Navigating the complexities of student loan repayment can feel daunting, especially when juggling the demands of academics and part-time employment. Understanding your discretionary income – the money left after essential expenses – is crucial for effective loan management. This guide delves into the intricacies of discretionary income for students, exploring how to identify, budget, and utilize it to successfully repay your student loans while maintaining a reasonable standard of living.

We’ll examine various income sources, explore different repayment plans, and offer practical budgeting strategies to help you navigate the financial challenges of student loan debt. We’ll also address the impact of unexpected expenses and economic fluctuations, providing you with the knowledge and tools to proactively manage your finances and avoid potential pitfalls.

Defining Discretionary Income for Students

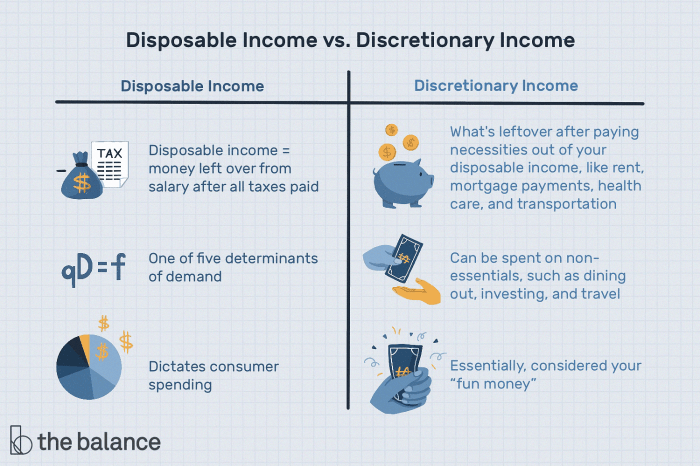

Understanding a student’s discretionary income is crucial for various reasons, including financial planning, loan applications, and budgeting. It represents the funds available after essential expenses are covered, allowing for flexibility in spending choices. This section will clarify the concept of discretionary income for students, differentiating it from gross income and exploring the factors that influence its level.

Discretionary income differs significantly from gross income. Gross income encompasses all earnings before any deductions, including taxes, insurance, or other mandatory payments. Discretionary income, on the other hand, is the amount remaining after all necessary expenses are subtracted from gross income. For students, this means the money left over after paying for tuition, housing, food, books, and transportation.

Income Sources Contributing to Discretionary Income

Several sources can contribute to a student’s discretionary income. These include part-time jobs, scholarships exceeding tuition costs, financial aid exceeding expenses, gifts from family or friends, and income from investments or side hustles. The availability and amount of each source will vary greatly depending on individual circumstances.

Factors Influencing Discretionary Income Level

Numerous factors significantly impact a student’s discretionary income level. These factors interact in complex ways, resulting in a wide range of income availability among students.

| Factor | Description | Impact on Discretionary Income | Examples |

|---|---|---|---|

| Employment | The number of hours worked and the hourly wage earned in part-time jobs or internships. | Higher hours and wages lead to higher discretionary income. | Working 10 hours/week at $15/hour vs. 20 hours/week at $10/hour. |

| Financial Aid & Scholarships | The amount of financial aid received, exceeding tuition and essential living costs. | Excess funds increase discretionary income. | A $10,000 scholarship exceeding tuition costs of $8,000 leaves $2,000 discretionary income. |

| Living Expenses | Costs associated with housing, food, transportation, and other necessities. | Higher living expenses reduce discretionary income. | Living on campus vs. off-campus; using public transport vs. owning a car. |

| Tuition Costs | The cost of tuition and fees for the academic year. | High tuition costs reduce discretionary income; low costs increase it. | Attending a public university vs. a private university. |

| Family Support | Financial contributions from family members. | Increases discretionary income significantly. | Regular allowance from parents or guardians; gifts for special occasions. |

| Personal Savings | Prior savings used to supplement income. | Provides a buffer, potentially increasing discretionary income. | Savings accumulated from previous employment or summer jobs. |

| Debt Obligations | Existing loans or credit card debts requiring monthly payments. | Reduces discretionary income. | Student loans, personal loans, or credit card debt payments. |

Student Loan Repayment and Discretionary Income

Understanding the relationship between discretionary income and student loan repayment is crucial for effective financial planning. Discretionary income, the money left after essential expenses, directly impacts a borrower’s ability to manage their student loan debt. Different repayment plans cater to varying income levels and offer flexibility in managing monthly payments.

