Navigating the world of student loans can feel overwhelming, especially when faced with the complexities of interest rates and repayment options. Understanding Discover student loan rates, in particular, requires careful consideration of various factors, from your credit history to the type of loan you choose. This guide aims to demystify the process, empowering you to make informed decisions about your financial future.

From comparing fixed versus variable rates to exploring the benefits of federal versus private loans, we’ll cover the essential elements of securing a student loan that aligns with your individual needs and financial goals. We’ll also delve into effective repayment strategies, government assistance programs, and the long-term implications of student loan debt. By the end, you’ll be equipped with the knowledge to confidently manage your student loan journey.

Understanding Student Loan Rates

Securing a student loan is a significant financial decision, and understanding the interest rate is crucial for managing your debt effectively. The interest rate determines the cost of borrowing, directly impacting the total amount you’ll repay. This section will clarify the key factors influencing student loan interest rates, the differences between fixed and variable rates, and the rate variations between federal and private lenders.

Factors Influencing Student Loan Interest Rates

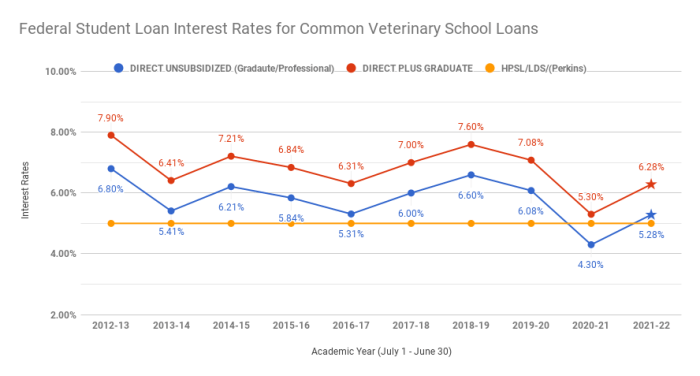

Several factors contribute to the interest rate you’ll receive on your student loan. These include your creditworthiness (for private loans), the loan’s term length, the type of loan (federal vs. private), and prevailing market interest rates. A strong credit history typically results in lower interest rates, while longer loan terms often come with higher rates. Furthermore, market conditions play a significant role, with higher interest rates prevailing during periods of economic uncertainty. Federal student loans often have lower interest rates than private loans due to government subsidies and risk mitigation strategies.

Fixed Versus Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictability and stability in your monthly payments. In contrast, a variable interest rate fluctuates based on market benchmarks, such as the prime rate or LIBOR. While a variable rate might start lower, it could increase significantly over time, leading to unpredictable payments. The choice between fixed and variable rates depends on individual risk tolerance and financial projections. A borrower comfortable with potential fluctuations might opt for a variable rate, while those preferring predictable payments should choose a fixed rate.

Federal Versus Private Student Loan Interest Rates

Federal student loans generally offer lower interest rates than private loans. This is because the federal government subsidizes these loans and bears some of the risk. Private lenders, on the other hand, assess borrowers’ creditworthiness more rigorously, resulting in higher interest rates for those with lower credit scores or limited credit history. Federal loans also offer various repayment plans and income-driven repayment options, providing more flexibility to borrowers. Private loans often have stricter terms and fewer options. The interest rate difference can be substantial, sometimes several percentage points, significantly affecting the total repayment amount over the loan’s life.

Comparison of Student Loan Repayment Plans

Choosing the right repayment plan is crucial for managing your student loan debt effectively. Different plans offer varying monthly payments and total repayment periods. The optimal choice depends on your individual financial circumstances and priorities.

| Repayment Plan | Monthly Payment | Loan Term | Advantages |

|---|---|---|---|

| Standard Repayment Plan (Federal) | Fixed monthly payment | 10 years | Simple, predictable payments. |

| Graduated Repayment Plan (Federal) | Payments increase over time | 10 years | Lower initial payments, potentially helpful in early career stages. |

| Extended Repayment Plan (Federal) | Lower monthly payments | Up to 25 years | Reduced monthly burden, but higher total interest paid. |

| Income-Driven Repayment (Federal) | Payment based on income and family size | 20-25 years | Affordability, potential loan forgiveness after 20-25 years (depending on plan). |

Finding the Best Student Loan Rate

Securing the lowest possible interest rate on your student loans is crucial, as it directly impacts the total amount you’ll repay over the life of the loan. A lower interest rate translates to significant savings, allowing you to manage your debt more effectively and achieve your financial goals sooner. This section will explore strategies to help you find the best rates available.

