Navigating the complexities of student loan repayment can feel overwhelming, especially when facing financial hardship. Understanding the process of loan delinquency and potential collection actions is crucial for borrowers to protect their credit and financial future. This exploration delves into the journey a student loan takes from missed payments to potential collection, examining the roles of loan servicers, credit bureaus, and debt collection agencies.

We’ll uncover the factors influencing whether a loan ends up in collections, including loan type, income, and the borrower’s legal protections. We will also highlight available resources and programs designed to help borrowers avoid or resolve default, offering strategies for navigating this challenging situation successfully.

Default Loan Servicing and Delinquency

Understanding the process of student loan delinquency and default is crucial for borrowers to avoid serious financial consequences. Missing payments can trigger a series of actions by your loan servicer, ultimately leading to default if the situation isn’t resolved. This section details the typical progression and borrower rights at each stage.

When you miss a student loan payment, your loan servicer initiates a process designed to bring your account current. This process typically begins with a series of communications and escalates if payments remain outstanding. The exact timeline and specific actions can vary depending on your loan type and servicer, but the general steps are consistent.

Loan Servicer Communication Methods

Loan servicers employ various methods to contact borrowers experiencing delinquency. These methods are designed to ensure borrowers are aware of their missed payments and the potential consequences. Common communication channels include written notices mailed to the borrower’s address on file, email notifications, phone calls, and potentially text messages (with prior consent). Servicers are generally required to attempt contact multiple times before escalating the situation. Failure to respond to these communications will not stop the delinquency process from advancing.

Progression from Delinquency to Default

The journey from a missed payment to loan default typically follows a predictable path. Initially, the account is marked as delinquent, and the servicer will send notices outlining the missed payment(s) and urging the borrower to contact them. As the delinquency continues, the servicer may increase the frequency of contact attempts. Further missed payments lead to more serious consequences, including potential damage to credit scores, referral to collections agencies, and ultimately, default. The exact timeframe for each stage varies depending on the loan type and servicer policies. For example, a loan may be considered delinquent after 30 days, while default may occur after 9 months of non-payment.

Stages of Student Loan Delinquency and Default

| Stage of Delinquency | Servicer Actions | Borrower Rights | Potential Consequences |

|---|---|---|---|

| 30-59 Days Delinquent | Notice of delinquency, phone calls, letters. | Right to contact the servicer to discuss repayment options, such as deferment or forbearance. | Negative impact on credit score. |

| 60-89 Days Delinquent | Increased contact attempts, potential referral to collections agency. | Right to negotiate a repayment plan, explore income-driven repayment options. | Further damage to credit score, potential wage garnishment. |

| 90+ Days Delinquent (Default) | Referral to collections, potential legal action, reporting to credit bureaus. | Right to challenge inaccurate information on credit reports, but limited options for repayment. | Severe damage to credit score, wage garnishment, tax refund offset, difficulty obtaining loans or credit. |

Factors Affecting Loan Collection

The journey of a student loan from disbursement to repayment can be complex, and several factors significantly influence whether a loan eventually ends up in collections. Understanding these factors is crucial for both borrowers and lenders to navigate the repayment process effectively. These factors range from the type of loan itself to the borrower’s financial circumstances and the collection practices employed by the loan servicer.