Income-Driven Repayment Plans versus Standard Repayment Plans

Income-driven repayment (IDR) plans and standard repayment plans differ significantly in how they factor discretionary income. Standard repayment plans typically require a fixed monthly payment over a set period (usually 10 years), regardless of income fluctuations. This can be challenging for borrowers with limited discretionary income, potentially leading to missed payments and delinquency. In contrast, IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), calculate monthly payments based on a percentage of discretionary income. This approach offers greater flexibility, particularly for borrowers facing financial hardship or experiencing periods of low income. For example, a recent graduate with a low-paying job might find an IDR plan far more manageable than a standard repayment plan. The lower monthly payments afforded by IDR plans allow for more discretionary income to be used for other financial needs like saving, paying off other debts, or investing. However, IDR plans typically extend the repayment period, leading to higher total interest paid over the life of the loan.

Impact of Discretionary Income Changes on Repayment Plans

Changes in discretionary income directly influence a borrower’s ability to meet their monthly student loan payments and may necessitate adjustments to their repayment plan. An increase in income might allow for higher payments, leading to faster loan repayment and reduced overall interest paid. Conversely, a decrease in income, such as job loss or unexpected expenses, may require a repayment plan adjustment. Borrowers can typically request a temporary forbearance or deferment, reducing or suspending payments temporarily. Alternatively, they can switch to an IDR plan, ensuring payments remain manageable given their current financial situation. For instance, a borrower who experiences a significant salary increase might opt to increase their monthly payment on their standard repayment plan or switch to a faster repayment plan to accelerate debt reduction. Conversely, a borrower who experiences a job loss might need to apply for an income-driven repayment plan or a temporary forbearance to avoid delinquency.

Scenario: Discretionary Income and Timely Loan Payments

Consider Sarah, a recent college graduate with $30,000 in student loan debt. She secures a job earning $35,000 annually. After accounting for rent, utilities, groceries, and transportation, Sarah has $500 in monthly discretionary income. With a standard repayment plan, her monthly payment might be $300, leaving her with $200 for other expenses. However, if Sarah’s car unexpectedly breaks down, requiring a $1,000 repair, this significantly impacts her discretionary income and could lead to missed loan payments. In this situation, exploring options like an IDR plan or a temporary deferment would be beneficial to prevent negative consequences. If, on the other hand, Sarah receives a promotion and her income rises to $50,000 annually, increasing her discretionary income, she might be able to make larger payments, reducing her overall debt faster. This illustrates the dynamic relationship between discretionary income, repayment plan choice, and the ability to make timely student loan payments.

Budgeting and Managing Discretionary Income for Loan Repayment

Successfully navigating student loan repayment requires a well-structured budget that prioritizes loan payments while still allowing for essential living expenses and some discretionary spending. This involves careful planning, consistent monitoring, and a proactive approach to managing potential financial pitfalls.

Effective budgeting is crucial for students to allocate their discretionary income towards loan repayment. This involves identifying all sources of income, tracking expenses meticulously, and creating a realistic budget that balances loan payments with other essential needs. Failing to do so can lead to missed payments, accruing interest, and potential damage to credit scores.

Practical Budgeting Strategies for Student Loan Repayment

Several strategies can help students effectively allocate discretionary income toward loan repayment. Prioritizing loan payments, even with limited funds, can minimize interest accumulation and accelerate the repayment process. Automating payments through direct debit ensures consistent repayment, avoiding late payment fees and improving creditworthiness. Exploring options like income-driven repayment plans can provide more manageable monthly payments, while refinancing loans could potentially lower interest rates and reduce the overall repayment burden. Furthermore, actively seeking ways to increase income through part-time jobs or freelancing can significantly boost loan repayment capacity.

