The question of student loan forgiveness for teachers is a complex one, touching upon crucial aspects of education, public service, and national financial policy. Many aspiring educators face significant student loan debt, potentially hindering their ability to pursue teaching careers, especially in under-resourced schools. Federal and state programs aim to alleviate this burden, offering loan forgiveness in exchange for teaching service in high-need areas or specific subjects. However, eligibility criteria, application processes, and program limitations vary significantly, making it essential to understand the nuances before relying on loan forgiveness as a career planning tool.

This exploration delves into the intricacies of teacher loan forgiveness programs, examining eligibility requirements, eligible loan types, the application process, and the long-term impact on teachers’ careers and financial well-being. We will explore both the benefits and potential drawbacks, offering a comprehensive overview to guide educators seeking to navigate this complex landscape.

Teacher Eligibility for Loan Forgiveness Programs

Many federal and state programs offer student loan forgiveness to teachers who meet specific requirements. These programs aim to incentivize individuals to pursue careers in education, particularly in high-need fields and underserved communities. Understanding the eligibility criteria is crucial for teachers seeking to reduce or eliminate their student loan debt.

Teacher loan forgiveness programs typically hinge on two main pillars: income limitations and service requirements. Meeting both is generally necessary to qualify for loan forgiveness. The specifics vary depending on the program, so careful review of each program’s guidelines is essential.

Income Limitations for Teacher Loan Forgiveness

Income-based repayment plans and loan forgiveness programs often have income thresholds. These thresholds determine eligibility and the amount of loan forgiveness received. For instance, a teacher might need to demonstrate an income below a certain level to qualify for a specific program. These income limits are adjusted periodically to reflect changes in the cost of living. Failing to meet these income requirements will disqualify a teacher from receiving loan forgiveness, regardless of fulfilling other requirements.

Service Requirements for Teacher Loan Forgiveness

Most teacher loan forgiveness programs require a commitment to teaching in specific settings for a defined period. This often involves teaching in high-need schools or subjects, such as mathematics, science, or special education, in low-income areas. The required length of service typically ranges from five to ten years. For example, the Public Service Loan Forgiveness (PSLF) program, while not exclusively for teachers, can benefit teachers working in qualifying public service jobs, requiring 120 qualifying monthly payments under an income-driven repayment plan. Meeting this service requirement is a critical factor in obtaining loan forgiveness.

Examples of Federal and State Teacher Loan Forgiveness Programs

Several programs offer loan forgiveness to teachers. The Public Service Loan Forgiveness (PSLF) program is a prominent federal program that may benefit teachers working in public schools. However, it’s crucial to understand that PSLF requires 120 qualifying payments under an income-driven repayment plan, and not all repayment plans qualify. Many states also offer their own teacher loan forgiveness programs, with varying eligibility criteria and forgiveness amounts. For example, some states might prioritize teachers in specific subject areas or those working in rural or underserved communities. These state programs often complement federal initiatives, providing additional opportunities for loan relief.

Comparison of Teacher Loan Forgiveness Options

Different loan forgiveness programs have distinct advantages and disadvantages. Some programs may offer larger amounts of forgiveness but require longer periods of service, while others may have less stringent service requirements but offer smaller amounts of forgiveness. Teachers should carefully weigh the benefits and drawbacks of each program to determine which best aligns with their individual circumstances and career goals. Factors such as the type of loan, the amount of debt, and the teacher’s career aspirations should all be considered when choosing a loan forgiveness option. A thorough comparison of program requirements and benefits is essential to making an informed decision.

Types of Student Loans Eligible for Forgiveness

Teacher loan forgiveness programs are designed to incentivize individuals to pursue careers in education, often by reducing or eliminating their student loan debt. Understanding which types of loans qualify is crucial for teachers seeking this benefit. Eligibility varies depending on the specific program and the type of loan.

