Navigating the complexities of student loan debt can feel overwhelming, especially when uncertainty about your outstanding balance lingers. This guide provides a clear and concise path to understanding your student loan situation, whether you’re a recent graduate facing repayment or a long-time borrower seeking clarity. We’ll explore how to locate your loan details, interpret the information provided, and plan for effective repayment strategies.

From identifying your loan servicer and accessing online portals to understanding key terms like principal and interest, we’ll demystify the process of managing your student loans. We’ll also discuss potential issues you might encounter and offer solutions for resolving them. This comprehensive guide empowers you to take control of your financial future and make informed decisions about your student loan repayment journey.

Understanding Your Student Loan Situation

Navigating the world of student loans can feel overwhelming, but understanding the different types and how to access your information is crucial for responsible repayment. This section will clarify the various loan types and guide you through the process of locating your loan details.

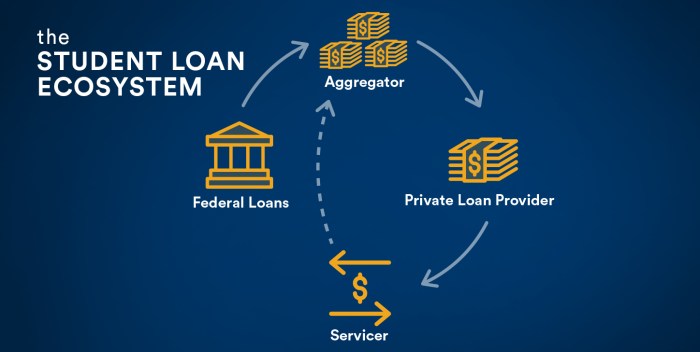

Federal and Private Student Loans

Federal student loans are offered by the U.S. government and generally come with more borrower protections than private loans. These include income-driven repayment plans and loan forgiveness programs. Private student loans, on the other hand, are provided by banks, credit unions, or other private lenders. They typically have higher interest rates and fewer repayment options than federal loans. Key differences include eligibility requirements, interest rates, repayment terms, and available deferment and forbearance options. Federal loans usually require completing the FAFSA (Free Application for Federal Student Aid), while private loans often involve a credit check and may require a co-signer.

Accessing Federal Student Loan Information Online

The primary resource for managing your federal student loans is the National Student Loan Data System (NSLDS). To access your information, you will need your Federal Student Aid (FSA) ID, which is a username and password you create. Once logged in, you can view your loan history, including the lender, loan type, interest rate, and outstanding balance for each loan. You can also access your repayment schedule, and make payments directly through the site. The NSLDS provides a comprehensive overview of your federal student aid, including grants, loans, and work-study.

Checking Your Private Student Loan Balance

Locating your private student loan information requires contacting your lender directly. Unlike federal loans, there isn’t a centralized system for private loans. Each lender will have its own online portal or customer service number. You’ll usually need your loan number or account number to access your account information. This information is typically found in your loan documents. Many private lenders provide online account access where you can view your statement, payment history, and current balance.

Finding Your Loan Servicer Information

Your loan servicer is the company responsible for managing your student loans. For federal loans, you can find your servicer information through the NSLDS website. For private loans, the information will be found in your loan documents or by contacting the lender directly. If you have difficulty locating your servicer, contacting the lender from whom you originally received the loan is the best course of action. They can direct you to the appropriate servicer if your loans have been transferred. Keeping track of your loan servicer’s contact information is essential for managing your account and making payments.

Locating Your Loan Details

Knowing the specifics of your student loans is crucial for effective repayment planning and avoiding potential issues. This section will guide you through the process of finding and verifying your loan information, both federal and private. Accurate information is key to making informed decisions about your financial future.

Accessing Your Federal Student Loan Information

The National Student Loan Data System (NSLDS) is the U.S. Department of Education’s central database for federal student aid. Accessing your NSLDS account provides a comprehensive overview of your federal student loans. To access your NSLDS account, you’ll need your Federal Student Aid (FSA) ID, which is your username and password for accessing federal student aid websites. Once logged in, you can view your loan history, including loan amounts, interest rates, repayment plans, and the names of your loan servicers. Remember to protect your FSA ID and keep your login information secure.

Locating Private Student Loan Information

Unlike federal loans, private student loans aren’t centralized in a single database. Locating your private loan details requires contacting each lender individually. You may have borrowed from multiple lenders over the years, so maintaining organized records is important.

