The question of whether student loans cover living expenses is a critical one for prospective students navigating the complexities of higher education financing. The cost of tuition, coupled with everyday living expenses like housing, food, and transportation, can quickly become overwhelming. Understanding the nuances of different loan types, eligibility criteria, and alternative funding sources is crucial for making informed financial decisions that avoid future debt burdens.

This guide explores the various facets of student loan financing, providing a clear picture of what these loans typically cover and offering strategies for managing expenses effectively. We’ll examine federal and private loan options, outlining their differences in terms of eligibility, disbursement processes, and the extent to which they contribute to living costs. Furthermore, we’ll delve into alternative financial aid avenues and responsible budgeting techniques to ensure a sustainable path through higher education.

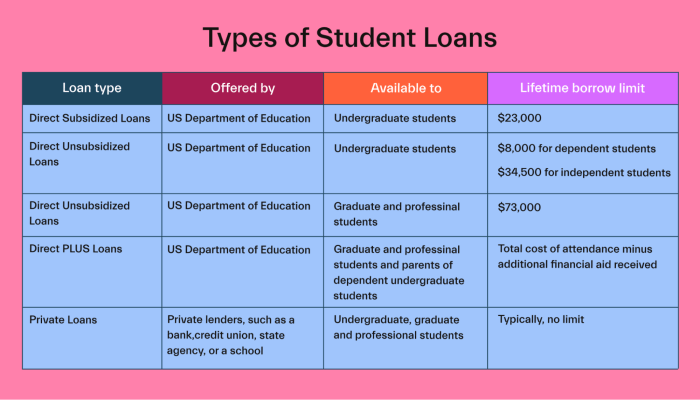

Types of Student Loans and Their Coverage

Understanding the different types of student loans and how they cover living expenses is crucial for effective financial planning during your education. This section details the various loan options available, their disbursement processes, and factors influencing loan amounts.

Federal Student Loans

Federal student loans are offered by the U.S. government and generally offer more favorable repayment terms and protections compared to private loans. Several types exist, each with its own eligibility criteria and borrowing limits. These include subsidized and unsubsidized Stafford Loans (for undergraduate and graduate students), PLUS Loans (for graduate students and parents of undergraduate students), and Perkins Loans (a need-based loan program). The interest rates on federal loans are typically fixed and set annually by the government.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. They are often used to supplement federal loans or when a student’s federal loan eligibility is insufficient to cover their educational costs. Unlike federal loans, private loan interest rates are variable, meaning they can fluctuate over the life of the loan. Eligibility for private loans is determined by the lender’s creditworthiness assessment, often requiring a creditworthy co-signer if the student lacks a strong credit history. The terms and conditions, including interest rates and fees, vary significantly among lenders.

Student Loan Disbursement

The disbursement process typically involves the loan funds being sent directly to the educational institution to cover tuition, fees, and other authorized charges. Any remaining funds, if applicable, are usually disbursed to the student. The disbursement schedule depends on the institution’s policies and the loan program. Funds are often disbursed in installments throughout the academic year. Students should check with their financial aid office for specific disbursement dates and procedures.

Loan Amount Determination

The amount a student can borrow depends on several factors, including their educational program, cost of attendance, financial need (for federal need-based loans), and creditworthiness (for private loans). For federal loans, the maximum loan amount is determined by factors such as the student’s year in school, dependency status, and the cost of attendance at their chosen institution. For private loans, the amount offered is based on the student’s credit score, income, debt, and the co-signer’s creditworthiness, if applicable. For example, a first-year undergraduate student might be eligible for a maximum federal loan amount of $5,500, while a graduate student might be eligible for a much higher amount. A student with excellent credit might receive a larger private loan than a student with poor credit.

