Securing financial aid for higher education is a crucial step for many students, and understanding how to access support is paramount. This guide focuses on locating the Discover Student Loans telephone number, addressing the common challenges students face in finding this vital contact information. We’ll explore various scenarios leading students to search for this number, highlighting the urgency often involved, and providing a straightforward path to obtaining official contact details.

Beyond the phone number, we’ll examine alternative contact methods offered by Discover Student Loans, comparing their effectiveness and accessibility. We’ll also delve into potential pitfalls, such as encountering outdated or fraudulent information, and provide strategies to avoid such risks. The goal is to empower students with the knowledge and resources needed to navigate the student loan process confidently and securely.

Understanding Search Intent Behind “Discover Student Loans Telephone Number”

Individuals searching for the Discover student loans telephone number are seeking a direct line of communication with the lender. This indicates a need for specific information or assistance related to their student loan account. The urgency behind the search varies greatly depending on the individual’s circumstances.

Understanding the various reasons behind this search provides valuable insight into the user’s needs and expectations. The level of urgency is a key factor in determining how quickly they require a response and what action they will likely take next.

User Scenarios Leading to the Search

The following table illustrates different scenarios that might lead a student to search for the Discover student loans telephone number. The scenarios demonstrate the diverse reasons for contact and the varying levels of urgency involved.

| User Type | Urgency Level | Likely Next Action |

|---|---|---|

| Student needing to make a payment | Medium | Call Discover to confirm payment details or make a payment over the phone. May also explore online payment options if the phone line is busy. |

| Student experiencing difficulty logging into their online account | High | Call Discover immediately to troubleshoot login issues and regain access to their account information. May try password reset options first. |

| Student with questions about their loan repayment plan | Low to Medium | Call Discover to discuss repayment options, inquire about interest rates, or seek clarification on their loan terms. May also explore information available on the Discover website first. |

| Student facing an immediate financial hardship and needing a deferment or forbearance | High | Call Discover urgently to request a deferment or forbearance, explaining their financial situation and seeking immediate assistance. May have already explored options online but require direct communication. |

| Student who received a concerning notice from Discover regarding their loan | High | Call Discover immediately to clarify the notice and understand the implications for their loan. May feel significant anxiety and require immediate reassurance. |

Locating Official Contact Information for Discover Student Loans

Finding the correct contact information for Discover Student Loans is crucial for managing your student loan account effectively. Whether you need to make a payment, address a billing issue, or simply have a question about your loan terms, having access to the right channels is essential. This section details how to locate the official contact information directly through the Discover Student Loans website and Artikels alternative methods for communication.

The Discover Student Loans website is designed to provide readily accessible contact information for its customers. However, the exact location of this information may vary slightly depending on website updates. The process generally involves navigating to a dedicated customer service or contact section.

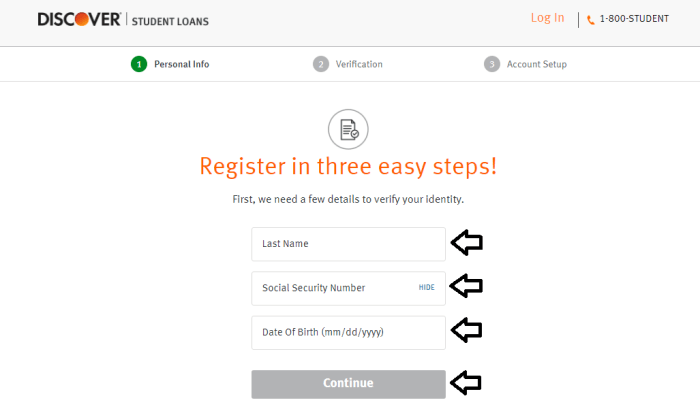

Discover Student Loans Website Navigation for Contact Information

Locating the official contact information on the Discover Student Loans website is a straightforward process. The following steps Artikel the typical navigation path. Remember that minor variations might occur due to website redesigns.

- Visit the Discover Student Loans website: Begin by visiting the official Discover Student Loans website. You can typically find this by searching “Discover Student Loans” on a search engine.

- Look for a “Contact Us,” “Help,” or “Support” link: These links are usually prominently displayed in the website’s header, footer, or a dedicated customer service section. The exact wording may vary.

- Navigate to the contact information page: Clicking on one of the links mentioned above will typically take you to a page containing various contact options. This page may include phone numbers, email addresses, FAQs, and links to online chat support.

- Locate the phone number: The phone number for Discover Student Loans should be clearly displayed on this contact page. It’s often presented alongside alternative contact methods.

Alternative Contact Methods

Beyond the primary phone number, Discover Student Loans typically offers several alternative contact methods to cater to various customer preferences and needs. These alternatives usually include email support and online chat functionalities.