Private Loan Information Websites

A list of websites to check for your private loan information will depend on your specific lenders. However, many private lenders have online portals for account access. It’s recommended to check your statements and any documentation you received at the time of borrowing to identify all your lenders. Contacting each lender directly if you’re unsure is always a good option. They should be able to provide you with the necessary login information and website address.

Comparison of Loan Servicing Websites

The information available on different loan servicing websites varies. Below is a table comparing common features. Note that this is not an exhaustive list, and the information provided may change depending on the lender.

| Lender | Website | Access Method | Information Provided |

|---|---|---|---|

| Sallie Mae | salliemae.com | Username and password | Loan balance, payment history, repayment plan options, interest rate, and contact information. |

| Discover | discover.com/student-loans | Username and password | Loan balance, payment history, repayment plan options, interest rate, and contact information. |

| Wells Fargo | wellsfargo.com/student | Username and password | Loan balance, payment history, repayment plan options, interest rate, and contact information. |

| PNC | pnc.com/student-loans | Username and password | Loan balance, payment history, repayment plan options, interest rate, and contact information. |

Verifying Loan Information Accuracy

It’s crucial to meticulously verify the accuracy of all your loan information. Discrepancies can lead to overpayments, missed payments, or incorrect interest calculations. Compare the information provided by each lender with your loan documents. If you find any discrepancies, contact the lender immediately to resolve the issue. Regularly reviewing your loan statements helps prevent future problems.

Interpreting Your Loan Information

Understanding the details of your student loan is crucial for effective repayment planning. This section will clarify key terms and demonstrate how to interpret your loan information to make informed decisions. We will cover essential concepts and provide examples to help you navigate this process.

Let’s begin by defining some fundamental terms.

Key Loan Terms

Understanding the terminology associated with your student loans is the first step to managing them effectively. Three key terms are central to understanding your loan situation: principal, interest, and loan balance.

- Principal: This is the original amount of money you borrowed. It’s the base amount of your loan, excluding any accumulated interest.

- Interest: This is the cost of borrowing money. Lenders charge interest as a percentage of your principal balance. The interest rate is typically fixed or variable, and it significantly impacts your total repayment cost.

- Loan Balance: This represents the remaining amount you owe on your loan. It’s the sum of your principal and accumulated interest. As you make payments, your loan balance decreases.

Calculating Monthly Payments

Your monthly payment depends on several factors, including your loan amount, interest rate, and repayment plan. While precise calculations often require loan amortization calculators (easily found online), understanding the basic formula is helpful.

The exact formula for calculating monthly payments is complex, but it generally involves the principal amount, the interest rate, and the loan term (number of months). Online calculators simplify this process significantly.

Different repayment plans significantly alter your monthly payment amount and overall repayment period. For instance, a standard repayment plan typically involves fixed monthly payments over a 10-year period, while an income-driven repayment plan adjusts payments based on your income and family size.

Common Repayment Plan Options

Several repayment plan options exist, each with its own advantages and disadvantages. Selecting the right plan depends on your individual financial situation and goals.

| Repayment Plan | Description | Implications |

|---|---|---|

| Standard Repayment Plan | Fixed monthly payments over 10 years. | Higher monthly payments, but loan paid off faster. |

| Graduated Repayment Plan | Payments start low and gradually increase over time. | Lower initial payments, but higher payments later. |

| Income-Driven Repayment Plan (IDR) | Payments based on your income and family size. | Lower monthly payments, but potentially longer repayment period. May lead to loan forgiveness after 20-25 years, depending on the plan. |

| Extended Repayment Plan | Longer repayment period than standard plan. | Lower monthly payments, but you pay more in interest over the life of the loan. |

Understanding Your Amortization Schedule

An amortization schedule details your loan payments over time, showing the breakdown of principal and interest for each payment. Reviewing this schedule allows you to track your progress and visualize how your loan balance decreases with each payment. Most lenders provide access to this schedule online through your loan account portal.

For example, an amortization schedule might show that in the first few months, a larger portion of your payment goes towards interest, while later payments allocate more to the principal. This is because interest is calculated on the remaining balance. As the balance reduces, the interest component decreases, and the principal repayment increases.

Dealing with Potential Issues

Accessing your student loan information might present unexpected challenges. Many factors can contribute to difficulties in locating or understanding your loan details, leading to frustration and potentially impacting your ability to manage your debt effectively. Understanding these common problems and having a plan to address them is crucial for responsible loan management.