Generally, federal student loans are more likely to be eligible for forgiveness programs than private loans. This is because federal loan programs are often structured to align with government initiatives, including teacher loan forgiveness. Private loans, on the other hand, are offered by private lenders with their own terms and conditions, and are less frequently included in government-sponsored forgiveness programs.

Federal Student Loan Eligibility

Federal student loans eligible for forgiveness under teacher loan forgiveness programs typically include Direct Subsidized Loans and Direct Unsubsidized Loans. These are the most common types of federal student loans disbursed through the federal government. Depending on the program, other federal loan types, such as Federal Stafford Loans (older programs), may also qualify. It’s important to check the specific requirements of the program you are applying for.

Private Student Loan Eligibility

Private student loans are generally not eligible for federal teacher loan forgiveness programs. These programs are primarily designed for federal student loans, as they are managed and overseen by the federal government. Private lenders set their own terms, and there is no government mandate requiring them to participate in teacher loan forgiveness initiatives. Therefore, teachers with only private student loans will not typically find relief through these programs.

Determining Loan Eligibility for Forgiveness

The process of determining which loans are eligible for forgiveness often involves submitting documentation to the relevant program administrator. This documentation usually includes the loan’s promissory note, demonstrating the loan type and lender, as well as evidence of employment as a qualifying teacher in a low-income school or school district. The program administrator will then verify the information provided against the program’s eligibility criteria. This process can vary slightly depending on the specific teacher loan forgiveness program.

Loan Type Eligibility Comparison

| Loan Type | Federal Loan? | Typical Eligibility for Teacher Loan Forgiveness | Notes |

|---|---|---|---|

| Direct Subsidized Loan | Yes | Generally Eligible | Interest may be subsidized while in school |

| Direct Unsubsidized Loan | Yes | Generally Eligible | Interest accrues while in school |

| Federal Stafford Loan (Older Programs) | Yes | Potentially Eligible (check program specifics) | May require additional documentation |

| Private Student Loan | No | Generally Not Eligible | Check with lender for any potential private programs |

The Application Process for Loan Forgiveness

Applying for teacher loan forgiveness can seem daunting, but a methodical approach can significantly increase your chances of success. Understanding the specific program requirements and meticulously completing the application is crucial. This section details the steps involved, common pitfalls to avoid, and provides a visual representation of the process.

Step-by-Step Application Guide

The application process generally involves several key steps. First, you must determine your eligibility for a specific program, such as the Public Service Loan Forgiveness (PSLF) program or a state-specific teacher loan forgiveness program. Each program has unique requirements regarding the type of employment, loan type, and repayment plan. Next, you’ll need to gather all necessary documentation, including employment verification, loan details, and tax returns. This documentation serves as proof of your eligibility and compliance with program requirements. Finally, you will submit your completed application through the designated channels, often online portals. Following these steps carefully is essential for a smooth application process.

Required Documentation and Paperwork

Successful loan forgiveness applications rely on complete and accurate documentation. This typically includes, but is not limited to, your federal student loan information (obtained from the National Student Loan Data System or NSLDS), proof of employment (typically a letter from your employer confirming your full-time employment status in a qualifying position and the dates of your employment), and tax returns (to verify your income and employment). Some programs may require additional documentation, such as proof of teaching certification or licensure. It is vital to meticulously check each document for accuracy before submission to avoid delays or rejection. Missing or inaccurate information is a frequent cause of application delays.

Common Mistakes to Avoid

Several common mistakes can hinder the loan forgiveness application process. One frequent error is failing to consolidate federal loans before applying for certain programs. Some programs require consolidation to be eligible. Another common mistake is not maintaining consistent employment in a qualifying role for the required period. Interruptions in employment or changes in job titles might disrupt the eligibility requirements. Finally, neglecting to submit all necessary documentation, or submitting incomplete or inaccurate information, is a major cause of application delays and rejections. Thorough preparation and careful review of all submitted materials are essential.

