Navigating the complexities of student loan repayment can be daunting, especially understanding how deferment impacts the overall cost. Many students wonder: do student loans accrue interest while in deferment? The answer, unfortunately, isn’t a simple yes or no. The accumulation of interest during a deferment period depends heavily on the type of loan and the specific deferment program utilized. This exploration delves into the intricacies of various deferment options, explaining how interest accrual works, and ultimately empowering you to make informed financial decisions regarding your student loans.

Understanding the nuances of interest capitalization, the impact of different deferment types, and the long-term financial consequences is crucial for responsible loan management. We’ll examine various scenarios, compare deferment to alternative repayment strategies, and provide clear, concise explanations to help you navigate this often confusing aspect of student loan repayment.

Types of Deferment

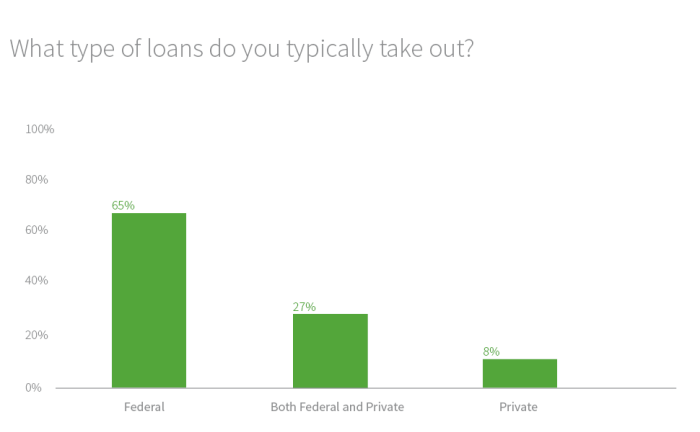

Student loan deferment allows borrowers to temporarily postpone their loan payments. Several types of deferment exist, each with specific eligibility requirements and terms. Understanding these differences is crucial for borrowers seeking to manage their student loan debt effectively. The availability and specifics of deferment programs can also vary depending on the type of loan (federal vs. private) and the lender.

Types of Federal Student Loan Deferment Programs

The federal government offers several deferment options for federal student loans. These programs provide temporary relief from loan payments under specific circumstances. Eligibility criteria and allowed deferment periods differ depending on the chosen program.

Income-Driven Repayment Deferments versus Other Deferment Options

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing monthly payments on income and family size. While not technically a deferment in the traditional sense (payments are still made, albeit reduced), IDR plans often lead to periods of significantly reduced payments, effectively offering similar financial relief. Other deferment options, such as those granted for unemployment or economic hardship, typically involve a complete suspension of payments for a defined period. The key difference lies in whether payments are completely halted or merely reduced based on income. IDR plans generally offer longer-term relief, but payments, however small, continue, whereas other deferments provide temporary complete payment relief.

Examples of Situations Warranting Deferment

Deferment may be granted in various circumstances. For example, unemployment, economic hardship, and enrollment in graduate school are common reasons borrowers seek deferment. Specific documentation may be required to prove eligibility for each situation. A borrower experiencing a significant medical emergency requiring extensive treatment might also qualify for deferment. Similarly, those experiencing a period of active military service often qualify for deferment of their federal student loans.

Comparison of Deferment Types

| Deferment Type | Eligibility | Maximum Duration | Interest Accrual |

|---|---|---|---|

| Economic Hardship Deferment | Demonstrated financial difficulty | Up to 3 years (may be extended) | Generally, yes (for subsidized loans, interest may be paid by the government during certain deferment periods) |

| Unemployment Deferment | Unemployment for at least 90 days | Up to 3 years (may be extended) | Generally, yes (for subsidized loans, interest may be paid by the government during certain deferment periods) |

| In-School Deferment | Enrollment at least half-time in a degree or certificate program | Length of enrollment | Generally, no (for subsidized loans) |

| Military Deferment | Active duty military service | Length of service | Generally, no (for subsidized loans) |

