Navigating the complexities of student loans can feel overwhelming. The simple act of searching “discover student loans call” reveals a pressing need for immediate assistance and clear information. This guide explores the motivations behind this search, examining the urgency, demographics, and underlying anxieties surrounding student loan applications. We’ll delve into effective communication strategies, address common concerns, and provide resources to empower you in your financial journey.

Understanding the “why” behind this search query is crucial. Many students and parents facing financial pressures seek quick answers and personalized guidance. This desire for a direct connection, often represented by a phone call, underscores the importance of providing accessible and responsive support. This guide aims to meet that need, offering multiple avenues for information and assistance beyond just a phone call.

Understanding the Search Intent

Individuals searching for “Discover student loans call” are actively seeking a direct line of communication with Discover regarding their student loans. This search query reveals a need for immediate assistance or information, suggesting a higher level of urgency than a general search for “Discover student loans.” The specific nature of their need, however, varies considerably.

The reasons behind this search are multifaceted. Users might be experiencing difficulties with their loan payments, requiring immediate clarification on payment amounts or due dates. They might need to discuss loan deferment or forbearance options, perhaps due to unforeseen financial hardship. Alternatively, they could be seeking information about refinancing their loans to secure a lower interest rate or consolidate multiple loans into a single payment. Finally, some users might simply require general information or clarification on their loan terms and conditions.

User Demographics

The demographic using this search term is likely broad, encompassing current college students facing immediate financial pressures, recent graduates navigating loan repayment, and even individuals who have held their loans for several years and are now encountering difficulties. Age ranges would span from late teens to middle age, with a potentially higher concentration within the 22-40 age bracket, representing those most actively managing student loan debt. Income levels would likely vary significantly, reflecting the diverse financial situations of those with student loan obligations. Geographic location would not significantly influence the search, as Discover operates nationwide. The common thread linking these diverse demographics is the shared need for direct contact with Discover regarding their student loan accounts.

Urgency and Need Implied by the Search

The phrase “Discover student loans call” strongly implies a sense of urgency. The preference for a phone call over other methods, such as email or online chat, suggests a need for immediate resolution or a complex issue requiring personalized attention. For instance, a user facing imminent default on their loan would be highly motivated to find a phone number and speak with a representative immediately. Similarly, someone needing clarification on a critical loan modification deadline would also demonstrate a high level of urgency in their search. The directness of the search term suggests a frustration with less immediate communication channels, implying a possibly time-sensitive situation demanding prompt action. The implication is clear: the user needs help, and they need it now.

Analyzing the Call to Action

A strong call to action (CTA) is crucial for converting website visitors into leads. In the context of student loan searches, the implied expectation of a phone call often stems from the perceived complexity of the loan process and the desire for personalized guidance. Users might believe a phone conversation allows for a more thorough understanding of their options and a quicker resolution to their financial needs. This necessitates a careful analysis of how to best respond to this user expectation.

The effectiveness of a website’s CTA directly impacts conversion rates. A poorly designed CTA can lead to high bounce rates and missed opportunities. Conversely, a well-crafted CTA can significantly increase engagement and lead generation. Understanding the user’s search intent and addressing their need for information or assistance is paramount in creating a successful CTA.

