Navigating the complexities of student loans can be daunting. Understanding repayment options, interest rates, and total costs is crucial for financial planning. A student loan calculator, like Discover’s, offers a powerful tool to visualize these financial implications, empowering students and families to make informed decisions about higher education funding.

This guide delves into the functionality of Discover’s student loan calculator, comparing it to competitors and exploring ways to enhance its user experience. We’ll examine the different user needs the calculator addresses, highlight key features, and address common misconceptions surrounding student loan repayment. The goal is to provide a clear and comprehensive understanding of how this tool can benefit prospective and current borrowers.

Understanding “Discover Student Loans Calculator” User Intent

The Discover Student Loans Calculator serves a diverse range of users navigating the complexities of higher education financing. Understanding their individual needs and anxieties is crucial for designing a truly helpful and user-friendly tool. This analysis explores the various user profiles, their goals, and concerns related to student loan management.

The primary purpose of the Discover Student Loans Calculator is to empower users to make informed decisions about their student loan options. By providing clear, concise, and personalized estimates, the calculator helps alleviate some of the stress and uncertainty inherent in the student loan process.

User Profiles and Their Needs

Users seeking out a student loan calculator like Discover’s fall into several distinct categories. These include prospective students planning their college funding, current students needing to manage existing loans, and parents assisting their children with financing their education. Each group has unique needs and goals. Prospective students primarily need to understand the potential cost of their education and explore different repayment scenarios. Current students might utilize the calculator to compare repayment plans or explore refinancing options. Parents often use such tools to help budget and plan for their children’s educational expenses. All users share a common need for clear, easily understandable information about loan amounts, interest rates, and repayment schedules.

User Anxieties and Concerns

The student loan process can be daunting, filled with complex terminology and potentially significant financial implications. Users often grapple with anxieties surrounding the total cost of education, the burden of long-term debt, and the impact of interest rates on their overall repayment amount. Concerns about credit scores, eligibility for different loan types, and the potential consequences of default are also prevalent. The uncertainty surrounding future income and job prospects can further amplify these anxieties. For example, a prospective student might worry about whether they can afford their chosen college based on projected loan payments, while a current student might be anxious about whether they can manage their debt load after graduation.

Stages of the Student Loan Process Where the Calculator is Most Useful

The Discover Student Loans Calculator offers significant value at various points in the student loan journey. During the planning phase, prospective students can use it to estimate the total cost of their education, explore different loan options, and determine their potential monthly payments. During the borrowing phase, the calculator helps students compare different loan offers and choose the most suitable option based on their individual circumstances. Once loans are obtained, the calculator can assist with exploring different repayment strategies, such as refinancing or income-driven repayment plans. Finally, it can help users to understand the long-term financial implications of their student loan choices and plan for their future. For instance, a user could input different loan amounts and interest rates to see how those changes affect their monthly payments and total repayment cost.

Features of an Ideal Student Loan Calculator

A robust student loan calculator should provide users with a clear and comprehensive understanding of their potential repayment scenarios. It needs to be user-friendly, accurate, and adaptable to various loan types and repayment plans. This allows users to make informed decisions about their educational financing.

An ideal calculator offers a streamlined interface, presenting information in an easily digestible format. It should be capable of handling complex calculations efficiently and accurately, providing users with realistic estimations of their future financial obligations. The calculator should also be adaptable to various user needs and preferences, allowing for adjustments in inputs and the selection of different repayment plan options.

Calculator Interface Design

The following table illustrates a suggested layout for a responsive, four-column student loan calculator interface. The design prioritizes clear labeling and easy input for a user-friendly experience.

| Loan Details | Repayment Options | Calculation Results | Additional Features |

|---|---|---|---|

| Loan Amount | Repayment Plan (Standard, Graduated, Income-Driven) | Monthly Payment | Loan Amortization Schedule Download |

| Interest Rate | Repayment Term (Years) | Total Interest Paid | What-if Scenarios (Interest Rate Changes) |

| Loan Type (Federal, Private) | Extra Payments (Optional) | Total Amount Paid | Savings Calculator (Integration with other financial tools) |

| Loan Fees (if any) | Start Date | Repayment Schedule (Table) | Financial Aid Information Links |

Required Input Fields

Accurate calculations require several key input fields. The calculator should clearly label each field to minimize user error.

