The weight of student loan debt is a significant concern for many recent graduates and even those years removed from their academic pursuits. Navigating the complex landscape of repayment plans, deferments, and forgiveness programs can feel overwhelming. Understanding your options and responsibilities is crucial to avoid financial hardship and secure your long-term financial well-being. This guide provides a comprehensive overview of the process, empowering you to make informed decisions about your student loan repayment journey.

From understanding the various repayment plans and their associated implications to exploring strategies for managing and potentially reducing your debt, this resource aims to clarify the intricacies of student loan repayment. We will examine the potential consequences of default, the benefits of seeking professional advice, and delve into specific programs designed to assist borrowers. Ultimately, our goal is to equip you with the knowledge and tools necessary to confidently navigate this crucial aspect of your financial future.

Understanding Student Loan Repayment

Navigating student loan repayment can feel overwhelming, but understanding the available options and factors influencing your monthly payments is crucial for effective financial planning. This section provides a clear overview of repayment plans and tools to help you estimate your monthly payments.

Student Loan Repayment Plans

Several repayment plans cater to different financial situations and income levels. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. The most common plans include:

- Standard Repayment Plan: This plan typically involves fixed monthly payments over 10 years. It’s straightforward but may result in higher monthly payments compared to other options.

- Graduated Repayment Plan: Payments start low and gradually increase over time, potentially offering lower initial payments but leading to higher payments later in the repayment period.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), lowering monthly payments but increasing the total interest paid over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base monthly payments on your income and family size. Payments are typically lower and may even be $0 in some cases, but remaining balances may be forgiven after a set period (often 20 or 25 years).

Factors Influencing Monthly Payment Amounts

Several key factors determine your monthly student loan payment. Understanding these factors is vital for accurate budgeting and financial planning.

- Loan Amount: The principal balance of your loan directly impacts your monthly payment. A larger loan amount naturally results in higher monthly payments.

- Interest Rate: The interest rate determines the cost of borrowing. Higher interest rates lead to higher monthly payments.

- Repayment Plan: As explained above, different repayment plans result in varying monthly payments. Longer repayment periods generally mean lower monthly payments but higher total interest paid.

- Loan Consolidation: Consolidating multiple loans into a single loan can simplify repayment but might affect your overall interest rate and repayment term.

Calculating Your Estimated Monthly Payment

While precise calculations require using a loan amortization calculator (often available on your lender’s website), a simplified estimation can be made using the following steps:

- Determine your loan amount (principal): This is the total amount you borrowed.

- Find your interest rate: This is the annual percentage rate (APR) of your loan.

- Determine your repayment term: This is the length of time you have to repay the loan (in months).

- Use a loan calculator: Numerous free online calculators are available to input these values and calculate your estimated monthly payment. Many lenders also provide this tool on their websites.

Examples of Repayment Scenarios

The following table illustrates how different loan amounts, interest rates, and repayment plans affect monthly payments. These are estimates and actual payments may vary.

| Loan Amount | Interest Rate | Repayment Plan | Monthly Payment (Estimate) |

|---|---|---|---|

| $20,000 | 5% | Standard (10 years) | $212 |

| $40,000 | 7% | Extended (25 years) | $290 |

| $30,000 | 6% | Graduated (10 years) | $315 (initial payment will be lower) |

| $15,000 | 4% | Income-Driven (varies greatly) | Varies based on income; could be significantly lower than other plans. |

Deferment and Forbearance Options

Navigating student loan repayment can be challenging, and sometimes borrowers need temporary relief. Deferment and forbearance are two programs offering such relief, but they differ significantly in their impact on your loan. Understanding the nuances of each is crucial for making informed decisions about your repayment strategy.

Deferment and forbearance provide temporary pauses in your student loan payments. However, they differ in the circumstances under which they are granted and their effect on accruing interest. Choosing between them requires careful consideration of your individual financial situation and long-term repayment goals.

Circumstances for Granting Deferment and Forbearance

Deferment is generally granted for specific reasons, often related to economic hardship or further education. Examples include unemployment, economic hardship, and enrollment in a qualifying graduate or professional degree program. Forbearance, on the other hand, is typically granted for reasons of temporary financial difficulty that don’t necessarily fall under the strict criteria for deferment. This might include medical emergencies, natural disasters, or other unforeseen circumstances. The specific qualifying reasons for both deferment and forbearance are determined by the loan servicer and the type of loan.

