based on accurate and current data.

- Federal Student Aid (FSA): The U.S. Department of Education’s website, StudentAid.gov, is the primary source for information on federal student loans. It offers detailed explanations of loan programs, eligibility requirements, repayment options, and tools to estimate loan costs and manage your loans.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides free and low-cost credit counseling services. They offer guidance on managing student loan debt, including debt consolidation and repayment strategies.

- Consumer Financial Protection Bureau (CFPB): The CFPB is a U.S. government agency that protects consumers from unfair, deceptive, or abusive financial practices. Their website provides information on student loan rights and protections, as well as resources for resolving disputes with lenders.

Identifying and Avoiding Predatory Lending Practices

Predatory lenders often target students and families, offering loans with hidden fees, extremely high interest rates, and deceptive terms. Recognizing these practices is crucial to protecting yourself financially. Understanding the warning signs can prevent you from falling victim to these unscrupulous lenders.

- Extremely high interest rates: Interest rates significantly above the national average for similar loans should raise a red flag. Compare rates from multiple lenders to identify outliers.

- Hidden fees and charges: Be wary of lenders who don’t clearly disclose all fees and charges associated with the loan. Read the fine print carefully.

- Aggressive sales tactics: High-pressure sales tactics, promises of guaranteed approval without proper credit checks, and vague loan terms are all warning signs of predatory lending.

- Lack of transparency: If a lender is unwilling to provide clear and concise information about the loan terms, interest rates, and repayment options, it’s best to avoid them.

Understanding Loan Terms and Conditions

Before signing any student loan agreement, it’s crucial to thoroughly understand all terms and conditions. Overlooking even seemingly minor details can have significant financial consequences. Take your time, read carefully, and seek clarification if anything is unclear.

- Interest rate: Understand the interest rate, whether it’s fixed or variable, and how it will affect your total repayment cost.

- Repayment terms: Familiarize yourself with the repayment schedule, including the loan term length and monthly payment amounts.

- Fees and charges: Understand all associated fees, including origination fees, late payment fees, and prepayment penalties.

- Deferment and forbearance options: Learn about options available if you need to temporarily postpone or reduce your payments.

Key Questions to Ask Lenders

Asking the right questions before committing to a student loan is crucial for ensuring you’re making an informed decision. Don’t hesitate to ask for clarification on anything you don’t understand. Your financial future depends on it.

- What is the annual percentage rate (APR) of the loan?

- What are the total fees associated with the loan?

- What is the repayment schedule, including the loan term and monthly payment amounts?

- What are the options for deferment and forbearance?

- What happens if I miss a payment?

- What is the lender’s policy on prepayment penalties?

- What are the lender’s customer service policies and procedures?

Final Summary

Securing student loans requires careful consideration of interest rates and repayment plans. By understanding the various factors influencing interest rates, comparing different lenders and loan types, and employing effective debt management strategies, you can minimize your long-term financial burden. Remember to utilize available resources, ask clarifying questions, and prioritize responsible borrowing to ensure a successful and financially sound educational experience. Taking a proactive and informed approach to student loan financing sets you up for a brighter financial future.

FAQ Overview

What is the difference between a fixed and variable interest rate on a Discover student loan?

A fixed interest rate remains constant throughout the loan term, while a variable interest rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may offer lower initial rates but carry the risk of increasing over time.

Can I refinance my Discover student loan with another lender?

Yes, you may be able to refinance your Discover student loan with another lender to potentially obtain a lower interest rate. However, carefully compare offers and consider the terms and conditions before refinancing.

What happens if I default on my Discover student loan?

Defaulting on a student loan has serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact Discover immediately if you are struggling to make payments to explore options for avoiding default.

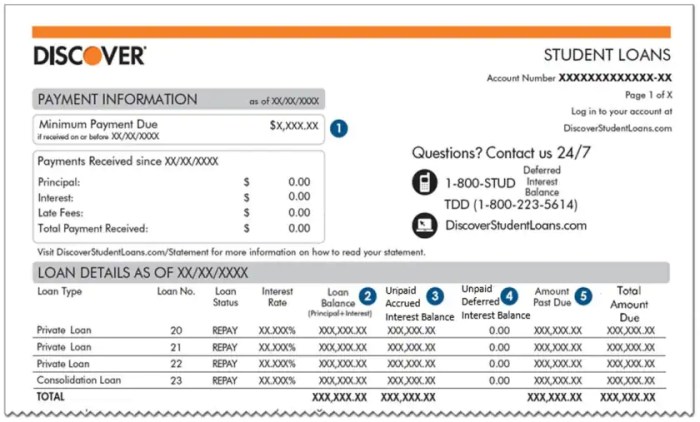

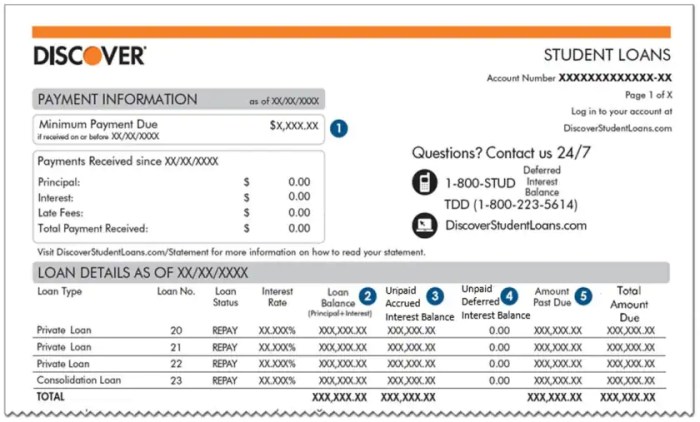

How can I check my Discover student loan interest rate?

You can typically find your interest rate information on your Discover student loan account statement or by logging into your online account.