Navigating the world of student loans can feel overwhelming, but understanding your options is crucial for a successful financial future. This guide delves into Discover student loans, providing a clear and concise overview of their offerings, application processes, and long-term implications. We’ll explore the various loan types, repayment plans, and essential considerations to help you make informed decisions.

From eligibility requirements and interest rates to managing your loan and accessing customer support, we aim to equip you with the knowledge needed to confidently navigate the complexities of Discover’s student loan programs and make the best choices for your educational journey and financial well-being.

Understanding “Discover Student Loans”

Discover Student Loans represent a segment of the broader student loan market offered by Discover Financial Services. They provide financing options to help students cover the costs of higher education, competing with other major lenders in this significant financial sector. Understanding their offerings and comparing them to competitors is crucial for prospective borrowers to make informed decisions.

Discover Student Loans offer a range of financing options designed to meet diverse student needs. These loans are not simply a monolithic product but rather a collection of loan types with varying terms and conditions.

Types of Discover Student Loans

Discover primarily offers two main types of student loans: federal and private. Federal student loans are backed by the government, offering benefits such as flexible repayment plans and potential loan forgiveness programs. Private student loans, on the other hand, are issued by private lenders like Discover and carry different terms and conditions. The specific terms, interest rates, and repayment options will vary based on individual creditworthiness and the type of loan chosen. Borrowers should carefully compare both federal and private options to determine the most suitable choice.

Comparison with Other Major Lenders

Discover competes with a range of other major lenders in the student loan market, including Sallie Mae, Wells Fargo, and Citizens Bank. A direct comparison requires examining factors such as interest rates, fees, repayment options, and customer service. While Discover may offer competitive interest rates in certain situations, other lenders might provide more favorable terms or additional benefits, such as loan forgiveness programs or borrower assistance options. It’s important for prospective borrowers to shop around and compare offers from multiple lenders before making a decision. Interest rates and fees are subject to change and are dependent on creditworthiness and market conditions. For example, a student with excellent credit may secure a lower interest rate than a student with a limited credit history.

Eligibility Criteria for Discover Student Loans

Eligibility for Discover Student Loans typically involves several key factors. These factors often include credit history (or the credit history of a co-signer), academic standing, enrollment status, and the type of degree program pursued. Discover will assess these factors to determine the applicant’s creditworthiness and risk level. Students with strong credit histories and a co-signer with a good credit score are generally more likely to qualify for favorable loan terms. Applicants will need to meet specific requirements regarding enrollment in an eligible educational institution. The specific criteria and requirements may change over time, and applicants should consult Discover’s official website for the most up-to-date information.

Interest Rates and Repayment Options

Understanding Discover student loan interest rates and repayment options is crucial for effective financial planning. Choosing the right repayment plan can significantly impact your overall loan cost and repayment timeline. This section details Discover’s current offerings and helps you assess the best fit for your circumstances.

Discover’s interest rates for student loans are variable and depend on several factors, including your creditworthiness, the type of loan (e.g., undergraduate, graduate, PLUS), and the prevailing market interest rates. It’s essential to check Discover’s website for the most up-to-date information, as rates are subject to change. Generally, you can expect interest rates to be competitive with other private student loan lenders.

Discover Student Loan Repayment Plans

Discover offers a variety of repayment plans designed to accommodate different financial situations and repayment preferences. These plans provide flexibility in managing your monthly payments and potentially reducing your overall loan cost.

The available repayment options typically include:

| Repayment Plan | Monthly Payment | Interest Capitalization | Potential Savings |

|---|---|---|---|

| Standard Repayment | Fixed monthly payment over a set term (e.g., 10-20 years) | Interest is not capitalized (added to principal) during repayment. | Lowest overall cost due to no capitalization. |

| Graduated Repayment | Payments start low and gradually increase over time. | Interest is not capitalized during repayment. | Lower initial payments, but higher total interest paid. |

| Extended Repayment | Lower monthly payments spread over a longer repayment term. | Interest is not capitalized during repayment. | Significantly lower monthly payments, but substantially higher total interest paid. |

| Income-Driven Repayment (IDR) | Payments are based on your income and family size. | Interest may or may not be capitalized depending on the specific plan details. Check with Discover. | Lower monthly payments, but potentially higher total interest paid over a longer repayment period. Forgiveness may be possible after a certain period, depending on eligibility criteria. |

Note: The specific terms and conditions of each repayment plan, including interest capitalization and potential savings, may vary. It’s crucial to carefully review the details of each plan provided by Discover before making a decision. The “Potential Savings” column in the table is a general comparison and does not represent guaranteed savings, as actual savings depend on individual circumstances and interest rates.

