Navigating the complex world of student loans can be daunting. Understanding the various loan options, interest rates, and repayment plans requires careful research. This guide delves into the crucial role of student loan review websites, analyzing their content and user experiences to help prospective borrowers make informed decisions. We’ll explore the nuances of federal versus private loans, highlighting common themes and trends revealed through a comprehensive analysis of online reviews.

By examining both positive and negative experiences, we aim to provide a balanced perspective, empowering you to compare lenders effectively and choose the financing option best suited to your individual needs and financial circumstances. This exploration goes beyond simple ratings, examining the underlying factors that contribute to positive and negative user experiences.

Understanding Student Loan Review Websites

Navigating the world of student loans can be daunting, and online reviews offer a seemingly helpful resource for prospective borrowers. However, understanding the nuances of these review websites is crucial to making informed decisions. These platforms aggregate user experiences and provide comparative information on various student loan providers, but their inherent limitations and potential biases must be considered.

Student loan review websites vary significantly in their approach and the information they present. A thorough understanding of their methodologies and potential shortcomings is essential for responsible loan selection.

Types of Student Loan Review Websites

Several types of websites offer student loan reviews. Some are independent platforms that compile user reviews and conduct their own research, while others are affiliated with specific lenders or financial institutions, potentially influencing their rankings and recommendations. Aggregators pull reviews from various sources, while dedicated review sites focus solely on student loans, offering more in-depth analyses and comparisons. Finally, some personal finance websites incorporate student loan reviews as part of a broader financial planning resource. Each type offers a unique perspective, but the level of objectivity can differ substantially.

Criteria for Ranking and Rating Student Loan Providers

Review websites employ various criteria to rank and rate student loan providers. Common factors include interest rates, repayment options, customer service ratings, loan fees, and the availability of deferment or forbearance programs. Some websites also consider the lender’s financial stability and history of responsible lending practices. The weighting given to each criterion can vary significantly between websites, influencing the final rankings. For instance, one site might prioritize low interest rates, while another may emphasize flexible repayment options. Understanding these weighting systems is vital for interpreting the rankings accurately.

Potential Biases in Online Student Loan Reviews

Online reviews are susceptible to various biases. Positive reviews might be incentivized by lenders, while negative reviews could stem from isolated incidents or individual user experiences rather than reflecting the overall quality of the lender’s services. The sheer volume of reviews can also be misleading, as a few highly negative reviews among many positive ones might not accurately represent the average borrower’s experience. Furthermore, the demographic composition of reviewers might skew the results, as certain loan products might appeal more to specific borrower profiles. Therefore, it’s crucial to approach online reviews with a critical eye and consider the potential for bias.

Features and Functionalities of Popular Student Loan Review Platforms

Popular student loan review platforms offer a range of features designed to aid borrowers in their decision-making process. These commonly include detailed loan comparison tools, allowing users to filter and sort lenders based on specific criteria; user review sections with ratings and comments from past borrowers; informative articles and guides on student loan topics; and calculators to estimate monthly payments and total loan costs. Some platforms also offer personalized recommendations based on individual financial situations and loan needs. The availability and quality of these features vary considerably among different websites. For example, some might offer advanced search filters while others may only provide basic comparison tools.

Analyzing Student Loan Review Content

Understanding the nuances of student loan reviews requires a comparative approach. By analyzing reviews from multiple sources, a more comprehensive picture of a lender’s strengths and weaknesses emerges, allowing prospective borrowers to make informed decisions. This analysis goes beyond simply averaging ratings and delves into the specific comments and recurring themes to gain a deeper understanding of the borrower experience.

Comparing and Contrasting Reviews from Different Sources

Examining reviews from various websites like Trustpilot, NerdWallet, and the lender’s own website reveals significant differences in both the volume and tone of feedback. For instance, a lender might receive overwhelmingly positive reviews on its own site, while reviews on independent platforms may present a more balanced, and potentially critical, perspective. This discrepancy highlights the importance of consulting multiple sources before making a decision. Consider a hypothetical scenario where Lender X boasts a 4.8-star rating on its site, but only a 3.5-star rating across other platforms. This disparity warrants closer investigation into the specific criticisms voiced on the independent review sites.

