Navigating the complexities of student loan repayment can feel overwhelming, especially when grappling with the nuances of interest accrual. Understanding how interest compounds—daily, monthly, or annually—significantly impacts the total amount you’ll ultimately repay. This exploration delves into the specifics of daily compounding on student loans, examining its implications for various loan types and offering practical strategies to manage its effects.

This crucial aspect of student loan repayment often goes unnoticed, leading to unexpected increases in the overall debt. By clarifying the mechanics of daily compounding and comparing it to other interest accrual methods, this guide aims to empower borrowers with the knowledge to make informed financial decisions and effectively manage their student loan debt.

Understanding Interest Accrual on Student Loans

Student loan interest accrual is a crucial aspect of repayment. Understanding how interest is calculated and added to your principal balance is essential for effective loan management and minimizing overall repayment costs. This section will clarify the different methods of interest accrual and the factors that influence them.

Interest Accrual Methods

Student loan interest can accrue in several ways, primarily determined by the loan’s terms and the lender’s practices. The most common methods involve calculating interest based on daily, monthly, or annual balances. Daily accrual is the most frequent, meaning interest is calculated each day on the outstanding principal balance. Monthly accrual calculates interest monthly, while annual accrual calculates it annually. The frequency of compounding also plays a significant role; daily compounding means interest earned is added to the principal daily, leading to slightly higher overall interest compared to less frequent compounding.

Factors Influencing Interest Calculation

Several factors influence how your student loan interest is calculated. The most significant is the interest rate itself, which can be fixed or variable. A fixed interest rate remains constant throughout the loan term, providing predictability in your monthly payments. A variable interest rate fluctuates based on market conditions, leading to potentially higher or lower payments over time. The loan’s principal balance, repayment plan, and any grace periods also affect the total interest accrued. Longer repayment periods generally result in higher overall interest payments due to the extended time the interest accrues.

Examples of Loan Scenarios with Varying Interest Accrual Frequencies

Let’s consider a $10,000 student loan with a 5% annual interest rate to illustrate different accrual frequencies.

Scenario 1: Daily Accrual – Interest is calculated daily and added to the principal daily. Over a year, this would lead to slightly more interest paid compared to less frequent compounding. The exact amount would depend on the precise daily calculation.

Scenario 2: Monthly Accrual – Interest is calculated at the end of each month and added to the principal. This results in slightly less interest accrued compared to daily accrual due to the less frequent compounding.

Scenario 3: Annual Accrual – Interest is calculated only at the end of the year and added to the principal. This method results in the least amount of interest accrued over the year because compounding happens only once annually.

Comparison of Compounding Frequencies

The following table compares the total interest accrued after one year for a $10,000 loan at a 5% annual interest rate with different compounding frequencies. Note that these are simplified examples and the actual figures might vary slightly depending on the specific calculation methods used by lenders.

| Compounding Frequency | Approximate Total Interest After One Year |

|---|---|

| Daily | $512.67 |

| Monthly | $511.62 |

| Annual | $500.00 |

Daily Compounding vs. Other Methods

Understanding how frequently interest is compounded on a student loan significantly impacts the total amount repaid. While daily compounding is the most common method, monthly and annual compounding also exist, each resulting in different levels of accumulated interest. This section will compare and contrast these methods, highlighting their mathematical underpinnings and demonstrating the practical differences through a hypothetical scenario.

Interest accrual on student loans isn’t a simple matter of adding a fixed percentage each year. The frequency of compounding directly affects how quickly the interest grows, impacting the overall cost of the loan. Daily compounding, for instance, means interest is calculated and added to the principal balance every day, leading to faster growth compared to less frequent compounding.

Comparison of Compounding Frequencies

The core difference lies in how often the accumulated interest is added to the principal balance. With daily compounding, interest is calculated and added daily. Monthly compounding adds interest monthly, and annual compounding adds it annually. This seemingly small difference in frequency significantly impacts the final amount owed. The more frequent the compounding, the faster the debt grows due to the effect of earning interest on interest.

