Navigating the complexities of student loans can be daunting. Discover Student Loan.com aims to simplify this process, offering a range of services designed to help students and borrowers manage their educational financing. This guide delves into the website’s features, loan options, user experience, and customer support, providing a comprehensive overview to help you determine if it’s the right platform for your needs.

From understanding the various loan types available to evaluating the website’s user-friendliness and security measures, we’ll explore key aspects of Discover Student Loan.com. We will also compare its offerings to those of competitors, highlighting both advantages and disadvantages to provide a balanced perspective.

Website Overview

Discover Student Loan.com serves as a comprehensive online resource for students and their families seeking information and assistance with student loan financing. Its primary purpose is to provide a centralized platform for understanding various loan options, comparing interest rates, and managing student loan debt effectively.

Discover Student Loan.com targets current and prospective college students, as well as their parents and guardians, who are navigating the complexities of student loan financing. This includes individuals exploring different loan types, seeking refinancing options, or needing guidance on repayment strategies.

Key Features and Services

The website offers a range of features designed to simplify the student loan process. These include tools for comparing loan offers from various lenders, educational resources on student loan topics, and calculators to estimate monthly payments and total loan costs. Users can also access personalized recommendations based on their financial profiles and educational goals. Additionally, the site often provides articles and guides covering topics such as budgeting for college, understanding loan terms, and managing student loan debt after graduation. Some services might include direct loan applications through partner lenders, although this may vary.

Comparison with Similar Websites

Discover Student Loan.com differentiates itself from competitors like Sallie Mae and Student Loan Hero primarily through its focus on providing a comprehensive, user-friendly experience tailored to a broad range of users, from those just starting their college search to those managing existing debt. While competitors often focus on specific loan products or services, Discover Student Loan.com strives to offer a more holistic view of the student loan landscape. This may include a wider variety of lender options presented for comparison, or a stronger emphasis on financial literacy resources. However, the specific features and services offered may change over time, and direct comparisons should be made based on the current offerings of each platform.

Key Features, Benefits, and Drawbacks

| Feature | Benefit | Drawback | Comparison to Competitor (e.g., Sallie Mae) |

|---|---|---|---|

| Loan Comparison Tool | Easy comparison of interest rates and terms from multiple lenders. | May not include all lenders in the market. | Sallie Mae offers a similar tool, but may focus more on its own products. |

| Educational Resources | Provides valuable information on student loan management and financial literacy. | Information may be general and not tailored to individual circumstances. | Sallie Mae also offers resources, but the depth and breadth may differ. |

| Repayment Calculators | Helps users estimate monthly payments and total loan costs. | Calculations are based on estimations and may not reflect actual costs. | Similar calculators are available on Sallie Mae, but the specific features may vary. |

| Personalized Recommendations | Offers tailored advice based on individual financial profiles. | Accuracy depends on the completeness and accuracy of user-provided information. | Sallie Mae may offer personalized recommendations, but the approach and scope may differ. |

Loan Products and Options

Discover Student Loans offers a range of financing options to help students pay for higher education. Understanding the differences between these loan types is crucial for selecting the most suitable option based on individual financial situations and needs. The key differences lie in interest rates, repayment terms, and eligibility criteria.

Discover primarily offers private student loans, which differ significantly from federal student loans. While federal loans offer various benefits like income-driven repayment plans and loan forgiveness programs, private loans like those from Discover are subject to different terms and conditions. It’s essential to compare both private and federal options before making a decision.

Discover Student Loan Types and Eligibility

Discover offers several types of private student loans, tailored to different student needs and borrowing situations. These include loans for undergraduate students, graduate students, and parent loans to help fund a child’s education. Eligibility generally involves factors such as credit history (often requiring a co-signer for students with limited credit), enrollment status at an eligible institution, and demonstrated financial need (though not always a strict requirement). Specific eligibility criteria and interest rates are subject to change and should be verified directly on the Discover Student Loans website.