Several factors influence the interest rate you’ll receive on your student loans. Understanding these factors and proactively addressing them can significantly improve your chances of securing a favorable rate. Careful planning and preparation are key to navigating the student loan process successfully.

Credit Score and Credit History’s Influence on Student Loan Rates

A strong credit score and a positive credit history are essential for obtaining the most favorable interest rates, especially when applying for private student loans. Lenders view a high credit score as an indicator of responsible financial behavior, reducing their perceived risk. A good credit history demonstrates your ability to manage debt effectively, making you a more attractive borrower. Conversely, a poor credit score or limited credit history can lead to higher interest rates or even loan denial. Building a good credit history before applying for loans is highly recommended. This can involve obtaining a credit card and using it responsibly, paying bills on time, and keeping credit utilization low.

Federal vs. Private Student Loans: A Comparison

Federal and private student loans offer distinct advantages and disadvantages regarding interest rates and repayment terms. Federal student loans typically offer fixed interest rates, meaning your rate won’t change throughout the loan’s life. They also often come with income-driven repayment plans and various borrower protections. However, federal loan amounts may be limited based on financial need and other factors. Private student loans, on the other hand, may offer higher loan amounts but often come with variable interest rates, which can fluctuate over time, potentially increasing your monthly payments. They may also have less favorable repayment options and fewer borrower protections. The best choice depends on individual circumstances and financial needs.

A Step-by-Step Guide to Applying for Student Loans

- Determine your financial need and loan amount: Carefully estimate your educational expenses, including tuition, fees, room and board, and other related costs. Subtract any financial aid you’ve already received (grants, scholarships) to determine the remaining amount you need to borrow.

- Check your credit report: Review your credit report for accuracy and identify any areas for improvement. A higher credit score will improve your chances of getting a lower interest rate.

- Compare loan offers from various lenders: Shop around and compare interest rates, fees, and repayment terms from multiple lenders, including both federal and private loan providers. Consider using online comparison tools to streamline this process.

- Complete the loan application: Fill out the loan application accurately and completely. Provide all necessary documentation, such as tax returns and proof of enrollment.

- Review and accept the loan terms: Carefully review the loan terms and conditions before accepting the loan. Understand the interest rate, fees, repayment schedule, and any other relevant details.

- Manage your loan responsibly: Once you receive your loan, make timely payments to avoid late fees and maintain a positive credit history.

Repaying Student Loans

Successfully navigating student loan repayment requires a proactive and organized approach. Understanding your repayment options, creating a realistic budget, and consistently monitoring your progress are crucial for minimizing debt and achieving financial stability. This section will Artikel effective strategies and tools to help you manage and repay your student loans efficiently.

Effective repayment strategies hinge on a combination of understanding your loan terms, exploring available repayment plans, and developing a robust personal budget. Failing to plan can lead to missed payments, penalties, and increased overall debt. A well-defined plan, however, can significantly reduce the time and money spent repaying your loans.

Student Loan Repayment Options

Several repayment plans are available, each with its own advantages and disadvantages. Choosing the right plan depends on your individual financial situation and income. Careful consideration of each option is vital to making an informed decision.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a 10-year period. It’s straightforward but may result in higher monthly payments compared to other options.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can be helpful initially but leads to higher payments later in the repayment period.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payment on your income and family size. Payments are typically lower, and any remaining balance may be forgiven after 20 or 25 years, depending on the plan. However, forgiveness may result in tax implications.

- Income-Contingent Repayment (ICR) Plan: Similar to IDR plans, ICR bases payments on income and family size. The repayment period can be up to 25 years, with potential for loan forgiveness. It also has potential tax implications for forgiven amounts.

Budgeting Techniques for Loan Repayment

Creating a realistic budget is fundamental to successful loan repayment. Allocating sufficient funds for loan payments while managing other expenses requires careful planning and tracking. Several budgeting methods can be employed to achieve this.