Effective Call-to-Action Strategies for Student Loan Websites

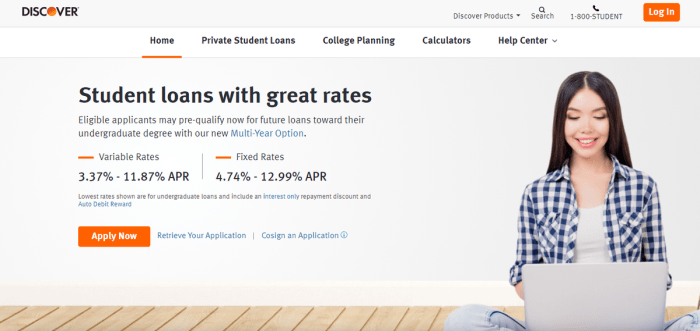

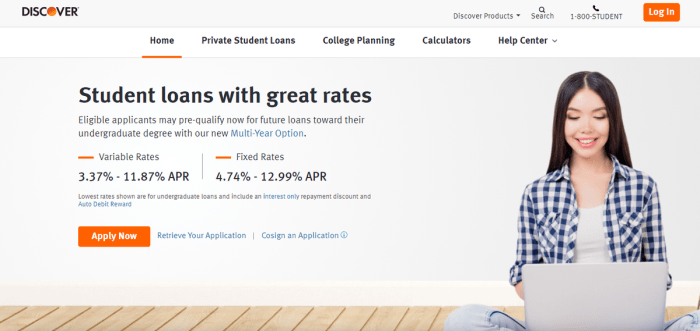

Effective CTAs for student loan websites go beyond simply providing a phone number. They should be strategically placed, visually appealing, and clearly communicate the benefit of taking action. For example, a button that says “Get a Personalized Loan Quote” is more compelling than a generic “Contact Us” button. Similarly, using action verbs like “Apply Now,” “Get Started,” or “Calculate Your Payment” encourages immediate engagement. These CTAs can be further enhanced by incorporating visually appealing design elements, such as contrasting colors or compelling imagery. A well-placed CTA near the end of a helpful article, for example, can significantly improve conversion.

Alternative Ways to Address User Needs Beyond a Phone Call

While phone calls remain a popular method of communication, providing alternative avenues for addressing user needs can broaden accessibility and cater to diverse preferences. A comprehensive FAQ section that addresses common questions about student loans is a crucial starting point. This allows users to quickly find answers to their queries without needing to make a phone call. Interactive calculators that allow users to estimate their monthly payments based on loan amount, interest rate, and repayment period provide valuable self-service tools. Furthermore, a comprehensive online application process that allows users to submit their information and track their application status provides a convenient and efficient alternative to phone calls. Finally, a live chat feature offers instant support and can answer immediate questions, thereby minimizing the need for a phone call.

Content Ideas for Addressing the Search

This section Artikels compelling content designed to effectively address common student loan search queries. We’ll explore headline options, a sample phone script, and a comparative table of student loan providers. This approach aims to provide potential borrowers with clear, concise information to assist them in making informed decisions.

Compelling Headlines

The headlines below are designed to attract attention and directly address the needs and concerns of students searching for loan options. They utilize s commonly used in searches and emphasize key benefits.

- Secure Your Future: Discover Affordable Student Loan Options Today

- Low Interest Rates & Flexible Repayment: Find the Perfect Student Loan

- Simplify Student Loan Search: Compare Rates & Lenders Now

- Student Loan Relief: Explore Options to Manage Your Debt

- Unlock Your Education: Get Pre-Approved for a Student Loan

Sample Phone Call Script

This script provides a framework for a concise and informative phone conversation regarding student loan options. It focuses on gathering essential information and guiding the caller towards the best solution.

Agent: “Thank you for calling Discover Student Loans. My name is [Agent Name]. How can I assist you today?”

Caller: [States their needs/questions]

Agent: “To best understand your needs, could you tell me about your educational goals and the estimated cost of your education?”

Agent: “Based on your information, we offer several loan options with varying interest rates and repayment plans. Would you like me to explain these in more detail?”

Agent: “Let’s discuss your credit history and income to determine your eligibility and the best loan option for you.”

Agent: “I can provide you with a personalized quote and guide you through the application process. Would you like to proceed?”

