Navigating the world of student loans can feel overwhelming, but understanding your options is key to a successful financial future. This guide delves into the specifics of Discover student loans, providing a clear and concise overview of their various offerings, application processes, repayment strategies, and potential challenges. We’ll equip you with the knowledge to make informed decisions about your educational financing.

From eligibility requirements and interest rates to repayment plans and customer service support, we’ll cover all the essential aspects of Discover student loans. We will also compare them to other lenders and loan types, helping you determine if a Discover loan is the right fit for your individual circumstances. This guide aims to demystify the process and empower you to confidently manage your student loan journey.

Understanding Discover Student Loans

Discover offers a range of student loan products designed to help students finance their education. Understanding the nuances of each loan type and comparing them to competitors is crucial for making an informed borrowing decision. This section details the various loan options, eligibility criteria, and a comparative analysis of interest rates and key features.

Discover Student Loan Types

Discover primarily offers two main types of student loans: federal student loans and private student loans. Federal student loans are offered through the government and generally come with more borrower protections and benefits. Private student loans, on the other hand, are offered by private lenders like Discover and have terms that can vary significantly. It’s important to note that eligibility and terms are subject to change and it’s always best to check Discover’s official website for the most up-to-date information.

Eligibility Requirements for Discover Student Loans

Eligibility criteria for Discover student loans vary depending on the type of loan and the applicant’s circumstances. Generally, applicants will need to be a U.S. citizen or permanent resident, be enrolled or accepted at an eligible school, and meet specific credit and income requirements. Federal student loans often have less stringent credit requirements than private loans. Co-signers might be required for applicants with limited credit history. Specific requirements can be found on the Discover website and may change.

Discover Student Loan Interest Rates Compared to Competitors

Discover’s student loan interest rates are competitive within the market but vary depending on factors such as creditworthiness, loan type (federal vs. private), and the prevailing interest rate environment. Direct comparison with competitors requires considering the specific loan terms and the applicant’s profile. For example, a borrower with excellent credit might receive a lower interest rate from Discover than a borrower with limited credit history. It’s recommended to compare interest rates from multiple lenders before making a decision, focusing not only on the initial interest rate but also on any potential fees and the overall cost of the loan. Online loan comparison tools can assist in this process.

Key Features Comparison of Discover Student Loans

The following table compares key features of Discover student loans. Remember that these are general guidelines and specific terms may vary based on individual circumstances and loan type. Always refer to the most current information available on Discover’s website.

| Feature | Discover Student Loan (Federal) | Discover Student Loan (Private) | Competitor Average (Example) |

|---|---|---|---|

| Loan Amount | Varies, up to the cost of attendance | Varies, subject to creditworthiness | Varies widely |

| Interest Rate | Fixed or variable, depending on loan type and program | Fixed or variable, based on credit score | Ranges from 3% to 12%+ |

| Repayment Options | Standard, graduated, extended | Various options, including fixed and variable payment plans | Typically includes standard, graduated, and income-driven repayment plans |

| Fees | May include origination fees (federal loans) | May include origination fees, late payment fees, etc. | Variable, depending on lender |

Application and Approval Process

Applying for a Discover student loan is a relatively straightforward process, designed to be accessible and efficient for students. The entire process, from initial application to loan disbursement, typically takes several weeks, but the exact timeline can vary depending on individual circumstances and the completeness of the application. Understanding the steps involved and preparing necessary documentation beforehand can significantly streamline the process.

The application process begins online through Discover’s website. Applicants will need to create an account and provide personal information, including their Social Security number, date of birth, and contact details. This information is used to verify identity and eligibility for the loan. Following this, applicants will need to provide details about their education, including the school they intend to attend, their intended major, and the expected graduation date. This information helps Discover assess the loan amount and repayment terms. Finally, applicants will need to provide their financial information, which is used to determine their creditworthiness and loan eligibility.

Required Documentation

The necessary documentation for a Discover student loan application typically includes proof of enrollment or acceptance at an eligible educational institution. This can be an acceptance letter, enrollment confirmation, or a transcript. Applicants will also need to provide their Social Security number for verification purposes. Finally, co-signers (if required) will need to provide their own personal and financial information, including credit history. The specific documents required may vary depending on the individual applicant’s circumstances. Providing all required documentation upfront will significantly expedite the review process.

Steps in the Application Process

A visual representation of the application process could be depicted as a flowchart. The flowchart would begin with the applicant completing the online application. This would lead to a box representing the submission of the application and supporting documentation. Following this would be a decision point, indicating whether the application is complete and meets the minimum requirements. If complete, the application moves to the review stage, represented by another box. The review stage involves verification of the information provided and a credit check (if applicable). After the review, a decision is made regarding approval or denial of the loan. Approval leads to the loan disbursement, while denial may lead to an explanation of reasons for denial and options for appeal or alternative solutions.

