Navigating the complexities of student loan deferment can be daunting. Understanding whether or not your deferred student loans accrue interest is crucial for responsible financial planning. This impacts not only your immediate financial situation but also your long-term debt burden. This guide will delve into the intricacies of interest accrual during deferment, exploring various loan types, influencing factors, and strategies for managing your debt effectively.

The implications of interest capitalization, the consequences of unpaid interest, and the benefits of proactive management are all critical considerations. By understanding these elements, you can make informed decisions to minimize your financial liability and pave the way for a smoother repayment journey.

Types of Deferred Student Loans

Understanding the different types of student loan deferment is crucial for borrowers seeking temporary relief from loan repayments. Deferment allows you to postpone payments, but it’s important to note that, depending on the loan type, interest may still accrue during the deferment period. This section will Artikel the various deferment options available for federal and private student loans.

Federal Student Loan Deferment Programs

Federal student loans offer several deferment options, each with specific eligibility requirements and terms. These programs are designed to provide temporary financial relief to borrowers facing hardship.

Federal student loan deferment programs generally fall into two categories: those based on economic hardship and those based on specific circumstances, such as graduate study or military service. The specific requirements and length of deferment vary depending on the program.

| Deferment Type | Eligibility Criteria | Maximum Deferment Length | Interest Accrual |

|---|---|---|---|

| Economic Hardship Deferment | Unemployment, financial difficulties, or other documented hardship. Requires documentation. | Up to 3 years total, with potential extensions | Interest usually accrues, except for subsidized federal loans. |

| In-School Deferment | Enrolled at least half-time in an eligible degree or certificate program. | As long as enrolled at least half-time | Interest accrues on unsubsidized loans. Subsidized loans do not accrue interest. |

| Deferment for Graduate Fellowship | Receiving a graduate fellowship or assistantship. | Length of fellowship or assistantship | Interest usually accrues, except for subsidized federal loans. |

| Military Deferment | Active duty in the military or called to active duty in the National Guard or Reserves. | Duration of active duty | Interest usually accrues, except for subsidized federal loans. |

Private Student Loan Deferment Programs

Private student loan deferment options are less standardized than federal programs. Eligibility criteria and terms vary significantly depending on the lender. It’s crucial to contact your lender directly to inquire about deferment options and requirements. Unlike federal loans, private loan deferment is not guaranteed.

| Deferment Type (Example) | Eligibility Criteria (Example) | Maximum Deferment Length (Example) | Interest Accrual |

|---|---|---|---|

| Unemployment Deferment | Proof of unemployment, often requiring documentation like unemployment benefits statements. | Varies by lender; typically 6-12 months, possibly renewable. | Interest almost always accrues. |

| Economic Hardship Deferment | Documentation of significant financial hardship, such as medical bills or loss of income. Specific criteria vary greatly by lender. | Varies by lender; potentially shorter durations than federal programs. | Interest almost always accrues. |

Interest Accrual During Deferment

Understanding how interest accrues on federal student loans during a deferment period is crucial for managing your debt effectively. The process differs significantly depending on whether you have subsidized or unsubsidized loans. This section will clarify these differences and illustrate the impact of interest capitalization.

Interest accrual refers to the accumulation of interest on your loan balance over time. Even when your loan payments are deferred, interest may still accrue, increasing your overall debt. The key difference lies in whether the government pays this interest (subsidized loans) or if it’s added to your principal (unsubsidized loans). Failing to understand this distinction can lead to a substantially higher loan balance after the deferment period.

Subsidized and Unsubsidized Loan Interest Accrual During Deferment

For subsidized federal student loans, the government pays the interest that accrues while the loan is in deferment, provided you meet certain eligibility requirements. This means your loan balance will not increase during the deferment period. However, it’s important to note that this interest is only paid during periods of deferment; interest will still accrue during periods of repayment. Unsubsidized federal student loans, on the other hand, accrue interest throughout the deferment period, regardless of your eligibility. This accumulated interest is added to your principal loan balance, a process known as capitalization.

Capitalized Interest and its Impact

Capitalized interest significantly increases the total amount you owe on your loan. When interest is capitalized, it’s added to your principal loan balance, thus increasing the amount upon which future interest is calculated. This creates a compounding effect, leading to a larger total repayment amount over the life of the loan. The longer the deferment period, the greater the impact of capitalization.

