Navigating the complexities of student loan debt can feel overwhelming, but understanding the potential of refinancing can significantly alleviate financial burdens. This guide delves into the world of Discover student loan refinancing, exploring its benefits, drawbacks, and the crucial steps involved in securing a more favorable repayment plan. We’ll examine eligibility criteria, compare various lenders, and provide practical advice to empower you to make informed decisions about your financial future.

From understanding the intricacies of federal versus private loan refinancing to mastering the application process and managing your refinanced loan effectively, we aim to provide a clear and concise pathway to achieving your financial goals. This guide equips you with the knowledge to navigate the process confidently and make the best choices for your unique circumstances.

Understanding Student Loan Refinancing

Student loan refinancing is the process of replacing your existing student loans with a new loan from a different lender, typically at a lower interest rate. This can significantly reduce your monthly payments and the total amount you pay over the life of your loan. However, it’s crucial to understand the nuances before making a decision.

Student loan refinancing involves applying to a new lender, providing them with your financial information, and receiving a new loan offer. The lender then pays off your existing student loans, and you begin making payments on the new loan. The process typically takes several weeks, and approval depends on your creditworthiness and income.

Benefits and Drawbacks of Refinancing Student Loans

Refinancing can offer substantial benefits, such as lower monthly payments and a reduced total interest paid. A lower interest rate can save you thousands of dollars over the life of your loan. Furthermore, refinancing can simplify your repayment process by consolidating multiple loans into a single monthly payment. However, refinancing also carries drawbacks. You might lose access to federal loan benefits like income-driven repayment plans or loan forgiveness programs. Additionally, if your credit score deteriorates after refinancing, your interest rate could increase. The length of the loan term might also increase, potentially leading to higher total interest paid despite a lower monthly payment.

Federal vs. Private Student Loan Refinancing

Federal student loans are offered by the government, while private student loans come from banks and other financial institutions. Refinancing federal loans with a private lender means losing the protections and benefits offered by the federal government. Federal loans often offer more flexible repayment options, such as income-driven repayment plans and deferment options. Private lenders generally offer lower interest rates to borrowers with excellent credit, but the terms and conditions can be less flexible. The decision to refinance federal loans should be carefully considered, weighing the potential interest rate savings against the loss of federal benefits.

Situations Where Refinancing is Beneficial and Not

Refinancing is generally beneficial for borrowers with good credit scores who can secure a significantly lower interest rate than their current loans. For example, someone with a 750+ credit score and multiple federal loans at high interest rates might save considerably by refinancing with a private lender. However, refinancing might not be advantageous for borrowers with poor credit scores or those who rely on federal loan benefits, such as income-driven repayment plans or public service loan forgiveness. For instance, a borrower with a low credit score and a federal loan with an income-driven repayment plan might find that refinancing eliminates their eligibility for these programs, negating any interest savings.

Eligibility Criteria for Refinancing

Refinancing your student loans can significantly impact your monthly payments and overall loan repayment strategy. However, eligibility depends on several factors lenders consider to assess your risk. Understanding these criteria is crucial before applying.

Eligibility for student loan refinancing hinges on a combination of creditworthiness, income stability, and the type and amount of your existing student loan debt. Lenders use a scoring system to evaluate these factors, and meeting their minimum requirements is essential for approval.

Credit Score Requirements

A strong credit score is typically the most significant factor influencing your eligibility for refinancing. Most lenders prefer applicants with a credit score of 660 or higher, although some may accept scores as low as 600, potentially with a higher interest rate. A higher credit score generally translates to more favorable interest rates and loan terms. For example, an applicant with a 750 credit score might qualify for a significantly lower interest rate compared to someone with a 660 score. Lenders use your credit report, which includes information on your payment history, credit utilization, and length of credit history, to determine your creditworthiness.

Income Requirements

Lenders also assess your income to determine your ability to repay the refinanced loan. They typically require a stable income stream that demonstrates sufficient capacity to handle the monthly payments. The specific income requirements vary among lenders, but generally, they require proof of consistent employment and sufficient income to comfortably manage your debt obligations. For instance, a lender might require a minimum annual income or a specific debt-to-income ratio (DTI). Documentation such as pay stubs, tax returns, or bank statements are typically needed to verify income.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a crucial factor in determining your eligibility. DTI represents the percentage of your gross monthly income that goes towards debt repayment. A lower DTI indicates a greater capacity to manage additional debt. Lenders generally prefer applicants with a DTI below 43%, although some may consider applicants with higher DTIs depending on other factors. For example, an applicant with a DTI of 35% and a strong credit score is more likely to be approved than an applicant with a DTI of 50%, even if they have a similar credit score.

