Navigating the complexities of student loans can feel like deciphering a financial code. Understanding whether, and how, student loans accrue interest is crucial for responsible financial planning. This exploration delves into the various types of student loans, the factors influencing interest rates, and the strategies for managing interest accumulation and repayment effectively. From understanding the differences between subsidized and unsubsidized loans to exploring the implications of various repayment plans, this guide provides a comprehensive overview of the interest landscape for student loan borrowers.

This overview aims to clarify the intricacies of student loan interest, empowering you to make informed decisions about your financial future. We’ll examine how interest accrues during different life stages—from your time in school to repayment—and discuss the long-term consequences of your choices. By understanding the mechanisms of interest calculation and the available strategies for minimizing its impact, you can gain control of your student loan debt and pave the way for a more financially secure future.

Types of Student Loans and Interest Accrual

Understanding the different types of student loans and how interest accrues is crucial for effective financial planning during and after your education. This knowledge allows borrowers to make informed decisions about repayment strategies and minimize long-term debt. The primary distinction lies between federal and private loans, each with its own set of characteristics.

Federal Student Loans

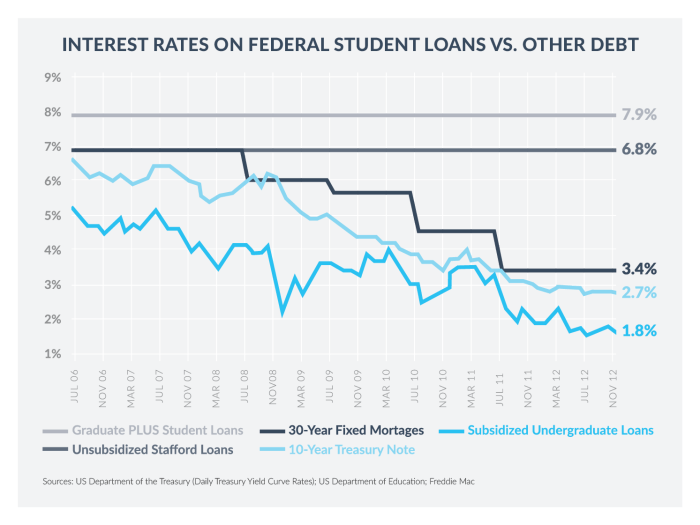

Federal student loans are offered by the U.S. government and generally come with more borrower protections than private loans. These loans are categorized into subsidized and unsubsidized options, impacting how interest accrues. Subsidized loans do not accrue interest while the borrower is enrolled at least half-time, during grace periods, and during certain deferment periods. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, regardless of the borrower’s enrollment status.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. These loans are not backed by the federal government, meaning they often have less favorable terms, such as higher interest rates and fewer repayment options. Interest rates on private student loans are typically variable, meaning they can fluctuate based on market conditions. They are determined by a lender’s assessment of the borrower’s creditworthiness, including credit score, income, and debt-to-income ratio. The lack of government backing also means fewer options for deferment or forbearance.

Interest Rate Determination

The interest rate for federal student loans is set annually by the government and varies based on the loan type and the borrower’s loan disbursement date. For example, the interest rate for Direct Subsidized Loans may differ from the rate for Direct Unsubsidized Loans. These rates are generally lower than those for private loans. Private loan interest rates, as mentioned earlier, are determined by the lender based on the borrower’s creditworthiness and prevailing market interest rates. A borrower with a higher credit score is likely to qualify for a lower interest rate.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This increases the total amount owed. For subsidized federal loans, interest does not capitalize while the borrower is in school at least half-time, during grace periods, and during certain deferment periods. However, for unsubsidized federal loans and private loans, interest typically capitalizes, meaning that the unpaid interest is added to the principal loan balance, increasing the total amount the borrower must repay. This can significantly increase the total cost of the loan over time.

