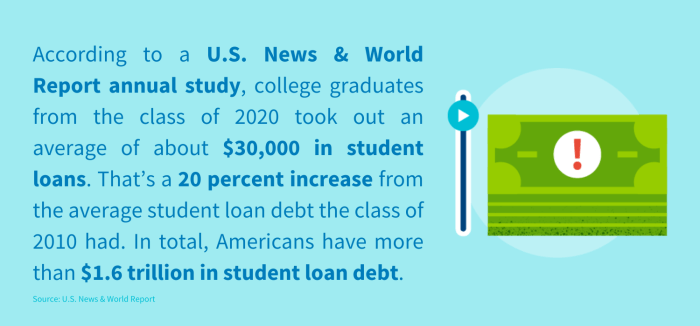

Navigating the complexities of student loans and their impact on your credit score can feel daunting. Understanding how these loans are reported, the consequences of missed payments, and the steps to repair any damage is crucial for maintaining strong financial health. This guide explores the relationship between student loans and your credit report, offering clarity and practical advice.

From the initial application process to repayment strategies, the journey of student loan management significantly influences your creditworthiness. This detailed examination covers federal and private loans, outlining the reporting practices of various servicers and the potential long-term effects on your credit score. We’ll also delve into strategies for managing your loans effectively and resolving any credit report inaccuracies.

Types of Student Loans and Credit Reporting

Understanding how student loans impact your credit report is crucial for financial planning. Both federal and private student loans are handled differently, leading to varying effects on your credit score. This section details the reporting processes and potential consequences for each type.

Federal Student Loan Reporting

Federal student loans are reported to the three major credit bureaus (Equifax, Experian, and TransUnion) by the Department of Education and its contracted loan servicers. The reporting typically begins once a loan enters repayment, although some lenders might report earlier. Information reported includes loan balances, payment history (on-time or late payments), and whether the loan is in good standing or default. Consistent on-time payments positively impact your credit score, while late or missed payments negatively affect it. The impact of a default on a federal student loan is severe, as it can significantly lower your credit score and may result in wage garnishment or tax refund offset.

Private Student Loan Reporting

Private student loans also affect your credit report. Unlike federal loans, the reporting process is handled directly by the private lender or its contracted servicer. The information reported is similar to that of federal loans: loan balances, payment history, and loan status. The reporting frequency and specifics may vary depending on the lender. Some lenders may report monthly, while others might report quarterly or less frequently. Private lenders’ reporting practices also vary in terms of how quickly they report late payments.

Impact of Federal vs. Private Loan Defaults

Defaulting on a federal student loan has broader consequences than defaulting on a private student loan. While both will negatively impact your credit score, federal loan defaults can lead to additional repercussions such as wage garnishment, tax refund offset, and the inability to obtain future federal student loans or other government benefits. Defaulting on a private student loan primarily affects your credit score and may lead to collection efforts by the lender. However, the damage to your credit score can still be substantial in both cases, potentially hindering your ability to secure loans, credit cards, or even rental housing in the future.

Loan Servicer Credit Reporting Practices

Different loan servicers may have slightly different approaches to credit reporting. For example, one servicer might report late payments more quickly than another, potentially causing a more immediate negative impact on your credit score. Similarly, some servicers might be more proactive in reporting changes in loan status, such as a loan being paid off. Understanding your servicer’s reporting practices can help you manage your credit effectively.

Comparison of Student Loan Servicer Credit Reporting Practices

| Servicer | Reporting Frequency | Types of Loans Reported | Impact of Late Payments |

|---|---|---|---|

| Navient | Monthly | Federal and Private | Negative impact; reported promptly |

| Nelnet | Monthly | Federal and Private | Negative impact; reported promptly |

| Great Lakes | Monthly | Federal | Negative impact; reported promptly |

| AES | Monthly | Private | Negative impact; reporting timeline varies |

Impact of Student Loan Payments on Credit Score

Your student loan payment history significantly impacts your credit score, a crucial factor in various financial decisions. Consistent, on-time payments build positive credit history, while missed or late payments can have serious, long-lasting consequences. Understanding this relationship is key to responsible financial management.

Positive Effects of On-Time Payments

Consistently making on-time student loan payments demonstrates responsible borrowing behavior to credit bureaus. This positive payment history directly contributes to a higher credit score. Lenders view this as a sign of reliability and trustworthiness, increasing your chances of approval for future loans, credit cards, and even rental applications, often at more favorable interest rates. The improvement in your credit score can translate to significant savings over time. For example, a higher credit score can lead to lower interest rates on mortgages, potentially saving thousands of dollars over the life of a loan.