Examples of Positive and Negative Reviews

Positive reviews frequently highlight aspects such as responsive customer service, straightforward application processes, competitive interest rates, and clear communication. For example, a positive review might state: “The application was easy, the interest rate was excellent, and their customer service team was incredibly helpful when I had questions.” Conversely, negative reviews often focus on issues like high fees, lengthy processing times, unresponsive customer service, and difficulties in refinancing or modifying loan terms. A negative review might read: “The application process was a nightmare, the fees were hidden, and I’ve been waiting weeks for a response to my inquiry.”

Common Themes and Trends in Student Loan Reviews

Analyzing numerous reviews reveals common trends across different lenders. Recurring positive themes often include user-friendly online platforms, personalized customer support, and transparent fee structures. Conversely, consistent negative feedback often centers on slow response times to inquiries, inflexible repayment options, and aggressive debt collection practices. These trends help identify lenders with consistent performance and those that struggle to meet borrower expectations.

Key Findings Summarized

| Lender | Average Rating | Common Positive Comments | Common Negative Comments |

|---|---|---|---|

| Lender A | 4.2 | Easy application, low interest rates, helpful customer service | Lengthy processing times, inflexible repayment options |

| Lender B | 3.8 | Competitive rates, transparent fees | Poor customer service, difficult to contact representatives |

| Lender C | 4.5 | Excellent customer support, quick response times | Higher interest rates compared to competitors |

Examining User Experiences

Understanding user experiences with student loans reveals crucial insights into the effectiveness and accessibility of the borrowing and repayment processes. Differences in experiences are heavily influenced by the type of loan, the borrower’s financial literacy, and the support received from lenders and educational institutions. Analyzing these experiences allows for a more comprehensive understanding of the challenges students face and informs potential improvements to the system.

User experiences with federal and private student loans differ significantly. Federal loans generally offer more borrower protections, including income-driven repayment plans and loan forgiveness programs. The application process for federal loans is often considered more straightforward and accessible, with clear eligibility criteria and readily available information. However, the sheer volume of federal loan programs can sometimes be overwhelming for borrowers. In contrast, private student loans may offer more flexible terms in some cases, but often lack the same level of consumer protection and can be more difficult to navigate. The application process may involve more stringent credit checks and higher interest rates, potentially excluding students with less-than-perfect credit scores. For example, a student with excellent credit might find a private loan with a lower interest rate more appealing than a federal loan, while a student with poor credit might struggle to qualify for a private loan at all, highlighting the stark contrast in experiences.

Differences in User Experiences Based on Loan Type

The contrasting experiences stem from the fundamental differences between the two loan types. Federal loans are backed by the government, offering a safety net for borrowers. Private loans, on the other hand, are offered by banks and credit unions, and their terms and conditions vary widely depending on the lender. This lack of standardization in private loans contributes to a more fragmented and potentially confusing experience for borrowers. The accessibility of information also plays a significant role; federal loan information is generally more readily available and easily understood, while navigating the complexities of private loan options can be a significant challenge for many students.

Challenges in Student Loan Application and Repayment

Students often face numerous challenges throughout the entire student loan lifecycle. The application process itself can be daunting, requiring borrowers to understand complex financial terminology, navigate various online portals, and gather extensive documentation. Many students lack the financial literacy necessary to make informed decisions about loan selection and repayment strategies. Furthermore, the sheer volume of information available can be overwhelming, leading to confusion and potentially poor choices. Once in repayment, many students struggle to manage their loan payments, especially when faced with unexpected life events or changes in employment. The lack of clear and accessible information regarding repayment options and available resources further exacerbates these challenges.