Required Documentation

The application process typically requires several documents to verify your identity, income, and existing student loan debt. Common documentation includes:

- Government-issued photo identification (e.g., driver’s license or passport)

- Social Security number

- Proof of income (e.g., pay stubs, tax returns, W-2 forms)

- Details of existing student loans (e.g., loan amounts, interest rates, lenders)

- Bank statements

Providing complete and accurate documentation significantly increases the chances of a smooth and timely application process. Incomplete applications may result in delays or rejection.

Finding the Best Refinancing Options

Choosing the right student loan refinancing option can significantly impact your repayment journey. A careful comparison of lenders and their offerings is crucial to securing the best possible terms. This section will guide you through the process of identifying and selecting a refinancing plan that aligns with your financial goals.

Comparison of Refinancing Lenders

Finding the best refinancing option involves comparing offers from multiple lenders. The following table provides a sample comparison – remember that rates and terms change frequently, so always check directly with the lender for the most up-to-date information. This data is for illustrative purposes only and should not be considered financial advice.

| Lender Name | Interest Rate (Example – Variable) | Fees | Repayment Options |

|---|---|---|---|

| Lender A | 6.5% – 11.5% | Origination fee: 1% of loan amount | Fixed-term, variable-term |

| Lender B | 7.0% – 12.0% | No origination fee | Fixed-term |

| Lender C | 6.0% – 10.0% | Origination fee: 0.5% of loan amount, Late payment fees apply | Fixed-term, variable-term, income-driven repayment |

| Lender D | 7.5% – 12.5% | No fees | Fixed-term, shorter-term options available |

Factors to Consider When Choosing a Refinancing Lender

Selecting a refinancing lender requires careful consideration of several key factors. These factors will help you make an informed decision that best suits your individual circumstances.

The following points highlight the importance of a thorough evaluation before committing to a refinancing plan.

- Interest Rate: The interest rate directly impacts your total repayment cost. Lower rates result in significant savings over the life of the loan.

- Fees: Origination fees, prepayment penalties, and late payment fees can add to your overall cost. Carefully review all fees associated with each lender’s offer.

- Repayment Terms: Consider the loan term length (e.g., 5 years, 10 years, 15 years). Shorter terms mean higher monthly payments but less interest paid overall, while longer terms result in lower monthly payments but higher overall interest costs.

- Repayment Options: Some lenders offer various repayment options, such as fixed-rate, variable-rate, or income-driven repayment plans. Choose an option that aligns with your financial stability and future income projections.

- Customer Service and Reputation: Research the lender’s reputation and customer service record. Read online reviews and check with the Better Business Bureau to assess their reliability.

- Eligibility Requirements: Ensure you meet the lender’s eligibility criteria, including credit score, debt-to-income ratio, and loan amount.

Step-by-Step Guide to Comparing Refinancing Offers

A systematic approach to comparing refinancing offers helps ensure you choose the best option. This structured process minimizes the risk of overlooking crucial details.

- Gather Offers: Obtain pre-qualification or formal offers from multiple lenders to compare their terms side-by-side.

- Compare Interest Rates and Fees: Analyze the interest rates and fees associated with each offer, paying close attention to any hidden charges.

- Evaluate Repayment Terms: Consider the loan term length and its impact on your monthly payments and total interest paid.

- Assess Repayment Options: Compare the flexibility and features offered by different repayment options.

- Review Lender Reputation: Research the reputation and customer service record of each lender.

- Calculate Total Cost: Use a loan amortization calculator to determine the total cost of each loan, including principal and interest.

- Make Your Decision: Choose the offer that best balances interest rate, fees, repayment terms, and lender reputation.

Calculating Potential Savings from Refinancing

Calculating potential savings helps demonstrate the financial benefits of refinancing. This calculation allows for a clear comparison between your current loan and a potential refinanced loan.

To illustrate, let’s assume you have a $30,000 student loan with a 9% interest rate and a 10-year repayment term. Your monthly payment would be approximately $380. If you refinance to a 6% interest rate with the same term, your monthly payment would decrease to approximately $310. This represents a savings of approximately $70 per month, or $840 per year. Over the 10-year loan term, your total savings would be approximately $8400 (excluding any fees).

Savings = (Original Monthly Payment – Refinanced Monthly Payment) * Number of Months

The Refinancing Application Process

Refinancing your student loans can significantly impact your monthly payments and overall debt burden. Understanding the application process is crucial for a smooth and successful experience. This section details the steps involved, common pitfalls to avoid, and strategies for a positive outcome.

