Navigating the world of student loans can feel overwhelming, but understanding the pre-qualification process is a crucial first step towards securing the funding you need for your education. Pre-qualification offers a valuable opportunity to explore your loan options without impacting your credit score significantly, allowing you to compare rates and terms from various lenders before committing to a full application. This process provides a clearer picture of your borrowing power and helps you make informed decisions about your financial future.

By pre-qualifying, you gain a head start in the loan application process, saving time and reducing stress. You can compare offers from different lenders, identify the best loan terms for your circumstances, and even explore options like co-signers to improve your chances of approval. This proactive approach empowers you to manage your student loan debt effectively from the outset.

Understanding “Discover Student Loans Pre-qualify”

Pre-qualifying for a Discover student loan is a valuable first step in the financial aid process. It allows you to get an estimate of how much you might be able to borrow without impacting your credit score, giving you a clearer picture of your financial options before committing to a full application. This process provides a crucial overview of your eligibility and potential loan terms.

The Meaning of Pre-qualification for Student Loans

Pre-qualification for a student loan, in the context of Discover or any lender, is a preliminary assessment of your eligibility for a loan. It involves providing basic personal and financial information to the lender, who then uses this data to generate an estimated loan amount and interest rate. This differs from a full application, where a more thorough review of your credit history and financial situation takes place. The pre-qualification process is designed to be quick and easy, providing a snapshot of your borrowing potential without the commitment of a formal application.

Benefits of Pre-qualifying for Student Loans

Pre-qualification offers several key advantages. Firstly, it provides a realistic expectation of the loan amount you might receive, helping you better plan for college expenses. Secondly, it allows you to compare loan offers from different lenders without impacting your credit score multiple times. This comparative shopping empowers you to make informed decisions based on interest rates and repayment terms. Finally, the process can help you identify any potential issues early on, such as insufficient income or credit history, allowing you to address these concerns before formally applying for a loan.

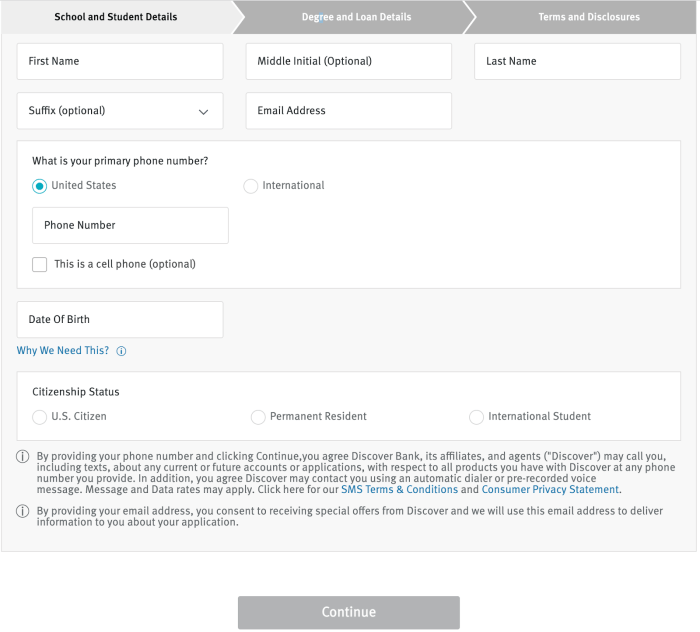

The Step-by-Step Pre-qualification Process

The process is typically straightforward and involves these steps: First, you’ll visit the Discover Student Loans website and locate the pre-qualification tool. Then, you will be asked to provide some basic information, such as your name, date of birth, and Social Security number. Next, you’ll need to provide details about your education, including the school you plan to attend and your expected graduation date. Finally, you’ll submit your information and receive a pre-qualification decision, usually within minutes. This decision will include an estimated loan amount and interest rate. Remember that this is only an estimate; the final loan terms may vary slightly after a full application.

Pre-qualification versus a Full Loan Application

Pre-qualification and a full loan application are distinct stages in the loan process. Pre-qualification is a quick, preliminary assessment that doesn’t affect your credit score. It provides an estimate of your borrowing power. A full application, on the other hand, involves a more thorough review of your credit history and financial situation, and a formal credit check is performed. The full application is necessary to secure the loan and finalize the loan terms. Think of pre-qualification as a trial run, giving you a general idea of your eligibility, while the full application is the formal commitment.