Differences Between Deferment and Forbearance

The key difference lies in interest accrual. With certain types of deferment, interest may not accrue on subsidized federal student loans. However, interest will always accrue on unsubsidized federal loans and most private student loans during both deferment and forbearance periods. Forbearance, regardless of loan type, almost always results in interest capitalization – meaning the accumulated interest is added to the principal loan balance, increasing the total amount owed. This ultimately leads to a higher total repayment amount over the life of the loan.

Drawbacks and Benefits of Deferment and Forbearance

Utilizing deferment or forbearance offers the obvious benefit of temporary relief from monthly payments, providing crucial breathing room during difficult financial times. However, the accumulation of interest during forbearance, and potentially during unsubsidized deferment, is a significant drawback. This can lead to a larger overall loan balance and potentially higher total interest paid over the life of the loan. Furthermore, extended periods of deferment or forbearance can negatively impact your credit score, especially if payments are missed. Therefore, it’s essential to weigh the short-term benefits against the potential long-term consequences.

Applying for Deferment and Forbearance: A Flowchart

[Imagine a flowchart here. The flowchart would begin with a box labeled “Need Deferment or Forbearance?”. This would branch to two boxes: “Yes” and “No.” The “No” branch would lead to the end. The “Yes” branch would lead to a box asking “What is the reason?”. This would branch to various reasons (e.g., unemployment, economic hardship, medical emergency). Each reason would lead to a box indicating the appropriate application process (contacting the loan servicer, gathering necessary documentation). This would then lead to a box labeled “Submit Application”. A subsequent box would indicate “Application Approved” or “Application Denied,” with the “Denied” branch leading to a box advising on alternative options or appeal processes. The “Approved” branch would lead to a box indicating the deferment or forbearance period.]

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a lifeline to student loan borrowers struggling with high monthly payments. These plans tie your monthly payment to your income and family size, making them significantly more manageable than standard repayment plans for many individuals. Understanding the nuances of each plan is crucial for choosing the option best suited to your financial circumstances.

IDR plans work by calculating your monthly payment based on a formula that considers your discretionary income (income after accounting for essential expenses) and family size. The remaining balance is typically forgiven after a set number of years, often 20 or 25, though the specifics vary depending on the plan and when you entered repayment. This forgiveness, however, is considered taxable income, a crucial point to remember when considering long-term financial implications. It’s important to note that the exact calculation method differs slightly between plans.

Income-Driven Repayment Plan Comparison

The primary IDR plans offered by the federal government include Income-Driven Repayment (IDR), Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). While they share the core concept of linking payments to income, subtle differences exist in their eligibility criteria, payment calculation formulas, and forgiveness timelines. For instance, REPAYE generally offers lower monthly payments than PAYE, but also has a longer repayment period. IBR is a less commonly used plan compared to REPAYE and PAYE, as it was superseded by newer plans offering better terms.

Detailed Explanation of Income-Driven Repayment Plan Functionality

Each IDR plan utilizes a specific formula to determine your monthly payment. This formula considers your adjusted gross income (AGI), family size, and the total amount of your federal student loans. The AGI is your gross income minus certain deductions, as defined by the IRS. The higher your AGI and family size, the higher your payment will likely be, although it will still be lower than a standard repayment plan. After subtracting a percentage of your AGI to account for living expenses, the remaining amount forms the basis for your monthly payment calculation. This calculation is performed annually, adjusting your payment as your income changes.

Examples of Successful IDR Plan Utilization

Consider Sarah, a teacher with significant student loan debt. After struggling with high monthly payments under a standard repayment plan, she switched to REPAYE. Her lower monthly payment allowed her to save more, reduce her financial stress, and even pay down some additional debt. Similarly, David, a social worker with a young family, found PAYE to be beneficial. The lower payments enabled him to manage his finances effectively while providing for his family. These are just two examples highlighting the potential benefits of IDR plans, which are tailored to individual financial circumstances.

Key Features of Each IDR Plan

Understanding the key differences between these plans is crucial for selecting the most appropriate option.

- Income-Driven Repayment (IDR): A general term encompassing several plans, offering flexibility based on income. Specific details vary depending on the chosen plan (IBR, PAYE, REPAYE).

- Income-Based Repayment (IBR): One of the original IDR plans, now less commonly used due to the availability of more favorable options like REPAYE and PAYE. Eligibility criteria and calculation formulas are less advantageous compared to newer plans.

- Pay As You Earn (PAYE): This plan offers lower monthly payments than standard repayment, based on a calculation of 10% of discretionary income. Forgiveness is generally available after 20 years of payments.

- Revised Pay As You Earn (REPAYE): This plan generally provides the lowest monthly payments among IDR plans, calculating payments based on 10% of discretionary income. Forgiveness is available after 20 or 25 years of payments, depending on loan type and when repayment began.