Hypothetical Scenario: Capitalized Interest Impact

Let’s consider a hypothetical scenario. Suppose you have a $10,000 unsubsidized federal student loan with a 5% annual interest rate. If you defer your loan for two years, and interest is capitalized at the end of the deferment period, here’s how it would play out:

Year 1: $10,000 x 0.05 = $500 interest accrued.

Year 2: ($10,000 + $500) x 0.05 = $525 interest accrued.

Total interest accrued after two years: $500 + $525 = $1025

After capitalization, your new principal balance would be $11,025 ($10,000 + $1025). This is the amount on which future interest calculations will be based. If you had a subsidized loan, your principal would remain at $10,000 after two years of deferment. The difference in total repayment amount between the two scenarios, even with identical repayment plans, would be substantial, showcasing the significant impact of capitalized interest.

Factors Affecting Interest Accrual

Several factors influence the interest rate applied to your deferred student loans, ultimately impacting the total interest accrued during the deferment period. Understanding these factors is crucial for effectively managing your student loan debt. These factors can interact in complex ways, so it’s always best to consult your loan servicer for specific details regarding your loans.

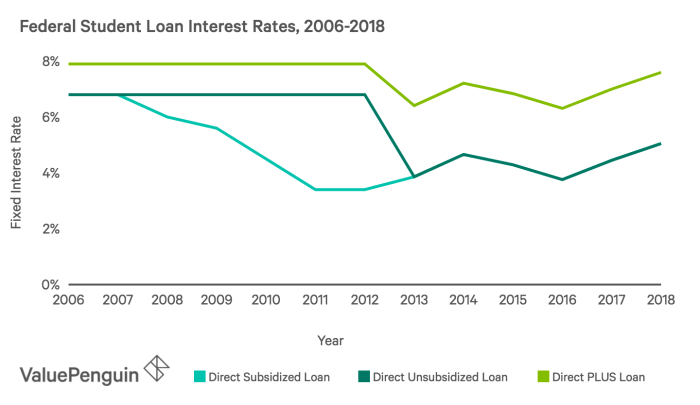

The primary factor determining the interest rate on your deferred student loan is the original interest rate assigned to the loan when it was disbursed. This rate is usually fixed, meaning it remains constant throughout the loan’s life, unless specific conditions are met. However, some loans may have variable interest rates, meaning they can fluctuate based on market conditions. The type of loan itself also plays a significant role; federal student loans typically have different interest rate structures compared to private student loans.

Interest Rate Changes During Deferment

While the underlying interest rate of a loan usually stays the same during deferment (unless it’s a variable rate loan), the *accrual* of interest continues. This means that even though you’re not making payments, interest is still added to your principal balance, increasing the total amount you owe. Several situations can lead to changes in the effective interest rate you experience during deferment, though not necessarily the underlying rate of the loan itself.

For example, a loan with a fixed interest rate of 5% might see an increase in the *total amount* of interest accrued if the deferment period is extended. A longer deferment period simply means more time for interest to accumulate. Conversely, a shorter deferment period will lead to less overall interest accumulation. Another example could be a change in your loan servicer. While the underlying interest rate remains the same, different servicers may have slightly different administrative fees or processes which might impact the overall cost of the loan. Lastly, a variable rate loan will obviously see fluctuations in its interest rate based on market indices, impacting the amount of interest that accrues.

Calculating Total Accrued Interest During Deferment

The calculation of total interest accrued during a deferment period involves several steps. Accurate calculation requires access to the specific loan details. It’s best to utilize the loan servicer’s online tools or contact them directly for precise figures. However, the following flowchart Artikels the general process.

[Flowchart Description]

Imagine a flowchart with four distinct boxes connected by arrows.

Box 1: “Determine Initial Loan Balance and Interest Rate.” This box describes the starting point of the calculation, requiring the initial principal balance of the loan and the applicable interest rate.

Box 2: “Determine Deferment Period Length.” This box shows the length of the deferment period in either months or years. This information is crucial for calculating the total interest accrued.

Box 3: “Calculate Simple Interest for Each Period.” This box details the calculation of simple interest for each period (usually monthly) during the deferment period. The formula used is:

Simple Interest = (Principal Balance * Interest Rate * Time)/12

where Time is expressed in months. The result of this calculation is added to the principal balance at the end of each period. This step is repeated for each month of the deferment.