Loan Type Coverage of Living Expenses

| Loan Type | Typical Amount | Eligibility Requirements | Coverage of Living Expenses |

|---|---|---|---|

| Federal Subsidized Stafford Loan | Varies by year in school and dependency status | Enrollment in eligible program, U.S. citizenship or eligible non-citizen status, satisfactory academic progress | Partial (Often requires additional funding sources) |

| Federal Unsubsidized Stafford Loan | Varies by year in school and dependency status | Enrollment in eligible program, U.S. citizenship or eligible non-citizen status, satisfactory academic progress | Partial (Often requires additional funding sources) |

| Federal PLUS Loan | Up to the cost of attendance minus other financial aid | Credit check, enrollment in eligible program, satisfactory academic progress (for graduate students; for parents, parental status and satisfactory credit history) | Partial (Can cover a larger portion than Stafford loans, but additional funds may still be needed) |

| Private Student Loan | Varies greatly by lender and applicant’s creditworthiness | Creditworthiness (often requires a co-signer), enrollment in eligible program | Partial (Lenders often assess creditworthiness and income to determine the amount) |

Budgeting and Financial Planning with Student Loans

Effective budgeting is crucial for navigating the financial landscape of higher education. Successfully managing student loan debt requires a realistic understanding of your income and expenses, allowing you to allocate funds appropriately and avoid unnecessary debt accumulation. Careful planning ensures you can cover essential living costs while minimizing the long-term impact of loans.

Creating a Realistic Student Budget

A realistic student budget begins with accurately assessing your income sources and expenses. Income might include student loans, part-time job earnings, grants, scholarships, or financial support from family. Expenses should encompass all costs associated with your studies and daily living. It’s essential to differentiate between needs and wants, prioritizing essential expenditures like housing and food before allocating funds to discretionary spending. Regularly reviewing and adjusting your budget based on changing circumstances is also vital.

Common Student Living Expenses

Common living expenses for students vary widely depending on location, lifestyle, and individual circumstances. However, some consistent expenses include:

- Housing: Rent, utilities (electricity, water, gas, internet), and potentially furnishings.

- Food: Groceries, eating out, and meal preparation costs.

- Transportation: Public transportation fares, car payments, gas, insurance, and maintenance.

- Education: Tuition, fees, books, and supplies.

- Healthcare: Health insurance premiums, medical expenses, and prescriptions.

- Personal Expenses: Clothing, entertainment, personal care items, and subscriptions.

Sample Monthly Budget

This example demonstrates a potential monthly budget for a student receiving $1,500 in student loan funds. Note that this is a sample, and individual budgets will vary significantly.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Student Loan | $1500 | Housing | $700 |

| Part-time Job | $500 | Food | $300 |

| Transportation | $150 | ||

| Education (books/supplies) | $50 | ||

| Healthcare | $100 | ||

| Personal Expenses | $200 | ||

| Total Income | $2000 | Total Expenses | $1500 |

| Savings | $500 |

Budgeting Methods and Student Loan Management

Different budgeting methods can help manage student loan funds effectively. One popular approach is the 50/30/20 rule:

50% of your after-tax income towards needs (housing, food, transportation), 30% towards wants (entertainment, dining out), and 20% towards savings and debt repayment.

Applying this to our example, the student could allocate $1000 towards needs, $600 towards wants, and $400 towards savings and loan repayment (exceeding the 20% due to the significant loan amount). Other methods, such as the zero-based budget (allocating every dollar to a specific category) or the envelope system (assigning cash to specific categories), could also be effective. The key is finding a method that aligns with your spending habits and financial goals.

Alternatives to Student Loans for Living Expenses

Securing funding for living expenses while pursuing higher education can be a significant challenge. While student loans are a common solution, they come with the burden of accumulating debt. Fortunately, several alternatives exist that can lessen the reliance on loans and potentially avoid long-term financial strain. Exploring these options carefully can lead to a more manageable and sustainable path to completing your education.

Scholarships and Grants

Scholarships and grants represent a significant source of funding that doesn’t require repayment. These awards are typically based on merit, financial need, or specific criteria set by the awarding institution or organization. Securing scholarships and grants can substantially reduce the need for student loans, freeing up resources for other essential expenses.

