The transition from student to graduate often brings excitement and new beginnings, but it also introduces the often-dreaded reality of student loan repayment. Understanding when your loan payments begin is crucial for effective financial planning. This guide will clarify the process, exploring grace periods, repayment plans, and the impact of graduation timing on your repayment schedule. We’ll demystify the complexities of federal and private loans, ensuring you’re well-equipped to navigate this significant financial milestone.

Successfully managing student loan repayment requires proactive planning and a clear understanding of your options. From choosing the most suitable repayment plan to understanding the implications of deferment and forbearance, this guide provides the necessary information to make informed decisions and avoid potential pitfalls. We’ll explore the various stages of repayment, offering practical advice and resources to help you confidently manage your student loan debt.

Loan Deferment and Forbearance

Understanding the differences between loan deferment and forbearance is crucial for managing your student loan repayment. Both offer temporary pauses in your payments, but they differ significantly in their impact on your loan and eligibility requirements. Choosing the right option can prevent negative consequences like late payment fees and damage to your credit score.

Deferment and Forbearance Eligibility

Eligibility for deferment and forbearance programs varies depending on the type of federal student loan you have and your individual circumstances. Generally, deferment is granted based on specific qualifying life events, while forbearance is often granted based on temporary financial hardship. Specific requirements and available programs can change, so it’s vital to check directly with your loan servicer for the most up-to-date information.

Deferment Options

Deferment temporarily suspends your loan payments, and, importantly, in many cases, interest may not accrue during the deferment period (depending on the loan type). This is a key advantage over forbearance. Several situations qualify for deferment, including unemployment, graduate school enrollment, and economic hardship (in certain cases).

Forbearance Options

Forbearance also pauses your payments, but unlike deferment, interest usually continues to accrue during the forbearance period. This can lead to a larger loan balance upon resuming payments. Forbearance is typically granted when you experience temporary financial difficulties that prevent you from making payments. There are different types of forbearance plans, with varying lengths and terms.

Applying for Deferment or Forbearance

The application process typically involves contacting your loan servicer directly. You will need to provide documentation to support your request, such as proof of unemployment or enrollment in a graduate program. The servicer will review your application and notify you of their decision. This process can take several weeks, so it’s best to apply well in advance of when you anticipate needing the relief.

Comparison of Deferment and Forbearance Plans

| Plan Type | Duration | Interest Accrual | Eligibility Requirements |

|---|---|---|---|

| In-School Deferment | Up to the length of your enrollment | Generally does not accrue (for subsidized loans) | Enrollment in at least half-time studies at an eligible institution |

| Unemployment Deferment | Up to 36 months total | Generally does not accrue (for subsidized loans) | Documentation of unemployment |

| Economic Hardship Deferment | Varies, up to 36 months | Generally does not accrue (for subsidized loans) | Documentation of economic hardship (income below a certain threshold) |

| Forbearance (General) | Varies, up to 12 months, potentially renewable | Accrues | Demonstrated financial hardship |

Grace Periods

Understanding grace periods is crucial for navigating the transition from student to loan repayment. This period offers a temporary reprieve before repayment officially begins, allowing graduates time to adjust to their new financial responsibilities. However, it’s essential to understand the specifics of these grace periods to avoid potential pitfalls.

Grace periods provide a buffer between the completion of your studies and the commencement of loan repayment. This timeframe allows borrowers to secure employment, establish a budget, and prepare for the financial commitment of monthly loan payments. The length and applicability of grace periods vary depending on the type of loan.

Standard Grace Period Length for Federal Student Loans

The standard grace period for federal student loans is six months after graduation, leaving school, or dropping below half-time enrollment. This applies to most federal student loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Federal Stafford Loans. It’s important to note that this six-month period begins after the final date of attendance at the institution, not necessarily the date of graduation ceremony. For borrowers who leave school before completing their degree, the grace period still applies, starting from the date they ceased being enrolled at least half-time.

Grace Period Applicability to Different Loan Types

Grace periods generally apply to federal student loans, providing a crucial period of relief before repayment begins. However, private student loans typically do *not* offer a grace period. Repayment on private student loans usually begins immediately upon leaving school or dropping below half-time enrollment, highlighting a key difference between federal and private loan structures. Borrowers with private loans should carefully review their loan agreements to understand their repayment schedule and avoid any potential late payment penalties.