Hypothetical User Journey Map

A typical student’s journey with student loan providers might look like this: The journey begins with researching loan options, comparing interest rates and terms, and completing the application process. This is followed by receiving loan disbursement, enrolling in repayment plans, and actively managing loan payments. Throughout this process, the student may encounter challenges such as understanding loan terms, navigating online portals, and managing unexpected financial setbacks. Support from lenders and educational institutions can significantly impact the student’s experience, making the process smoother or more difficult depending on the level of assistance provided. This journey could be mapped visually, showing touchpoints and pain points along the way. For instance, a visual representation might show the student’s emotional state at each stage, from initial excitement to potential frustration during the application or repayment process. This would illustrate the emotional rollercoaster many students experience while navigating student loans.

Summary of Positive and Negative Aspects of Student Loan Experiences

Based on numerous student loan reviews and anecdotal evidence, the following points summarize the frequently reported positive and negative aspects:

- Positive Aspects: Access to higher education, flexible repayment options (for some loans), government support and protections (for federal loans), potential for loan forgiveness programs.

- Negative Aspects: High interest rates (especially for private loans), overwhelming application process, confusing repayment options, difficulty managing payments, lack of financial literacy support, potential for debt burden and financial hardship.

Exploring Specific Loan Features and Terms

Choosing a student loan involves carefully considering various features and terms that significantly impact your long-term financial well-being. Understanding these details is crucial for making an informed decision and avoiding potential pitfalls. This section will delve into key aspects of student loan offerings to aid in your comparison process.

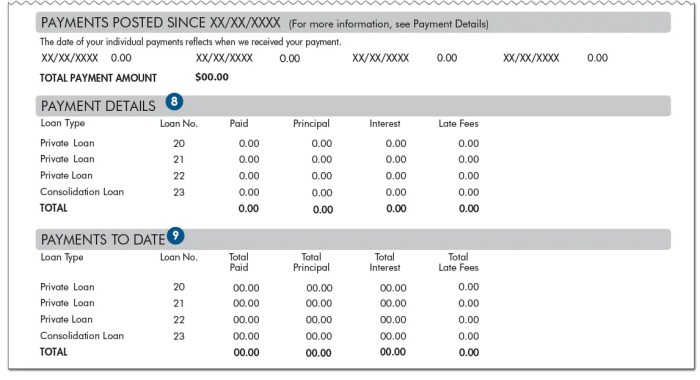

Interest Rates, Repayment Options, and Fees

Interest rates, repayment options, and fees are fundamental components of any student loan. Interest rates determine the cost of borrowing, while repayment options influence the length and amount of monthly payments. Fees can add to the overall cost of the loan. Comparing these factors across different lenders is essential. For instance, a fixed interest rate remains constant throughout the loan term, offering predictability, while a variable rate fluctuates based on market conditions, potentially leading to higher or lower payments over time. Repayment plans vary, with some offering longer repayment periods (leading to lower monthly payments but higher overall interest paid) and others prioritizing faster repayment (resulting in higher monthly payments but less overall interest). Fees, such as origination fees or late payment fees, can significantly add to the total cost of borrowing. A thorough comparison of these elements from multiple lenders empowers borrowers to choose the most cost-effective option.

Implications of Various Repayment Plans

Different repayment plans significantly influence the total cost and repayment timeline of a student loan. A standard repayment plan typically involves fixed monthly payments over a 10-year period. Income-driven repayment plans, conversely, adjust monthly payments based on your income and family size, potentially lowering monthly payments but extending the repayment period. For example, an income-driven plan might result in lower monthly payments during periods of lower income, but the total interest paid over the life of the loan could be higher compared to a standard repayment plan. Understanding the trade-offs between shorter repayment periods and lower monthly payments is crucial in selecting the most suitable plan for individual circumstances. Careful consideration of your income projections and financial goals is vital in this decision-making process.

Federal vs. Private Student Loans

Federal and private student loans differ significantly in their terms, eligibility requirements, and benefits. Federal loans are offered by the government and typically come with more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Private loans, on the other hand, are offered by banks and credit unions and often have stricter eligibility criteria and potentially higher interest rates. For example, federal loans often offer deferment or forbearance options during periods of financial hardship, while private loans may not provide such flexibility. The choice between federal and private loans depends on individual circumstances, creditworthiness, and the availability of federal loan funds.