Part-Time Employment

Working part-time while studying offers a direct way to earn money for living expenses. The amount earned will vary depending on the number of hours worked and the hourly wage. Balancing work and studies requires careful time management and prioritization, but the financial independence gained can be invaluable. Many students find part-time jobs on campus, which offer flexibility and convenience.

Family Contributions

Family support can play a crucial role in funding education. This could involve direct financial contributions from parents or other family members, or assistance with living expenses such as housing or utilities. The level of family support available will vary greatly depending on individual circumstances. Open communication with family members about financial needs and resources is vital in exploring this option.

Comparison of Funding Sources

The following table compares student loans with the alternative funding options discussed above.

| Funding Source | Availability | Application Process | Impact on Future Finances |

|---|---|---|---|

| Student Loans | Widely available, but requires creditworthiness or co-signer | Application through lender, often involves credit checks and documentation | Accumulates debt requiring repayment with interest, impacting credit score and future financial planning. |

| Scholarships | Competitive, varies by institution and organization | Application varies, often requires essays, transcripts, and recommendations | No debt incurred; positive impact on future finances. |

| Grants | Based on financial need or specific criteria; often requires FAFSA completion | Application through institution or government agency | No debt incurred; positive impact on future finances. |

| Part-Time Jobs | Readily available, but hours may be limited | Direct application to employers | Reduces reliance on loans, but may impact study time. |

| Family Contributions | Varies greatly depending on family circumstances | Open communication and agreement with family | Reduces reliance on loans, but dependent on family resources. |

Resources for Scholarships and Grants

Several websites provide comprehensive listings of scholarships and grants. These include Fastweb (fastweb.com), Scholarships.com (scholarships.com), and the Federal Student Aid website (studentaid.gov). Each site offers search tools to filter scholarships based on criteria such as major, academic achievement, and financial need. It’s crucial to research and apply for scholarships well in advance of deadlines.

The Role of Financial Aid Offices

Navigating the complexities of higher education financing can be daunting for students and their families. Fortunately, most colleges and universities employ financial aid offices dedicated to assisting students in securing the financial resources they need to pursue their education. These offices serve as invaluable resources, providing guidance, support, and access to various financial aid opportunities. Their role extends beyond simply processing applications; they act as crucial partners in the student’s financial well-being throughout their academic journey.

Financial aid offices play a multifaceted role in assisting students with financial planning. They provide a centralized location for students to access information about various funding sources, including grants, scholarships, loans, and work-study programs. Furthermore, they offer personalized guidance based on individual circumstances, helping students understand their options and make informed decisions about how to finance their education. This guidance often involves creating a comprehensive financial plan tailored to the student’s specific needs and goals.

Services Provided by Financial Aid Offices

Financial aid offices typically offer a range of services designed to support students throughout the financial aid process. These services can include individual counseling sessions where students can discuss their financial situation and explore various funding options. Workshops and seminars on topics such as budgeting, financial literacy, and loan repayment strategies are frequently offered. Many offices also maintain online resources, such as FAQs, financial aid calculators, and application guides, which provide readily accessible information 24/7. Some offices even offer assistance with completing the Free Application for Federal Student Aid (FAFSA) and other necessary financial aid forms.

Examples of Questions Students Should Ask Their Financial Aid Offices

Students should proactively engage with their financial aid office to maximize the benefits of available resources. Understanding the different types of aid available, including merit-based and need-based options, is crucial. Students should inquire about the deadlines for applying for financial aid and any requirements for maintaining eligibility. Inquiring about potential scholarships or grants specific to their major or academic interests can uncover additional funding opportunities. Finally, understanding the repayment options and implications of student loans is essential, and financial aid offices can provide valuable guidance in this area. For example, a student might ask about the differences between subsidized and unsubsidized federal loans, or about income-driven repayment plans.