Implications of Not Making Payments During the Grace Period

While no payments are due during the grace period for federal loans, it’s crucial to understand the implications of inaction. Although no payments are required, interest may still accrue on unsubsidized federal loans during this time. This means that the principal loan amount will increase, leading to a higher total repayment amount over the life of the loan. Furthermore, failing to make payments *after* the grace period ends will result in delinquency, negatively impacting your credit score and potentially leading to additional fees and collection actions. This emphasizes the importance of actively planning for repayment even during the grace period.

Flowchart: Graduation to Repayment

The following describes a visual representation of the process, although a visual flowchart cannot be included in this text-based response. Imagine a flowchart with the following boxes and arrows:

Box 1: Graduation/Leaving School.

Arrow pointing to: Box 2: Six-Month Grace Period (Federal Loans Only).

Arrow pointing to: Box 3: Loan Repayment Begins.

Arrow pointing to: Box 4: Monthly Loan Payments.

(A separate branch from Box 1 could show: Private Loan Repayment Begins Immediately.)

Repayment Plans

Choosing the right student loan repayment plan is crucial for managing your debt effectively and avoiding financial strain. Several plans cater to different financial situations and repayment preferences, each with its own advantages and disadvantages. Understanding these options will empower you to make an informed decision that aligns with your individual circumstances.

Different repayment plans offer varying monthly payments and total repayment periods. The most common types include Standard, Graduated, and Income-Driven Repayment (IDR) plans. The best plan for you will depend on your income, debt amount, and long-term financial goals. Careful consideration of these factors is key to choosing a plan that allows you to repay your loans responsibly while maintaining financial stability.

Student Loan Repayment Plan Comparison

This section compares and contrasts the three main types of federal student loan repayment plans: Standard, Graduated, and Income-Driven Repayment (IDR).

| Feature | Standard Repayment | Graduated Repayment | Income-Driven Repayment (IDR) |

|---|---|---|---|

| Payment Amount | Fixed monthly payment over a 10-year period. | Payments start low and gradually increase over time (typically over a 10-year period). | Payment calculated based on your discretionary income and family size; repayment period can extend beyond 20 or 25 years. |

| Pros | Predictable payments, shortest repayment period, lower total interest paid. | Lower initial payments, manageable in early career stages. | Affordable monthly payments, potential for loan forgiveness after 20 or 25 years (depending on the specific plan and income). |

| Cons | Higher initial payments may be challenging. | Payments increase significantly over time, potentially becoming difficult to manage. | Longer repayment period, potentially higher total interest paid over the life of the loan. |

| Best For | Borrowers with stable income and the ability to make higher monthly payments. | Borrowers expecting income growth over time. | Borrowers with low income or high debt relative to their income. |

Factors Influencing Repayment Plan Choice

Several key factors should influence your decision regarding a repayment plan. Understanding these factors will allow you to choose the option that best fits your financial situation and goals.

- Current Income: Your current income significantly impacts your ability to manage monthly payments. Lower income might necessitate an IDR plan.

- Expected Future Income: Projected income growth can influence the choice between a graduated and standard plan.

- Total Loan Amount: A higher loan amount might make a longer repayment period (like IDR) more appealing.

- Interest Rate: Higher interest rates make shorter repayment periods more advantageous to minimize overall interest paid.

- Long-Term Financial Goals: Your plans for homeownership, retirement, or other major financial goals should be considered.

Resources for Repayment Plan Information

Reliable information on student loan repayment plans is readily available from various sources. These resources can help you navigate the complexities of repayment and make informed decisions.

- Federal Student Aid (FSA): The official website of the U.S. Department of Education, offering comprehensive information on all federal student loan programs.

- Your Loan Servicer: Your loan servicer can provide personalized information about your repayment options and answer your specific questions.

- National Student Loan Data System (NSLDS): This system allows you to access your federal student loan information and see your repayment options.

- Financial Aid Offices at Your College/University: Many colleges and universities offer guidance and resources to help graduates manage their student loans.

Types of Student Loans and Repayment

Understanding the nuances of student loan repayment is crucial for effective financial planning after graduation. This section will delve into the differences between federal and private loans, the impact of interest capitalization, the consequences of default, and how varying interest rates affect the total repayment cost.