Common problems encountered when accessing loan information include outdated contact information on file, incorrect login credentials, website glitches or maintenance, and difficulties navigating complex loan servicer websites. In some cases, individuals may struggle to recall the names of their lenders or the specific details of their loan agreements, particularly if they haven’t interacted with their loans for an extended period. These issues can significantly delay your ability to make payments, understand your repayment options, or consolidate your debt.

Troubleshooting Loan Information Access

If you cannot locate your loan details, a systematic approach is essential. The following flowchart illustrates a step-by-step process to resolve the issue:

[Imagine a flowchart here. The flowchart would begin with a “Start” box. The next box would be “Check Existing Documents (Loan Agreements, etc.)”. If yes, the flowchart would proceed to “Review Information and Verify”. If no, it would branch to “Contact the National Student Loan Data System (NSLDS)”. If NSLDS provides information, the flowchart would proceed to “Review Information and Verify”. If NSLDS does not provide information, the flowchart would branch to “Attempt to Recall Lender Information (Name, Contact Details)”. If this is successful, the flowchart would proceed to “Contact Lender Directly”. If unsuccessful, the flowchart would branch to “Seek Assistance from a Financial Advisor or Credit Counseling Agency”. The flowchart would end with an “End” box.]

Reasons for Discrepancies in Loan Information

Discrepancies in loan information can stem from various sources. Data entry errors by lenders or servicers are a common cause, leading to inaccuracies in interest rates, loan balances, or payment schedules. Changes in loan servicers, a frequent occurrence in the student loan industry, can also result in discrepancies as information is transferred between different companies. Furthermore, borrowers may encounter discrepancies if they have multiple loans from different lenders, making it challenging to track all accounts accurately. Finally, human error, such as incorrect reporting of payments or loan modifications, can contribute to these inconsistencies. For example, a borrower might notice a difference between their online account balance and a paper statement they received. Another example could be a discrepancy between the interest rate reported by the servicer and the rate originally Artikeld in the loan agreement.

Contacting Your Loan Servicer

When facing issues with your loan information, contacting your loan servicer is crucial. Before contacting them, gather all relevant information, including your loan identification numbers, Social Security number, and any documentation related to your loan. Most servicers provide multiple contact methods, including phone, email, and online chat. Clearly explain the issue you are experiencing, providing specific details about the discrepancies or missing information. Be prepared to provide supporting documentation if necessary. Keep detailed records of all communication with your servicer, including dates, times, and the names of the representatives you spoke with. Persistence is key; if your initial contact doesn’t resolve the issue, follow up with additional calls or emails. Consider escalating the issue to a supervisor if you are not satisfied with the response.

Planning for Loan Repayment

Successfully navigating student loan repayment requires careful planning and a proactive approach. Understanding your budget, exploring repayment options, and utilizing available resources are crucial steps to managing your debt effectively and minimizing financial stress. This section will guide you through the process of developing a personalized repayment strategy.

Creating a Repayment Budget

A comprehensive budget is essential for incorporating your student loan payments. This involves tracking your income and expenses to identify areas where you can save and allocate funds towards your loans. A simple budget template might include categories such as income (salary, part-time jobs, etc.), fixed expenses (rent, utilities, transportation), variable expenses (groceries, entertainment), and debt payments (student loans, credit cards). By meticulously tracking these categories, you can gain a clear picture of your financial situation and determine a realistic monthly payment amount for your student loans. Remember to factor in unexpected expenses, such as car repairs or medical bills, to ensure your budget remains flexible. Using budgeting apps or spreadsheets can simplify this process and offer helpful visualizations of your financial health.

Prioritizing Student Loan Repayment Strategies

Several strategies exist for prioritizing student loan repayment, each with its own advantages and disadvantages. The most common approaches include the avalanche method (prioritizing loans with the highest interest rates) and the snowball method (prioritizing loans with the smallest balances). The avalanche method is generally more efficient in the long run, minimizing the total interest paid. However, the snowball method can provide psychological benefits by quickly eliminating smaller loans, providing motivation to continue the repayment process. The best strategy depends on your individual financial situation and personality. For example, someone highly motivated by quick wins might prefer the snowball method, while someone focused on long-term financial efficiency might choose the avalanche method.