The accuracy of the loan repayment calculations directly depends on the correct input of these values. Inaccurate input will result in inaccurate projections.

- Loan Amount: The total principal amount borrowed.

- Interest Rate: The annual interest rate applied to the loan.

- Loan Term (Repayment Period): The length of time (in years) allocated for loan repayment.

- Loan Type (Federal or Private): This distinction affects interest rates and repayment options.

- Repayment Plan: The chosen repayment plan (Standard, Graduated, Income-Driven).

- Fees (if any): Any additional fees associated with the loan.

- Optional Extra Payments: The option to input any planned additional payments beyond the standard monthly payment.

- Start Date: The date the repayment period begins.

Repayment Plan Options

The calculator should accommodate a variety of repayment plans to reflect real-world scenarios.

Different repayment plans can significantly impact the total cost and monthly payment amount. Understanding these differences is crucial for informed decision-making.

- Standard Repayment Plan: Fixed monthly payments over a set period.

- Graduated Repayment Plan: Payments start low and gradually increase over time.

- Income-Driven Repayment Plan: Monthly payments are based on a percentage of the borrower’s income.

- Extended Repayment Plan: Lengthens the repayment period, reducing monthly payments but increasing total interest paid.

Repayment Schedule Display

The calculator should present a clear and concise repayment schedule. This allows users to visualize their repayment journey and understand the long-term financial implications.

A well-formatted repayment schedule is essential for users to understand their financial obligations over the loan term.

| Month | Beginning Balance | Payment | Interest Paid |

|---|---|---|---|

| 1 | $10,000 | $100 | $8.33 |

| 2 | $9,900 | $100 | $8.25 |

| 3 | $9,800 | $100 | $8.17 |

| … | … | … | … |

Comparison with Competitors

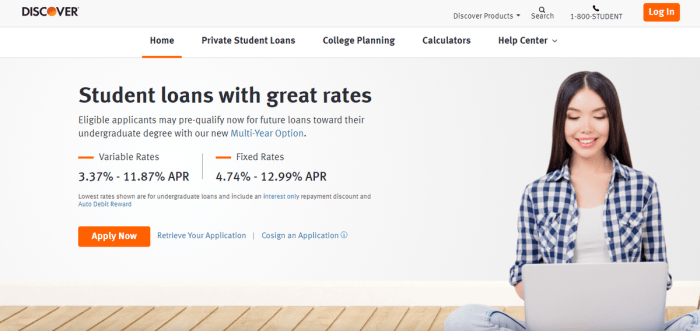

Discover’s student loan calculator is a useful tool, but how does it stack up against other options available to prospective borrowers? This section compares Discover’s calculator with those offered by Sallie Mae and College Ave, focusing on key features, ease of use, and overall presentation.

Direct comparison reveals both similarities and significant differences across these platforms. While all three calculators aim to provide estimates of monthly payments and total loan costs, their approaches to data input, presentation of results, and inclusion of additional features vary considerably.

Feature Comparison of Student Loan Calculators

A key aspect of comparing these calculators lies in understanding their core features. This includes the types of loans accommodated, the level of detail required for input, and the comprehensiveness of the output provided. While all three platforms offer basic loan repayment estimations, some offer more advanced features.

| Feature | Discover | Sallie Mae | College Ave |

|---|---|---|---|

| Loan Types Supported | Federal and private loans | Federal and private loans | Primarily private loans, some federal loan information |

| Repayment Plan Options | Standard, extended | Standard, extended, income-driven (limited information) | Standard, extended (details vary based on loan type) |

| Input Fields | Loan amount, interest rate, loan term | Loan amount, interest rate, loan term, additional fees (some) | Loan amount, interest rate, loan term, potential additional fees (detailed) |

| Output Presentation | Clear monthly payment and total cost; simple visualization | Detailed amortization schedule, total interest paid, summary table | Interactive graph showing principal vs. interest payments, detailed breakdown of costs |

| Additional Features | Limited additional features | Integration with other Sallie Mae tools | Loan comparison tool, prequalification options |

| Usability | Intuitive and straightforward | More detailed, potentially overwhelming for first-time users | User-friendly with interactive elements |

Strengths and Weaknesses of Discover’s Calculator

Discover’s student loan calculator excels in its simplicity and ease of use. The clean interface makes it straightforward for users to input information and quickly receive an estimate. However, this simplicity comes at the cost of some detail. It lacks the advanced features and comprehensive output found in competitors’ calculators.