Interest Rates and Repayment Options

Interest rates for Discover student loans vary depending on several factors, including creditworthiness, the type of loan (undergraduate vs. graduate), the loan amount, and prevailing market interest rates. Generally, borrowers with stronger credit histories and lower loan amounts will qualify for lower interest rates. Repayment options typically include fixed-rate and variable-rate loans. Fixed-rate loans offer predictable monthly payments, while variable-rate loans may fluctuate based on market conditions. Discover also offers various repayment plans, allowing borrowers to choose a plan that best fits their budget and financial circumstances. It is crucial to carefully review the terms and conditions of each loan type before committing to a loan.

Discover Student Loan Application Process

The application process for a Discover student loan is generally straightforward and can be completed online. The following flowchart illustrates the typical steps involved:

Flowchart: Discover Student Loan Application

Step 1: Begin Application – Access the online application portal on Discover Student Loans’ website.

Step 2: Provide Information – Complete the application form, providing personal and financial information, including details about your education, income, and credit history.

Step 3: Credit Check – Discover will perform a credit check to assess your creditworthiness.

Step 4: Co-signer Consideration (if needed) – If your credit history is insufficient, you may need a co-signer to strengthen your application.

Step 5: Loan Approval/Denial – Discover will review your application and notify you of their decision.

Step 6: Loan Disbursement – Upon approval, the loan funds will be disbursed according to the terms of your loan agreement, typically directly to the educational institution.

Loan Repayment Plans

Understanding the available repayment plans is crucial for managing your student loan debt effectively. Discover likely offers a variety of options to help borrowers manage their payments.

- Standard Repayment: Fixed monthly payments over a set period (e.g., 10 or 15 years).

- Extended Repayment: Longer repayment term resulting in lower monthly payments but higher overall interest paid.

- Graduated Repayment: Payments start low and gradually increase over time.

Note: Specific repayment plans and their terms are subject to change and should be confirmed directly with Discover Student Loans.

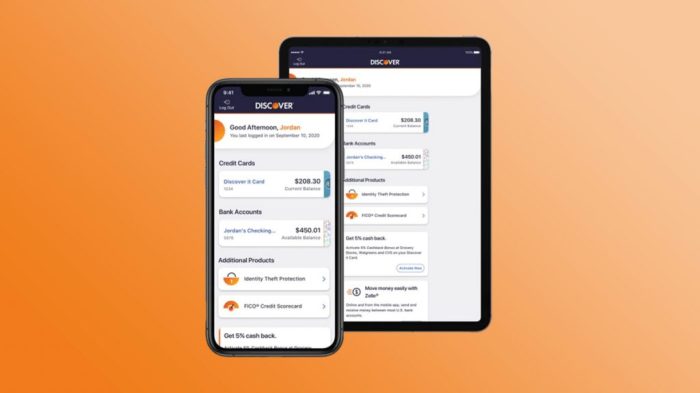

User Experience and Website Design

Discover Student Loan’s website aims to provide a straightforward and informative experience for prospective borrowers. However, the success of this goal hinges on the website’s user-friendliness, aesthetic appeal, and overall functionality. A well-designed website can significantly improve user satisfaction and encourage loan applications, while a poorly designed one can lead to frustration and lost opportunities.

The website’s navigation and design play a crucial role in shaping the user experience. Intuitive navigation allows users to quickly find the information they need, while a visually appealing design enhances the overall experience. Conversely, a cluttered or confusing layout can deter users and make it difficult to access key information.

Website Navigation and User-Friendliness

The Discover Student Loan website generally offers a clear navigational structure. The main menu is easily accessible, and major sections are well-organized. However, some users might find the depth of information overwhelming, particularly when trying to compare different loan options. For instance, the process of filtering loan options based on specific criteria could be improved for enhanced clarity. A streamlined filtering system with clear visual cues would enhance user experience and reduce the cognitive load on the user. Furthermore, the search functionality could be enhanced to offer more precise results, improving the overall efficiency of information retrieval.

Aesthetic Appeal and Design

The website’s visual design is clean and modern, utilizing a consistent color palette and typography. The use of white space effectively prevents the site from feeling cluttered. However, the design could benefit from incorporating more visual elements, such as high-quality images or infographics, to break up large blocks of text and make the information more engaging. Adding visual cues to highlight key information, such as loan interest rates or repayment terms, would further improve the user experience. Currently, the design, while functional, lacks a certain vibrancy that could resonate better with a younger demographic.