Loan Type Comparison

| Loan Type | Interest Rate | Repayment Plans | Deferment Options |

|---|---|---|---|

| Federal Subsidized Loan | Variable, set annually by the government; generally lower than unsubsidized loans | Standard, extended, graduated, income-driven | In-school, economic hardship, unemployment |

| Federal Unsubsidized Loan | Variable, set annually by the government; generally higher than subsidized loans | Standard, extended, graduated, income-driven | Economic hardship, unemployment (in-school deferment not applicable as interest accrues during this period) |

| Private Student Loan | Variable or fixed; determined by lender based on creditworthiness; generally higher than federal loans | Varies by lender; may include standard, graduated, or other options | Limited or unavailable; options vary significantly by lender |

Interest Accrual During Different Periods

Understanding how interest accrues on student loans throughout different phases—in-school, grace periods, deferment, and forbearance—is crucial for effective financial planning. The way interest accumulates varies depending on the loan type and the borrower’s circumstances. Failing to understand these nuances can lead to significantly higher loan balances upon repayment.

Interest accrual on student loans isn’t a uniform process; it changes depending on the life cycle of the loan.

In-School Interest Accrual

For subsidized federal student loans, the government pays the interest while the borrower is enrolled at least half-time in an eligible educational program. This means that no interest is added to the principal balance during this period. Unsubsidized federal loans and most private student loans, however, accrue interest from the moment the loan is disbursed, even while the borrower is still in school. This interest can be capitalized (added to the principal balance), increasing the total amount owed. The specific terms and conditions will be Artikeld in the loan documents.

Interest Accrual During Grace Periods

A grace period is a temporary period after graduation or leaving school before loan repayment begins. The length of the grace period varies depending on the loan type. During this period, interest typically accrues on both subsidized and unsubsidized federal loans and private loans. This means the total loan balance increases, even though no payments are required. For example, a borrower with a $10,000 unsubsidized loan might accrue $500 in interest during a six-month grace period at a 5% annual interest rate. This $500 would then be added to the principal balance, increasing the total debt to $10,500 at the start of the repayment period.

Interest Accrual During Deferment and Forbearance Periods

Deferment and forbearance are both periods where loan payments are temporarily suspended, but they differ significantly in how interest accrues. During a deferment period (granted for reasons like returning to school or experiencing unemployment), interest may or may not accrue depending on the loan type. For subsidized federal loans, interest is usually not charged during deferment, whereas for unsubsidized federal loans and private loans, interest typically continues to accrue. Forbearance, on the other hand, usually involves interest accruing on all loan types. The borrower will typically have to pay accumulated interest later, potentially adding to the total loan amount.

Examples of Interest Accumulation

- Scenario 1: Subsidized Federal Loan (In-school): A student has a $5,000 subsidized federal loan. No interest accrues while they are enrolled full-time.

- Scenario 2: Unsubsidized Federal Loan (In-school): A student has a $5,000 unsubsidized federal loan. Assuming a 5% annual interest rate, and four years of study, interest will accrue throughout the four years. The exact amount will depend on how frequently interest is compounded, but it will significantly increase the total loan balance by graduation.

- Scenario 3: Private Loan (Grace Period): A graduate has a $10,000 private loan with a 7% annual interest rate and a six-month grace period. During the grace period, approximately $350 in interest will accrue, increasing the total debt to $10,350 before repayment begins.

- Scenario 4: Federal Loan (Deferment): A borrower with a $12,000 unsubsidized federal loan enters a 12-month deferment period with a 6% annual interest rate. Approximately $720 in interest will accrue during this period, increasing the total debt to $12,720 at the end of the deferment.

Factors Influencing Interest Rates

Student loan interest rates are not arbitrary; they are determined by a complex interplay of factors that lenders consider to assess the risk associated with lending you money. Understanding these factors can help you navigate the loan application process and potentially secure a more favorable interest rate. This section will detail the key influences on your student loan interest rate.