Student Loan Repayment Plan Options

Various repayment plans are available, each with its own terms and conditions. Standard repayment plans typically involve fixed monthly payments over a 10-year period. Income-driven repayment plans (IDR) adjust your monthly payments based on your income and family size. These plans can result in lower monthly payments but may extend the repayment period and increase the total interest paid over the life of the loan. Deferment and forbearance temporarily postpone your payments, but interest may still accrue. Choosing the right plan requires careful consideration of your current financial situation and long-term goals. For example, a recent graduate with a low income might benefit from an IDR plan, while someone with a stable, higher income might prefer a standard repayment plan to pay off their loans faster.

Resources for Financial Planning and Student Loan Repayment Assistance

Numerous resources are available to assist with financial planning and student loan repayment. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services. The U.S. Department of Education provides information on various repayment plans and loan forgiveness programs. Many non-profit organizations and educational institutions offer workshops and seminars on personal finance and debt management. Utilizing these resources can empower you to make informed decisions and effectively manage your student loans. For example, the Federal Student Aid website provides a comprehensive overview of all federal student loan programs and repayment options, while the NFCC can connect you with a certified credit counselor to develop a personalized debt management plan.

Visualizing Loan Information

Visualizing your student loan debt can significantly aid in understanding its scope and planning for repayment. Transforming complex numerical data into easily digestible visual representations provides a clearer picture of your financial situation and allows for more effective decision-making. This section will explore several ways to visualize your loan information, offering a more intuitive grasp of your overall debt.

Loan Balance Breakdown by Lender

A bar chart effectively visualizes the distribution of your loan balance across different lenders. The horizontal axis would list each lender (e.g., Sallie Mae, Navient, Federal Direct Loan Program), and the vertical axis would represent the loan balance in dollars. Each lender would be represented by a bar whose height corresponds to the outstanding loan amount. For example, if you owe $10,000 to Sallie Mae, $5,000 to Navient, and $15,000 to the Federal Direct Loan Program, the bar for the Federal Direct Loan Program would be the tallest, followed by Sallie Mae, and then Navient. This visual instantly shows which lender holds the largest portion of your debt. The chart could also include a total loan balance at the top for a clear overview.

Loan Repayment Timeline under Different Scenarios

A timeline illustrates the potential repayment journeys under various repayment plans. The horizontal axis represents time, typically in years, stretching from the present to the projected loan payoff date. Multiple lines could be plotted on the timeline, each representing a different repayment scenario (e.g., standard repayment, extended repayment, income-driven repayment). Each line would show the remaining loan balance over time. For instance, the standard repayment plan might show a steeper decline in the loan balance due to higher monthly payments, resulting in a shorter repayment period compared to an income-driven repayment plan, which would exhibit a more gradual decline. Key milestones, such as the point at which half the loan is repaid, could be marked on the timeline for easy reference.

Loan Forgiveness Program Summary

| Program Name | Eligibility Requirements | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Work full-time for a qualifying government or non-profit organization; make 120 qualifying monthly payments under an income-driven repayment plan. | Remaining loan balance | Apply through your loan servicer. |

| Teacher Loan Forgiveness | Teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. | Up to $17,500 | Apply through the Department of Education. |

| Income-Driven Repayment (IDR) Plans | Vary by plan; generally based on income and family size. | Remaining balance after 20-25 years (depending on the plan) | Apply through your loan servicer. |

| IBR, PAYE, REPAYE | Vary slightly by plan, but generally based on income and family size. | Remaining balance after 20-25 years (depending on the plan) | Apply through your loan servicer. |

Last Word

Successfully navigating the world of student loans requires a proactive approach. By understanding the different types of loans, accessing your loan information, and interpreting key details, you can develop a personalized repayment plan. Remember to utilize available resources, seek assistance when needed, and prioritize responsible financial management to ensure a smooth and successful repayment journey. Taking control of your student loan situation empowers you to achieve your financial goals.

Expert Answers

What if I can’t find my loan servicer?

Contact the National Student Loan Data System (NSLDS) or your lender directly. They can provide you with the necessary contact information for your loan servicer.

How often should I check my loan balance?

It’s recommended to check your loan balance at least once a month to monitor your progress and identify any potential discrepancies.

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default. Contact your servicer immediately if you anticipate difficulties making a payment.

Are there any programs to help with student loan repayment?

Yes, several programs offer assistance, such as income-driven repayment plans and loan forgiveness programs. Research options based on your eligibility.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan, potentially simplifying repayment. However, carefully consider the potential impact on your interest rate.