Negative Consequences of Missed or Late Payments

Missed or late student loan payments negatively impact your credit score. These late payments are reported to credit bureaus, creating a negative mark on your credit report that can remain for seven years. This can make it harder to secure loans or credit cards in the future, or result in higher interest rates if you are approved. Furthermore, late payments can lead to collections activity, which further damages your credit score and can negatively affect your ability to rent an apartment or secure employment in certain fields.

Factors Influencing the Severity of Negative Impact

Several factors influence the severity of the negative impact of student loan delinquency on credit scores. The number of missed or late payments is a major factor; multiple instances of delinquency will have a more significant impact than a single incident. The length of the delinquency also matters; a longer period of non-payment results in a more severe negative impact. The type of loan and the lender also play a role; federal student loans may have different reporting procedures than private loans. Finally, your overall credit history influences the impact; individuals with already strong credit scores may experience a less dramatic drop than those with weaker credit histories.

Hypothetical Scenario: Single Missed Payment vs. Consistent Late Payments

Imagine two individuals, both with similar credit scores initially. Individual A misses a single student loan payment due to an unexpected emergency. Their credit score will likely drop, but the impact will be relatively minor if they quickly rectify the situation. Individual B, however, consistently makes late payments for several months. Their credit score will experience a much more significant and sustained decline, potentially impacting their ability to obtain credit in the future. The difference highlights the cumulative effect of repeated late payments.

Incorporation of Student Loan Payment History into Credit Scoring Models

Credit scoring models, such as FICO scores, incorporate student loan payment history as a significant factor. The models analyze the frequency and severity of late or missed payments, weighting them accordingly. On-time payments are viewed positively, contributing to a higher score. Conversely, late or missed payments reduce the score, potentially impacting the individual’s access to credit and interest rates offered. The specific weight given to student loan payments varies depending on the scoring model and the individual’s overall credit profile, but it is consistently a substantial component.

Student Loan Default and Credit Report

Defaulting on student loans has serious and long-lasting consequences, significantly impacting your credit report and overall financial health. Understanding this process is crucial for responsible loan management.

Student loan default occurs when you fail to make your scheduled payments for a specific period, typically 9 months or more, depending on your loan type and servicer. This triggers immediate negative consequences. Your loan servicer will report the default to all three major credit bureaus (Equifax, Experian, and TransUnion). This results in a significant drop in your credit score, making it harder to secure loans, rent an apartment, or even get a job in some cases. Furthermore, the defaulted amount will be added to your outstanding debt, potentially accruing late fees and interest. The government may also take collection actions such as wage garnishment or tax refund offset.

Immediate Impact of Student Loan Default on Credit Reports

A default is reported immediately to the credit bureaus. This negative mark stays on your credit report for seven years from the date of default. The severity of the impact depends on your credit history prior to the default; however, even individuals with excellent credit will experience a substantial drop in their score. The default will also appear as a public record, further impacting creditworthiness. This means potential lenders can see that you’ve defaulted on a loan, even if they don’t have access to your full credit report.

Long-Term Consequences of Student Loan Default on Creditworthiness

The long-term consequences of student loan default extend far beyond the initial credit score drop. Securing future loans, including mortgages, auto loans, and credit cards, becomes significantly more difficult, if not impossible, due to the negative mark on your credit report. Higher interest rates are applied to any new loans you might qualify for, making borrowing considerably more expensive. Defaulting can also impact your ability to rent an apartment or obtain certain jobs, as many landlords and employers conduct credit checks. The debt itself continues to grow, with the potential for collection agencies to pursue aggressive collection tactics. The financial strain and stress associated with default can have significant consequences on your overall well-being.

Rehabilitating a Defaulted Student Loan and Its Effect on Credit Scores

Rehabilitation involves making consistent, on-time payments for a specified period, usually nine to twelve months, to bring your account back into good standing. This process demonstrates to lenders your commitment to repayment and can positively impact your credit score over time. However, the default will still remain on your credit report for seven years, although the negative impact may lessen as positive payment history accumulates. The rehabilitation process may involve working directly with your loan servicer or a government agency, such as the Department of Education.

