Navigating the complex world of student loans can be daunting. Discover Student Loans.com aims to simplify this process by providing a centralized platform for information and resources. This guide delves into the website’s features, loan options, repayment plans, and security measures, offering a comprehensive overview to help prospective borrowers make informed decisions.

We’ll explore the various loan types offered, eligibility criteria, interest rates, and repayment options. We’ll also examine the website’s user interface, customer support channels, and security protocols, comparing it to similar platforms to provide a well-rounded perspective. Understanding the potential risks and benefits associated with student loans is crucial, and we will address this aspect to promote responsible borrowing practices.

Website Overview of discoverstudentloans.com

Discover student loans’ website provides a comprehensive platform for students and parents seeking financial aid for higher education. It offers a user-friendly interface designed to simplify the often complex process of applying for and managing student loans. The site aims to empower users with the information and tools necessary to make informed decisions about their educational financing.

The website’s main features include a loan eligibility calculator, which provides an estimated loan amount based on user inputs. Users can also explore different loan options, compare interest rates, and understand repayment plans. A robust FAQ section addresses common questions, while integrated resources offer guidance on financial literacy and budgeting. The application process is streamlined through the website, allowing users to submit applications and track their progress online.

User Interface and Navigation

The website boasts a clean and intuitive design. Navigation is straightforward, with clearly labeled menus and sections. The use of visual aids, such as charts and graphs, effectively presents complex financial information in an accessible manner. Information is presented logically, guiding users through the process step-by-step. The overall experience is designed to minimize user frustration and encourage engagement.

Target Audience

Discover student loans primarily targets students pursuing higher education, as well as their parents and guardians who may be involved in the financial planning process. The website’s content reflects this focus, with information tailored to the needs and concerns of this demographic. The language used is clear and concise, avoiding overly technical jargon. Furthermore, the resources provided address common anxieties related to student loan debt, such as repayment strategies and budgeting tools.

Comparison with Similar Websites

The following table compares discoverstudentloans.com with three other prominent student loan websites:

| Website Name | Key Features | Target Audience | User Experience |

|---|---|---|---|

| Discover Student Loans | Eligibility calculator, loan comparison tool, repayment plan options, financial literacy resources | Students, parents, and guardians | Clean, intuitive interface; straightforward navigation; comprehensive information |

| Sallie Mae | Various loan options, online application, repayment assistance programs, financial planning tools | Students, parents, and graduates | User-friendly, but may present a large amount of information at once |

| Nelnet | Loan servicing, payment options, online account management, customer support | Existing loan borrowers | Functional, but may lack the visual appeal of other sites |

| Federal Student Aid | Information on federal student aid programs, application assistance, loan repayment information | All students seeking federal financial aid | Comprehensive, but can be overwhelming for first-time users due to its breadth of information |

Loan Types Offered

Discover Student Loans primarily focuses on private student loans, offering various options to meet different borrower needs. Unlike federal loans, eligibility criteria and interest rates are determined by Discover based on individual creditworthiness and other factors. It’s crucial to understand the nuances of each loan type before applying.

Discover Student Loans Eligibility Criteria

Eligibility for Discover student loans hinges on several key factors. Applicants generally need to be a U.S. citizen or permanent resident, enrolled at least half-time in an eligible educational program, and possess a Social Security number. Credit history plays a significant role, with higher credit scores often leading to more favorable interest rates and loan terms. Co-signers may be required for applicants with limited or poor credit history. Finally, the specific program of study and the institution attended are also considered. The exact requirements may vary depending on the applicant’s circumstances and the specific loan product.