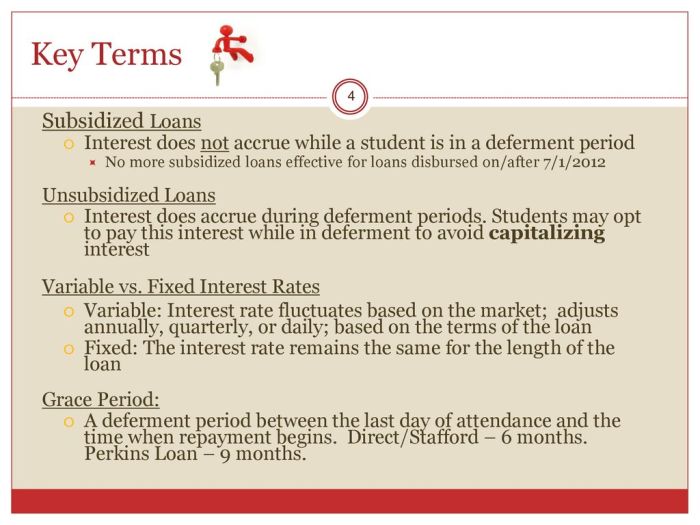

Interest Accrual During Deferment

Student loan deferment offers temporary relief from loan payments, but it’s crucial to understand how interest accrual functions during this period. While you’re not required to make payments, interest typically continues to accumulate on your loan balance, increasing the overall amount you eventually owe.

Interest capitalization is the process where accumulated interest is added to your principal loan balance. This happens at the end of a deferment period (or sometimes at other specified times, depending on your loan type and servicer). The newly capitalized interest then begins to accrue interest itself, leading to a snowball effect that significantly increases the total cost of your loan over time.

Interest Capitalization During Deferment

Interest capitalization during deferment directly impacts the total amount owed after the deferment period ends. The longer the deferment, the more interest accrues, and consequently, the larger the principal balance becomes after capitalization. This increased principal balance then necessitates higher monthly payments upon repayment resumption, extending the repayment timeline and increasing the total interest paid over the life of the loan. For example, if a $10,000 loan accrues $1,000 in interest during a deferment, the new principal balance after capitalization will be $11,000. Future interest calculations will be based on this higher amount, leading to greater overall interest payments.

Scenarios Where Interest Does Not Accrue During Deferment

While rare, some specific federal loan programs or deferment types may offer interest subsidies or waivers, meaning the government covers the interest that accrues during the deferment period. This eliminates the need for capitalization and prevents the loan balance from growing. These scenarios are usually tied to specific circumstances, such as economic hardship or active military service. It’s essential to carefully review your loan terms and contact your loan servicer to determine if your deferment qualifies for an interest subsidy. Private loans almost never offer this benefit.

Calculating Interest Accrued During Deferment

Calculating accrued interest during deferment requires knowing the interest rate, the principal balance at the beginning of the deferment, and the length of the deferment period. A simple calculation uses the following formula:

Total Interest = Principal Balance * (Annual Interest Rate / 12) * Number of Months in Deferment

Let’s illustrate this with an example. Suppose you have a $20,000 loan with a 6% annual interest rate, and you are granted a 12-month deferment.

Step 1: Calculate the monthly interest rate: 6% / 12 months = 0.5% or 0.005.

Step 2: Calculate the monthly interest: $20,000 * 0.005 = $100.

Step 3: Calculate the total interest accrued during the deferment: $100/month * 12 months = $1200.

Therefore, after a 12-month deferment, $1200 in interest would be capitalized, increasing your principal balance to $21,200. It is crucial to remember that this is a simplified calculation and doesn’t account for any potential compounding effects or variations in interest rates during the deferment period. The actual amount may vary slightly depending on the loan servicer’s calculation methods.

Impact of Deferment on Loan Repayment

Deferring student loan payments might seem like a helpful short-term solution, but it significantly impacts the overall cost of repayment. The interest continues to accrue during the deferment period, increasing the principal balance and ultimately leading to a larger total repayment amount. Understanding this long-term financial consequence is crucial for responsible financial planning.

Deferment extends the repayment period, resulting in a higher total interest paid. This increase is directly proportional to the length of the deferment and the interest rate applied to the loan. Higher interest rates exacerbate this effect, leading to substantially larger total repayment costs. The following examples illustrate the financial implications of different deferment scenarios.

Comparison of Repayment Amounts with and without Deferment

The table below compares total repayment amounts for a $20,000 student loan with a 10-year repayment plan, under different interest rates and deferment periods. We assume a simple interest calculation for illustrative purposes; actual calculations may vary based on loan terms and amortization schedules.

| Interest Rate | Deferment (Years) | Total Repayment (No Deferment) | Total Repayment (With Deferment) |

|---|---|---|---|

| 5% | 0 | $25,000 | $25,000 |

| 5% | 2 | $25,000 | $27,500 |

| 7% | 0 | $28,000 | $28,000 |

| 7% | 2 | $28,000 | $31,500 |

Examples of Financial Implications

Consider two scenarios: In the first, a borrower with a $30,000 loan at 6% interest defers payments for three years. Without deferment, their 10-year repayment plan would cost approximately $39,000. With the three-year deferment, the total cost increases to roughly $43,000 due to accrued interest.