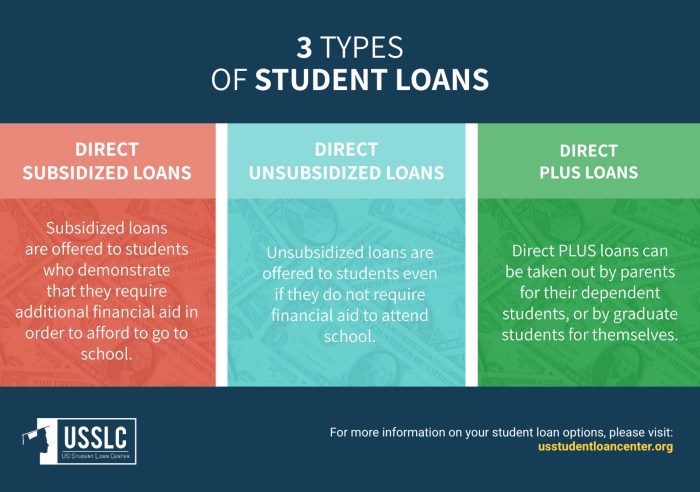

Loan Type and Collection Process

Federal and private student loans differ significantly in their collection processes. Federal loans are subject to specific regulations and protections under federal law, offering borrowers more avenues for repayment assistance and hardship deferments. The Department of Education oversees the collection of federal student loans, employing various strategies, including wage garnishment and tax refund offset, but often prioritizing rehabilitation and repayment plans. Private loans, conversely, are governed by individual lender policies and state laws, often resulting in more aggressive collection tactics, potentially including lawsuits and damage to credit scores. The lack of federal protections means fewer options for borrowers struggling with repayment. For example, a borrower with a defaulted federal loan might be eligible for income-driven repayment, while a similar situation with a private loan might result in immediate referral to collections.

Income Levels and Employment Status

A borrower’s income and employment status are strong indicators of their ability to repay student loans. Individuals with stable, high-income employment are far less likely to default and have their loans sent to collections. Conversely, unemployment, underemployment, or low income significantly increases the risk of delinquency and eventual default. A person experiencing job loss might struggle to meet minimum monthly payments, leading to delinquency and, if not resolved, collection actions. The impact of income is particularly pronounced for borrowers with high loan balances relative to their income. For example, a borrower with a $100,000 loan and an annual income of $30,000 faces a substantially higher risk of default than someone with the same loan but an annual income of $100,000.

Collection Practices of Loan Servicers

Different loan servicers employ varying collection strategies, ranging from relatively lenient approaches to aggressive tactics. Some servicers prioritize communication and offer flexible repayment options, while others may quickly pursue legal action. Factors influencing a servicer’s approach include their internal policies, the type of loan they service, and the borrower’s repayment history. While some servicers might offer extended forbearance periods, others might initiate collection proceedings after a shorter period of delinquency. For instance, one servicer might focus on phone calls and letters initially, while another might immediately pursue wage garnishment. This variability highlights the importance of understanding the specific servicer’s policies.

Legal Protections for Borrowers

Borrowers facing collection actions have several legal protections. The Fair Debt Collection Practices Act (FDCPA) restricts the methods collection agencies can use, prohibiting harassment, threats, and deceptive practices. Additionally, the Bankruptcy Code allows borrowers to discharge certain student loan debt under specific circumstances, although this is generally difficult to achieve. State laws also offer some protections, potentially limiting the actions of collection agencies. For example, the FDCPA prevents collectors from contacting borrowers at unreasonable hours or repeatedly calling when the borrower requests them to stop. Furthermore, borrowers can dispute the validity of the debt with the collection agency or credit reporting bureaus. Understanding these protections is vital for borrowers to defend their rights and navigate the legal complexities of loan collections.

The Role of Credit Bureaus

Student loan defaults have significant consequences, extending beyond the financial burden on the borrower. The interaction with credit bureaus is a crucial aspect of this process, impacting a borrower’s creditworthiness and future financial opportunities. Understanding how defaults are reported and the subsequent effects is essential for both borrowers and lenders.

The reporting of student loan defaults to credit bureaus is a systematic process. When a federal student loan enters default (typically after 270 days of non-payment), the Department of Education (or its contracted loan servicer) reports this information to all three major credit bureaus: Equifax, Experian, and TransUnion. This negative information remains on a borrower’s credit report for seven years from the date of default, significantly impacting their credit score. Private student loans follow a similar process, although the specific timelines might vary slightly depending on the lender’s policies.

Student Loan Default’s Impact on Credit Score

A student loan default severely damages a credit score. The negative mark on a credit report lowers a credit score considerably, potentially making it difficult to obtain credit in the future. This includes mortgages, auto loans, credit cards, and even renting an apartment. The extent of the damage depends on various factors, including the borrower’s overall credit history and the amount of the defaulted loan. For instance, a borrower with a previously excellent credit score might see a significant drop, while someone with a history of poor credit might experience a less dramatic change, but still a substantial negative impact. The impact is long-lasting, affecting the borrower’s ability to secure favorable interest rates and credit terms for years after the default is resolved.