Credit History Impact on Interest Rates

A strong credit history is a significant factor in determining your student loan interest rate. Lenders use your credit score and history to assess your creditworthiness – essentially, how likely you are to repay the loan. A higher credit score, reflecting responsible borrowing and repayment in the past, generally leads to lower interest rates. Conversely, a poor credit history, marked by late payments, defaults, or high credit utilization, can result in higher interest rates or even loan denial. For example, a borrower with an excellent credit score might qualify for a federal student loan with a 4% interest rate, while a borrower with a poor credit score might face an interest rate of 7% or higher, even for the same loan type. This difference can significantly impact the total cost of the loan over its lifetime.

Loan Type and Lender’s Role in Interest Rate Determination

The type of student loan you choose and the lender you select also play crucial roles in setting the interest rate. Federal student loans, backed by the government, typically offer lower interest rates than private student loans, which are issued by banks and other financial institutions. Federal loans often have fixed interest rates, meaning the rate remains constant throughout the loan’s term. Private loans, on the other hand, may have variable interest rates, meaning the rate can fluctuate based on market conditions, potentially leading to unpredictable monthly payments. Different lenders also have varying lending criteria and risk assessments, leading to a range of interest rates even within the same loan type. For instance, a well-established bank might offer a lower interest rate on a private student loan compared to a smaller, less established lender.

Flowchart Illustrating Interest Rate Determination

The following flowchart visually represents the interaction of the factors discussed above to determine the final student loan interest rate:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Student Loan Application.” Arrows would branch out to boxes representing “Credit Score,” “Loan Type (Federal/Private),” and “Lender.” These boxes would then each have arrows pointing to a central box labeled “Interest Rate Calculation.” From this central box, an arrow would lead to a final box labeled “Final Interest Rate.” The flowchart would visually demonstrate how each factor contributes to the final interest rate calculation.]

Repayment Plans and Interest

Choosing the right student loan repayment plan significantly impacts the total amount you pay back, influencing both the length of repayment and the total interest accrued. Understanding the differences between various plans is crucial for effective financial planning after graduation. The following Artikels key repayment options and their respective effects on your overall loan cost.

Comparison of Repayment Plans

Different repayment plans cater to varying financial situations and repayment preferences. The most common options include Standard, Extended, and Income-Driven Repayment plans. Each plan has a unique structure affecting monthly payments and the total interest paid over the life of the loan.

| Repayment Plan | Payment Structure | Loan Term | Impact on Total Interest |

|---|---|---|---|

| Standard Repayment | Fixed monthly payments over 10 years | 10 years | Generally the lowest total interest due to shorter repayment period. |

| Extended Repayment | Fixed monthly payments over a longer period (up to 25 years) | Up to 25 years | Higher total interest due to longer repayment period. |

| Income-Driven Repayment (IDR) | Monthly payments based on income and family size | Varies, potentially up to 20-25 years | Potentially high total interest, but lower monthly payments make it manageable for borrowers with lower incomes. |