In the second scenario, a borrower with a $15,000 loan at 4% interest defers for one year. Their original 5-year repayment plan would cost approximately $17,000. With the one-year deferment, the total cost might increase to about $17,500. While this increase seems smaller, the impact is still significant, especially considering the compounding effect of interest over a longer repayment period. These examples highlight the importance of carefully considering the long-term implications before opting for deferment.

Government Regulations and Deferment

Student loan deferment is governed by a complex set of federal regulations designed to provide borrowers with temporary relief from repayment obligations under specific circumstances. Understanding these regulations is crucial for borrowers seeking deferment, as failure to comply can have significant financial consequences. The process involves navigating specific eligibility criteria and submitting accurate documentation to the loan servicer.

The primary federal regulations governing student loan deferment are found within the Higher Education Act of 1965 and subsequent amendments, as well as regulations issued by the U.S. Department of Education. These regulations define eligible reasons for deferment, the duration of deferment periods, and the responsibilities of both borrowers and loan servicers. Specific details may vary depending on the type of federal student loan (e.g., Direct Subsidized Loans, Direct Unsubsidized Loans, Federal Perkins Loans) and the borrower’s circumstances.

Applying for Deferment and Required Documentation

Applying for deferment typically involves completing an application form provided by the loan servicer. This application requires the borrower to provide supporting documentation that verifies their eligibility for deferment. The required documentation varies depending on the reason for deferment. For example, a borrower seeking deferment due to unemployment may need to provide proof of unemployment benefits or a letter from their employer confirming job loss. A borrower seeking deferment due to economic hardship might need to provide documentation of their income and expenses. Accurate and complete documentation is essential for a successful deferment application. Incomplete or inaccurate information may lead to delays or denial of the deferment request.

Consequences of Non-Compliance with Deferment Requirements

Failure to meet the requirements for deferment can result in the denial of the deferment request. This means that the borrower remains obligated to make monthly loan payments as scheduled. If payments are missed, the borrower may face negative consequences, including late payment fees, damage to their credit score, and potential loan default. Furthermore, interest may continue to accrue on the loan balance during the period for which deferment was requested but not granted, increasing the overall cost of the loan.

Consequences of Misrepresenting Information During the Deferment Application Process

Misrepresenting information on a deferment application is a serious offense that can have significant legal and financial consequences. Federal regulations prohibit borrowers from providing false or misleading information to obtain deferment. Doing so can lead to the denial of the deferment request and potential penalties, including repayment of the loan balance with accrued interest, and even legal action. In some cases, misrepresentation could result in criminal charges. It’s crucial to provide accurate and truthful information when applying for deferment.

Alternative Solutions to Deferment

Deferment, while offering temporary relief from student loan payments, isn’t always the best solution. It often results in accumulating interest, ultimately increasing the total loan amount. Exploring alternative strategies can lead to more effective long-term debt management. This section Artikels several options and compares them to deferment, helping borrowers make informed decisions about their financial future.

Several strategies exist for managing student loan debt besides deferment, each with its own advantages and disadvantages. Understanding these options allows borrowers to choose the most suitable approach based on their individual financial circumstances and long-term goals.

Forbearance

Forbearance, similar to deferment, temporarily suspends or reduces your monthly loan payments. However, unlike deferment, interest usually continues to accrue during forbearance, leading to a larger loan balance upon repayment resumption. This makes forbearance generally less favorable than deferment unless you are facing a truly short-term financial hardship. Choosing forbearance requires careful consideration of the potential increase in your overall debt. For example, a borrower might choose forbearance for a few months while dealing with an unexpected job loss, understanding that the interest will increase the principal.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans offer lower monthly payments than standard repayment plans, making them particularly beneficial for borrowers with limited income. Several types of IDR plans exist, each with its own eligibility requirements and payment calculation methods. These plans typically extend the repayment period, potentially resulting in paying more interest over the life of the loan. However, after a specific period (often 20 or 25 years), the remaining loan balance may be forgiven under certain programs, like the Public Service Loan Forgiveness (PSLF) program. For instance, a teacher earning a modest salary might find an IDR plan more manageable than a standard repayment plan, even though it lengthens the repayment period.