Factors Affecting Pre-qualification

Pre-qualifying for a Discover student loan involves a quick assessment of your eligibility based on the information you provide. Several key factors contribute to the lender’s decision, ultimately determining whether you receive a pre-qualification offer or not. Understanding these factors can help you prepare a strong application and increase your chances of approval.

Several key pieces of information are analyzed during the pre-qualification process. Lenders use this information to assess your creditworthiness and the likelihood of you repaying the loan.

Credit History

Your credit history plays a significant role in pre-qualification. Lenders review your credit report, looking at factors like your payment history, credit utilization, and the length of your credit history. A strong credit history, characterized by consistent on-time payments and low credit utilization, significantly improves your chances of pre-qualification. Conversely, a poor credit history, including missed payments, high credit utilization, or bankruptcies, can negatively impact your pre-qualification outcome. For example, an applicant with a history of consistently late payments on credit cards might be deemed a higher risk and receive a less favorable pre-qualification offer, or even be denied altogether. A good credit score, generally above 670, often improves the chances of pre-qualification.

Income and Co-signer Status

Your income and the presence of a co-signer are also crucial factors. Lenders assess your ability to repay the loan based on your current income and employment history. A stable income and consistent employment history demonstrate your capacity to manage loan repayments. If your income is insufficient to comfortably cover the monthly loan payments, a co-signer with a strong credit history and stable income can significantly strengthen your application. A co-signer essentially acts as a guarantor, agreeing to repay the loan if you are unable to. For instance, a student with limited income might secure pre-qualification with a parent or guardian co-signing the loan. Conversely, an applicant with a low or inconsistent income and without a co-signer might face pre-qualification denial.

Situations Resulting in Pre-qualification Denial

Several situations can lead to pre-qualification denial. These include having a very low credit score, a history of significant debt, a lack of stable income, or insufficient information provided during the application process. For example, an applicant with a history of multiple bankruptcies or a very low credit score below 550 may be denied pre-qualification due to the high perceived risk of default. Similarly, an applicant who provides incomplete or inaccurate information may also be denied. A lack of verifiable income or employment history can also lead to rejection, as it makes it difficult for the lender to assess the applicant’s repayment ability.

Types of Student Loans and Pre-qualification

Understanding the different types of student loans and their pre-qualification processes is crucial for securing the best financing for your education. This section will clarify the key distinctions between federal and private student loans, focusing on the pre-qualification requirements for each.

The pre-qualification process for student loans, whether federal or private, helps you understand your eligibility before formally applying. It provides a preliminary assessment of your borrowing power, allowing you to compare loan offers and make informed decisions about your financing options.

Federal and Private Student Loan Pre-qualification Comparison

The pre-qualification process differs significantly between federal and private student loans. Federal loans generally have simpler requirements, while private loans often involve a more rigorous credit and financial assessment.

| Loan Type | Credit Check Required | Income Verification | Co-signer Requirements |

|---|---|---|---|

| Federal Student Loans (e.g., Direct Subsidized/Unsubsidized Loans, PLUS Loans) | Generally No (creditworthiness is assessed based on other factors, such as enrollment status and financial need) | Required for some loans (e.g., PLUS Loans); may involve verification of financial information through the FAFSA | Generally not required for undergraduate students; may be required for graduate students (PLUS Loans) |

| Private Student Loans | Almost always required; lenders use credit scores and history to assess risk | Often required; lenders may verify income through pay stubs, tax returns, or bank statements | Often required, especially for students with limited or poor credit history |

Typical Interest Rates and Repayment Terms

Interest rates and repayment terms vary considerably depending on the loan type, your creditworthiness, and the lender. Federal loans typically offer lower interest rates than private loans, but the repayment terms may be less flexible. Understanding these variations is essential for choosing a loan that aligns with your financial capabilities.