Impact of Repayment Plan Choice on Long-Term Loan Costs

The repayment plan you select significantly influences your long-term loan costs. While a longer repayment term with lower monthly payments might seem appealing initially, it will generally lead to a higher total interest paid over the life of the loan. Conversely, a shorter repayment term with higher monthly payments will result in less interest paid overall.

For example, choosing an extended repayment plan might offer manageable monthly payments, but the added interest over a longer repayment period could substantially increase your total cost compared to a standard repayment plan. Conversely, a standard repayment plan with higher monthly payments will reduce the total interest paid, saving you money in the long run. Carefully weigh your immediate financial needs against the long-term cost implications to determine the most suitable option for your individual situation.

Application Process and Required Documentation

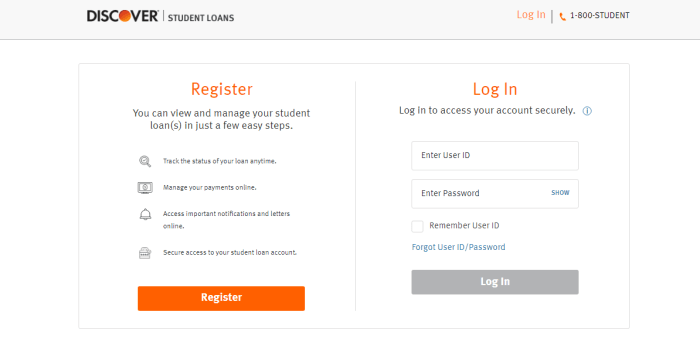

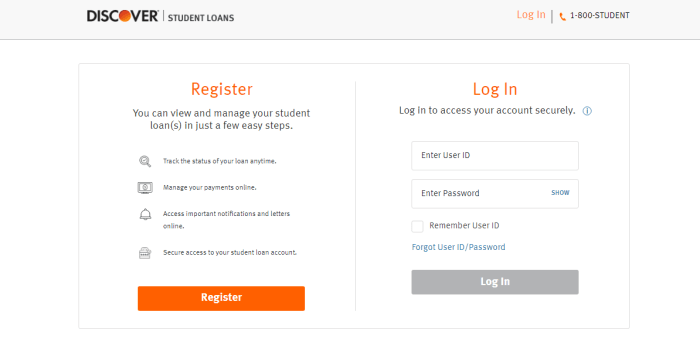

Applying for a Discover student loan is a straightforward process designed to be completed online. The application itself is designed for ease of use, guiding you through each step with clear instructions. However, having the necessary documentation prepared beforehand will significantly expedite the application process.

The application process involves several key steps, beginning with creating an account and concluding with the loan disbursement. Careful completion of each step is crucial for a timely and successful application. Understanding the required documentation is equally important to avoid delays.

The Step-by-Step Application Process

The Discover student loan application process generally follows these steps: First, you’ll create an online account. Next, you’ll complete the application form, providing personal and financial information. This includes details about your education, such as the school you’re attending and your intended program of study. You’ll then need to provide information about your income and any existing debts. After submitting the application, Discover will review your information and notify you of their decision. Finally, if approved, the loan will be disbursed directly to your school.

Required Documentation

To successfully complete the Discover student loan application, you will need to provide several key documents. These documents verify your identity, financial status, and enrollment in an eligible educational program. Providing accurate and complete documentation ensures a smooth and efficient application process.

Checklist of Documents Needed for a Successful Application

Before starting your application, gather the following documents:

- Government-issued photo identification: Such as a driver’s license or passport.