Application Process Flowchart

Imagine a flowchart beginning with a “Start” box. An arrow points to a “Determine Eligibility” box, which branches to “Eligible” and “Ineligible” boxes. The “Ineligible” box leads to an “End” box. The “Eligible” box connects to a “Gather Documentation” box, followed by a “Complete Application” box. This then leads to a “Submit Application” box, which branches to “Application Approved” and “Application Denied” boxes. “Application Approved” leads to “Loan Forgiveness” and then “End,” while “Application Denied” leads to a “Review and Resubmit” box, which loops back to the “Submit Application” box. This visual representation clearly illustrates the sequential steps involved and potential outcomes.

Impact of Loan Forgiveness on Teachers

Loan forgiveness programs offer significant financial relief to teachers burdened by student loan debt. This relief can have a profound impact on their financial well-being, career choices, and long-term financial planning, ultimately benefiting both the teachers themselves and the education system as a whole. The extent of this impact, however, can vary depending on several factors.

Financial Benefits of Loan Forgiveness

Loan forgiveness directly reduces a teacher’s monthly debt payments, freeing up substantial funds for other essential needs. This immediate financial relief can alleviate stress, improve credit scores, and allow teachers to focus on their professional development and personal well-being. For example, a teacher with $50,000 in student loan debt might see their monthly payments reduced by hundreds of dollars, depending on the interest rate and loan repayment plan. This extra money can be used for housing, childcare, transportation, or even investing in their retirement. The long-term financial impact is significant, potentially accelerating wealth accumulation and improving overall financial security.