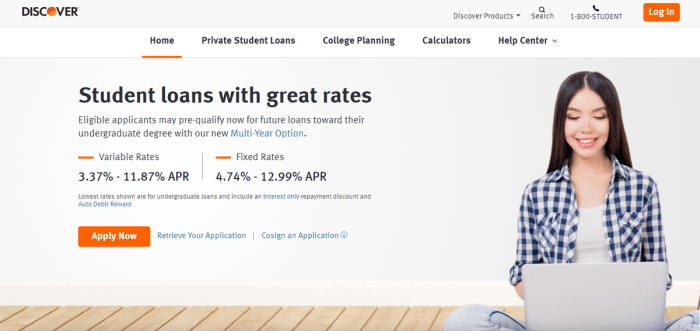

Interest Rates and Repayment Terms for Discover Student Loans

Discover’s interest rates for private student loans are variable, meaning they fluctuate based on market conditions. The specific rate offered to an individual will depend on their creditworthiness, the loan amount, and the repayment term selected. Generally, longer repayment terms result in lower monthly payments but accrue more interest over the life of the loan. Conversely, shorter repayment terms lead to higher monthly payments but less total interest paid. Discover provides interest rate ranges on their website, but the actual rate offered to an individual is determined during the application process. For example, a borrower with excellent credit might receive a lower interest rate than a borrower with limited credit history. Repayment terms typically range from 5 to 15 years, though specific options depend on the loan amount and individual circumstances.

Federal Student Loan Application Process Flowchart

This flowchart Artikels the typical application process for a federal student loan. Note that specific steps and requirements may vary depending on the type of federal loan (e.g., subsidized vs. unsubsidized).

[Diagram description: The flowchart begins with “Start”. It then branches to “Complete FAFSA (Free Application for Federal Student Aid)”. Following that is “Receive Student Aid Report (SAR)”. Next is “Choose Loan Type and Lender”. This leads to “Complete Loan Application with Chosen Lender”. After this comes “Loan Approval/Denial”. If approved, the process moves to “Loan Funds Disbursed”. If denied, it goes to “Explore Alternative Funding Options”. Finally, the flowchart ends with “End”.]

Repayment Options and Tools

Managing your Discover student loans effectively requires understanding the available repayment options and utilizing the tools provided to help you stay on track. Choosing the right plan and actively managing your debt can significantly impact your financial future. This section details the repayment plans, available resources, and the potential consequences of default.

Available Repayment Plans

Discover offers various repayment plans to accommodate different financial situations. The specific plans available may vary depending on your loan type and terms. It’s crucial to review your loan documents and contact Discover directly to determine the best option for your circumstances. Generally, you might find options like standard repayment, extended repayment, graduated repayment, and income-driven repayment plans. Standard repayment involves fixed monthly payments over a set period (usually 10 years). Extended repayment stretches the repayment period, lowering monthly payments but increasing the total interest paid. Graduated repayment starts with lower payments that gradually increase over time. Income-driven repayment plans base your monthly payment on your income and family size, potentially resulting in lower payments but a longer repayment period.

Repayment Calculators and Budgeting Tools

Discover provides online tools to help you estimate your monthly payments and create a personalized repayment budget. These calculators consider factors such as loan amount, interest rate, and repayment plan to project your total repayment cost and monthly obligations. Budgeting tools may offer features like expense tracking and savings goal setting, helping you manage your finances effectively alongside your loan repayment. Utilizing these resources can empower you to make informed decisions and plan for successful repayment. For example, the repayment calculator might show you that choosing an extended repayment plan will reduce your monthly payment by $100, but will ultimately cost you an extra $5,000 in interest over the life of the loan.

Consequences of Loan Default

Failing to make your student loan payments can lead to serious consequences. Defaulting on your loan can negatively impact your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Further, your wages may be garnished, and your tax refund could be seized to repay the debt. In severe cases, default can lead to legal action and collection fees. The impact of loan default extends beyond financial repercussions; it can also create significant stress and strain on your personal life.

Step-by-Step Guide for Managing Student Loan Debt

Effectively managing student loan debt involves a proactive and organized approach. Follow these steps to navigate repayment successfully:

- Understand your loans: Review your loan documents carefully to understand the terms, interest rates, and repayment options available.