Income-Driven Repayment Plan Details

Different IDR plans utilize varying formulas to determine monthly payments. Understanding these differences is crucial for selecting the most suitable plan. Key factors include the type of loan, income level, family size, and loan balance. Each plan’s details are Artikeld on the federal student aid website. Careful review of these details is essential before making a decision.

Choosing Between Deferment and Other Strategies: A Decision Flowchart

The following flowchart illustrates a simplified decision-making process for selecting the most appropriate strategy for managing student loan debt. It highlights key considerations and guides borrowers toward the best option for their specific situation.

Flowchart (Textual Representation):

Start -> Are you facing a temporary financial hardship? -> Yes: Proceed to Deferment/Forbearance Decision; No: Proceed to IDR Plan Consideration.

Deferment/Forbearance Decision: Is the hardship short-term and will you be able to resume payments soon? -> Yes: Consider Forbearance (aware of interest accrual); No: Consider Deferment (check eligibility).

IDR Plan Consideration: Is your income low relative to your loan balance? -> Yes: Explore various IDR plans and choose the most suitable one; No: Consider Standard Repayment Plan.

End

Illustrative Examples

Understanding the implications of deferment versus alternative repayment plans requires concrete examples. Let’s examine two hypothetical scenarios to illustrate the potential financial consequences of each approach.

Scenario 1: Deferment

Sarah borrows $30,000 in federal student loans at a 5% annual interest rate. She enters a deferment period for three years while pursuing a postgraduate degree. During this deferment, interest continues to accrue on her loan. At the end of three years, the total interest accrued is approximately $4,800 (calculated using simple interest, for simplification; the actual amount would depend on the loan’s compounding frequency). Therefore, Sarah’s loan balance at the end of deferment is $34,800, significantly more than her initial loan amount. Once her deferment ends, she must begin repayment on this larger balance. This impacts her monthly payments and the overall time it takes to repay the loan.

Scenario 2: Income-Driven Repayment Plan

John also borrows $30,000 in federal student loans at a 5% annual interest rate. Instead of deferment, he opts for an income-driven repayment plan. This plan adjusts his monthly payments based on his income and family size. While he still pays interest, the lower monthly payments allow him to manage his debt more effectively, potentially reducing the total interest paid over the life of the loan compared to deferring and then facing a larger balance. Although the repayment period might be longer than a standard repayment plan, his manageable monthly payments prevent him from defaulting and potentially incurring further penalties and negative impacts on his credit score.

Comparative Table

| Feature | Deferment (Sarah) | Income-Driven Repayment (John) |

|---|---|---|

| Initial Loan Amount | $30,000 | $30,000 |

| Interest Rate | 5% | 5% |

| Deferment/Repayment Period | 3 years deferment | Extended repayment period (length depends on income) |

| Interest Accrued During Deferment/Repayment | ~$4,800 (simple interest calculation) | Lower than deferment due to smaller payments |

| Loan Balance After Deferment/Repayment | $34,800 | Lower than deferment, exact amount depends on income and repayment duration |

| Monthly Payment | Higher after deferment | Lower, income-based |

| Total Interest Paid | Potentially higher due to accumulated interest during deferment | Potentially lower due to longer repayment period with smaller payments |

| Pros | Temporary relief from payments | Manageable payments, avoids default |

| Cons | Significant interest accrual, larger loan balance after deferment | Longer repayment period |

Closing Notes

Successfully managing student loan debt requires a comprehensive understanding of available options and their potential consequences. While deferment can provide temporary relief, it’s crucial to weigh the long-term implications of interest accrual and the potential increase in your total loan balance. By carefully considering the information presented, you can make informed decisions that align with your financial goals and ultimately lead to a more efficient and effective repayment strategy. Remember to explore all available options and seek professional financial advice if needed.

FAQ Corner

What happens to my loan payments during deferment?

During a deferment, your required monthly payments are temporarily suspended.

Can I defer my student loans indefinitely?

No, deferments are typically granted for a specific period, and extensions may be subject to eligibility requirements.

Will my credit score be affected by a deferment?

While a deferment itself doesn’t usually negatively impact your credit score, missed payments after the deferment period can.

How do I apply for a student loan deferment?

The application process varies depending on your loan servicer. Contact your servicer directly for instructions and required documentation.