Loan Forgiveness Programs

Student loan forgiveness programs offer the possibility of eliminating a portion or all of your student loan debt under specific circumstances. These programs are designed to incentivize certain career paths or provide relief to borrowers facing financial hardship. However, eligibility requirements are often stringent, and the application process can be complex. Understanding the nuances of these programs is crucial before relying on them as a primary repayment strategy.

Eligibility Requirements for Loan Forgiveness Programs

Eligibility for loan forgiveness programs varies significantly depending on the specific program. Factors considered include the type of loan (federal or private), the borrower’s occupation, income level, and the length of time employed in a qualifying field. For example, the Public Service Loan Forgiveness (PSLF) program requires borrowers to make 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Other programs, such as Teacher Loan Forgiveness, have their own specific criteria related to teaching experience and location. It’s crucial to carefully review the requirements of each program to determine eligibility.

The Application Process for Loan Forgiveness

Applying for loan forgiveness is generally a multi-step process that requires meticulous documentation. Borrowers typically need to complete an application form, provide proof of employment and income, and submit documentation verifying their loan type and repayment history. The application process can be lengthy and require considerable effort in gathering and organizing the necessary paperwork. It is important to begin the application process well in advance of the anticipated forgiveness date to allow sufficient time for processing and potential corrections. Failure to submit complete and accurate documentation can result in delays or denial of the application.

Benefits and Limitations of Loan Forgiveness Programs

The primary benefit of loan forgiveness programs is the potential for significant debt reduction or elimination. This can dramatically improve a borrower’s financial well-being, allowing them to save money, invest in other areas, or reduce financial stress. However, there are limitations. Many programs have strict eligibility requirements, limiting the number of borrowers who can qualify. The forgiveness process can be lengthy and complex, requiring patience and persistence. Furthermore, some programs may only forgive a portion of the loan, leaving borrowers with a remaining balance. Finally, the tax implications of loan forgiveness should be considered; in some cases, forgiven debt may be considered taxable income.

Comparison of Loan Forgiveness Programs

| Program Name | Eligibility Criteria | Forgiveness Timeline |

|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. | 10-12 years (120 payments) |

| Teacher Loan Forgiveness | Five years of full-time teaching in a low-income school or educational service agency. | After completion of five years of teaching. |

| Income-Driven Repayment (IDR) Plans with Forgiveness | Various income-based repayment plans with potential for loan forgiveness after 20-25 years. | 20-25 years, depending on the plan. |

Dealing with Student Loan Debt

Managing student loan debt effectively requires a proactive and strategic approach. This involves understanding your repayment options, creating a realistic budget, and utilizing available resources to minimize the financial burden. Failing to address student loan debt proactively can lead to significant financial strain and hinder long-term financial goals.

Strategies for Managing and Reducing Student Loan Debt

Effective management of student loan debt hinges on several key strategies. Prioritizing high-interest loans for repayment can save money on interest over the life of the loan. Exploring refinancing options with lower interest rates can also significantly reduce the total amount paid. Additionally, consistent on-time payments demonstrate financial responsibility and can improve credit scores, opening up further financial opportunities. Finally, actively seeking opportunities for loan forgiveness programs, where applicable, can alleviate a substantial portion of the debt.

Budgeting Techniques for Individuals with Student Loan Debt

Creating a realistic budget is crucial for successfully managing student loan debt. The 50/30/20 budgeting rule—allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment—provides a helpful framework. However, for individuals with significant student loan debt, it may be necessary to adjust this allocation, prioritizing debt repayment within the 20% or even reallocating funds from the ‘wants’ category. Tracking expenses meticulously using budgeting apps or spreadsheets allows for identification of areas where spending can be reduced. For example, meticulously tracking daily expenses can reveal hidden spending habits, such as frequent coffee purchases or subscription services that can be eliminated or reduced. This process enables informed decision-making regarding spending and debt repayment.

Resources and Tools Available to Help Manage Student Loan Debt

Several resources and tools are available to assist in managing student loan debt. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, providing guidance on budgeting and debt management strategies. StudentAid.gov, the official U.S. Department of Education website, provides comprehensive information on federal student loan programs, repayment options, and available resources. Numerous budgeting apps, such as Mint or YNAB (You Need A Budget), offer automated tracking and analysis of expenses, facilitating informed financial decisions. These tools empower individuals to gain control of their finances and make progress towards eliminating student loan debt.