Disputing Inaccurate Information on Credit Reports

Borrowers have the right to dispute inaccurate information reported to the credit bureaus. If a borrower believes the information regarding their student loan default is incorrect—for example, if the loan was paid in full or if the default was due to a clerical error—they should follow a specific process. First, they need to obtain a copy of their credit report from each of the three major bureaus. Then, they should carefully review the report for inaccuracies. If any are found, they need to contact the credit bureau directly and submit a dispute, providing documentation to support their claim (such as proof of payment or evidence of a lender error). The credit bureau is then obligated to investigate the dispute and update the report accordingly if the information is indeed incorrect. If the dispute is not resolved with the credit bureau, the borrower can contact the original creditor (the loan servicer) to attempt to resolve the issue.

Flowchart: Default Interaction

The following flowchart illustrates the interaction between loan servicers, borrowers, and credit bureaus in the event of a student loan default:

[Diagram Description: The flowchart begins with a box labeled “Student Loan Default (270+ days past due)”. An arrow points to a box labeled “Loan Servicer”. From the Loan Servicer box, two arrows branch out. One arrow points to a box labeled “Report to Credit Bureaus (Equifax, Experian, TransUnion)”, and the other points to a box labeled “Attempts to Contact Borrower for Resolution”. From the “Report to Credit Bureaus” box, an arrow points to a box labeled “Negative Impact on Credit Score”. From the “Attempts to Contact Borrower for Resolution” box, two arrows branch out. One leads to a box labeled “Resolution Achieved”, which connects to an end point labeled “Default Removed from Credit Report (after certain conditions are met)”. The other leads to a box labeled “No Resolution”, which connects back to the “Report to Credit Bureaus” box. From the “Negative Impact on Credit Score” box, an arrow points to a box labeled “Borrower Disputes Information with Credit Bureau”. This leads to a box labeled “Credit Bureau Investigation”, followed by a decision box labeled “Inaccurate Information?”. A “Yes” branch leads to a box labeled “Credit Report Corrected”, and a “No” branch leads back to the “Negative Impact on Credit Score” box.]

Debt Collection Agencies

Debt collection agencies are third-party companies hired by lenders to recover outstanding student loan debt. Understanding their practices and your rights is crucial to navigating this challenging situation. These agencies operate under specific legal frameworks, and borrowers possess significant protections against aggressive or unethical collection tactics.

Borrowers’ Legal Rights When Interacting with Debt Collection Agencies

The Fair Debt Collection Practices Act (FDCPA) provides significant protection for borrowers. This federal law restricts the methods debt collectors can use to contact you and collect a debt. For instance, they are prohibited from contacting you before 8:00 a.m. or after 9:00 p.m., contacting you at your workplace if you’ve informed them that your employer prohibits such calls, or using harassing or abusive language. The FDCPA also mandates that collectors provide you with validation of the debt within 30 days of initial contact, detailing the amount owed and the creditor to whom the debt is owed. Failure to comply with these regulations can result in legal action against the debt collection agency. You have the right to dispute the debt if you believe it’s inaccurate or if you’ve already paid it. Furthermore, you have the right to request that the agency cease all communication with you, except to inform you of specific actions they are taking.

Common Tactics Used by Debt Collection Agencies

Debt collection agencies often employ various strategies to encourage repayment. Some common tactics include repeated phone calls at inconvenient times, threatening legal action (without immediately following through), sending numerous letters demanding payment, and contacting family members or friends. While some of these tactics are within legal bounds, persistent harassment or misrepresentation of legal consequences is a violation of the FDCPA. For example, threatening to seize your assets without a court order is illegal. Another common tactic is offering debt settlement, where you agree to pay a reduced amount to settle the debt. While this can be a viable option, it’s essential to carefully consider the terms and negotiate strategically.

Ethical Considerations Related to Debt Collection Practices

Ethical debt collection involves treating borrowers with respect and fairness. Transparency is key; borrowers should understand precisely what they owe and the options available to them. Agencies should avoid employing manipulative tactics designed to pressure borrowers into making payments they cannot afford. The ethical collection process should prioritize open communication and a willingness to work with borrowers to find mutually agreeable solutions, such as repayment plans or debt consolidation. Unfortunately, not all agencies adhere to these ethical standards.