- Social Security number: This is crucial for verifying your identity.

- Proof of enrollment: This could be an acceptance letter from your school or current enrollment verification.

- Federal tax returns (or equivalent): This helps Discover assess your financial situation.

- Bank statements: To verify your banking information and financial stability.

Note: Specific documentation requirements may vary slightly depending on individual circumstances. Always refer to the Discover Student Loans website for the most up-to-date and precise requirements.

Completing the Application Form Accurately and Efficiently

Accurate and complete information is essential for a smooth application process. Take your time to review each section of the application form carefully before submitting it. Double-check all personal information, financial details, and educational information for accuracy. If you encounter any difficulties or have questions, contact Discover Student Loans customer support for assistance. Providing accurate information from the outset will prevent delays and potential complications during the loan approval process. Using a quiet space free of distractions will help you focus and ensure accurate completion of the form.

Managing and Monitoring Student Loans

Successfully managing your Discover student loans requires proactive planning and consistent effort. Understanding your loan details, employing effective tracking methods, and incorporating your loan payments into your overall budget are key components of responsible loan management. Failing to do so can lead to missed payments, increased interest accrual, and potential damage to your credit score.

Effective Strategies for Managing Discover Student Loans

Loan Details and Account Access

Understanding your loan terms is paramount. This includes knowing your principal balance, interest rate (both fixed and variable if applicable), repayment plan, and the due date for your monthly payments. Regularly logging into your Discover student loan account online provides access to this information, allowing you to monitor your progress and identify any discrepancies promptly. The online portal typically offers a detailed breakdown of your loan balance, payment history, and future payment schedules. Familiarize yourself with all features of the online portal to maximize its utility in managing your loans.

Tracking Loan Balances, Interest Accrual, and Payment History

Maintaining a detailed record of your loan information is crucial. You can utilize the Discover online portal, but creating a separate spreadsheet or using personal finance software can provide a comprehensive overview. This should include the initial loan amount, the current balance, the interest rate, the minimum monthly payment, the payment due date, and a record of all payments made. Tracking interest accrual helps you understand the impact of your payments and the overall cost of borrowing. Analyzing your payment history allows you to identify any missed payments or inconsistencies in your repayment schedule.

Budgeting and Financial Planning

Integrating your student loan payments into your monthly budget is essential for successful repayment. Create a realistic budget that allocates sufficient funds for your loan payments while also covering essential expenses like housing, food, transportation, and utilities. Consider using budgeting apps or spreadsheets to track your income and expenses, ensuring you have enough money available each month to meet your loan obligations. Prioritize your loan payments to avoid late fees and negative impacts on your credit score. Financial planning, which includes budgeting and saving, should also account for potential unexpected expenses. Having an emergency fund can help you avoid falling behind on loan payments if unexpected financial issues arise.

Resources for Borrower Assistance

Discover offers various resources to support borrowers in managing their loans. Their online portal provides access to loan information, payment options, and educational materials. Additionally, Discover’s customer service representatives are available to answer questions and provide guidance. Beyond Discover’s resources, independent financial advisors can provide personalized advice on managing student loan debt and creating a comprehensive financial plan. Many non-profit organizations offer free financial counseling services, providing valuable support for navigating student loan repayment. Finally, government websites and educational institutions frequently provide resources and workshops on financial literacy and student loan management.

Potential Benefits and Drawbacks

Choosing a student loan provider requires careful consideration of both the advantages and disadvantages. Discover student loans, like any other financial product, offer a specific set of benefits and drawbacks that prospective borrowers should weigh against their individual circumstances and financial goals. Understanding these aspects is crucial for making an informed decision.

Discover student loans offer several potential benefits, but also come with certain limitations. A thorough evaluation of both sides is essential before committing to this type of financing.

Discover Student Loan Benefits

Discover student loans can offer several advantages to borrowers. These benefits often center around competitive interest rates, flexible repayment options, and potential rewards programs.

- Competitive Interest Rates: Discover frequently offers interest rates that are competitive with other private student loan lenders. The specific rate offered will depend on factors such as creditworthiness, co-signer availability, and the loan’s terms. For example, a borrower with excellent credit and a co-signer might qualify for a significantly lower interest rate than a borrower with limited credit history.