- Create a budget: Track your income and expenses to determine how much you can realistically afford to pay towards your loans each month.

- Choose a repayment plan: Select a repayment plan that aligns with your financial situation and long-term goals. Consider the trade-offs between monthly payment amounts and total interest paid.

- Set up automatic payments: Automate your loan payments to avoid late fees and ensure consistent repayment.

- Monitor your progress: Regularly check your loan account online to track your payments and ensure everything is on track.

- Seek help if needed: If you encounter financial difficulties, contact your loan servicer immediately to explore options like forbearance or deferment. Do not ignore the problem; proactive communication is key.

Customer Support and Resources

Discover Student Loans prioritizes providing comprehensive support and resources to its borrowers throughout their loan journey. Access to helpful information and responsive customer service is crucial for a positive borrowing experience, and Discover aims to meet these needs through a variety of channels and tools. This section details the available support options and resources designed to assist borrowers with any questions or concerns.

Discover Student Loans offers multiple avenues for borrowers to access assistance. These channels are designed to provide support in the manner most convenient for each individual.

Customer Support Channels

Borrowers can connect with Discover Student Loans customer support through several methods, ensuring accessibility for diverse communication preferences. Phone support provides immediate assistance for urgent matters, while email allows for detailed inquiries and follow-up. The online chat feature offers a quick and convenient way to address simpler questions or obtain immediate clarification. These options, combined, provide a robust support system.

Available Resources for Borrowers

Beyond direct contact, Discover provides a wealth of self-service resources to empower borrowers to manage their loans effectively. A comprehensive FAQ section addresses common questions, covering topics from loan applications to repayment options. Informative articles and tutorials offer detailed explanations of loan processes and financial management strategies. These resources are readily accessible online, providing immediate answers and guidance to many frequently asked questions.

Contacting Customer Support and Resolving Issues

The process for contacting Discover Student Loans customer support is straightforward. Borrowers can find contact information, including phone numbers and email addresses, prominently displayed on the website. When contacting support, borrowers should clearly state their issue and provide any relevant information, such as their loan number and account details. Discover aims to resolve issues efficiently and effectively, providing timely responses and solutions. For complex issues, a dedicated representative may be assigned to work with the borrower until the matter is resolved.

Frequently Asked Questions

Understanding common concerns helps borrowers navigate their loan journey with confidence. The following list addresses frequently asked questions regarding Discover Student Loans.

- Q: How do I apply for a Discover Student Loan?

A: The application process is detailed on the Discover Student Loans website and involves completing an online application form, providing necessary documentation, and undergoing a credit check (if applicable). - Q: What types of student loans does Discover offer?

A: Discover offers various loan types, including federal and private student loans, catering to different educational needs and financial situations. Specific loan options may vary depending on eligibility criteria. - Q: What repayment options are available?

A: Discover provides various repayment options, such as fixed and variable interest rates, and different repayment plans to accommodate borrowers’ financial circumstances. These options are explained in detail on the website and can be discussed with a customer service representative. - Q: How can I make a loan payment?

A: Discover offers multiple payment methods, including online payments through their website, automated clearing house (ACH) transfers, and mail-in checks. Details on each payment method are available on the Discover Student Loans website. - Q: What happens if I miss a loan payment?

A: Missing a loan payment can result in late fees and negatively impact your credit score. Discover encourages borrowers to contact customer service immediately if they anticipate difficulty making a payment to explore available options.

Security and Privacy

Protecting your personal information is a top priority at Discover Student Loans. We understand the sensitive nature of financial data and employ robust security measures to safeguard your account and prevent unauthorized access. Our commitment to privacy is reflected in our comprehensive policies and practices, designed to meet and exceed industry standards.

We utilize a multi-layered approach to security, incorporating several key elements. This includes robust firewalls to prevent unauthorized access to our systems, regular security audits to identify and address vulnerabilities, and encryption technology to protect data both in transit and at rest. Our systems are constantly monitored for suspicious activity, and we employ advanced threat detection techniques to proactively identify and mitigate potential risks.