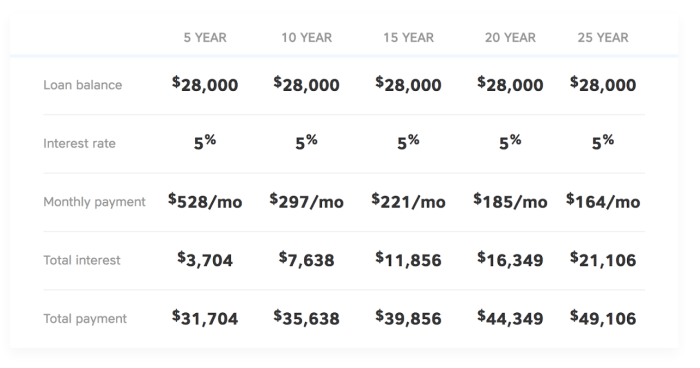

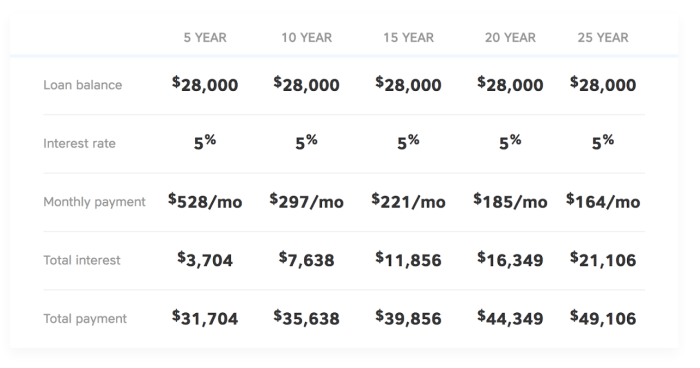

Impact of Repayment Plan Choice on Total Loan Cost

The choice of repayment plan directly influences the total cost of your student loans. For example, a $50,000 loan with a 5% interest rate repaid under the standard 10-year plan might cost approximately $65,000 in total (principal + interest). The same loan under an extended 25-year plan could result in a total cost exceeding $85,000 due to the significantly longer accrual period. Income-driven repayment plans can vary greatly depending on income fluctuations, but often lead to higher overall costs than standard plans due to their longer repayment periods.

Implications of Shorter vs. Longer Repayment Periods

Choosing a shorter repayment period, like the standard 10-year plan, leads to lower total interest paid. This is because the principal balance is reduced more quickly, limiting the time interest accrues. However, shorter repayment periods mean higher monthly payments, which might be challenging for some borrowers. Conversely, longer repayment periods (e.g., extended or income-driven plans) result in lower monthly payments, making them more manageable in the short term. However, the extended repayment period allows for significantly more interest to accrue, ultimately increasing the total cost of the loan. For instance, a borrower choosing a 25-year repayment plan instead of a 10-year plan might save money monthly, but pay tens of thousands of dollars more in interest over the life of the loan.

Consequences of Defaulting on Student Loans

Defaulting on student loans carries significant and long-lasting negative consequences that extend far beyond simply owing the original debt. The ramifications affect your finances, creditworthiness, and future opportunities. Understanding these consequences is crucial to responsible loan management.

Defaulting on a student loan triggers a cascade of negative events, impacting your financial well-being and future prospects. The immediate consequences include the immediate cessation of any grace periods or deferment options, leading to the rapid accumulation of additional interest and fees. This accelerates the overall debt burden, making repayment even more challenging. Furthermore, the government or private lender will initiate collection actions to recover the outstanding balance.

Collection Actions Following Default

Following a default, the loan servicer will employ various collection strategies. These may include wage garnishment, where a portion of your paycheck is automatically deducted to repay the debt. Tax refund offset is another common method, whereby the government intercepts your tax refund to apply it to your student loan debt. In some cases, the government may even seize a portion of your Social Security benefits. Finally, legal action, including lawsuits and judgments, can result in the seizure of assets to satisfy the debt. These actions can significantly disrupt your financial stability and daily life.

Impact on Credit Score and Future Borrowing

A student loan default has a severely detrimental effect on your credit score. The default is reported to the major credit bureaus (Equifax, Experian, and TransUnion), drastically lowering your credit score. This negative mark remains on your credit report for seven years, making it extremely difficult to obtain credit in the future. Securing a mortgage, car loan, or even a credit card becomes significantly harder, and if approved, you’ll likely face much higher interest rates due to your impaired credit. This can severely limit your financial options and opportunities. For example, a low credit score might prevent someone from purchasing a home, even if they have the income to afford the mortgage payments.

Financial Penalties Associated with Student Loan Default

The financial penalties associated with student loan default are substantial. Beyond the accumulating interest and fees, which can quickly double or even triple the original loan amount, borrowers face additional charges. These can include late payment fees, collection agency fees, and court costs if legal action is taken. For example, a $20,000 loan could easily balloon to over $40,000 or more due to these compounding penalties. Furthermore, defaulting can impact eligibility for government benefits and programs, potentially leading to further financial hardship. The long-term financial consequences can be devastating, making it extremely difficult to recover financially.