Areas for Potential Improvement

Several areas could be improved to enhance the user experience. Firstly, improving the mobile responsiveness of the website is crucial. Many users access websites via mobile devices, and the current mobile version could benefit from a more optimized layout and functionality. Secondly, implementing a more robust FAQ section with easily searchable answers to common questions would greatly reduce the need for users to contact customer support. Finally, adding personalized recommendations based on user-provided information (e.g., education level, expected income) would create a more tailored and engaging experience.

Examples of Positive and Negative User Experiences

A positive experience would involve a user easily finding the information needed to compare loan options, quickly completing a pre-qualification form, and understanding the repayment terms clearly. A negative experience might involve difficulty navigating the site, encountering broken links, or struggling to understand the loan terms and conditions. For example, a user might struggle to understand the implications of different repayment plans without clear visual aids or simplified explanations. Another negative experience could stem from the lack of a readily available chat function for immediate assistance.

Mock-up of Improved Website Design

Imagine a redesigned homepage with a clean, modern layout. A prominent search bar is placed at the top, allowing users to quickly find specific information. Below the search bar, clear, concise sections showcase key features, such as loan types, interest rates, and eligibility criteria. Each section could include a brief description and a visually appealing call-to-action button. Further down, a carousel of testimonials from satisfied customers adds a layer of social proof. The overall design emphasizes visual hierarchy and utilizes high-quality imagery and infographics to make the information more engaging and easily digestible. The mobile version mirrors this design, ensuring a seamless experience across all devices. A prominent and easily accessible FAQ section and a live chat feature would further enhance the user experience.

Customer Support and Resources

Discover Student Loan’s customer support system is a crucial element of their overall service. Effective communication and readily available resources are vital for borrowers navigating the complexities of student loan repayment. The accessibility and responsiveness of support channels directly impact borrower satisfaction and their ability to manage their loans effectively.

Discover Student Loan offers a range of customer support channels designed to cater to diverse user preferences. The effectiveness of these channels, however, varies depending on individual experiences and the specific issue at hand. A comprehensive evaluation considers both the stated availability of support and the actual responsiveness observed by users.

Available Customer Support Channels

Discover Student Loan provides multiple avenues for borrowers to seek assistance. These channels allow for various levels of interaction, from quick queries to detailed discussions of complex financial situations. The accessibility of these channels is a key factor in determining overall customer satisfaction.

- Phone Support: A dedicated phone number allows for direct conversation with a customer service representative. This method is often preferred for urgent issues or complex situations requiring immediate attention.

- Email Support: Borrowers can submit inquiries via email, receiving a response within a specified timeframe. This is a suitable option for non-urgent matters or for providing detailed information that may be difficult to convey verbally.

- Online Chat: A live chat feature on the website enables real-time interaction with a support agent. This is convenient for quick questions or immediate clarifications.

Customer Support Responsiveness and Helpfulness

The responsiveness of Discover Student Loan’s customer support varies based on factors such as the time of day, day of the week, and the complexity of the issue. While the website may advertise specific response times, actual experiences may differ. User reviews and online forums often provide insights into the average wait times and the helpfulness of the representatives. A comparison with competitor websites can reveal whether Discover’s response times and support quality are competitive within the industry.

Website Resources and FAQs

The website’s resources and FAQs section plays a crucial role in providing self-service support to borrowers. A well-organized and comprehensive FAQ section can address many common questions, reducing the need to contact customer support directly. The clarity and comprehensiveness of these resources are vital in empowering borrowers to manage their loans independently.

The helpfulness of the FAQs is evaluated based on their ability to clearly and concisely answer questions, use plain language, and cover a wide range of relevant topics. A well-designed FAQ section reduces the burden on customer support representatives, allowing them to focus on more complex issues.

