Navigating the complexities of student loan repayment can feel overwhelming, especially when considering its impact on your credit score. Understanding how student loans are reported, the effects of timely versus late payments, and the long-term consequences of default is crucial for maintaining good financial health. This exploration will demystify the connection between student loans and your credit, empowering you to make informed decisions about your financial future.

From the initial application to eventual repayment, your student loan journey significantly interacts with your credit report. This guide will provide a clear understanding of this relationship, covering various loan types, repayment strategies, and the potential consequences of both responsible and irresponsible management of your student loan debt. We will explore how your credit score can be both positively and negatively impacted, providing practical advice to navigate this important aspect of personal finance.

How Student Loans Appear on Credit Reports

Student loans, like other forms of credit, significantly impact your credit report and score. Understanding how they’re reported is crucial for managing your finances and building a strong credit history. This section details the process and what you can expect to see on your credit report regarding your student loans.

Student loan information is reported to the three major credit bureaus (Equifax, Experian, and TransUnion) by your lender. This reporting process typically begins once you’ve made a few payments on your loan, and it continues for as long as the loan remains active or until it’s paid in full. The information transmitted includes details about your loan type, account status, payment history, and the amount owed.

Types of Student Loans and Their Reporting

There are various types of student loans, each potentially impacting your credit report differently. Federal student loans, such as Direct Subsidized and Unsubsidized Loans, and Federal PLUS Loans, are all reported to credit bureaus. Private student loans, offered by banks and other financial institutions, are also reported. The reporting process is generally consistent across loan types, but the specifics of your loan terms may influence how the information appears on your credit report. For example, a loan in deferment might show a different status than a loan in repayment.

Examples of Student Loan Information on a Credit Report

Your credit report will list each student loan as a separate account. Each entry will typically include the lender’s name (e.g., Sallie Mae, Nelnet, a specific bank), the loan type (e.g., Federal Direct Unsubsidized Loan, Private Student Loan), the account status (e.g., Open, Closed, Paid in Full, Default), the credit limit (the original loan amount), the current balance, and your payment history. A consistent record of on-time payments is crucial for maintaining a good credit score. Late or missed payments will negatively affect your credit score. For example, a credit report might show an entry for “Sallie Mae – Federal Direct Subsidized Loan, Account Status: Open, Payment History: Always Paid On Time.” Another entry might be “Wells Fargo – Private Student Loan, Account Status: Open, Payment History: 30 days late in 2022, current payments on time.”

Key Data Points Reported for Student Loans

The following table summarizes the key data points typically reported to credit bureaus for student loans.

| Loan Type | Lender | Account Status | Payment History |

|---|---|---|---|

| Federal Direct Unsubsidized Loan | Department of Education | Open | Always Paid On Time |

| Private Student Loan | Bank of America | Closed | Paid in Full |

| Federal PLUS Loan | Nelnet | Open | 30 days late in 2023, current payments on time |

| Private Student Loan | Discover | Default | Multiple late payments |

Impact of On-Time Payments on Credit Score

Paying your student loans on time has a significant positive impact on your credit score. Consistent, timely payments demonstrate responsible financial behavior to lenders, leading to a higher creditworthiness rating and improved access to credit in the future. This is crucial because your credit score is a key factor in various financial decisions, including securing loans, mortgages, and even securing certain jobs.

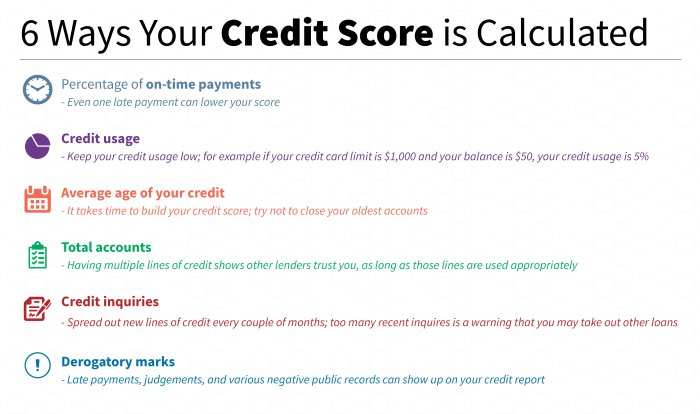

On-time student loan payments directly contribute to several factors that comprise your credit score. These factors, typically weighted differently by credit scoring models, include payment history, amounts owed, length of credit history, and credit mix. Consistent on-time payments significantly boost your payment history, which is usually the most heavily weighted factor.