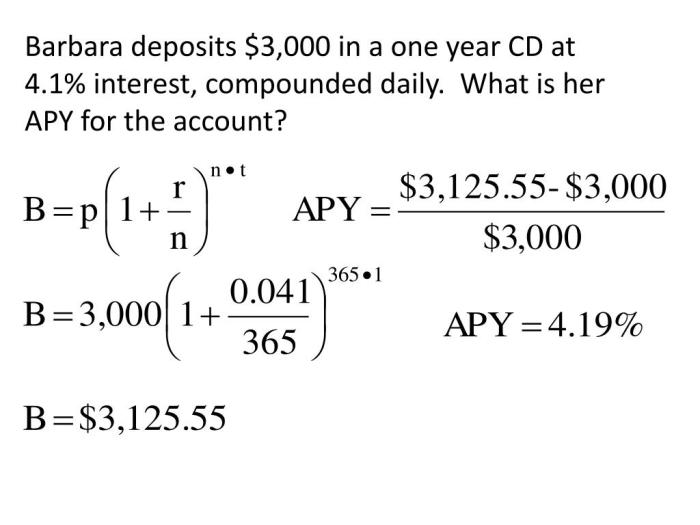

Mathematical Formulas for Interest Calculation

The general formula for compound interest is: A = P (1 + r/n)^(nt)

Where:

A = the future value of the investment/loan, including interest

P = the principal investment amount (the initial deposit or loan amount)

r = the annual interest rate (decimal)

n = the number of times that interest is compounded per year

t = the number of years the money is invested or borrowed for

For daily compounding, n = 365; for monthly compounding, n = 12; and for annual compounding, n = 1. Let’s illustrate this with a hypothetical example.

Hypothetical Scenario: Daily vs. Monthly Compounding

Imagine a $10,000 student loan with a 5% annual interest rate over a 10-year term. Let’s compare the total interest paid under daily and monthly compounding.

Using the formula above:

* Daily Compounding: A = 10000 (1 + 0.05/365)^(365*10) ≈ $16486.65. Total interest paid: $6486.65

* Monthly Compounding: A = 10000 (1 + 0.05/12)^(12*10) ≈ $16470.10. Total interest paid: $6470.10

This scenario shows that while the difference isn’t enormous, daily compounding results in approximately $16.55 more in interest paid over the 10-year period compared to monthly compounding. This difference becomes more pronounced with higher interest rates, longer loan terms, or larger loan amounts. The impact of daily compounding, while seemingly small in individual cases, becomes significant across a large population of borrowers.

Impact of Different Loan Types

Understanding how interest accrues on your student loans depends heavily on the type of loan you have. Different loan types have varying interest rates, repayment schedules, and, crucially, how interest is calculated and applied. This section will explore the key differences between common student loan types and their impact on overall loan costs.

Interest accrual methods vary significantly across federal and private student loans. Federal loans, generally considered more favorable to borrowers, often have more predictable interest calculations and potential benefits like subsidized periods where interest doesn’t accrue. Private loans, on the other hand, can be more complex, with potentially higher interest rates and less flexible terms. The consequences of these differences can substantially impact the total amount repaid over the loan’s lifetime.

Federal Subsidized vs. Unsubsidized Loans

Federal subsidized loans are awarded based on financial need. A key difference is that the government pays the interest while the borrower is in school at least half-time, during grace periods, and during deferment periods. Unsubsidized loans, conversely, accrue interest from the moment the loan is disbursed, regardless of the borrower’s enrollment status. This means that borrowers of unsubsidized loans will owe more than the initial principal amount even before they start repayment. Interest capitalization, the process of adding accrued but unpaid interest to the principal loan balance, further compounds this difference. For example, if a borrower has $10,000 in unsubsidized loans and $500 in accrued interest, after capitalization, their new principal balance will be $10,500. This increased principal balance will then accrue interest, leading to a larger total repayment amount.

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. They often have higher interest rates than federal loans, and the terms and conditions can vary significantly between lenders. Interest accrual typically begins immediately upon disbursement, and the lender may offer various repayment plans with different interest capitalization policies. For instance, a private loan might capitalize interest annually, while another might do so only at the end of the loan term. This can significantly impact the overall cost, potentially leading to a much higher total repayment amount compared to a federal loan with a similar principal balance.

