Navigating the complexities of student loan repayment can feel overwhelming, particularly when understanding how interest accrues. The seemingly simple question of whether interest compounds monthly or yearly significantly impacts the total cost of your loan over time. This exploration delves into the mechanics of student loan interest, comparing monthly and yearly accrual methods, and highlighting strategies for minimizing your overall debt burden.

Understanding the nuances of interest calculation is crucial for making informed financial decisions. Different loan types, repayment plans, and interest rates all play a role in determining how quickly your debt grows. By grasping these concepts, you can proactively manage your student loans and potentially save thousands of dollars in the long run.

Understanding Interest Accrual on Student Loans

Student loan interest accrual is a crucial aspect of repayment. Understanding how interest is calculated and applied to your loan balance is essential for effective financial planning and minimizing the total cost of borrowing. This section will explore the fundamental principles of interest accrual, the different types of student loans, and illustrate a step-by-step calculation.

Interest Accrual Fundamentals

Interest accrual on student loans refers to the process by which interest charges accumulate over time on the outstanding loan balance. The amount of interest you owe depends primarily on your loan’s interest rate and the principal balance. Interest typically accrues daily, but it’s often calculated and added to your principal balance monthly. This means that you’re paying interest not only on your initial loan amount but also on the accumulated interest itself – a process known as compound interest. The longer you take to repay your loans, the more interest you will accrue, ultimately increasing your total repayment amount.

Types of Student Loans and Interest Calculation

Several types of student loans exist, each with its own interest rate and calculation method. Generally, federal student loans offer fixed interest rates, meaning the rate remains constant throughout the loan’s life. Private student loans, on the other hand, can have either fixed or variable interest rates. Variable rates fluctuate based on market conditions, making it more difficult to predict your future payments. Interest calculations remain consistent across loan types; however, the interest rate itself will significantly impact the total interest accrued.

Interest Calculation Example

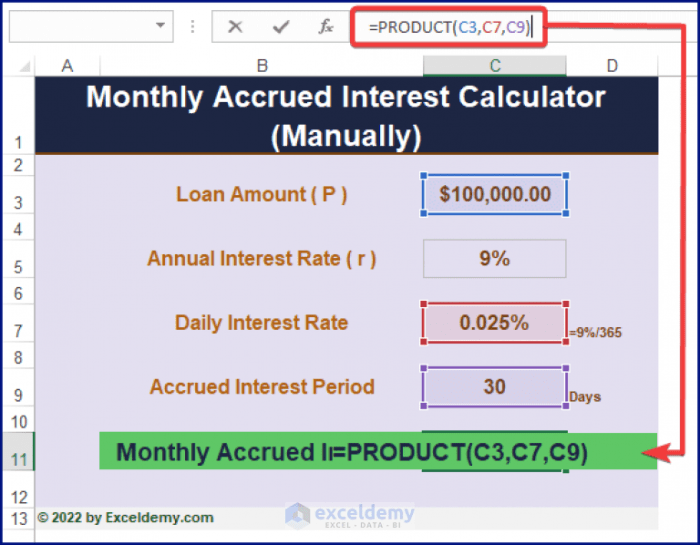

Let’s illustrate interest calculation with a hypothetical example. We’ll examine both monthly and yearly accrual for two common loan types: a subsidized federal loan and an unsubsidized private loan.

| Loan Type | Interest Rate | Monthly Accrual Example | Yearly Accrual Example |

|---|---|---|---|

| Subsidized Federal Loan | 4.5% | Assume a $10,000 loan balance. With a 4.5% annual rate, the monthly rate is approximately 0.375% (4.5%/12). The monthly interest accrual would be $37.50 ($10,000 * 0.00375). | The yearly interest accrual would be approximately $450 ($10,000 * 0.045). Note that this calculation assumes no payments are made during the year. |

| Unsubsidized Private Loan | 7% | With a $10,000 loan balance and a 7% annual rate, the monthly rate is approximately 0.583% (7%/12). The monthly interest accrual would be $58.33 ($10,000 * 0.00583). | The yearly interest accrual would be approximately $700 ($10,000 * 0.07). Again, this calculation assumes no payments are made during the year. |

Note: These examples simplify the calculation. Actual interest accrual may vary slightly depending on the specific loan terms and the method used by the lender. Always refer to your loan documents for precise details.

Monthly vs. Yearly Interest Calculation

Understanding how student loan interest is calculated—monthly versus yearly—is crucial for effective financial planning. The method used significantly impacts the total interest paid over the loan’s lifespan and, consequently, the overall cost of your education. While the final amount owed will be the same regardless of the calculation frequency, the way interest is compounded makes a noticeable difference.

The primary difference lies in the frequency of interest capitalization. With monthly calculations, interest is added to the principal balance each month, leading to compounding. Yearly calculations, conversely, add interest to the principal only once a year. This seemingly small difference can result in a substantial increase in the total interest paid over the life of the loan due to the power of compounding. The more frequent the compounding, the faster the debt grows.