Email support allows for asynchronous communication, providing the flexibility to send inquiries at any time and receive a response within a reasonable timeframe. Online chat, on the other hand, offers immediate assistance for more urgent matters. The choice between these methods depends largely on the urgency and nature of your inquiry.

Accessibility and Convenience Comparison

Each contact method offers different levels of accessibility and convenience. The phone number provides immediate access to a live representative, which can be beneficial for urgent situations requiring immediate resolution. However, phone calls can be time-consuming, especially if you encounter long wait times. Email offers more flexibility but may take longer to receive a response. Online chat provides a balance, offering relatively quick responses while maintaining a degree of flexibility compared to a phone call. The best method will depend on your individual needs and preferences.

Addressing Potential Challenges in Finding the Phone Number

Finding the contact information, specifically a phone number, for Discover student loans can be surprisingly difficult for some users. This is often due to a combination of website design choices and user expectations. Many individuals assume a prominent phone number will be readily available on the homepage, leading to frustration when it’s not immediately visible.

Website design significantly impacts a user’s ability to locate desired information. Poorly structured websites often bury essential contact details deep within nested menus or require users to navigate multiple pages before finding the information they need. This can lead to significant user frustration and potentially lost business for the company. The lack of clear, concise navigation and intuitive information architecture contributes to this issue.

Website Structure and User Experience

The way a website is structured directly influences the ease with which users can find information. For example, a website that uses a complex, multi-layered menu system with poorly labeled sections can make it challenging to find a simple phone number. Similarly, websites that prioritize visual elements over clear navigation can obscure crucial contact information. A user might spend considerable time scrolling through irrelevant content or clicking through numerous links before finally stumbling upon the phone number, if they find it at all. This creates a negative user experience, and users may opt to contact the company through alternative, potentially less efficient channels.

Hypothetical Website Layout Improvement

A significantly improved website layout could place the phone number prominently in the header or footer of every page. This ensures immediate visibility regardless of the user’s location within the website. Imagine a header with a clean, simple design. On the far right, a prominent phone number is displayed in a large, easily readable font. Next to the phone number, a small, clearly labeled “Contact Us” link could be added for users who prefer to explore further contact options. The footer could mirror this, providing a backup location for the number. This design ensures that the crucial contact information is readily accessible, regardless of where the user is on the site. Such a change would dramatically improve the user experience and minimize the frustration associated with searching for a simple phone number.

Alternative Resources for Student Loan Information

Finding the right contact information for your student loans can sometimes be tricky. Fortunately, there are several alternative resources available to help you access the information you need regarding your Discover student loans, or student loans in general. These resources offer various methods of obtaining information, each with its own advantages and disadvantages. Understanding these differences can help you choose the most efficient path to resolving your inquiries.

Government Websites as Information Sources

Government websites, such as the Federal Student Aid website (studentaid.gov) and the Consumer Financial Protection Bureau (CFPB) website, provide valuable, unbiased information about federal student loans and general borrowing practices. These sites are often updated regularly to reflect current regulations and policies.

- Federal Student Aid (studentaid.gov): Strengths: Comprehensive information on federal student loan programs, repayment plans, and forgiveness options; reliable and trustworthy source. Limitations: May not contain specific information about private loans like those from Discover; focuses primarily on federal loans.

- Consumer Financial Protection Bureau (CFPB): Strengths: Offers resources on managing debt, understanding loan terms, and avoiding predatory lending practices; provides consumer protection advice. Limitations: Information may be general and not specific to Discover or a particular loan; less focused on the specifics of individual loan programs.

Financial Aid Offices at Educational Institutions

Your college or university’s financial aid office can be a valuable resource, particularly if you have questions about your loan history while enrolled at that institution. They can often provide guidance on loan repayment and may have access to some of your loan details.

- College/University Financial Aid Offices: Strengths: Access to your institutional loan history; personalized advice based on your specific situation; may offer assistance with loan application processes. Limitations: May not have information about loans taken from other institutions; their expertise may be limited to federal loans and institutional programs; may not be able to help with repayment or delinquency issues once you have graduated.

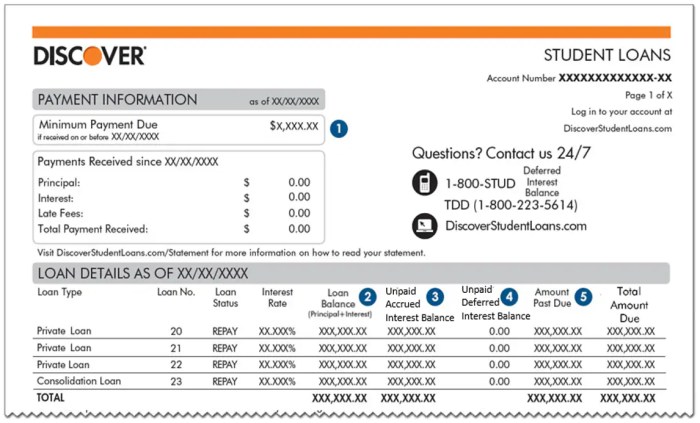

Discover’s Online Account Management System

While you are seeking a phone number, remember that Discover likely has a robust online account management system. This system often provides a wealth of information regarding your loan balance, payment history, interest rates, and upcoming payment due dates.