| Loan Type | Interest Rate Range (Example – subject to change) | Repayment Period Range | Potential Fees |

|---|---|---|---|

| Federal Student Loans (variable rates shown for illustration) | 2-7% (variable, depending on loan type and market conditions) | 10-25 years (depending on loan type and repayment plan) | Origination fees (a small percentage of the loan amount) |

| Private Student Loans (variable rates shown for illustration) | 5-15% (variable, depending on credit score, co-signer, and market conditions) | 5-15 years (depending on lender and loan terms) | Origination fees, late payment fees, prepayment penalties (may vary by lender) |

Finding and Comparing Lenders

Securing the best student loan requires careful consideration of various lenders and their offerings. Understanding the nuances of interest rates, fees, and repayment options is crucial to making an informed decision and avoiding potential financial pitfalls. This section will guide you through the process of finding reputable lenders, comparing their offerings, and identifying potential predatory practices.

Choosing the right student loan lender is a significant financial decision. Several reputable institutions offer student loans, each with its own terms and conditions. Comparing these offers allows you to select the option best suited to your individual circumstances and financial goals. Failure to compare could lead to unnecessarily high interest rates and fees, impacting your long-term financial well-being.

Reputable Student Loan Lenders

Several lenders are known for their responsible lending practices and transparent terms. It’s important to research each lender thoroughly before making a decision. Remember that this list is not exhaustive and lender availability may vary by location.

- Discover Student Loans: Offers various loan types and repayment plans.

- Sallie Mae: A well-established lender with a wide range of loan options.

- Wells Fargo: Provides student loans alongside other financial services.

- Navient: A major servicer of federal and private student loans.

- PNC Bank: Offers student loans as part of its broader banking services.

Comparing Interest Rates and Fees

Interest rates and fees significantly impact the overall cost of your student loan. A seemingly small difference in interest rates can translate to thousands of dollars in extra payments over the life of the loan. Therefore, a thorough comparison is essential.

Consider the following when comparing:

- Annual Percentage Rate (APR): This represents the total cost of borrowing, including interest and fees.

- Origination Fees: These are one-time fees charged when you receive the loan.

- Late Payment Fees: These penalties are assessed if you miss a payment.

- Prepayment Penalties: Some lenders charge fees if you pay off your loan early.

Use online loan calculators to model different loan scenarios and see how variations in interest rates and fees affect your total repayment amount.

Identifying Predatory Lending Practices

Predatory lenders often target vulnerable borrowers with deceptive practices. Being aware of these tactics can help you avoid falling victim.

- Extremely high interest rates: Rates significantly above market average should raise red flags.

- Hidden fees: Lenders should clearly disclose all fees upfront.

- Aggressive sales tactics: Be wary of high-pressure sales techniques.

- Lack of transparency: Avoid lenders who are unclear about loan terms and conditions.

- Difficulty contacting the lender: A reputable lender will be easily accessible.

Always read the fine print carefully and compare offers from multiple lenders before signing any loan documents.

Utilizing Online Tools for Comparison

Several online resources can assist in comparing student loan offers. These tools often allow you to input your financial information and receive personalized loan comparisons. This streamlines the process and makes it easier to identify the best option for your needs.

Many financial websites and comparison tools provide detailed information on various student loan lenders. These tools typically allow you to filter results based on criteria such as interest rates, loan amounts, and repayment terms. Using these tools can significantly reduce the time and effort involved in comparing loans from different lenders.

Post-Pre-qualification Steps

Receiving a student loan pre-qualification is an encouraging first step, but it’s crucial to understand that it’s not a guarantee of loan approval. A pre-qualification simply indicates that a lender believes you *might* qualify based on the limited information you provided. The next steps involve solidifying your application and navigating the formal approval process.

Understanding the distinction between pre-qualification and formal approval is key. Pre-qualification is a preliminary assessment based on your credit score, income, and debt, often requiring minimal documentation. Formal approval, on the other hand, involves a comprehensive review of your financial situation, including verification of income, employment history, and academic enrollment. This process is significantly more rigorous and requires substantial documentation.

Documents Required for a Full Loan Application

To complete a full loan application, lenders typically request several documents to verify the information provided during pre-qualification. These usually include proof of identity (such as a driver’s license or passport), proof of income (pay stubs, tax returns, or bank statements), proof of enrollment (acceptance letter from your college or university), and possibly your Free Application for Federal Student Aid (FAFSA) data. Providing complete and accurate documentation expedites the approval process.