- 50/30/20 Rule: Allocate 50% of your after-tax income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment (including student loans).

- Zero-Based Budgeting: Track every dollar of income and allocate it to specific expenses, ensuring that income equals expenses. This method provides a clear picture of your spending habits and helps identify areas for potential savings.

- Envelope System: Allocate cash for different expense categories into separate envelopes. Once the cash in an envelope is gone, that category’s spending is limited for the period. This promotes mindful spending.

Example: Let’s say your monthly after-tax income is $3,000. Using the 50/30/20 rule, you would allocate $1,500 to needs, $900 to wants, and $600 to savings and debt repayment. A portion of the $600 should be dedicated to your student loan payments.

Impact of Interest Capitalization

Interest capitalization occurs when unpaid interest is added to your principal loan balance. This increases the total amount you owe and can significantly impact the overall cost of your loan. Understanding how capitalization works is crucial for effective loan management.

For example, imagine you have a $10,000 loan with a 5% interest rate. If you don’t make payments for a year, the accrued interest will be capitalized. At the end of the year, approximately $500 in interest ($10,000 x 0.05) will be added to your principal balance, increasing your loan to approximately $10,500. Future interest will then be calculated on this higher amount, resulting in a larger total repayment amount over the life of the loan.

Capitalization significantly increases the total amount owed over the life of the loan. Making consistent payments is crucial to avoid this.

Government Programs and Student Loan Assistance

Navigating the complexities of student loan repayment can be daunting, but numerous government programs exist to help borrowers manage their debt and potentially reduce their overall financial burden. Understanding these programs and their eligibility requirements is crucial for effective debt management.

Eligibility for government-sponsored student loan programs is primarily determined by factors such as the type of loan (federal or private), the borrower’s income, and the repayment plan chosen. Federal student loans, unlike private loans, often have income-based repayment options and access to forgiveness programs. Specific eligibility criteria vary depending on the program, and it’s essential to check the official government website for the most up-to-date information.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing monthly payments on a borrower’s income and family size. These plans offer lower monthly payments than standard repayment plans, but they typically extend the repayment period, potentially leading to higher overall interest paid. Benefits include affordability and preventing default, while limitations include longer repayment timelines and higher total interest accrued over the life of the loan. Several IDR plans exist, each with its own specific eligibility requirements and payment calculation formula. For example, the Revised Pay As You Earn (REPAYE) plan considers 10% of discretionary income, while the Income-Based Repayment (IBR) plan uses a different calculation method. Borrowers should carefully compare the various IDR plans to determine which best suits their individual financial situation.

Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, offering the possibility of having a portion or all of your student loan debt discharged. These programs often target specific professions, such as teaching or public service, or are based on years of qualifying payments under an income-driven repayment plan. The application processes for these programs can be complex and require meticulous documentation. For instance, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under a qualifying IDR plan while employed full-time by a government or non-profit organization. Failure to meet all requirements can result in ineligibility for forgiveness. It’s crucial to thoroughly understand the specific criteria and application procedures for each program to maximize your chances of success.

Summary of Government Assistance Programs

| Program Name | Description | Eligibility Requirements | Benefits |

|---|---|---|---|

| Income-Driven Repayment (IDR) Plans (e.g., REPAYE, IBR) | Adjusts monthly payments based on income and family size. | Federal student loans; income below a certain threshold. | Lower monthly payments; prevents default. |

| Public Service Loan Forgiveness (PSLF) | Forgives remaining debt after 120 qualifying payments in public service. | Federal student loans; employment in qualifying public service job; payments under qualifying IDR plan. | Complete loan forgiveness. |

| Teacher Loan Forgiveness | Forgives a portion of loans for teachers who meet specific requirements. | Federal student loans; teaching in low-income schools or educational service agencies; specific teaching experience requirements. | Partial loan forgiveness. |

| Income-Contingent Repayment (ICR) | Payment amount is calculated based on income and loan amount. | Federal student loans; income below a certain threshold. | Lower monthly payments; potential for longer repayment term. |

Impact of Student Loan Debt

Student loan debt can significantly impact borrowers’ financial well-being, extending far beyond the repayment period. The long-term consequences affect various aspects of personal finance, from credit scores and borrowing capacity to major life decisions like homeownership and retirement planning. Understanding these implications is crucial for responsible financial planning.