Methods for Resolving Student Loan Defaults

Several methods exist for resolving student loan defaults, each with its own implications. Rehabilitation, as discussed above, is one option. Consolidation is another, combining multiple loans into one, often with a lower interest rate. This simplifies payments, but it doesn’t remove the default from your credit report. Loan forgiveness programs, available under certain circumstances, can eliminate the debt, but are often subject to stringent eligibility requirements. In some cases, bankruptcy might be considered, but this is a last resort and doesn’t always discharge student loans.

Steps for Repairing Credit After a Student Loan Default

Repairing your credit after a student loan default requires patience and diligence. The process involves several key steps:

- Understand your situation: Obtain your credit reports and review them carefully to identify all negative marks associated with the default.

- Contact your loan servicer: Discuss repayment options, including rehabilitation, consolidation, or other available programs.

- Create a budget: Develop a realistic budget that allows you to make consistent loan payments and reduce other debts.

- Make consistent on-time payments: Regular, timely payments are crucial for rebuilding your credit. Even small payments demonstrate a commitment to repayment.

- Monitor your credit score: Regularly check your credit reports and score to track your progress and identify any further issues.

- Consider credit counseling: A credit counselor can offer guidance and support in managing your debt and improving your credit score.

Understanding Credit Reports and Student Loan Information

Your credit report is a detailed record of your borrowing history, and student loans, being a significant form of debt for many, play a substantial role in shaping your creditworthiness. Understanding how student loan information is presented on your credit report is crucial for maintaining a healthy credit score and avoiding potential problems. This section will guide you through accessing, interpreting, and correcting any inaccuracies related to your student loans on your credit report.

Accessing and Interpreting Student Loan Information on a Credit Report

To access your credit report, you can obtain a free copy annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion, through AnnualCreditReport.com. This is the only authorized website for free credit reports; be wary of others claiming to offer this service. Once you receive your report, locate the “Accounts” or “Tradelines” section. This section lists your open and closed credit accounts, including student loans. Each listing typically includes the creditor’s name (the lender), the account number, the date the account was opened, the credit limit (if applicable), the current balance, and the payment history. For student loans, you’ll also see the loan type (e.g., federal subsidized, private unsubsidized), the original loan amount, and the repayment plan. Payment history is represented by a series of letters and numbers, often explained in a legend on the report itself.

Common Abbreviations and Terms Used to Describe Student Loan Status

Credit reports use standardized abbreviations to represent payment history. “P” might indicate a payment made on time, while “L” might denote a late payment. “D” could represent a payment that is delinquent. Terms like “Current,” “Past Due,” “Charged Off,” and “Default” describe the status of your loan. “Current” means you’re making payments as agreed. “Past Due” indicates missed payments. “Charged Off” means the lender has written off the debt as uncollectible, and “Default” signifies a serious breach of your loan agreement, resulting in negative consequences. Understanding these abbreviations is key to interpreting your payment history. For instance, a consistent record of “P” indicates responsible repayment, while a pattern of “L” or “D” may negatively impact your credit score.

Identifying Inaccuracies or Discrepancies in Student Loan Information

Carefully review each detail of your student loan information. Check the lender’s name, account number, loan amount, payment history, and dates for accuracy. Compare this information with your loan documents and statements. Any discrepancies, such as incorrect payment dates, amounts, or loan balances, should be noted. Even a single inaccurate entry can significantly impact your credit score. For example, a late payment mistakenly reported as a default can have a severe negative effect.

Disputing Incorrect Student Loan Information

If you discover inaccuracies, immediately contact the credit bureau directly to initiate a dispute. You’ll typically need to submit a dispute form along with documentation proving the error, such as loan statements or payment receipts. The credit bureau will then investigate the claim and contact the lender to verify the information. The process can take several weeks or months, so be patient and persistent. Keep records of all communication with the credit bureau and the lender. Failure to address these inaccuracies can lead to continued negative impacts on your credit.

Visual Representation of Student Loan Information on a Credit Report

The following illustrates a simplified representation of how student loan information might appear on a credit report:

“`

Account Type: Student Loan

Creditor: Sallie Mae

Account Number: 1234567890

Date Opened: 08/2015

Original Loan Amount: $25,000

Current Balance: $18,000

Payment History: P P P P L P P P (P = Paid on Time, L = Late Payment)

Status: Current

“`

This example demonstrates the key elements usually included. Note that the exact format may vary slightly depending on the credit bureau.