Potential Pitfalls in Managing Discretionary Income and Loans

Students often face various challenges when managing discretionary income and loans. Overspending on non-essential items can significantly reduce the amount available for loan repayment, leading to missed payments and increased debt. Unexpected expenses, such as medical bills or car repairs, can disrupt carefully planned budgets and negatively impact loan repayment. A lack of financial literacy can hinder effective budgeting and lead to poor financial decisions. Moreover, failing to track expenses and monitor income carefully can create a false sense of financial security and hinder effective debt management. Finally, neglecting to explore loan repayment options and strategies can lead to prolonged repayment periods and increased interest costs.

Sample Student Budget Balancing Loan Payments and Other Expenses

A well-structured budget is essential for successful loan repayment. The following example demonstrates how a student can balance loan payments with other necessary expenses. This is a sample and should be adjusted to reflect individual circumstances.

- Income: $2,000 per month (part-time job + potential savings)

- Loan Payment: $300 (Prioritized payment)

- Rent/Housing: $600

- Groceries: $300

- Utilities: $100

- Transportation: $150

- Books/Education: $100

- Savings: $250 (Emergency fund & future goals)

- Discretionary Spending: $200 (Entertainment, social activities)

Effective Expense Tracking and Discretionary Income Monitoring

Effective tracking and monitoring are vital for responsible financial management. Utilizing budgeting apps or spreadsheets allows for detailed recording of income and expenses, providing a clear picture of spending habits and identifying areas for potential savings. Regularly reviewing the budget allows for adjustments based on changes in income or expenses, ensuring that loan payments remain prioritized. This proactive approach helps maintain financial stability and facilitates successful loan repayment. Moreover, comparing monthly spending against the budget reveals potential overspending and allows for timely adjustments to avoid accumulating debt.

Impact of External Factors on Discretionary Income and Loan Repayment

Successfully managing student loan repayment hinges significantly on consistent discretionary income. However, unforeseen circumstances and economic shifts can dramatically impact a student’s financial stability and ability to meet their loan obligations. Understanding these external factors is crucial for effective financial planning and mitigating potential risks.

Unexpected Expenses and Loan Repayment

Unexpected expenses, such as medical emergencies, car repairs, or home maintenance, can severely deplete a student’s discretionary income, leaving little to nothing for loan repayments. These unforeseen costs often require immediate attention, forcing students to prioritize essential spending, potentially leading to missed or delayed loan payments. The resulting late fees and negative impact on credit scores can further complicate the situation, creating a vicious cycle of financial difficulty.

Changes in Employment Status and Part-Time Work Availability

Fluctuations in employment significantly influence a student’s ability to manage loan payments. Job loss, reduced work hours, or the inability to secure part-time work can drastically reduce or eliminate a student’s discretionary income. This loss of income directly impacts their capacity to meet loan repayment obligations, potentially resulting in delinquency or default. Seasonal employment or industries prone to layoffs can expose students to particularly high levels of financial instability.

Inflation’s Impact on Discretionary Income and Loan Repayment

Inflation erodes the purchasing power of money. As the cost of goods and services rises, a student’s discretionary income effectively shrinks, even if their nominal income remains unchanged. This means that the same amount of money can buy fewer necessities, leaving less available for loan repayment. Furthermore, if interest rates rise along with inflation, the cost of borrowing increases, adding further strain on a student’s budget and repayment capacity.

Hypothetical Example of Loan Default Due to Decreased Discretionary Income

Imagine Sarah, a recent graduate with a $30,000 student loan and a monthly payment of $500. She works part-time, earning $2,000 per month. After paying rent, utilities, and essential expenses, she has $800 in discretionary income. This comfortably covers her loan payment. However, she unexpectedly faces a $2,000 car repair bill. To cover this, she depletes her savings and is forced to miss two loan payments. The subsequent late fees and negative impact on her credit score further complicate her financial situation, potentially leading to a downward spiral and ultimately, loan default. This example highlights how a seemingly manageable financial situation can quickly deteriorate due to unexpected expenses and the subsequent decrease in discretionary income.