Creating a Realistic Budget that Incorporates Student Loan Payments

Constructing a budget that successfully integrates student loan payments requires careful planning and prioritization. Begin by listing all monthly income sources, including salary, part-time income, and any other sources. Then, meticulously list all monthly expenses, categorizing them into needs (housing, food, transportation), wants (entertainment, dining out), and debt payments (student loans, credit cards). Calculate the total income and total expenses. The difference represents the surplus or deficit. If a deficit exists, adjustments must be made by reducing expenses or increasing income. For example, reducing dining-out expenses by $100 per month and cutting a streaming service subscription by $20 could free up $120 for student loan repayment. This process allows for a clear understanding of current financial standing and provides a roadmap for managing and reducing student loan debt.

Consequences of Defaulting on Student Loans

Defaulting on your student loans has serious and far-reaching consequences that can significantly impact your financial well-being and future opportunities. Ignoring your student loan debt will not make it disappear; instead, it will trigger a cascade of negative events that can be difficult to overcome. Understanding these consequences is crucial for responsible loan management.

The ramifications of student loan default extend beyond simply damaging your credit score. It can lead to significant financial penalties, legal actions, and limitations on future opportunities. These consequences can be severe and long-lasting, impacting various aspects of your life.

Wage Garnishment

Wage garnishment is a legal process where a portion of your earnings is automatically deducted by your employer to pay off your defaulted student loans. The amount garnished can be substantial, significantly reducing your disposable income and making it difficult to meet your daily expenses. The process begins with the loan servicer obtaining a court order, allowing them to directly contact your employer to initiate the deductions. The percentage of your wages that can be garnished varies by state but is generally capped at a certain percentage of your disposable income. For example, in some states, up to 15% of disposable income can be garnished for student loan debt. This can severely impact your ability to manage other financial obligations.

Tax Refund Offset

The government can also seize a portion or all of your federal tax refund to settle your defaulted student loan debt. This means that money you were expecting to receive back as a refund will be redirected to the loan servicer. This process typically happens automatically; you won’t receive a notification before the offset occurs. The IRS works directly with the Department of Education to identify individuals with defaulted loans and intercept their refunds. The amount offset can be the entire refund or a portion, depending on the outstanding debt. This can leave individuals with significantly less money available after tax season.

Credit Reporting and Impact on Future Borrowing

Defaulting on student loans has a devastating effect on your credit score. A default is reported to the major credit bureaus (Equifax, Experian, and TransUnion), significantly lowering your credit score. This negative mark remains on your credit report for seven years, making it extremely difficult to secure loans, credit cards, or even rent an apartment. A low credit score translates to higher interest rates on any future borrowing, increasing the overall cost of credit. For instance, securing a mortgage or auto loan becomes significantly harder and more expensive, if not impossible, with a severely damaged credit history.

Legal Ramifications

Beyond financial consequences, defaulting on student loans can have serious legal repercussions. Lawsuits can be filed against you to recover the debt, potentially leading to wage garnishment, bank levy, and even property seizure. In some cases, your professional licenses could be at risk, particularly in regulated professions. The Department of Education can pursue various legal avenues to collect the debt, including referring the debt to collections agencies, which can further impact your credit and increase the overall debt due to added fees and interest. Furthermore, the legal fees associated with defending against such lawsuits can add to your financial burden.

Seeking Professional Advice

Navigating the complexities of student loan repayment can be overwhelming. Seeking professional financial advice offers significant benefits, providing clarity and potentially saving you considerable time and money in the long run. A qualified advisor can help you understand your options, create a personalized repayment strategy, and avoid potential pitfalls.

The benefits of professional guidance extend beyond simply understanding repayment plans. A financial advisor can analyze your overall financial picture, considering your income, expenses, and other debts, to create a comprehensive plan that addresses your student loans within the context of your broader financial goals. This holistic approach can prevent you from making short-sighted decisions that could negatively impact your long-term financial well-being.

Types of Professionals Offering Assistance

Several types of professionals can provide valuable assistance with student loan management. Certified Financial Planners (CFPs), financial advisors, and student loan counselors all possess expertise in this area, although their specific areas of focus may vary. CFPs, for example, typically offer a broader range of financial planning services, while student loan counselors specialize exclusively in student loan management. Choosing the right professional depends on your individual needs and the complexity of your situation.

Finding a Reputable Financial Advisor

Finding a trustworthy financial advisor requires careful research and due diligence. Start by seeking recommendations from trusted sources such as friends, family, or colleagues. Online resources like the websites of professional organizations (e.g., the Certified Financial Planner Board of Standards) can help you locate qualified advisors in your area. Check online reviews and verify their credentials and licensing information. A reputable advisor will be transparent about their fees and services, and will take the time to understand your individual circumstances before offering advice.

