Navigating the complexities of higher education often involves the crucial question: do student loans cover the cost of living? The answer, unfortunately, isn’t a simple yes or no. The amount of financial aid received varies significantly depending on the type of loan (federal versus private), the institution’s policies, and the individual student’s financial need. Understanding these nuances is key to effectively planning your finances throughout your college years and beyond. This exploration delves into the intricacies of student loan disbursement, allowable expenses, and alternative funding options to help you make informed decisions.

This guide provides a comprehensive overview of how student loans can (or cannot) contribute to your living expenses. We’ll examine different loan types, their disbursement methods, and restrictions on how the funds can be used. We’ll also explore budgeting strategies, alternative funding sources, and the long-term implications of student loan debt. By the end, you’ll have a clearer understanding of how to finance your education and manage your finances responsibly.

Types of Student Loans and Their Coverage

Student loans are a crucial funding source for higher education, but understanding the different types and their implications is vital for responsible borrowing. This section will detail federal and private student loan programs, outlining their eligibility criteria, disbursement methods, and usage restrictions.

Federal Student Loan Programs

Federal student loans are offered by the U.S. government and generally offer more favorable terms than private loans. These programs include subsidized and unsubsidized Stafford Loans, PLUS Loans (for parents and graduate students), and Perkins Loans (limited availability). Eligibility hinges on factors such as enrollment status (at least half-time), U.S. citizenship or eligible non-citizen status, and a valid Social Security number. Applicants must also complete the Free Application for Federal Student Aid (FAFSA) to determine eligibility and loan amounts.

Private Student Loan Programs

Private student loans are offered by banks, credit unions, and other financial institutions. They are not backed by the government, meaning interest rates and repayment terms can vary significantly depending on creditworthiness and other factors. Eligibility requirements typically involve a credit check, co-signer (often a parent or guardian), and proof of enrollment. Because they aren’t federally backed, there’s often less regulatory oversight regarding interest rates and fees.

Disbursement Methods for Student Loans

Federal student loans are typically disbursed directly to the educational institution. The school then credits the funds to the student’s account to cover tuition, fees, and other eligible expenses. Disbursement often occurs in multiple installments, usually per semester or academic year. Private loans may have more varied disbursement methods; some may be disbursed directly to the student, while others may be sent to the school. The specific method is Artikeld in the loan agreement.

Limitations and Restrictions on Loan Fund Usage

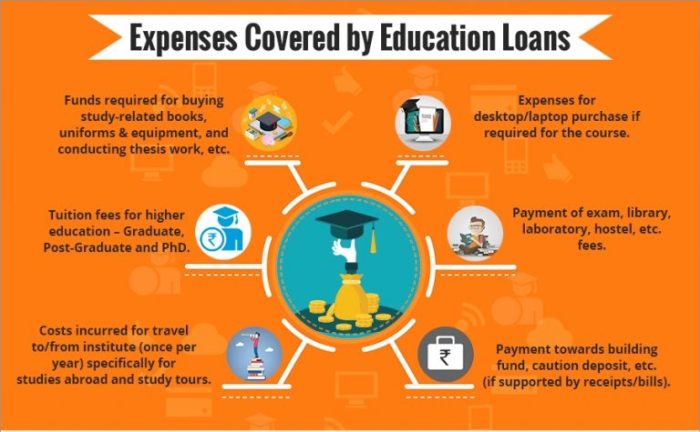

Both federal and private loans typically have restrictions on how the funds can be used. Generally, funds can be used for tuition, fees, room and board, books, and other education-related expenses. However, using loan funds for non-educational purposes, such as personal expenses or luxury items, is usually prohibited. Specific limitations are detailed in the loan agreement and may vary depending on the lender and loan type. Misuse of funds can lead to penalties.

Comparison of Loan Types

| Loan Type | Disbursement Method | Allowable Uses | Restrictions |

|---|---|---|---|

| Federal Stafford Loan (Subsidized/Unsubsidized) | Direct to institution | Tuition, fees, room and board, books, supplies | Must be enrolled at least half-time; subject to federal loan limits |

| Federal PLUS Loan | Direct to institution | Tuition, fees, room and board, books, supplies | Credit check required; subject to federal loan limits; parent or graduate student borrower |

| Federal Perkins Loan | Direct to institution | Tuition, fees, room and board, books, supplies | Limited availability; need-based; lower interest rates |

| Private Student Loan | Direct to student or institution | Tuition, fees, room and board, books, supplies (may vary) | Credit check required; co-signer often needed; variable interest rates and fees; repayment terms vary |

Living Costs Covered by Student Loans

Student loans can significantly ease the financial burden of higher education, but their coverage of living expenses varies greatly depending on several factors. Understanding how much these loans typically contribute to daily necessities is crucial for effective financial planning during your studies. This section will explore the typical living expenses faced by students and examine how much student loans, on average, cover these costs.