Data Encryption and Secure Transactions

Discover Student Loans utilizes industry-standard encryption protocols, such as Transport Layer Security (TLS) and Secure Sockets Layer (SSL), to encrypt all data transmitted between your browser and our servers. This ensures that your personal information, including your loan application details and financial information, remains confidential during transmission. For sensitive transactions, such as loan applications and payments, we employ additional security measures, such as multi-factor authentication, to further protect your account. These measures add an extra layer of security, requiring verification beyond just your password, thus making it significantly more difficult for unauthorized individuals to access your account.

Privacy Policy and Data Protection Compliance

Our comprehensive privacy policy clearly Artikels how we collect, use, and protect your personal information. This policy details the types of data we collect, the purposes for which we collect it, and your rights regarding your data. We are committed to transparency and strive to provide clear and concise information about our data practices. Discover Student Loans adheres to all relevant data protection regulations, including the California Consumer Privacy Act (CCPA) and other applicable federal and state laws. We regularly review and update our policies and procedures to ensure ongoing compliance with these regulations. This includes implementing data minimization practices, meaning we only collect the data necessary to provide our services, and maintaining robust data retention policies to ensure data is only kept for as long as needed.

Website Security Measures

Our website incorporates several security features designed to protect user data. These include regular security updates to our software and infrastructure to address any known vulnerabilities, and intrusion detection systems that monitor for and respond to suspicious activity. We also conduct penetration testing on a regular basis to simulate real-world attacks and identify weaknesses in our security posture. The results of these tests inform ongoing improvements to our security measures, ensuring our website remains a secure environment for our users.

Potential Risks and Benefits

Choosing a student loan provider is a significant financial decision. Understanding both the potential benefits and risks associated with using Discover Student Loans is crucial for making an informed choice that aligns with your individual financial circumstances and long-term goals. This section will explore these aspects, comparing Discover to other options available in the market.

Discover Student Loans, like any other student loan provider, presents both advantages and disadvantages. While it offers competitive interest rates and convenient repayment options for some borrowers, it’s essential to weigh these benefits against potential drawbacks and the overall financial implications. Responsible borrowing practices and a strong understanding of personal finance are paramount to successfully managing student loan debt.

Potential Risks of Using Discover Student Loans

Borrowing money, regardless of the lender, carries inherent risks. With Discover Student Loans, potential risks include the possibility of high interest rates depending on creditworthiness and market conditions, potentially leading to a larger overall debt burden. Another risk is the possibility of difficulty in repayment if unforeseen circumstances arise, such as job loss or unexpected medical expenses. Finally, the terms and conditions of the loan agreement should be thoroughly understood before signing, as failing to meet these terms could result in negative consequences such as late payment fees or damage to credit score.

Potential Benefits of Using Discover Student Loans

Discover Student Loans may offer several benefits to eligible students. These can include competitive interest rates compared to other lenders, flexible repayment options tailored to individual needs, and potentially access to financial literacy resources to assist in responsible debt management. Some borrowers may find the online application process straightforward and user-friendly, streamlining the borrowing experience. The availability of various loan types, such as federal and private loans, might also be attractive to students with diverse financial situations.

Comparison with Other Loan Options

Discover Student Loans compete with a wide range of other lenders offering student loans, including both federal and private loan providers. Federal student loans often come with fixed interest rates and income-driven repayment plans, offering greater protection against economic downturns. However, federal loans may have stricter eligibility requirements. Private lenders, like Discover, may offer more flexible terms but often come with variable interest rates that can fluctuate, leading to uncertainty in repayment amounts. The best option depends on individual circumstances, credit history, and risk tolerance. A thorough comparison of interest rates, fees, and repayment options from multiple lenders is recommended before making a decision.