Comparison with Competitor Websites

To provide a comprehensive assessment of Discover Student Loan’s customer support, a comparison with similar services offered by competitors is necessary. This comparison should consider various factors, including the availability of support channels, response times, the helpfulness of support staff, and the quality of online resources. Competitors such as Sallie Mae, Nelnet, and other major student loan providers serve as benchmarks for evaluating the overall effectiveness of Discover’s support system.

For example, a comparison might reveal that one competitor offers 24/7 phone support, while Discover only provides support during business hours. Or, a competitor might have a more comprehensive and user-friendly FAQ section. This analysis helps to identify areas where Discover Student Loan can improve its customer support offerings.

Sample Email to Customer Support

The following email demonstrates a clear and concise way to request information on a specific loan feature. This example highlights the importance of providing sufficient detail to enable a quick and accurate response from customer support.

Subject: Inquiry Regarding Interest Rate Calculation

Dear Discover Student Loan Customer Support,

I am writing to inquire about the interest rate calculation method used for my student loan account, [Account Number]. Specifically, I would like to understand how the interest is compounded and applied to my monthly payments. Could you please provide a detailed explanation or point me to a resource that clarifies this process?

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Email Address]

[Your Phone Number]

Financial Literacy Resources

Discover Student Loan’s website offers a range of financial literacy resources aimed at helping students understand and manage their loans effectively. The effectiveness of these resources varies, however, and a comparison with other financial institutions reveals both strengths and weaknesses.

Types of Financial Literacy Resources Available

Discover Student Loan’s website includes several resources, such as articles, blog posts, and possibly downloadable guides or worksheets. These materials may cover topics like budgeting, creating a repayment plan, understanding interest rates, and avoiding loan scams. The availability and depth of these resources should be assessed to determine their overall value. The presence of interactive tools, such as loan calculators or budgeting apps, would significantly enhance the user experience and learning outcomes.

Effectiveness of Financial Literacy Resources

The effectiveness of Discover Student Loan’s financial literacy resources depends on several factors, including the clarity of the information presented, the engagement level of the content, and the accessibility of the resources. Well-designed infographics, short videos, and interactive quizzes can significantly improve user understanding and retention compared to lengthy, text-heavy articles. The effectiveness should be measured by user feedback, engagement metrics, and improvements in user financial literacy demonstrated through changes in borrowing behavior.

Comparison with Other Financial Institutions

Compared to other financial institutions, Discover Student Loan’s resources might fall short in terms of comprehensiveness or innovation. Some banks and credit unions offer more extensive financial literacy programs, including workshops, webinars, and personalized financial counseling. Others may integrate their resources more seamlessly into the loan application and management process. A comprehensive analysis comparing the breadth and depth of resources offered by Discover Student Loan to those of its competitors, including Sallie Mae, Nelnet, and major banks, would provide a valuable benchmark.

Examples of Effective and Ineffective Financial Literacy Content

An effective example would be a short video explaining the difference between subsidized and unsubsidized loans using simple language and visuals. This is effective because it leverages multiple learning modalities (visual and auditory) and simplifies complex information. An ineffective example would be a lengthy, dense article on loan amortization schedules with minimal visual aids. This is ineffective due to its poor readability and lack of engagement. A clear and concise FAQ section addressing common student loan questions would also be considered effective.

Suggested Improvements to Financial Literacy Resources

To improve the website’s financial literacy resources, several changes are suggested:

- Expand the range of topics covered: Include more detailed information on topics such as credit scores, debt consolidation, and long-term financial planning.

- Increase interactivity: Incorporate quizzes, interactive calculators, and budgeting tools to enhance user engagement and knowledge retention.

- Improve accessibility: Ensure resources are available in multiple formats (text, audio, video) and are compliant with accessibility standards.

- Personalize the experience: Offer customized recommendations and resources based on individual user needs and loan profiles.

- Track and measure effectiveness: Regularly assess the impact of the resources on user knowledge and behavior through surveys and analytics.

Security and Privacy

Protecting your personal information is paramount at Discover Student Loan.com. We understand the sensitive nature of financial data and employ multiple layers of security to safeguard your account and information from unauthorized access, use, or disclosure. Our commitment extends to maintaining transparency regarding our data practices and adhering to all relevant regulations.