Interest Calculation Methods and Their Financial Implications

Monthly interest calculations result in more frequent compounding. This means that interest is calculated on a larger principal balance each month, leading to a higher total interest paid compared to yearly calculations. Conversely, yearly calculations, while simpler to understand, lead to lower total interest payments because the interest is added to the principal less frequently. Borrowers should be aware that even a seemingly small difference in interest rates can significantly impact the total cost of their loan, especially over a long repayment period. For example, a 0.5% difference in interest rate can result in thousands of dollars more in interest paid over the life of a typical student loan.

Impact of Repayment Plans on Total Interest Paid

Different repayment plans influence the total interest paid, and this effect is further modified by the frequency of interest calculation (monthly or yearly). Income-driven repayment plans, for instance, typically extend the loan term, leading to higher total interest paid regardless of the calculation frequency. However, the monthly calculation method will exacerbate this effect due to more frequent compounding. Standard repayment plans, with their shorter repayment terms, result in lower overall interest paid, but the difference between monthly and yearly calculations remains significant.

| Repayment Plan | Monthly Interest Calculation (Example: 10-year loan, 5% interest) | Yearly Interest Calculation (Example: 10-year loan, 5% interest) |

|---|---|---|

| Standard | $X (higher total interest) | $Y (lower total interest) |

| Income-Driven (e.g., ICR) | $Z (significantly higher total interest) | $W (higher total interest than standard, but lower than monthly ICR) |

Note: The values X, Y, Z, and W represent hypothetical amounts and would vary based on loan amount, interest rate, and specific repayment plan details. These are illustrative examples to highlight the difference in total interest paid under different scenarios. Accurate calculations require using a student loan amortization calculator with the specific loan details.

Factors Influencing Student Loan Interest Accrual

Several key factors significantly influence the amount of interest that accrues on your student loans. Understanding these factors is crucial for effective loan management and minimizing the overall cost of borrowing. The most prominent factors are the interest rate itself, the loan’s capitalization process, and, to a lesser extent, the repayment plan chosen.

The interest rate is the foundation upon which all interest calculations are built. It represents the annual percentage of the loan’s principal balance that you’ll pay as interest. A higher interest rate leads to faster interest accrual and a greater total interest paid over the life of the loan. Conversely, a lower interest rate results in slower interest growth and lower overall interest costs.

Interest Rate’s Impact on Interest Accrual

The interest rate directly determines the amount of interest accrued each month and year. Let’s illustrate with examples:

Imagine two student loans, both with a principal balance of $10,000. Loan A has a 5% annual interest rate, while Loan B has a 7% annual interest rate.

For Loan A (5% interest rate):

* Monthly interest: ($10,000 * 0.05) / 12 ≈ $41.67

* Yearly interest: $10,000 * 0.05 = $500

For Loan B (7% interest rate):

* Monthly interest: ($10,000 * 0.07) / 12 ≈ $58.33

* Yearly interest: $10,000 * 0.07 = $700

As shown, the higher interest rate on Loan B results in significantly higher monthly and yearly interest payments compared to Loan A. This difference compounds over time, leading to a substantial difference in the total interest paid over the life of the loan.

The Influence of Loan Capitalization

Loan capitalization is the process of adding accumulated interest to the principal loan balance. This increases the principal amount on which future interest is calculated, leading to a snowball effect where you pay interest on previously accrued interest. This significantly impacts the total interest paid over the loan’s lifetime.

The timing and frequency of capitalization vary depending on the loan type and servicer. Capitalization usually happens when a loan enters deferment or forbearance, or at the end of a grace period. It can dramatically increase the overall cost of the loan.

Here are some scenarios where loan capitalization significantly impacts the total cost:

- Extended periods of deferment or forbearance: During these periods, interest continues to accrue but is not typically paid. When the loan is reinstated, the accrued interest is capitalized, increasing the principal balance and future payments.

- Frequent changes in repayment plans: Switching between different repayment plans can lead to capitalization events, particularly if a plan involves a period of reduced or suspended payments.

- Inconsistent payments or missed payments: While not directly causing capitalization, inconsistent payments can prolong the loan repayment period, giving interest more time to accrue and potentially increasing the chances of capitalization if deferment or forbearance is necessary.

For example, let’s consider a $20,000 loan with a 6% interest rate over 10 years. If no interest is capitalized, the total interest paid might be around $5,000. However, if interest is capitalized after a 2-year deferment period, the total interest paid could increase to $7,000 or more, depending on the specific circumstances. This illustrates how capitalization can significantly inflate the total loan cost.

Practical Implications for Borrowers

Understanding how student loan interest accrues is crucial for responsible financial planning. Knowing whether interest compounds monthly or yearly directly impacts the total cost of your education and influences your repayment strategy. Armed with this knowledge, you can make informed decisions to minimize your debt burden and achieve your financial goals more effectively.