Managing Student Loan Interest

Effectively managing student loan interest is crucial for minimizing the overall cost of your education. Understanding the various strategies available and implementing them proactively can significantly reduce your debt burden and accelerate your path to financial freedom. This section Artikels key strategies to help you achieve this goal.

Strategies for Minimizing Interest Payments

Several strategies can help borrowers minimize interest payments on their student loans. Prioritizing high-interest loans for repayment is a key element. Additionally, exploring options like refinancing or income-driven repayment plans can also significantly impact the overall interest paid. Careful budgeting and disciplined saving can also free up funds for extra principal payments.

Benefits of Extra Principal Payments

Making extra payments toward your student loan principal offers substantial benefits. Each extra payment directly reduces the loan’s principal balance, leading to lower overall interest accrued over the life of the loan. This translates to less money paid in interest and a faster path to becoming debt-free. For example, even an extra $50 per month can significantly reduce the total interest paid over the loan’s term. The effect is amplified when these extra payments are made early in the loan repayment period.

Refinancing Student Loans to Lower Interest Rates

Refinancing your student loans can be a viable option to lower your interest rate, particularly if interest rates have decreased since you initially took out your loans. Refinancing involves consolidating your existing loans into a new loan with a lower interest rate. However, it’s crucial to carefully compare offers from different lenders and ensure that the new loan terms are favorable. Consider factors like fees and the length of the new loan term before making a decision. Refinancing may not be suitable for all borrowers, especially those with poor credit scores.

Step-by-Step Guide to Effectively Manage Student Loan Debt and Minimize Interest

Effective student loan management requires a proactive and organized approach. Following these steps can significantly help in minimizing interest and accelerating debt repayment.

- Create a Budget: Track your income and expenses to identify areas where you can save money and allocate funds towards extra loan payments.

- List All Loans: Compile a complete list of your student loans, including lenders, interest rates, and minimum monthly payments. This will provide a clear overview of your debt.

- Prioritize High-Interest Loans: Focus extra payments on loans with the highest interest rates to maximize savings. This strategy minimizes the total interest paid over the life of the loans.

- Explore Repayment Options: Research different repayment plans, including income-driven repayment plans, to determine the most suitable option for your financial situation. Income-driven plans may result in lower monthly payments but can extend the repayment period and increase overall interest paid.

- Make Extra Payments: Whenever possible, make extra payments towards your loan principal. Even small extra payments can significantly reduce the total interest paid over time.

- Consider Refinancing: Explore refinancing options if interest rates have fallen since you took out your loans. Compare offers from different lenders to find the best deal.

- Automate Payments: Set up automatic payments to ensure consistent and timely payments, avoiding late fees and negative impacts on your credit score.

- Monitor Progress Regularly: Track your loan balances and interest payments regularly to monitor your progress and make adjustments as needed.

Final Review

Successfully managing student loan debt hinges on a thorough understanding of how interest accrues and the various strategies available to minimize its impact. From selecting the appropriate repayment plan to exploring options like refinancing, proactive management can significantly reduce the overall cost of borrowing. By carefully considering the factors influencing interest rates and employing effective debt management techniques, you can navigate the complexities of student loan repayment and achieve your long-term financial goals. Remember, informed decision-making is key to responsible borrowing and a brighter financial future.

FAQ Overview

What happens if I don’t pay my student loans?

Failure to repay your student loans can lead to default, resulting in damaged credit, wage garnishment, and tax refund offset.

Can I deduct student loan interest on my taxes?

You may be able to deduct the amount you paid in student loan interest, up to a certain limit, on your federal income tax return. Check the current IRS guidelines for eligibility and limitations.

What is interest capitalization?

Interest capitalization is the process of adding accumulated interest to the principal balance of your loan, increasing the total amount you owe.

How often is interest calculated on student loans?

Interest is typically calculated daily on most student loans and added to the principal balance periodically (monthly or quarterly).