Resources and Support for Managing Student Loan Debt

Managing student loan debt can be a significant challenge, but numerous resources are available to help borrowers navigate this process effectively. Understanding the available options and leveraging these resources can significantly reduce stress and improve long-term financial well-being. This section Artikels several key avenues for support, including government programs, non-profit organizations, and financial institutions specializing in debt management solutions.

Government Programs and Resources

The federal government offers several programs designed to assist students struggling with loan repayment. These programs provide various forms of assistance, ranging from income-driven repayment plans to loan forgiveness programs for specific professions. Understanding eligibility requirements and application processes is crucial for maximizing the benefits of these programs.

- Income-Driven Repayment (IDR) Plans: IDR plans adjust monthly payments based on your income and family size. Several plans exist, including Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE). These plans can significantly lower monthly payments, making them more manageable for borrowers facing financial hardship.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. Specific eligibility criteria must be met, and careful documentation is essential throughout the repayment process.

- Teacher Loan Forgiveness Program: This program offers forgiveness of up to $17,500 on federal student loans for teachers who meet specific requirements, including teaching full-time for five consecutive academic years in a low-income school or educational service agency.

Non-Profit Organizations and Financial Institutions

Beyond government programs, numerous non-profit organizations and financial institutions provide valuable support to students managing student loan debt. These entities often offer free or low-cost counseling, workshops, and resources to help borrowers develop effective repayment strategies and navigate the complexities of the student loan system.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers credit counseling services, including assistance with student loan debt management. They can help borrowers create a budget, explore repayment options, and negotiate with lenders.

- Student Loan Borrower Assistance Programs: Many non-profit organizations offer dedicated programs to assist student loan borrowers. These programs often provide free or low-cost counseling, workshops, and resources. Researching local and national non-profit organizations specializing in financial literacy and debt management is recommended.

- Financial Institutions Offering Debt Management Services: Some financial institutions offer debt consolidation or management programs specifically designed for student loans. It is important to compare fees and interest rates before choosing a program.

Debt Consolidation Options and Their Impact on Discretionary Income

Debt consolidation involves combining multiple student loans into a single loan, often with a lower interest rate or more manageable monthly payment. This can potentially free up discretionary income by reducing the overall monthly payment amount. However, it’s crucial to carefully evaluate the terms of any consolidation loan to ensure it’s a financially beneficial option.

- Federal Direct Consolidation Loan: This program allows borrowers to combine multiple federal student loans into a single loan with a fixed interest rate. The new interest rate is a weighted average of the interest rates on the original loans.

- Private Consolidation Loans: Private lenders also offer consolidation options, but these loans may come with higher interest rates or fees than federal consolidation loans. It’s vital to compare offers from multiple lenders before making a decision.

- Impact on Discretionary Income: Successfully consolidating loans can lead to a lower monthly payment, freeing up discretionary income for other financial needs. However, extending the loan repayment term may result in paying more interest over the life of the loan.

Closing Summary

Successfully managing student loan debt requires a proactive and informed approach. By understanding your discretionary income, implementing effective budgeting strategies, and utilizing available resources, you can create a sustainable repayment plan that aligns with your financial circumstances. Remember that seeking help when needed is a sign of strength, not weakness. Take control of your financial future by mastering the art of managing your discretionary income for student loan repayment.

FAQ Overview

What happens if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can help you explore options like forbearance, deferment, or income-driven repayment plans to temporarily reduce or suspend payments.

Can I deduct student loan interest from my taxes?

Yes, in many countries, you may be able to deduct the amount of student loan interest you paid during the tax year. Check with your tax advisor or the relevant government agency for specific eligibility requirements and limitations.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends or reduces your payments, but interest may still accrue. Deferment temporarily suspends payments, and in some cases, interest may not accrue.

How do I find a trustworthy financial advisor to help me manage my student loans?

Seek referrals from trusted sources, check online reviews, and verify their credentials with relevant professional organizations. Consider meeting with a few advisors before making a decision.