Understanding the mechanics of interest accrual empowers borrowers to proactively manage their student loan debt. By recognizing the impact of different interest rates and compounding frequencies, borrowers can make more strategic choices regarding repayment plans, potentially saving thousands of dollars over the life of their loans. This knowledge is particularly valuable when comparing loan options or considering refinancing opportunities.

Strategies for Minimizing Interest Payments

Effective strategies exist to reduce the overall interest paid on student loans. These strategies can significantly lower the total repayment amount, freeing up funds for other financial priorities. A combination of approaches often yields the best results.

- Aggressive Repayment: Paying more than the minimum monthly payment reduces the principal balance faster, leading to less interest accumulating over time. Even small extra payments can make a substantial difference in the long run. For example, adding just $50 to your monthly payment can shorten the repayment period and reduce total interest paid significantly.

- Refinancing: If interest rates have fallen since you took out your loans, refinancing to a lower rate can substantially reduce your monthly payments and overall interest costs. However, carefully consider the terms and fees associated with refinancing before making a decision.

- Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income and family size. While they may extend your repayment period, they can make payments more manageable in the short term, especially during periods of lower income. The trade-off is that you’ll pay more interest overall.

- Consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower your interest rate, especially if you have loans with varying interest rates. However, this might also extend the repayment period.

Estimating Total Interest Payments

Accurately estimating total interest payments is vital for budgeting and long-term financial planning. Both monthly and yearly calculations can be used, though the monthly calculation provides a more precise estimate due to the frequent compounding of interest.

Let’s consider an example: A student loan of $20,000 with a 6% annual interest rate, compounded monthly, over a 10-year repayment period.

Using a monthly calculation (more accurate), we’d use a loan amortization calculator (easily found online) to determine the total interest paid. This calculation factors in the monthly compounding of interest. A typical result would show total interest paid to be significantly higher than a simple yearly calculation.

A simplified yearly calculation (less accurate) would involve calculating the simple interest for each year (Principal * Interest Rate), but this ignores the compounding effect within each year, resulting in an underestimate of the total interest paid.

The accuracy of the total interest paid estimation greatly improves with a monthly calculation that incorporates the compounding effect of interest.

Illustrative Examples

Understanding how student loan interest accrues can be challenging. Visual representations can greatly simplify this process, making the impact of different factors more apparent. The following examples illustrate the differences between monthly and yearly compounding, and the benefit of making extra principal payments.

Monthly Versus Yearly Interest Accrual

Imagine two bar graphs, both tracking the growth of a $10,000 loan with a 5% annual interest rate over five years. The first graph represents monthly compounding. Each bar shows the loan balance at the end of each year. You’ll see a gradual, but steady, increase in the loan balance, reflecting the interest added monthly. The height of the bars will progressively increase, demonstrating the accelerating effect of compounding. The final bar would show a significantly higher balance than the initial $10,000. The second graph shows yearly compounding. The bars here would also show the loan balance at the end of each year, but the increase from year to year would be less steep than in the monthly compounding graph. The difference in the final loan balance between the two graphs clearly illustrates the power of monthly compounding. The total interest accrued under monthly compounding will be noticeably higher than under yearly compounding.

Impact of Extra Principal Payments

This visual representation would utilize a line graph. The x-axis represents the time (in years) over the loan’s repayment period, and the y-axis represents the total interest paid. One line represents a scenario where only the minimum payments are made. This line will show a relatively high total interest paid over the loan’s lifetime, gradually increasing as the loan progresses. A second line represents a scenario where an extra $100 is paid each month. This line will show a significantly lower total interest paid, with a much gentler slope. A third line might show the impact of paying an extra $200 per month, demonstrating an even more dramatic reduction in total interest paid. The graph would clearly illustrate how even small extra payments can significantly reduce the total interest paid over the life of the loan, leading to substantial savings. The difference between the lines visually highlights the substantial cost savings achieved through proactive principal reduction.

Conclusive Thoughts

Ultimately, the question of whether student loan interest accrues monthly or yearly doesn’t have a single, simple answer. The method of calculation varies depending on the specific loan type and lender. However, a thorough understanding of how interest is calculated, along with the factors influencing its growth, empowers borrowers to make strategic decisions about repayment and minimize the long-term cost of their education. By actively managing your loans and employing effective repayment strategies, you can take control of your financial future and achieve debt freedom sooner.

FAQ Guide

What happens if I don’t make my student loan payments?

Failure to make payments will lead to delinquency, negatively impacting your credit score and potentially resulting in fees and collection actions.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing may be an option, but it depends on your credit score and the current market interest rates. Compare offers carefully.

How does loan capitalization affect my total interest paid?

Capitalization adds accrued interest to your principal balance, increasing the amount on which future interest is calculated, leading to higher overall interest payments.

Are there any government programs to help with student loan repayment?

Yes, several programs exist, including income-driven repayment plans and potential loan forgiveness programs depending on your occupation and other factors. Research your eligibility.