Resources Available to Borrowers Facing Aggressive Debt Collection Tactics

Several resources are available to borrowers facing aggressive debt collection tactics. The Consumer Financial Protection Bureau (CFPB) website provides comprehensive information on consumer rights and offers tools for filing complaints. State attorney general offices also handle consumer complaints and can investigate alleged violations of the FDCPA. Non-profit credit counseling agencies can offer guidance on managing debt and negotiating with creditors or debt collectors. Legal aid societies may provide free or low-cost legal assistance to borrowers facing legal challenges related to debt collection. Finally, the National Foundation for Credit Counseling (NFCC) offers certified credit counselors who can provide personalized advice and support.

Rehabilitation and Consolidation Programs

Defaulting on student loans can have severe consequences, but there are programs designed to help borrowers get back on track. Rehabilitation and consolidation offer pathways to manage debt and potentially improve credit standing. Understanding the processes and implications of these programs is crucial for borrowers facing financial hardship.

Rehabilitating defaulted student loans involves making on-time payments for a specific period, typically nine to ten consecutive months. The exact terms depend on the loan servicer and the type of loan. Successful rehabilitation removes the default status from the borrower’s credit report and can reinstate eligibility for certain benefits, such as deferment or forbearance. The process generally requires contacting the loan servicer to establish a rehabilitation agreement, which Artikels the payment plan and the required number of payments. Failure to adhere to the agreement can result in the loan returning to default status.

Loan Rehabilitation Processes

The rehabilitation process begins with contacting the loan servicer. The servicer will assess the borrower’s financial situation and work with them to create a manageable repayment plan. This plan typically involves smaller monthly payments than the original loan terms. The borrower must then make the agreed-upon number of consecutive on-time payments. Once this is complete, the default status is removed, and the loan is reinstated to a non-defaulted status. The length of time required for rehabilitation varies, but it usually takes several months. It is crucial for borrowers to carefully review and understand the terms of the rehabilitation agreement before signing it. Any missed payments during this period will likely restart the rehabilitation process.

Benefits and Drawbacks of Loan Consolidation

Consolidating multiple student loans into a single loan simplifies repayment by combining various interest rates and monthly payments into one manageable payment. This can improve cash flow management for borrowers. However, consolidation can sometimes result in a higher overall interest rate over the life of the loan if the new interest rate is higher than the weighted average of the original loans’ interest rates. This ultimately increases the total cost of repayment. The length of the repayment period might also increase, leading to more interest accrued over time. Furthermore, borrowers lose the benefits of certain loan repayment plans, such as income-driven repayment, which may have been available under the original loan terms.

Eligibility Requirements for Rehabilitation and Consolidation Programs

Eligibility for loan rehabilitation is generally straightforward. Borrowers with defaulted federal student loans are typically eligible. However, specific requirements might vary based on the loan type and servicer. For consolidation, borrowers generally need to have multiple federal student loans. Eligibility criteria for specific consolidation programs may vary. For example, some programs may have income requirements or restrictions on the types of loans that can be consolidated. It’s advisable to contact the Federal Student Aid website or a loan servicer to obtain the most up-to-date and precise eligibility information.

Impact on Repayment Cost and Credit Score

Loan rehabilitation can significantly impact the overall cost of repayment by removing the default status and potentially lowering the monthly payments. The impact on the credit score is also positive as it removes the negative mark of a defaulted loan. Consolidation, on the other hand, can increase the total repayment cost due to potential higher interest rates and extended repayment periods, although it simplifies the repayment process and may improve credit scores by reducing the number of accounts reported to credit bureaus. The effect on credit scores depends on factors like the borrower’s overall credit history and how they manage the consolidated loan. A consistent repayment history on the consolidated loan will improve credit scores over time.

Consequences of Default

Defaulting on student loans carries significant and far-reaching consequences that extend beyond the immediate financial burden. These repercussions can impact various aspects of a borrower’s life, creating a ripple effect with long-term implications for their financial stability and overall well-being.