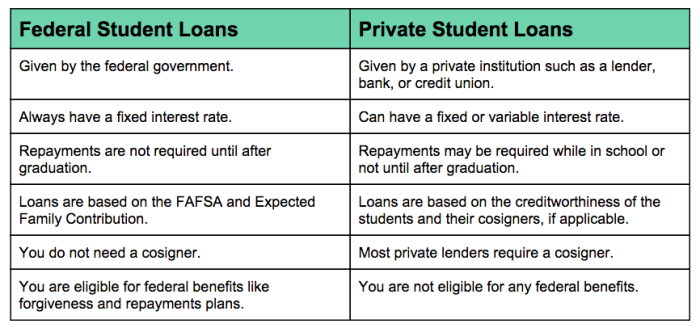

Federal and private student loans differ significantly in their repayment structures and the protections they offer borrowers. Federal loans generally offer more flexible repayment options, including income-driven repayment plans and loan forgiveness programs, which are not typically available with private loans. Private loans, on the other hand, often have stricter terms and higher interest rates.

Federal and Private Loan Repayment Schedules

Federal student loans typically offer a standard repayment plan, as well as income-driven repayment plans. Standard plans usually require repayment within 10 years, while income-driven plans adjust monthly payments based on your income and family size. Private loan repayment schedules vary greatly depending on the lender and the loan agreement. They may offer similar options to federal loans, but these are not standardized, and terms are less borrower-friendly. It is crucial to review your loan agreement carefully to understand your specific repayment schedule.

Interest Capitalization

Interest capitalization occurs when accumulated interest on a loan is added to the principal balance, increasing the total amount owed. This effectively means you are paying interest on your interest. For example, imagine a $10,000 loan with a 5% interest rate. If you don’t make payments for a year, you’ll accrue $500 in interest. With capitalization, that $500 is added to your principal, making your new principal $10,500. Future interest calculations will be based on this higher amount, resulting in a larger total repayment amount over the life of the loan. Understanding capitalization is crucial for minimizing the total cost of your loans. Deferment and forbearance can temporarily halt payments, but interest often continues to accrue and may eventually be capitalized.

Consequences of Student Loan Default

Defaulting on student loans has severe financial consequences. These can include wage garnishment, tax refund offset, damage to your credit score, making it difficult to obtain loans or rent an apartment in the future, and potential legal action. The impact of default can be long-lasting and significantly affect your financial well-being. It’s essential to contact your loan servicer immediately if you are struggling to make payments to explore available options like deferment, forbearance, or income-driven repayment plans before defaulting.

Impact of Different Interest Rates

Different interest rates dramatically affect the total cost of repayment. Consider two hypothetical scenarios: Loan A has a $20,000 principal with a 4% interest rate, and Loan B has the same principal but an 8% interest rate, both with a 10-year repayment term. Over the 10 years, Loan A will likely have significantly lower total interest payments compared to Loan B. This difference in interest rates can amount to thousands of dollars over the life of the loan. Borrowers should carefully compare interest rates when choosing loans and prioritize lower rates whenever possible. A lower interest rate will always result in less total interest paid over the loan’s life, leading to significant savings.

Impact of Graduation Date on Repayment

The timing of your graduation significantly impacts your student loan repayment schedule. Graduating early can mean starting repayments sooner, while delaying graduation pushes back the start date, influencing the overall repayment period and potentially the total interest accrued. Understanding this relationship is crucial for effective financial planning after college.

Graduating early or late directly affects the length of your repayment period. Early graduation means you begin repayment sooner, potentially shortening the overall repayment timeline and minimizing the total interest paid. Conversely, a delayed graduation extends the grace period and delays the start of repayment, resulting in a longer repayment period and increased overall interest costs. This is because interest continues to accrue on the principal loan amount even during the grace period and throughout the repayment period.

Notification of Loan Servicers

Upon graduation, promptly notifying your loan servicers is essential. This typically involves providing them with your official graduation date, usually found on your transcript or graduation certificate. Most servicers have online portals where you can update your information; alternatively, you may need to contact them directly via phone or mail. Failing to notify them can lead to delays in processing your repayment plan and potential penalties. Accurate and timely communication is key to a smooth transition into repayment.