Improving Chances of Loan Approval

Several factors can positively influence the approval of a Discover student loan application. Maintaining a good credit history, if applicable, is crucial. A strong credit history demonstrates financial responsibility and increases the likelihood of approval, particularly if the applicant is applying for a loan without a co-signer. Providing accurate and complete information on the application is equally important; any inconsistencies or missing information can delay the process or lead to rejection. Additionally, applicants should ensure they meet the minimum eligibility requirements, including enrollment in an eligible educational institution and demonstrating a need for financial assistance. Finally, having a co-signer with a strong credit history can significantly improve the chances of approval, especially for applicants with limited or no credit history.

Repayment Options and Strategies

Choosing the right repayment plan for your Discover student loan is crucial for managing your debt effectively and minimizing interest costs. Several options are available, each with its own advantages and disadvantages depending on your financial circumstances and repayment goals. Understanding these options and developing a sound repayment strategy is key to successful loan management.

Discover offers a range of repayment plans designed to accommodate varying financial situations. The best option will depend on your individual income, budget, and long-term financial goals. Careful consideration of each plan’s features is essential before making a decision.

Discover’s Repayment Plan Options

Understanding the various repayment plans available is the first step in creating a successful repayment strategy. Discover typically offers several options, though specific plans and their details might change, so it’s vital to check directly with Discover for the most up-to-date information.

- Standard Repayment Plan: This is usually the default plan, requiring fixed monthly payments over a standard loan term (e.g., 10 years). It offers predictability but may result in higher total interest paid compared to other options.

- Graduated Repayment Plan: Payments start low and gradually increase over time, making it potentially easier to manage early on. However, the increasing payments might become challenging later in the repayment period. This plan typically stretches the repayment period, leading to higher overall interest paid.

- Extended Repayment Plan: This option extends the loan repayment period, resulting in lower monthly payments. However, it significantly increases the total interest paid over the life of the loan.

- Income-Driven Repayment (IDR) Plans: (If available with Discover) These plans base monthly payments on your income and family size. Payments are typically lower, and any remaining balance may be forgiven after a certain number of years. Eligibility criteria and forgiveness terms vary depending on the specific IDR plan offered.

Comparing Repayment Plan Benefits and Drawbacks

Each repayment plan presents a trade-off between monthly payment affordability and the total interest paid.

| Repayment Plan | Benefits | Drawbacks |

|---|---|---|

| Standard Repayment | Predictable payments, shorter repayment period | Higher monthly payments, higher total interest |

| Graduated Repayment | Lower initial payments | Increasing payments, longer repayment period, higher total interest |

| Extended Repayment | Lowest monthly payments | Much longer repayment period, significantly higher total interest |

| Income-Driven Repayment (IDR) | Lower monthly payments based on income, potential for loan forgiveness | Longer repayment period, potential for higher total interest if not forgiven |

Repayment Strategies for Different Income Levels

A successful repayment strategy depends heavily on your income.

- Low Income: An IDR plan (if available) is often the most suitable option, prioritizing affordability over faster repayment. Budgeting meticulously and exploring additional income sources are crucial for staying on track.

- Medium Income: A standard or graduated repayment plan might be feasible, depending on your comfort level with monthly payments. Prioritizing higher payments to reduce the total interest paid could be a worthwhile strategy.

- High Income: A standard repayment plan, or even accelerated repayment (paying more than the minimum monthly payment), is likely the best choice to minimize the total interest paid and pay off the loan faster. Consider aggressively paying down the loan to save on interest.

Example: A borrower with a low income might choose an IDR plan with a $200 monthly payment, even if it extends the repayment period to 25 years. A borrower with a high income might opt for a standard 10-year plan and make extra principal payments each month to reduce the loan faster.

Managing Your Discover Student Loan

Successfully managing your Discover student loan involves proactive steps to ensure timely payments, understand your account details, and navigate any challenges effectively. This section Artikels practical strategies for responsible loan management.

Effective loan management is crucial for maintaining a positive credit history and avoiding unnecessary fees. By understanding the available tools and resources, you can streamline the process and ensure a smooth repayment journey.

Making Timely Payments

Timely payments are essential for avoiding late fees and maintaining a good credit score. Discover offers several convenient methods for making payments. You can schedule automatic payments directly from your bank account, ensuring you never miss a payment. Alternatively, you can make one-time payments online through your account dashboard or by phone. You can also mail a check or money order, though this method is generally slower.

