Navigating the world of student loans can be overwhelming, especially when trying to locate your servicer’s address. This guide clarifies the reasons behind searching for “Discover student loans address,” explores various information sources, addresses privacy concerns, and offers alternative contact methods. Understanding the nuances of finding this information is crucial for effective loan management and communication with your lender.

We’ll delve into the different types of information seekers might need, from simply verifying an address to resolving billing discrepancies or initiating a more complex process. The process can be challenging, given the potential for outdated information and the need to prioritize data security. This guide aims to provide a clear and practical approach to locating your Discover student loan servicer’s address while safeguarding your personal information.

Understanding the Search Intent Behind “Discover Student Loans Address”

Users searching for “Discover Student Loans address” are likely seeking contact information for various reasons related to their student loan accounts. This search query reflects a need for direct interaction with the lender, indicating a potential issue or question requiring immediate attention.

Understanding the motivations behind this search reveals crucial insights into user needs and allows for more effective communication strategies. By analyzing the demographics and information requirements, Discover can optimize its online presence and customer service resources.

User Demographics and Needs

The user base searching for this phrase is diverse, ranging from current students actively managing their loans to alumni navigating repayment plans years after graduation. Their needs vary significantly depending on their stage in the loan lifecycle. For example, a current student might be seeking the address to send in paperwork, while a former student might need to address a billing inquiry or request account information. The urgency of their need also influences their behavior; a user facing an immediate payment issue will likely exhibit different online behavior than someone casually checking their account status.

Information Users Might Be Seeking

Users searching for the Discover Student Loans address are seeking a variety of information, depending on their specific needs. This could include the physical address for mailing payments, correspondence regarding loan modifications, or inquiries about account issues. Some users may be looking for a local branch address for in-person assistance, though this is less likely given the predominantly online nature of student loan management. Others might be searching for a customer service phone number or email address, even though they initiated their search with an address-focused query.

Comparison of User Search Intents

| Intent | User Type | Information Needed | Example Query Refinement |

|---|---|---|---|

| Make a payment | Current student | Mailing address for payment | “Discover student loans payment address” |

| Address a billing dispute | Recent graduate | Physical address for formal correspondence | “Discover student loans address for complaints” |

| Request account information | Alumnus | Contact information (address or phone number) | “Discover student loans contact information” |

| Inquire about loan modification | Current student facing financial hardship | Physical or mailing address for formal request | “Discover student loans address for hardship application” |

Locating Relevant Information Sources

Finding the correct address for your Discover student loan servicer requires accessing reliable information sources. This process can be straightforward with the right approach, but inaccuracies and outdated information present challenges. Understanding where to look and how to effectively search is crucial for success.

Finding the correct contact information for your student loan servicer, including their physical address, involves utilizing several key resources. These sources offer varying levels of detail and accessibility, so a multi-pronged approach is often necessary.

Government Websites as Information Sources

Government websites, such as the Federal Student Aid website (studentaid.gov) and the National Student Loan Data System (NSLDS), provide valuable information about federal student loans. These sites are designed to help borrowers manage their loans, and they offer tools to locate your servicer. Effective searching on these sites involves using your Federal Student Aid ID (FSA ID) or your Social Security number to access your personalized loan information. This information often includes the name and contact details of your loan servicer, which may include a physical address. However, it’s important to note that these sites primarily focus on federal loans and may not contain information about private loans from Discover.

Private Lender Websites as Information Sources

Discover’s official website is the primary source for information regarding your Discover student loans. Their website typically has a dedicated section for customer service, where you can find contact information, including a physical address for their headquarters or relevant customer service departments. Searching effectively involves using s like “contact us,” “customer service,” or “help center.” Navigation through their site’s help section may also provide a link to a physical address or a contact form that allows you to request the address.

Challenges in Locating Accurate and Up-to-Date Addresses

One major challenge is the potential for outdated information. Servicers sometimes change addresses or even transfer servicing rights to other companies. Another challenge is the potential for misleading or inaccurate information found on unofficial websites or forums. It’s crucial to rely solely on official sources to ensure accuracy. Finally, some servicers might only provide a general mailing address for correspondence rather than a specific street address for in-person visits.

Step-by-Step Guide to Locating a Student Loan Servicer’s Address

This guide Artikels how to find a student loan servicer’s address using online search engines, focusing on Discover student loans.