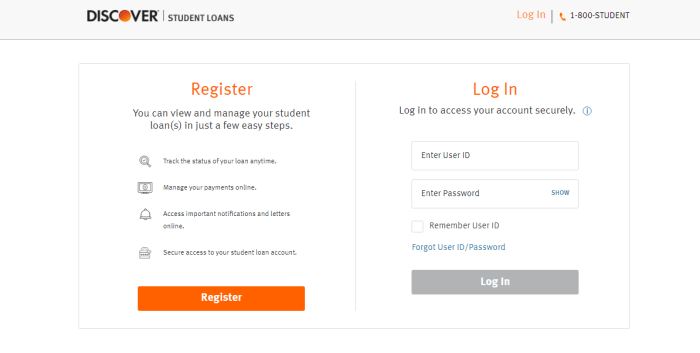

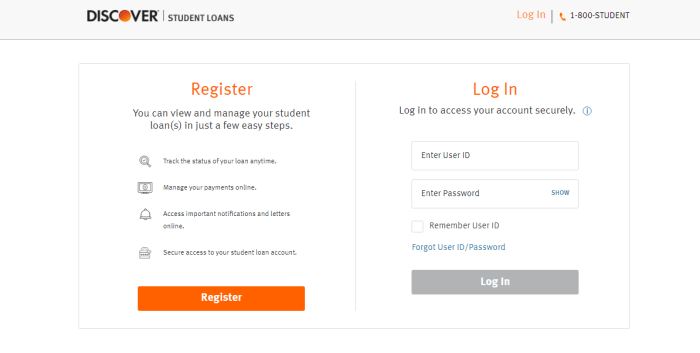

The application process generally involves several key steps. First, you’ll need to gather your financial information, including your credit score, income, and existing student loan details. Next, you’ll compare offers from different lenders, considering interest rates, repayment terms, and fees. Once you’ve chosen a lender, you’ll complete their online application, providing the necessary documentation. The lender will then review your application and, if approved, you’ll receive a loan offer. Finally, you’ll review the loan documents carefully, ensuring you understand all the terms and conditions before signing.

Common Application Mistakes

Avoiding common mistakes during the application process can save you time and frustration. Failing to thoroughly research lenders and compare offers can lead to accepting a less favorable loan. Inaccurate or incomplete information provided on the application can delay the process or lead to rejection. Not understanding the terms and conditions of the loan before signing can result in unexpected fees or higher interest rates. Finally, neglecting to check your credit report for errors before applying can negatively impact your chances of approval.

Reviewing Loan Documents

Before signing any loan documents, it’s essential to review them thoroughly. Pay close attention to the interest rate, repayment terms, fees, and any other conditions. Compare the terms of the loan offer to your initial expectations and research to ensure there are no discrepancies. If anything is unclear or seems unfavorable, don’t hesitate to contact the lender for clarification before proceeding. This careful review protects you from unexpected costs and ensures you’re comfortable with the terms of your refinanced loan.

Tips for a Successful Application

A successful application involves proactive steps. Improve your credit score before applying by paying bills on time and reducing debt. Gather all necessary documentation beforehand, including tax returns, pay stubs, and student loan statements. Compare offers from multiple lenders to secure the best interest rate and terms. Complete the application accurately and thoroughly to avoid delays. Finally, maintain open communication with the lender throughout the process, addressing any questions or concerns promptly.

Post-Refinancing Management

Refinancing your student loans can significantly impact your monthly payments and overall debt burden. However, the process doesn’t end with securing a new loan. Effective post-refinancing management is crucial to ensure you benefit fully from the refinancing and avoid potential pitfalls. This involves consistent monitoring, proactive debt management strategies, and a plan for addressing unforeseen financial challenges.

Successful student loan refinancing requires ongoing attention. Failing to monitor your loan payments and interest rates can lead to missed payments, late fees, and damage to your credit score. Furthermore, understanding the terms of your new loan, including interest rates and repayment schedules, is vital for making informed financial decisions.

Monitoring Loan Payments and Interest Rates

Regularly checking your loan account online is essential. This allows you to verify that payments are being processed correctly and that the interest rate remains as agreed upon. Discrepancies should be reported immediately to your lender. Consider setting up automatic payments to avoid missed payments and late fees. Budgeting tools and financial tracking apps can aid in monitoring your loan payments alongside other financial obligations. A slight deviation in interest rates, while seemingly insignificant initially, can accumulate over time, impacting the total repayment amount.