Box 4: “Calculate Total Accrued Interest.” This box represents the final step where the total interest accrued over the entire deferment period is summed up. This is done by adding up the simple interest calculated in each period (from Box 3). The final result is the total interest accrued during the deferment.

The arrows connecting the boxes indicate the sequential steps involved in the calculation.

Managing Deferred Student Loans

Managing deferred student loans effectively requires proactive planning and understanding of the process. Failing to understand the implications of deferment can lead to significant increases in your overall loan balance due to accumulating interest. This section will Artikel steps for applying for deferment, strategies for minimizing interest accrual, and methods for tracking your loan’s progress.

Applying for a Student Loan Deferment

The application process for a student loan deferment varies depending on your loan servicer and your specific circumstances. Generally, you’ll need to contact your loan servicer directly. They will provide you with the necessary forms and instructions. Be prepared to provide documentation supporting your eligibility for deferment, such as proof of unemployment or enrollment in a qualifying program.

Strategies for Minimizing Interest Accrual During Deferment

While interest accrues during most deferment periods, there are strategies to mitigate the impact. One key strategy is to make interest-only payments during the deferment period. This prevents the interest from capitalizing (being added to your principal balance), thereby slowing down the growth of your loan. Another strategy is to explore income-driven repayment plans if you qualify. These plans adjust your monthly payments based on your income, making them more manageable, even if you can’t afford to pay off the principal during deferment. For example, if you are temporarily unemployed and your income is low, an income-driven repayment plan might significantly reduce your monthly payments during this period. Finally, if possible, continue to make payments towards your principal balance even during the deferment period. Every extra dollar you pay goes directly towards reducing the loan’s principal, minimizing the overall interest paid in the long run.

Methods for Tracking Accrued Interest on Deferred Student Loans

Keeping track of accrued interest is crucial for managing your debt effectively. Most loan servicers provide online portals where you can access your loan details, including the amount of interest accrued since the deferment began. Regularly checking this portal allows you to monitor your loan balance and stay informed. Alternatively, you can maintain a spreadsheet or use a budgeting app to manually track your interest accrual. This involves noting the initial loan balance at the start of the deferment, the interest rate, and the length of the deferment period. Using this information, you can calculate the approximate interest accrued. For example, if your loan balance is $10,000, your interest rate is 5%, and your deferment period is 6 months, you can calculate the approximate interest accrued using a simple interest calculation. It’s also advisable to regularly reconcile your manual calculations with the information provided by your loan servicer to ensure accuracy.

Consequences of Unpaid Interest

Failing to pay accrued interest on your deferred student loans, even though payments are temporarily suspended, can have significant long-term financial repercussions. The interest continues to accumulate, effectively increasing your overall loan balance. This means you’ll ultimately owe more than your original loan amount when repayment begins. Understanding these consequences is crucial for effective loan management.

The most immediate consequence is a larger principal balance upon the end of the deferment period. This increased balance will lead to higher monthly payments during repayment, extending the repayment period and potentially increasing the total interest paid over the life of the loan. In some cases, the accrued interest can even exceed the original loan amount, significantly impacting your financial future. For example, a $10,000 loan with a 6% interest rate accumulating interest for three years of deferment could easily add several thousand dollars to the total owed.

Loan Consolidation and its Effect on Deferred Loans and Accrued Interest

Loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment plan. While consolidation simplifies repayment, it doesn’t erase accrued interest during deferment. The total amount owed, including the accumulated interest, is rolled into the new consolidated loan. The new interest rate will be a weighted average of the rates of the original loans, which may be higher or lower than your current rates. This could result in either higher or lower total interest paid over the life of the consolidated loan, depending on the new interest rate and the repayment plan selected. Careful consideration of the potential long-term effects is essential before consolidating.

Long-Term Financial Implications of Deferment and Repayment Strategies

Choosing between different deferment and repayment strategies significantly impacts long-term financial outcomes. A longer deferment period, while offering short-term relief, results in substantially higher interest accrual and a larger overall loan balance. Conversely, shorter deferment periods, or even income-driven repayment plans during deferment (if available), can minimize interest accumulation, but might require more immediate financial sacrifice.