- Flexible Repayment Options: Discover typically provides various repayment plans, allowing borrowers to choose an option that aligns with their post-graduation financial situation. Options might include graduated repayment (lower payments initially, increasing over time), extended repayment (longer repayment period, potentially lower monthly payments), and income-driven repayment (payments adjusted based on income). The availability of these options provides flexibility in managing loan repayments.

- Rewards Programs: Some Discover student loan products may be linked to rewards programs, offering cashback or other benefits on purchases made with a linked Discover credit card. This feature can provide additional value to borrowers who already use Discover credit cards. However, it is important to note that this benefit may not be available for all loan products and is dependent on specific program terms.

Discover Student Loan Drawbacks

While Discover student loans offer several advantages, it’s important to acknowledge potential drawbacks. These limitations should be carefully considered alongside the benefits.

- Credit Score Requirement: Securing a Discover student loan often requires a relatively good credit score. Borrowers with poor or limited credit history may find it difficult to qualify, or may be offered less favorable interest rates. This can be a significant barrier for some students.

- Co-signer Requirement: In some cases, a co-signer with good credit may be required to secure a loan, especially for borrowers with limited credit history. This means relying on another person to share the responsibility of repayment, which can be a significant commitment for both parties.

- Variable Interest Rates: Some Discover student loan products may offer variable interest rates, meaning the interest rate can fluctuate over the life of the loan. This can lead to unpredictable monthly payments and make long-term budgeting more challenging compared to fixed-rate loans. A rise in interest rates could significantly increase the total cost of the loan.

Comparison with Other Student Loan Options

Comparing Discover student loans to other options, such as federal student loans, is crucial. Federal loans often offer borrower protections like income-driven repayment plans and loan forgiveness programs, which may not be available with private loans like those from Discover. However, federal loans may have less favorable interest rates depending on the borrower’s creditworthiness and the current market conditions. Private loans, including those from Discover, might offer more competitive rates for borrowers with strong credit. The best choice depends on individual circumstances and risk tolerance.

Long-Term Financial Implications

Taking out Discover student loans, or any student loan, has significant long-term financial implications. The total amount borrowed, the interest rate, and the repayment plan all contribute to the overall cost of the loan. For example, a $30,000 loan with a 7% interest rate over 10 years could result in significantly higher total repayment costs than the initial loan amount. Careful budgeting and financial planning are crucial to manage loan repayments effectively and avoid long-term financial strain. Failing to manage student loan debt responsibly can negatively impact credit scores, future borrowing opportunities, and overall financial well-being. A realistic budget and repayment strategy are essential.

Customer Service and Support

Discover Student Loans offers a range of customer service options designed to assist borrowers throughout their loan journey. Understanding the available support channels and the experiences of other borrowers is crucial for a positive lending experience. This section details the various ways borrowers can access assistance and provides insights into the effectiveness of Discover’s customer service.

Discover’s customer service channels include phone support, online messaging, and a comprehensive FAQ section on their website. Phone support generally provides immediate assistance for urgent issues, while online messaging allows for asynchronous communication, enabling borrowers to pose questions and receive responses at their convenience. The FAQ section addresses common queries related to loan management, repayment, and other pertinent topics. The accessibility and responsiveness of these channels vary depending on factors such as time of day and volume of inquiries.

Customer Service Options

Discover provides multiple avenues for borrowers to access assistance. These include a dedicated phone number for immediate support, a secure online messaging platform for non-urgent inquiries, and an extensive frequently asked questions (FAQ) section on their website that covers a wide array of topics. Additionally, Discover may offer email support as another communication channel, depending on the specific needs of the borrower.

Borrower Experiences and Feedback

Online reviews and forums provide a glimpse into the experiences of Discover student loan borrowers regarding customer service. While some borrowers report positive experiences, citing helpful and responsive representatives, others describe challenges in reaching support or experiencing long wait times. The overall sentiment appears mixed, suggesting that the quality of customer service can be inconsistent. Specific examples from online reviews might include comments praising the efficiency of online messaging or criticizing lengthy hold times on the phone.