Loan Forgiveness and Career Choices

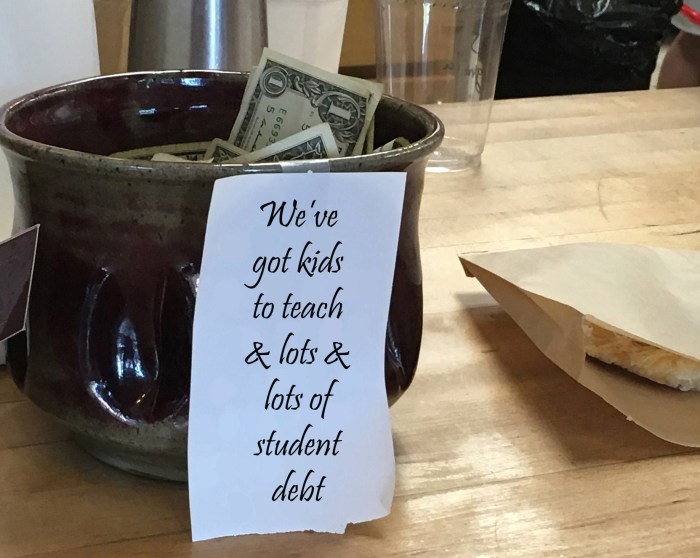

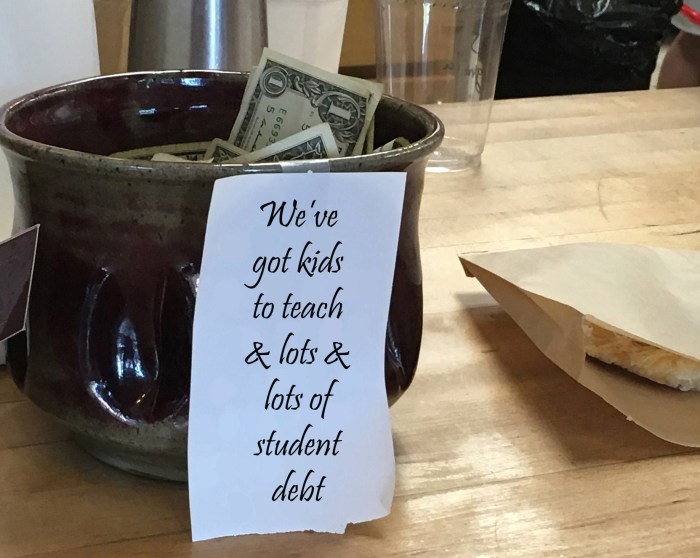

The prospect of loan forgiveness can influence a teacher’s career choices. The financial burden of student loan debt often deters individuals from pursuing teaching careers, particularly in high-need areas like special education or underserved communities, where salaries might be lower. Loan forgiveness programs can incentivize individuals to choose teaching as a profession, even in less lucrative settings. It can also encourage teachers to remain in the profession longer, reducing teacher turnover and improving the stability of schools. For instance, a teacher considering a higher-paying job in the private sector might choose to stay in teaching if loan forgiveness significantly reduces their financial strain.

Impact Across States and School Districts

The impact of loan forgiveness varies across states and school districts due to differences in teacher salaries, cost of living, and the availability of state-level loan forgiveness programs. Teachers in high-cost-of-living areas, such as major metropolitan centers on the coasts, may experience a more significant financial benefit from loan forgiveness compared to those in rural areas with lower living expenses and lower salaries. Similarly, school districts with robust teacher support programs may offer additional incentives, compounding the positive impact of federal loan forgiveness. For example, a teacher in New York City, where the cost of living is high, would likely benefit more from loan forgiveness than a teacher in a rural area of the Midwest.

Positive and Negative Consequences of Loan Forgiveness for Teachers

The implementation of loan forgiveness programs presents both potential benefits and drawbacks.

It’s important to consider both sides of the issue. While the benefits are significant, potential drawbacks need careful consideration.

- Positive Consequences: Increased teacher retention, attraction of qualified individuals to the teaching profession, improved teacher morale and job satisfaction, enhanced financial stability for teachers, potential economic stimulus in communities due to increased teacher spending.

- Negative Consequences: Potential for increased program costs, potential for inequitable distribution of benefits (some teachers may benefit more than others), possibility of unintended consequences (e.g., increased tuition costs if institutions anticipate loan forgiveness).

Teacher Loan Forgiveness Programs and Public Service

Teacher loan forgiveness programs are a vital component of broader public service initiatives. They recognize the crucial role educators play in society and aim to incentivize individuals to pursue teaching careers, particularly in areas facing teacher shortages. These programs acknowledge that teaching, while immensely rewarding, often comes with significant financial burdens, especially for those entering the profession with substantial student loan debt.

The rationale behind providing loan forgiveness to teachers rests on the premise that a well-educated and motivated teaching force is essential for a thriving society. Educators are responsible for shaping future generations, fostering critical thinking, and preparing students for successful lives. By alleviating the financial strain of student loan debt, these programs aim to attract and retain highly qualified individuals who might otherwise be deterred by the prospect of substantial debt repayment. This, in turn, benefits students and the wider community.

Teacher Loan Forgiveness Programs and Underserved Areas

Many teacher loan forgiveness programs specifically target underserved areas, which often face significant challenges in attracting and retaining qualified educators. These areas may be located in rural communities, urban districts with high poverty rates, or regions experiencing a shortage of teachers in specific subject areas, such as STEM fields. Loan forgiveness programs offer a powerful incentive for teachers to choose these challenging but critically important roles, ensuring that all students have access to high-quality instruction regardless of their location or background. For example, some programs offer increased loan forgiveness amounts for teachers who work in high-needs schools for a specified period. This directly addresses the teacher shortage in those areas. Another example might be a program offering preferential loan forgiveness terms for teachers specializing in critical subjects like mathematics or science in under-resourced districts. This helps to improve educational outcomes in areas where these skills are most needed.

Societal Benefits of Attracting and Retaining Highly Skilled Educators

The societal benefits of attracting and retaining highly skilled educators through loan forgiveness programs are far-reaching. A strong teaching force contributes to improved student academic performance, higher graduation rates, increased civic engagement, and a more productive workforce. These programs indirectly contribute to a more equitable society by ensuring that students in all communities, regardless of socioeconomic status or geographic location, have access to excellent teachers. The long-term economic benefits are also significant, as a more educated and skilled workforce leads to increased economic productivity and innovation. Studies have shown a positive correlation between teacher quality and student achievement, which directly impacts future economic growth and social mobility. Furthermore, a stable and well-compensated teaching profession attracts individuals with a passion for education, leading to a more dedicated and engaged teaching workforce, benefiting students and communities alike.