Student Loan Provider Comparison

The table below compares several student loan providers, highlighting key features to aid in decision-making. Note that interest rates and repayment plans can vary based on individual circumstances. Always check with the lender for the most up-to-date information.

| Lender | Interest Rates (Example – Subject to Change) | Repayment Plans | Customer Service Options |

|---|---|---|---|

| Federal Student Loans | Variable, depending on loan type and market conditions. Check studentaid.gov for current rates. | Standard, Graduated, Extended, Income-Driven Repayment (IDR) plans available. | Website, phone, and email support. |

| Sallie Mae | Variable, dependent on creditworthiness and loan type. Check Sallie Mae website for current rates. | Various repayment options, including fixed and variable interest rate plans. | Website, phone, and online chat support. |

| Discover | Variable, dependent on creditworthiness and loan type. Check Discover website for current rates. | Options for fixed and variable rate loans, with different repayment terms. | Website, phone, and online chat support. |

| Private Lender X (Example) | Variable, dependent on creditworthiness and loan type. Check Lender X website for current rates. | Flexible repayment plans may be available. | Website, phone support, possibly online chat. |

Addressing User Concerns and Questions

Applying for student loans can be a stressful process, filled with uncertainty about eligibility, repayment, and the overall impact on your financial future. Many students worry about the long-term implications of debt, the complexities of the application, and the potential for default. Understanding these anxieties and addressing them proactively is crucial for a positive student loan experience.

The application process itself can feel overwhelming. It involves navigating various forms, understanding different loan types, and gathering necessary documentation. Furthermore, concerns about managing repayments and avoiding default are significant stressors for many borrowers. This section aims to clarify the process and alleviate these common anxieties.

Student Loan Application Process

The student loan application process typically begins with completing the Free Application for Federal Student Aid (FAFSA). This form gathers information about your financial situation and is used to determine your eligibility for federal student aid, including loans. After submitting the FAFSA, you’ll receive a Student Aid Report (SAR) summarizing your information and eligibility. Next, you’ll need to choose a lender and complete their application. This may involve providing additional documentation, such as tax returns or bank statements. Once approved, the funds will be disbursed directly to your educational institution. The exact process can vary slightly depending on the lender and the type of loan you are applying for. Remember to carefully review all documents and understand the terms and conditions before signing anything.

Addressing Concerns About Loan Repayment

Managing student loan repayment can be daunting. Many borrowers worry about the monthly payments and the total amount of interest they will pay over the life of the loan. Understanding different repayment plans is key to managing this debt effectively. Federal student loans offer various repayment options, including standard, graduated, extended, and income-driven repayment plans. Each plan has its own terms and conditions, impacting the monthly payment amount and the total repayment period. For example, an income-driven repayment plan adjusts your monthly payment based on your income and family size, making it more manageable during periods of lower earnings. Careful planning and budgeting are essential to ensure timely repayments and avoid default.

Understanding and Avoiding Loan Default

Defaulting on a student loan has serious consequences. It can negatively impact your credit score, making it difficult to obtain loans or credit cards in the future. It can also lead to wage garnishment, tax refund offset, and even legal action. To avoid default, it’s crucial to understand your repayment obligations and proactively address any challenges. Contacting your lender early if you anticipate difficulty making payments is vital. They may offer options such as forbearance or deferment, which can temporarily suspend or reduce your payments. Open communication with your lender is crucial to prevent default and navigate any financial difficulties you may encounter. Remember, many resources are available to help you manage your student loans, including financial counseling services and government programs.

Visual Representation of Information

Visual aids can significantly improve understanding and engagement when exploring complex financial topics like student loans. Clear, concise visuals help users quickly grasp key information and make informed decisions. We’ll explore how infographics, illustrations, and flowcharts can effectively communicate the nuances of student loan options.

Infographic: Types of Student Loans

This infographic uses a clean, modern design with a color palette of blues and greens to convey trustworthiness and stability. The main title, “Understanding Your Student Loan Options,” is prominently displayed at the top in a bold, easily readable font. Each type of student loan (Federal Subsidized Loans, Federal Unsubsidized Loans, Federal PLUS Loans, Private Student Loans) is represented by a distinct section, using icons (e.g., a graduation cap for Federal loans, a bank building for Private loans) to visually differentiate them. A simple bar graph compares average interest rates for each loan type, clearly showing the range. Key features of each loan (e.g., interest accrual, eligibility requirements, repayment plans) are presented using concise bullet points accompanied by small, relevant icons. The infographic concludes with a call to action, encouraging viewers to explore the Discover Student Loans website for more details.