For instance, let’s compare two scenarios: Scenario A involves a five-year deferment, resulting in significant interest accrual and a much larger final loan balance. Scenario B utilizes a shorter, one-year deferment followed by an income-driven repayment plan, potentially leading to lower total interest paid over the lifetime of the loan, despite requiring payments during the repayment period. The choice depends on individual financial circumstances and risk tolerance. Careful planning and consideration of long-term implications are paramount to making the best choice.

Resources and Further Information

Navigating the complexities of student loan deferment and interest accrual can be challenging. Fortunately, numerous resources are available to help borrowers understand their rights and options. Accessing reliable information is crucial for making informed decisions about managing your student loans effectively. This section provides a list of helpful websites and organizations, along with key terms and definitions, to aid in your understanding.

Understanding the specific terms and conditions of your student loan is paramount before initiating a deferment. These terms dictate the rules governing your deferment, including the length of the deferment period, the types of interest accrual, and any potential penalties for non-compliance. Failure to fully comprehend these conditions could lead to unexpected financial burdens.

Reliable Websites and Organizations

Several government agencies and non-profit organizations offer valuable resources on student loan management. These organizations provide comprehensive information, tools, and support to assist borrowers in navigating the intricacies of their student loans. Utilizing these resources can significantly enhance your understanding of deferment options and interest accrual.

- Federal Student Aid (FSA): The official U.S. Department of Education website provides comprehensive information on federal student loans, including deferment options, eligibility requirements, and interest accrual details. It offers interactive tools and calculators to help borrowers estimate their loan payments and plan for repayment.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services. They can provide guidance on managing student loan debt, including exploring deferment options and creating a repayment plan.

- Student Loan Borrower Assistance (SLBA): Many organizations offer free or low-cost assistance to student loan borrowers. These organizations often provide one-on-one counseling and guidance, assisting with navigating complex loan programs and understanding deferment implications.

Key Terms and Definitions

Understanding the terminology associated with student loan deferment is essential for making informed decisions. The following definitions clarify some common terms and concepts related to student loan deferment and interest accrual. Familiarizing yourself with these terms will empower you to effectively manage your student loan debt.

- Deferment: A temporary postponement of student loan payments. Interest may or may not accrue during a deferment, depending on the loan type and circumstances.

- Forbearance: A temporary postponement of student loan payments. Unlike deferment, forbearance typically involves interest accruing on the loan balance.

- Capitalization: The process of adding accrued but unpaid interest to the principal loan balance. This increases the total amount owed.

- Interest Rate: The percentage of the loan balance charged as interest over a period of time.

- Principal: The original amount of the loan borrowed, excluding interest.

Importance of Understanding Loan Terms and Conditions

Before entering a deferment period, it’s crucial to carefully review and fully understand the terms and conditions of your specific student loan. This includes understanding the type of loan, the length of the deferment period, whether interest will accrue, and the implications of unpaid interest. Ignoring these details can lead to unforeseen financial consequences, such as increased debt and potential negative impacts on your credit score. For example, a subsidized loan might not accrue interest during deferment, while an unsubsidized loan will. This difference significantly impacts the total amount owed after the deferment period. Reviewing your loan documents carefully and seeking clarification from your loan servicer when needed is a crucial step in responsible student loan management.

Final Summary

Ultimately, the question of whether deferred student loans accrue interest depends significantly on the loan type and specific deferment program. Proactive planning, including understanding your loan terms, exploring deferment options, and strategically managing accrued interest, is key to mitigating the long-term financial impact of student loan debt. Remember to utilize available resources and seek professional advice when necessary to ensure you make the best decisions for your financial future.

FAQ Corner

What happens if I can’t afford to pay the accrued interest during deferment?

Failure to pay accrued interest will result in capitalization, adding that interest to your principal loan balance, increasing the total amount you owe and ultimately the amount you’ll pay in interest over the life of the loan.

Are there any types of deferment where interest is not accrued?

Yes, subsidized federal student loans generally do not accrue interest during certain deferment periods, while unsubsidized loans do. The specifics depend on the deferment type and eligibility.

How long can I defer my student loans?

The length of a deferment varies depending on the type of loan and the reason for deferment. There are limits, and you should check your loan servicer’s guidelines.

Can I defer my private student loans?

The availability of deferment for private student loans depends entirely on the lender’s policies. Contact your lender directly to inquire about their deferment options.