Credit Score Improvement Trajectories

The positive effect of timely student loan payments on credit scores is often noticeable over time. Consider these examples: A borrower with a 650 credit score who consistently makes on-time payments on their student loans over a year might see their score rise to 680 or higher. This improvement reflects the positive impact of demonstrating responsible repayment behavior. Similarly, someone with a lower score might see a more dramatic improvement; for example, a score of 580 could potentially rise to 650 with a year or more of consistent on-time payments. The exact improvement depends on various factors including the individual’s overall credit history and the credit scoring model used. These are illustrative examples and not guaranteed outcomes.

Demonstrating Creditworthiness to Lenders

On-time student loan payments are a strong indicator of creditworthiness. Lenders use your credit report to assess your risk as a borrower. A consistent history of on-time payments shows lenders that you are reliable and capable of managing your debt responsibly. This, in turn, increases your chances of approval for future loans with potentially more favorable interest rates. Conversely, late or missed payments signal a higher risk to lenders, potentially resulting in loan denials or higher interest rates. The consistent, positive signal of on-time payments significantly reduces this risk, leading to better financial opportunities.

Visual Representation of On-Time Payments and Credit Score Changes

Imagine a graph with “Number of Consecutive On-Time Payments” on the horizontal axis and “Credit Score” on the vertical axis. The line representing the relationship would generally show an upward trend. Starting at a baseline credit score, the line would gradually incline upwards with each consecutive on-time payment. The slope of the line might not be perfectly linear; the initial increase might be more significant, with smaller increases as the score approaches a higher range. The graph would visually demonstrate how consistent on-time payments lead to a steady improvement in credit score over time, reinforcing the importance of responsible repayment behavior. The steeper the upward slope, the faster the credit score improves in response to timely payments. Factors like the initial credit score and the total amount of debt will influence the overall shape and steepness of this line.

Impact of Missed or Late Payments on Credit Score

Missing or making late payments on your student loans can significantly harm your credit score. This negative impact stems from the fact that lenders report your payment history to the major credit bureaus (Equifax, Experian, and TransUnion), and consistent late or missed payments are a major red flag indicating potential credit risk. The severity of the damage depends on several factors, including the frequency of late payments, the amount of the missed payments, and the type of loan.

Factors Influencing the Severity of Negative Impact

Several factors determine how severely missed or late student loan payments affect your credit score. The number of late payments is crucial; a single missed payment will have a less significant impact than a pattern of consistent delinquency. The length of the delinquency also matters; a 30-day late payment will have a less severe effect than a 90-day or longer delinquency. The type of loan and your overall credit history also play a role. Someone with an otherwise excellent credit history may see a smaller drop in their score than someone with a history of poor credit management. Finally, the amount of the missed payment, while less influential than the frequency and duration, can contribute to the overall negative impact.

Examples of Credit Score Damage from Delinquency

Imagine a borrower with a good credit score of 720. A single 30-day late payment might drop their score by 20-30 points. However, if this becomes a recurring issue, with multiple 30-day late payments over several months, the score could plummet by 50-100 points or more. If the borrower then experiences a 90-day delinquency, the drop could be even more dramatic, potentially impacting their ability to secure future loans, rent an apartment, or even get certain jobs. Conversely, a borrower with a lower initial credit score might experience a proportionally larger drop in their score for the same delinquency. For example, a borrower with a 600 credit score might see a larger percentage drop for a single late payment compared to the borrower with the 720 score.

Stages of Delinquency and Their Impact on Credit Scores

Understanding the stages of delinquency and their associated impact is vital for proactive credit management. The impact isn’t simply a linear progression; each stage represents a more serious credit risk.

The following illustrates the general impact. Specific score changes depend on the credit scoring model used and other factors in your credit report.

- 30-day delinquency: Minor negative impact, potentially a score decrease of 20-30 points. This is usually considered a warning sign.

- 60-day delinquency: More significant negative impact, potentially a score decrease of 50-80 points. This signals a more serious credit problem.

- 90-day delinquency: Severe negative impact, potentially a score decrease of 100 points or more. This is considered a major delinquency and significantly damages creditworthiness. It may also lead to collection agency involvement.

- 120+ day delinquency: The most severe impact, often resulting in a substantial drop in credit score, and potentially leading to loan default and negative marks on the credit report that can remain for seven years or more.

Student Loan Default and its Credit Impact

Defaulting on student loans has severe and long-lasting consequences, significantly impacting your creditworthiness and financial future. Understanding the process and potential repercussions is crucial for borrowers facing financial hardship.