Conversely, Sallie Mae and College Ave offer more comprehensive features but may be less intuitive for users unfamiliar with student loan terminology or repayment options. The increased detail can be beneficial for informed decision-making but might also overwhelm less experienced users.

Improving the User Experience

A well-designed student loan calculator can significantly reduce the stress and confusion associated with financial planning for higher education. By focusing on intuitive design and clear presentation of information, we can create a tool that empowers users to make informed decisions confidently. Improving the user experience is key to maximizing the calculator’s effectiveness and ensuring widespread adoption.

The current Discover student loan calculator could benefit from several enhancements to streamline the user journey and improve overall usability. These improvements would focus on simplifying input processes, clarifying results, and making the interface more visually appealing and intuitive.

Simplified Input and Data Entry

Streamlining the input process is crucial for a positive user experience. Currently, some users may find the input fields overwhelming or unclear. The following suggestions aim to address these concerns:

- Clearer Labeling and Instructions: Replace ambiguous labels with concise and easily understandable terms. Provide brief, helpful tooltips or explanations for each input field, clarifying the type of data required (e.g., “Annual Tuition,” “Estimated Living Expenses”).

- Input Validation and Error Handling: Implement robust input validation to prevent users from entering incorrect data types (e.g., text in a numerical field). Provide clear and immediate error messages if invalid data is entered, guiding the user towards correction.

- Dropdown Menus and Pre-filled Options: For fields with limited options (e.g., loan type, repayment plan), use dropdown menus instead of free-text input. Pre-fill common values to reduce typing and potential errors.

- Progressive Disclosure: Instead of presenting all input fields at once, use a progressive disclosure approach. Initially show only the essential fields, revealing more advanced options only when the user needs them (e.g., through a “Show Advanced Options” button).

Enhanced Results Presentation and Understanding

The presentation of results significantly impacts the user’s ability to understand and utilize the information provided. Improvements in this area can make the calculator much more effective.

- Visual Representation of Data: Use charts and graphs to visualize loan amounts, interest accrual, and repayment schedules. A visual representation can make complex financial information much easier to grasp.

- Clear Summary of Key Findings: Present a concise summary of the most important results at the top of the results page, highlighting key figures like total loan cost, monthly payment, and total interest paid.

- Detailed Breakdown of Calculations: Provide a detailed breakdown of the calculations performed, allowing users to verify the results and understand how the figures were derived. This transparency builds trust and encourages user engagement.

- Interactive Repayment Scenarios: Allow users to experiment with different repayment plans and loan amounts to see how their choices affect the total cost and repayment schedule. This interactive element enhances engagement and aids in decision-making.

Illustrative Example of Improved User Experience

Imagine a user, Sarah, planning her college education. She accesses the improved Discover student loan calculator. The initial screen presents only essential fields: tuition cost, living expenses, and desired loan amount. Clear labels and tooltips guide her input. After entering her data, the calculator instantly displays a summary: “Estimated Total Loan Cost: $40,000; Estimated Monthly Payment: $400; Estimated Total Interest Paid: $10,000”. Below the summary, an interactive chart shows the loan balance decreasing over time under different repayment plans (Standard, Graduated, Income-Driven). Sarah can hover over data points to see specific figures. A detailed breakdown of calculations is available with a single click, providing transparency and confidence in the results. Sarah easily explores different scenarios, changing the loan amount and repayment plan to find the option that best suits her financial situation. The entire process is intuitive, efficient, and leaves Sarah feeling empowered and informed.