Impact of Loan Forgiveness Programs

Loan forgiveness programs can significantly reduce the overall cost of student loans. These programs typically target specific professions (like teaching or public service) or borrowers who meet certain income requirements. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments. However, eligibility requirements for these programs are often stringent, and the process of obtaining forgiveness can be lengthy and complex. Understanding the eligibility criteria and application process is vital for borrowers who wish to utilize these programs to reduce their debt burden. The potential benefits of loan forgiveness should be carefully weighed against the time commitment and potential challenges involved in meeting program requirements.

Visualizing Key Findings

Data visualization is crucial for understanding the complex landscape of student loan options. By representing key findings visually, we can readily identify trends and patterns that might otherwise be obscured within raw data. This section will present three visualizations that illustrate important aspects of student loan interest rates, repayment periods, and default rates.

Student Loan Interest Rate Distribution

A histogram would effectively display the distribution of student loan interest rates across various lenders. The x-axis would represent the interest rate ranges (e.g., 0-2%, 2-4%, 4-6%, etc.), while the y-axis would represent the frequency or number of loans falling within each range. Different colors could be used to distinguish between different lenders (e.g., federal loans, private loans from Lender A, private loans from Lender B). This would allow for a quick comparison of the interest rate offerings across the various lenders and highlight any significant differences in their pricing strategies. For instance, a lender consistently offering lower interest rates would be clearly identifiable through a larger concentration of data points in the lower interest rate ranges on the histogram.

Comparison of Average Repayment Periods for Different Loan Types

A bar chart would be ideal for comparing the average repayment periods of different student loan types. The x-axis would list the loan types (e.g., federal subsidized loans, federal unsubsidized loans, private loans, graduate PLUS loans). The y-axis would represent the average repayment period in years. The height of each bar would visually represent the average repayment length for that specific loan type. This visualization would immediately highlight which loan types typically have longer or shorter repayment terms, providing valuable insight for borrowers seeking to manage their debt effectively. For example, a longer bar for graduate PLUS loans would indicate a longer average repayment period compared to other loan types.

Relationship Between Loan Amounts and Default Rates

A scatter plot would best illustrate the relationship between loan amounts and default rates. The x-axis would represent the loan amount (in dollars), and the y-axis would represent the default rate (as a percentage). Each point on the scatter plot would represent a single loan or a group of loans with similar characteristics. The plot would visually reveal any correlation between loan amount and default rate. A positive correlation, indicated by a general upward trend of the points, would suggest that larger loan amounts are associated with higher default rates. Conversely, a lack of correlation would suggest that loan amount is not a significant predictor of default. This visualization could be further enhanced by using different colors or symbols to represent different loan types or borrower characteristics. For instance, loans that defaulted could be highlighted differently from those that did not.

Conclusion

Ultimately, understanding Discover student loans and similar options requires a multifaceted approach. While online reviews offer valuable insights into user experiences, it’s crucial to remember that individual experiences can vary. This guide has aimed to provide a framework for critical analysis of these reviews, enabling you to navigate the complexities of student loan selection with greater confidence and a clear understanding of the potential benefits and drawbacks of different lenders and loan types. Remember to thoroughly research all options and consider your personal financial situation before making any decisions.

Key Questions Answered

What are the key differences between Discover student loans and other lenders?

Discover student loans offer various features, including potential interest rate discounts and repayment options. However, specific terms and conditions vary and should be compared directly with offers from other lenders to determine the best fit for individual needs.

How can I verify the authenticity of online student loan reviews?

Look for reviews from multiple sources and compare them. Be wary of reviews that seem overly positive or negative without specific details. Consider checking review platforms’ reputations and verifying user identities where possible.

What should I do if I have a negative experience with a student loan provider?

Contact the lender directly to address your concerns. If the issue remains unresolved, consider filing a complaint with the relevant consumer protection agency or seeking legal advice.