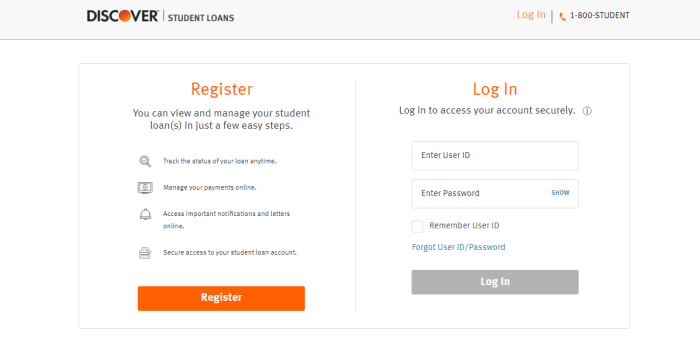

Managing Your Loan Account Online

Discover’s online account management system provides a centralized hub for all your loan-related information. Through the online portal, you can view your loan balance, payment history, upcoming payments, and interest rate. You can also update your personal information, such as your address and contact details, and modify your payment preferences. The intuitive interface allows for easy navigation and access to all relevant account details.

Avoiding Late Payment Fees and Penalties

Late payment fees can significantly impact your overall repayment costs. To avoid these fees, set up automatic payments or utilize online payment reminders. Staying organized and proactively managing your finances will help you stay on track with your payments. Budgeting tools and financial planning can help you allocate funds specifically for your loan repayment. If you anticipate difficulty making a payment, contact Discover customer service immediately to explore potential options such as deferment or forbearance.

Contacting Discover Customer Service

Discover provides multiple channels for contacting customer service. You can reach them by phone, through their website’s online chat feature, or via email. Their customer service representatives are available to answer questions about your loan, payment options, and any other concerns you may have. The contact information is readily available on the Discover student loans website. Detailed FAQs are also available online, addressing many common questions before needing to contact support.

Potential Challenges and Solutions

Navigating student loan repayment can present various challenges, even with a well-structured plan. Understanding these potential hurdles and proactively implementing solutions is crucial for successful repayment and maintaining financial well-being. This section Artikels common difficulties faced by Discover student loan borrowers and provides practical strategies for overcoming them.

Financial difficulties are a common concern for student loan borrowers. Unexpected life events, job loss, or changes in income can significantly impact repayment ability. Discover offers several resources and programs designed to assist borrowers during these challenging times. Understanding these options and utilizing them appropriately can prevent default and protect your credit score.

Loan Deferment and Forbearance Options

Discover offers both deferment and forbearance programs, providing temporary pauses or reductions in your monthly payments. Deferment typically requires demonstrating financial hardship, such as unemployment or enrollment in school, and often results in the interest not accruing. Forbearance, on the other hand, usually involves temporarily reducing your payments, but interest may continue to accrue during this period. It’s important to carefully review the terms and conditions of each program to understand their implications before applying. Choosing between deferment and forbearance depends on your individual circumstances and financial goals.

Addressing Financial Difficulties

Effective strategies for managing financial difficulties involve proactive planning and resource utilization. Creating a detailed budget that tracks income and expenses is essential. Identifying areas where spending can be reduced and exploring additional income streams can improve your financial situation. Contacting Discover directly to discuss your challenges and explore available repayment options, such as income-driven repayment plans, is also crucial. Consider seeking professional financial advice from a credit counselor or financial advisor to develop a personalized repayment strategy. They can offer tailored guidance based on your specific circumstances.

Solutions for Common Challenges

| Challenge | Solution | Discover Resource | Additional Advice |

|---|---|---|---|

| Job Loss/Unemployment | Apply for loan deferment or forbearance; explore unemployment benefits; create a strict budget; seek alternative employment. | Discover’s customer service for deferment/forbearance application. | Network with contacts, update resume, utilize job search websites. |

| Unexpected Medical Expenses | Apply for loan deferment or forbearance; explore medical payment assistance programs; create a budget prioritizing essential expenses. | Discover’s customer service for deferment/forbearance application. | Seek assistance from family, friends, or community resources. |

| Low Income | Explore income-driven repayment plans; create a detailed budget; seek higher-paying employment or additional income sources. | Discover’s website for income-driven repayment plan information. | Consider part-time work, freelance opportunities, or skill development. |

| Difficulty Budgeting | Utilize budgeting apps or tools; create a detailed budget categorizing income and expenses; seek guidance from a financial advisor. | Numerous free budgeting apps are available online. | Track spending habits meticulously for a month to identify areas for improvement. |

Discover Student Loan vs. Other Lenders

Choosing the right student loan can significantly impact your financial future. Understanding the differences between Discover student loans and other options, both federal and private, is crucial for making an informed decision. This section will compare key features to help you navigate this important choice.

Discover Student Loans Compared to Federal Student Loans

Federal student loans are offered by the government and generally come with more borrower protections than private loans. However, they also often have a more rigorous application process and may not always offer the most competitive interest rates. The comparison below highlights key differences.

- Interest Rates: Federal student loan interest rates are typically set by the government and are often lower than those offered by private lenders like Discover. However, these rates can fluctuate annually.