Typical Student Living Expenses

Students face a range of expenses beyond tuition fees. These include housing, food, transportation, books and supplies, and personal expenses. The specific costs vary widely based on location (rural versus urban), lifestyle choices, and the type of institution attended (a state college versus a private university).

- Housing: Rent for an apartment or dorm room can range from a few hundred dollars per month to well over a thousand, depending on location and housing type. This includes utilities in some cases, while others require separate payments for electricity, water, and internet.

- Food: Groceries, eating out, and meal plans contribute significantly to living expenses. A student’s budget can range from very frugal to more lavish, resulting in a wide spectrum of food costs.

- Transportation: This includes costs associated with commuting to campus, whether by car (including gas, insurance, and maintenance), public transportation, or cycling. Proximity to campus greatly influences this expense.

- Books and Supplies: Textbooks, stationery, and other academic materials can be surprisingly expensive, especially at higher education levels.

- Personal Expenses: This broad category encompasses clothing, entertainment, healthcare, and other personal needs. The amount spent here depends heavily on individual preferences and lifestyles.

Loan Coverage of Living Expenses

The extent to which student loans cover living expenses is highly variable. Federal loans often have limits on the total amount disbursed, and institutions may have their own disbursement policies. Furthermore, the total cost of attendance (including tuition, fees, and living expenses) used to determine loan eligibility differs widely between institutions.

- Federal Loans: These loans often provide a set amount based on financial need and cost of attendance. While a portion may be allocated to living expenses, it may not fully cover the student’s actual costs, requiring additional financial resources.

- Private Loans: Private loans offer more flexibility in terms of loan amounts, but they typically come with higher interest rates and stricter eligibility criteria. The amount a student can borrow for living expenses depends on the lender’s assessment of the student’s creditworthiness and repayment ability.

Comparison of Living Expenses and Loan Disbursements

The following bulleted list offers a comparison, acknowledging that these are averages and can vary significantly:

- Average Annual Living Expenses (example): $15,000 (This is a hypothetical average and varies widely by location and lifestyle)

- Average Annual Loan Disbursement for Living Expenses (example): $7,500 (This is a hypothetical average and varies significantly by loan type and institution)

This illustrates that, on average, student loans might only cover approximately half of the living expenses. It’s crucial to remember that these figures are estimates, and the actual coverage can differ considerably.

Visual Representation of Loan Coverage

A pie chart could effectively illustrate this. Imagine a circle representing the total average annual living expenses ($15,000 in our example). One segment would represent the portion covered by federal student loans (perhaps 40%, or $6,000), another segment would represent the portion covered by private loans (perhaps 10%, or $1,500), and the remaining segment would represent the uncovered portion (50%, or $7,500), requiring students to cover the gap through savings, part-time jobs, or family contributions. The sizes of the segments would visually demonstrate the proportion of living expenses covered by each loan type and the significant portion students need to fund themselves. The chart’s title could be “Proportion of Living Expenses Covered by Student Loans.” Clear labels for each segment would specify the loan type and the dollar amount covered.

Budgeting and Financial Planning for Students

Successfully navigating the financial landscape of higher education requires careful planning and budgeting. A well-structured budget is crucial for managing student loan repayments, covering living expenses, and avoiding overwhelming debt. This section Artikels essential budgeting strategies for students to ensure financial stability throughout their academic journey and beyond.

Creating a Realistic Budget

A realistic budget is a roadmap to responsible financial management. It involves meticulously tracking income and expenses to understand where your money goes and to identify areas for potential savings. Essential budget components include tuition fees, accommodation costs (rent or dorm fees), textbooks and supplies, transportation, food, utilities, personal care items, entertainment, and loan repayments. Unexpected expenses should also be factored in, creating a buffer for unforeseen circumstances. A realistic budget acknowledges that there will be variations from month to month, but it provides a framework for consistent financial control.

Developing a Personal Budget

Developing a personal budget is a step-by-step process. First, calculate your total monthly income, including any financial aid, part-time job earnings, and loan disbursements. Next, list all your monthly expenses, categorizing them for better understanding. Third, subtract your total expenses from your total income. A positive result indicates a surplus, while a negative result shows a deficit. If you have a deficit, identify areas where you can reduce spending or increase your income. Finally, regularly review and adjust your budget as your income or expenses change. For example, a student might reduce their entertainment budget during exam periods to allocate more funds towards study materials.