Contact Information and Resources

To contact Discover Student Loan customer service, borrowers can utilize the phone number listed on their loan statements or the Discover website. The website also provides access to online messaging and the comprehensive FAQ section. For specific issues or inquiries, referring to the relevant sections of the website or contacting customer service directly is recommended. Additional resources, such as guides on loan repayment and managing accounts, are typically available on the Discover website.

Accessibility and Responsiveness of Customer Service Channels

The accessibility of Discover’s customer service channels generally appears to be good, with multiple options available. However, the responsiveness can vary. Phone support may experience longer wait times during peak hours, while online messaging often offers quicker responses for non-urgent inquiries. The FAQ section provides immediate answers to common questions, reducing the need to contact customer service directly for simple inquiries. Discover’s overall commitment to accessible and responsive customer service is a factor borrowers should consider when choosing a student loan provider.

Illustrative Scenarios

This section provides concrete examples to illustrate the Discover student loan process, repayment options, and potential problem-solving scenarios. These examples use hypothetical data for clarity and understanding. Remember that individual experiences may vary.

Loan Application Process Scenario

Let’s imagine Sarah, a prospective college student, is applying for a Discover student loan to cover her tuition and living expenses at State University. Her expected tuition is $20,000 per year, and her estimated living expenses are $10,000 per year. She plans to attend for four years. Sarah first completes the online application, providing her personal information, academic details (including acceptance letter from State University), and her parent’s financial information (as she is applying as a dependent student). She then provides supporting documentation, including her tax returns and bank statements, verifying her family’s income and assets. Discover reviews her application and supporting documents. After a few business days, Sarah receives a loan offer for $120,000 (the total cost of her education) with an interest rate of 5% fixed. She accepts the offer electronically, completing the final steps in the loan process.

Impact of Different Repayment Plans Scenario

Consider two scenarios for David, who borrowed $50,000 for his education. In Scenario A, David chooses a standard 10-year repayment plan. With a 6% interest rate, his monthly payment would be approximately $550, and he would pay roughly $16,000 in interest over the life of the loan. In Scenario B, David opts for a longer, 20-year repayment plan. His monthly payment would be around $360, significantly lower. However, due to the extended repayment period, he would pay approximately $32,000 in interest – substantially more than in Scenario A. This illustrates the trade-off between lower monthly payments and increased overall interest costs.

Problem Resolution Scenario

Imagine John, a Discover student loan borrower, experiences a delay in his monthly payment due to an unexpected medical emergency. He immediately contacts Discover’s customer service via phone. A representative guides him through the process of requesting a temporary deferment or forbearance. John provides documentation of his medical emergency, and after a brief review, Discover grants him a three-month forbearance, allowing him to temporarily suspend his payments without impacting his credit score. Discover’s customer service representative clearly explains the terms of the forbearance and answers all of John’s questions, providing him with peace of mind during a difficult time.

Closing Summary

Securing a student loan is a significant financial undertaking. By carefully considering the information presented here regarding Discover student loans—including interest rates, repayment options, and the application process—you can make a well-informed decision that aligns with your financial goals. Remember to explore all available resources and seek personalized financial advice to ensure a smooth and successful loan experience.

Query Resolution

What credit score is needed for Discover student loans?

Discover doesn’t publicly list a minimum credit score requirement. However, a higher credit score generally improves your chances of approval and securing a favorable interest rate. A co-signer may be an option if your credit is limited.

Can I refinance my existing student loans with Discover?

Discover offers student loan refinancing, allowing you to potentially lower your interest rate and simplify payments. Eligibility criteria apply, and you should compare offers from multiple lenders before refinancing.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and may result in late fees and increased interest charges. Contact Discover immediately if you anticipate difficulty making a payment to explore options such as deferment or forbearance.

Does Discover offer any hardship programs for student loan borrowers?

Yes, Discover offers various hardship programs for borrowers experiencing financial difficulties. These programs may include deferment, forbearance, or income-driven repayment plans. Contact their customer service for details and eligibility requirements.