The weight of student loan debt often casts a long shadow over borrowers’ financial futures. The sheer amount owed can dictate lifestyle choices, limiting opportunities for saving, investing, and pursuing other financial goals. This burden can be particularly acute for those who struggle to find employment in fields commensurate with their education level or who face unexpected financial hardships.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can severely constrain a borrower’s financial flexibility for many years. High monthly payments can leave little room in a budget for other essential expenses, such as rent, groceries, healthcare, and transportation. This can lead to a cycle of debt, where borrowers rely on credit cards or other high-interest loans to cover their expenses, further compounding their financial difficulties. Delayed or reduced savings for retirement, down payments on a house, or other significant life events are common consequences. For example, a borrower with $50,000 in student loan debt at a 7% interest rate could face monthly payments exceeding $500 for over a decade, significantly impacting their ability to save for a down payment on a home.

Student Loan Debt’s Effect on Credit Scores and Future Borrowing

Student loan debt directly impacts credit scores. Missed or late payments can severely damage a credit score, making it harder to secure loans for a car, mortgage, or even a credit card in the future. Even consistent on-time payments can negatively affect a credit score if the debt-to-income ratio is too high. Lenders assess creditworthiness based on a borrower’s debt-to-income ratio and credit history, making it more challenging to qualify for favorable interest rates and loan terms with substantial student loan debt. A low credit score can lead to higher interest rates on future loans, resulting in a greater overall financial burden.

Financial Challenges Faced by Borrowers with High Student Loan Debt

Borrowers with high student loan debt often face numerous financial challenges. These can include difficulty affording basic necessities, delayed homeownership, inability to save for retirement, and increased stress and anxiety related to finances. Many find it difficult to accumulate savings for emergencies or significant life events, leaving them vulnerable to unforeseen circumstances. The constant pressure of repayment can significantly impact mental and emotional well-being. For instance, someone burdened with significant student loan debt may delay starting a family or purchasing a home due to the financial constraints.

Infographic: Average Student Loan Debt Burden Across Demographics

The infographic would be a bar chart showing average student loan debt by demographic group (e.g., age group, gender, degree type). The horizontal axis would represent the demographic group, and the vertical axis would represent the average student loan debt in US dollars. Data points would be sourced from reputable organizations like the National Center for Education Statistics (NCES) or the Federal Reserve. The chart would use different colored bars for each demographic group to enhance visual appeal. A title like “Average Student Loan Debt by Demographic Group” would be prominently displayed. A key would clearly define each bar’s color and corresponding demographic group. Additional visual elements, such as small icons representing each demographic group (e.g., a graduation cap for degree type), would further enhance clarity and engagement. Data points would be presented numerically on each bar and also in a small table next to the chart for easy reference. For example, it might show that the average debt for a 25-34-year-old with a bachelor’s degree is significantly higher than that of a 25-34-year-old with an associate’s degree. The infographic would also include a brief caption summarizing the key findings, such as the overall trend of increasing student loan debt across various demographics and potential disparities between groups.

Final Conclusion

Securing a favorable student loan rate requires proactive planning and a thorough understanding of the available options. By carefully considering your creditworthiness, comparing lender offerings, and exploring various repayment plans, you can significantly reduce your long-term financial burden. Remember to leverage available resources, including government assistance programs, to navigate the complexities of student loan repayment effectively. Armed with this knowledge, you can confidently embark on your educational journey without undue financial strain.

Question Bank

What is the Discover student loan grace period?

The grace period for Discover student loans typically begins after graduation or leaving school and allows a period of time before repayment begins. The exact length varies depending on the loan type and program.

Can I refinance my Discover student loan?

Yes, you may be able to refinance your Discover student loan with another lender to potentially secure a lower interest rate or consolidate multiple loans. However, refinancing may impact your eligibility for certain government programs.

What happens if I miss a Discover student loan payment?

Missing payments can result in late fees, damage to your credit score, and potential default on the loan. Contact Discover immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

How does Discover calculate my student loan interest?

Discover uses either a fixed or variable interest rate, depending on your loan. The interest is typically calculated daily on the outstanding principal balance. Your loan documents will detail the specific calculation method.