Illustration: Student Loan Application Process

This step-by-step illustration depicts the process of completing a student loan application using a series of numbered panels. Panel 1 shows a student sitting at a computer, ready to begin the online application. Panel 2 illustrates the process of entering personal information (name, address, social security number). Panel 3 depicts the section for educational details (school, program, expected graduation date). Panel 4 showcases the financial information section (income, assets, co-signer information, if applicable). Panel 5 depicts the review and submission process, with a confirmation screen displayed. Finally, Panel 6 shows a confirmation email, indicating successful application submission. Each panel uses simple, clear icons and minimal text to focus attention on the key action in each step.

Flowchart: Choosing a Student Loan Provider

This flowchart guides users through the decision-making process of selecting a student loan provider. It begins with a central question: “What are my financial needs and priorities?” The flowchart then branches into two paths: “Need low interest rates” and “Need flexible repayment options.” Each path further branches based on additional criteria, such as “Need a co-signer” or “Prefer online application process.” The flowchart uses clear decision points (diamonds) and action steps (rectangles) with directional arrows. Each final branch leads to a recommendation: “Consider Federal Loans,” “Explore Private Loans from Discover,” or “Compare multiple lenders.” The flowchart utilizes a consistent color scheme and clear, concise language to ensure easy navigation and understanding.

Exploring Alternative Search Terms

Understanding the nuances of user search intent is crucial for effective marketing. While “Discover student loans call” is a direct query, many users might express similar needs using different phrasing. Analyzing these alternative search terms allows us to broaden our reach and provide relevant information to a wider audience.

The intent behind “Discover student loans call” is clear: the user needs to contact Discover regarding their student loans. However, other searches might reflect a slightly different approach or stage in the user’s journey. By anticipating these variations, we can tailor our content to better address their specific needs.

Alternative Search Terms and Corresponding User Intent

The following three alternative search terms represent variations in how a user might express their need to contact Discover about their student loans: “Discover student loan customer service,” “Contact Discover about student loans,” and “Discover student loan phone number.” While all indicate a desire to communicate with Discover about student loans, the subtle differences in phrasing reflect varying levels of urgency and specificity. “Discover student loan customer service” suggests a broader need for assistance, while “Discover student loan phone number” indicates a more immediate desire for direct contact. “Contact Discover about student loans” sits in between, representing a general need to reach out to the company.

Content Examples Targeting Alternative Search Terms

Effective content targeting these alternative search terms would involve providing readily accessible contact information, clearly displayed phone numbers, and links to online help centers. For example, a webpage targeting “Discover student loan customer service” could feature a prominent FAQ section addressing common student loan questions, alongside multiple contact options, including a phone number, email address, and a link to a live chat feature. The webpage for “Contact Discover about student loans” could be a streamlined version, prioritizing quick access to the contact information. Finally, a page optimized for “Discover student loan phone number” would simply and clearly display the relevant phone number, perhaps with a brief description of its purpose. These variations in content structure reflect the specific intent behind each search term, ensuring users find the information they need quickly and efficiently.

Concluding Remarks

Securing student loans shouldn’t be a daunting process. By understanding the user’s intent behind the search “discover student loans call,” we can create more effective resources. This guide has explored various approaches, from compelling headlines and informative scripts to visual aids and FAQs. Remember, accessing reliable information and understanding your options are key to making informed decisions and navigating the path to higher education with confidence.

FAQ Resource

What if I can’t afford my student loan payments?

Contact your lender immediately. They may offer options like forbearance or deferment to temporarily reduce or suspend payments.

How long does it take to get approved for a Discover student loan?

Processing times vary, but you can expect a decision within a few weeks of submitting your application. Check the Discover website for current estimates.

What types of student loans does Discover offer?

Discover offers both federal and private student loans, each with its own set of terms and conditions. Review their website for detailed information on available loan options.

What documents do I need to apply for a Discover student loan?

Typically, you’ll need your Social Security number, tax information (or your parents’, if you’re a dependent), and details about your enrollment at your chosen educational institution. Specific requirements are Artikeld on Discover’s application page.