Defaulting on federal student loans triggers a cascade of negative events. The most immediate and impactful consequences often include damage to credit scores, wage garnishment, and tax refund offset. These actions can severely limit a borrower’s financial flexibility and create a cycle of debt that is difficult to break. Furthermore, the inability to secure future loans or credit, coupled with the emotional stress associated with debt collection, significantly impacts a borrower’s quality of life.

Financial Consequences of Student Loan Default

Defaulting on student loans results in immediate and long-term financial hardship. The most common consequences include wage garnishment, where a portion of a borrower’s income is directly seized by the government to repay the debt. This can severely impact a borrower’s ability to meet their basic living expenses. Additionally, the government can offset a borrower’s tax refund, using the refund to pay down the defaulted loan. This means a borrower may not receive any of their tax refund, further exacerbating their financial difficulties. Late payment fees and collection costs also accumulate, increasing the overall debt burden. A defaulted loan negatively impacts credit scores, making it extremely difficult to obtain future loans, credit cards, or even rent an apartment. This financial instability can extend for years, significantly hindering the ability to achieve financial goals like buying a home or starting a business.

Impact on Future Borrowing Opportunities

A student loan default creates a significant barrier to future borrowing. Lenders view a default as a major red flag, significantly reducing the likelihood of loan approval. Even for loans unrelated to education, such as mortgages or auto loans, a defaulted student loan can result in higher interest rates or outright rejection. The negative impact on credit scores, a key factor in loan approvals, persists for years, making it challenging to access credit for essential needs or opportunities for financial growth. The inability to borrow money can hinder career advancement, limit entrepreneurial pursuits, and perpetuate a cycle of financial instability. For example, someone hoping to buy a house after defaulting on student loans will likely face significantly higher interest rates or be unable to secure a mortgage altogether.

Emotional and Psychological Toll of Student Loan Default

The emotional and psychological consequences of student loan default are substantial and often overlooked. The constant pressure of debt collection, the feeling of being trapped in a cycle of financial instability, and the shame associated with default can lead to significant stress, anxiety, and depression. The impact on mental health can be profound, affecting relationships, work performance, and overall well-being. Many borrowers experience feelings of hopelessness and powerlessness, struggling to see a path out of their financial predicament. This emotional burden can be exacerbated by the social stigma associated with debt, leading to isolation and further exacerbating mental health challenges. Seeking support from financial counselors or mental health professionals can be crucial in navigating this challenging period.

Long-Term Effects of Student Loan Default on Financial Well-being

Imagine a graph charting financial well-being over time. Before default, the line shows steady, albeit perhaps slow, upward progress. After default, the line plummets sharply, representing the immediate financial consequences like wage garnishment and tax refund offset. It then plateaus at a significantly lower level than before, illustrating the persistent impact on credit scores and future borrowing opportunities. The line may show occasional small upward blips representing periods of hard work and financial responsibility, but these are generally short-lived and unable to reach the level of financial well-being before the default. Over the long term, the line remains significantly below its pre-default trajectory, symbolizing the lasting and pervasive effects of the default on the borrower’s overall financial health and future prospects. The graph demonstrates a stark contrast between a life path with responsible loan management and one marked by default, highlighting the significant and long-lasting consequences of failing to meet student loan obligations.

Final Review

Ultimately, proactive management and understanding of your student loan obligations are key to avoiding the pitfalls of default and collection. While the process can be daunting, resources exist to assist borrowers in navigating the system and exploring options for rehabilitation and consolidation. By understanding your rights and the potential consequences of default, you can take control of your financial future and mitigate the long-term impact of delinquent student loans.

Key Questions Answered

What happens if I can’t afford my student loan payments?

Contact your loan servicer immediately. They may offer forbearance or deferment, temporarily suspending payments. Explore income-driven repayment plans to lower monthly payments.

Can my student loans be forgiven?

While total forgiveness is rare, some programs offer loan forgiveness for specific professions (e.g., public service) or after a certain number of qualifying payments under income-driven repayment plans. Eligibility criteria vary.

How long does it take for a student loan to go to collections?

The timeframe varies, but typically a loan enters default after 9 months of missed payments. Then, it may be sold to a collection agency after a period of time, though this isn’t always the case.

What are the consequences of a student loan default on my taxes?

The government can garnish your tax refund to recover defaulted student loan debt. This can significantly impact your annual tax return.