Interest Capitalization’s Effect on Total Loan Cost

Interest capitalization is a critical factor affecting the total cost of all loan types, but its impact is especially noticeable with unsubsidized federal loans and private loans. When interest is capitalized, it becomes part of the principal balance, increasing the amount on which future interest is calculated. This process accelerates the growth of the loan balance, leading to a significantly higher total repayment amount over the life of the loan. For example, a $20,000 loan with an annual interest rate of 6% and interest capitalization after each year will accumulate significantly more interest over time than a similar loan without capitalization. The added interest increases the loan balance, leading to larger monthly payments and higher total repayment.

Summary of Interest Accrual Details

| Loan Type | Interest Accrual Begins | Interest Subsidized? | Capitalization Frequency |

|---|---|---|---|

| Federal Subsidized | Deferment/Grace Period | Yes | Typically at loan maturity |

| Federal Unsubsidized | Disbursement | No | Typically at loan maturity; may vary |

| Private | Disbursement | No | Varies by lender; can be annual or at maturity |

Practical Implications for Borrowers

Understanding the daily compounding of student loan interest is crucial for effective repayment planning. The seemingly small daily accrual can significantly impact the total amount repaid over the loan’s lifetime, potentially adding thousands of dollars to your final cost. This section explores the practical implications of this compounding and offers strategies to mitigate its effects.

Daily compounding necessitates a proactive approach to repayment. Ignoring the constant growth of interest can lead to a snowball effect, making the loan increasingly difficult to manage. A comprehensive understanding of your loan terms, interest rate, and repayment schedule is paramount to develop a successful repayment strategy. Failing to do so can result in paying substantially more than the initial loan amount.

Minimizing the Impact of Compounding Interest

Several strategies can help borrowers minimize the impact of daily compounding. Prioritizing early and consistent payments is key. Even small extra payments can significantly reduce the total interest paid over the life of the loan. This is because extra payments directly reduce the principal balance, thereby reducing the base upon which interest is calculated each day. Another effective approach is exploring loan refinancing options to secure a lower interest rate, thus reducing the amount of interest accruing daily. Careful consideration of these options can lead to considerable savings.

Importance of Understanding Loan Terms and Interest Calculations

A thorough understanding of your student loan’s terms, including the interest rate, repayment schedule, and any associated fees, is essential. This knowledge empowers you to make informed decisions about repayment strategies and helps you avoid unexpected costs. Understanding how daily compounding works is crucial in this process, as it directly affects the total amount you will repay. Failure to comprehend these details can lead to financial difficulties and unexpected debt burdens. Reviewing your loan documents carefully and seeking clarification from your lender if needed is vital.

Calculating Total Interest Paid with Daily Compounding

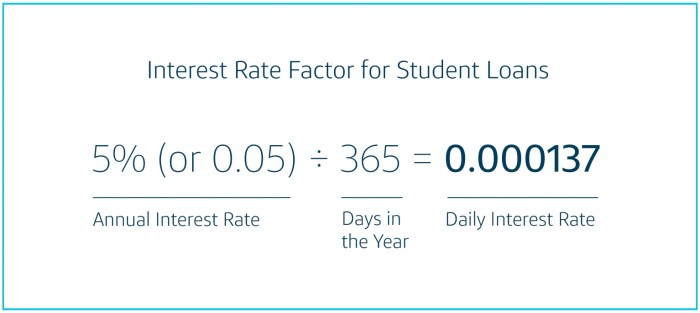

Calculating the precise total interest paid with daily compounding requires a more complex calculation than simple annual interest. While precise calculations often involve specialized financial software or online calculators, a simplified approximation can be helpful for understanding the general magnitude.

- Determine the daily interest rate: Divide your annual interest rate by 365 (or 360, depending on the lender’s calculation method). For example, a 6% annual rate becomes approximately 0.06/365 = 0.000164 daily rate.

- Calculate daily interest accrued: Multiply the daily interest rate by your outstanding principal balance. This will vary daily as the principal is reduced by payments.

- Project interest over the loan term: This is the most complex step. You need to repeat step 2 for each day of the loan term, accounting for payments made. This requires either a spreadsheet program, financial calculator, or an online student loan amortization calculator. These tools account for the daily compounding and the impact of payments.