Importance of Responsible Borrowing and Financial Literacy

Responsible borrowing is paramount when taking out student loans. This involves carefully considering the total cost of borrowing, including interest and fees, and ensuring that the loan amount aligns with your ability to repay the debt after graduation. Financial literacy plays a crucial role in this process. Understanding budgeting, credit scores, and debt management strategies empowers students to make informed decisions and avoid financial pitfalls. Seeking advice from financial advisors or utilizing free online resources can significantly improve your understanding of personal finance and assist in developing a responsible approach to student loan repayment.

Visual Representation of Key Information

Understanding the visual representation of key loan information is crucial for making informed decisions. Clear visualizations help borrowers quickly grasp complex financial details, such as interest rate changes, repayment schedules, and plan comparisons. This section provides descriptive examples of such visualizations.

Interest Rate Fluctuation Over Time

This visual would be a line graph charting the interest rate of a fixed-rate federal student loan over the loan’s lifespan. The x-axis represents time (in years), starting from the loan origination date and extending to the loan’s maturity date. The y-axis represents the interest rate (as a percentage). A single, straight horizontal line would indicate a fixed interest rate, remaining constant throughout the loan term. The graph’s title would clearly state the loan type (e.g., “Fixed-Rate Federal Direct Unsubsidized Loan Interest Rate”). The graph would include a legend clearly identifying the line representing the interest rate. For example, if the interest rate is a fixed 5%, the line would remain at 5% across the entire x-axis.

Breakdown of Repayment Amounts Over the Loan Term

This visual would be a bar chart illustrating the monthly payment amounts over the loan’s repayment period. The x-axis represents time (in months), showing the duration of the repayment plan. The y-axis represents the monthly payment amount (in dollars). Each bar represents a month, and its height corresponds to the monthly payment for that month. A standard repayment plan would show relatively consistent bar heights throughout the loan term. The chart title would specify the loan amount, interest rate, and repayment plan (e.g., “Monthly Payment Breakdown: $20,000 Loan, 5% Interest, Standard 10-Year Repayment”). The chart would also include a total repayment amount displayed prominently.

Comparison of Different Repayment Plan Options

This visual would be a table comparing three common repayment plan options: Standard, Extended, and Income-Driven Repayment. The table would have four columns: “Repayment Plan,” “Monthly Payment,” “Loan Term (Years),” and “Total Repayment Amount.” Each row would represent a different repayment plan. For example, a $20,000 loan at 5% interest might have the following approximate values (these are examples and actual values will vary):

| Repayment Plan | Monthly Payment | Loan Term (Years) | Total Repayment Amount |

|---|---|---|---|

| Standard | $210 | 10 | $25,200 |

| Extended | $120 | 20 | $28,800 |

| Income-Driven (Example) | $100 | 25 | $30,000 |

The table would clearly indicate that while the monthly payment is lower with extended and income-driven plans, the total repayment amount and loan term increase. A brief description of each plan type would be included below the table.

Last Point

Ultimately, understanding your options and making informed choices is key to successfully managing student loan debt. Discover Student Loans.com offers a valuable resource for students seeking to navigate the complexities of financing their education. By carefully considering the information presented here, and by actively engaging with the resources available on the website, borrowers can empower themselves to make responsible financial decisions that will positively impact their future.

Essential FAQs

What types of student loans are NOT offered through Discover Student Loans.com?

Discover Student Loans.com primarily focuses on federal student loans. They do not typically offer private student loans.

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage to your credit score, and potential loan default. Contact Discover Student Loans.com immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Does Discover Student Loans.com offer loan consolidation services?

While Discover Student Loans.com helps manage existing federal student loans, they may not directly offer loan consolidation services. Information on consolidation options may be available through the federal government’s student aid website.

How secure is my personal information on Discover Student Loans.com?

Discover Student Loans.com employs industry-standard security measures to protect user data, including encryption and secure servers. Their privacy policy Artikels how they handle and protect personal information.