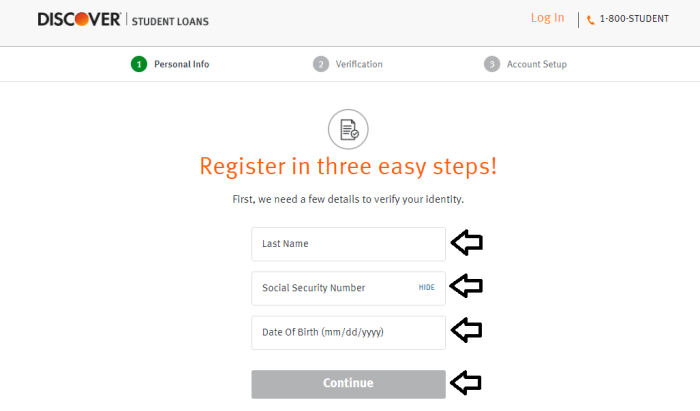

- Log in to your Discover Student Loans account: Access your online account through the Discover website. Your account dashboard should contain your servicer’s contact information.

- Navigate to the “Contact Us” or “Help” section: Most websites have a dedicated section for customer support. This section usually contains contact information, including a physical address or a mailing address.

- Search the website using s: If you cannot find the address directly, use s like “address,” “location,” “contact information,” or “headquarters” in the website’s search bar.

- Check your loan documents: Review any paperwork related to your student loan. The servicer’s address should be printed on official statements or agreements.

- Use a search engine: If the above steps fail, use a search engine like Google, Bing, or DuckDuckGo. Search for “[Discover Student Loans] address” or “[Discover Student Loans] contact information”. Carefully evaluate the results, prioritizing official sources over unofficial blogs or forums.

Data Privacy and Security Concerns

Searching for the address of a student loan provider, or even a specific individual’s address associated with their student loan account, carries significant privacy implications. The seemingly innocuous act of seeking an address can inadvertently expose sensitive personal information, creating vulnerabilities for both the individual searching and the person whose information is sought. Understanding these risks and employing best practices is crucial to maintaining data security.

Sharing or obtaining personal address information, especially in the context of student loans, presents several potential risks. Malicious actors could use this information for identity theft, phishing scams, or even physical harm. Unauthorized access to an address could facilitate stalking, harassment, or mail fraud. Furthermore, the accidental release of this data by a loan provider could lead to significant legal and reputational damage for the institution.

Potential Risks Associated with Sharing or Obtaining Personal Address Information

The unauthorized disclosure of an address linked to a student loan account can have severe consequences. For instance, an individual’s address might be used to create fraudulent accounts in their name, apply for credit cards, or even file false tax returns. Phishing attempts often leverage personal information, including addresses, to trick individuals into revealing sensitive financial details. The misuse of this information can lead to substantial financial losses and damage to credit scores. In extreme cases, knowing an individual’s address could facilitate physical harm or stalking.

Best Practices for Protecting Personal Information While Seeking Student Loan Details

Protecting personal information during the search for student loan details requires a proactive approach. Avoid sharing personal information unnecessarily online, particularly on unsecured websites or social media platforms. When contacting a student loan provider, only use official communication channels such as their official website or verified phone numbers. Be wary of unsolicited emails or phone calls requesting personal information. Always verify the legitimacy of any website or communication before providing any personal details. Use strong, unique passwords for all online accounts and consider enabling multi-factor authentication for enhanced security. Regularly monitor your credit report for any suspicious activity.

Ethical Considerations When Handling Sensitive Data Related to Student Loans

Handling sensitive data related to student loans necessitates a strong ethical framework. Respect for individual privacy is paramount. Data should only be collected and used for legitimate purposes, with explicit consent from the individual whenever possible. Data minimization should be practiced, collecting only the information necessary to fulfill a specific purpose. Data security measures must be robust to prevent unauthorized access, use, or disclosure. Transparency is essential; individuals should be informed about how their data is being used and protected. Compliance with relevant data protection laws and regulations, such as GDPR or CCPA, is mandatory. Accountability for data breaches and misuse must be established. Finally, a culture of data ethics should be fostered within organizations handling student loan information.

Alternative Methods for Contacting Student Loan Servicers

Choosing the right method to contact your student loan servicer is crucial for efficient communication and timely resolution of any issues. Different methods offer varying levels of immediacy, formality, and documentation. Understanding the advantages and disadvantages of each approach can help you choose the best option for your specific situation.

Contacting Servicers via Phone

A phone call provides immediate interaction with a representative. You can directly explain your situation and receive real-time answers. However, hold times can be lengthy, and conversations aren’t documented unless you take notes. This method is best for urgent matters or situations requiring immediate clarification.

- Locate your servicer’s phone number on their website or your loan documents.

- Have your loan information readily available, including your account number.

- Clearly and concisely explain your issue to the representative.

- Take notes of the conversation, including the representative’s name and any agreed-upon actions.

- Follow up in writing if necessary to confirm agreements or actions.