Addressing User Concerns and Misconceptions

Many students and their families harbor misconceptions about student loans, leading to poor financial planning and potentially overwhelming debt. These misconceptions often stem from a lack of understanding of loan terms, repayment options, and the long-term financial implications of borrowing. Our student loan calculator aims to alleviate these concerns by providing clear, accurate, and personalized information.

The calculator’s ability to provide personalized repayment scenarios, based on factors like loan amount, interest rate, and repayment plan, directly addresses many common misconceptions. By visualizing the potential impact of different choices, users can make more informed decisions, avoiding costly mistakes.

Common Misconceptions About Student Loan Repayment

Understanding the nuances of student loan repayment is crucial for effective financial planning. Many borrowers are unaware of the various repayment plans available, the impact of interest capitalization, or the potential consequences of default. The calculator can help clarify these complexities.

- Misconception: All student loans have the same repayment terms. Reality: Various repayment plans exist, including standard, graduated, extended, and income-driven plans, each with different monthly payments and total repayment costs. The calculator allows users to explore these options and see the impact on their monthly budget and total interest paid.

- Misconception: Interest doesn’t matter much during the grace period. Reality: Interest continues to accrue on most federal and private student loans even during the grace period, potentially increasing the total loan amount significantly. The calculator demonstrates the impact of interest capitalization, showing how this compounding effect can lead to higher overall costs.

- Misconception: Defaulting on student loans has minimal consequences. Reality: Defaulting on student loans can have severe consequences, including damage to credit score, wage garnishment, and tax refund offset. The calculator can highlight the potential long-term financial implications of default, emphasizing responsible borrowing and repayment.

Educational Content Integration

To further enhance user understanding, the calculator could incorporate several forms of educational content. This supplementary information can proactively address common concerns and provide valuable financial literacy resources.

- Interactive Glossary: A glossary defining key terms like “principal,” “interest,” “amortization,” “grace period,” and “deferment” would clarify complex terminology. Each term could link to a short, easily digestible explanation.

- Infographics: Visually appealing infographics could illustrate concepts like the impact of interest rates on total repayment costs or the comparison of different repayment plans. For example, a simple bar chart comparing total interest paid under different repayment plans would be very effective.

- Short Videos: Short, engaging videos explaining complex topics, such as income-driven repayment plans or the process of loan consolidation, could improve comprehension and retention. For instance, a 60-second video explaining the benefits and drawbacks of income-driven repayment plans could be highly beneficial.

Importance of Clear and Concise Communication

The calculator’s interface must prioritize clear and concise communication to avoid confusion. Using plain language, avoiding jargon, and presenting information in a visually appealing and easily digestible format are crucial for user understanding and engagement. The use of consistent terminology, intuitive navigation, and well-organized data displays are essential for a positive user experience. For example, using clear labels for input fields (e.g., “Loan Amount,” “Interest Rate,” “Repayment Period”) and providing immediate feedback to user inputs will minimize errors and frustration.

Last Point

Ultimately, a well-designed student loan calculator, such as Discover’s, serves as an invaluable resource for navigating the often-confusing world of student loan debt. By providing clear, concise information and facilitating informed decision-making, these tools empower borrowers to take control of their financial futures. Understanding the features, limitations, and potential improvements of these calculators is key to making the most of this important financial planning tool.

Essential Questionnaire

What types of loans does the Discover student loan calculator handle?

It typically handles federal and private student loans, allowing users to input details for various loan types to calculate repayment scenarios.

Can I factor in potential loan forgiveness programs?

Most calculators don’t directly incorporate loan forgiveness programs into their calculations. These programs have complex eligibility criteria, making precise integration challenging. However, the calculated repayment amount can serve as a baseline, and users should consult separate resources for information on forgiveness programs.

What if my interest rate changes over time?

Standard calculators assume a fixed interest rate throughout the loan term. For variable interest rates, users should input the current rate, understanding that the projections might vary as the rate fluctuates. It’s advisable to run multiple scenarios using different potential future interest rates.

How accurate are the projections provided by the calculator?

The accuracy depends on the accuracy of the input data. While calculators provide estimates, unforeseen circumstances (like job loss) could affect repayment plans. The projections should be considered a helpful guide, not a definitive prediction.