Strategies for Effective Financial Management

Effective financial management involves a multi-pronged approach. Saving money is crucial, even small amounts consistently saved can accumulate over time. Consider opening a savings account specifically for emergencies or future goals. Avoid unnecessary debt by making informed purchasing decisions and utilizing credit responsibly. Prioritize needs over wants, and explore options for reducing expenses, such as cooking at home instead of eating out frequently. Tracking spending habits helps identify areas of overspending, allowing for adjustments in the budget. For example, a student might track their daily coffee purchases and realize they could save significantly by brewing coffee at home.

Using Spreadsheets or Budgeting Apps

Spreadsheets and budgeting apps are invaluable tools for tracking income and expenses. A spreadsheet can be designed with columns for date, description of expense/income, category (e.g., tuition, food, entertainment), and amount. Functions like SUM can automatically calculate total income and expenses. Many budgeting apps offer similar functionalities, often with additional features like expense categorization, budgeting tools, and financial goal setting. For example, a student might use a spreadsheet to track their loan repayments, noting the principal and interest amounts paid each month, visualizing their progress towards loan repayment. A budgeting app might provide visual representations of spending habits, highlighting areas where adjustments are needed. The key is to find a method that suits your personal preferences and technological comfort level.

Alternatives to Student Loans for Living Expenses

Securing funding for living expenses while pursuing higher education can be challenging. While student loans are a common option, they come with significant long-term financial obligations. Fortunately, several alternatives exist that can lessen reliance on loans or even eliminate the need for them entirely. Exploring these options carefully can lead to a more manageable financial future.

Many students successfully fund their living costs through a combination of strategies, rather than relying solely on one source. A balanced approach often proves most effective.

Scholarships and Grants

Scholarships and grants represent non-repayable financial aid. They are awarded based on merit, financial need, or specific criteria set by the awarding organization. These funds can significantly reduce or eliminate the need for student loans to cover living expenses.

| Funding Source | Eligibility Requirements | Application Process | Advantages/Disadvantages |

|---|---|---|---|

| Merit-Based Scholarships | High GPA, standardized test scores, extracurricular activities, demonstrated talent in a specific area (e.g., arts, athletics). | Varies widely depending on the scholarship provider; often involves submitting applications, transcripts, essays, and letters of recommendation. | Advantages: Non-repayable funding; can significantly reduce overall educational costs. Disadvantages: Competitive application process; may require significant effort to secure. |

| Need-Based Grants (e.g., Pell Grant) | Demonstrated financial need, as determined by the Free Application for Federal Student Aid (FAFSA). Factors considered include family income, assets, and family size. | Complete the FAFSA form; eligibility is determined by the institution and/or government agency. | Advantages: Non-repayable funding; accessible to students from low-income backgrounds. Disadvantages: Limited funding availability; may not fully cover living expenses. |

| Institution-Specific Scholarships and Grants | Vary widely depending on the institution; may be based on academic achievement, major, or demonstrated financial need. | Typically involves applying through the institution’s financial aid office; often requires separate application forms. | Advantages: Can supplement federal aid; may be easier to obtain than national scholarships. Disadvantages: Limited availability; eligibility criteria vary greatly between institutions. |

Part-Time Jobs

Working part-time while studying can provide a valuable source of income to cover living expenses. The amount earned will depend on the number of hours worked and the hourly wage.

Many students find employment on campus (e.g., library assistant, research assistant) or off-campus (e.g., retail, food service). Balancing work and academics requires careful time management and prioritization.

Family Contributions

Financial support from family members can be a significant source of funding for living expenses. This can take many forms, including direct financial contributions, help with housing costs, or assistance with other expenses. Open communication with family about financial needs and expectations is crucial.