- Discover Online Account: Strengths: Provides immediate access to your account information; allows for online payments and communication; often includes tools for managing your loan repayment schedule. Limitations: Requires access to the online portal; may not answer all questions; limited support for technical issues with the website itself.

Illustrating the Importance of Official Contact Information

Using the correct contact information for your Discover student loans is crucial for your financial well-being and security. Incorrect or outdated information can lead to missed payments, delayed resolutions to issues, and, most seriously, exposure to scams. Relying on official channels ensures you’re interacting with legitimate representatives and protecting your personal data.

The risks associated with using unofficial or outdated contact information are significant. Outdated numbers might connect you to a disconnected line or, worse, someone who intercepts your information. Unofficial websites or numbers may contain inaccurate information, leading to missed payment deadlines or incorrect repayment strategies. This can negatively impact your credit score and overall financial standing.

Risks of Using Unofficial or Outdated Contact Information

Using unofficial or outdated contact information for your Discover student loans exposes you to several potential problems. For instance, contacting an outdated number might lead you to a disconnected line, leaving your inquiries unanswered. Conversely, a seemingly accurate but unofficial number might connect you to a third party who could potentially harvest your personal information for fraudulent purposes. This could range from identity theft to unauthorized access to your financial accounts. Inaccurate information found on unofficial websites could lead to incorrect repayment strategies, resulting in late payments and damage to your credit score. The potential consequences include higher interest charges, difficulty securing future loans, and overall financial instability.

Consequences of Contacting Fraudulent Entities

Contacting fraudulent entities posing as student loan providers can have severe consequences. These scams often involve phishing attempts, where individuals impersonate Discover representatives to obtain your personal and financial information. They may promise loan forgiveness, consolidation at unrealistically low rates, or other benefits that are too good to be true. Providing your information to these fraudulent entities can lead to identity theft, financial loss, and significant legal complications. They may drain your bank accounts, open fraudulent credit accounts in your name, or even use your identity to commit other crimes.

Examples of Student Loan Scams and Avoidance Strategies

Numerous scams target student loan borrowers. One common tactic involves unsolicited phone calls or emails promising rapid loan forgiveness or debt consolidation at exceptionally low rates. Another involves fraudulent websites mimicking legitimate student loan providers’ websites. These sites often request personal information, including Social Security numbers and bank account details, under the guise of loan processing or modification. To avoid these scams, always verify the authenticity of any communication by contacting Discover directly through their official website or known contact numbers. Never share sensitive personal information unless you are absolutely certain of the recipient’s legitimacy. Be wary of unsolicited offers that seem too good to be true and report suspicious activity to the appropriate authorities.

Visual Representation of the Dangers of Unverified Contact Information

Imagine a branching pathway. The main path, clearly marked “Official Discover Contact,” leads to a safe, secure destination representing successful loan management. However, numerous unmarked, overgrown paths branch off, labeled with things like “Unverified Website,” “Unknown Phone Number,” and “Suspicious Email.” These paths lead to dead ends, representing missed payments, identity theft, financial loss, and legal complications. The image emphasizes that only the clearly marked, official path ensures a safe and secure outcome for managing student loan repayment. Choosing an unverified path represents a significant risk with potentially devastating consequences.

Summary

Finding the correct contact information for your student loans is critical for efficient communication and avoiding potential scams. While navigating websites can sometimes prove challenging, understanding the various resources available, from official websites to alternative support channels, empowers students to take control of their financial aid journey. Remember to always prioritize verified information and official channels to ensure the safety and security of your personal and financial data.

Clarifying Questions

What if I can’t find the phone number on the Discover website?

Try searching the site’s help section or FAQ page. You can also try contacting Discover through their online chat or email options.

What are the hours of operation for the Discover Student Loans phone line?

This information is usually available on their website’s contact page. Look for business hours or a section detailing customer service availability.

What should I do if I suspect I’ve been contacted by a fraudulent entity regarding my student loans?

Immediately contact Discover Student Loans through their official channels to report the suspicious contact. Never provide sensitive information to unverified sources.

Are there any fees associated with calling Discover Student Loans?

Generally, calls to official student loan providers are toll-free, but it’s best to verify this on their website.