Maintaining Eligibility for Loan Forgiveness

Maintaining eligibility for teacher loan forgiveness programs requires consistent adherence to specific criteria. Failure to meet these ongoing requirements can result in the loss of forgiveness benefits, potentially leading to significant financial repercussions for the teacher. Understanding these requirements and proactively addressing potential issues is crucial for teachers seeking loan forgiveness.

The specific requirements vary depending on the program, but generally involve continued employment in a qualifying position at a qualifying school. This often necessitates working a minimum number of years in a low-income school or in a specific subject area with a demonstrated teacher shortage. Additional requirements may include maintaining a certain level of teaching performance or completing professional development activities. Regularly reviewing the terms and conditions of your specific loan forgiveness program is essential to stay informed about your responsibilities.

Situations Leading to Loss of Eligibility

Several situations can lead to the loss of eligibility for teacher loan forgiveness. These situations often involve a change in employment status, a failure to meet the required service obligations, or a violation of the program’s terms and conditions. For example, leaving a qualifying teaching position before completing the required service period, switching to a non-qualifying school, or failing to submit required documentation on time can all result in ineligibility. Furthermore, some programs may revoke forgiveness if a teacher is found to have provided false information during the application process. These scenarios highlight the importance of carefully reviewing and adhering to the program’s stipulations.

Appealing a Decision to Revoke Loan Forgiveness

If a teacher’s loan forgiveness is revoked, they generally have the right to appeal the decision. The appeal process usually involves submitting a written request outlining the reasons for the appeal and providing supporting documentation. This documentation might include evidence of continued employment at a qualifying school, proof of completion of required service, or clarification of any misunderstandings regarding the program’s terms. The success of an appeal often hinges on the strength of the evidence presented and the clarity of the explanation. It’s advisable to consult with a legal professional or the loan servicer to understand the specific appeal process and gather the necessary documentation.

Actions to Ensure Continued Eligibility

It is vital for teachers to take proactive steps to maintain their eligibility for loan forgiveness. Failing to do so can result in the loss of substantial financial benefits.

To ensure continued eligibility, teachers should:

- Regularly review the terms and conditions of their loan forgiveness program.

- Maintain accurate records of their employment, including dates of employment, school location, and subject taught.

- Submit all required documentation on time and in the correct format.

- Keep in contact with their loan servicer and promptly address any questions or concerns.

- Seek clarification from the loan servicer if there is any uncertainty about their eligibility status.

- Understand and adhere to all program requirements, including service obligations and performance standards.

Summary

Ultimately, the pursuit of student loan forgiveness for teachers involves careful consideration of eligibility requirements, program specifics, and long-term financial planning. While loan forgiveness offers significant financial relief and can incentivize careers in education, understanding the nuances of the application process and maintaining eligibility are crucial for success. By carefully navigating the available options and understanding the implications, teachers can make informed decisions that best support their professional goals and long-term financial stability.

Commonly Asked Questions

What happens if I lose my eligibility for loan forgiveness?

Losing eligibility typically means you’ll need to repay the forgiven amount, possibly with interest. Appeal processes may be available, depending on the reason for ineligibility.

Are there any tax implications for forgiven student loans?

Generally, forgiven student loan debt may be considered taxable income. Consult a tax professional for personalized advice.

Can I consolidate my loans before applying for forgiveness?

Loan consolidation can simplify repayment but might affect your eligibility for certain forgiveness programs. Review program requirements before consolidating.

What if I change schools or leave teaching before fulfilling the service requirement?

Early termination of employment usually results in the need to repay a portion or all of the forgiven amount, depending on the specific program.