Student Loan Repayment Plans and Credit Scores

Choosing a student loan repayment plan significantly impacts your credit score. Understanding the nuances of each plan and its effect on your credit report is crucial for responsible debt management and long-term financial health. Different plans offer varying payment amounts and durations, leading to different credit reporting implications.

Income-Driven Repayment Plans and Credit Reporting

Income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), calculate monthly payments based on your income and family size. While these plans offer lower monthly payments, potentially making repayment more manageable, they can have unique implications for your credit report. The lower monthly payments might not fully cover the accruing interest, leading to a higher loan balance over time. This can impact your credit utilization ratio, which is a factor in your credit score. However, making consistent, on-time payments, even if small, demonstrates responsible credit behavior and can still positively influence your credit score. It is important to note that consistent, on-time payments are always the most significant factor in improving credit scores, regardless of the payment amount.

Comparison of Repayment Plan Options and Credit Reporting Implications

Several repayment plan options exist, each with different implications for credit reporting. A standard repayment plan typically involves fixed monthly payments over a 10-year period. This offers faster loan repayment and a potentially quicker positive impact on your credit score due to the consistent payments and faster reduction of debt. Extended repayment plans stretch payments over a longer period (up to 25 years), leading to lower monthly payments but potentially impacting your credit score due to the extended length of debt. The longer repayment period may also lead to higher overall interest paid. Income-driven repayment plans, as discussed above, offer flexible payments but may result in a slower reduction of debt and a potential longer negative impact on credit utilization. The key is consistent on-time payments; regardless of the plan, responsible repayment is crucial.

Benefits and Drawbacks of Repayment Plans Regarding Credit Scores

The benefits of standard repayment plans include faster debt reduction and potentially quicker improvement in credit scores due to consistent, larger payments and a shorter debt history. However, the higher monthly payments might be challenging for some borrowers. IDR plans offer lower monthly payments, making repayment more manageable, but potentially slower debt reduction and a longer period of impact on credit utilization. Extended repayment plans provide the lowest monthly payments but may result in significantly higher interest paid over the life of the loan and a longer period of impact on credit scores. The optimal choice depends on individual financial circumstances and priorities. Careful consideration of both short-term financial needs and long-term credit health is necessary.

Student Loan Repayment Plan Comparison

| Plan Name | Eligibility Criteria | Payment Calculation | Impact on Credit Report |

|---|---|---|---|

| Standard Repayment | Generally available to all federal student loan borrowers. | Fixed monthly payment over 10 years. | Consistent, on-time payments can positively impact credit score; faster debt reduction. |

| Extended Repayment | Available to borrowers with high loan balances. | Fixed monthly payment over a longer period (up to 25 years). | Lower monthly payments, but slower debt reduction and longer period of debt may negatively affect credit score. |

| Income-Based Repayment (IBR) | Based on income and family size. | Monthly payment calculated as a percentage of discretionary income. | Lower monthly payments, but may not cover accruing interest; consistent on-time payments are crucial for positive credit impact. |

| Pay As You Earn (PAYE) | Based on income and family size. | Monthly payment calculated as 10% of discretionary income. | Similar to IBR; lower payments but potential for slower debt reduction and impact on credit utilization. |

| Revised Pay As You Earn (REPAYE) | Based on income and family size. | Monthly payment calculated as 10% of discretionary income; interest is capitalized. | Similar to IBR and PAYE; careful monitoring is crucial due to interest capitalization. |

Last Word

Successfully managing your student loans is a key step toward building and maintaining a strong credit history. By understanding how these loans are reported, proactively addressing potential issues, and utilizing available resources, you can navigate the complexities of student loan repayment and achieve your financial goals. Remember, consistent on-time payments are essential, and addressing any inaccuracies on your credit report promptly is vital for protecting your financial future.

FAQ Summary

What if my student loan servicer isn’t reporting my payments accurately?

Contact your servicer immediately to dispute the inaccurate information. If the issue persists, file a dispute with the credit bureaus (Equifax, Experian, and TransUnion).

How long does a student loan default stay on my credit report?

A student loan default can remain on your credit report for seven years from the date of default.

Can I get a credit card with a poor credit score due to student loan issues?

It might be more difficult, but secured credit cards or credit-builder loans are options to help rebuild credit.

Do all types of student loan deferments affect my credit report?

No, some deferments don’t impact your credit report, but it’s crucial to check with your servicer for specifics. Always clarify the impact of any deferment plan on your credit before choosing it.