Negotiating Loan Terms and Conditions

While pre-qualification provides a preliminary interest rate estimate, the final interest rate offered may vary. After receiving your formal loan offer, review the terms and conditions carefully, paying close attention to the interest rate, fees, repayment options, and any potential deferment or forbearance periods. If you are unsatisfied with any aspect of the loan offer, it’s often possible to negotiate. This might involve comparing offers from multiple lenders to leverage a better deal or presenting evidence of improved financial circumstances since your initial pre-qualification. For example, if you’ve received a significant raise or paid down other debts, you might be able to negotiate a lower interest rate. Remember to maintain a professional and courteous approach during negotiations. Clearly articulate your concerns and be prepared to justify your request for changes to the loan terms.

Illustrating the Pre-qualification Process

Understanding the student loan pre-qualification process can feel overwhelming, but breaking it down into manageable steps makes it far less daunting. This section will visually represent the process and explore the emotional rollercoaster students often experience.

The pre-qualification process can be visualized as a flowchart. It begins with the student’s initial inquiry, followed by providing basic personal and financial information. The lender then runs a preliminary credit check and assesses the provided information. This leads to either a pre-qualification offer or a rejection. If pre-qualified, the student then proceeds to a formal application, which involves a more thorough review of their credit history and financial situation. This final step results in either loan approval or denial.

The Emotional Journey of Pre-qualification

The emotional experience of pre-qualification is often a mix of anticipation, hope, and potential disappointment. Initially, students may feel excited about the possibility of securing funding for their education. This excitement stems from the belief that their dreams are within reach. As they complete the pre-qualification process, anxiety might increase as they await the lender’s decision. If pre-qualified, relief and a sense of accomplishment are common feelings. However, rejection can lead to feelings of frustration, disappointment, and even desperation. Students might feel overwhelmed and uncertain about how to proceed with their educational plans. The emotional impact can be significant, affecting their overall well-being and academic performance. For example, a student might experience sleeplessness or difficulty concentrating on their studies while awaiting the pre-qualification results. A rejection can lead to stress and potentially impact their academic performance due to the added pressure of financial uncertainty.

Impact on Financial Planning and Future Decisions

Pre-qualification significantly impacts a student’s financial planning and future decisions. A pre-qualification offer provides a clear picture of potential loan amounts and interest rates, allowing students to better budget and plan for college expenses. Knowing the potential loan amount influences decisions regarding college choice, major selection, and overall financial strategy. For example, a student pre-qualified for a smaller loan amount might reconsider attending a more expensive university or choose a less expensive major to reduce overall educational costs. Conversely, a higher pre-qualification amount could offer greater flexibility and options. Furthermore, the interest rates offered during pre-qualification influence the long-term cost of the loan and the student’s overall debt burden after graduation. Understanding these figures early allows for more informed decision-making regarding borrowing and repayment strategies. For instance, a student might choose to explore alternative funding options if the interest rates are significantly high. In essence, pre-qualification empowers students to make informed financial decisions that align with their educational goals and long-term financial well-being.

Final Thoughts

Successfully pre-qualifying for student loans is a significant achievement, marking a pivotal step towards achieving your educational goals. Remember that pre-qualification is not a guarantee of loan approval; a full application is still required. However, by understanding the factors that influence pre-qualification and diligently comparing loan offers, you can significantly increase your chances of securing the best possible financing for your education. Proactive planning and informed decision-making are key to managing your student loan debt responsibly.

Expert Answers

What happens after I pre-qualify for a Discover student loan?

Pre-qualification is just the first step. You’ll receive an estimate of how much you might be able to borrow. To get the actual loan, you’ll need to complete a full application and provide further documentation.

Can I pre-qualify for a student loan without impacting my credit score?

Discover and many other lenders perform a “soft” credit pull during pre-qualification, which generally doesn’t affect your credit score. However, a full application will require a “hard” inquiry, which can slightly impact your score.

What if I’m denied pre-qualification?

Don’t be discouraged. Explore ways to improve your credit score or consider a co-signer. You can also reapply after addressing any issues that may have contributed to the denial.

How long does the pre-qualification process take?

The process is typically quick, often taking only a few minutes to complete the online application. However, receiving a pre-qualification decision may take a little longer.