Student loan default occurs when you fail to make payments on your student loans for a specific period, typically 9 months for federal loans. This triggers a series of actions by the lender, leading to immediate and long-term negative consequences.

Immediate Consequences of Student Loan Default

The immediate consequences of student loan default are substantial. Your lender will report the default to the major credit bureaus (Equifax, Experian, and TransUnion), resulting in a significant drop in your credit score. This makes it harder to obtain credit in the future, whether for a car loan, mortgage, or even a credit card. Wage garnishment, tax refund offset, and even legal action are possible. For federal loans, the government may also garnish your Social Security benefits. The impact on your financial life is immediate and profound. For example, a person with a good credit score seeking a mortgage may find their application rejected or receive a significantly higher interest rate after defaulting on their student loans.

Long-Term Implications of Student Loan Default on Credit Reports and Credit Scores

The negative impact of a student loan default on your credit report extends far beyond the initial reporting. The default will remain on your credit report for seven years from the date of default. During this time, it significantly hinders your ability to secure favorable interest rates on loans and credit cards. Even after the seven years, the default may still impact your credit score indirectly as it lowers your average credit age and impacts your credit utilization ratio. The long-term financial consequences of default can make it challenging to achieve financial stability. For instance, someone who defaults on their student loans may find themselves unable to purchase a home for many years due to their damaged credit history.

Comparison of Defaulting on Federal vs. Private Student Loans

Defaulting on federal and private student loans has similar negative consequences on your credit report, both resulting in a significant drop in your credit score and the reporting of the default to credit bureaus. However, there are key differences. The government offers various rehabilitation and consolidation programs for federal student loans, providing opportunities to avoid the most severe consequences of default. Private lenders generally have fewer options for borrowers in default. Furthermore, the collection methods employed by the government for federal loans might differ from those used by private lenders. The government has broader powers to collect defaulted federal student loans, including wage garnishment and tax refund offset, whereas private lenders may pursue more traditional legal avenues, such as lawsuits.

Steps to Take if Facing Potential Student Loan Default

Facing potential student loan default can be overwhelming, but proactive steps can mitigate the damage. Here’s a step-by-step guide:

- Contact your lender immediately: Don’t ignore delinquency notices. Explain your situation and explore options like forbearance, deferment, or income-driven repayment plans.

- Explore income-driven repayment plans: These plans base your monthly payments on your income and family size, making them more manageable.

- Consider loan consolidation: Combining multiple loans into one can simplify payments and potentially lower your monthly payment.

- Seek professional financial advice: A credit counselor or financial advisor can provide personalized guidance and help you develop a budget and repayment plan.

- Document all communication: Keep records of all conversations and correspondence with your lender.

Repaying Student Loans and Credit Score Improvement

Successfully managing student loan repayment significantly impacts your credit score. Consistent on-time payments demonstrate financial responsibility, a key factor in determining creditworthiness. Conversely, missed or late payments can negatively affect your credit score, potentially hindering future financial opportunities. Understanding different repayment strategies and their impact is crucial for building a strong credit history.

Repayment Strategies and Their Effects on Credit Scores

Different repayment plans offer varying levels of flexibility, but all impact your credit score through their influence on your payment history. Standard repayment plans typically involve fixed monthly payments over a set period. Income-driven repayment plans, however, adjust your monthly payment based on your income and family size, potentially resulting in lower monthly payments but a longer repayment period. While both methods report to credit bureaus, the consistency of payments is the most significant factor. Consistent on-time payments, regardless of the plan, positively influence your credit score. Conversely, even a single missed payment under any plan can negatively impact your score.

Consistent Repayment and Credit Score Improvement

Consistent, on-time payments, even small ones, contribute positively to your credit score over time. The frequency and timeliness of payments are heavily weighted in credit scoring models. Even if you’re only paying the minimum amount due each month, consistently meeting that obligation demonstrates responsible financial behavior. This consistency builds a positive payment history, which is a crucial component of a strong credit score. For example, someone consistently paying the minimum on a $10,000 loan will see a better credit score improvement than someone sporadically making larger payments. The predictability of payment is key.

Examples of Successful Student Loan Repayment and Credit Score Improvement

Consider two individuals: Alice and Bob. Alice consistently made on-time minimum payments on her student loans for five years. Bob, on the other hand, experienced several late payments during the same period. As a result, even though both may have paid off a similar amount, Alice’s credit score would likely be significantly higher than Bob’s due to her consistent payment history. Another example is someone who initially struggled with payments but then implemented a budget and consistently paid on time for two years. Their credit score would likely see a significant boost reflecting their improved financial management.