Discover Student Loan.com utilizes a multi-faceted approach to security, encompassing robust technological measures and adherence to established industry best practices. This includes employing advanced encryption techniques, regular security audits, and employee training programs focused on data protection. Our privacy policy details how we collect, use, and protect your data, and it is regularly reviewed and updated to reflect changes in technology and regulations.

Data Encryption Methods

Discover Student Loan.com employs industry-standard encryption protocols, such as Transport Layer Security (TLS) and Secure Sockets Layer (SSL), to protect data transmitted between your browser and our servers. This ensures that sensitive information, such as your personal details and loan application data, is encrypted and unreadable to unauthorized individuals during transmission. Furthermore, data at rest—meaning data stored on our servers—is also encrypted using robust encryption algorithms to protect against unauthorized access even if a breach were to occur. The specific algorithms used are regularly reviewed and updated to maintain the highest level of security. For example, we may utilize AES-256 encryption for data at rest, a widely recognized and highly secure encryption standard.

Data Collection, Use, and Protection

The following table Artikels the types of data collected by Discover Student Loan.com, how this data is used, and the security measures implemented to protect it.

| Data Type | How It’s Used | How It’s Protected |

|---|---|---|

| Personal Information (Name, Address, Social Security Number) | To verify your identity, process your loan application, and communicate with you. | Stored securely on encrypted servers, accessed only by authorized personnel, and protected by access controls and multi-factor authentication. |

| Financial Information (Bank Account Details, Income Information) | To assess your creditworthiness, disburse loan funds, and manage your account. | Protected by encryption both in transit and at rest, and subject to strict access controls. |

| Loan Application Data (Loan Amount, Purpose of Loan) | To process your loan application and manage your loan account. | Stored securely on encrypted servers and protected by access controls. |

| Website Usage Data (IP Address, Browser Type) | To improve website functionality and user experience. This data is generally anonymized. | Stored securely and may be used for aggregate analysis, not linked to individual users without consent. |

Privacy Policy Adherence to Regulations

Discover Student Loan.com’s privacy policy is designed to comply with all applicable data protection regulations, including but not limited to the Gramm-Leach-Bliley Act (GLBA) in the United States and the General Data Protection Regulation (GDPR) in the European Union, where applicable. We regularly review and update our privacy policy to ensure its continued compliance with evolving regulations and best practices. We are committed to providing transparency regarding our data handling practices and giving users control over their personal information.

Comparison to Industry Best Practices

Discover Student Loan.com’s security measures are aligned with, and in many cases exceed, industry best practices for online financial services. We regularly conduct vulnerability assessments and penetration testing to identify and address potential security weaknesses. Our security team monitors our systems for suspicious activity and responds promptly to any security incidents. We also invest in employee training programs to ensure that our staff is aware of and adheres to our security policies and procedures. This proactive approach helps us maintain a strong security posture and protect our users’ data.

Final Summary

Ultimately, the effectiveness of Discover Student Loan.com hinges on individual needs and preferences. While the website offers a streamlined approach to student loan management, careful consideration of its features, limitations, and customer support is crucial. By understanding the platform’s strengths and weaknesses, prospective users can make informed decisions about whether it aligns with their financial goals and borrowing requirements. Remember to thoroughly research all options before committing to any student loan provider.

Key Questions Answered

What types of student loans does Discover Student Loan.com offer?

This information would need to be gathered directly from Discover Student Loan.com as loan offerings can change. Generally, websites like this offer federal and/or private student loans.

What is the application process like?

The application process varies depending on the loan type. Generally, it involves completing an online application, providing documentation, and undergoing a credit check (for private loans). Specific steps are detailed on the Discover Student Loan.com website.

What security measures does Discover Student Loan.com have in place?

Details on specific security measures are usually found in the website’s privacy policy. Generally, reputable lenders utilize encryption and other security protocols to protect user data. Always check the website’s security information before submitting any personal or financial information.

How responsive is their customer support?

Customer support responsiveness can vary. Check online reviews and the website’s contact information for details on how to reach them and what to expect in terms of response times.