Utilizing Financial Aid Office Resources Effectively

To effectively utilize the resources offered by the financial aid office, students should start early in the process, ideally before even applying to colleges. They should attend any workshops or seminars offered, and schedule individual meetings with a financial aid counselor to discuss their specific financial situation and explore all available options. Students should also take advantage of online resources, such as financial aid calculators and FAQs, to understand their eligibility for different types of aid. Maintaining open communication with the financial aid office throughout their academic career is crucial, as circumstances can change, and the office can provide ongoing support and guidance. For instance, if a student’s financial situation changes, contacting the financial aid office promptly can help them explore options for adjusting their financial aid package.

Potential Risks and Considerations

Borrowing significant sums for living expenses while pursuing higher education presents considerable financial risks that extend far beyond the immediate costs. Understanding these potential pitfalls and implementing proactive strategies is crucial for navigating the complexities of student loan debt and ensuring long-term financial well-being.

The potential for substantial debt accumulation is a primary concern. Living expenses, even with careful budgeting, can quickly escalate, leading to larger loan amounts than initially anticipated. This increased debt burden can significantly impact future financial decisions, such as purchasing a home, starting a family, or investing in retirement. The interest accrued on these loans compounds over time, further increasing the total repayment amount. For instance, a $20,000 loan at a 7% interest rate could easily balloon to over $30,000 within a decade if not addressed diligently.

Long-Term Implications of Student Loan Debt

High levels of student loan debt can have profound long-term financial consequences. It can delay major life milestones like homeownership, starting a family, or saving for retirement. The weight of monthly loan payments can restrict financial flexibility, limiting opportunities for career advancement or entrepreneurial pursuits. In some cases, excessive debt can lead to significant financial stress and negatively impact mental health. For example, individuals burdened with substantial debt may find themselves unable to afford essential living expenses, leading to a cycle of financial hardship.

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt post-graduation is essential for minimizing its long-term impact. Creating a comprehensive repayment plan, prioritizing high-interest loans, and exploring options like income-driven repayment plans are crucial steps. Careful budgeting and tracking expenses can help allocate funds effectively towards loan repayment. Moreover, exploring opportunities for loan consolidation or refinancing can potentially lower monthly payments and reduce the overall interest paid. For instance, consolidating multiple loans into a single loan with a lower interest rate can significantly reduce the total repayment amount over the loan’s lifespan.

Resources and Tools for Managing Student Loan Debt

Several resources and tools are available to assist in managing student loan debt effectively. Loan repayment calculators, available online through various financial institutions and government websites, allow individuals to estimate their monthly payments and total repayment costs under different scenarios. These calculators can help individuals make informed decisions regarding repayment strategies and explore different loan options. Additionally, federal student aid websites offer comprehensive information on repayment plans, loan forgiveness programs, and other debt management resources. For example, the Federal Student Aid website provides a detailed breakdown of various repayment plans and eligibility criteria, enabling borrowers to choose the plan that best suits their individual financial circumstances.

Conclusion

Securing funding for higher education requires careful planning and a thorough understanding of available resources. While student loans can play a significant role, they shouldn’t be the sole reliance for covering living expenses. By exploring alternative funding options, creating a realistic budget, and leveraging the support of financial aid offices, students can navigate the financial landscape of college with greater confidence and minimize the long-term impact of debt. Remember, proactive financial management is key to a successful and less stressful academic journey.

Top FAQs

Can I use student loans to pay for my rent?

While student loans primarily cover tuition and fees, some portions might indirectly contribute to living expenses if you choose to use funds for housing costs. However, it’s important to carefully budget and prioritize essential educational expenses first.

What happens if I don’t use all my student loan money?

Any unused funds typically remain in your account, and you can access them as needed throughout the academic year. However, it’s advisable to plan your expenses carefully to avoid unnecessary borrowing.

Are there any penalties for paying off student loans early?

Most federal student loans don’t have prepayment penalties, but it’s always best to check your loan agreement for specific terms and conditions.

Can I get a student loan if I have bad credit?

Securing a private student loan with bad credit can be challenging. Federal student loans generally have less stringent credit requirements but may still require a co-signer.