Comparison of Credit Score Impact of Different Repayment Plans

The following table compares the potential impact of different repayment plans on credit scores, assuming consistent on-time payments. Remember, the most significant factor is consistent, timely payments, regardless of the plan chosen.

| Repayment Plan | Monthly Payment Amount | Repayment Period | Potential Credit Score Impact (Illustrative) |

|---|---|---|---|

| Standard Repayment | High, fixed amount | Shorter | Significant positive impact if payments are consistently on time; potential for faster credit score improvement. |

| Income-Driven Repayment | Lower, variable amount | Longer | Positive impact if payments are consistently on time; improvement may be slower due to longer repayment period. |

| Graduated Repayment | Starts low, increases over time | Medium | Positive impact if payments are consistently on time; credit score improvement may reflect the increasing payment amounts over time. |

| Extended Repayment | Lower than standard | Longer than standard | Positive impact if payments are consistently on time; improvement may be slower due to the extended repayment period. |

Student Loan Debt and Overall Financial Health

Student loan debt significantly impacts an individual’s overall financial well-being, extending far beyond the monthly payment. The amount of debt influences various aspects of financial life, from saving for retirement to securing a mortgage. Understanding this relationship is crucial for effective financial planning and long-term stability.

High levels of student loan debt can severely restrict financial flexibility and opportunities. The weight of these payments directly affects disposable income, limiting the ability to save, invest, and address unexpected expenses. This constraint can create a cycle of financial difficulty, making it harder to improve one’s financial standing.

Impact of Student Loan Debt on Access to Other Credit

The presence of substantial student loan debt can negatively affect an individual’s credit score and creditworthiness, making it more challenging to obtain other forms of credit, such as auto loans, mortgages, or credit cards. Lenders assess the debt-to-income ratio (DTI), a key indicator of credit risk. A high DTI, often driven by significant student loan payments, can lead to loan applications being rejected or result in higher interest rates. For example, an individual with a high student loan payment might find it difficult to qualify for a mortgage, even if their income is sufficient, because their DTI exceeds the lender’s acceptable threshold. This can significantly delay major life purchases like a home.

Key Indicators of Financial Health Influenced by Student Loan Debt

Several key indicators of financial health are directly influenced by the level of student loan debt. These include the debt-to-income ratio (DTI), credit score, savings rate, and net worth. A high DTI, stemming from substantial student loan payments, can negatively impact credit scores, hindering access to credit and potentially increasing interest rates on future loans. A high debt burden also reduces the amount of money available for savings and investments, impacting long-term financial security and potentially delaying retirement planning. Net worth, the difference between assets and liabilities, is also negatively affected by significant student loan debt, illustrating the overall financial strain.

Student Loan Debt’s Impact on Major Financial Decisions

The following flowchart illustrates how student loan debt can impact major financial decisions:

High Student Loan Debt

|

V

Increased Debt-to-Income Ratio (DTI) & Lower Credit Score

|

V

Difficulty Obtaining Mortgages/Auto Loans/Credit Cards (Higher Interest Rates)

|

V

Reduced Disposable Income (Less Money for Savings, Investments, Emergency Funds)

|

V

Delayed Homeownership, Investment Opportunities, Retirement Planning

|

V

Potential for Increased Financial Stress and Reduced Financial Security

Closing Summary

In conclusion, the impact of student loans on your credit score is undeniable, yet manageable. Consistent on-time payments are paramount to building a strong credit history, while late or missed payments can severely damage your creditworthiness. Understanding the nuances of different repayment plans and the potential consequences of default is key to responsible financial planning. By proactively managing your student loans, you can safeguard your credit score and build a solid foundation for your future financial endeavors.

FAQ

What happens if I consolidate my student loans?

Consolidating your loans simplifies repayment by combining multiple loans into one. It may affect your credit score temporarily due to a new account opening, but responsible repayment on the consolidated loan will generally improve your score over time.

Can I get a mortgage with student loan debt?

Yes, but high student loan debt can impact your debt-to-income ratio, making it harder to qualify for a mortgage or potentially resulting in a higher interest rate. Responsible repayment demonstrates financial responsibility and improves your chances of approval.

How long does a student loan stay on my credit report?

Generally, positive and negative information about student loans remains on your credit report for seven years from the date of the last activity on the account. Even after this period, the impact of past behavior may still affect your eligibility for certain financial products.

What is the difference between federal and private student loans in terms of credit impact?

Defaulting on a federal student loan can have severe consequences, including wage garnishment and tax refund offset. Defaulting on a private student loan can negatively impact your credit score and may lead to collection actions.