- Fees: Federal loans may have origination fees, which are deducted from the loan disbursement. Discover student loans may also have fees, but these vary based on the loan terms and can be clearly Artikeld in the loan documents.

- Repayment Options: Federal student loans offer various repayment plans, including income-driven repayment, which can significantly reduce monthly payments based on income. Discover offers several repayment plans, but they might not be as flexible or forgiving as federal options. For example, income-driven repayment plans are not typically available through private lenders.

- Loan Forgiveness Programs: Federal student loans are eligible for certain forgiveness programs, depending on your career path (e.g., public service loan forgiveness). Discover student loans do not generally offer such programs.

- Borrower Protections: Federal loans provide greater borrower protections, including deferment and forbearance options in case of financial hardship. While Discover offers some protections, they might be less extensive.

Discover Student Loans Compared to Other Private Student Loans

The private student loan market is highly competitive, with many lenders offering various loan products. Comparing Discover to other private lenders requires careful consideration of several factors.

- Interest Rates: Interest rates for private student loans, including those from Discover, can vary significantly depending on creditworthiness, co-signer availability, and market conditions. It’s essential to shop around and compare rates from multiple lenders before making a decision. A borrower with excellent credit might secure a lower rate than someone with limited credit history.

- Fees: Private lenders, including Discover, may charge various fees, such as origination fees, late payment fees, and prepayment penalties. Carefully review the loan terms to understand all associated costs.

- Repayment Options: Repayment options offered by private lenders can vary. While Discover offers several plans, other lenders may offer different options, such as extended repayment terms or graduated repayment. It is vital to compare the available repayment structures to choose the one best suited to your financial circumstances.

- Customer Service and Support: The level of customer service and support provided by different lenders can vary. Reading reviews and comparing the customer support options offered by different lenders can help determine the best fit.

Illustrative Scenarios

To further clarify the suitability of a Discover student loan, let’s examine scenarios where it proves beneficial and others where alternative options might be more advantageous. These examples highlight the importance of considering individual financial circumstances and long-term goals when selecting a student loan provider.

Discover Student Loan as a Good Choice

This scenario illustrates a situation where a Discover student loan is a strong contender. Sarah, a diligent undergraduate student at a state university, has maintained a high GPA and demonstrates excellent financial responsibility. She’s researching loan options for her final year, needing approximately $10,000. Discover offers her a competitive interest rate, attractive repayment options, and a robust online platform for managing her loan. She also appreciates Discover’s educational resources and customer service reputation. Her credit history, while limited, reflects responsible borrowing behavior, making her a suitable candidate for favorable loan terms.

A Discover student loan is a good fit for Sarah due to its competitive interest rates, flexible repayment options, and user-friendly online platform. Her responsible financial history further enhances her eligibility for favorable loan terms.

Discover Student Loan Might Not Be the Best Option

This scenario highlights a situation where a Discover student loan might not be the optimal choice. Mark, a graduate student pursuing a specialized Master’s program, requires a significantly larger loan amount – $50,000 – to cover tuition and living expenses. While Discover offers graduate student loans, Mark’s research reveals that several federal loan programs and private lenders offer more favorable interest rates and potentially better repayment terms tailored to graduate students’ unique financial needs and repayment timelines. Furthermore, his existing credit card debt and a less-than-perfect credit score might lead to higher interest rates from Discover than from other lenders specializing in high-risk borrowers.

For Mark, a Discover student loan might not be the best option due to the potentially higher interest rates compared to federal loan programs or other private lenders specializing in graduate student loans and high-risk borrowers. His higher loan amount and existing debt further contribute to this assessment.

Last Point

Securing funding for higher education is a significant step, and choosing the right student loan can significantly impact your financial well-being. This guide has provided a thorough examination of Discover student loans, covering everything from application to repayment. By understanding the intricacies of these loans, including their advantages and potential drawbacks, you can make a well-informed decision that aligns with your financial goals and sets you up for long-term success. Remember to carefully compare options and seek professional advice if needed.

Essential Questionnaire

What credit score is needed for a Discover student loan?

Discover’s credit score requirements vary depending on the loan type and applicant’s co-signer status. Generally, a higher credit score improves your chances of approval and may result in a lower interest rate.

Can I refinance my Discover student loan?

Yes, you can typically refinance your Discover student loan with another lender once you’ve made payments for a certain period. Refinancing might offer a lower interest rate, but it’s essential to compare offers carefully.

What happens if I miss a payment on my Discover student loan?

Missing payments can lead to late fees, negatively impact your credit score, and potentially affect your ability to access future credit. Contact Discover immediately if you anticipate difficulties making a payment to explore options like deferment or forbearance.

Does Discover offer loan forgiveness programs?

Discover does not offer loan forgiveness programs in the same way as federal student loans. However, they may have hardship programs or options for borrowers facing financial difficulties.