Strategies for Effective Student Loan Debt Management

After refinancing, implement a robust debt management strategy. This might include creating a detailed budget to allocate funds for loan repayments while prioritizing essential expenses. Exploring additional income streams, such as a part-time job or freelance work, can accelerate debt repayment. Prioritizing high-interest debt is a key strategy; while your refinanced loan likely has a lower rate than your previous loans, other debts might still warrant quicker repayment. Consider exploring debt avalanche or debt snowball methods to strategically allocate payments based on interest rates or loan balances.

Addressing Difficulties with Refinanced Loans

Unexpected financial setbacks can impact anyone. If you face difficulties making your refinanced loan payments, contact your lender immediately. Many lenders offer forbearance or deferment options, temporarily suspending or reducing payments. Explore income-driven repayment plans if applicable; these plans adjust your monthly payment based on your income and family size. Failing to communicate with your lender can lead to negative consequences, such as defaulting on the loan. Proactive communication is key to navigating financial hardship.

Resources for Borrowers Facing Financial Hardship

Several resources exist to assist borrowers facing financial difficulties. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, helping individuals create personalized debt management plans. The Consumer Financial Protection Bureau (CFPB) provides information and resources on consumer rights and financial education. Additionally, many non-profit organizations offer financial literacy programs and debt management assistance. Remember, seeking help is a sign of strength, not weakness, and there are resources available to support you.

Illustrative Examples of Refinancing Scenarios

Understanding the potential benefits and drawbacks of student loan refinancing requires examining real-world examples. The following scenarios illustrate situations where refinancing proved advantageous and where it did not, emphasizing the importance of careful consideration before making a decision.

Successful Refinancing Scenario

Sarah, a recent graduate, had $50,000 in federal student loans with an average interest rate of 7%. Her monthly payment was $600. After researching refinancing options, she found a private lender offering a 4% interest rate. By refinancing, Sarah secured a new loan of $50,000 at 4%, reducing her monthly payment to $470. This resulted in a monthly savings of $130 and significant long-term interest savings, allowing her to pay off her loans faster. The lower interest rate and reduced monthly payment significantly improved her financial situation.

Unsuccessful Refinancing Scenario

Mark had $30,000 in federal student loans, including subsidized and unsubsidized loans, with an average interest rate of 5%. His monthly payment was $350. He considered refinancing to a private lender offering a 4.5% interest rate. While the interest rate reduction seemed minimal, the more significant factor was the loss of federal loan benefits, including income-driven repayment plans and potential loan forgiveness programs. His new monthly payment would be $340, only a $10 reduction, not enough to offset the loss of federal protections. In Mark’s case, the marginal benefit of a slightly lower interest rate did not outweigh the risk of losing access to critical federal student loan benefits.

Comparison of Refinancing Repayment Schedules

This visual representation compares two refinancing options for a $40,000 loan. Option A, a 5-year loan at 5% interest, would have a monthly payment of approximately $746 and a total repayment of $44,760. Option B, a 7-year loan at 4% interest, would have a lower monthly payment of approximately $570, but a total repayment of $47,880. A table showing the monthly payments and remaining balances for each option over the life of the loan would clearly illustrate the trade-off between a lower monthly payment and higher total interest paid. Option A would result in a quicker payoff but higher monthly cost, while Option B would result in a lower monthly cost but a longer repayment period and a higher total repayment amount.

Final Summary

Refinancing your student loans can be a powerful tool for achieving financial freedom, but careful consideration and planning are essential. By understanding the process, eligibility requirements, and potential pitfalls, you can make an informed decision that aligns with your financial situation and long-term goals. Remember to compare offers meticulously, carefully review loan documents, and proactively manage your refinanced loan to maximize the benefits and minimize potential risks. Take control of your student loan debt and pave the way for a brighter financial future.

FAQ Guide

What is the minimum credit score required for Discover student loan refinancing?

Discover’s minimum credit score requirement varies depending on several factors, including co-borrowers and the type of loan. It’s best to check their website or contact them directly for the most up-to-date information.

Can I refinance federal student loans with Discover?

Yes, Discover offers refinancing options for federal student loans, but keep in mind that refinancing federal loans means losing federal protections like income-driven repayment plans.

What are the fees associated with Discover student loan refinancing?

Discover may charge origination fees. The exact amount will vary based on your loan amount and creditworthiness. Review the loan documents carefully to understand all associated fees.

How long does the Discover student loan refinancing application process take?

The application process timeline can vary, but generally, it takes several weeks from application submission to loan disbursement. Factors such as credit checks and document verification can affect processing time.