Hypothetical Scenario Illustrating Repayment Differences

Let’s consider two hypothetical graduates, both borrowing $30,000 at a 6% interest rate with a 10-year repayment plan. Sarah graduates on time and begins repayment immediately, while John delays graduation by a year. Assuming a standard grace period of six months, Sarah’s repayment begins six months after her graduation date, while John’s starts 18 months after his. Over the life of the loan, John will pay significantly more in interest due to the extended repayment period, even though the principal amount is the same. While precise figures would depend on the specific repayment plan and interest capitalization rules, the difference could easily be several thousand dollars. This highlights the financial advantage of graduating on time or even early.

Actions to Take Upon Graduation Regarding Student Loans

Before focusing on job hunting or celebrating, it’s crucial to take proactive steps concerning your student loans. This ensures a smooth transition into repayment and avoids potential financial pitfalls.

- Obtain your official graduation date from your institution.

- Contact your loan servicers and update your information with your graduation date.

- Review your loan terms and repayment options to choose the plan that best suits your financial situation.

- Create a realistic budget that incorporates your monthly loan payments.

- Explore options for income-driven repayment plans if necessary.

- Consider exploring loan consolidation if you have multiple loans.

In-School Deferment

In-school deferment is a valuable option for students who are enrolled at least half-time in an eligible educational program. This allows borrowers to temporarily postpone their student loan payments while they focus on their studies, preventing the accumulation of missed payments and potential negative impacts on their credit history. Understanding the specifics of in-school deferment is crucial for responsible student loan management.

In-school deferment essentially pauses your student loan repayment obligation for the duration of your enrollment in an eligible educational program. Interest may or may not accrue depending on the type of loan; subsidized federal loans generally do not accrue interest during in-school deferment, while unsubsidized loans do. This means that while payments are postponed, the principal loan amount may remain the same (for subsidized loans), or increase (for unsubsidized loans) due to accumulating interest. Upon graduation or leaving school, regular repayment begins.

Requirements for Maintaining In-School Deferment

Maintaining in-school deferment requires consistent enrollment in an eligible educational program. This typically means being enrolled at least half-time, which is generally defined as taking at least six credit hours per semester or equivalent. Borrowers must also regularly provide their loan servicer with proof of enrollment, such as a copy of their enrollment verification or a transcript showing their current course load. Failure to provide this documentation could result in the termination of the deferment and the immediate requirement to begin repayment. The specific requirements may vary slightly depending on the lender and loan type.

Situations Where In-School Deferment Might Not Be Applicable

In-school deferment is not available indefinitely. It is generally only applicable while actively pursuing a degree or certificate at an eligible institution. If a student takes a leave of absence for an extended period, the deferment may be terminated. Similarly, if a student drops below half-time enrollment, the deferment may also end. Additionally, students attending unaccredited institutions or pursuing programs not approved for federal student aid may not be eligible for in-school deferment. Finally, some private student loans may not offer this option.

Sample Communication to a Loan Servicer Regarding In-School Deferment

Subject: Request for In-School Deferment – [Your Name] – [Loan Account Number]

Dear [Loan Servicer Name],

This letter is to formally request an in-school deferment for my student loan account, [Loan Account Number]. I am currently a [full-time/part-time] student at [University Name], pursuing a [Degree] in [Major]. My enrollment verification is attached to this email. My anticipated graduation date is [Date].

Please confirm receipt of this request and let me know if any additional documentation is required.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Closure

Successfully navigating the complexities of student loan repayment hinges on understanding your rights and responsibilities. By familiarizing yourself with grace periods, repayment plans, and the impact of your graduation date, you can proactively manage your debt and build a solid financial foundation for the future. Remember, seeking guidance from your loan servicer and exploring available resources is key to ensuring a smooth and successful repayment journey. Proactive planning empowers you to take control of your finances and achieve long-term financial stability.

Quick FAQs

What happens if I don’t make payments during my grace period?

Interest will continue to accrue on your loan balance during the grace period, potentially increasing your total debt. After the grace period ends, you’ll be considered delinquent if you haven’t started repayment, impacting your credit score.

Can I extend my grace period?

Generally, grace periods are fixed. However, you might qualify for deferment or forbearance under specific circumstances, such as unemployment or financial hardship. Contact your loan servicer to explore these options.

What if I graduate early or late?

Your repayment schedule may be affected. Early graduation might mean your repayment starts sooner, while late graduation could delay it. Notify your loan servicer of your graduation date to ensure accurate repayment calculations.

Are there penalties for paying off my student loans early?

Most federal student loans don’t have prepayment penalties. However, check your loan agreement to confirm this for your specific loans, especially private loans.