Contacting Servicers via Email

Email allows for a documented record of your communication, which can be beneficial if you need to refer back to the conversation later. However, it is slower than a phone call, and responses might be delayed. This method is ideal for non-urgent matters or situations requiring a written record.

- Locate your servicer’s email address on their website.

- Use a clear and concise subject line that summarizes your issue.

- Include all relevant information, including your account number and a detailed description of your problem.

- Attach any supporting documentation, such as payment confirmations or letters.

- Keep a copy of the email and any responses for your records.

Contacting Servicers via Mail

Sending a letter provides a formal record of your communication, suitable for complex or sensitive issues. However, it’s the slowest method, with potential delays in receiving a response. This method is best for important requests that require a physical paper trail or when dealing with sensitive information.

- Locate your servicer’s mailing address on their website or your loan documents.

- Type or neatly write your letter, including your account number and a clear explanation of your issue.

- Include all relevant documentation, such as payment confirmations or letters.

- Send the letter via certified mail with return receipt requested for proof of delivery.

- Keep a copy of the letter and any received responses for your records.

Effective Communication Strategies for Resolving Student Loan Issues

Effective communication involves being clear, concise, and organized. Prepare your points beforehand and present them logically. Remain calm and respectful, even if frustrated. Actively listen to the representative’s responses and ask clarifying questions. If the issue isn’t resolved immediately, follow up as needed, referencing previous communications. For example, if you are disputing a charge, provide clear documentation supporting your claim. If you are requesting a forbearance, clearly state your financial circumstances and the duration of assistance needed. Always maintain a professional tone and avoid emotional outbursts. This approach increases the likelihood of a positive outcome.

Visual Representation of Information

Student loan servicer websites typically prioritize clear and accessible information, especially regarding contact details. Understanding the visual layout and design choices is crucial for quickly locating the necessary address information. These websites often employ a consistent design language, making navigation relatively intuitive.

Finding the address usually involves a structured approach. Most websites feature a prominent navigation menu, often located at the top of the page. This menu usually contains sections such as “Contact Us,” “Help,” or “About Us.” Clicking on one of these sections typically leads to a dedicated page containing various contact methods, including a physical address and potentially a mailing address. The design frequently utilizes a clean layout with clear headings and subheadings to guide the user through the information. Visual cues, such as icons and bold text, are used to highlight important information like addresses.

Website Layout and Address Location

A typical student loan servicer website might present contact information within a dedicated “Contact Us” section. This section could be further organized with subsections for phone numbers, email addresses, and physical addresses. The physical address might be displayed prominently, perhaps with a map embedded for easy location identification. Below the address, there might be a detailed explanation of when to use the mailing address versus the physical address. For example, the mailing address might be used for sending official documents while the physical address may be used for in-person visits, although in-person visits are less common with student loan servicers. The layout often incorporates a clean, uncluttered design to enhance readability and prevent information overload. The use of clear fonts, sufficient white space, and a logical arrangement of elements contributes to a user-friendly experience.

Interpreting Address Information

Different types of addresses presented on a website serve distinct purposes. A physical address represents the location of the servicer’s office. This is where you might be able to visit in person (though appointments are usually required and this is less common). The mailing address is the location where you should send correspondence, such as letters or documents. These addresses are clearly labeled on the website to avoid confusion. Sometimes, the physical and mailing addresses are the same, but this is not always the case. The website will explicitly state whether an address is for physical visits or for mailing purposes. For example, the website might display “Mailing Address:” followed by the mailing address and “Physical Address:” followed by the physical address. It is crucial to use the correct address for the intended purpose to ensure timely and accurate delivery of your communication.

Ultimate Conclusion

Successfully locating your Discover student loan servicer’s address requires a strategic approach that balances the need for accurate information with the importance of data privacy. By utilizing the methods and resources Artikeld in this guide, you can effectively communicate with your lender, resolve any outstanding issues, and maintain control over your student loan journey. Remember to always prioritize your personal information security throughout the process. This comprehensive guide equips you with the knowledge and tools to confidently manage your student loans.

FAQ Section

What if I can’t find my Discover student loan servicer’s address online?

Contact Discover’s customer service directly via phone or their online portal. They can provide the correct address.

Is it safe to share my address with my student loan servicer?

Yes, sharing your address with your servicer is generally safe, as it’s necessary for important communications and potential mailed documents. Ensure you’re interacting with official channels only.

What if the address listed online is outdated?

Contact Discover directly to verify the current address. They will have the most up-to-date information.

Can I use a PO Box instead of my physical address?

You may be able to use a PO Box, but it’s best to check with Discover’s guidelines. They may require a physical address for certain communications.