Questions to Ask a Potential Financial Advisor

Before engaging a financial advisor, it’s crucial to ask clarifying questions to ensure they are the right fit for your needs. This includes inquiring about their experience with student loan management, their fee structure, their approach to developing a repayment plan, and their conflict-of-interest policies. Asking about their professional certifications and memberships in relevant organizations can also provide valuable insight into their qualifications. A comprehensive understanding of their approach and fees upfront will ensure a smooth and productive working relationship. Examples of questions to ask include: “What is your experience with clients in similar financial situations?”, “What are your fees, and how are they structured?”, and “What is your process for developing a student loan repayment plan?”.

Closure

Successfully managing student loan debt requires a proactive and informed approach. By understanding the different repayment options, exploring available programs, and budgeting effectively, you can significantly reduce the burden and pave the way for a more secure financial future. Remember that seeking professional advice can provide invaluable support and guidance in navigating this complex process. Don’t hesitate to utilize the resources and strategies Artikeld in this guide to take control of your student loan repayment journey and achieve your financial goals.

Clarifying Questions

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

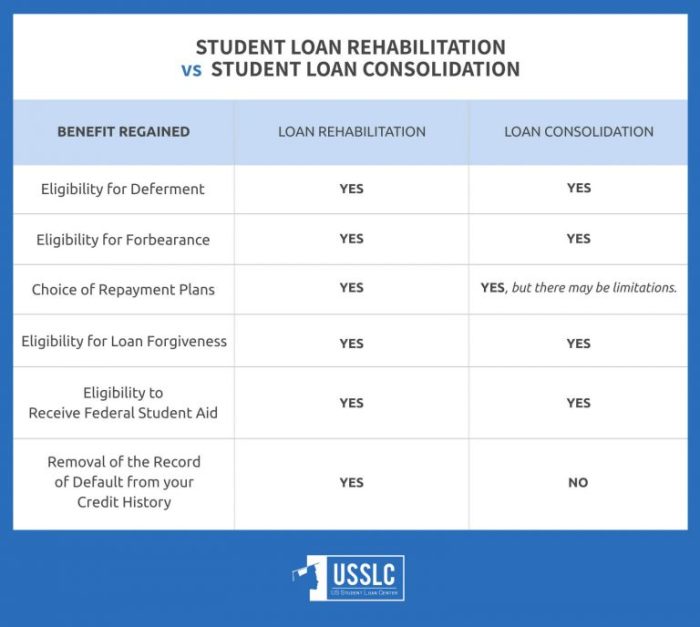

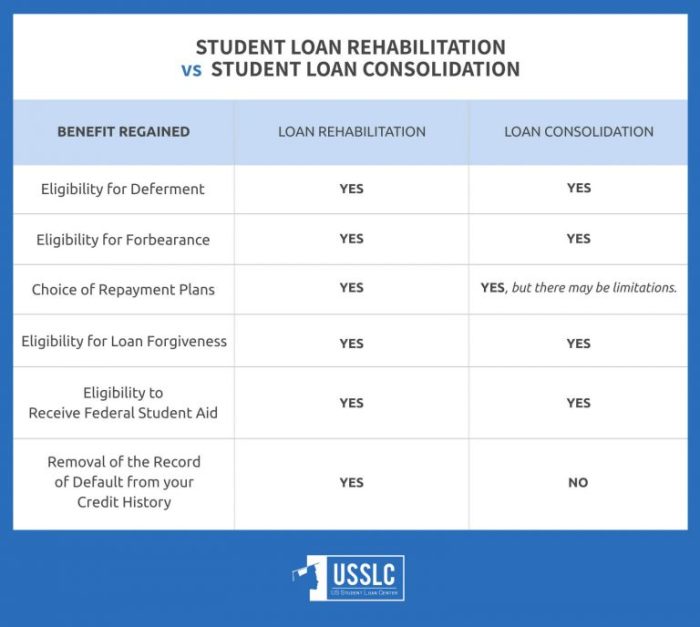

Can I consolidate my student loans?

Yes, consolidating multiple loans into a single loan can simplify payments and potentially lower your monthly payment, though this may affect your overall interest paid.

How do I find my student loan servicer?

You can typically find this information on the National Student Loan Data System (NSLDS) website or through your loan documents.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Are there any tax deductions for student loan interest?

Yes, there may be; consult a tax professional or the IRS website for current eligibility requirements and limitations.