- Sum the daily interest: Add up all the daily interest figures calculated in step 3. This gives you an approximation of the total interest paid over the life of the loan.

Note: This is a simplified approximation. Accurate calculation requires using specialized financial software or online calculators that account for all aspects of daily compounding and loan repayment schedules.

Illustrative Examples and Scenarios

Understanding the impact of daily compounding on student loan repayment requires examining specific scenarios. The seemingly small difference in daily versus, say, monthly compounding can accumulate to a substantial sum over the loan’s lifespan, significantly affecting the total amount repaid. The following examples illustrate this effect.

Scenario: The Impact of Daily Compounding on Repayment Plan

Let’s consider two borrowers, Alex and Ben, both with a $30,000 federal student loan at a 5% annual interest rate. Alex’s loan compounds daily, while Ben’s (hypothetically) compounds monthly. Both have a 10-year repayment plan. While the annual interest rate is the same, the more frequent compounding on Alex’s loan means that interest accrues on a daily basis, leading to a slightly higher overall interest burden compared to Ben’s loan. This difference, though seemingly minor initially, adds up over the 10 years, potentially resulting in Alex paying several hundred dollars more in total interest. This highlights the importance of understanding compounding frequency when comparing loan offers and planning for repayment.

Comparison of Total Repayment Amounts for Loans with Different Compounding Frequencies

To illustrate the difference, let’s use a simplified example. Assume a $10,000 loan with a 6% annual interest rate over 5 years. If the interest compounds daily, the total interest paid might be approximately $1,618. If the interest compounds annually, the total interest paid would be $1,600. This seemingly small difference of $18 highlights the compounding effect over time. The actual figures will vary depending on the specific loan terms and repayment schedule, but this demonstrates the principle. The higher the interest rate and the longer the loan term, the more significant the difference between daily and less frequent compounding becomes.

Early Repayment and Reduction in Total Interest Paid

Early repayment offers significant benefits, especially when dealing with daily compounding. Let’s say Sarah has a $25,000 student loan with a 7% annual interest rate and daily compounding. If she makes extra payments, reducing the principal balance more quickly, she will pay less interest overall. For instance, paying an extra $100 per month could significantly shorten the loan term and reduce the total interest paid by potentially thousands of dollars, compared to only making minimum payments. This is because the daily compounding means interest is calculated on a smaller principal balance sooner.

Visual Representation of Interest Growth Under Daily Compounding

Imagine a graph with time on the x-axis (representing months or years) and the total interest accrued on the y-axis. The line representing daily compounding would show a slightly steeper upward curve compared to a line representing, for instance, annual compounding. While both lines would show exponential growth, the daily compounding line would exhibit a more pronounced upward trajectory, reflecting the faster accumulation of interest due to the more frequent compounding periods. The difference between the two lines would be minimal initially, but would become increasingly more noticeable as the loan term progresses. This visualization emphasizes how small daily differences in interest calculation can accumulate into substantial amounts over the long term.

Final Wrap-Up

In conclusion, while the seemingly small difference in daily compounding versus other methods might appear insignificant at first glance, the cumulative effect over the life of a student loan can be substantial. Understanding the intricacies of interest accrual, particularly daily compounding, is paramount for responsible financial planning. By actively monitoring loan terms, employing effective repayment strategies, and seeking professional guidance when needed, borrowers can navigate the complexities of student loan repayment and minimize the overall cost of their education.

Essential Questionnaire

Does the type of student loan (federal vs. private) affect daily compounding?

Generally, the compounding frequency (often daily) is consistent across most student loan types. However, the interest rate itself varies significantly between federal and private loans, impacting the overall interest accrued.

Can I avoid daily compounding altogether?

No, most student loans accrue interest daily. However, you can minimize its impact by making extra payments or paying off the loan faster.

How does capitalization affect daily compounding?

Interest capitalization adds accrued but unpaid interest to the principal loan balance. This increases the principal amount subject to daily compounding, leading to higher overall interest payments.

What if I have multiple student loans with different interest rates?

Each loan will accrue interest daily based on its individual interest rate and balance. Prioritizing repayment on loans with higher interest rates is generally recommended.