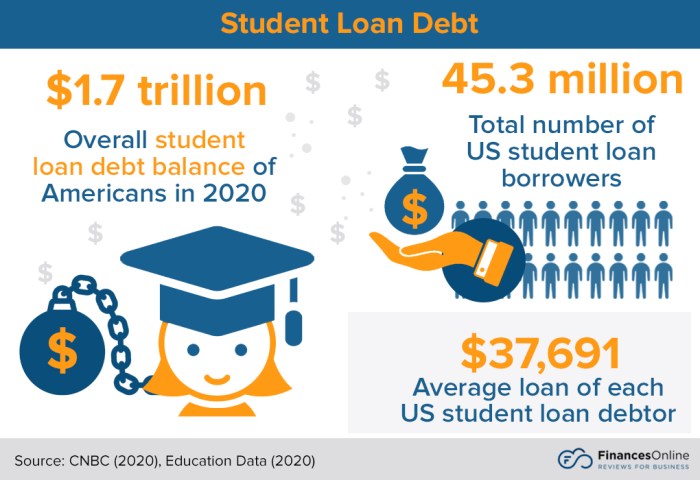

Impact of Student Loan Debt on Post-Graduation Life

The weight of student loan debt can significantly impact a graduate’s financial trajectory, extending far beyond the immediate post-graduation period. Understanding the long-term implications and employing effective management strategies is crucial for navigating this significant financial challenge and achieving long-term financial stability. The burden of repayment can influence major life decisions and shape overall financial well-being for years to come.

Student loan debt’s long-term effects on financial stability are multifaceted. High monthly payments can restrict a graduate’s ability to save for retirement, invest in assets, or build an emergency fund. This can lead to increased financial vulnerability and a slower accumulation of wealth over time. The constant pressure of repayment can also impact mental health and overall well-being, further complicating financial decision-making. For example, a graduate burdened with $50,000 in loans might find it challenging to save for a down payment on a house or contribute meaningfully to a 401(k) plan, delaying major life milestones and potentially reducing long-term financial security.

Strategies for Managing and Repaying Student Loans

Effective management of student loan debt requires a proactive approach. This involves understanding the terms of each loan, exploring different repayment options, and creating a realistic budget that prioritizes loan repayment. Building a strong credit history through timely payments is also essential for securing favorable interest rates on future loans. Moreover, actively seeking opportunities for professional development and higher-paying jobs can accelerate the repayment process. Consider creating a detailed repayment plan, perhaps using a spreadsheet or budgeting app, to track progress and adjust strategies as needed. For instance, a graduate could prioritize higher-interest loans first using the avalanche method or focus on paying off the smallest loans first using the snowball method to maintain motivation.

Student Loan Repayment Plans and Their Impact

Several repayment plans are available, each with its own implications for long-term financial planning. The standard repayment plan involves fixed monthly payments over a 10-year period. Income-driven repayment (IDR) plans, such as the Revised Pay As You Earn (REPAYE) plan, tie monthly payments to a borrower’s income and family size, resulting in lower monthly payments but potentially extending the repayment period and increasing total interest paid. Deferment and forbearance options temporarily postpone payments but usually accrue interest, leading to a larger overall debt. The choice of repayment plan should be carefully considered based on individual financial circumstances and long-term goals. Choosing an IDR plan might provide immediate relief but could lead to a significantly larger total repayment amount over the long run.

Impact of High Student Loan Debt on Major Life Decisions

High levels of student loan debt can significantly impact major life decisions. For example, the substantial monthly payments can delay or prevent homeownership, forcing graduates to rent for longer periods and potentially missing out on building equity. Similarly, the financial burden can postpone family planning, as the cost of raising children adds another layer of financial strain. Starting a business or pursuing further education might also be less feasible due to limited financial resources. A graduate with substantial debt might find it challenging to save for a down payment, impacting their ability to purchase a home, compared to a graduate with minimal or no debt. Similarly, the financial constraints could delay having children, potentially affecting family planning timelines.

Closure

Securing funding for higher education requires careful planning and a thorough understanding of available resources. While student loans can significantly contribute to tuition and fees, their coverage of living expenses varies considerably. This guide has highlighted the importance of budgeting, exploring alternative funding options, and understanding the long-term implications of student loan debt. By proactively addressing these factors, students can navigate the financial landscape of higher education more effectively and lay a solid foundation for their future financial well-being. Remember to research your specific loan options and institutional policies for the most accurate and relevant information.

FAQ Section

What are the typical living expenses for college students?

Typical living expenses include rent or dorm fees, groceries, utilities, transportation, textbooks, and personal items. The exact costs vary greatly depending on location and lifestyle.

Can I use student loans for entertainment expenses?

Generally, student loans are intended to cover educational expenses and essential living costs directly related to your studies. Entertainment expenses are usually not covered.

What happens if I don’t repay my student loans?

Failure to repay student loans can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action.

Are there any resources available to help me manage my student loan debt?

Yes, many resources are available, including government websites, non-profit organizations, and financial advisors specializing in student loan debt management.